7 Cheapest Ways to Buy Bitcoin (BTC) in 2024

The crypto market has grown at an extraordinary rate, and as adoption rates have increased platforms have made it easier and easier to buy Bitcoin. Now, the question is no longer where to buy Bitcoin but which platform offers the cheapest way.

CoinJournal to the rescue. This guide explores the cheapest way to buy Bitcoin, detailing the best platforms and highlighting their fee structures. At the end of this guide, you will find a suitable place to buy Bitcoin at pocket-friendly fees.

The Best Cheap Places to Buy Bitcoin - Our Top 3 Picks

Looking for a quick answer? Here are our top 3 cheapest ways to buy Bitcoin

The Cheapest Ways to Buy Bitcoin in 2024

1. eToro – Best Overall Cheapest Way to Buy Bitcoin

2. Binance – Cheapest Way to Buy Bitcoin with Altcoin Selection

3. Coinbase – Cheapest Way to Buy Bitcoin for Beginners

4. Bitpanda – Cheapest Way to Buy Bitcoin for Traditional Investors

5. Capital.com – Cheapest Way to Buy Bitcoin CFDs

6. Skilling – Cheapest Way for Minimal Bitcoin Exposure

7. Bitstamp – Cheapest Most Secure Way to Buy Bitcoin

Cheapest Places to Buy Bitcoin Compared

|

Platform |

Regulation |

Minimum Deposit |

Fees |

No of Coins Supported |

Overall Score |

|

eToro |

FCA, CySEC, AFSL |

$10(£8.6) |

1% |

63+ |

9 |

|

Binance |

AMF |

$50 |

0.10% |

600+ |

8 |

|

Coinbase |

FCA |

$2 |

1% |

193+ |

8 |

|

Bitpanda |

FMA, AMF, Czech Trade Authority |

€25 |

0.025% – 2% |

170+ |

7 |

|

Capital.com |

FCA, CySEC, ASIC |

$20 |

Varies |

400+ CFD pairs |

7 |

|

Skilling |

CySEC, FSA |

$100 |

Varies |

55+ |

7 |

|

Bitstamp |

CSSF |

$10 |

0.5% |

75+ |

8 |

The 7 Cheapest Places to Buy Bitcoin Reviewed

1. eToro – Overall Cheapest Way to Buy Bitcoin

With over 25 million global users, eToro is one of the largest social investment networks in the world, granting access to more than 60 cryptos and several other assets.

The investment platform is known for its emphasis on compliance. It is regulated by several global regulators like the Financial Conduct Authority UK (FCA), the Cyprus Securities Exchange Commission (CySEC), and the Australian Financial Services (FSA).

Through these regulations, combined with several years of strong service delivery, eToro has built a solid reputation for being one of the most trustworthy and effective cryptocurrency exchanges for selling Bitcoin and other cryptocurrencies.

When buying Bitcoin with eToro, you can search for it (and many other cryptos) in the Discover section and buy Bitcoin with American Express, bank account deposit, PayPal, or Skrill to pay. Transaction fees are a low 1% added to the spread.

Deposits are free but have a minimum required amount of $10 (£8.6), while withdrawals cost $5 (£4.07) for amounts above $30. Accounts are denominated in USD, so fiat currency deposits in other currencies (GBP, for instance) are subject to a conversion fee, depending on bank transfer rates.

eToro also offers staking services of crypto assets that generate yield on your crypto if you plan to hold for a considerably long period.

To begin using eToro, sign up for an account using your name and email address. Then verify your account using a government-issued ID and a proof of address document like a utility bill.

Read our full eToro review here.

Pros

-

Low 1% purchase fee for Bitcoin and other cryptos

-

Low minimum deposit amount of $10

-

Free deposits and withdrawals under $30

-

No commission charged

-

Social investing features that allow you to copy others’ trades

-

Highly regulated and trusted

-

Has a mobile app

Cons

-

Not available in remote regions

-

Crypto selection is quite limited when compared to some competitors

Why we chose eToro

The cost of using an unregulated platform could exceed that of high fees for Bitcoin transactions if situations arise. eToro understands this, which is why its platform is secure and well-regulated. They also have a 15-year track record to prove it.

