The 10 Best Decentralized Exchanges

Since the fall of FTX, attention has shifted to decentralized crypto exchanges as people realise the risk of entrusting their crypto to platforms that aren’t regulated as strictly as traditional financial institutions.

Unlike their centralized exchange counterparts, decentralised exchanges allow people retain custody of their crypto asset right until the point of exchange. However, this doesn’t mean that they are fool-proof.

There are recorded events of common crypto scams that rob unsuspecting users of their crypto. This guide helps you avoid that.

Leveraging our years of experience in decentralised trading, we have put together this guide to walk you through the best decentralized exchanges in the cryptoverse. We will dive into each one, highlighting its pros, cons, and what makes it special.

By the end of this guide, you should know which decentralized exchanges are worth your time and have the confidence to begin using one.

Best decentralized exchanges - Our top picks

Looking for a quick answer? These are our top picks.

Best Decentralized Exchanges in 2025

Best Decentralized Crypto Exchanges - Key Metrics

Top 10 Decentralized Exchanges Reviewed

What is a DEX?

A decentralized exchange (DEX) is an exchange that primarily operates on a blockchain and allows people to trade tokens in a decentralized way while retaining custody of their funds.

The primary differentiator between centralized exchanges and top decentralized exchanges is that there is no middle man or organisation running a decentralized exchange. Users do not need to entrust their digital assets to middlemen by depositing it in a “crypto trading account”.

Instead, crypto assets remain in the users’ personal wallets throughout the entire process until they swap it for other digital assets.

To achieve this, Dexes are made up of smart contracts that run perpetually once deployed on a blockchain network.

These contracts contain the code that runs the safest cryptocurrency exchanges, and because they are open source, anyone can view the code to ensure that it is secure and that the best decentralized crypto exchanges do what they claims.

Types of Dexes

There are three main types of Dexes. They include Automated Market Makers, Order Books, and Aggregators.

Automated Market Makers (AMMs)

An Automated Market Maker (AMM) is a type of decentralized exchange that does what traditional market makers do: add depth and liquidity to the market to facilitate instant trades.

The proliferation of decentralized finance requires Dexes to be able to swap tokens immediately. To do this, there must be liquidity, vis-a-vis tokens ready to be traded at any time to facilitate decentralized trading.

To achieve this, the AMM maintains liquidity pools that are made up of at least two tokens in a specified proportion to each other both price and volume wise. When traders need to swap between the two tokens in a pool, they simply pay token A and receive the dollar equivalent of token B.

AMMs are made up of these liquidity pools and an algorithm (or robot) that quotes exchange rates between tokens as well as maintains the initial proportions between the tokens in various pools.

AMMs are the most popular types of decentralized exchanges in crypto as it provides the on-demand liquidity needed to rival the efficiency of centralized exchanges.

Also, because everything is decentralized, the liquidity pools rely on other people to deposit their tokens into it to provide the liquidity. The AMM then rewards these depositors, called liquidity providers or LPs, with a cut of the trading fees it charges.

On one end, people make money from providing liquidity, and on another, people trade instantly, thereby creating a sustainable model for this decentralized exchange.

Order Book Dexes

An order book Dex is one that facilitates trades using order books like those found on centralized exchanges. These order books usually contain a list of open orders on both the buy and sell sides.

The exchange then compares buy and sell orders and initiates swaps on matching orders.

Because this type of Dex uses order books to match buyers and sellers, it usually does not rely on liquidity pools as much as AMMs, which could sometimes lead to liquidity shortages. Some get around this by combining order books with liquidity pools.

Also, order books can either be on-chain or off-chain. On-chain order books store open trade data on its blockchain and are often found on layer2 networks that provide higher throughput.

Off-chain order books, on the other hand, are run on centralized servers while the swaps are carried out on-chain. This once made them faster and cheaper than on-chain order books, however, the rise of high-throughput networks has shifted focus back to on-chain order books.

Decentralized Exchange Aggregator

Dex aggregators or exchanges that do not have AMMs or order books. Instead, they connect to liquidity pools on other Dexes and AMMs and allow users to access them from the comfort of one interface.

Some powerful aggregators can split trades between multiple liquidity pools or route trades through multiple pools to enable swaps between exotic pairs that do not outrightly have their own pools.

