The 11 Best Places to Buy Bitcoin in 2024

Bitcoin pioneered the concept of cryptocurrency and is still by far the most popular coin. This means there is an ever-growing number of places where you can buy BTC. The choice may seem overwhelming, but this guide is designed to help you arrive at a decision.

We’ve researched and picked out the best places to buy Bitcoin. On this page, you will find detailed reviews of all the top platforms, information on different types of platforms, and how safe they are. By the end, you should be confident in choosing the platform that is right for you.

Best Places to Buy Bitcoin - Our Top 3 Picks

Want to find a great place to buy Bitcoin right away? The table below shows our top 3 best places to buy Bitcoin.

The 11 Best Places to Buy Bitcoin

What Is a Bitcoin Exchange & How Does It Work?

A Bitcoin exchange is a place where you can buy Bitcoin. Most crypto exchanges will offer a range of other cryptocurrencies alongside Bitcoin. As well as buying and selling Bitcoin, some exchanges may enable you to trade between different cryptocurrencies.

As exchanges have lots of users buying and selling BTC in the same place, it is very quick to make a trade. A number of exchanges provide a simple buying experience for beginners, as well as more advanced tools for experienced traders.

Many of the most popular exchanges have a mobile app, enabling you to buy and sell Bitcoin from your smartphone wherever you are. All of the platforms in this guide (except Coinmama) provide a mobile Bitcoin app.

What Is a Bitcoin Broker?

A Bitcoin broker is also a place where you can trade Bitcoin. Many people use the terms “exchange” and “broker” interchangeably, and the line between them isn’t always clear as a number of platforms offer both exchange and broker features. However, there is technically a difference between the two types of platforms, as will be discussed in the next section.

Bitcoin Brokers vs Exchanges

Bitcoin Brokers

A Bitcoin broker acts as an intermediary between a user and the market, so broker users don’t trade directly with each other. The crypto broker sets the prices and generates revenue from the difference between buy and sell prices, which is called the spread. Brokers may also charge commissions on trades, along with fees for other services.

Broker platforms provide more flexible settlement, so you don’t necessarily need the funds in your account when you initiate a trade. Many Bitcoin brokers offer the trading of Bitcoin derivatives, like CFDs, rather than actual Bitcoin. This means users can speculate on the price of Bitcoin without actually owning it.

Bitcoin Exchanges

Users trade with each other on a Bitcoin exchange. The exchange facilitates this by collating orders in an order book and matching buy orders with sell orders. Users pay a trading fee for this service, and the price of Bitcoin on an exchange is decided by the balance between buying and selling action.

When an exchange has lots of active users, and therefore high liquidity, Bitcoin purchases and sales are settled instantly. Some exchanges only offer Bitcoin trading with fiat currencies, while some only offer trading between Bitcoin and other cryptocurrencies, and some offer both.

Key Things to Look for in the Place You Buy Bitcoin

Platform Fees

Every platform charges some kind of fee as this is how they make their revenue. It’s worth checking the fees page on a platform to find out exactly how much they charge and what for, so you won’t be hit with unexpected costs.

Most of the platforms reviewed here charge a trading fee or commission, which is a flat or percentage fee that is charged on each Bitcoin purchase or Bitcoin sale you make. Some platforms charge a spread instead or as well, which is the difference between the buy and sell prices.

You will probably have to pay when you make a deposit or withdrawal or both. How much you will be charged will depend on your location and which payment method you choose. Other fees that your platform may charge you include account management, inactivity, and overnight fees.

Amount of Other Cryptocurrencies Offered

All these places to buy Bitcoin offer other cryptocurrencies as well. If you want to buy more than one type of coin, then this is something you might want to factor into your decision-making process.

KuCoin offers the most cryptocurrencies, with more than 700 available. Coinmama, on the other hand, only offers 15 coins. If it’s just the most popular coins that you want to buy, you can likely find them on any platform, so other factors will decide which platform you choose. If you want to buy some obscure cryptocurrencies, you will need a platform with a large selection.

Some platforms will only offer fiat-to-crypto trading pairs, while others will offer crypto-to-crypto trading pairs. If you want to trade Bitcoin against another cryptocurrency, it’s worth checking which trading pairs your platform offers.

Other Investment Assets Available

Most of the platforms on our list are crypto platforms that only offer cryptocurrencies. However, a few of them are multi-asset platforms that also offer more traditional financial instruments, like stocks, ETFs, and commodities.

If you want to build a diversified portfolio, including a range of asset types in addition to Bitcoin, then a multi-asset platform is convenient as you can do all your investing and trading in the same place.

eToro, Bitpanda, Capital.com, and Skilling are all multi-asset platforms. Bitpanda even enables users to make direct swaps between Bitcoin and other types of assets.

Educational and Informational Resources

Many platforms now provide their users with information about cryptocurrencies. Some have pages explaining the function and background of each coin they list, along with current and historical price information. This can be great for researching a coin you are thinking of investing in.

Some platforms, like Binance, have an “academy” full of educational articles on a range of crypto and trading topics. This is particularly useful for beginners who want help understanding the fundamentals of cryptocurrency.

