The 10 Best Decentralized Exchanges for US Users

Since the fall of FTX, attention has shifted to decentralized crypto exchanges as people realise the risk of entrusting their crypto to platforms that aren’t regulated as strictly as traditional financial institutions.

Unlike their centralized exchange counterparts, decentralised exchanges allow people retain custody of their crypto asset right until the point of exchange. However, this doesn’t mean that they are fool-proof.

There are recorded events of common crypto scams that rob unsuspecting users of their crypto. This guide helps you avoid that.

Leveraging our years of experience in decentralised trading, we have put together this guide to walk you through the best decentralized exchanges in the cryptoverse. We will dive into each one, highlighting its pros, cons, and what makes it special.

By the end of this guide, you should know which decentralized exchanges are worth your time and have the confidence to begin using one.

Best Decentralized Exchanges in 2024

1. Uniswap – Best Overall Decentralized Exchange

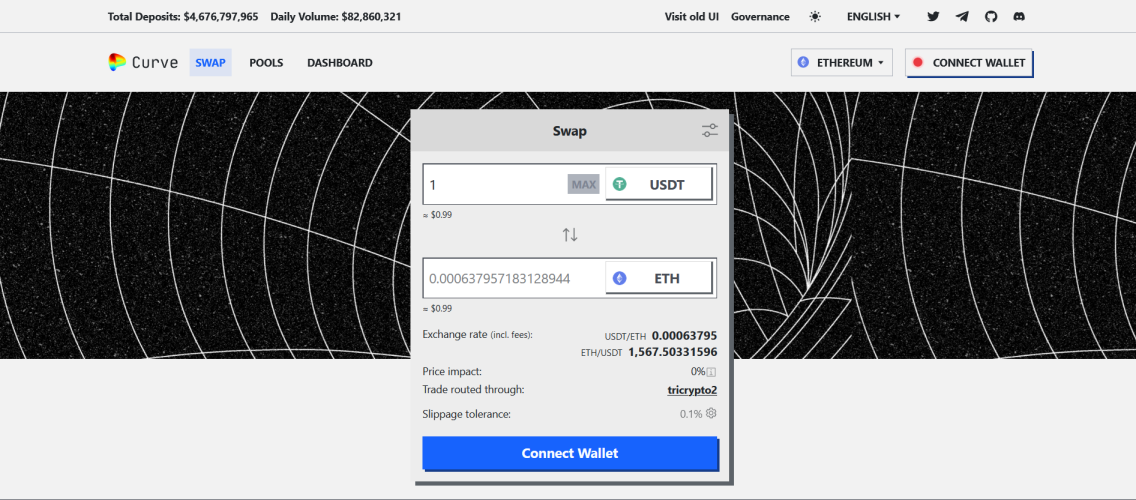

2. Curve Finance – Best Stablecoin Exchange

3. Pancake Swap – Best Decentralized Exchange on the Binance Smart Chain

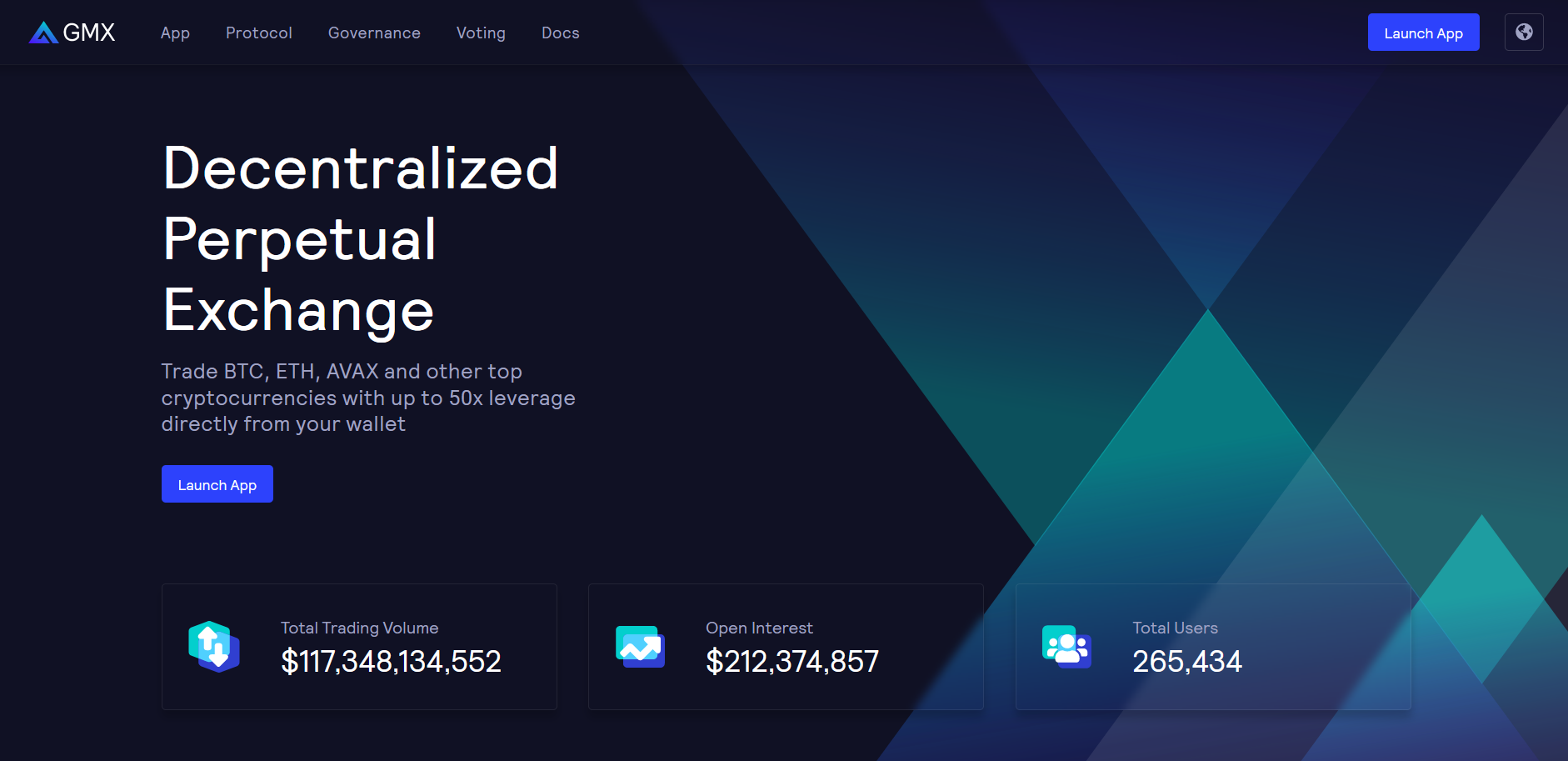

4. GMX – Best Perpetual Trading Exchange

5. Osmosis Dex – Best Interoperable Exchange

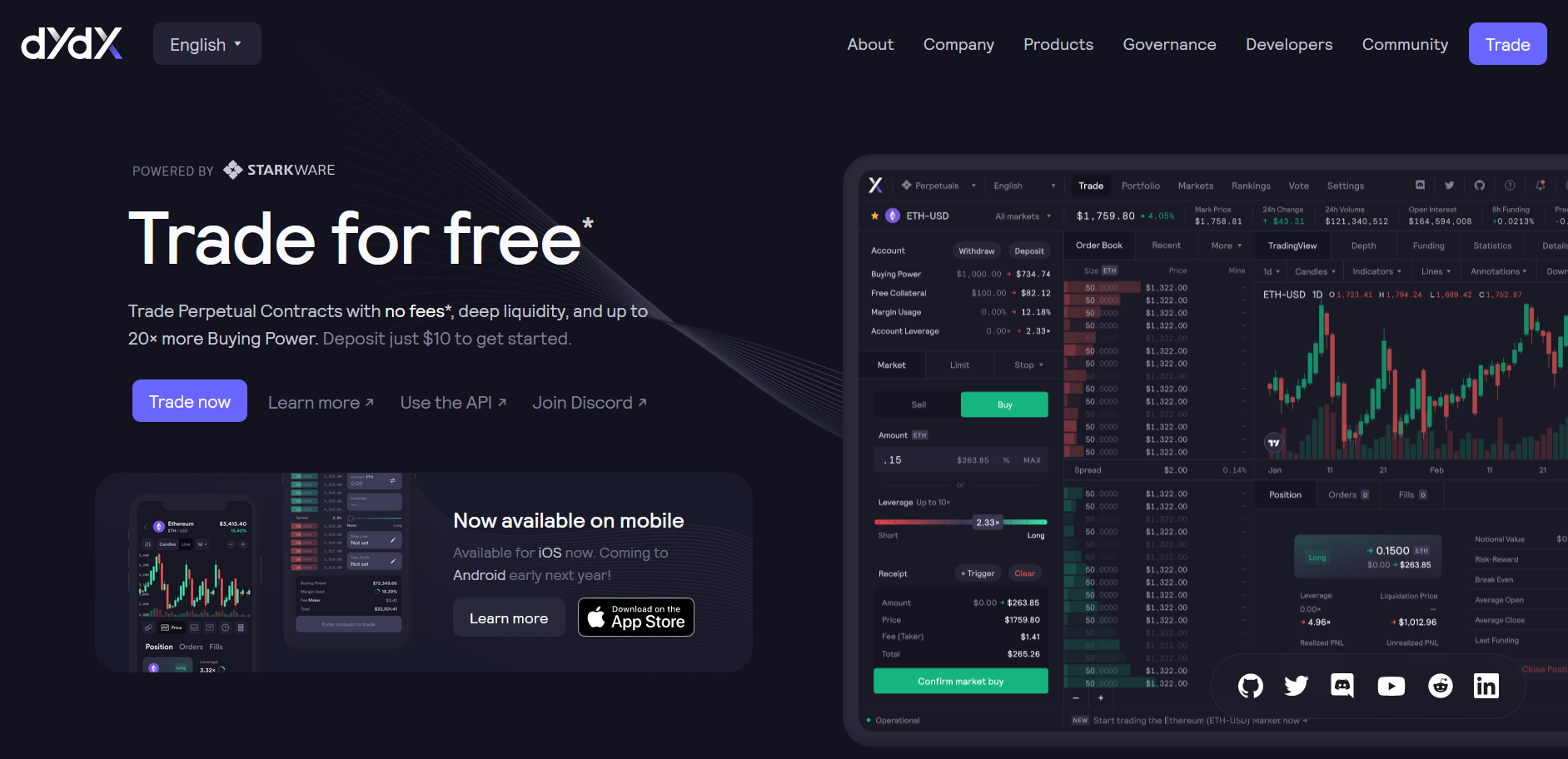

6. dYdX – Best Exchange with an Order Book

7. Sushiswap – Best Multi Chain Decentralized Exchange

8. Stargate Finance – Best Omnichain Exchange

9. Balancer – Best Exchange with Flexible Liquidity Pools

10. 1Inch – Best Decentralized Aggregator

The Best Decentralized Exchanges Compared

|

Exchange |

Blockchain Network | Total Locked Value (TVL) |

| Uniswap | 6+ | $3.9 billion |

| Curve Finance | 12+ | $4.62 billion |