2. Binance – Cheapest Way to Buy Bitcoin with Altcoin Selection

Binance is one of the largest and most popular crypto exchanges globally. In many ways, it has grown from just an exchange to an all-around solution for crypto retailers everywhere, and cryptocurrency exchanges offering Bitcoin, thereby setting itself apart from the Binance alternatives.

When it comes to buying Bitcoin and other crypto assets, the Goliath is best known for its ultra-low crypto and Bitcoin trading fees at 0.10% and its monster collection of over 600 crypto assets.

Deposits to Binance can be made in 61 different fiat currency options and are subject to a minimum requirement of $50 when using official payment channels like credit cards, bank transfers, and electronic wallets.

However, this minimum payment method varies in the peer-to-peer (p2p) market, which is another way to acquire BTC and get crypto into your Binance account. This market consists of people from different countries transacting with one another while Binance acts as an escrow service. P2P markets usually serve as an alternative funding method that cuts out deposit fees.

For the official deposit method, Binance charges $1 for a bank transfer and about 1.8% of transaction volume for credit card deposits. Other methods depend on the deposit currency.

Fiat withdrawals follow a similar pattern, $1 for bank transfers and about 1.8% for credit card payments. Crypto withdrawal fees depend on the network and the activity level, while deposits are free.

Read our full Binance review

Pros

-

Wide selection of 600+ coins

-

Low spot market fees at 0.1%

-

24/7 chat support. Email support for more serious issues

-

Robust platform for staking, earning, and saving

-

Has a mobile app

Cons

-

Has faced regulatory hurdles in various countries

-

Withdrawal fees may be higher than necessary for some cryptos

Why we chose Binance

We chose Binance because of its suite of services. Its robust crypto trading platform has something to offer everyone, from beginners who trade Bitcoin to advanced investors. This crypto exchange with low fees and an even cheaper p2p market makes Binance an all-in-one place for purchasing Bitcoin cheap.

3. Coinbase – Cheapest Way to Buy Bitcoin for Beginners

Coinbase is known for being extremely easy to use. Its user interface guides users starting their crypto journey and its flexible payment options make it easy and possible winner for the cheapest way to buy Bitcoin.

The trading platform’s collection of 193+ cryptos makes it one of the largest in the United States compared to Coinbase alternatives, and a minimum crypto trading size of $2 lowers the barrier of entry to buy Bitcoin online for newbies.

Deposits are straightforward through ACH transfers, credit cards, wire transfers, and PayPal. ACH transfers are free, credit card payments cost 2.49% of the transaction value, and wire transfers cost $10.

Withdrawals can be processed through the same methods as above for US citizens, while others are limited to transferring funds through bank transfers. ACH transfers remain free for withdrawals, credit card payments still cost 2.49% of the transaction value, and wire transfers cost $25.

The Coinbase cryptocurrency exchange charges a 1% conversion fee for direct conversions from either fiat currency to crypto or crypto to crypto and between 0.05% – 0.60% for spot trading.

Read our full Coinbase review.

Pros

-

Largest crypto selection in the United States at 170+

-

Intuitive platform perfect for beginners

-

Small trade sizes to test before using capital

-

Low transaction fees

-

Has a mobile app

Cons

-

Fees are not as low as some competitors in the US

-

Not suitable for users in remote regions without access to popular payment methods

Why we chose Coinbase

Coinbase is perfect for new users in developed countries new to cryptocurrency exchanges because it supports popular payment channels and maintains an easy-to-use trading platform. You can also store crypto with Coinbase for long periods.

4. Bitpanda – Cheapest Way to Buy Bitcoin for Traditional Investors

Bitpanda is an investment platform built for traditional investors who wish to gain some crypto exposure. The platform supports traditional investments and acts as an all-in-one platform for modern investors.

The European digital currency platform offers over 170 cryptocurrencies and is highly regulated by several bodies like the Financial Market Authority (FMA) Austria, the French Autorité Des Marchés Financiers (AMF), and the Czech Trade Authority. It is also secure and compliant with AML5 policies.

Investors can deposit funds to their Bitcoin accounts using payment methods like Sepa, Giropay, Skrill, Neteller, Sofort, Visa, and Mastercard, but only in the Eurozone. Clients from other countries must use other options available to them.

Bitpanda charges a 2% fee to deposit cryptocurrency for direct fiat-to-crypto conversions and 0.025% for maker/taker trades on their trading terminal. The platform also imposes a €25 minimum deposit requirement to start your journey to buy Bitcoin cheap.

