5 Best Crypto Apps UK in 2025

Crypto apps are a great way to access and manage your crypto from anywhere with your smartphone. There is a wide variety of different apps available, but this guide will help you find the best crypto app in United Kingdom that’s right for you.

We’ve reviewed over 100 crypto apps and compared them on a range of factors, such as features, fees, security, and regulation. On this page, you will find detailed reviews of our top 5 recommendations for United Kingdom users, along with all the information you need to start using a crypto app.

Best Crypto Apps for the UK - Our Top 3 Picks

Want to start buying and selling crypto with an app right now? Here are our top 3 recommendations.

The Best Crypto Apps United Kingdom for 2025

1. eToro – Overall Best Crypto App in United Kingdom

2. OKX – Best Crypto App for Advanced Crypto Traders in United Kingdom

3. Coinbase – Best Crypto App For Beginners in United Kingdom

4. CEX.IO – Most Reliable Crypto App in United Kingdom

5. Uphold – Safest Crypto App in United Kingdom

Top 5 Best Cryptocurrency Apps UK - Compared

|

Regulation |

No. of coins |

Trading fees |

Min deposit |

|

|

eToro |

FCA, CySEC |

70+ |

1% plus spread |

£10 |

|

OKX |

VARA |

340+ |

Up to 0.1% |

Min purchase $5 |

|

Coinbase |

FCA, most US states |

150+ |

Up to 0.6% |

£50 |

|

CEX.IO |

GFSC, 33+ US states |

70+ |

Up to 0.25% |

£20 |

|

Uphold |

FCA, FinCEN |

160+ |

Spread of 0.85% to 1.25% |

£10 |

Top 5 Cryptocurrency Apps United Kingdom Reviewed

Here is a detailed look at the best five crypto apps for United Kingdom users.

1. eToro – Overall Best Crypto App in United Kingdom

eToro provides user-friendly trading and investing services to more than 25 million people, making it one of the world’s largest crypto exchange. There are multiple asset types available on the app. In addition to more than 70 cryptocurrencies, you’ll be able to trade other digital assets plus stocks, commodities, forex, and ETFs. eToro has also obtained licences from a number of regulators.

The Discover tab in the app is a great place to find out which cryptocurrencies are trending and surging, and you can set up price alerts by adding your favourites to your watchlist. You’ll also find information on each in the Stats, News, and Research tabs to help you with fundamental analysis.

To start trading on the eToro app, you’ll need to make a minimum deposit of about £8 ($10). There are no deposit fees, and you will have the option to deposit via card, bank transfer, Skrill, Neteller, Trustly, or Rapid Transfer. Trading crypto incurs a 1% fee plus spread, and the minimum amount you can purchase is about £8 ($10). Read our full eToro review here.

eToro Pros

-

App is easy to navigate

-

Features for social investing

-

Multi-asset platform

-

Licensed and secure

-

Virtual account

-

Deposits are free

-

Variety of payment options

eToro Cons

-

PayPal deposits unavailable in United Kingdom

-

Fewer cryptocurrencies than some competitors

Why we chose this app

eToro is at the top of our list as it has built a reputation for trustworthiness and excellence over its 15+ year history. It secures users’ crypto in offline storage, uses SSL encryption, and provides free insurance. The app is also regulated by the FCA, making eToro a safe place to trade for United Kingdom users.

What really sets eToro apart from the competition is its social investing features. You can connect with other users, share ideas, and learn from more experienced traders. You can even automatically replicate the trades of a pro by using the unique CopyTrader feature.

On top of this, you can use the smart portfolio feature to set up thematic investment strategies, and even practise trading for free without the risk in your virtual account. eToro is an accessible and affordable option thanks to its low minimums and free deposits.