| Pancake Swap | 3+ | $2.47 billion |

| GMX | 2+ | $617.37 million |

| Osmosis Dex | Osmosis | $163.15 million |

| dYdX | Ethereum | $339.00 million |

| Sushiswap | 24+ | $556.84 million |

| Stargate Finance | 8+ | $381.26 million |

| Balancer | 4+ | $1.35 billion |

| 1Inch | 2+ |

$6.79 million |

Our Top 10 Best Decentralized Exchanges Reviewed

1. Uniswap – Best Overall Decentralized Exchange

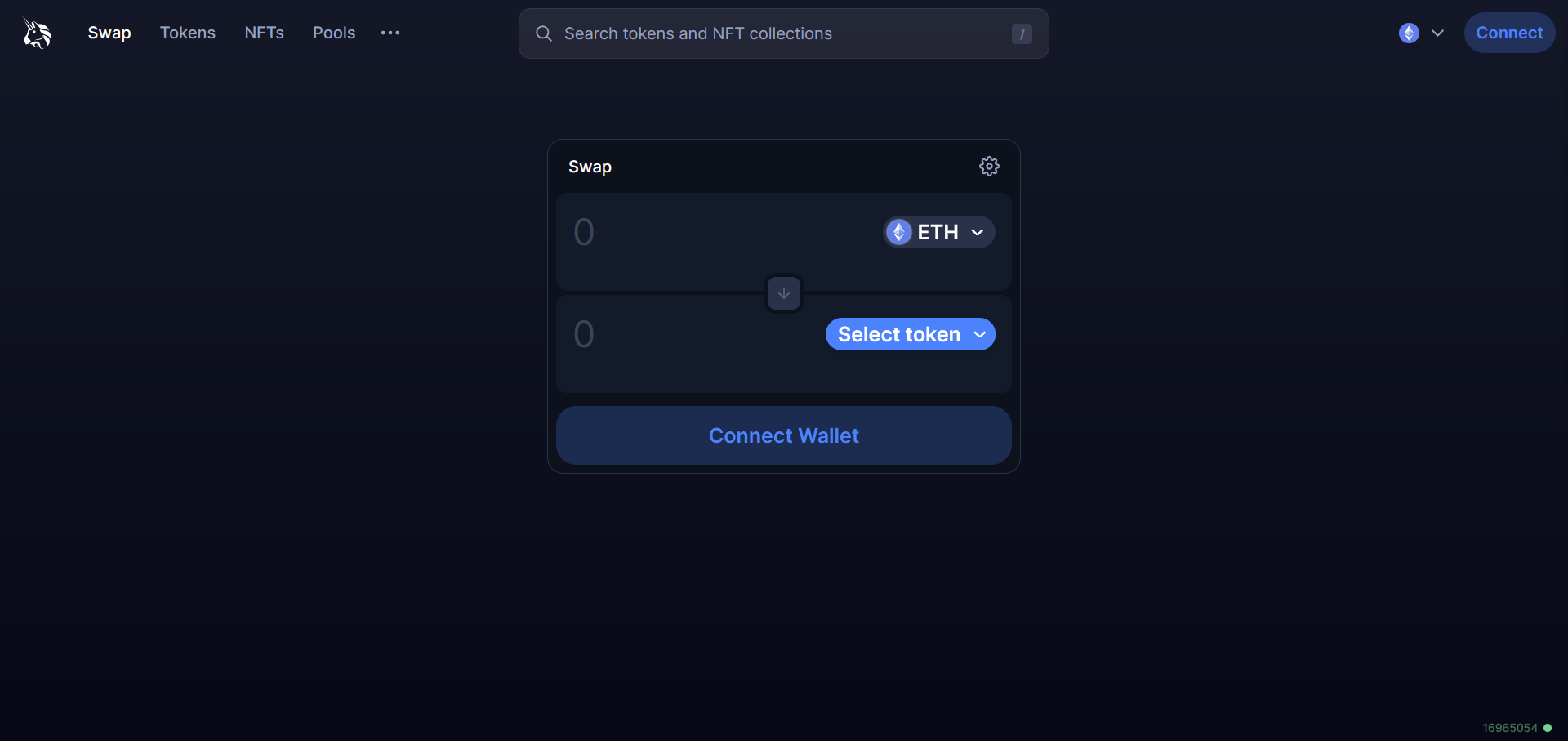

Uniswap is a popular decentralized exchange that started on the Ethereum network but has since expanded to five other blockchain networks including Arbitrum, Binance Smart Chain, Celo, Polygon, and Optimism.

This decentralized exchange (also called Dex) has come a long way from its beginnings in November 2018 to processing a total of $1.4 trillion, integrate with over 300 other dapps, trade NFTs, and serve as infrastructure for others to build on.