While there are no specific deposit and bank transfer charges for the various payment methods on their website, Sepa payments are usually free within the Eurozone, while credit card payments charge between 1% – 3% of the transaction value. Read our Bitpanda review for an in-depth guide.

Pros

-

Highly secure and regulated

-

Familiar interface for traditional investors

-

Simple, easy-to-use platform

-

Low €25 minimum deposit and withdrawal requirement

-

0.025% fee if investors use the trading platform

Cons

-

Conversion fee applied to deposits other than EUR

-

Withdrawal is via bank account only

Why we chose Bitpanda

Bitpanda is an investment platform built for traditional investors who wish to gain some crypto exposure. The platform supports traditional investments and acts as an all-in-one platform for modern investors.

The European digital currency platform offers over 170 cryptocurrencies and is highly regulated by several bodies like the Financial Market Authority (FMA) Austria, the French Autorité Des Marchés Financiers (AMF), and the Czech Trade Authority. It is also secure and compliant with AML5 policies.

Investors can deposit funds to their Bitcoin accounts using payment methods like Sepa, Giropay, Skrill, Neteller, Sofort, Visa, and Mastercard, but only in the Eurozone. Clients from other countries must use other options available to them.

Bitpanda charges a 2% fee to deposit cryptocurrency for direct fiat-to-crypto conversions and 0.025% for maker/taker trades on their trading terminal. The platform also imposes a €25 minimum deposit requirement to start your journey to buy Bitcoin cheap.

While there are no specific deposit and bank transfer charges for the various payment methods on their website, Sepa payments are usually free within the Eurozone, while credit card payments charge between 1% – 3% of the transaction value. Read our Bitpanda review for an in-depth guide.

Pros

- Highly secure and regulated

- Familiar interface for traditional investors

- Low €25 minimum deposit and withdrawal requirement

- 0.025% fee if investors use the trading platform

Cons

- Conversion fee applied to deposits other than EUR

- Withdrawal is via bank account only

Why we chose Bitpanda

Bitpanda provides a secure way to manage and buy Bitcoin as an investment, even when it is time to sell Bitcoin. Its interface is familiar to traditional investors and is well-regulated amongst crypto exchange platforms.

5. Capital.com – Cheapest Way to Buy Bitcoin CFDs

Capital.com is one of the best CFD brokers across various financial markets, including cryptocurrency. It is ideal for traders who want a cheap way to profit from Bitcoin’s price movements.

The FCA, CySEC, and ASIC-regulated broker offers over 456 cryptocurrency contracts for most major fiat currencies and crypto crosses. Traders can use a suite of indicators to trade these digital currency contracts in long and short directions.

The broker charges variable spreads on its crypto contracts, meaning that the cost of trading could change. However, at the time of writing, the spread on Bitcoin was 60 pips, i.e. $600 per 100,000 units (lot), $60 per 10,000 units (mini lot), and $6 per 1,000 units (micro lot).

Deposits are more pocket-friendly as Capital.com covers all deposit and withdrawal fees. Nevertheless, your payment service provider may charge you, especially when using a credit or debit card.

A minimum deposit of $20 is required to get started and can be sent through a bank transfer, credit card payment, PayPal, or wire transfer, depending on your location.

Pros

-

Highly regulated broker

-

Low minimum deposit of $20

-

Commission-less trading

-

Multiple payment channels available

-

No deposit or withdrawal fees on the broker side

Cons

-

Not available to US clients

-

Does not provide account insurance

-

Crypto CFDs are not available for UK residents

Why we chose Capital.com

Capital.com provides a cheap way for traders to gain exposure to a Bitcoin holdings account without buying the underlying asset. Its favorable spreads and low minimum deposit allow investors to test the waters without risking a sizable investment.

6. Skilling – Cheapest Way for Minimal Bitcoin Exposure

Skilling provides a way to buy Bitcoin CFDs cheaply. It offers access to the CFDs of over 55 cryptos, and its spread on Bitcoin is an affordable 0.2% per trade.

The platform is regulated by the Financial Services Authority (now the FCA) and the Cyprus Securities Exchange Commission (CySEC). It also implements industry-standard security protocols to safeguard user funds.