Bonuses

One of the ways platforms attract users is by offering bonuses, and the chance to earn free crypto could influence which platform you use. Some platforms may offer a sign-up bonus to new users, either permanently or as a temporary promotion. You could even sign up to more than one platform to claim multiple sign-up bonuses.

Another type of reward that platforms such as Coinbase offer are free crypto for “learn and earn” campaigns. These involve watching videos or reading articles about a certain coin or topic. All you have to do is answer some questions correctly to earn free crypto.

There are a variety of other promotions that platforms may run, such as giving trading bonuses to users who trade a certain volume or complete a specific activity. You can also earn free crypto on platforms like Binance by depositing your crypto into a crypto savings account.

Ease of Use and Accessibility

User experience is an important aspect of any platform. If you are going to be spending a lot of time using a platform and investing your own money through it, you’ll want to find a platform that you feel completely comfortable navigating.

Some platforms, such as Coinbase, are designed to be very intuitive to use to make them accessible for beginners. More experienced users may prefer a platform that is a bit more complicated to use but provides advanced trading tools.

The best places to buy Bitcoin provide a mobile app as well as a web platform, making them accessible from anywhere.

Liquidity and Speed

Liquidity is the availability of assets and the volume of activity in a market. When a market has high liquidity, assets can be bought or sold quickly without having a drastic effect on the price of the asset. On a high-liquidity Bitcoin platform, there is always lots of Bitcoin available to be bought and sold.

The crypto platforms with the highest liquidity are those with the most users and the largest trading volumes. A high-liquidity platform enables you to buy or sell Bitcoin instantly. This speed makes it possible for traders to react quickly to market changes and implement strategies such as scalping or high-frequency trading.

As well as the liquidity of assets, the speed of the platform is important. Constantly waiting for pages to load each time you go to another section of the website can be frustrating and impede your trading experience.

Geographical Availability

One of the first things you will need to find out about a prospective platform is which countries it operates in—clearly, a platform is of no use to you if it isn’t available in your country.

You can check the geographical availability on the platform website. It is also worth finding out where platforms are regulated, as those regulated in your country are the safest to use.

Some platforms may offer different services in different countries. For example, those regulated by the FCA can’t offer crypto derivatives trading to their UK retail customers, though this service may be available in their other jurisdictions.

Anonymity

If you want to buy Bitcoin anonymously, you will need to use a platform that doesn’t require identity verification. This is hard to do as regulated platforms, such as the ones in this guide or Bitcoin gambling sites, are required to collect personal information from their users as part of their Know Your Customer (KYC) process.

You can buy Bitcoin anonymously on an unregulated platform, such as the peer-to-peer marketplace Paxful. But this is a more complicated process that can leave you vulnerable to crypto scams.

As it is perfectly legal to buy Bitcoin, the safest option is to go through KYC and use a regulated platform, as they have the best security and features. Many platforms have made their identity verification process quick and easy to complete.

Payment Methods

The number and range of payment methods accepted vary by platform. The majority accept deposits via bank transfer and/or credit and debit card. Some platforms, like KuCoin, only accept crypto deposits but allow users to make instant card purchases.

If you want to use a less common payment method, like Skrill or Google Pay, your choice of platforms will be more limited. Your location may also affect which payment methods you can use. For example, Coinbase accepts PayPal deposits from US users, but not from users in Europe.

Platform Security

Strong security is one of the most important factors to look for in the place you are buying Bitcoin. If you’re going to be trusting a platform with your funds and personal information, you want to know that they will be kept safe.

The most secure platforms keep most of their crypto in cold wallet storage. Some may also have crypto-insurance, ensuring you will be able to recover your assets in the event of a hack or bankruptcy.

Many platforms use SSL encryption to protect personal information. Other security features you should enable if available include address whitelisting and two-factor authentication (2FA).

Reputation

If a platform has built a strong reputation over a number of years, this is a good indication of its quality and reliability. The number of satisfied users a platform has speaks to its reputation. You can look for ratings on websites such as Trustpilot, and read reviews from other users to get an idea of what sort of reputation a platform has.

Customer Service

Strong customer service that you can rely on is an important feature of any Bitcoin platform, especially for those who are new to crypto and may require extra support.

Most platforms have an FAQ section to deal with common issues. Customer support may be provided via web chat, email, phone, or some combination of these.

Is Buying Bitcoin Safe?

It is possible to buy Bitcoin safely as long as you bear a couple of things in mind.

Firstly, it is important to consider the platform you are using to buy Bitcoin. The safest platforms are licensed and regulated, use secure storage such as cold wallets, and protect your account with features such as 2FA. Also, if your platform has crypto-insurance, you can be sure of retrieving your Bitcoin even if the platform gets hacked or declares bankruptcy.

Regardless of where you buy your Bitcoin, you need to remember that the price of Bitcoin is volatile and can surge or crash in a very short space of time. You should keep this in mind when you formulate your investment plan, and never invest more than you can afford to lose. Read our advice on responsible investing.

What Is the Safest Place to Buy Bitcoin?

We selected the platforms on this shortlist as we believe them to be the safest places to buy Bitcoin. They are all licensed by respected regulatory authorities, and they employ the latest security technologies.