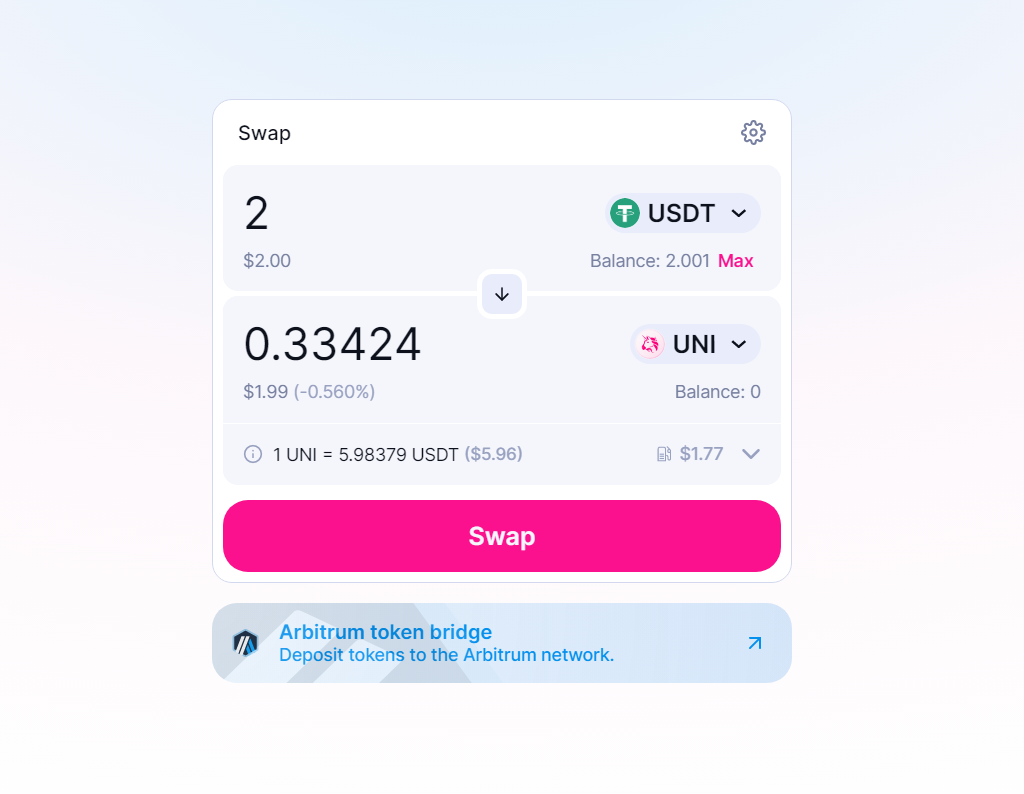

With Uniswap, you can swap between 100+ tokens, buy crypto using any of the integrated fiat onramps (like MoonPay), earn yields by providing liquidity to pools, and trade NFTs across multiple marketplaces, all while maintaining full custody of your assets.

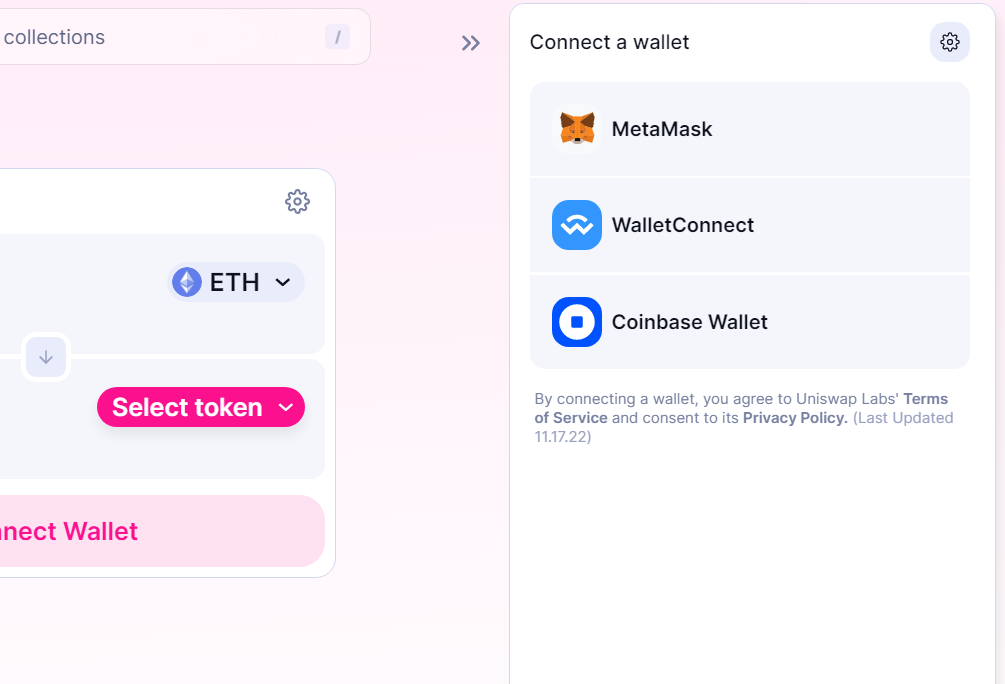

To use Uniswap, you’ll need a decentralized crypto wallet like MetaMask, Coinbase wallet, or any wallet that is wallet-connect enabled. You’ll need to have some crypto on your wallet beforehand, otherwise you’ll have to buy directly on the decentralized cryptocurrency exchanges.

Select the coins you wish to swap and click on the Swap icon. However, ensure that both coins are on the same chain. You can select the chain you wish to trade on at the top right of the screen. Also ensure your wallet is set to the same network.

The NFT section displays a list of popular collections and the cheapest prices across various NFT marketplaces.

Finally, you can earn yield by providing liquidity to the liquidity pools. Deposit tokens in equal proportions into any liquidity pool of your choice and earn passive income from crypto trading revenue.

Pros

-

Fully decentralized

-

Non custodial

-

No barrier to entry

-

Anonymous

-

Multichain

Cons

-

Not regulated

-

Risk of impermanent loss for liquidity providers

Features

-

Low Swap fees

-

No KYC

-

Decentralized liquidity pools

2. Curve Finance – Best Stablecoin Exchange

Curve Finance is the decentralized autonomous organisation (DAO) that manages the Curve Protocol. Curve is a decentralized automated market maker (AMM) that manages decentralized liquidity pools and allows people to swap between tokens in the pools.

Curve uses a method called the StableSwap invariance to govern its stablecoin pools. This method ensures minimum slippage when swapping and controlled price impact to the coin proportions within each pool.

Despite the protocol’s retro look, Curve’s AMM is cutting edge, making it the go to place for stablecoin swaps. Everyone from whales to institutions and even other protocols swap with Curve.