Deposits are straightforward, costing a meager 2.9% for funds sent through Skrill and Neteller. Bank transfers, credit card deposits, Fasa payments, Webmoney, Pay retailers, and UnionPay are free for both deposits and withdrawals.

A minimum amount of $100 is required to get started with Skilling. After deposit confirmation, a 1:50 leverage facility is made available.

Read our full Skilling review here.

Pros

-

Cheap Bitcoin spreads among CFD brokers

-

Highly secure and well-regulated

-

1:50 leverage facility

-

Free deposits and withdrawals for all payment methods aside from Skrill and Neteller

Cons

-

Minimum deposit higher than others

Why we chose Skilling

Skilling is a well-regulated crypto broker with an impressive leverage facility and cheap funding methods compared to other crypto exchanges. It is ideal for clients who wish to gain leveraged exposure to Bitcoin’s price movement cheaply.

7. Bitstamp – Cheapest and Most Secure Way to Buy Bitcoin

Bitstamp is a full-fledged crypto exchange with a track record of over 10 years of service delivery, cutting-edge security, and a selection of 78 digital currency options. It is an ideal option for users who value reputation for Bitcoin purchases.

The exchange has a cryptocurrency app version desktop and mobile version for investors to take advantage of price changes. It also features a Pro mode with a trading terminal for more trading-focused clients when they want to sell Bitcoin.

For conversions and trade orders, Bitstamp charges a 0% fee for accounts with 30-day transaction volumes under $1,000. However, it charges accounts with 30-day transaction volumes under $10,000 between 0.30% – 0.40% per trade. This fee reduces as the transaction volumes increase.

Deposits in either USD, GBP, or EUR through payment channels like Sepa, ACH, Faster Payments, credit cards, Google Pay, Apple Pay, and wire transfers are accepted as a payment method.

Credit card transactions, Google Pay, and ApplePay cost 5% for both deposits and withdrawals, Sepa deposits are free while withdrawals cost €3, ACH transfers are free both ways, and Faster Payments deposits are free while withdrawals cost £2.

Finally, a wire transfer costs 0.05% with a minimum of $7.5 (£5) and a maximum of $300 (£250) while withdrawals cost 0.1% with a minimum of $25. The minimum deposit amount is $10. You can read our full Bitstamp review for a more in-depth guide.

Pros

-

Regulated by the CSSF

-

Implements military-grade security

-

Low minimum deposit requirement

-

Flexible payment methods

-

Transparent fee schedule

Cons

-

High trade fees for smaller amounts

Why we chose Bitstamp

Bitstamp has proven itself a reliable way for purchasing Bitcoin over the years. Its military-grade security features and flexible payment options make it a great long-term safe crypto exchange.

What is Bitcoin? A Brief Overview

Bitcoin is a digital currency that is cryptographically secure and decentralized, i.e., it does not require middlemen like banks and financial institutions to process financial transactions. It runs on infrastructure, called blockchain technology, which provides its security and decentralized properties.

A Blockchain is a public record that logs transactions in a secure way that cannot be changed, thanks to a cryptographic algorithm. Think about an Excel sheet whose cells lock immediately after data is entered into them, making it impossible for anyone to change the data in the cells. This property is called immutability.

A blockchain is like an Excel spreadsheet. It logs transactions and publishes them for everyone to see while hiding the names of the people who make the transactions. This way, the data can always be referred to as a source of truth without giving away any private information.

This record is maintained by several computers simultaneously on a network so that no one computer owns it and all computers must agree before logging transactions.

Bitcoin transactions are secure because its records cannot be falsified, it protects private data, and transactions are processed by the network participants and cryptocurrency exchanges.

Instead of using bank accounts, users have crypto wallets that store their coins. And unlike bank accounts, they have total control over these wallets, provided the wallets are decentralized exchanges

Key Things to Look Out For in the Place You Buy Bitcoin

Security

Security is the number one factor for any product or service that deals with crypto because and hacks are common and are oftentimes perpetuated by brilliant minds.

Firstly, the crypto exchanges or brokers must use the highest security standards and have the certification to show it. Certifications like ISO information security certificates are popular in the finance industry.

Another factor to look out for is two-factor authentication. Secure cryptocurrency exchanges always have two-factor authentication capabilities which you should take advantage of, as passwords can be derived using social engineering techniques.