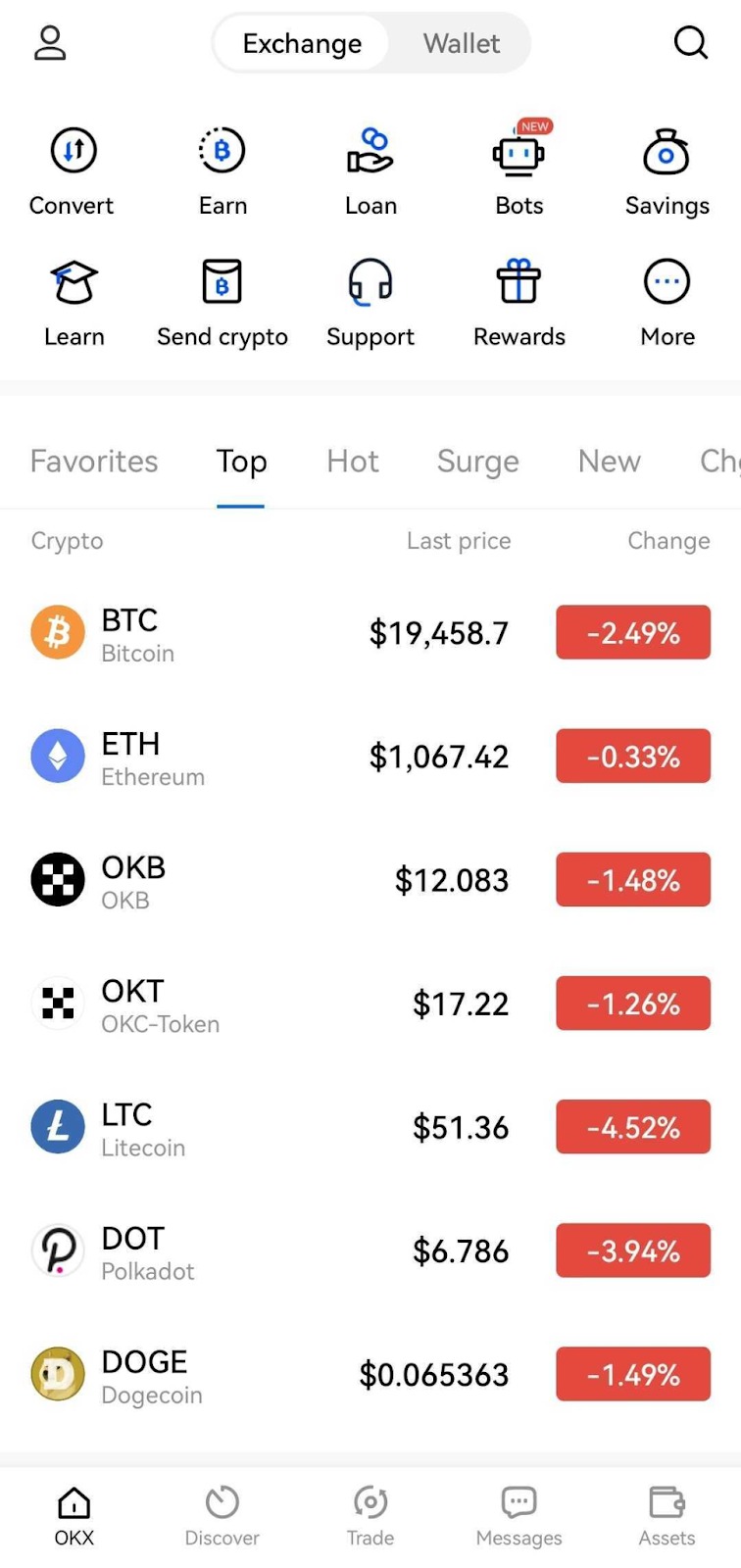

2. OKX – Best Crypto App For Advanced Traders in United Kingdom

The OKX app is suitable for users of all abilities as it is available in different versions. OKX Lite is perfect for beginners as the easy-to-use interface makes it quick and simple to buy and sell crypto in a couple of taps. Newbies will also appreciate the tutorials, ideas, and analysis in the Learn section.

Meanwhile, experienced users can access more advanced trading features with the Pro version of the app. The Earn section is a great place for those who want to generate interest on their crypto holdings. The available products include staking, savings, fixed income, dual investment, and DeFi rewards.

There are more than 340 cryptocurrencies available to trade on the app, and you can purchase as little as $5 (about £4). Although you can’t deposit fiat on the app, you can make instant card purchases for a 1.99% fee. When making crypto-to-crypto trades, the fees are up to 0.1%.

OKX Pros

-

340+ coins

-

Advanced trading tools

-

Trading bots

-

Web3 functionality

-

Earn interest

-

Low trading fees

OKX Cons

-

No fiat deposits

Why we chose this app

Although beginners should have no trouble using the Lite version, OKX made our top five due to its offering for advanced traders. You’ll be able to access customisable charts, technical indicators, and a variety of order types, as well as margin and derivatives trading, powerful APIs, and trading bots.