As such, it has some of the largest liquidity pools in crypto to support high trading volumes. For example, its 3pool, a liquidity pool containing the stablecoins USDT, USDC, and DAI has a total locked value of $436 million, while the ETHstEH pool, which contains ETH and stETH has a TVL of $1.75 billion.

Thanks to Curve’s decentralized nature, anyone can create a liquidity pool and determine the fees to charge for swaps while investors can add funds to the decentralized liquidity pools and earn a chunk of swap fees as revenue.

To use Curve, simply connect your decentralized wallet to the dapp. The protocol works with several wallets like MetaMask, Formatic, Coinbase wallet, Ledger Nano, and Phantom on 12 different blockchain networks.

Pros

-

Cheap swap fees

-

Decentralized

-

Anonymous

-

Non custodial

-

Multichain

-

Low slippage and price impact

-

Wide wallet support

Cons

-

Retro look might throw of new users

-

Low yield due to large pools

Features

-

Factory pools

3. Pancake Swap – Best Decentralized Exchange on the Binance Smart Chain

Pancake Swap is the biggest Dex on the Binance Smart Chain (BSC), although it has expanded into the Aptos and Ethereum ecosystems. Built around a pancake-loving Rabbit theme, this Dex claims to have been used by 1.6 million people who made 20 million trades in the last 30 days.

The Pancake Swap ecosystem is made up of an automated market maker, a Dex, and yield farms. The AMM governs swapping and balances tokens in liquidity pools. The Dex is the front for the AMM where users interface with the AMM, while the yield farms generate extra yields for liquidity providers.

With a market capitalization of $675 million, Pancake Swap stands out from several other Dexes by featuring limit orders which are useful when trading cryptocurrencies. Several early Dexes do not have limit order features, mainly due to technological constraints.

However, it is inadvisable to use the limit feature on taxed tokens, which are tokens that are charged a buy or sell tax. To get started with Pancake Swap, simply connect your decentralized wallet to the protocol through its website.

Remember to switch the network of your wallet to BSC, if you use wallets that support multiple blockchain networks. Swap fees are around 0.0000125 BNB ($0.00395) which is lower than most centralized exchanges.

Pros

-

Low swap fees

-

Easy to use

-

Decentralized

-

Anonymous

-

Wide wallet support

Cons

-

Limited to 3 networks

-

Many scam coins

Features

-

Limit orders

-

Yield farms

-

Raffle ticket promotions

4. GMX – Best Perpetual Trading Exchange

GMX is a decentralized leveraged trading platform on the Arbitrum network. It is the leading derivatives trading platform on its network with a total trading volume exceeding $117 billion and 256,000 active users.

We love GMX because it goes beyond the average Dex’s token swapping features to provide leveraged trading services and even limit and trigger orders.

You can choose which service you want by selecting which direction you wish to trade. You can choose either “Long”, “Short”, or “Swap”. The Swap option toggles the regular swap functionality at low fees (0.25%).

The Long and Short options toggle the derivatives trading service, allowing you to trade crypto perpetuals with up to 50x leverage. However, you are limited to trading ETH, BTC, LINK, and UNI.

When you’re not trading, you can earn part of the platform’s revenue by providing liquidity. Simply stake the platform’s native token, GMX, to earn up to 7% per year. GMX stakers earn 30% of the platform’s generated revenue.

You can also stake another platform token called GLP to earn 70% of the platform revenue which is about 25% yield per year.

GMX is available on the Arbitrum and Avalanche networks. You can get started with a decentralized wallet like the Coinbase wallet.

Pros

-

Easy to use

-

Leveraged for trading

-

Allows users to short cryptos

-

Low trading fees

Cons

-

Limited token selection

Features

-

Leveraged trading facilities

-

Staking pool

-

Insurance for staked tokens

5. Osmosis Dex – Best Interoperable Exchange

Osmosis Dex is a decentralized exchange that provides liquidity for an entire cosmos. This Dex lives in the Cosmos ecosystem of interconnected blockchain networks and acts as a liquidity layer for several blockchains.

It has a total locked value of $167 million, processes roughly $9 million in daily volume, and has powered over 1,000 interchain transfers.

With Osmosis Dex, you can swap between coins of virtually every blockchain in the Cosmos ecosystem by first bridging them to the Osmosis blockchain. Unlike bridging coins on other ecosystems, bridged coins are in their native form as all blockchains in the cosmos ecosystem are all IBC enabled.

You can also provide liquidity to the pools on the Dex for a yearly percentage yield by converting your token into “shares” that are entitled to earnings on every swap. You can then go a level deeper by bonding your shares for a period.

Within this period, your shares are locked, however, you earn higher yields. Most of the yields at this level are double digits (i.e. above 10% per year) with some going as high as 70%.

However, there is also the risk of impermanent loss due to fluctuating proportions and value of coins in the pools.

To use Osmosis, you’ll need a Kepler wallet, which is a decentralized, non-custodial wallet that allows you to interact with blockchains in the Cosmos ecosystem.

Pros

-

High yields

-

Simple user interface

-

Essential infrastructure to Cosmos

Cons

-

No yield farming

Features

-

Inter blockchain connectivity

-

Wallet staking

6. dYdX – Best Exchange with an Order Book

dYdX is a decentralized exchange on the Ethereum network that processes around $1.17 billion in transactions from over 334,000 daily trades. It has more than 25,000 active traders and is the 9th largest Dex with a market capitalization of over $361 million.

Unlike many other exchanges and DeFi apps, dYdX trades perpetual contracts. It is geared towards core traders who are not bent on owning coins, but are, instead, more focused on profiting from price action from buying short term crypto.

Nonetheless, dYdX remains an exchange as you can deposit tokens, trade them for others, and use leverage to amplify your buying power. The exchange also has an order book like those of centralized exchanges and retains a traditional feel.

