How to Buy Bitcoin with Debit Card in 2024

...

As the original and most popular cryptocurrency, Bitcoin is the coin that many investors buy first when they enter the crypto market. Debit cards are a popular method of buying Bitcoin as they are convenient and widely accepted by crypto platforms.

This guide will provide you with step-by-step instructions on how to buy Bitcoin with a debit card, as well as recommendations for the best Bitcoin platforms that accept debit cards and everything else you need to know about the process.

How to Buy Bitcoin With a Debit Card

The simplest way to buy Bitcoin with a debit card is to purchase it online from a crypto exchange. Exchanges make it easy to buy and sell Bitcoin with a debit card and other cryptocurrencies directly from your smartphone, tablet or computer. Check out our recommended platforms below and follow the steps to buy Bitcoin with a debit card safely.

1. Choose a platform

You’ll have plenty of choices when it comes to platforms that support Bitcoin and accept debit cards. Pick one that meets all your needs regarding features, security, and fees. The next section will go into detail about some of the best places to buy Bitcoin with your debit card, but you can click on one of our top recommendations below to get started right away.

2. Create and fund your account using a debit card

Go to the website of your chosen platform and click the sign-up button. This will take you to a registration page where you can fill in your details. You may also need to verify your identity with a photo ID. Click on “Deposit” and select debit card. Enter the amount you wish to deposit, fill in your card details, and complete the transfer.

3. Buy Bitcoin

On your platform, look for the trading pair for BTC and your local currency. You can use a limit order if you want to buy Bitcoin once it reaches a specific price. If you want to buy Bitcoin immediately at the current price, simply select market order, fill in the amount you want to purchase and click on the “Buy” button.

5 Ways to Buy Bitcoin With a Debit Card - These Are the Platforms That Accept a Debit Card

1. Buy Bitcoin with a debit card on eToro

eToro is a great platform for a diverse range of investing and trading activities. It offers stocks, indices, and ETFs, as well as over 70 cryptocurrencies. It is secure and regulated and offers unique features such as smart portfolios and social investing. The minimum deposit and trade size is $10, and the BTC trading fees are a transparent 1% plus spread. Read our full eToro Review here.

How to buy Bitcoin with a debit card on eToro

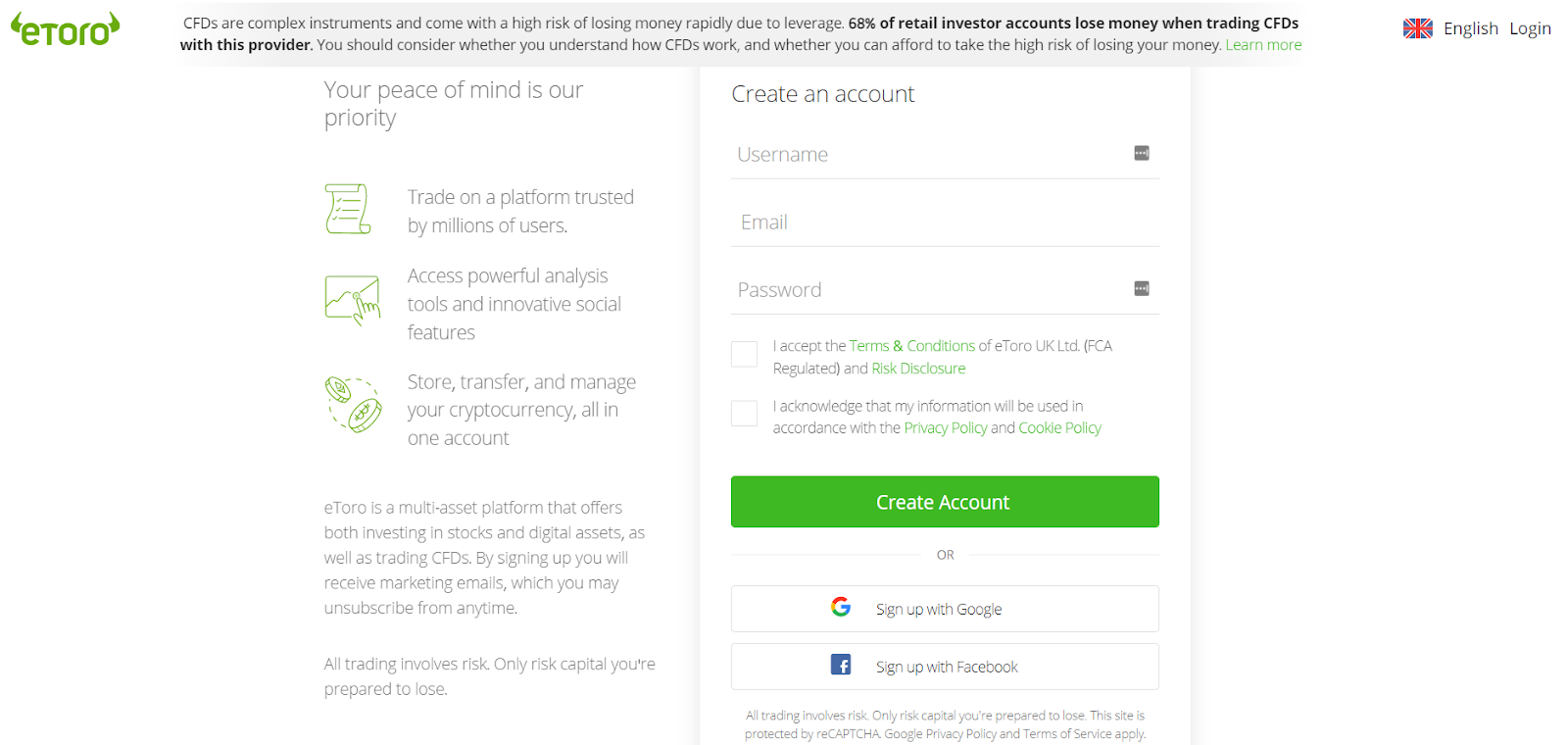

1. Open an account

On the eToro website, click on the “Join Now” button to go to the registration page. Here, you will need to provide a username, email address, and password, and then tick the boxes to confirm that you accept the terms and conditions. Click on the “Create Account” button to complete the registration.

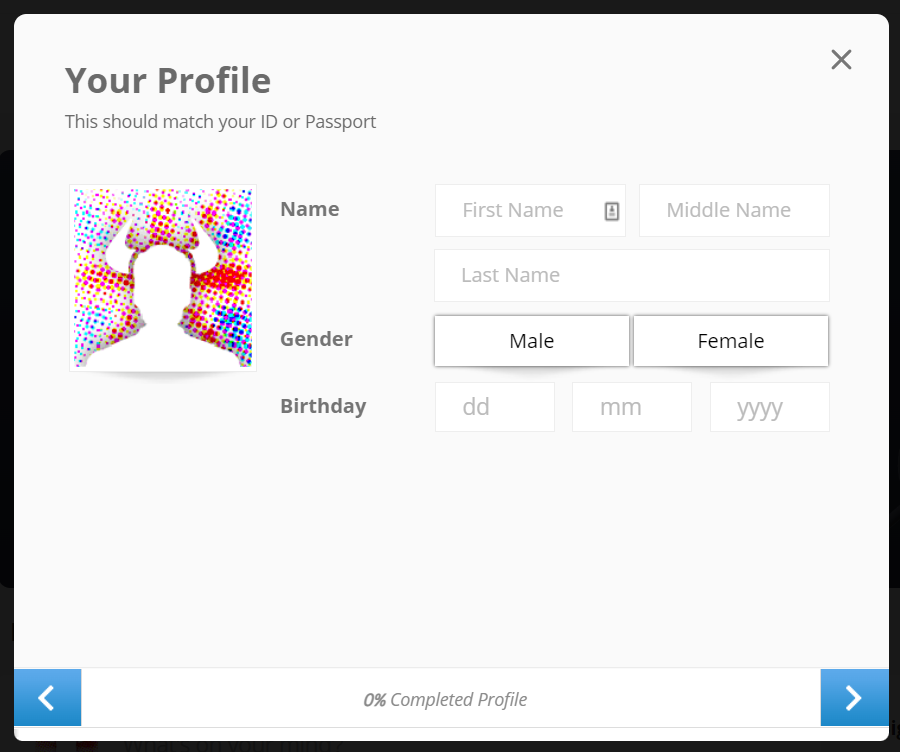

2. Verify your account

You will receive an email with a link in it that you will need to click to confirm your email address. After that, you will need to provide details such as your full name, date of birth, and address to complete your profile. If you are prompted to verify your identity, upload an image of an accepted form of photo ID, and then answer some questions about your investing experience.

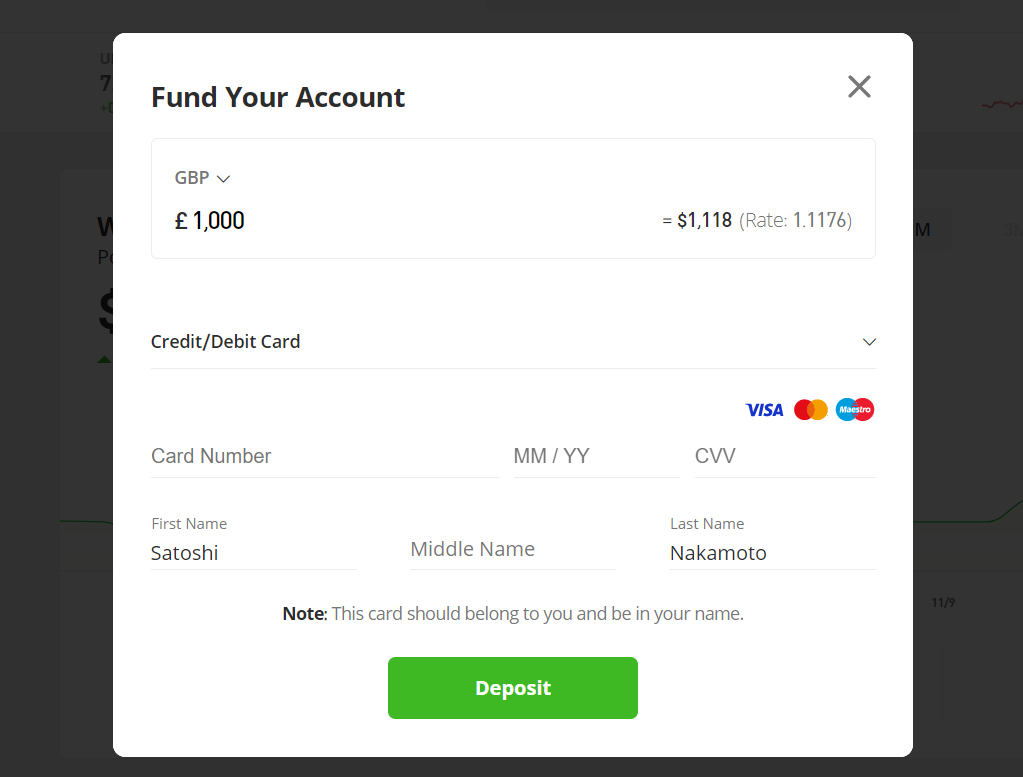

3. Make a deposit with a debit card

Click on the “Deposit Funds” button and fill in how much you wish to deposit. Use the dropdown menu to select “Credit/Debit Card” as the payment method. Fill in your card details and then click on the “Deposit” button to complete the payment.