OKX is also one of the best apps for exploring Web3. When you toggle to the Web3 version, you will have access to a wallet that supports a variety of blockchains. You can also explore NFT markets and dApps, such as a decentralised exchange.

3. Coinbase – Best Crypto App for Beginners in United Kingdom

Coinbase describes itself as the easiest place to buy and sell cryptocurrency. Its simple interface is designed to be easy to navigate, even for those who have never invested before. You can trade more than 150 coins, view the top movers, and add your favourites to your watchlist to get price alerts.

You can use the recurring buys feature to set up regular automatic crypto purchases, and earn interest on a handful of cryptocurrencies. Coinbase is also one of the most secure crypto trading platforms, as it has offline storage, crypto insurance, and an e-money licence from the FCA.

An initial deposit of at least £50 is recommended to verify your bank account, and you can then buy crypto in the Trade tab for a fee of 0.6% plus spread. Alternatively, you can make instant card purchases for as little £2, though the fees for this can be much higher. Read our full Coinbase review here.

Coinbase Pros

-

Easy to use

-

150+ coins

-

Regulated and secure

-

Low order minimum

-

Recurring buys

-

Educational resources

-

Learning rewards

Coinbase Cons

-

Higher minimum deposit than some competitors

-

Limited payment options in United Kingdom

-

Fees for card purchases can be a bit high

Why we chose this app

We picked Coinbase due to its accessibility for users of all levels of experience. The low order minimum makes the app affordable for people on a low budget, and the recurring buys feature makes it easy for anyone to implement a dollar cost averaging strategy.

One of the standout features of Coinbase is the Learn section. Here, you will find tips and tutorials, crypto market updates, and articles explaining everything from crypto basics to navigating Web3. There is even a Learning rewards section where you can earn some free crypto while completing lessons on new crypto projects.

4. CEX.IO – Most Reliable Crypto App in United Kingdom

CEX.IO provides an easy way to access more than 70 cryptocurrencies. You can buy, sell, swap, and stake coins with a couple of taps on the app, and stay informed with order notifications and price alerts.

Trades are executed quickly thanks to the app’s high liquidity order books and favourable conditions for market making. Proffesional traders will appreciate the analytical tools, API solutions for automated trading, and advanced order-matching algorithms that make it possible to engage in high-frequency trading and scalping strategies.

You’ll need to deposit at least £20 to get started, and card transactions carry a 1.49% fee, while depositing via Faster Payments is free. There is a competitive fee of 0.25% for each trade. Read our full CEX.IO review here.

CEX.IO Pros

-

High-liquidity order book

-

Simple interface for beginners

-

API solutions

-

Advanced trading tools

-

Strong security

-

Round-the-clock support

CEX.IO Cons

-

Verification process can be a little complicated

Why we chose CEX.IO

CEX.IO is among our top picks as it has built a reputation for reliability. It has been in operation since 2013, and in that time, it has gained 4 million registered users and lost 0% of customers’ funds.

Its strong security features include cold storage for crypto, full data encryption, protection against DDoS attacks, and compliance with PCI DSS safeguarding standards. The app also provides dedicated round-the-clock support via email, phone, and live chat.

5. Uphold – Safest Crypto App in United Kingdom

Uphold is a useful cryptocurrency app for United Kingdom users. There is no need to buy stablecoins or go through a currency conversion, as you can buy crypto directly with GBP. After registering an account, it’s quick and easy to make a crypto purchase with the tap of a button.

You can schedule automatic purchases or set up limit orders for any of the 160+ cryptocurrencies available. Something that really makes Uphold stand out is its staking products. You can earn up to 25% APY in weekly rewards through staking more than 20 popular coins.

You’ll need to fund your account with a minimum of £10, and you can do this for a 2.49% fee with a debit card or for free with a bank transfer. The spread when buying and selling varies by cryptocurrency, but is typically in the 0.85% to 1.25% range.

Uphold Pros

-

User-friendly

-

160+ cryptocurrencies

-

Automatic crypto purchases and limit orders

-

Earn staking rewards

-

Strong security

-

Regulated by the FCA

Uphold Cons

-

Lack of advanced trading features

-

Credit card deposits aren’t available in United Kingdom

Why we chose this app

Uphold is among our top recommendations as it provides a simple and secure place to trade for more than 10 million users. The crypto exchange platform is always at least 100% reserved and never loans out your money. The reserves can be viewed at any time as Uphold publishes all cryptocurrency transactions and holdings in real time.