The minimum trade size is $10 worth of any crypto you use. You also do not need to pay gas fees when you deposit to the platform as it uses a Layer 2 scaling solution called Starkware to minimise crypto gas fees and speed up transactions.

Note that dYdX is decentralized despite the need for users to “deposit” tokens. This deposit is simply you moving your tokens from Ethereum’s layer 1 network to the layer 2 network that the Dex uses, like bridging tokens.

Once your tokens have been bridged, you can begin trading. To use dYdX, you’ll need a decentralized wallet like MetaMask, Trust, Coinbase wallet, imToken, or any wallet that has the Wallet Connect feature.

Pros

-

Low gas fees

-

Quick deposit and withdrawals

-

Familiar traditional feel

-

Leveraged trading

Cons

-

No yield farms

Features

-

On-chain order book

-

Gasless trades

-

Mobile app

7. Sushi – Best Multi Chain Decentralized Exchange

Sushi is a multichain Dex that trades over 400 tokens on 19 blockchain networks. The exchange has logged a total trading volume of about $315 billion, over 31,000 total pairs, and about $689 million in liquidity.

We love Sushi because it is available on every major blockchain network. This Dex has made more strides towards multichain availability than probably any other. You can swap between tokens on different blockchains in one bundled transaction, a feat that most Dexes have not yet achieved.

Swap fees are cheaper than centralized exchanges at approximately $0.0497 per trade. Due to price impact and the mechanics governing the balance between tokens in liquidity pools, you could end up getting slightly more tokens than you would normally get when you swap. However, this is more of an observation than a feature.

You can also earn returns by providing liquidity. Yields start from 0.28% and go up to 50% per year.

To begin using Sushi, connect your decentralized wallet to the exchange and select a network you’d like to use. Ensure that the network chosen on the exchange is the same with the one selected on your blockchain wallet, especially if you use wallets like Metamask.

Pros

-

Decentralized

-

Available on multiple blockchain networks

-

Easy to use

-

Anonymous

-

Low fees

Cons

-

Expensive cross chain swaps

Features

-

Cross chain swap functionality

-

Multichain availability

-

Wide wallet support

8. Stargate Finance – Best Omnichain Exchange

Stargate is an omnichain transfer protocol that moves liquidity between various blockchain networks. It is the next step in cross-chain technology that allows tokens to be moved natively between chains.

It does this by maintaining liquidity pools on the networks it supports and using them to facilitate instant transfers. So far, the Dex only supports stablecoins like USDT, USDC, DAI, LUSD, and FRAX.

In essence, you can swap native USDT on the Ethereum network for native USDC on Binance Smart Chain in a single transaction. Other Dexes and protocols can also access Stargate for the same purposes.

Cross-chain swaps aren’t a new thing, however, they can be expensive and involve several steps. For example, cross chain swaps on Sushi may cost $120, but with Stargate, it costs a measly $0.01 and involves only one step.

As of writing, the Dex has $366 million worth of locked value, processes 117,000 transactions per week worth about $256 million.

To begin using Stargate, you’ll need a decentralized wallet like MetaMask, Coinbase wallet, or a wallet with the Wallet Connect feature. Remember to align the networks on the exchange and on your wallet when swapping.

Pros

-

Native cross-chain swaps

-

Cheap cross-chain swaps

-

Easy to use

-

Anonymous

-

Decentralized

Cons

-

Only swaps stablecoins

-

Only supports 8 blockchain networks

Features

-

Omnichain operability

-

Yield farms

-

Community-owned liquidity pools

9. Balancer – Best Exchange with Flexible Liquidity Pools

Balancer is an automated market maker that helps people and protocols manage their liquidity. This AMM is different from others because it separates its swapping functionality from its AMM logic, resulting in a protocol that allows people to apply custom rules to their liquidity pool designs.

Traditional liquidity pools contain two tokens that are balanced using the constant product formula. However, liquidity pools on Balancer can contain more than two tokens, implement custom trading rules, and swap between exotic coins without needing to pair with a major token or ETH.

The Balancer Dex is built on this AMM protocol. It connects to the liquidity pools on the backend and swaps between their tokens. The Dex is available on the Ethereum, Polygon, Arbitrum, and Gnosis networks.

Trading fees can be quite high on the Dex. We found that swapping $399 worth of ARB for USDC cost about $10.

When you’re not swapping, you can earn revenue by providing liquidity to the pools on the protocol. The annual percentage return is displayed near the pools and ranges from 0.4% to 32%.

To begin using Balancer, connect your decentralized wallet like Tally or MetaMask.

Pros

-

Flexible pools mean more swap options

-

Easy to use

-

Simple interface

-

Liquidity farms

Cons

-

High swap fees

Features

-

Flexible liquidity pools

10. 1Inch – Best Decentralised Aggregator

1Inch is a decentralized exchange and aggregator that provides access to hundreds of Dexes on various networks. While the exchange has swap capabilities, it does not possess its own market maker, which is what houses liquidity pools.

Instead, it scans several AMMs on the 8 blockchain networks it operates on and presents the best possible price for any two tokens. It also splits transactions across multiple Dexes to get the best price possible.

Transaction fees are around 0.114 GWEI ($0.051) per transaction. You can also run p2p transactions where other 1Inch users can be counterparties to your trades.

As of writing, the aggregator is connected to 358 liquidity sources, has processed over $282 billion worth of trades for over 4.4 million unique wallets. It also has a limit order protocol that allows you to place limit orders. However, this protocol is partly centralized and requires that funds remain in your wallet until orders are triggered.

To begin using 1Inch, click on the “Connect Wallet” icon. Choose your network from the list and select a wallet from the list of available options. You can also download 1Inch’s mobile wallet to use the aggregator on the go.