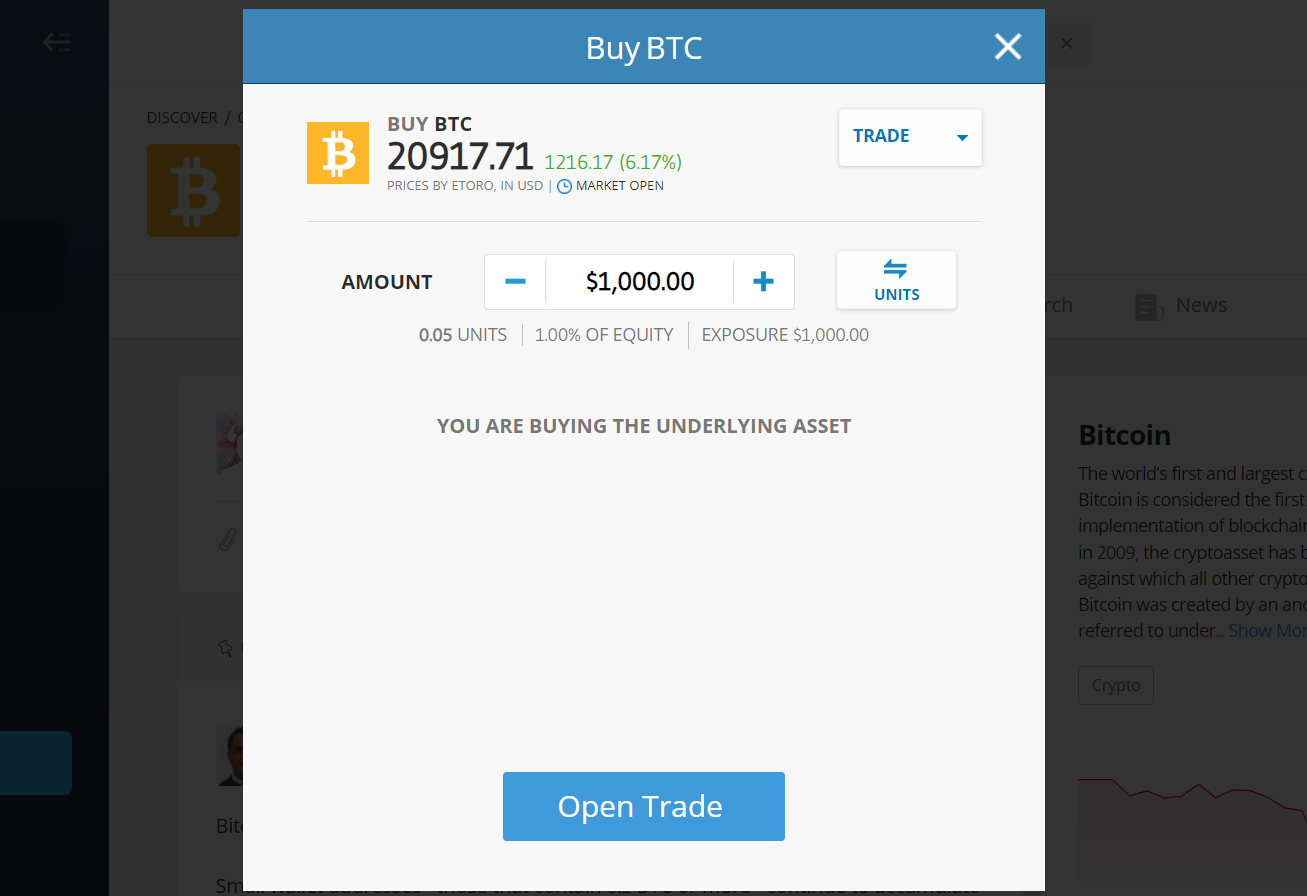

4. Buy Bitcoin

Find Bitcoin using the search bar at the top of the site and click “Trade”. A box will appear where you can enter the amount that you would like to purchase. Switch from Trade to Order if you would prefer to use a limit order to buy BTC in the future. Otherwise, just click “Open Trade” to buy Bitcoin instantly.

eToro Pros

-

Fast and easy to buy BTC

-

Secure and regulated

-

Free debit card deposits

-

Copy trading

-

Demo account

-

Multiple asset types

-

Mobile app

eToro Cons

-

$5 withdrawal fee

-

Not available in every country

Why we chose eToro

eToro is a reliable platform, regulated by various authorities around the world and using industry-leading security practices. Users can take advantage of smart portfolios to build thematic investment strategies around Bitcoin, as well as unique social investing features such as copying pro-BTC traders. The process of buying Bitcoin with a debit card is very beginner-friendly, and users will benefit from free deposits.

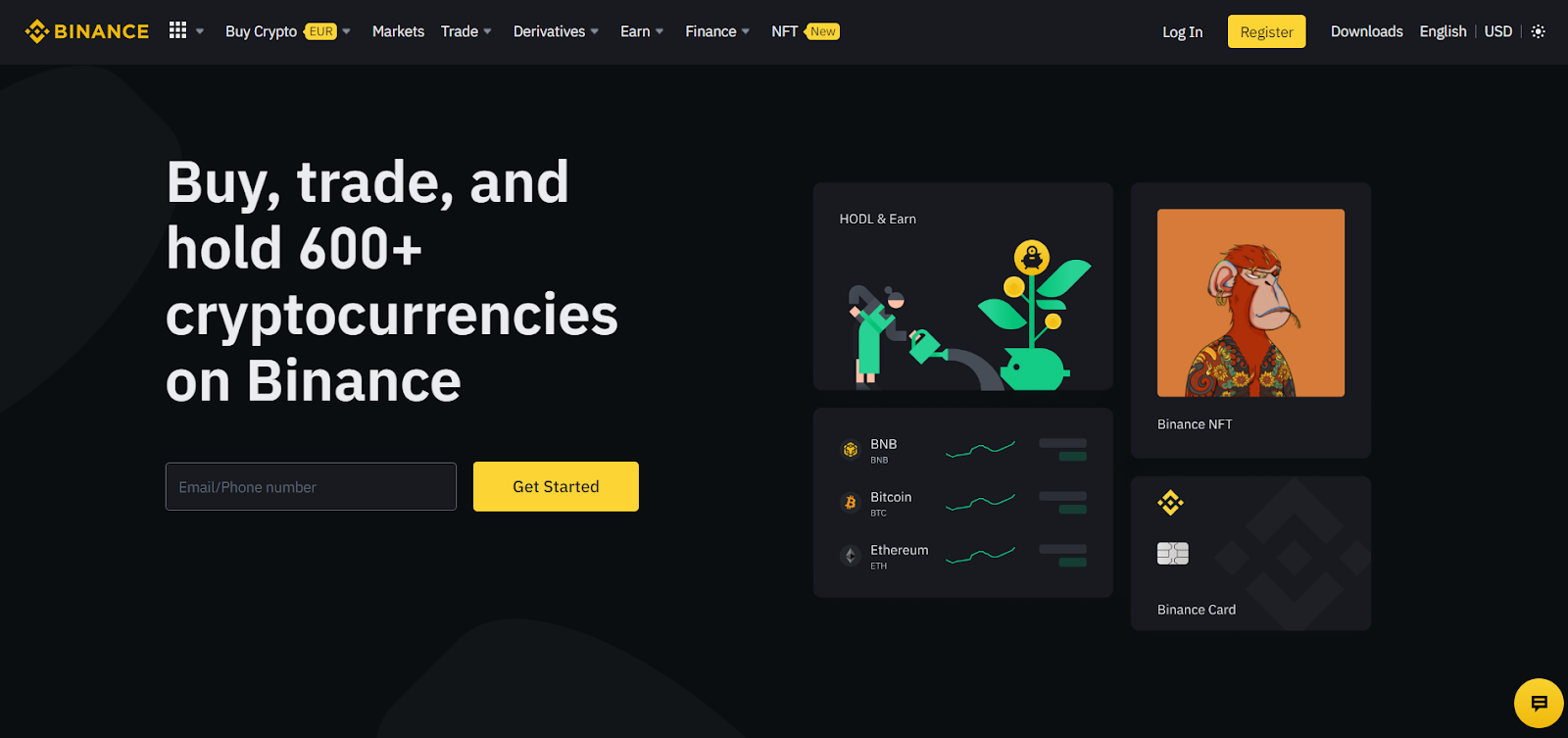

2. Buy Bitcoin with a debit card on Binance

Binance is the go-to trading platform for many experienced traders as it supports more than 600 cryptocurrencies, provides advanced trading tools, and offers Bitcoin derivatives and ways to earn more from your crypto. It also provides an instant card purchase process that is easy to use for beginners. The minimum USD deposit is $50, while the minimum trade size is $10, and the trading fees are up to 0.1%. Read the full Binance review here.

How to buy Bitcoin with a debit card on Binance

1. Open an account

Click on the “Register” button on the Binance website. You can use Apple or Google to sign up, or click on “Sign up with phone or email”. After that, you will need to enter your country, phone number or email address, and a password. You will then be texted or emailed a verification code that you will need to enter to complete the signup process.

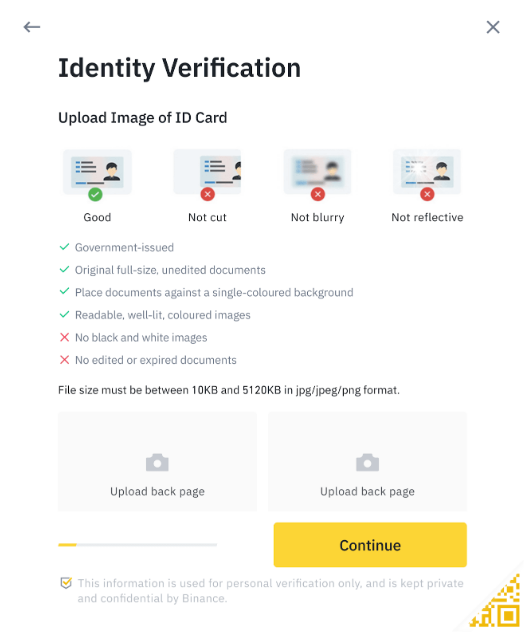

2. Verify your account

Click on “Identification” in the menu under your user icon. Then click “Verify” in the Identity Verification section and choose your country. You will be asked to provide some personal information, and then you can select your ID type and upload an image of it. Your identity will be verified through facial recognition once you give Binance access to your webcam or mobile camera.

