The 16 Best New Cryptos to Buy in 2024

New cryptocurrencies present opportunities for growth and potential returns as the burgeoning ecosystems they belong to create value. And while most crypto coins do not perform well, there are those that beat expectations and return great profit for their holders.

This guide explores the latter, the best new cryptos that have the greatest potential to outperform their peers. On this page, we dive into 18 new crypto coins that show immense potential for growth and gains.

We explain what crypto world ecosystems they power, what the ecosystems do, what makes them stand out, and where you can get them.

Best New Cryptocurrency Coins to Buy in 2024

- Poodlana ($POODL) – Best Lifestyle-Inspired Solana Memecoin

- Solciety ($SLCTY) – Best Politically-inspired Memecoin

- BitBot ($BitBot) – Best New Crypto Trading Bot

- Bitcoin Dogs ($0DOG) – Best Bitcoin BRC-20 Token

- Memeinator (MMTR) – Best New Memecoin Community

- Metacade (MCADE) – Best New Gaming Hub

- Arbitrum (ARB) – Best Layer 2 Network

- Radiant Finance (RDNT) – Best Crosschain Lending Cryptocurrency

- Optimism (OP) – Best Optimistic Rollup Cryptocurrency

- Aptos (APT) – Best Layer 1 Cryptocurrency

- Mute (MUTE) – Best ZK Rollup Decentralised Exchange

- Pepe (PEPE) – Best New Memecoin

- Camelot (GRAIL) – Best New Composable Decentralised Exchange

- Bitget (BGB) – Best New Centralised Exchange

- Arcadeum (ARC) – Best New Crypto Gambling Cryptocurrency

- Gala Games (GALA) – Best Relaunched Gaming Studio

The Best New Crypto Coins to Buy Now Compared

| Cryptocurrency | Category | Market Capitalization | Number of Tokens | Where to Buy |

| Poodlana ($POODL) |

Memecoin |

None yet |

1 Billion |

|

| Solciety ($SLCTY) |

Memecoin |

None yet |

10 Billion |

|

| BitBot (BITBOT) |

Utility |

None yet |

1 Billion |

|

| Bitcoin Dogs ($0DOG) |

Gaming |

None yet |

900 million |

|

| Memeinator | Community | None yet | 1 Billion | Buy MMTR |

| Metacade | Community | $19 million | 2 billion | Buy MCADE |

| Arbitrum | Layer 2 | $1.40 billion | 10 billion | Buy ARB |

| Radiant Finance | Crosschain Lending | $78.55 million | 1 billion | Buy RDNT |

| Optimism | Layer 2 | $784.56 million | 4.2 billion | Buy OP |

| Aptos | Layer 1 | $1.48 billion | 1 billion | Buy APT |

| Mute | Dex | $20.65 million | 40 million | Buy MUTE |

| Pepe | Memecoin | $652.10 million | 420 trillion | Buy PEPE |

| Camelot | Dex | $14.70 million | 100,000 | Buy GRAIL |

| Bitget | Centralised Exchange | $690.15 million | 2 billion | Buy BGB |

| Arcadeum | Gambling | $108,824 | 10 million | Buy ARC |

| Gala Games | Gaming | $587.23 million | 24.3 million | Buy GALA |

A Closer Look at the 15 Best New Crypto Coins to Invest in

Poodlana (POODL) – Lifestyle-Inspired Solana Memecoin

In a sea of flat dog-inspired memecoins with no edge, Poodlana stands out as the creme de la creme of lifestyle, fashion, and class by redefining what it means to be fabulous in the digital age.

Why invest in POODL?

According to a news report from Coindesk, 80% of memecoins’ price growth occurs during Asian trading hours, making the Asian market vital to their success.

POODL is inspired by the Poodle dog breed, the third most popular breed in the Asian region. Considering that most of the strongest memecoins on Solana are tied to real-world narratives, the project can create a strong narrative by keying into the region’s love for the Poodle breed.

Crypto ranking data shows that memecoins popular in Asia tend to perform well globally and reach million-dollar market capitalisations. Some examples are Peipei ($78 million market cap), Biaoqing ($12.97 million market cap), and KFC ($195 million market cap).

By differentiating itself as a high-class memecoin for the fashion elite based on a popular dog breed, POODL can lock into a popular narrative and achieve breakout growth.

Risks in investing in POODL

Most memecoins that try to start (or key into) a popular narrative eventually fail. POODL’s success relies largely on its positioning as a high-class memecoin that is a step above the rest and its fair launch. Like most memecoins, it has no utility and is a risky venture.

POODL has a total supply of 1 billion tokens, 50% of which will be offered for sale in the 30-day presale event starting on July 3rd. After the presale, the token will be listed on Raydium within 60 minutes of the presale close. All tokens will be unlocked and hit the market simultaneously, making the next 30 days the only time investors can get their hands on the token before launch.

To participate in the presale, visit the Poodlana website.