Storage Options

Crypto platforms usually have account wallets that are hot i.e. they are always connected to the internet. However, on the back end, they use a combination of cold and hot wallets to store users’ funds.

Cold wallets keep crypto offline, making it less vulnerable to hacks. The ideal exchange should store the bulk of funds in a cold wallet for better security and only access it when clients wish to make sizable withdrawals.

User Friendliness and Accessibility

While user-friendliness varies with platforms, the ideal exchange should be easy to navigate, even for beginners when purchasing Bitcoin and other crypto. This is especially true for platforms that offer a suite of services that may require users to move crypto between wallets within one account.

The user interface should be plain enough to understand where everything is and navigate and should have a mobile version. Crypto mobile apps are quite essential these days as you may need to react to market moves while on the go.

Asset Selection

Although this guide is about the cheapest ways to buy Bitcoin, most exchanges sell Bitcoin and other cryptocurrencies. When it comes to crypto collections, the more the merrier. A wider selection provides more opportunities to trade Bitcoin and make money.

It also improves security as users won’t need to traverse multiple platforms to get the coins they want. They are less likely to repeat the same password for several platforms and can focus on creating a solid password for one platform rather than average ones for multiple platforms.

Platforms that offer assets beyond crypto are also a plus. For example, Bitpanda offers stocks, commodities, ETFs, cryptocurrency, and precious metals. It is much easier to build and maintain a balanced portfolio on Bitpanda than on a platform that only offers cryptocurrency.

Promotions and Bonuses

Bonuses are in no way a prerequisite to choosing a platform, rather they are good add-ons when a platform has checked the other criteria.

Exchanges like Binance and Coinbase periodically run promotional campaigns and bonuses to attract new users, reward existing users, or get users to perform specific actions.

If an exchange has passed other factors on this list, check if they run bonus programs. You’ll find that the large ones usually do.

Educational and Helpful Resources

Several exchanges provide helpful resources, guides, and mini-courses on fundamental crypto concepts. Binance is an example of one crypto exchange platform that does this. The platform has an academy dedicated to helping its users gain crypto-literacy.

While educational resources are helpful, general resources about crypto are not a must as the web is filled with crypto resources. However, guides on how to use platforms should be available.

Fees

Fees are probably the second most important factor to consider when choosing a platform. The first fees you should check are transaction fees. These are the charges for trading and converting crypto.

Sometimes, platforms slash transaction fees when you meet criteria like trading a specified monthly volume or holding their native coin. Bitstamp is a good example of this. The higher your monthly trade volume, the fewer fees you pay per trade.

Next, check for account fees. Most crypto platforms do not charge fees for maintaining an account, but some brokers like eToro may charge inactivity fees.

Lastly, pay attention to deposit and withdrawal fees. The most expensive payment method is usually a credit card, charging anywhere between 0%- 3% for payments. ACH and Sepa transfers are usually free across platforms.

KYC Requirements

Well-regulated platforms usually require users to pass KYC by submitting a government-issued ID and a proof of address document like a utility bill. This is standard procedure, and centralized platforms that do not do this should be treated with caution.

Where Do the Costs Come from When Buying Bitcoin?

Bitcoin’s cost comes from a few sources:

The first is the price of the Bitcoin itself. This is the price it trades on the spot market based on demand, supply, and external economic factors.

The second source is the conversion fee charged by exchanges and brokers. These usually come as percentages of the transaction value or as markups added to price spreads.

The third is the fee associated with moving money to and from the platform. These include the deposit fee, the fiat currency used, the base currency of the account, and the deposit method used. For example, USD transactions made within the US cost less than transactions made outside the US, like wire transfers.

Also, if your account is denominated in USD, making deposits in other currencies may attract a conversion charge as the platform will have to convert your fiat money currency. This is true for platforms like eToro.

Lastly, payment methods like buying Bitcoin with American Express and credit cards and electronic wallets like Skrill usually carry a higher charge than local bank transfers.

Why is Finding the Cheapest Way to Buy Bitcoin Important?

The price of Bitcoin varies, sometimes a significant amount depending on the platform that you use to purchase it from. In general, the cost of Bitcoin will also vary depending on the payment method that you use to purchase it.