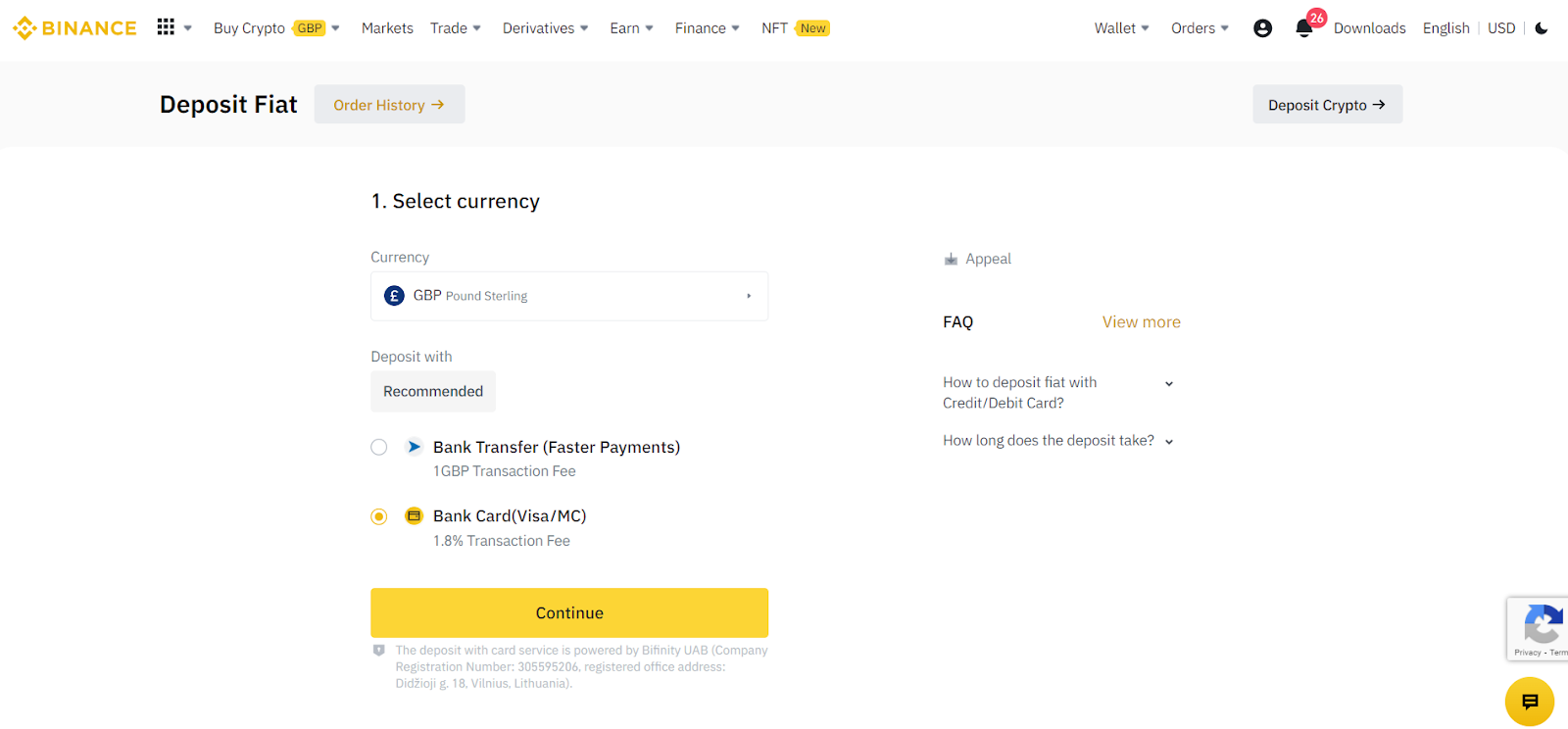

3. Make a deposit with a debit card

Go to “Fiat and Spot” under the Wallet menu and click “Deposit”. Select your currency from the dropdown menu and choose “Bank Card(Visa/MC)” if it is one of the supported payment methods for your chosen currency. Click “Continue”, and then enter your debit card details and click “Add Card”. Now you can enter how much you want and click “Continue” to complete the process.

4. Buy Bitcoin

Go to “Spot” under the Trade tab and use the search box to find the trading pair for BTC and your local currency. Using the order form at the bottom, select “Market”, enter how much you want to buy, and click “Buy BTC”. You can alternatively switch to “Limit” if you want to set a price to buy at in the future.

If card deposits aren’t available in your currency or you want to simplify the process, click on “Credit/Debit Card” under the Buy Crypto tab. Here you can select your local currency and BTC, enter how much you want, and click “Continue”. You will then need to click “Add new card” and fill in your card details before completing the transaction.

Binance Pros

-

Advanced trading tools

-

Low trading fees

-

600+ coins

-

Educational resources

-

Bitcoin derivatives

-

Ways to earn interest

-

Mobile app

Binance Cons

-

Payment options in some countries are limited

-

Minimum deposit for USD is quite high

Why we chose Binance

Binance made our top five as it has everything BTC traders need. There are customizable charts and indicators for conducting technical analysis, access to Bitcoin derivatives like futures and options, and the trading fees are the lowest on the market. There is also a simplified instant card purchase feature to cater to the less experienced, as well as a wealth of educational resources in the Binance Academy. You can even earn interest on your BTC and other coins with products such as savings accounts.

3. Buy Bitcoin with a debit card on Coinbase

Coinbase is an accessible platform, designed to make the process of buying and selling 150+ cryptocurrencies easy for users of all abilities. The tutorials and intuitive interface are ideal for beginners, while more experienced users can still access advanced trading tools on Coinbase Pro. The minimum deposit is $50, the minimum trade size is $2, and the trading fees are 0.6% plus spread. Read the full Coinbase review here.