The app is committed to compliance and is regulated by the FCA. Its state-of-the-art security includes encryption, auditing and testing, third-party due diligence, personnel standards, a responsive 24/7 monitoring system, and a bug bounty programme.

What Is a Cryptocurrency App & How Do They Work?

The most common type of crypto app is one that enables you to buy and sell crypto from your smartphone. To do this, you will need to make a deposit or provide your card details to make instant card purchases.

You will be able to view the prices of the different cryptocurrencies available on your app. You may then be able to make simple purchases by tapping the coin you want, filling in the amount you wish to purchase, and tapping the “Buy” button.

Some apps may offer more advanced features, such as customisable price charts, analytics tools, price alerts, and tools for strategy trading. You will be able to make a purchase by creating a buy order, which could be a market order to buy immediately or a limit order to buy the coin when it reaches a certain price.

Different Types of Crypto Apps Available

There are various types of crypto apps available that have different functions and features. The most common types are detailed below.

Crypto Exchange apps

This is the most popular type of crypto app, and all the apps on this page fall into this category. Crypto exchange apps enable you to make exchanges, either between fiat currencies and cryptocurrencies or between two cryptocurrencies.

Your app may only enable you to make simple purchases and sales of crypto. On the other hand, you may have the option to engage in trading, with access to different order types and trading tools.

Uphold simply provides an easy way to buy and sell crypto against fiat. Coinbase, OKX, and CEX.IO all facilitate simple instant card purchases, but also provide tools for trading. OKX only offers crypto-crypto trading pairs, while Coinbase and CEX.IO offer both crypto-crypto and fiat-crypto trading pairs.

eToro doesn’t have an instant card purchase feature, but buying crypto with your deposited funds is pretty straightforward. It provides a range of trading tools, but you can only trade crypto against USD.

Wallet apps

Wallet apps provide a way for you to access your blockchain wallet from your mobile device and send and receive crypto.

There are many mobile wallets available that store the private keys to your wallet on your device. You will be given a seed phrase when you set it up, which you will need to keep somewhere safe. If your device is lost or broken, you will be able to recover your wallet on another device with the seed phrase.

There are also web wallets, which, although more vulnerable to hacking, are easier to use. You won’t have any private keys or seed phrases to look after as your wallet provider takes custody of your coins and safeguards this information.

All the apps reviewed on this page include free web wallets. The benefit of using one of these apps as your wallet is you will be able to sell, trade, lend, or stake your crypto straight from your wallet without needing to transfer it first. The potential vulnerabilities of web wallets mean that you should make sure to select an app with very strong security.

Decentralised apps

Decentralised applications, or dApps, are distributed software applications that use smart contracts to operate autonomously and run on a blockchain network, rather than running on a single device and using the internet.

They come in many different types. There are decentralised exchange (DEX) apps, decentralised lending apps, decentralised NFT markets, and decentralised games, to name a few.

All the apps reviewed on this page are centralised apps, meaning they are owned and operated by a central authority and run on the internet rather than the blockchain. However, the OKX app also acts as a portal to Web3 and can be used to access dApps such as decentralised exchanges.

Staking and savings apps

Some apps provide interest on crypto holdings, making them popular with long-term investors who want to earn some passive income on their coins. All you need to do is deposit your crypto into the app’s wallet or smart contract.

You may earn interest in the form of staking rewards if your app stakes your coins on your behalf to secure a blockchain network. There are also apps that provide crypto savings accounts, as they use your deposited crypto to fund loans and then use the profit they make from loans to pay you savings interest.

eToro, Coinbase, and Uphold all enable you to stake crypto. Meanwhile, OKX and CEX.IO offer both staking services and savings accounts. You will be able to opt into these services simply by navigating to the staking or savings section of the app and tapping the subscribe button for your chosen product.

Lending apps

Crypto lending apps provide a service to both those who want to borrow funds and those who want to earn interest by lending out their funds. You will be able to take out a loan, often using crypto as collateral, and then pay it back, plus the agreed interest rate.

Crypto loans are much easier to acquire than bank loans as you generally don’t need to go through financial checks or gain approval from an authority. Also, using crypto as collateral means you can borrow the funds you need without having to sell your crypto investments.

OKX and CEX.IO both enable users to take out crypto-backed loans. Users can also earn interest by letting their app loan their crypto out to other users.

How We Chose the Best Crypto Apps in United Kingdom

Here are some of the key criteria we considered when deciding which apps should make our top five list.