A main point to remember however is that the price of Bitcoin itself is extremely volatile and the difference in prices of a few dollars can ultimately lead to hundreds of dollars in the future. Overpaying for Bitcoin by even $1 can translate into an overpayment of $30 or more if you purchased at the wrong time.

Now, if you completed many of those trades in large volumes, you can lose a large amount of money simply because you did not use the cheapest way to buy Bitcoin.

Is Buying Bitcoin Safe?

Safety, in this sense, can be broken down into two categories, technological safety and financial safety.

The technological safety of your purchase depends on the security of the platform you use and the strength of your password. Secure platforms are usually safe as they employ industry-standard encryption.

However, the question of whether is Bitcoin safe will depend on a weak password and the lack of two-factor authentication security measures on your part can render your account vulnerable. Use strong alpha-numeric strings as passwords and a text or an authenticator app for 2FA.

For financial safety, we cannot say whether or not Bitcoin is safe as its price fluctuates. You’ll have to do your research to find out if it is at a price that makes financial sense to buy.

Why is Bitcoin Cheaper on Some Platforms Compared to Others?

The prices shown on various websites and trackers are aggregates of prices from major exchanges. On an exchange basis, prices could vary due to factors such as liquidity pool rebalancing, trading fees, and network fees.

Exchanges, even some centralized ones, use liquidity pools to facilitate trades between currency pairs. These pools work based on mathematical algorithms that rebalance the coins in preset proportions, e.g. 50/50 between two coins, 30/30/40 between three coins, etc.

When one coin exchanges for another, there is an imbalance that the algorithm works to rectify by selling off one coin for another. As more people exchange one coin for another in a pool, the price of the quote coin increases while that of the base coin decreases.

For example, if several people exchange ETH for BTC within a pool, the price of BTC will increase as demand grows, while the price of ETH will decrease as supply increases. This is called price impact. However, the more liquid a pool is, the less the effect of this impact.

Exchanges usually maintain several liquidity pools and the price of Bitcoin may vary based on the price impact in these pools.

Trading fees also play a role as higher fees increase the overall cost to acquire Bitcoin, especially for high-frequency traders.

Lastly, network fees play a role as they increase when the blockchain networks become congested.

Can I Buy Bitcoin Without Fees?

The only instance where you can buy Bitcoin without paying any fees is when your chosen platform takes on the cost. However, you can skip one or two fees depending on the cryptocurrency exchange you use.

If you use a decentralized exchange, you don’t pay deposit or withdrawal fees, but you pay exchange fees as liquidity pools charge. However, it is significantly less than what centralized exchanges charge. You also pay network fees.

If you use a centralized exchange, you may need to pay deposit and withdrawal fees for your Bitcoin account. However, you may not need to pay network fees within the cryptocurrency exchange ecosystem.

If you use a CFD broker, you won’t pay network fees for buying Bitcoin or selling Bitcoin. However, you may need to pay deposit and withdrawal fees, trading fees, and currency conversion fees.

How can I buy Bitcoin? Step-by-Step Tutorial

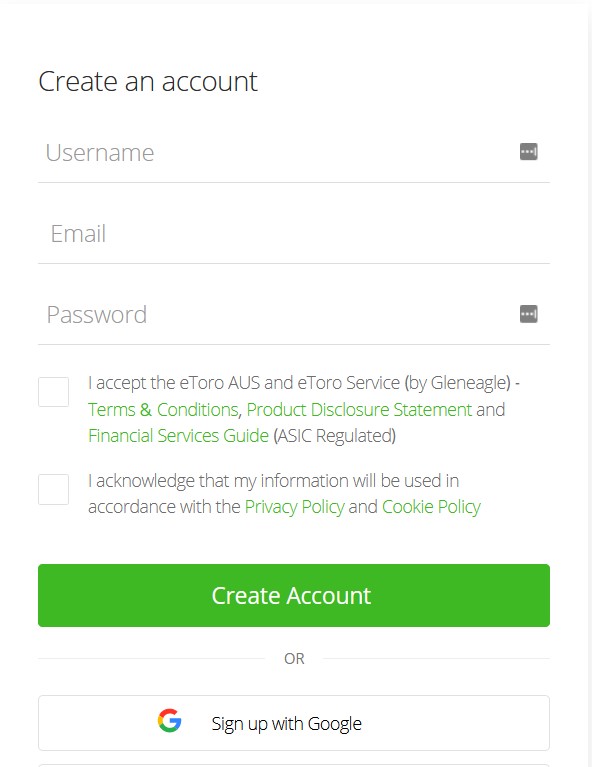

1. Open an Account

To start buying Bitcoin, navigate to the eToro website and click on the Start investing icon or download the mobile app from the Play Store/App Store and click on Sign up. Fill out the form with your full name, email address, and password.