How to buy Bitcoin with a debit card on Coinbase

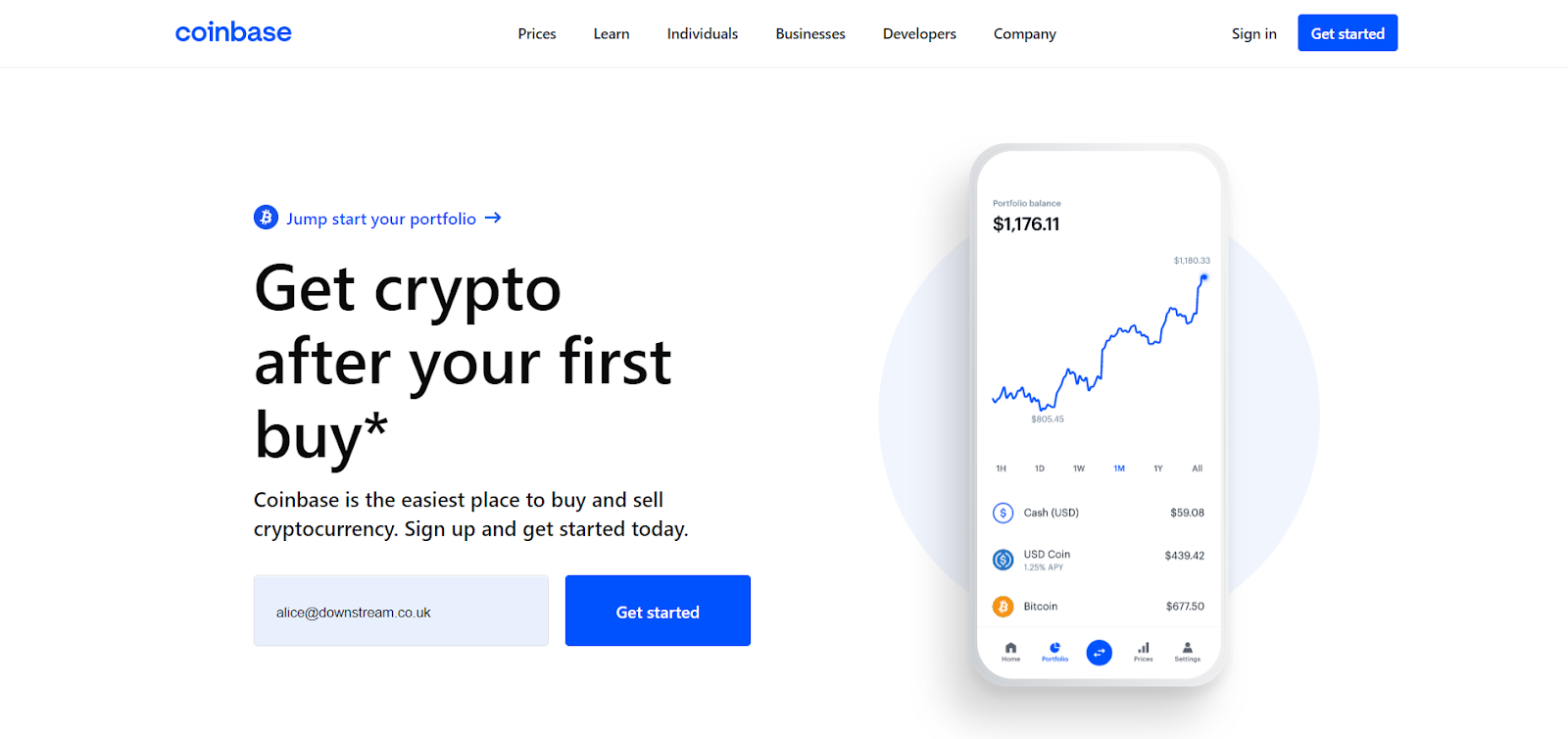

1. Open an account

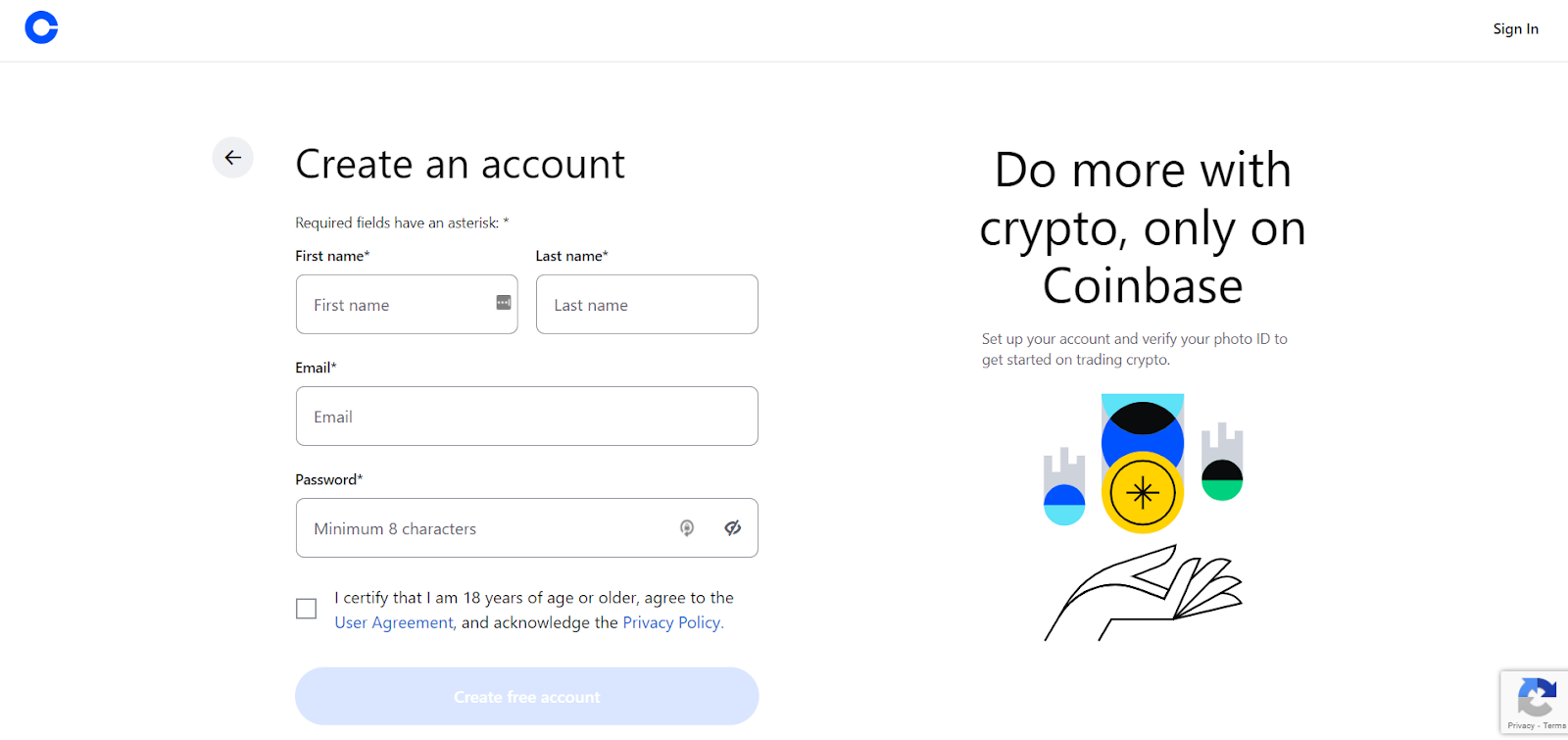

Click the “Get Started” button on the Coinbase website and provide your name, email address, and password. You will be emailed a verification link you will need to click, and then provide your phone number and verify it using the code you will be texted.

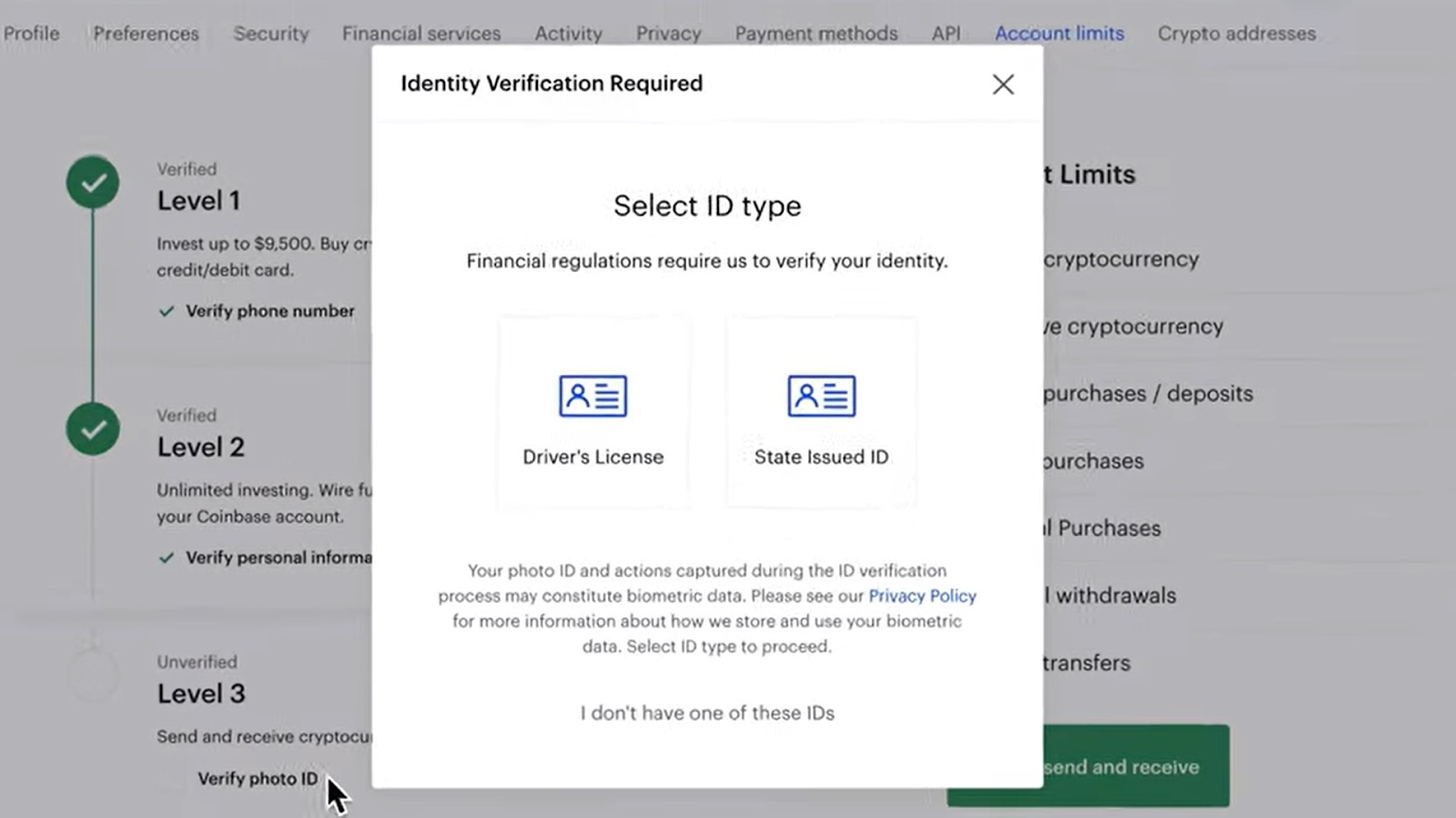

2. Verify your account

After filling in your date of birth and address, you will be asked some questions about your job and investing activities. In Settings under Account Limits, you can verify your identity by choosing your ID type and uploading an image of your photo ID, such as a driver’s license or passport.

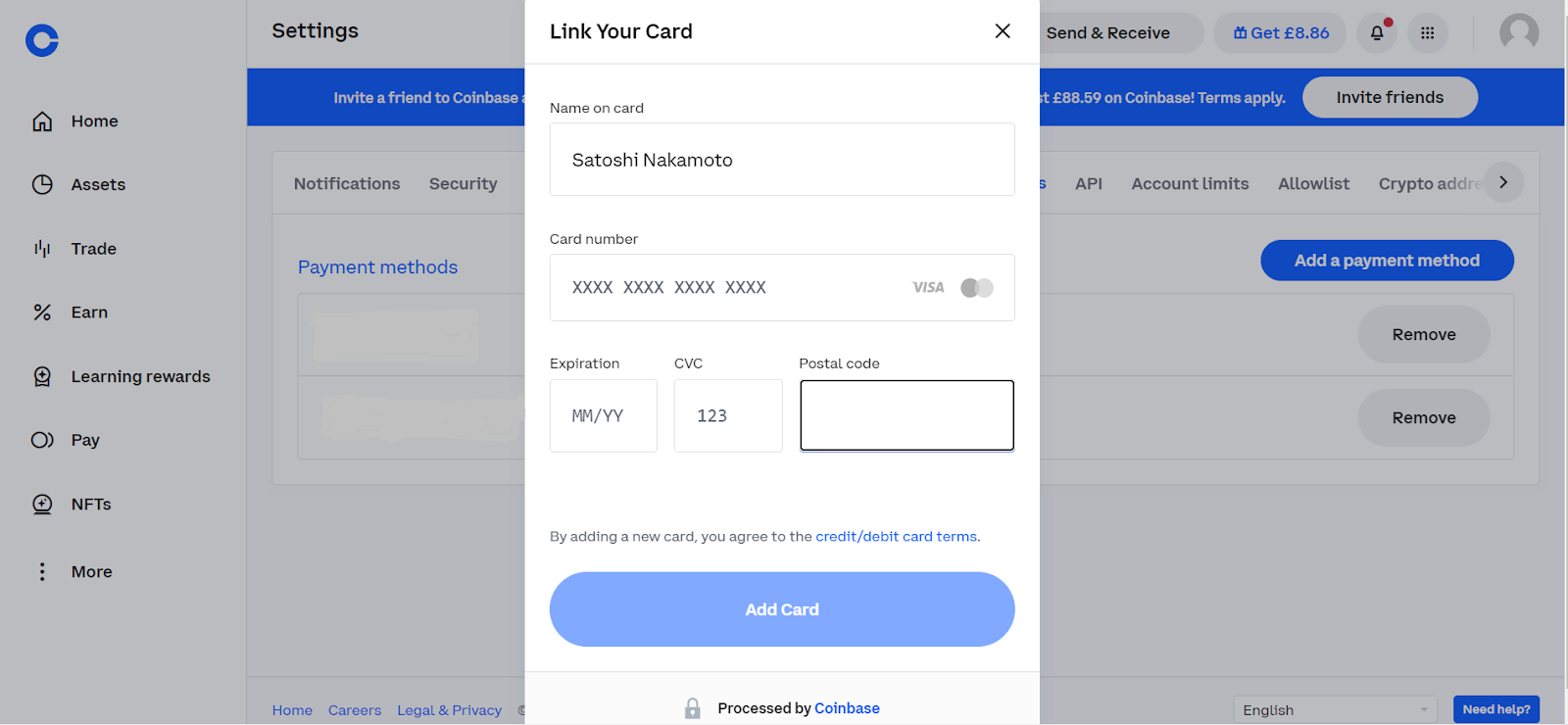

3. Link your debit card

Go to Settings and then Payment methods. Click the “Add a payment method” button and select “Credit/Debit Card”. Fill in your card details and click the “Add Card” button.