Pros

-

Gets the best exchange price available

-

Easy to use

-

Wide coin selection

Cons

-

No native AMM

Features

-

Aggregation features

-

Limit order protocol

-

Liquidity pools

-

P2P transaction capabilities

What is a DEX?

A decentralized exchange (Dex) is an exchange that primarily operates on a blockchain and allows people to trade tokens in a decentralized way while retaining custody of their funds.

The primary differentiator between centralized exchanges and top decentralized exchanges is that there is no middle man or organisation running a decentralized exchange. Users do not need to entrust their digital assets to middlemen by depositing it in a “crypto trading account”.

Instead, crypto assets remain in the users’ personal wallets throughout the entire process until they swap it for other digital assets.

To achieve this, Dexes are made up of smart contracts that run perpetually once deployed on a blockchain network.

These contracts contain the code that runs the safest cryptocurrency exchanges, and because they are open source, anyone can view the code to ensure that it is secure and that the best decentralized crypto exchanges do what they claims.

Types of Dexes

There are three main types of Dexes. They include Automated Market Makers, Order Books, and Aggregators.

Automated Market Makers (AMMs)

An Automated Market Maker (AMM) is a type of decentralized exchange that does what traditional market makers do: add depth and liquidity to the market to facilitate instant trades.

The proliferation of decentralized finance requires Dexes to be able to swap tokens immediately. To do this, there must be liquidity, vis-a-vis tokens ready to be traded at any time to facilitate decentralized trading.

To achieve this, the AMM maintains liquidity pools that are made up of at least two tokens in a specified proportion to each other both price and volume wise. When traders need to swap between the two tokens in a pool, they simply pay token A and receive the dollar equivalent of token B.

AMMs are made up of these liquidity pools and an algorithm (or robot) that quotes exchange rates between tokens as well as maintains the initial proportions between the tokens in various pools.

AMMs are the most popular types of decentralized exchanges in crypto as it provides the on-demand liquidity needed to rival the efficiency of centralized exchanges.

Also, because everything is decentralized, the liquidity pools rely on other people to deposit their tokens into it to provide the liquidity. The AMM then rewards these depositors, called liquidity providers or LPs, with a cut of the trading fees it charges.

On one end, people make money from providing liquidity, and on another, people trade instantly, thereby creating a sustainable model for this decentralized exchange.

Order Book Dexes

An order book Dex is one that facilitates trades using order books like those found on centralized exchanges. These order books usually contain a list of open orders on both the buy and sell sides.

The exchange then compares buy and sell orders and initiates swaps on matching orders.

Because this type of Dex uses order books to match buyers and sellers, it usually does not rely on liquidity pools as much as AMMs, which could sometimes lead to liquidity shortages. Some get around this by combining order books with liquidity pools.

Also, order books can either be on-chain or off-chain. On-chain order books store open trade data on its blockchain and are often found on layer2 networks that provide higher throughput.

Off-chain order books, on the other hand, are run on centralized servers while the swaps are carried out on-chain. This once made them faster and cheaper than on-chain order books, however, the rise of high-throughput networks has shifted focus back to on-chain order books.

Decentralized Exchange Aggregator

Dex aggregators or exchanges that do not have AMMs or order books. Instead, they connect to liquidity pools on other Dexes and AMMs and allow users to access them from the comfort of one interface.

Some powerful aggregators can split trades between multiple liquidity pools or route trades through multiple pools to enable swaps between exotic pairs that do not outrightly have their own pools.

Aggregators are great for users who wish to find the best prices for their trades, which is why platforms like 1Inch are quite popular.

DEX vs CEX

A Centralized exchange and decentralized exchanges allow users to trade tokens. However, their key differences lie in how they go about this.

Centralized exchanges are run by companies. They act as an intermediary between buyers and sellers. They have central servers, provide liquidity themselves, and store their tokens in vaults that are controlled by a central authority, the company.

The exchange also takes care of security, availability, and throughput. Customers need to create accounts with them and deposit their funds in them.

The upside to centralized exchanges is that their services are usually quick and seamless, and they can be better regulated by authorities.

Top decentralized exchanges, on the other hand, are not run by companies or intermediaries. They are run by immutable code on blockchain networks. The best decentralized exchanges inherit the blockchain’s security, so developers do not have to worry about providing security beyond the smart contract level.

Because these decentralized exchanges are run by code, there is no need for intermediate companies to manage them. As such, liquidity is provided by people who deposit their funds into liquidity pools. The decentralized exchange shares revenue from trading fees with these liquidity providers to incentivise them to keep their funds in the pools.

Decentralized exchange users retain custody of their tokens at all times. They do not need to deposit into accounts or pass KYC requirements.

The upside to decentralized exchanges is that the cost of trading is much lower as there are no servers or liquidity to manage. It is also usually much easier to set up than centralized exchanges.

Latest DEX News

- 1inch price prediction as 1INCH surges 16% to multi-week highs

- Solana-Based Crypto Exchange Raydium Proposes $2M Bug Bounty Fund

- Sushi Swap CEO Says He No Longer Feels ‘Inspired’ Amid U.S. Regulators’ Crypto Crackdown

How to Trade Crypto Using a DEX - Step-by-Step Tutorial

Some decentralized exchanges require extra steps to trading, like bridging assets, however this guide covers the basic steps required by all cryptocurrency exchanges that are decentralized.

1. Download a Decentralized Wallet Application

To use any Dex, you’ll need to first get a decentralised wallet. There are various options on the market, but MetaMask and Coinbase Wallet are two great and widely used wallets. We used MetaMask for this guide. Navigate to the wallet website and add the extension, or download the app.