Solciety ($SLCTY) – Best Politically-inspired Memecoin

Solciety is a memecoin project pushing beyond the norm to create a community for all degens. The coin leans into the PolitiFi narrative by presenting itself as an on-chain political party for all memecoin lovers focused on gains, not policies.

Why invest in Solciety?

Memecoins thrive on attention and are built around narratives—the more relevant the theme, the more attention the memecoin garners. Politics is a prominent narrative this year as US elections approach, and Solciety being the first memecoin heralding the political party meta, enjoys first mover advantage.

The project stands on the proven success of Political tokens like Donald Tremp and Joe Boden but differs from them in that it does not lean toward one party but creates a community for everyone.

Furthermore, the project is built on Solana and enjoys the network’s speed, scalability, and growing user base.

Risks in Investing in SLCTY

Like all memecoins, SLCTY risks performing admirably or failing spectacularly. Investors also risk a lack of longevity as most memecoins lose the greater part of their values after the hype around their narrative dies down.

SLCTY’s presale launched on 18 June, and will run for 30 days offering 3 billion tokens to early investors. Visit the Solciety website to participate in the presales.

Bitbot (BITBOT) – Best Crypto Trading Bot

Bitbot is a crypto trading bot that allows you to trade cryptos on-chain using simple text instructions on Telegram. The bot is part of a rising trend of people using bots with instant execution speeds to keep up with institutional traders.

These bots are usually integrated with the Telegram messaging platform, allowing users to control their trading activities using simple commands. Because of their ease, efficiency, and speed, traders can use them to uncover and buy tokens before they launch on major exchanges.

Why invest in Bitbot?

Bitbot offers features that place it ahead of other trading bots. The most pertinent is its emphasis on decentralization. Most Telegram bots hold on to their users’ private keys, creating an attack vector.

We saw this happen with popular bots like Unibot which was hacked in October 2023. The attacker could drain funds from connected wallets because the platform stored its users’ private keys.

Bitbot uses a completely decentralized structure to ensure users are always in charge of their tokens.

Risks in investing in Bitbot

While the bot has utility, the success of its token depends on the company’s ability to attract and retain users, which is usually easier to accomplish during a bull market than a bearish one.

2024 is expected to be bullish thanks to Bitcoin’s halving, however, interest beyond the bull season is yet to be determined.

Bitbot has a total supply of 1 billion tokens, 30% of which will be sold in an upcoming presale event. This presale includes a competition that will reward participants with up to $100,000. To stay current on the presale, visit the Bitbot website.

Bitcoin Dogs ($0DOG) – Best Bitcoin BRC-20 Token

Bitcoin Dogs’ native token, $0DOG, will launch as the first-ever ICO on the Bitcoin blockchain. Thanks to cutting-edge Bitcoin Ordinal technology, Bitcoin Dogs is pushing the boundary of what is being built on the Bitcoin network.

By combining memecoins, NFTs, and Ordinals, this project aims to go where none has gone before along with all who dare to run ahead of the pack. Given the industry’s love for breaking new milestones, this project will attract the interest of people within and outside the Bitcoin community.

Why invest in Bitcoin Dogs?

Bitcoin Dogs keys into strong crypto narratives like BRC-20 and the Bitcoin halving that could place it in investors’ sights, and allow for innovation and significant upside; several BRC-20 projects that have launched have garnered traction from investors and Bitcoin enthusiasts.

Bitcoin Dogs has gone further than most other projects to build the first Bitcoin-native gaming ecosystem with tokens, a planned NFT collection, and even games further down the line.

Bitcoin on-chain metrics data from Dune Analytics show a significant increase in transaction count on the blockchain that started close to the end of January 2023, when Ordinals was launched.

Higher volumes combined with the Bitcoin halving in April 2024 could catalyze significant growth for the network and its most promising projects, like Bitcoin Dogs.

Risks in Investing in Bitcoin Dogs

Bitcoin Dogs is a new project attempting a feat that has never been done before. As such, there are bound to be obstacles that are novel to this project, and a history of token launches shows that plans are hardly ever without hiccups.

$0DOG will be the native token of the Bitcoin Dog ecosystem. It has a maximum supply of 900 million units, 90% of which is allocated to the presale. This means that investors will get the bulk of tokens, making this as close to a fair launch project as possible.

To join this project early, head over to the Bitcoin Dogs website.

Memeinator (MMTR) – Best New Memecoin Community

Memeinator is a memecoin with a twist. While other memecoins adopt an animal theme, either a dog or frog, Memeinator has chosen to adopt themes from the wildly popular Terminator series. It features terminator dogs that have traveled back in time to dominate the meme market.

Why invest in Memeinator?

In the memecoin space, virality is the difference between success and failure. Memeinator has employed innovative marketing strategies, an engaging story, and an upcoming suite of products to keep its growing community engaged.

Despite the uncertainty of the memecoin space, Memeinator has displayed the potential to create a community of loyal supporters by offering innovative rewards. One of which is a trip to space on the Virgin Galactic, worth a whopping $250,000.