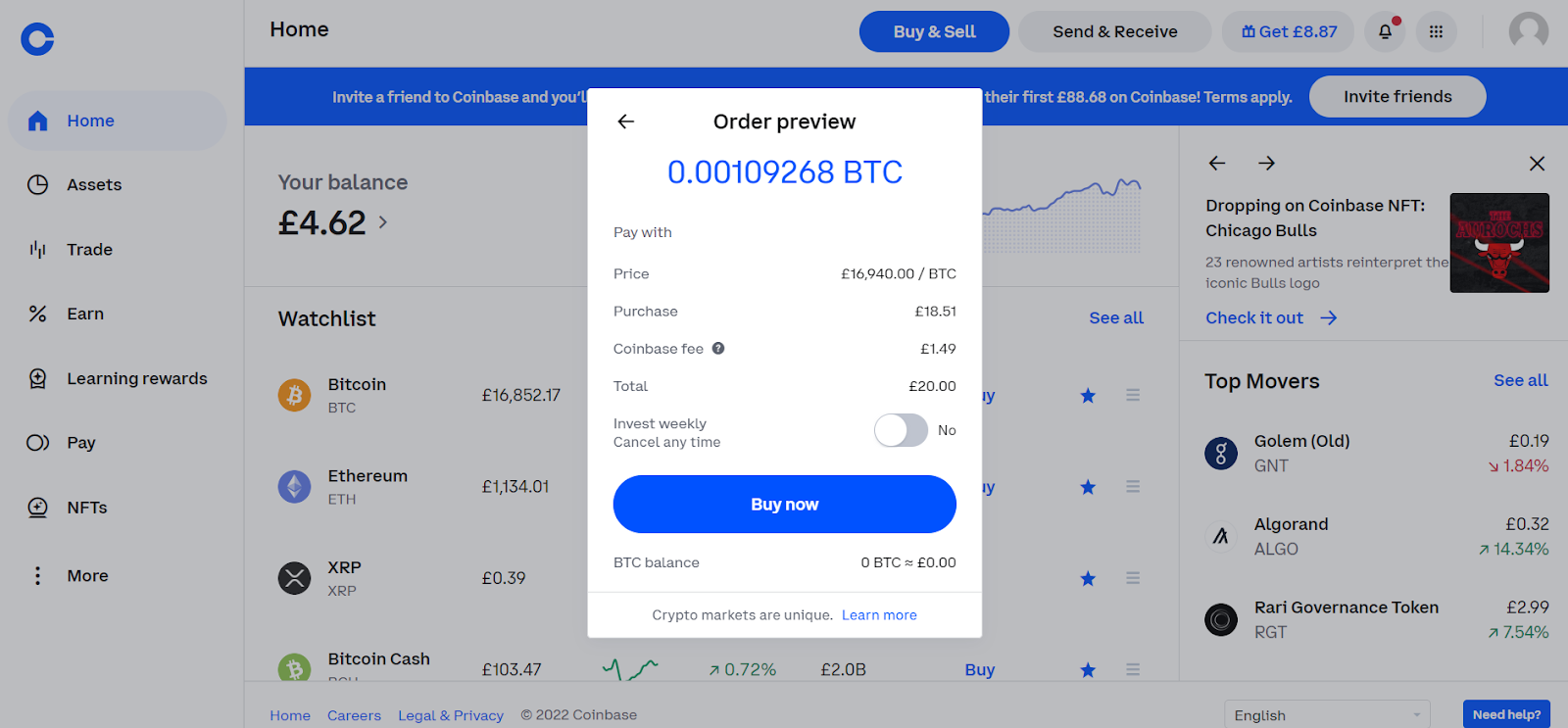

4. Buy Bitcoin

Click the “Buy & Sell” button at the top and make sure Bitcoin is the asset selected. Enter how much you want and select your debit card from the available payment options under “Pay with”. Click “Preview Buy”, and if you are happy with the details in the order preview, simply click the “Buy now” button.

Coinbase Pros

-

Easy to use for beginners

-

Instant debit card purchases

-

Minimum purchase size of $2

-

Recurring buys feature

-

Learning rewards

-

Educational materials

-

Regulated and secure

-

Mobile app

Coinbase Cons

-

Debit cards can’t be used for making deposits

-

Instant card purchase fees can be high for small amounts

Why we chose Coinbase

Coinbase is a great place for anyone new to Bitcoin, as the platform is easy to navigate, the minimum purchase amount is very low, and there are helpful tips and tutorials in the Learn section. You can even earn free crypto with the Learning rewards feature. Coinbase is also a secure and reliable platform with regulatory licenses, cold storage, and crypto insurance.

4. Buy Bitcoin with a debit card on Bitpanda

Bitpanda is a multi-asset trading platform that offers over 200 cryptocurrencies, as well as crypto indices, stocks, metals, and ETFs. It’s a quick and safe way to make instant purchases, set up recurring buys with a savings plan, and develop your knowledge with the Bitpanda Academy. The minimum deposit is $25, the minimum purchase is $1, and the quoted asset prices include a 1.49% premium. You can learn more with our Bitpanda review.

How to buy Bitcoin with a debit card on Bitpanda

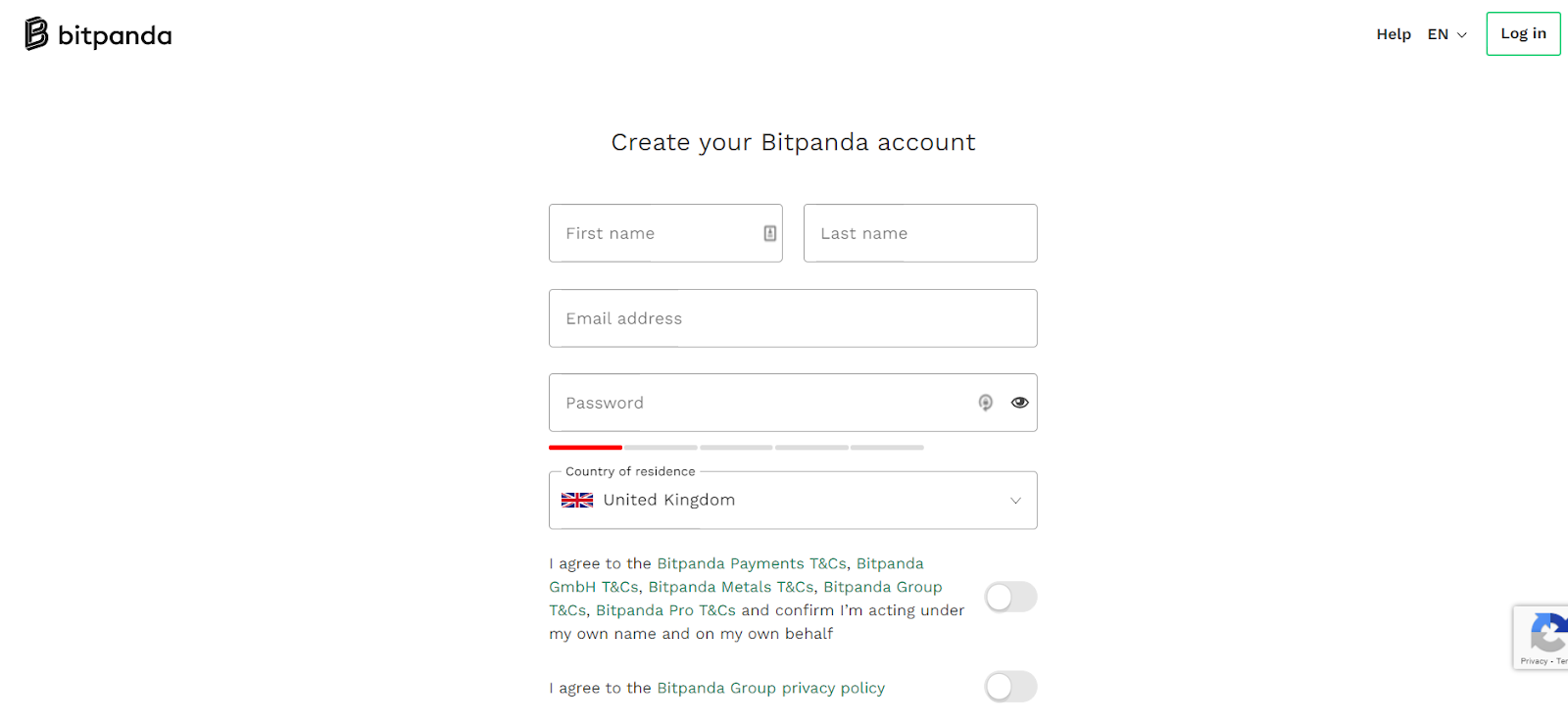

1. Open an account

Click the “Sign-up” button at the top of the website to go to the registration page. You will need to fill in your name, email address, password, and country of residence. Accept all the terms and conditions, and then click “Create account”.