Aggregators are great for users who wish to find the best prices for their trades, which is why platforms like 1Inch are quite popular.

DEX vs CEX

A Centralized exchange and decentralized exchanges allow users to trade tokens. However, their key differences lie in how they go about this.

Centralized exchanges are run by companies. They act as an intermediary between buyers and sellers. They have central servers, provide liquidity themselves, and store their tokens in vaults that are controlled by a central authority, the company.

The exchange also takes care of security, availability, and throughput. Customers need to create accounts with them and deposit their funds in them.

The upside to centralized exchanges is that their services are usually quick and seamless, and they can be better regulated by authorities.

Top decentralized exchanges, on the other hand, are not run by companies or intermediaries. They are run by immutable code on blockchain networks. The best decentralized exchanges inherit the blockchain’s security, so developers do not have to worry about providing security beyond the smart contract level.

Because these decentralized exchanges are run by code, there is no need for intermediate companies to manage them. As such, liquidity is provided by people who deposit their funds into liquidity pools. The decentralized exchange shares revenue from trading fees with these liquidity providers to incentivise them to keep their funds in the pools.

Decentralized exchange users retain custody of their tokens at all times. They do not need to deposit into accounts or pass KYC requirements.

The upside to decentralized exchanges is that the cost of trading is much lower as there are no servers or liquidity to manage. It is also usually much easier to set up than centralized exchanges.

Latest DEX News

- 1inch price prediction as 1INCH surges 16% to multi-week highs

- Solana-Based Crypto Exchange Raydium Proposes $2M Bug Bounty Fund

- Sushi Swap CEO Says He No Longer Feels ‘Inspired’ Amid U.S. Regulators’ Crypto Crackdown

How to Trade Crypto Using a DEX - Step-by-Step Tutorial

Some decentralized exchanges require extra steps to trading, like bridging assets, however this guide covers the basic steps required by all cryptocurrency exchanges that are decentralized.

1. Download a Decentralized Wallet Application

To use any Dex, you’ll need to first get a decentralised wallet. There are various options on the market, but MetaMask and Coinbase Wallet are two great and widely used wallets. We used MetaMask for this guide. Navigate to the wallet website and add the extension, or download the app.