In the future, the MMTR token will be the key to unlocking the ecosystem which will include exclusive NFTs and an action game.

Risks in investing in Memeinator

Big plans and hype are common tools that memecoins employ to get people onboard, and while Memeinator is making strides, it is still untested. Most memecoins fail, and there is a possibility that Memeinator will as well.

MMTR has a maximum supply of 1 billion tokens, 62.5% of which is on offer in the presale which is currently ongoing. This is suitable as most of the supply will be in the hands of the public, making it less prone to manipulation.

To join the presale, head over to the Memeinator site.

Metacade (MCADE) – Best New Gaming Hub

Metacade is a hub that is built to foster community among the crypto space game builders, players, reviewers, bloggers, and enthusiasts. It stands out by providing a holistic gaming experience to everyone involved.

Why Invest In Metacade?

Although still new, this crypto project platform will integrate with several top-tier blockchain technology games so that players will be able to access their favorite games from a unified dashboard. These integrations will also allow Metacade to publish and update rankings for gaming leaderboards across several titles.

The platform will also feature a trending section that will display the trending or most played games so newbies can join games with vibrant communities and a review section that will allow players to write reviews of their gaming experience. This will be a useful feedback source for game builders.

Finally, with Metacade, players will get access to GameFi strategies to help maximize their in-game earnings as financial mechanics are a standard part of most blockchain games.

Risks In Investing In Metacade

Metacade has several tasks to complete in the way of development and integration if it wishes to deliver on its claims of a holistic gaming community with integrations in top gaming cryptos.

It is difficult to predict how the market and crypto space will react to news of this crypto project’s developments.

The Metacade platform is powered by the MCADE token which has a total supply of 2 billion tokens at a fully diluted valuation of $49 million. Compared to other social platforms like Decentralised Social with a market capitalization of $105 million, MCADE still has plenty of room to grow.

You can buy MCADE here

Arbitrum (ARB) – Best Layer 2 Network

Arbitrum is a layer 2 network built on the Ethereum network to help with scaling. A layer 2 network is an extra layer built on top of a regular blockchain to help process transactions faster. The network usually handles computation while relying on the underlying blockchain for security.

Why Invest In Arbitrum?

Arbitrum is currently the biggest layer 2 network in the crypto space with a total value locked of $2.18 billion as of writing. It is a rollup network that validates transactions on its network and then records them in bulk on the Ethereum network, thus saving cost and increasing speed.

The crypto project network launched its new crypto token, ARB, in March 2023 and it has been one of the largest launches this year. The token powers the decentralized autonomous organization (DAO) that decides on the future of the network.

Scaling solutions are a big theme this year and Arbitrum leads the pack in that regard. This crypto projects ecosystem is growing exponentially and we do not see it going away anytime soon.

Risks In Investing In Arbitrum

Arbitrum’s native token is not used to pay gas fees on its network, Ethereum is. ARB is also not accepted as a collateral on major lending platforms like Aave and Compound. As such, the token’s major use case is a utility and governance token which may or may not be enough to propel its price.

ARB has a total supply of 10 billion tokens, 1.2 billion of which are currently in circulation, bringing the network’s market cap to $1.8 billion, a small fraction of Ethereum’s $222 billion market capitalization.

As of writing it trades at $1.45 with an all-time high of around $10 and a low of $1.16.

You can buy ARB on crypto exchanges like eToro.

Radiant Capital (RDNT) – Best Crosschain Lending Cryptocurrency

Radiant Capital is a cross-chain lending protocol on the Arbitrum network. It is a traditional lending market but with a twist. Powered by multi chain technology, Layer Zero, Radiant can borrow and lend assets seamlessly between blockchains.

Why Invest In Radiant?

Radiant is currently the third largest finance protocol on Arbitrum with a total locked value of around $141 as of writing. It has accrued a total of $4.56 million in fees paid to its native coin stakers and liquidity providers.

You can supply and borrow DAI, USDT, USDC, WBTC, and ETH on the platform. To borrow funds, you must supply collateral that is at least 120% of the value you wish to borrow. The interest rate charged is displayed as “Borrow APY” while the yield earned on collateral is “Supply APY”.

Naturally, borrowing APY exceeds supply APY. However, you can supply coins without borrowing and still enjoy returns. You can read our piece on APY vs APR to know the difference.

Risks In Investing In Radiant

RDNT has a total supply of 1 billion tokens, 261 million of which are in circulation. Most of these new crypto projects tokens are allocated towards rewards for collateral, placing some inflationary pressure on the token.

However, we believe that the platform is primed to onboard more users as it expands to other blockchain networks, and the resulting growth could outpace token emissions and offset inflation.

RDNT trades at $0.39 per token as of writing with a market cap of $104 million. To compare, lending protocols like Compound have a market capitalization of $271 million, at least twice of what Radiant is.

You can buy RDNT on exchanges like Coinbase.

Optimism (OP) – Best Optimistic Rollup Network

Optimism is another layer 2 network crypto project that has garnered attention in the crypto space this year. It works on a similar technology as Arbitrum, optimistic rollups, and has proven to be fast, scalable, and secure.