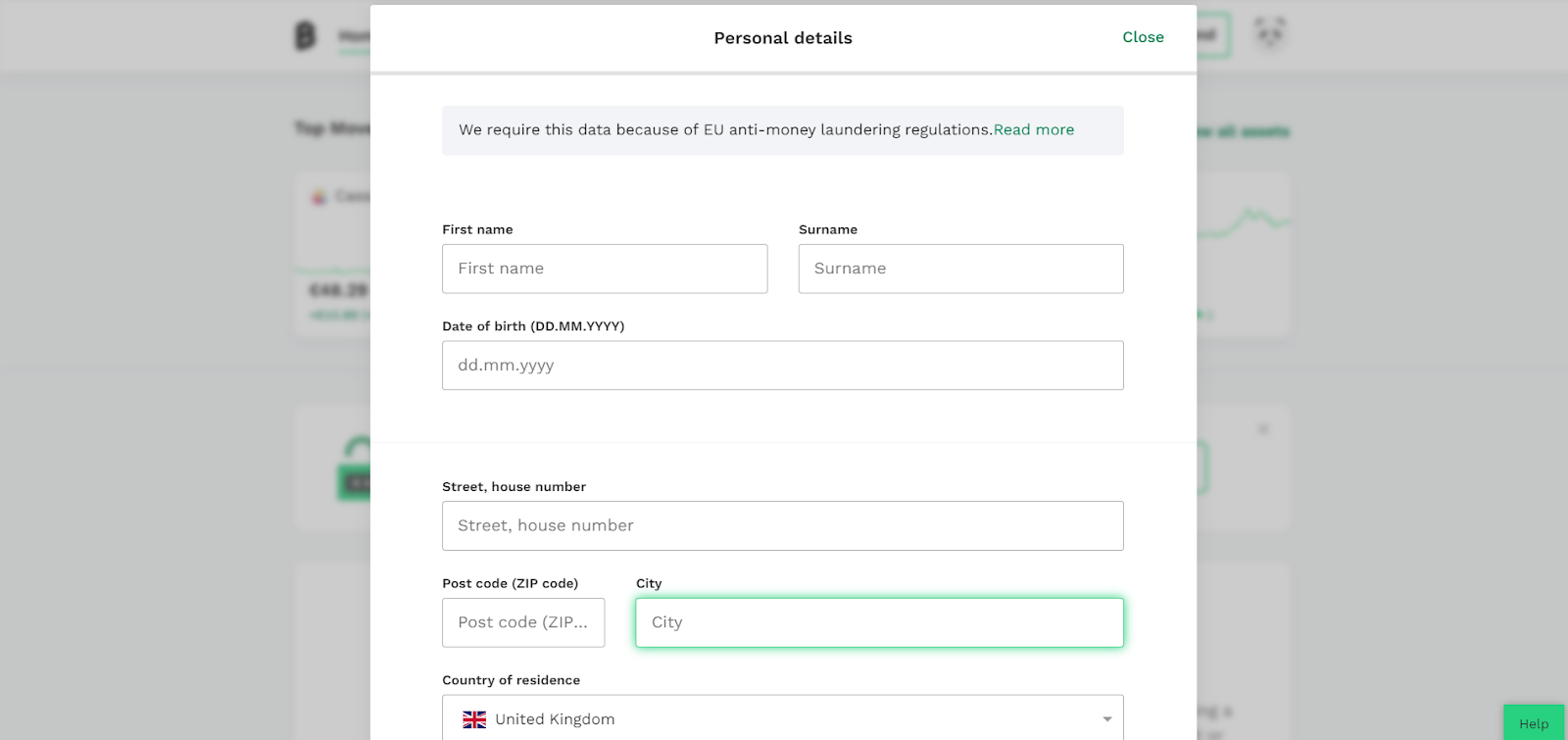

2. Verify your account

When you click the link in your email, you will be prompted to click “Continue” and answer some questions about your finances and employment. Then click the “Start verifying” button and fill in your personal details on the next page, such as your full name, date of birth, address, and phone number.

Click “Save and continue” and enter the SMS code you receive. You will then need to select an ID document to upload and give Bitpanda access to your webcam, following the instructions to record a short video of yourself. On the next page, click “Get secure link” and scan the QR code with your phone. This will enable you to upload an image of your ID with your mobile camera. Click “Submit”, and you will receive an email confirmation that your account has been verified within a few minutes.

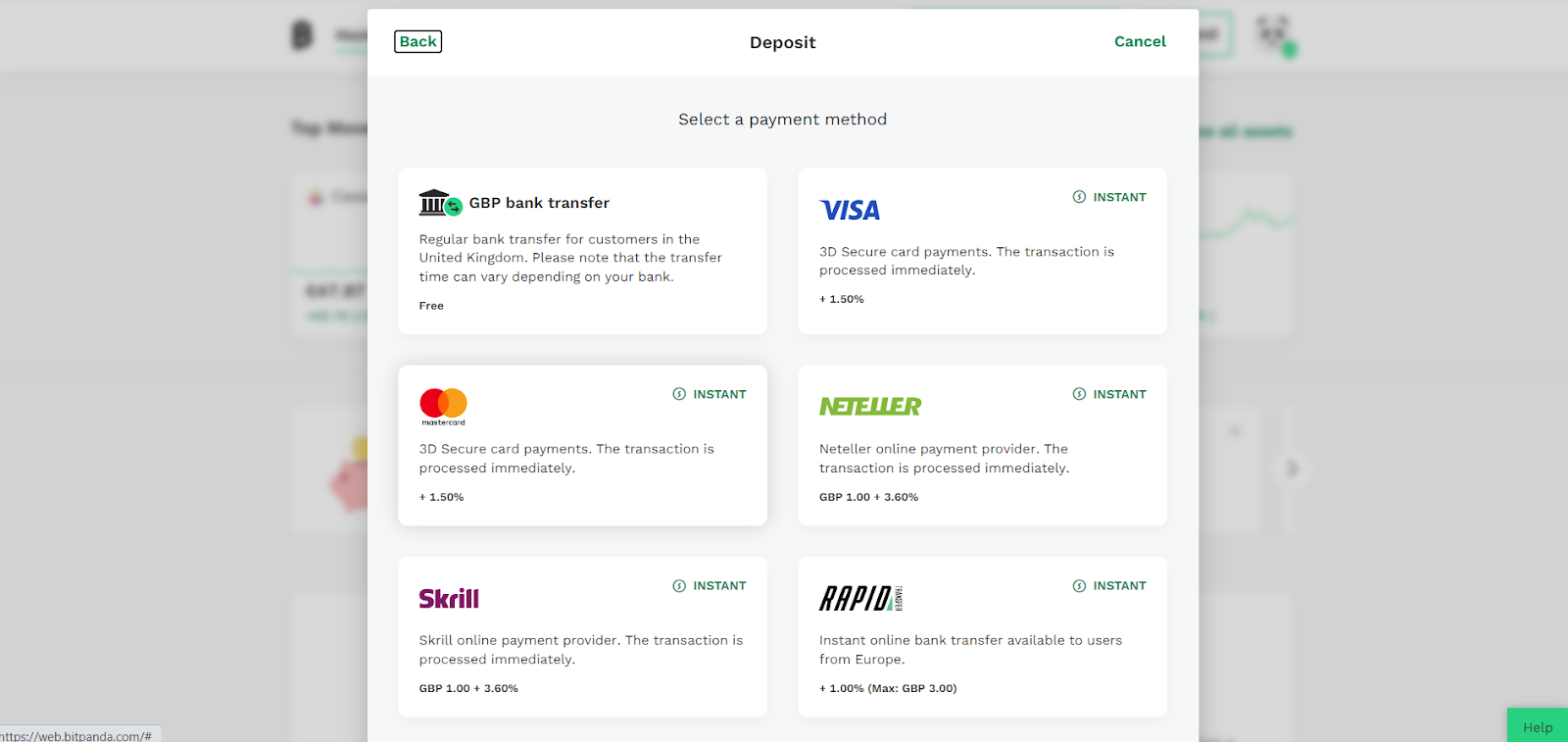

3. Make a deposit with a debit card

Click the “Deposit” button at the top and select the currency you wish to deposit. Select either Visa or Mastercard from the payment options, enter how much you want to transfer, and click “Go to summary”. Accept the conditions and click “Confirm”. You will be texted an SMS code to enter on the next page. You will then be connected to your bank to fill in your card details and complete the payment.

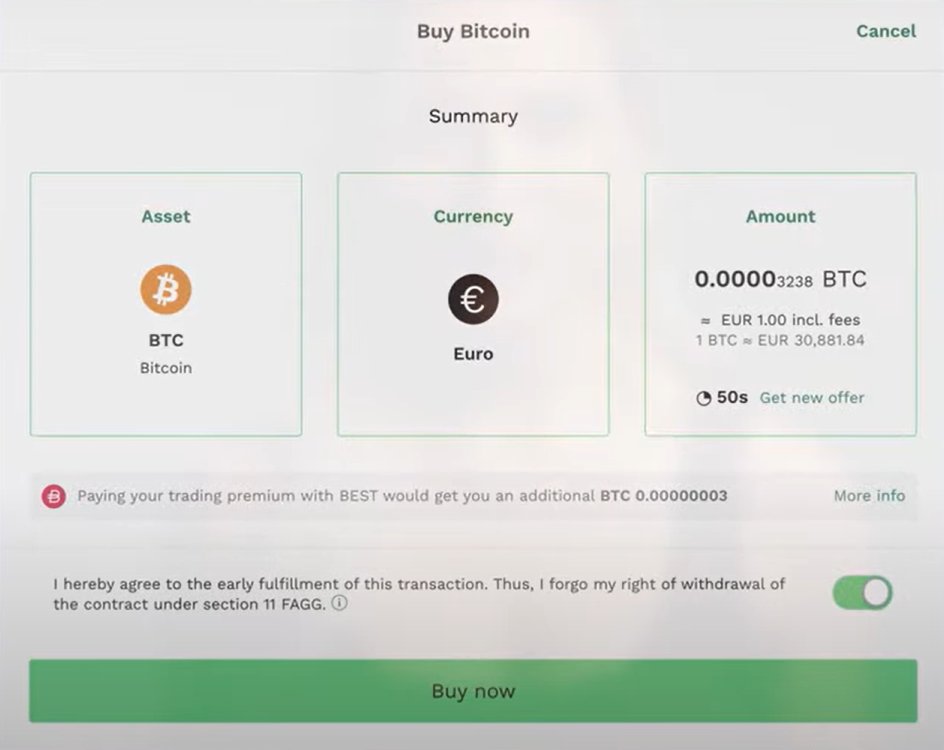

4. Buy Bitcoin

Click the “Trade” button at the top and click “Buy”. Select Bitcoin and the fiat wallet you want to use to pay. Next, enter the amount you want and click “Go to summary”. Check that you are happy with the summary and click “Buy now” to purchase BTC instantly.

Bitpanda Pros

-

Multi-asset platform

-

Licensed and secure

-

Simple to use

-

$1 minimum trade

-

Educational resources

-

Mobile app

Bitpanda Cons

-

Mostly unavailable outside Europe

-

Only support provided is via email

Why we chose Bitpanda

We picked Bitpanda as it is the best place for beginners who want to build a diverse portfolio. You can trade in multiple markets and even swap your Bitcoin directly with Gold and other asset types. The simple interface and educational resources are great for those who are new to Bitcoin, and as a fully licensed platform with offline storage, Bitpanda is a safe place to start your crypto journey. The platform is also rated as excellent on Trustpilot.

5. Buy Bitcoin with a debit card on Capital.com

Capital.com is a trading platform that supports the trading of more than 6,000 CFDs, spanning markets such as stocks, commodities, indices, forex, and crypto. There are hundreds of crypto pairs to trade, and users can access advanced trading fees and up to 30x leverage. The minimum deposit is $20, and there is no commission, with Bitcoin CFDs having a spread of about 66.