Cryptocurrencies available

The best crypto app should provide access to all the cryptocurrencies you want. If you only intend to trade Bitcoin and a handful of the most popular coins, then you could opt for an app with a smaller selection of cryptocurrencies that meets your other needs. eToro, for example, has fewer coins than some of its competitors but may be the best option for people who want to buy well-known cryptocurrencies on a user-friendly app with innovative features.

If, on the other hand, you might want to buy some newer or more obscure cryptocurrencies, it is better to opt for an app with a larger selection. Popular apps such as OKX offer hundreds of coins, which will likely cover everything you want to invest in.

We also looked into the trading pairs available on each app. You will be able to buy and sell crypto with fiat currencies on most apps. But when it comes to trading crypto, some apps (e.g. eToro) only offer fiat-crypto trading pairs, some (e.g. OKX) only offer crypto-crypto trading pairs, and some (e.g. Coinbase) offer both.

User experience

How an app feels to use is an important decision-making factor, especially if you are going to be spending a lot of time using your app. It should be intuitive and make you feel comfortable about managing your investments through it.

For beginners, this will likely mean picking a simple app that has a clear layout and is easy to navigate. You may prefer an app where actions can be performed with a couple of taps as they aren’t complicated by technical trading tools.

A satisfactory user experience for more advanced users will likely mean access to a range of intuitive, advanced tools and features. The speed and performance of the app are also key. If it lags or crashes, it isn’t much use for reacting quickly to changes in the crypto market.

Features and tools

Which features and tools are provided can vary greatly from one app to another. Apps aimed at beginners can be fairly stripped back, only providing basic features so as not to overwhelm users with technical tools that can be complicated to understand and use.

Apps aimed at traders will likely provide a range of trading tools, such as customisable advanced charts, technical indicators, and advanced order types. They may also offer features for different types of trading crypto, such as derivatives and margin trading.

Other features you may come across include recurring buys, wallet custody, savings and staking services, educational material resources, and tools for using strategies or robots. Some apps have developed their own innovative features, such as eToro’s CopyTrader and OKX’s NFT marketplace.

Fees

Many traders and investors want to find an app with low fees. There are many different types of fees, so you will need to consider and aggregate them all to find out which app is the cheapest to use. Some times you may have to pay fees that are low in one area but there are larger hidden fees in others. It always pays to weigh up all fees.

Deposit and withdrawal fees

Most apps charge a fee for deposits or withdrawals, or both. The amount of these fees may vary depending on your location and chosen payment method.

For example, CEX.IO charges United Kingdom customers a 1.49% fee for card deposits, up to 3.99% for Google Pay or Apple Pay, but no fee for Faster Payments bank transfers. Coinbase only accepts bank transfers in United Kingdom, which are free for deposits but carry a £1 fee for withdrawals.

The best app for deposits is eToro, where deposits can be made free of charge with any payment method. But eToro does charge a flat $5 withdrawal fee, regardless of the withdrawal method used.

Some apps support instant card purchases as well as or instead of deposits, and this could incur higher fees. OKX, for instance, charges a 1.99% fee for card purchases, and Coinbase charges a fee that varies depending on purchase size.

There could also be fees for depositing and withdrawing crypto. Many apps, like OKX, don’t charge for crypto deposits but charge a fee for crypto withdrawals.

Trading fees

Most apps charge a trading fee or commission. This is a fee that you pay every time you make a crypto purchase, sale, or swap with deposited funds, and it is usually charged as a percentage of your order size. For example, eToro charges a 1% fee every time you buy or sell crypto.

Many apps use a maker-taker fee model for trading fees. This means that makers (those who create liquidity by setting limit orders) will pay a different fee from takers (those who buy or sell instantly at prices set by market makers). These fees may also be tiered according to the size of your order, holdings, or daily trading volume.

For example, Coinbase maker and taker fees start at 0.4% and 0.6%, respectively, and can be as low as 0% and 0.05% respectively for users in the highest pricing tier. OKX, meanwhile, has the low trading fees, with regular users paying maker fees of 0.06% to 0.08% and taker fees of 0.08% to 0.1%. VIP users pay even lower fees.

Spread

The spread is the difference between the bid price from buyers and the ask price from sellers. The size of the spread can vary between different cryptocurrencies and change with volatility. Some crypto apps don’t charge a spread, while others may charge a spread instead of or on top of a trading fee or commission.