Why Invest In Optimism?

Optimism is the second largest network on Ethereum with a total locked value of $922.57 million and more than 105 protocols operating on the network.

The network features a native token, called OP, used primarily for governance purposes. OP has a total supply of 4.2 billion tokens, 314 million of which are currently in circulation at a market capitalization of $707 million.

One way that Optimism stands out compared to other rollup network crypto projects is that it runs on a single-round fraud-proof system. This means that it checks for fraud only once which makes transactions much faster than that of even Arbitrum.

Compared to Arbitrum’s $1.8 billion market capitalization, Optimism still has room to grow as new crypto projects with layer 2 networks take center stage in 2023 thanks to Ethereum’s Shapella update.

Risks In Investing In Optimism

Like Arbitrum, the major use case for OP is governance. The risk here is that new layer 2 networks are being launched using the technologically superior zk rollups. The growth of these networks may draw investors away from Optimism.

You can buy OP on exchanges like Coinbase.

Aptos (APT) – Best Layer 1 Cryptocurrency

Aptos is a blockchain created by a company called Aptos Labs and launched in October 2022 as a new layer 1 network that features a unique virtual machine based on a programming language called Move.

Why Invest In Aptos?

According to Defillama, the network has a total value locked of $60 million with over 23 decentralized applications. While the blockchain is still quite new, it has already surpassed Cardano in wallet addresses, hinting at rapid adoption.

The blockchain is also partnered with VC firms and legacy tech companies like Google in an attempt to merge Web2 and Web3.

As of writing, Aptos’ native coin, APT, trades at $10.14 with an all-time high of $18.42 reached in January 2023 and an all-time low of $3.2 in December 2022. However, considering that the coin launched in October 2022 (i.e. in the middle of a bear market), we reckon there is plenty of room for growth.

APT has an infinite maximum supply, meaning that the blockchain developers can always mint more coins. This is not necessarily a bad thing as Ethereum also has an infinite theoretical supply.

Provided the burn rate exceeds emissions, APT should increase in value. So far, only 1.03 billion coins have been minted, 187 million of which are in circulation, bringing the network’s market capitalization to $1.9 billion.

Risks In Investing In Aptos

While Aptos has a lot of growth potential, we must mention that the vesting schedule for contributors and early investors is only one year as of writing. This means that after a year, early investors and contributors will be able to sell their tokens, potentially creating immense sell pressure.

Furthermore, Aptos Foundation lacks proper online representation in the crypto space, and there has been some secrecy around the new crypto coins supply and distribution where an overwhelming amount of the new crypto projects coins were allocated to insiders.

You can buy APT on exchanges like Coinbase.

Mute (MUTE) – Best ZK Rollup Decentralized Exchange

Mute is a new decentralized exchange on ZKSync Era, a ZK-rollup on the Ethereum blockchain. While this crypto projects token, called MUTE, is not a new one, its migration to the ZKSync network creates new use cases with boundless potential for the best DeFi projects.

Why Invest In Mute?

Mute now identifies primarily as a ZK-rollup Defi platform with a built-in decentralized exchange, an automated market maker, a bond platform, and a yield farming platform. So far, the protocol has processed a total volume of $88 million and has a total value locked of $13 million.

The automated market maker works like a regular one, balancing tokens in liquidity pools and facilitating swaps. The decentralized exchange is the front end for the AMM and supports yield farming by allowing token holders to deposit funds into its liquidity pools to facilitate trade for a cut of trading fees, a way to generate passive income.

After providing liquidity, you will be issued with LP tokens to represent the liquidity you provide. You can use those tokens to withdraw your liquidity or to get MUTE tokens at a discount using the bond function.

The crypto projects bond function allows you to vest your LP tokens for MUTE at a discount to its market price. At the end of the vesting schedule (usually 7 days), you get MUTE tokens at the displayed discount price. The difference between the discount and market price is your profit.

However, if the price of MUTE falls drastically within the vesting period, you could end up at a loss.

Risks In Investing In Mute

The zkSync Era ecosystem is still undergoing rapid growth. It is still too early to make long-term crypto investment decisions based on Mute’s dominance on the network as this could change with time.

MUTE has a total supply of 40 million tokens, all of which are in circulation. This is the ideal situation as the tokens will never be exposed to sell pressure due to token unlocks. As of writing, its price is $0.98 with an all-time high of $2.72 in January 2022 and an all-time low of $0.11 in September 2021.

We reckon Mute has immense potential as many of the protocols on ZKSync Era will integrate with the Dex. And seeing as ZKSync is the premiere ZKRollup network on Ethereum, the cryptocurrency projects growth potential is palpable.

You can buy MUTE on an exchange like Coinbase

Pepe (PEPE)– Best New Memecoin

Pepe is a new memecoin building on the popularity of the crypto Pepe memes. The cryptocurrency projects Pepe memes are a wildly popular meme in the crypto industry that features a green creature making various faces in reaction to different scenarios.