How to buy Bitcoin with a debit card on Capital.com

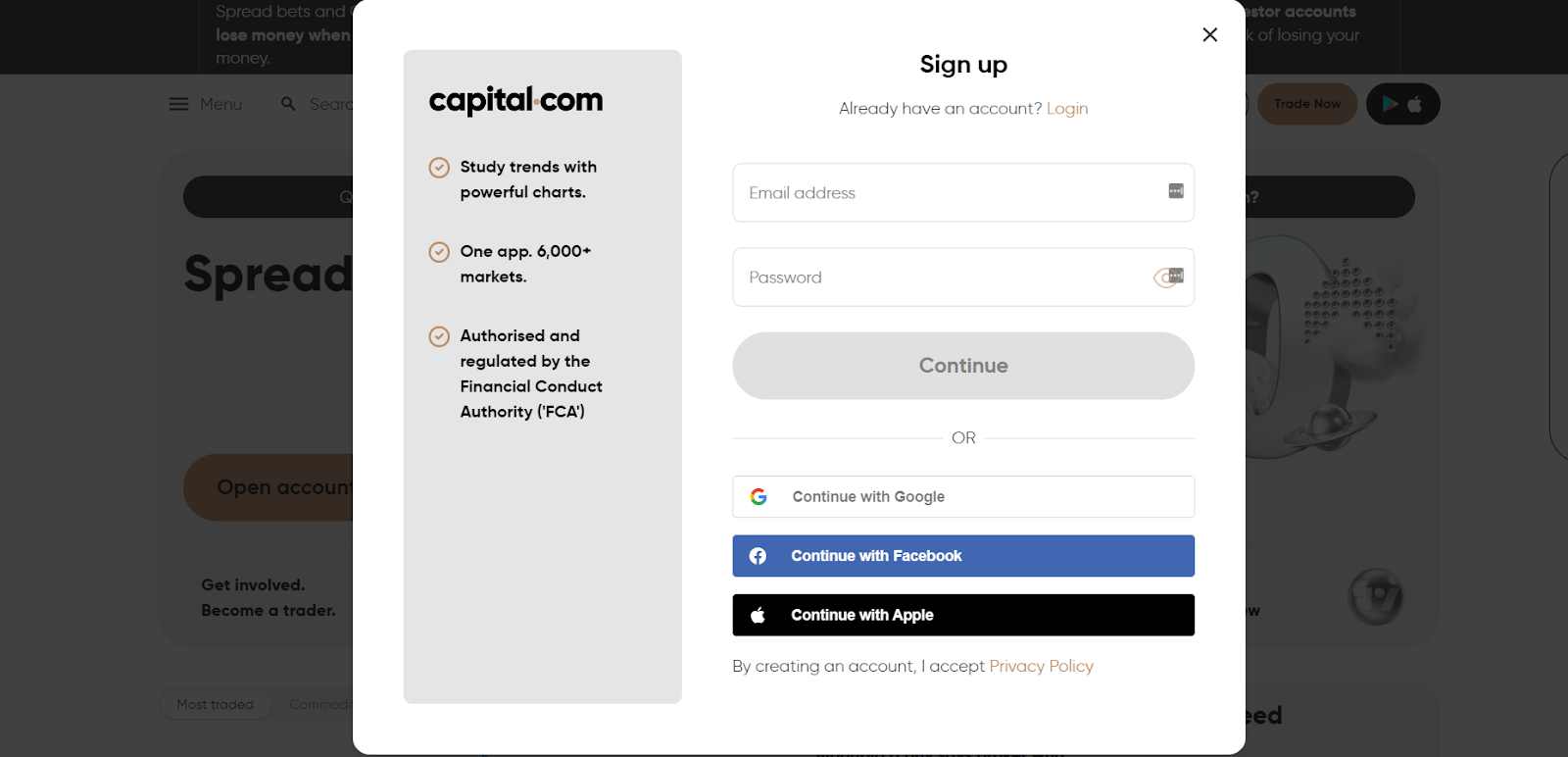

1. Open an account

Click the “Trade Now” button in the top right corner of the homepage. You can sign up with Google, Apple, or Facebook. Otherwise, provide an email address and password and click “Continue”. You will then need to accept all the terms and policies.

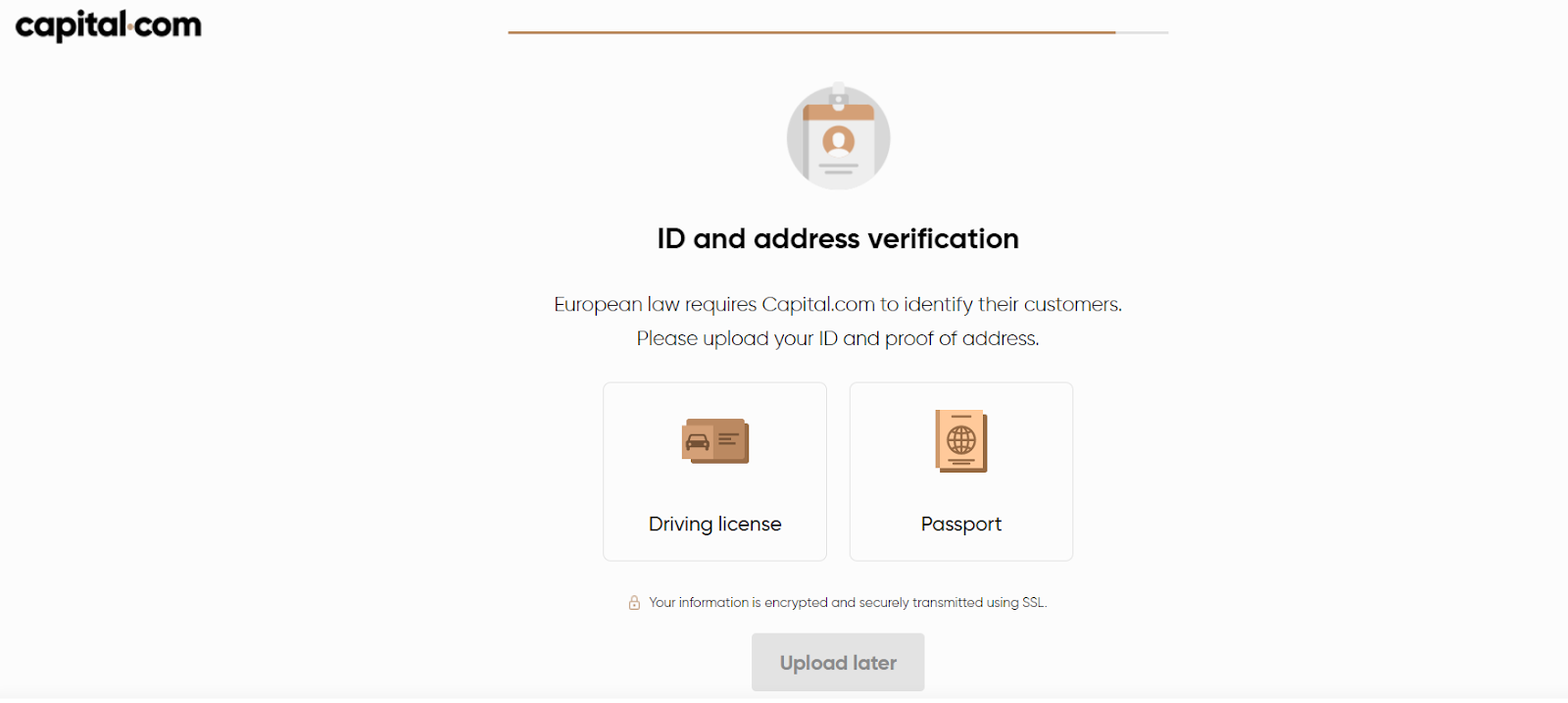

2. Verify your account

Click the “Complete registration” button in the top right corner of the platform. You will then be asked to answer some questions about your trading plans, experience, education, employment, and income. After that, you’ll need to provide some personal information, such as your full name, date of birth, sex, national identification number, address, and phone number. Then you can choose your account type and currency. Select an ID type for the verification process and upload an image of it.

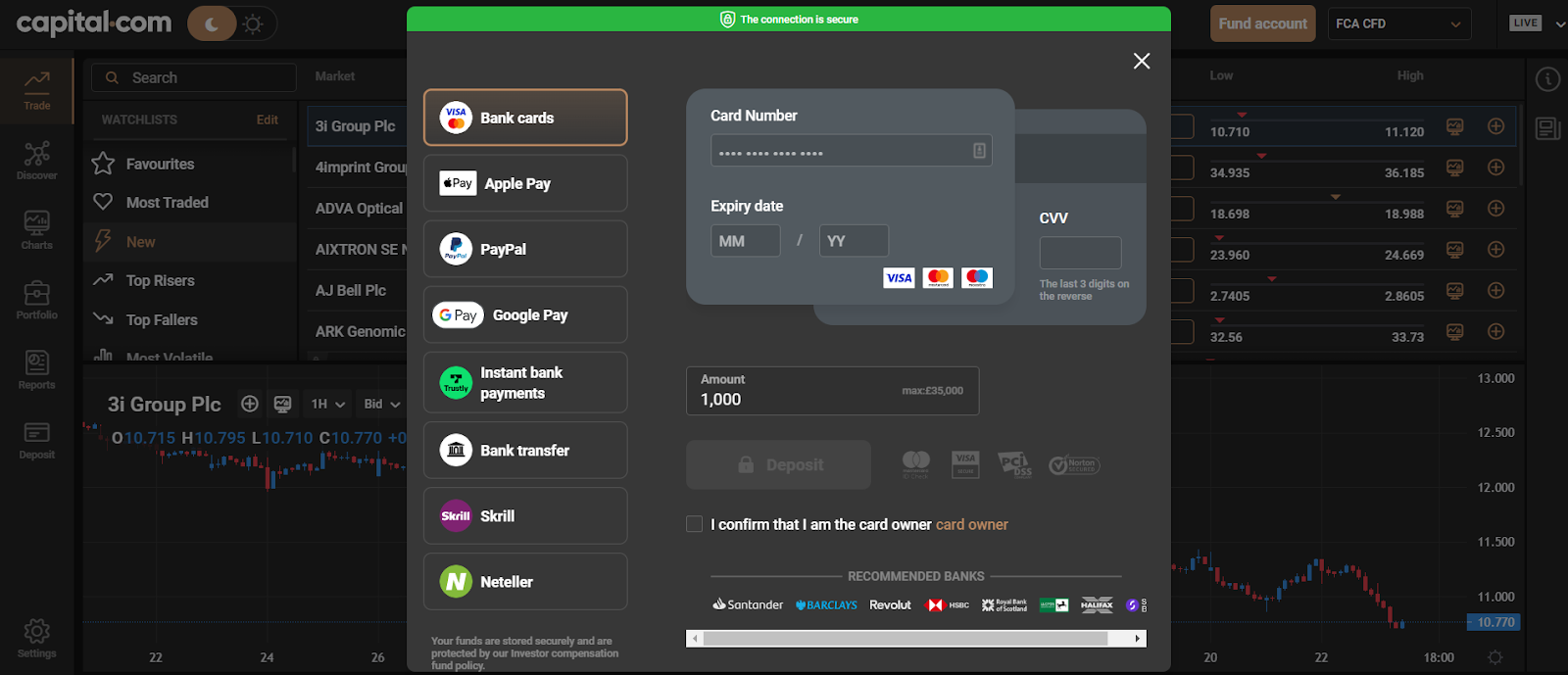

3. Make a deposit with a debit card

Click the “Fund account” button in the top right of the platform. Select “Bank cards” from the payment options on the left and fill in your debit card details. Enter how much you wish to transfer, tick the box to confirm that you are the card owner, and click the “Deposit” button.