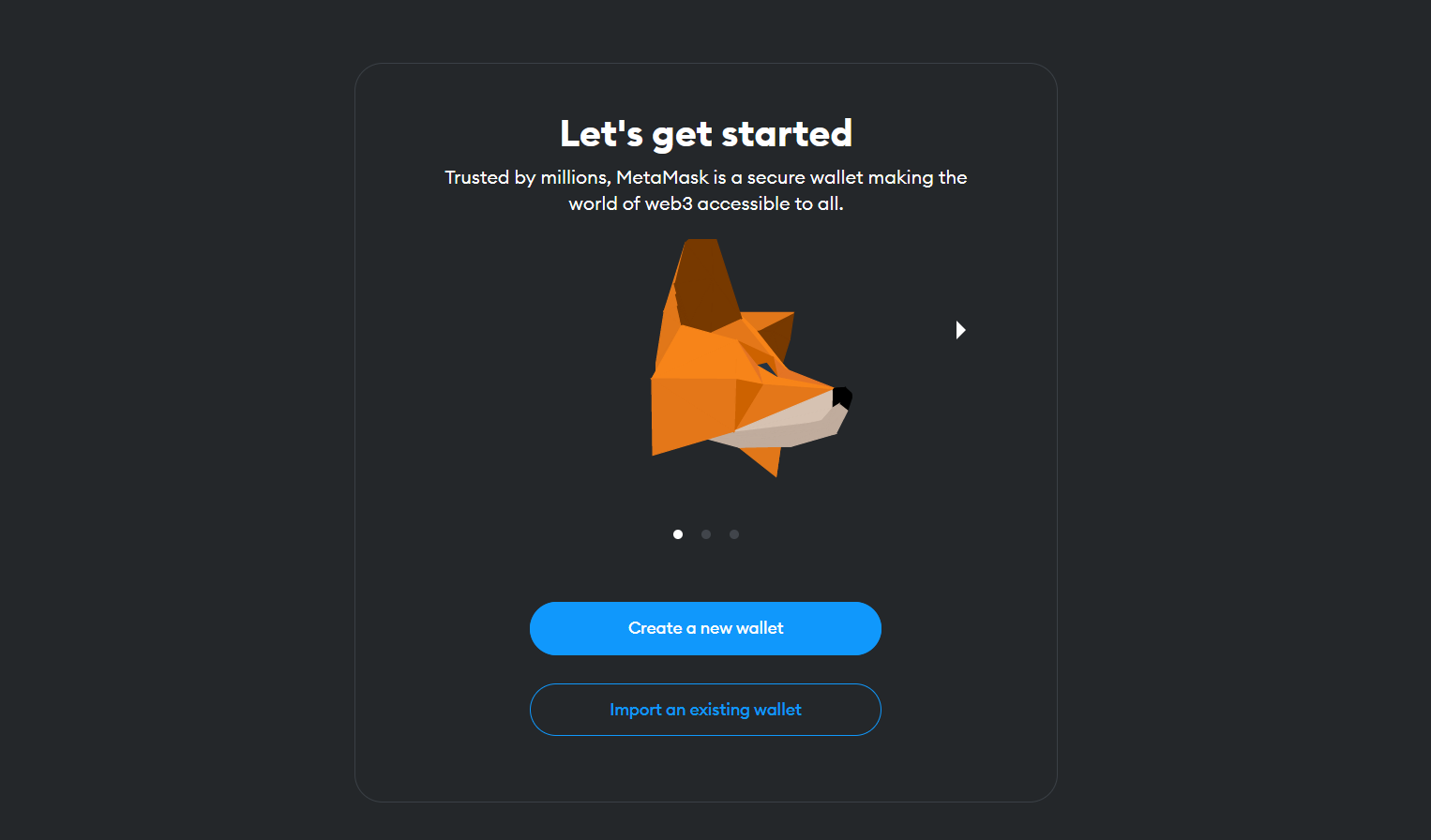

2. Create a Wallet

This part is important as it could determine how secure your wallet is. When creating a wallet, you’ll be given a seed phrase. Write this down and keep it offline at all times. It is advisable to write it in multiple places.

3. Navigate to your Decentralized Exchange

You can use any decentalized exchange you want, but your decision will usually be guided by the blockchain network you’re on and the tokens you wish to trade. To avoid scams, use data sources like Coingecko to get the correct web address of your Dex. Avoid using a Google search.