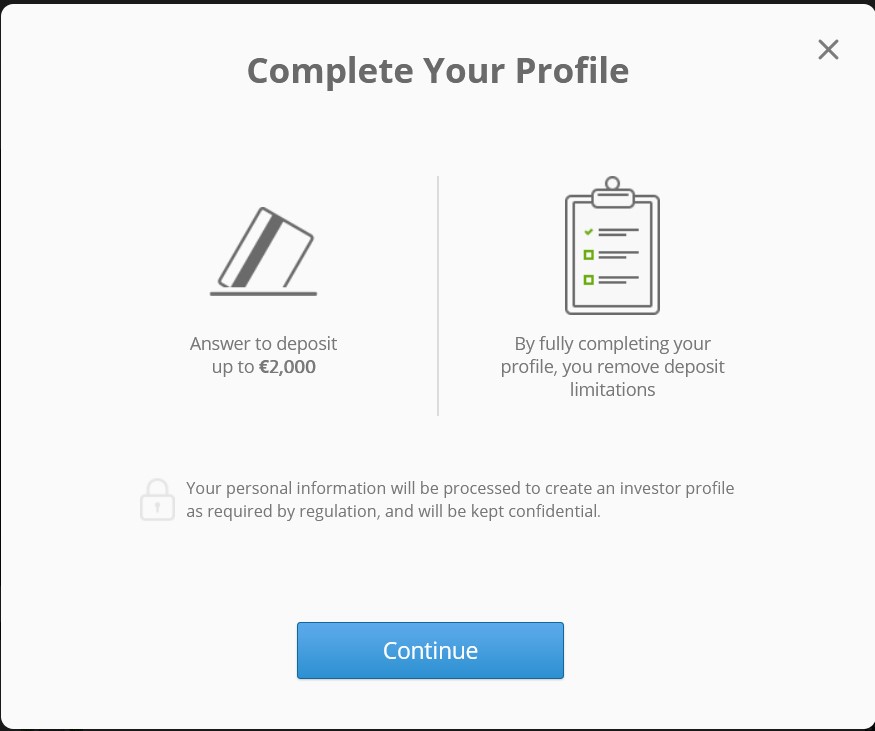

2. Verify Your Account

Next, verify your account with personal details like your date of birth and a passport photo, after which submit KYC documents. These documents include proof of ID (National ID or driver’s license) and proof of residence (utility bill)

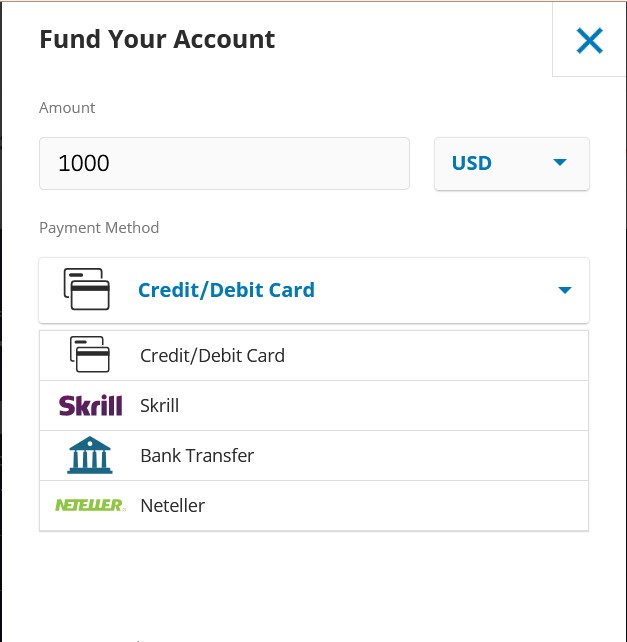

3. Make a Deposit

Once your account has been verified, click on Deposit funds on the left pane of the page. The deposit options available will be displayed. Choose one and set the amount you’d like to deposit into your Bitcoin exchange.