Why Invest In Pepe?

As the most recognisable meme in the industry, it’s no surprise that this coin achieved wild success and became a cryptocurrency to invest in just two days after launch. PEPE meme token launched on April 18th 2023 and already has over 35,000 holders.

The meme token has a total token supply of 420 trillion tokens, terrible tokenomics for serious new crypto projects, but about right for a meme token. All its tokens are currently in circulation as the developers released all tokens at the same time, a move which is quite uncommon in the industry.

The developers also refrained from implementing buy or sales tax on their crypto tokens, which is a mechanism used by memecoins to generate profit, albeit an unsustainable one. As of writing, you can buy PEPE meme token just as easily as you would buy Ethereum on a decentralized exchange like Uniswap.

All LP tokens have been burned, meaning that developers cannot drain liquidity from the token’s smart contracts. The only issue we foresee is that there is not enough liquidity in the pools for all holders of the new crypto projects token to cash out.

Risks In Investing In Pepe

Pepe does not offer any utility token use and hence does not provide tangible value that could retain investors long term. The token is held up by hype, and that is usually fickle.

PEPE has a market cap of $100 million, making it the sixth largest memecoin by market capitalization. And while that can change in the future, this cryptocurrency projects coin can grow immensely when the next bull market begins, which is projected for 2024.

Camelot (GRAIL) – Best New Composable Decentralized Exchange

Camelot is a medieval-themed decentralized exchange on the Arbitrum network with a total value locked of $93 million, making it the sixth-largest financial protocol on Arbitrum.

Why Invest In Camelot?

Camelot stands out from regular Dexes and other cryptocurrency projects with its composability. It is not just a Dex, but a full-fledged DeFi protocol with liquidity pools, an AMM, yield farms, and even a dividends mechanism.

The Dex is also powered by a protocol called Odos that allows you to swap between any two new crypto coins on the Arbitrum network, regardless of the configurations of Camelot’s liquidity pools.

The entire ecosystem is powered by the GRAIL crypto coin. With GRAIL, users can earn a cut of the platform’s revenue by staking it for XGRAIL and allocating to the Dividend mechanism.

You can also allocate XGRAIL to the liquidity booster mechanism which gives you extra yields on LP positions, or the launchpad mechanism which grants a cut on earnings from the platform’s coming launchpad.

Risks In Investing In Camelot

Camelot’s token is tied to the cryptocurrency project platform’s fees, which in turn is tied to the volume of trades it processes. Hence, Camelot will need to remain a major Dex on Arbitrum to receive high trade volumes and retain investors with attractive yields.

GRAIL has a total supply of 100,000 tokens, 74,000 of which are in existence. Of all existing tokens, only 9,665 are in circulation, a conservative number that accounts for its high price.

GRAIL has already made significant profits for early crypto coin holders as the coin hit the market at around $220 in December 2022 and trades at $1,800 as of writing. However, some sell pressure is expected at future token release dates.

You can buy GRAIL on exchanges like Coinbase.

Bitget (BGB) – Best New Centralized Exchange

Bitget is a centralized crypto exchange that is fast growing to fill in the void left by the FTX cryptocurrency project. The exchange features an easy-to-use trading interface, spot markets, margin trading, crypto futures markets, a peer-to-peer marketplace, and even a launchpad.

Why Invest In Bitget?

The exchange is known for being quick to list new crypto tokens, giving its users an opportunity to get in early on cryptos that will otherwise not be listed on centralized exchanges.

With Bitget, you can buy crypto in 72 fiat currencies, more than what Binance currently offers. You also get customized payment methods based on the currency you choose, however, credit cards and third-party solutions are usually recurring.

Bitget also offers a copy trading feature that allows you to copy the trades of more experienced users, several earn programs, and staking vaults to generate returns for new crypto holders.

The exchange also features a native token called BGB which is issued on the Ethereum blockchain. BGB qualifies its holders for discounts on trades and staking rewards.

Risks In Investing In Bitget

The Biget token qualifies its holders for discounts on trades and staking rewards, and not much else. Compared to Binance’s BNB which is also the native token for the Binance Smart Chain, BGB doesn’t have so many reasons to encourage investors to hold.

BGB has a total supply of 2 billion tokens, 1.4 billion of which are already in circulation at a market capitalization of $496 million. Compared to other exchange tokens like GT from Gate.io with a market capitalization of $761 million, BGB has room for growth.

A word of warning, however, we could not find clear information on where the exchange is registered or what regulators they are under. While its token is on the Ethereum blockchain and are therefore decentralized, they are also tied to the success of the exchange.

You can buy BGB on Coinbase.

Arcadeum (ARC) – Best New Crypto Gambling Cryptocurrency

Arcedeum is a gambling protocol that allows users to play casino-styles games in a decentralized environment where their funds never leave their wallet and is not passed through a middleman.

Why Invest In Arcadeum?