You won’t encounter spread fees on OKX, but you will on eToro. Coinbase, meanwhile, includes a spread in the price when you make a simple purchase, sale, or conversion, but doesn’t when you interact directly with the order book in the Trade tab.

Other fees

You may come across other types of fees on some apps. For example, if your account isn’t denominated in GBP, you may need to pay a currency conversion fee when you make a GBP deposit or withdrawal.

Some apps, particularly CFD trading apps, may charge overnight fees when you leave a position open overnight. In some cases, you could also encounter costs for account management and prolonged inactivity.

Payment methods

All the apps recommended on this page accept payment methods that are available to most United Kingdom users, as being able to make deposits and withdrawals easily is an important factor when finding a suitable app.

The number and variety of payment methods accepted vary between apps. Coinbase has somewhat limited payment options for United Kingdom users, as if you are using GBP, you can only use a bank transfer for deposits and a card for instant purchases.

OKX doesn’t accept deposits in fiat currencies, but you can make instant purchases with your card or through third-party payment providers using Apple Pay, Google Pay, and local payment methods. You can also buy crypto on OKX P2P, where a wider range of payment methods are available, including all the major United Kingdom banks, Skrill, Neteller, and PayPal.

eToro does support fiat deposits, and the accepted payment methods in United Kingdom are credit or debit card, bank transfer, Skrill, Trustly, and Rapid Transfer.

Security

We only recommend apps that provide strong security, as the bare minimum for a reliable crypto app is that it should keep your funds and personal information safe.

All of our top five apps keep the vast majority of users’ crypto in cold wallets. This means that most of the crypto is stored offline, where it isn’t vulnerable to hacking. The apps also all use strong encryption to secure important information, such as passwords.

Many apps offer further security features. Coinbase, for example, has an insurance policy for the portion of user assets held in hot wallets. The best apps will also enable you to set up extra levels of protection on your account, such as two-factor authentication, security questions, and address whitelisting.

Regulation and reputation

We only recommend apps that are regulated, as unregulated apps could be of poor quality or even be scams. In order to achieve regulatory approval, an app must meet certain standards of quality, security, and professionalism.

The best apps for United Kingdom users are ones that are regulated by the FCA or another regulatory authority that is recognised by the FCA. eToro and Coinbase are both FCA-regulated, while OKX is regulated by the Dubai authority VARA.

Gaining regulatory licences can help bolster the reputation of an app, but there are other things you could consider to ascertain whether an app is reputable. These could include how well known the brand is, who its partners are, how long it has been in operation, whether it has suffered any security breaches, and what its customers think. You can find out what users have to say about an app on forums and in online reviews.

Customer service

Having reliable customer service is important for an app, especially for new users who may require more support using the app. The best customer support is available round the clock through multiple channels, such as email, phone, and live chat.

All our recommended apps provide a help section or FAQ where you will be able to find answers to all the common questions. Some apps, like Coinbase and OKX, also have a Learn section, where you can find more in-depth educational materials on crypto and trading topics.

How to Use a Crypto Trading App in United Kingdom

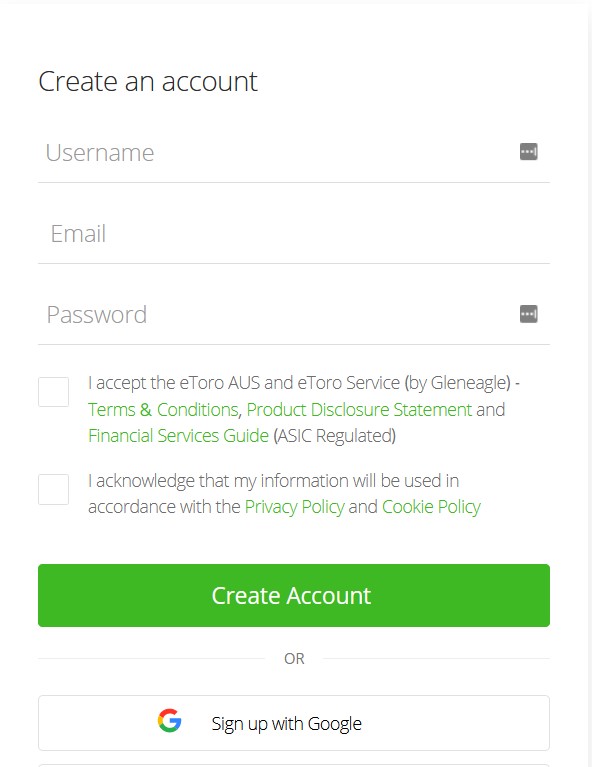

1. Open an account with a crypto app

Start by choosing a crypto app. You can find our top 3 recommendations at the top of this page, with our best being eToro. Click on one to go to the app website and then click the sign-up button. You will need to provide a few details to open any retail investor accounts, such as an email address or phone number and a password.