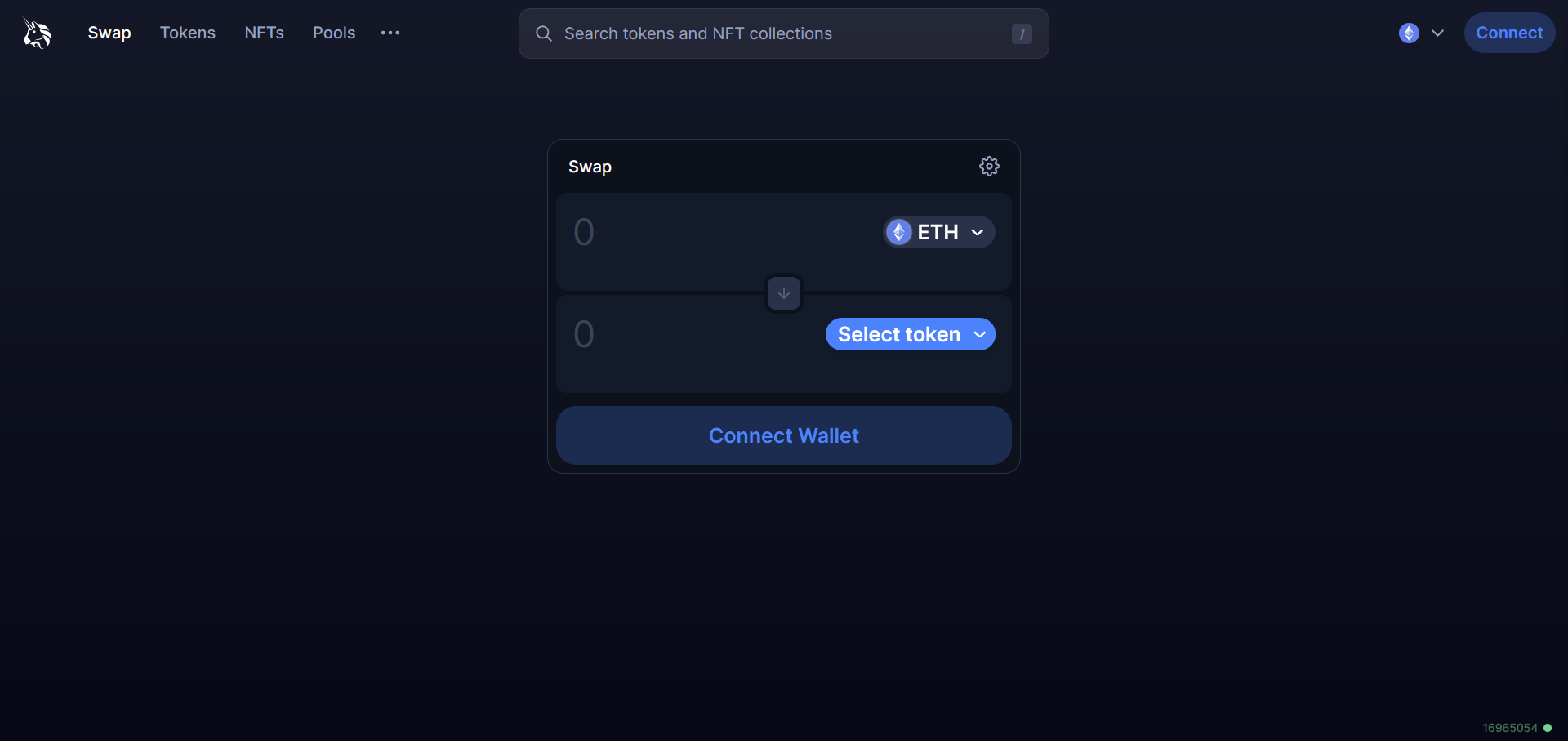

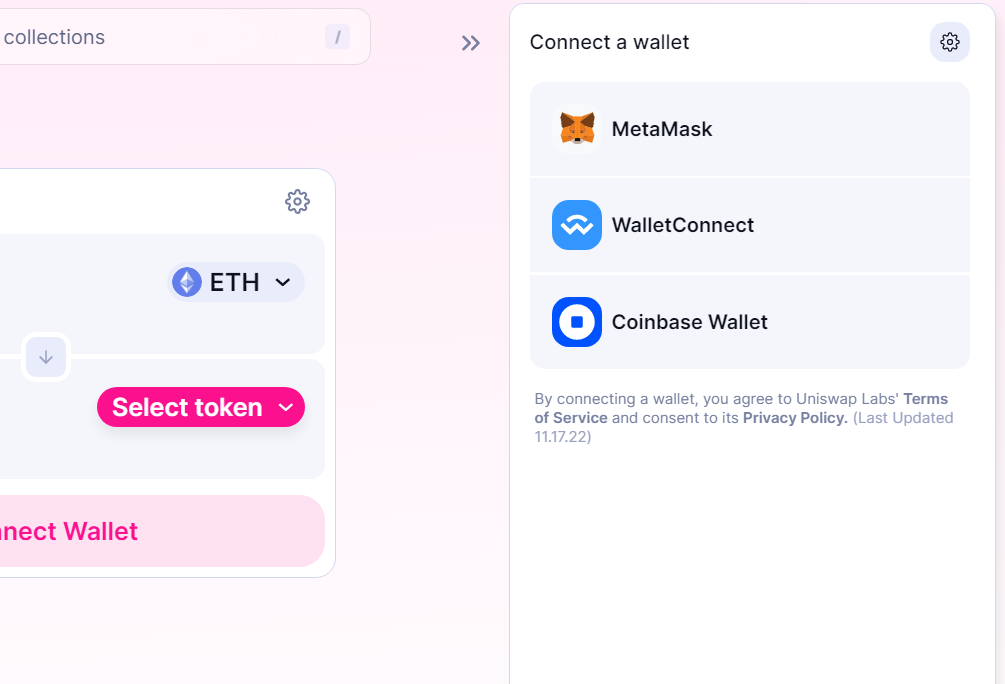

4. Connect Your Wallet

There is usually a “Connect Wallet” icon at the top right corner of every decentralized exchange. If you do not see one, then there will be an Launch dApp button somewhere visible. Launch the dapp and connect your wallet. You’ll need to sign a transaction the first time you connect, and that’s fine.