Arcadeum is different from regular gambling sites because it is fully decentralized. While other gambling sites may have integrated various crypto mechanisms, they are still centralized and under legal jurisdictions.

The platform features Roulette, Dice, Slides, Coin Flip, Wheel, and Rock Paper Scissors, while other games like Slots, Poker, and Lottery are coming soon.

For available games, Arcadeum ensures fairness by using a quantum random number service, called API3, which provides provably random variables used in the games.

If you don’t want to play the games but still wish to profit from the platform, you can buy ALP, which is a liquidity provider token that grants you a cut of the house’s profits. You can also stake ARC for a yearly return.

Risks In Investing In Arcadeum

Arcadeum is still in its early stages and as such, there are no guarantees that the project will survive the first five years. The project is also attempting to decentralize online gambling, which is no easy feat, especially for a project that is as funded as its competitors. A need for some cheap Bitcoin will become more apparent as online crypto gambling continues to grow.

ARC has a total supply of 10 million tokens, however, the number of tokens in circulation is unknown, which is normal for new projects as ARC launched in February 2023. However, the token has around 4,000 holders.

As of writing, ARC trades at $0.21 per token with an all-time high of $2.33 in March 2023 and an all-time low of $0.16 in April 2023. Its current price places its fully diluted market capitalization at just above $2 million.

For comparison, the fifth largest crypto gambling token, according to Coingecko, is ExeedMe, which has a market cap of $8 million, four times that of Arcadeum. A word of warning, however, the platform is still very new and largely untested. Investments in ARC could easily go sideways as crypto gambling is one of the less mature sectors of the industry.

You can buy ARC on exchanges like Coinbase.

Gala Games (GALA) – Best Relaunched Gaming Studio

Gala Games is the gaming arm of Gala Studios, a crypto-focused multimedia entertainment studio with gaming, film, and music subsidiaries. Gala Games is not a new project or cryptocurrency to invest in, however, they are on the verge of revamping their GALA tokens and implementing new mechanics in their gaming department that sets the project up for growth.

Why Invest In Gala Games?

Gala Games made it on our list because its games are already some of the most enjoyable in the crypto industry. Its farming simulation, Town Star, has had 6,000 unique active wallets interact with the game’s smart contracts within the last 30 days.

The studio has also partnered with AMC’s The Walking Dead franchise to build a game with blockchain mechanics like NFTs.

Risks In Investing In Gala Games

One issue that plagued the project was its bad tokenomics. Luckily, a new version of the GALA token has been distributed to holders. The new tokenomics saw $600 million worth of GALA tokens burned.

All the games are undergoing revamps and will enjoy new economic models that are yet to be fully revealed, however, one feature that has been talked about are upgradable NFTs.

However, we have yet seen the long-term effects of these changes and hence cannot make accurate predictions in this regard.

Which New Crypto Coin is Going to See Amazing Gains in 2024?

We believe that all the new cryptos on this list stand a good chance of delivering significant returns in 2024.

However, one in particular stands out as a cryptocurrency to invest in and the hottest crypto to buy now. That coin is Solciety.

We believe Solciety has huge growth potential because it taps into the recent Solana memecoin growth, and its narrative positions it to go viral.

How Regularly are New Crypto Coins Released to Potential Investors?

There is no set time for this. Release schedules are based on the development timelines. We cannot definitively say how regularly new crypto coins are released to potential investors. In fact, the question itself can be quite misleading as it implies that there is a regular schedule of new coin issues, which is highly false.

How Can Investors Find New Cryptocurrency Coins to Buy?

Tens and hundreds of new cryptos are released everyday, and the majority of them never amount to anything. Hence, finding new crypto tokens within the cryptocurrency space with potential is essential. While there is no exact science to it, some tools and methods will aid in your search.

Follow Long-Term Narratives

The crypto market moves according to narratives. Some are short-term trends that span a year or a market cycle while others are long-term and span years. While short-term trends tend to produce coins that increase significantly within a short period, they often end up crashing.

Long-term trends, however, produce coins that grow steadily over the years. They may spike up during bull markets or fall significantly during downturns, but their moving average steadily increases over the years.

To take advantage of long-term trends, research what sectors are quintessential to the growth of the industry and focus on top new crypto projects within the sector.

Use Tools

There are tools that provide data on various cryptocurrency projects. Defillama, for example, lists the DeFi apps on various chains along with their total locked value. You can use this data to anticipate upcoming top new crypto projects on blockchain networks.

Other tools like TokenSniffer allow you to check smart contracts for signs of a possible rug pull, i.e., when nefarious developers drain the liquidity from smart contracts and leave token holders high and dry.

Also, familiarize yourself with tools that help you track tokens on the blockchains. Some tokens don’t make it to popular tools like Coingecko immediately when they are launched. However, with tools like DexScreener, you can track them as soon as they hit the open market.

Track Whales

One of the best ways to find new cryptocurrency coins is to follow the people who know how to find them. These include whales, insiders, and builders. Oftentimes, they find and buy a new crypto token before they blow up.