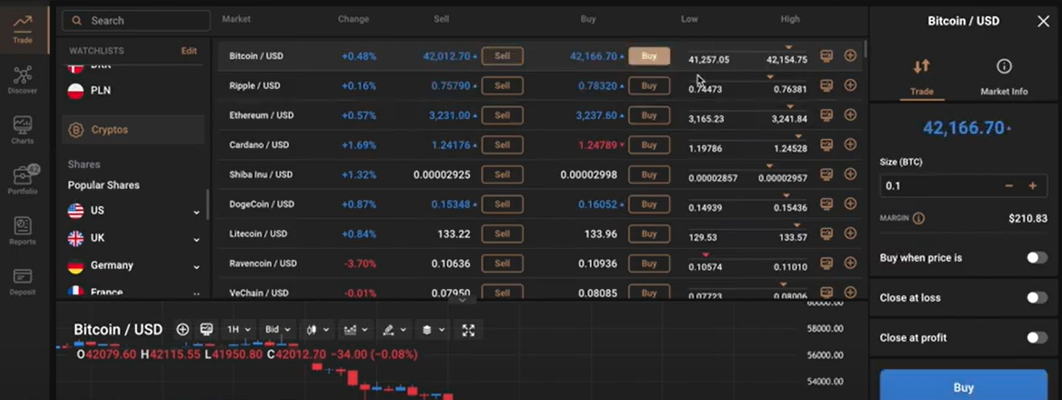

4. Trade Bitcoin CFDs

Use the search bar at the top to find the BTC/USD pairing. You can adjust the leverage by going to Settings, selecting your account, and clicking on the trading options icon. Click “Buy” if you want to go long on Bitcoin or “Sell” if you want to go short. Enter the amount of BTC you wish to speculate on, and use the toggles below to make it a limit order, set a stop loss, or set a take profit. Click the “Buy” (or “Sell”) button.

Capital.com Pros

-

Trade crypto CFDs easily, without custody concerns

-

6,000+ CFDs across multiple markets

-

Advanced trading tools and up to 30x leverage

-

Risk management tools and financial education

-

Regulated and secure

-

Demo account

-

Mobile app

Capital.com Cons

-

CFDs are high risk

-

Crypto CFDs are not available in the UK

Why we chose Capital.com

Capital.com allows you to speculate on the price of multiple asset types in the same place—without actually owning them. While advanced users will appreciate features like AI-powered post-trade analysis and client sentiment, beginners also benefit from the risk management tools, financial education, and virtual trading account. What’s more, it’s free to make debit card deposits.

Why Should I Buy Bitcoin With a debit card?

Here are some of the reasons that you might want to use a debit card to make a Bitcoin purchase.

Speed

A debit card is one of the fastest ways to make a deposit on a crypto platform. While you might have to wait days for a bank transfer to be processed, debit card deposits are processed immediately, leaving you able to trade with your funds straight away.

Convenience

You will only need to input your debit card details once, and then it will be linked to your account. After that, it is quick and simple to make deposits. A number of platforms also have an instant card purchase feature, which speeds up the BTC buying process and simplifies it further.

Familiarity

Most debit card holders already use their cards for a range of other purchases. When you use your card to make a deposit or purchase on a crypto platform, the process will be the same as that which you are already used to when making other online purchases. No need to set up a new account or learn to use a new payment service.

Acceptance

While some payment methods may only be accepted by a limited number of crypto platforms, debit cards are supported by the majority. This gives you plenty of options when it comes to where to purchase Bitcoin.

Buying Bitcoin With a Debit Card via Crypto Exchange vs P2P vs Broker

There are different types of platforms you could use to buy Bitcoin with a debit card, and we’ll look at the pros and cons of each below.

Crypto exchange

Crypto exchanges are one of the most popular places to buy BTC with a debit card as they provide a range of useful trading tools and features like earning products, as well as generally offering affordable trading fees and deposit minimums.

Regulated exchanges have strong security and often good customer service. The most popular crypto exchanges also have high liquidity, meaning fast trades and a smooth user experience. You can even make instant debit card purchases on some exchanges.

P2P

Peer-to-peer (P2P) platforms enable you to find Bitcoin sellers that accept debit card payments and send them money through escrow in return for BTC. You can sometimes do this without going through an identity verification process.

There are no fees, but the seller may charge a higher exchange rate than other platforms, and caution is needed as some users may attempt to scam you. Buying P2P tends to be slower and more complicated than using an exchange, and you probably won’t get access to features like technical analysis tools, Bitcoin custody, and earning products.

Broker

Crypto brokers enable you to speculate on the price of Bitcoin and other assets without actually owning them, through derivatives like CFDs. They tend to be licensed and secure, but CFDs are high-risk instruments and may not be suitable for beginners.

The minimum debit card deposit on some brokers may be higher than on exchanges, but brokers tend to be rich in useful features and support advanced trading. Brokers make a profit by charging a spread, and they may also charge a commission on trades.

Buying Bitcoin Anonymously Using a Debit Card

As all regulated exchanges and brokers have KYC requirements, it is not possible to use them to buy Bitcoin anonymously with a debit card. The only way to avoid KYC is by using a P2P platform to find a BTC seller who accepts debit card payments from unverified users.

However, this is less secure and leaves you at risk of potential crypto scams. What’s more, the process will not really be anonymous as the seller will receive your payment details, and the payment will be visible to your bank.

Pros and cons of using a debit card to buy Bitcoin

Pros

- Speed – Deposits and card purchases are processed instantly

- Convenience – The process is simple, especially once you’ve saved your card details

- Familiarity – The process is just like using your debit card for other online purchases

- Secure – The payment will be processed by your bank, which uses industry-best security practices

- Beginner-friendly – Making purchases with a debit card is easy, so anyone can do it

- Broad acceptance – A large number of crypto platforms accept debit cards, giving you lots of options

Cons

- Buying restrictions – When using your debit card, there may be limits on how much BTC you can buy

- Security checks – You could be required to do a security check with your bank first, prolonging the process

How Much Does It Cost to Buy Bitcoin Using a Debit Card? - What Are the Fees?

Unlike with credit cards, there are no annual fees for owning a debit card. If you want to use a debit card to buy Bitcoin, whether you pay fees and how much will depend on the platform you use.

eToro doesn’t charge any deposit fees, but charges 1% plus spread on each BTC purchase. Using a debit card to make an instant purchase on Coinbase incurs a fee that varies according to a number of factors, as well as spread. Binance charges a 1.8% fee for debit card deposits and up to 0.1% on Bitcoin purchases.

Is Using a Debit Card the Best Way to Buy Bitcoin?

We’ve already seen what the pros and cons are of using a debit card to buy Bitcoin, but how does it compare to other payment methods? Which payment method is best for you will depend on your personal needs and circumstances. Some of the most popular alternatives are discussed below.

What are the alternative methods?

Credit card

Using Credit cards to buy Bitcoin provides the speed and convenience of debit cards, with the addition of better security and the flexibility to pay later or in installments. The downside is that is that they have annual fees and interest payments, and you risk going into debt if you can’t pay what you owe.

Bank account

Making a bank transfer to buy Bitcoin is often the cheapest way to buy Bitcoin as the fees are lower or non-existent. The payment could take days to process, but when using a service like Faster Payments, bank transfers can be pretty much immediate.

Neteller

Neteller is a digital wallet and e-money transfer service that is convenient for its speed and ease of use. Most crypto platforms don’t accept Neteller, but you can use Neteller to buy Bitcoin on Bitpanda and Capital.com.

Paysafecard

Buying Bitcoin with a Paysafecard is a simple way to pay with cash. This is convenient for people who don’t have access to a bank account or credit card. However, there are limits on how much you can spend and where you can use it.

Paypal

Buying Bitcoin on PayPal is a popular online payment method due to its speed and convenience, and you can even buy BTC directly on the PayPal platform (you won’t have access to as many features and coins as on crypto platforms, though). However, few crypto platforms accept PayPal deposits from users outside the US.

Apple Pay

Buying Bitcoin with Apple Pay is simple, secure, and private. It speeds up the checkout process but Apple Pay isn’t accepted as a payment method on many platforms other than Capital.com.

Google Pay

Buying Bitcoin with Google Pay is a fast and secure method of paying online. It’s easy to set up and there is no limit on transactions, but very few crypto platforms accept Google Pay. Capital.com is one of the few that do.

Amex

Buying Bitcoin with American Express is a trusted method of payment that can be used to buy Bitcoin quickly and safely. There is a choice of Amex cards available, and you can earn rewards when you use them, but the fees can be high and not all platforms that accept cards accept Amex.

Venmo

Venmo is a digital wallet designed for peer-to-peer payments. You can buy Bitcoin on Venmo in the crypto tab of the Venmo platform, where you can easily and quickly buy as little as $1. However, there are only four cryptocurrencies available, and Venmo has higher fees and much fewer features than most crypto platforms.

Skrill

Skrill is a digital wallet, similar to Neteller, that provides a fast and secure way to buy Bitcoin. Most crypto platforms don’t accept Skrill to buy Bitcoin, but you can use it on eToro, Bitpanda, and Capital.com.

Final Thoughts on Buying Bitcoin With a Debit Card

To summarise, debit cards are one of the most popular payment methods when buying Bitcoin, as they are fast, convenient, and widely accepted. The majority of crypto platforms support debit card deposits, and the best ones are listed on this page.

Our top recommendation is eToro, where you can make a debit card deposit for free. After that, the Bitcoin buying process is simple and secure, and you can benefit from unique social investing features like copy trading. There are step-by-step instructions for buying Bitcoin with a debit card on eToro further up this page.

Methodology - How we picked the best platforms to buy Bitcoin with a debit card

We have a duty to provide reliable information and guidance that you can trust when you are making investment decisions. We rigorously test each platform we review as part of our quality control process.

The processes and features we test include signing up, making a deposit, speed and performance of interface, trading tools and features, available assets, fees, educational content, customer support, security, and regulation.

Frequently Asked Questions

Top Bitcoin Stories

Bitstamp to distribute Mt. Gox BTC from July 25

24 July 2024 Bitstamp plans to distribute Mt. Gox Bitcoin and Bitcoin Cash as from Thursday, July 25. The exchange…

Bitcoin hovers near $66.5k as Mt.Gox users ‘choose to hodl’

24 July 2024 Bitcoin price still hovers above $66k despite Mt. Gox repayments. Analysts say on-chain data shows most BTC…

Swan Bitcoin halts IPO plans and shuts down mining operations

22 July 2024 Swan Bitcoin delays IPO plans due to shutdown of its mining operations. CEO cites reduced revenue from…

Mark Cuban: Inflationary Pressure Could See Bitcoin Become Global Reserve

18 July 2024 Inflationary pressure and geopolitical uncertainty could see Bitcoin become a global reserve currency, states Cuban The billionaire…

StarkWare verifies first zero-knowledge proof on Bitcoin

17 July 2024 StarkWare has verified the first zero-knowledge (ZK) proof on the Bitcoin. It’s part of the core Starknet…