4. Buy Bitcoin

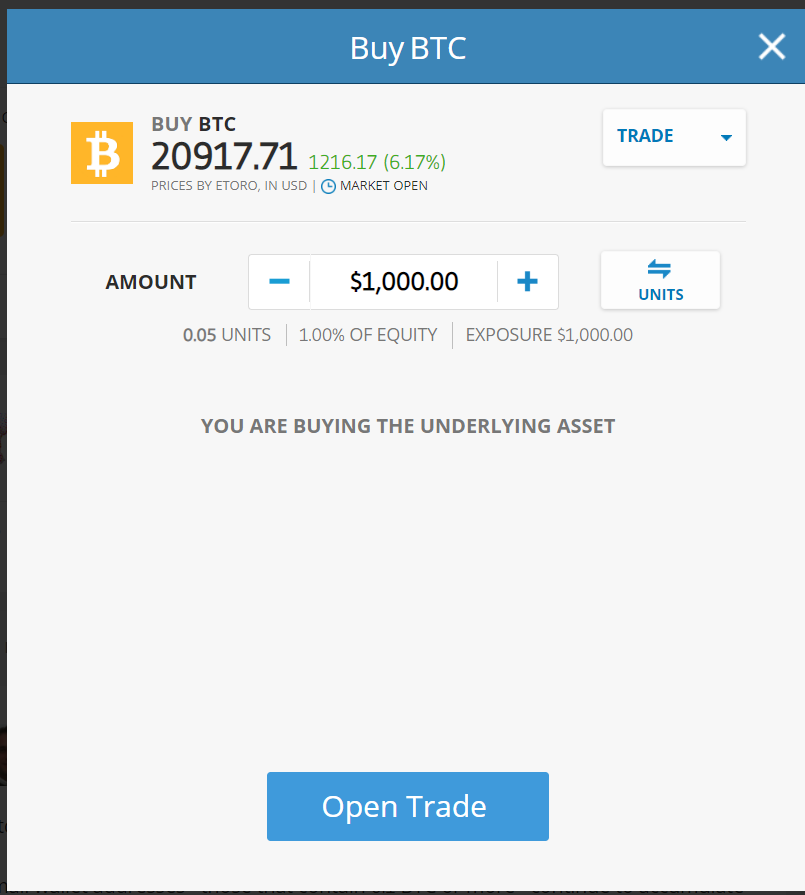

Once your crypto exchange account is funded, search for Bitcoin in the Discover tab. An interface like the one below should load. You can then set your parameters and buy Bitcoin.

Latest Cheap Way to Buy Bitcoin News

-

Bitcoin Mining Stocks are far riskier than Bitcoin itself as mining stocks have heavily underperformed compared to Bitcoin over the last year.

-

The crypto industry is destined to be Bitcoin-focused due to regulators.

Final Thoughts on the Cheapest way to Buy Bitcoin

This guide explored 7 of the cheapest ways to buy Bitcoin today. The best overall way on our list is eToro because of its strict adherence to regulation and its 15-year track record.

These qualities build trust as users can rest easy knowing that their funds are behind industry standard firewalls and covered by legal regulations with this crypto exchange.

It’s no surprise that the cryptocurrency exchange platform houses 25 million users around the world, forming a vibrant community that helps each other grow via social trading features.

The crypto exchange platform also supports several payment methods and charges a low 1% markup to buy Bitcoin and other crypto purchases. You can get started with as little as $10.

The other platforms on our list are all excellent places to buy Bitcoin in cheap ways. From Binance’s p2p market to Bitstamp’s free bank transfers, and Bitpanda’s free Sepa payments, these platforms take out as much of the cost of buying Bitcoin as they can.

Methodology - How We Picked the Cheapest Places to Buy Bitcoin

The crypto exchanges covered in this guide were derived through rigorous testing, research, and reviews. We paid attention to security, transparency, reputation, trading fees, bank transfer deposit and withdrawal methods, time in the game, coin selection, and competitive edge.

The Bitcoin exchange platforms listed are the best we found in the various categories we listed them. For example, we found that Binance had the largest altcoin selection and hence named it the cheapest trading platform to purchase Bitcoin with a robust altcoin collection.

Check out our ‘why trust us’ and ‘how we test’ pages for more information on our testing process.