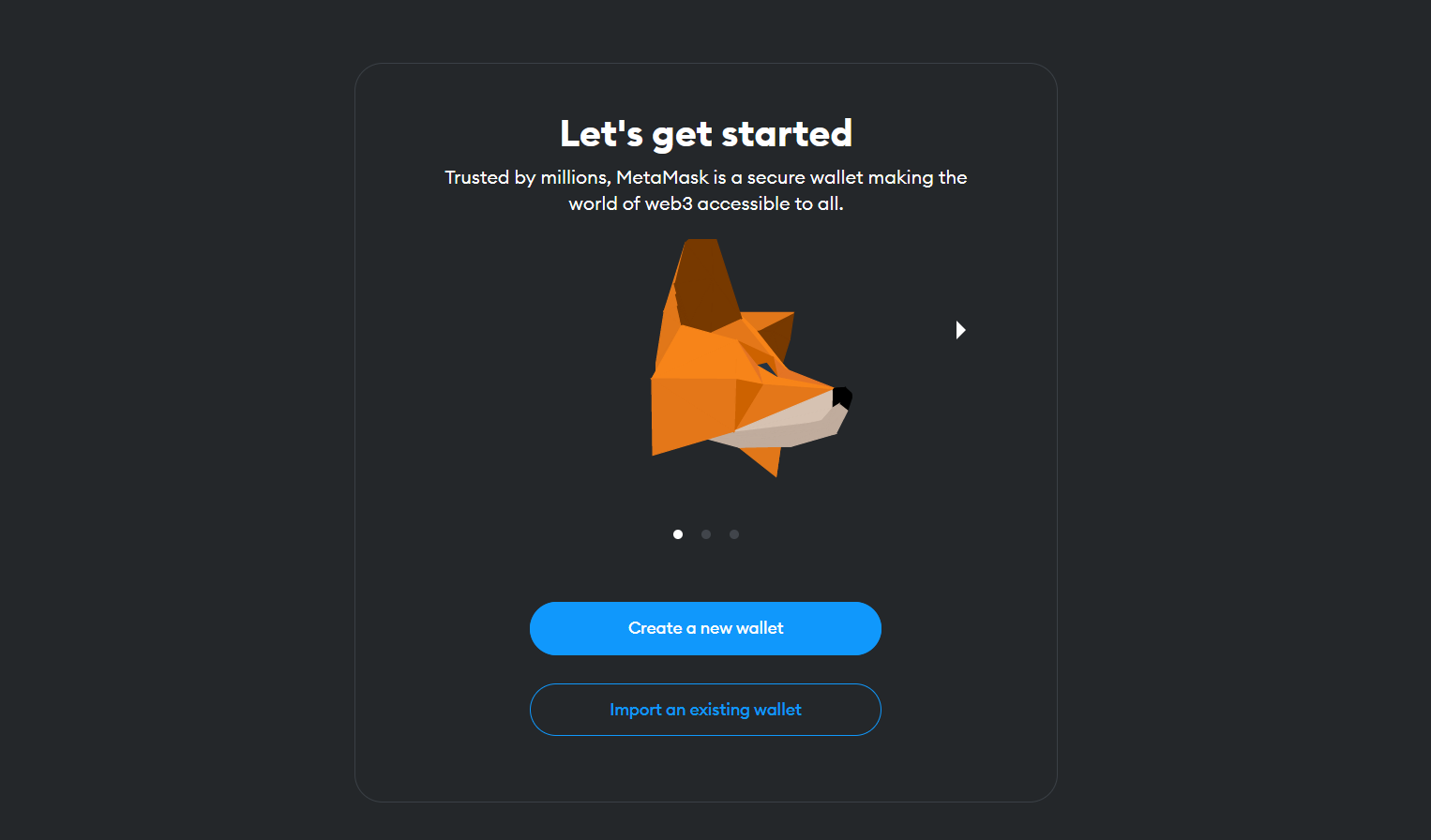

2. Create a Wallet

This part is important as it could determine how secure your wallet is. When creating a wallet, you’ll be given a seed phrase. Write this down and keep it offline at all times. It is advisable to write it in multiple places.

3. Navigate to your Decentralized Exchange

You can use any decentalized exchange you want, but your decision will usually be guided by the blockchain network you’re on and the tokens you wish to trade. To avoid scams, use data sources like Coingecko to get the correct web address of your Dex. Avoid using a Google search.

4. Connect Your Wallet

There is usually a “Connect Wallet” icon at the top right corner of every decentralized exchange. If you do not see one, then there will be an Launch dApp button somewhere visible. Launch the dapp and connect your wallet. You’ll need to sign a transaction the first time you connect, and that’s fine.

5. Swap Your Tokens

Once you have connected your wallet, you can select the tokens you wish to swap, input the amount you wish, click Swap, and approve the transaction in your wallet.

Final Thoughts on the Best Decentralized Exchanges

We explored the best decentralized exchanges in the crypto industry and chose Uniswap as our overall best because it is the most capitalized, has won the trust of both retail and institutional users, and is available on several blockchain networks.

Nonetheless, all the cdecentralized exchanges on our list are good options. We also included diverse types of exchanges for various needs. For example, if you wish to trade perpetuals, GMX is your go to cryptocurrency exchange.

On the other hand, if you wish to trade crypto on an exchange with a traditional feel and an order book, then dYdX is more ideal.

The best decentralized exchange for you will also depend on the blockchain of your choice. While many of these Dexes are multichain, some are more available on several chains than others. Sushi, for example, has the widest reach among our list and can facilitate cross chain swaps.

Methodology - How We Picked the Best Decentralized Exchanges

The decentralized exchanges we covered in this guide were chosen through rigorous research and reviews. We paid attention to security, transparency, reputation, coin selection, crypto support, and competitive edge.

The decentralized exchanges listed are the best we found in the various categories we listed them. For example, we listed 1Inch as the best aggregator because it connects to various decentralized exchanges to get the best price among them.

Check out our why trust us and how we test pages for more information on our testing process.