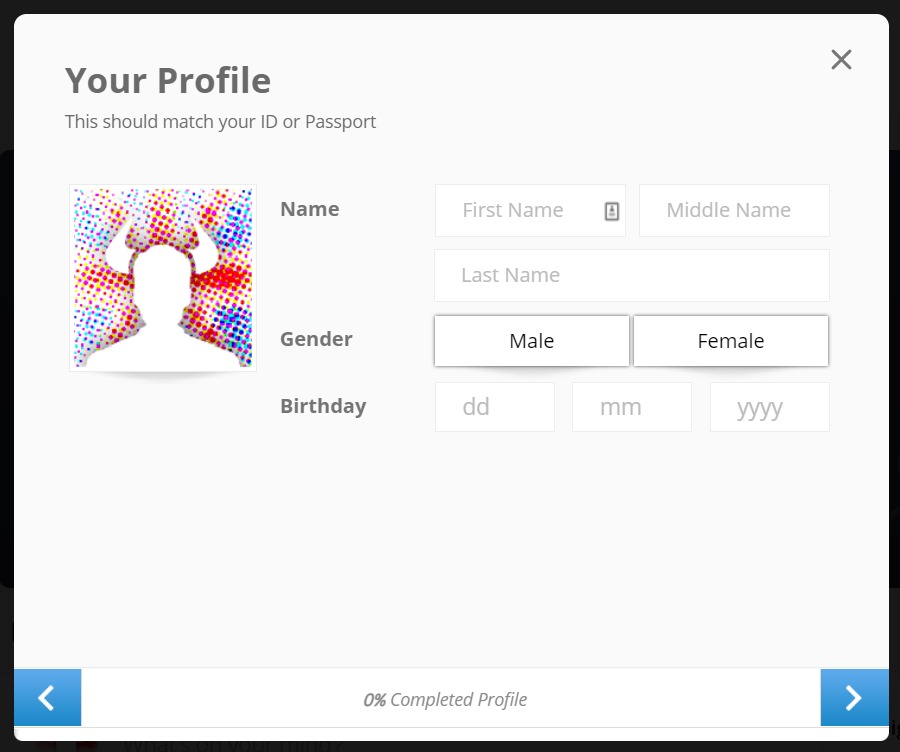

2. Verify your account

When creating an account with a regulated app, you will need to complete a Know Your Customer process. The first step will likely be verifying your email address or phone number with a verification link or code. You will then need to verify your identity, which you can do by uploading an image of your passport or driving licence. Some crypto exchanges or broker may also ask for proof of address, such as a utility bill or bank statement.

3. Make a deposit

Go to the deposit page of your app and tap the deposit button. Select GBP as the currency and enter how much you want to deposit. Choose which payment method you want to use. If making a card payment, you will need to fill in your card details. For bank transfers, you will be given the bank details for your app, which you should enter in your mobile banking app to make the transfer.