You can use tools like Debank to track wallet addresses. Debank shows you the assets in any EVM wallet you check, the DeFi protocols that the wallet has funds in, and even the wallet’s transaction history. However, you’ll need to get your hands on a whale’s wallet to begin.

If you do not know any whale wallets, simply go to the Debank website and click on Whales. A list of whale wallets ordered by total funds will be displayed. You can start using a copy trading platform to follow them further.

Use Dexes

Most times, coins trade for a while on decentralized exchanges before making it to popular exchanges like Binance or eToro. You need to get comfortable buying the best crypto to buy now on Dexes before they hit the popular Cexes.

To use a Dex, you’ll need to get a non-custodial crypto wallet like MetaMask.

Are New Cryptocurrencies a Worthwhile Investment?

New cryptocurrencies can be a worthwhile investment as they have room for tremendous growth. However, a majority of them end up worthless, so the trick is finding projects that have the highest probability of success.

The cryptocurrencies on our list are the fastest-growing crypto projects that we believe are more likely to succeed. However, we must mention that this is not a guarantee. They, like any other, can still fail.

Nonetheless, we listed them because we believe they are less likely to fail because of their cutting-edge technologies, their active communities, and the presence of heavy VC funding.

Factors to Consider When Choosing a New Crypto to Invest in

Development Team

Choosing the next big crypto to invest in is a little trickier than choosing established crypto because you often do not have past performance data, either price-wise or technically, and new projects can be fraught with bugs and mistakes.

This is why the team is a good place to start. The ideal team is one whose members all have prior experience in the roles they fill. Place an emphasis on the CEO and CTO as they are usually key members that have a direct impact on the success of the project

Blockchain Network

The blockchain network a project is built on can go a long way to determine whether the project gains any traction. For example, games built on Ethereum that require speed may find transaction fees too expensive for retail users at peak periods, while NFT projects building on Cronos may find that the blockchain network doesn’t foster a large NFT marketplace community.

Utility

The best way to gauge utility is to ask three questions. The first is: does this project solve any problems? If it does, then ask, how important is this problem? If the problem is important. Finally ask, how sustainable is this particular solution?

New projects that offer real utility from the onset are more likely to last than projects that are built of hype and expectations.

Funding

While funded projects can still crash, they are less likely to than their bootstrapped counterparts. Projects with large treasuries can usually afford to pay for much of the personnel, connections, and infrastructure that they need to gain an edge over the competition.

What are the Risks Involved With New Cryptos?

Price Volatility

The prices of new cryptos can be volatile especially during launch as new buyers get in and investors who may have gotten tokens at a discount to the launch price (usually during presales) sell.

If you intend to buy a new token after it launches, you may want to wait for the initial volatility to die down before moving ahead.

Smart Contract Risk

New projects usually face this risk as their smart contracts may have vulnerabilities that the development team or even the smart contract auditors, like Certik, may have missed. The industry is littered with tales of projects whose smart contracts were drained due to some overlooked flaw.

How to Buy New Cryptocurrency Coins

For this guide, we covered how to buy new cryptocurrency coins on centralised exchanges, using eToro. Follow the steps below to get yours.

1. Open an Account

Go to eToro’s website and create an account by clicking on “Start Investing”. You can also create an account on the mobile app. Fill out the signup form with your full name, email address, and a password.

2. Verify Your Account

Next, verify your account by completing your profile and submitting KYC data like a valid ID and a proof of address document like a utility bill.

3. Make a Deposit

Once your account has been verified, deposit funds using a convenient payment method; eToro supports several. Enter the amount you’d like to deposit.