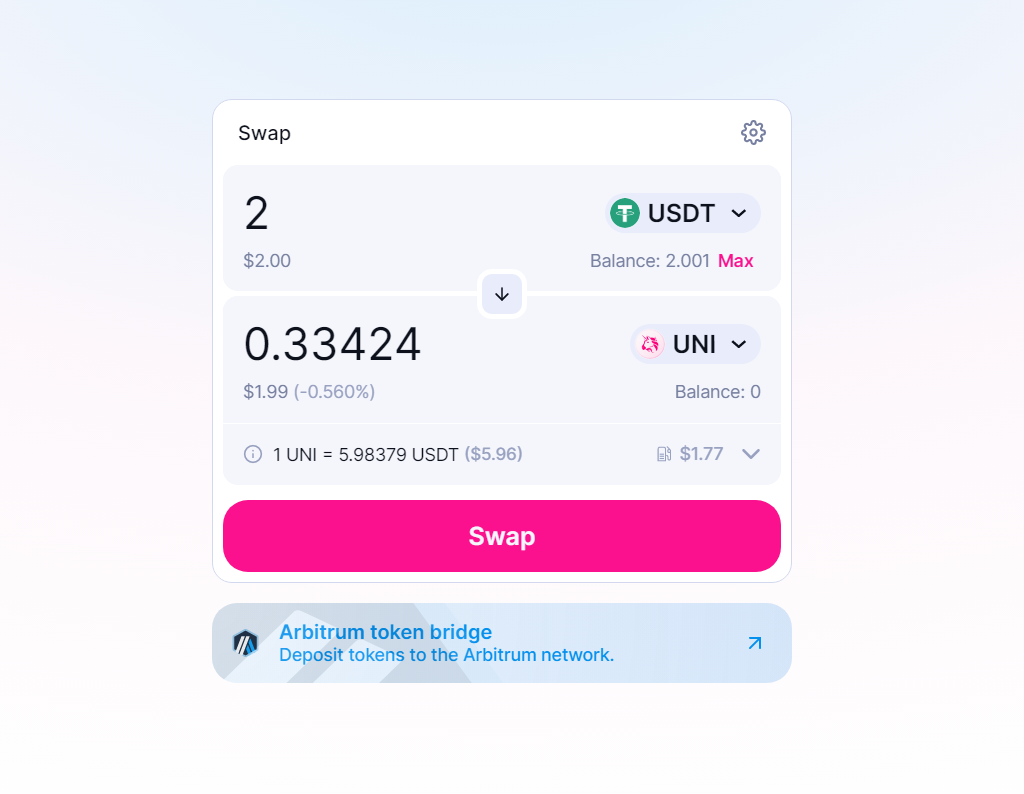

5. Swap Your Tokens

Once you have connected your wallet, you can select the tokens you wish to swap, input the amount you wish, click Swap, and approve the transaction in your wallet.

Final Thoughts on the Best Decentralized Exchanges

We explored the best decentralized exchanges in the crypto industry and chose Uniswap as our overall best because it is the most capitalized, has won the trust of both retail and institutional users, and is available on several blockchain networks.

Nonetheless, all the cdecentralized exchanges on our list are good options. We also included diverse types of exchanges for various needs. For example, if you wish to trade perpetuals, GMX is your go to cryptocurrency exchange.

On the other hand, if you wish to trade crypto on an exchange with a traditional feel and an order book, then dYdX is more ideal.

The best decentralized exchange for you will also depend on the blockchain of your choice. While many of these Dexes are multichain, some are more available on several chains than others. Sushi, for example, has the widest reach among our list and can facilitate cross chain swaps.

Methodology - How We Picked the Best Decentralized Exchanges

The decentralized exchanges we covered in this guide were chosen through rigorous research and reviews. We paid attention to security, transparency, reputation, coin selection, crypto support, and competitive edge.

The decentralized exchanges listed are the best we found in the various categories we listed them. For example, we listed 1Inch as the best aggregator because it connects to various decentralized exchanges to get the best price among them.

Check out our why trust us and how we test pages for more information on our testing process.