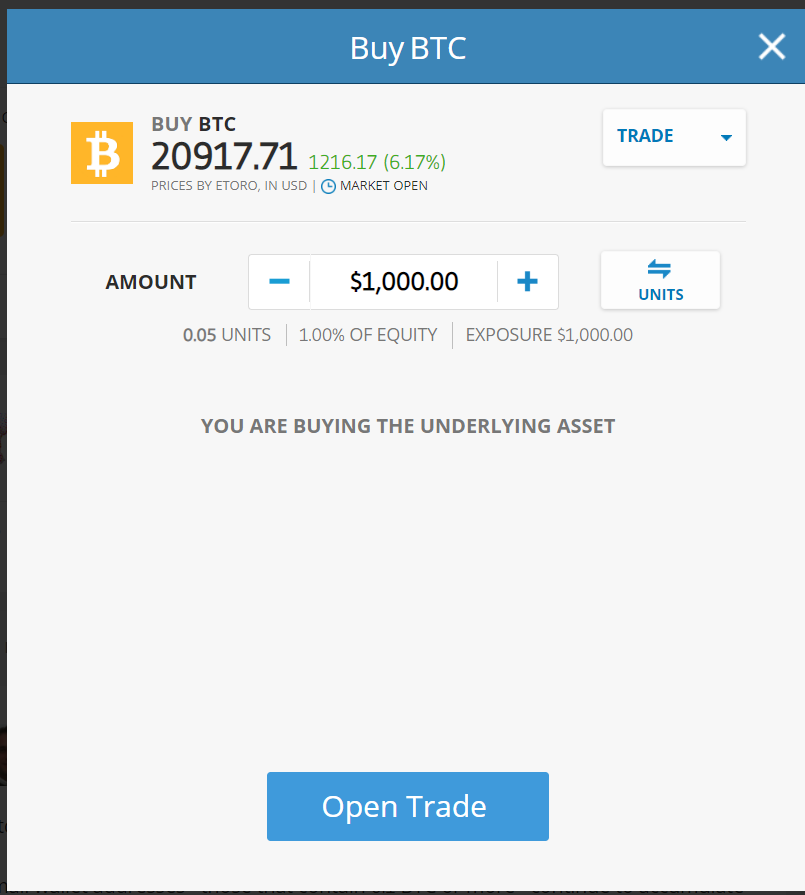

4. Purchase Cryptocurrency

Use the search bar in your app to look for the cryptocurrency you want to buy. Depending on which app you use, it may as simple as tapping the “Buy” button. On other apps, you will need to create a buy order, which you can set to market (buy immediately) or limit (buy once the coin reaches a certain price). Fill in how much you want to purchase and tap “Buy”.

Is Crypto Legal in United Kingdom?

The short answer is yes. Anyone is allowed to buy, sell, swap, and trade Bitcoin and crypto in United Kingdom. Although the United Kingdom government has informed consumers about the risks of dealing with crypto, it has never made any move to ban it. Retail trading of crypto derivatives, such as trading CFDs, futures, and options, is banned in United Kingdom, but it is perfectly legal to trade cryptocurrencies themselves.

Is Crypto Regulated in United Kingdom?

Cryptocurrencies themselves are unregulated in United Kingdom, which means that if something goes wrong with your crypto investment, you are unlikely to have access to the consumer protection offered by the Financial Ombudsman Service (FOS) or the Financial Services Compensation Scheme (FSCS).

Crypto asset businesses, on the other hand, are regulated in United Kingdom. This means that United Kingdom crypto businesses, such as crypto exchanges and crypto trading apps, are required to register with the Financial Conduct Authority (FCA) and comply with regulations relating to money laundering and counter-terrorist financing.

Do I Have to Pay Tax on Crypto in United Kingdom?

Crypto profits are taxed in United Kingdom. Whether you need to pay tax, what type of tax, and how much it will be will depend on the type of activities you engage in and how much you make from them. There is no tax for simply buying and holding crypto.

When you sell crypto for a profit, this triggers Capital Gains Tax, but you will only need to pay CGT if your total capital gains are above the tax-free threshold. Activities such as staking, lending, and DeFi could lead to either CGT or Income Tax, depending on the nature of the return.

Regardless of how much you make from crypto, you should report your crypto activities accurately to HMRC on your tax return to avoid penalties. You can find out more about how to get your taxes right in our Crypto Tax United Kingdom Guide.

Final Thoughts

Crypto apps make it convenient for anyone to buy and sell crypto from their smartphone, and there is a wide variety of apps available. This page has detailed some of the best ones available in United Kingdom. In deciding on our top picks, we tested a range of factors, such as security, fees, and features.

In conclusion, eToro is our top recommendation for United Kingdom users as it excels in all these areas and more. eToro is FCA-regulated, employs top-tier security practices, and has a transparent fee structure, including free deposits.

On top of this, eToro provides access to multiple other asset types, a virtual trading account, and a range of innovative features, such as smart portfolios, communicating with other users, and copy trading.

You can create a free account with eToro in a matter of minutes by clicking on the button below.

Review Methodology

We aim to give our readers all the information and guidance they need to enter the crypto world safely. To that end, we only recommend apps that we have thoroughly tested and that meet our standards for quality and reliability.

There are many different things that we assess when testing an app. These include registration, account funding, assets available, types of trading offered, fees, user experience, regulation, security, and support.

You can find out more about our processes on our why trust us and how we test pages.

Similar United Kingdom Guides

If you are in United Kingdom and want to know more about crypto, you may find the following guides useful.