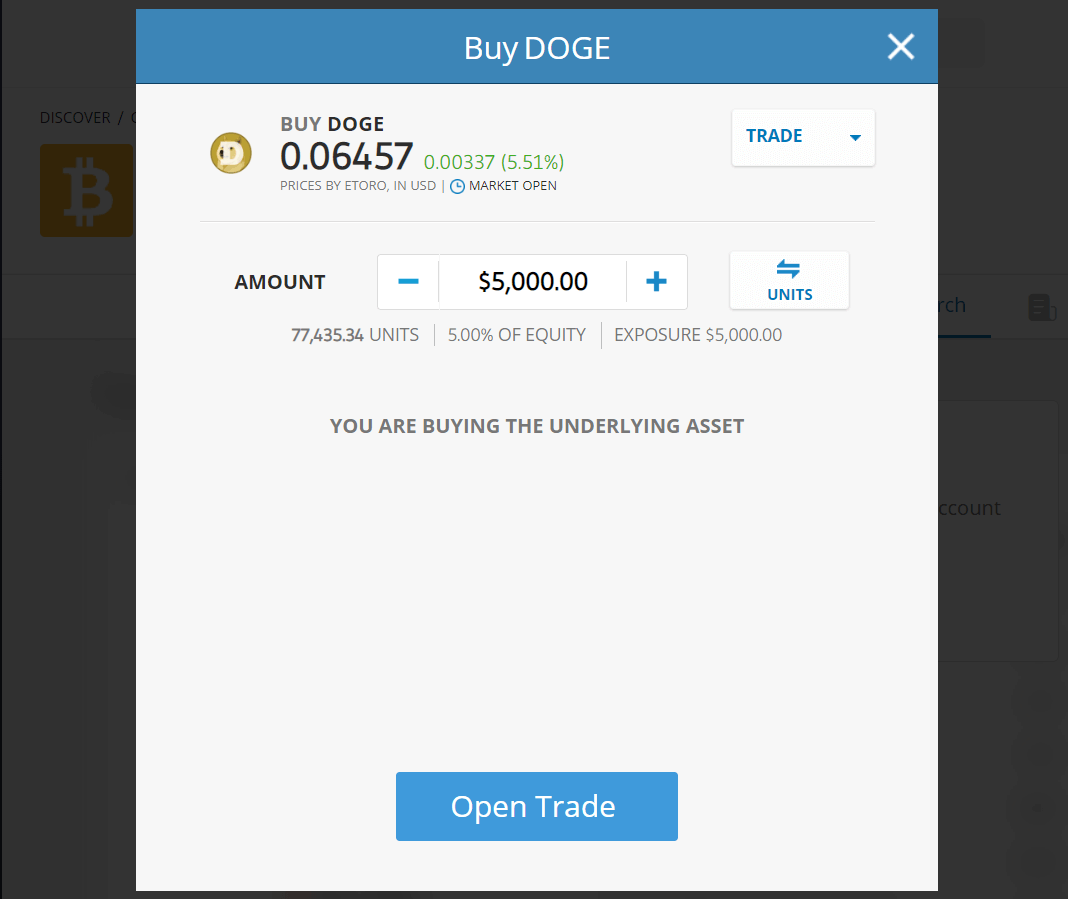

4. Buy Crypto

Once your account is funded, search for any of the cryptos mentioned in the Discover tab. An interface like the one below should load. You can then set your parameters and buy.

Where To Buy New Coins

To get your hands on new cryptos like Solciety that are not yet listed on exchanges, you’ll have to purchase them directly on their websites using a crypto wallet. We created a guide to help you do that.

Step 1: Download A Wallet

We used MetaMask for this guide. Download the wallet app on your phone or use the web platform via a browser extension on your laptop. Create a new wallet. Ensure you keep your seed phrase safe and offline.

Step 2: Buy Some Crypto

You’ll need SOL to buy new SLCTY tokens. Buy some on an exchange like eToro and transfer to your wallet, or use a fiat onramp on the MetaMask web interface.

Step 3: Connect Wallet

Navigate to Solciety’s website and connect your wallet to join the presale. You can do this from the in-built browser on the mobile app. Buy SLCTY tokens using SOL. Ensure you have enough to pay for gas fees.

Step 4: Wait To Claim

You’ll need to wait until the presale is over to claim your tokens.

Latest New Cryptocurrency Coin News

- Pepe gets listed on Gemini Foundation as it inches closer to a US listing.

- Optimism, a Layer 2 network for scaling Ethereum applications, has rebranded as OP Mainnet, aiming to create a “superchain” network of Layer 2 blockchains

- Decentralised betting platform, Chancer presale hits $436K as investors bet on positive crypto market sentiment

Final Thoughts on the Best New Crypto to Invest in

We explored the best new cryptocurrency coins to buy now and chose Arbitrum as our top choice because it is the largest layer 2 solution on the Ethereum blockchain with a $1.8 billion market cap and a total locked value of $2.16 billion.

It is also well funded by VC firms and has an active developer community with over 200 decentralized finance and gaming protocols, including heavy hitters like GMX and Radiant Capital.

Nonetheless, all the cryptocurrency coins on our list are good new investments. However, they are not guaranteed, and like most content creators in the crypto space say, do your own research and do not invest more than you are willing to lose.

To invest in cryptos, visit eToro.

Methodology - How We Picked the Best New Crypto

The projects covered in this guide were chosen through rigorous research and reviews. We paid attention to security, transparency, reputation, tokenomics, and competitive edge.

The tokens listed are the best we found in the various categories we listed them. For example, we listed Optimism as the best optimistic rollup network as it is the fastest optimistic rollup on the market right now.

Check out our why trust us and how we test pages for more information on our testing process.

Additional Crypto Coin Reviews

- Best Cryptos to Buy now

- Best ICOs

- Best Crypto Presales

- Best Metaverse Crypto Coins

- Best ERC-20 Cryptos

- Top Gaming Cryptos

- Best Staking Cryptos

- Best GameFi Crypto Tokens

- Best Long Term Crypto

- Best Cheap Cryptos

- Best Web3 Crypto

- Best Penny Cryptos

- Best Utility Cryptos

- Best Altcoins

- Best Meme Coins

- Best DeFi Projects

- Hottest Cryptos to Buy

- Next Big Crypto

- Best AI Cryptos

- Fastest Growing Cryptocurrencies