For example, eToro is regulated by the FCA, CySEC, and ASIC, and is a member of FINRA and SIPC. It also uses top-tier security solutions, such as cold storage, state-of-the-art monitoring tools, and SSL encryption for personal information.

If you want your Bitcoin to be kept safe while it’s on your platform, you should know that the safest platforms to use are the ones that use cold storage. Platforms with crypto insurance further reduce the risks of losing Bitcoin.

What Is the Safest Place to Store Bitcoin?

The safest place to store your Bitcoin for the long term is a hardware wallet. These are physical devices that often come in the form of a USB stick. Unlike hot wallets, hardware wallets aren’t connected to the internet, so they aren’t vulnerable to being hacked.

Although software wallets are free, hardware wallets can be expensive. But it’s worth the money if you have a significant amount of Bitcoin to store. The best hardware wallets that offer Bitcoin storage solutions are Trezor, BitBox, and Ledger.

How Can I Buy Bitcoin? - Step-By-Step Tutorial

You can buy Bitcoin quickly and easily on eToro by following the simple steps below.

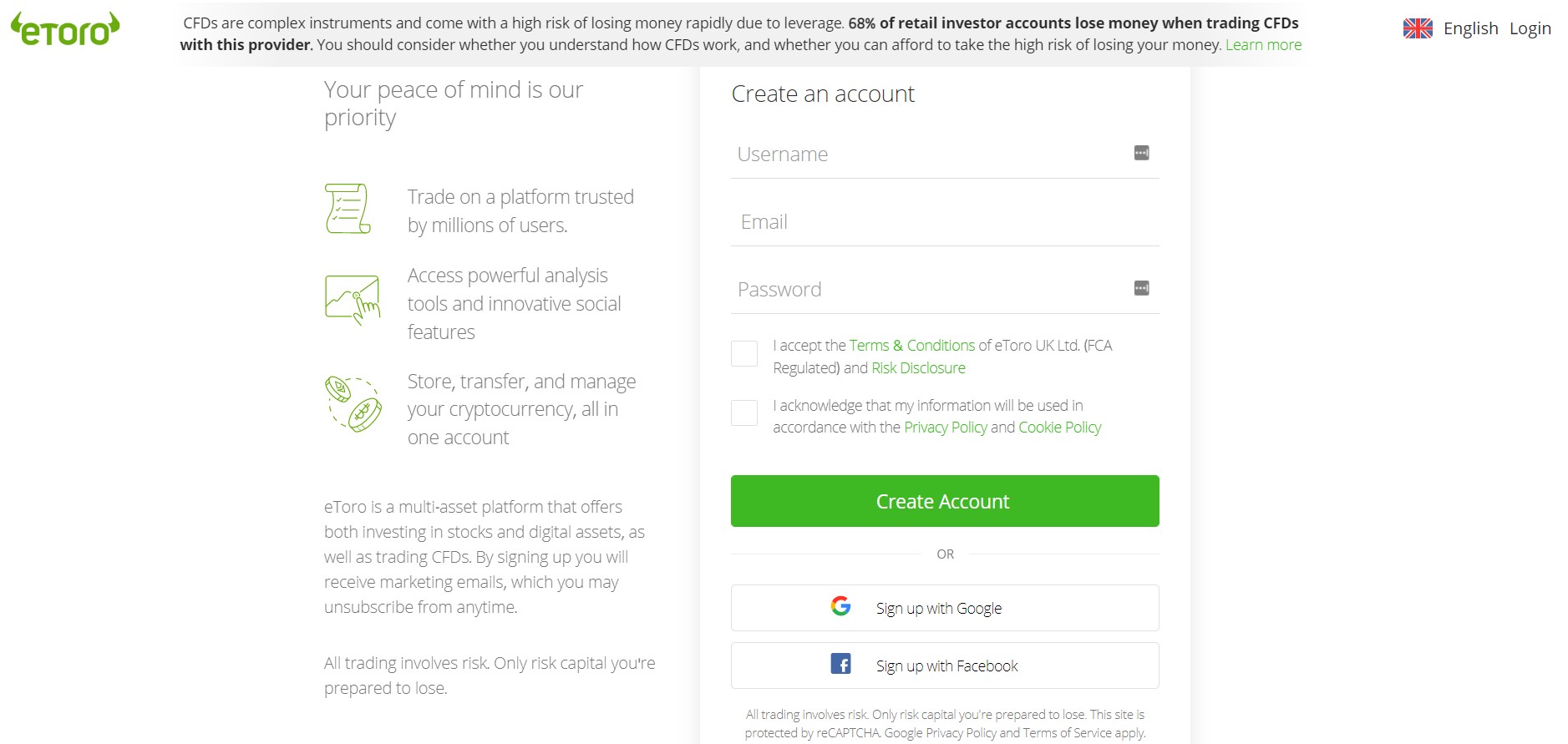

1. Create a free account

Click on the “Join Now” button on the website and complete the registration form by providing an email address, username, and password. Accept the terms and conditions by ticking the boxes, and then click the “Create Account” button.

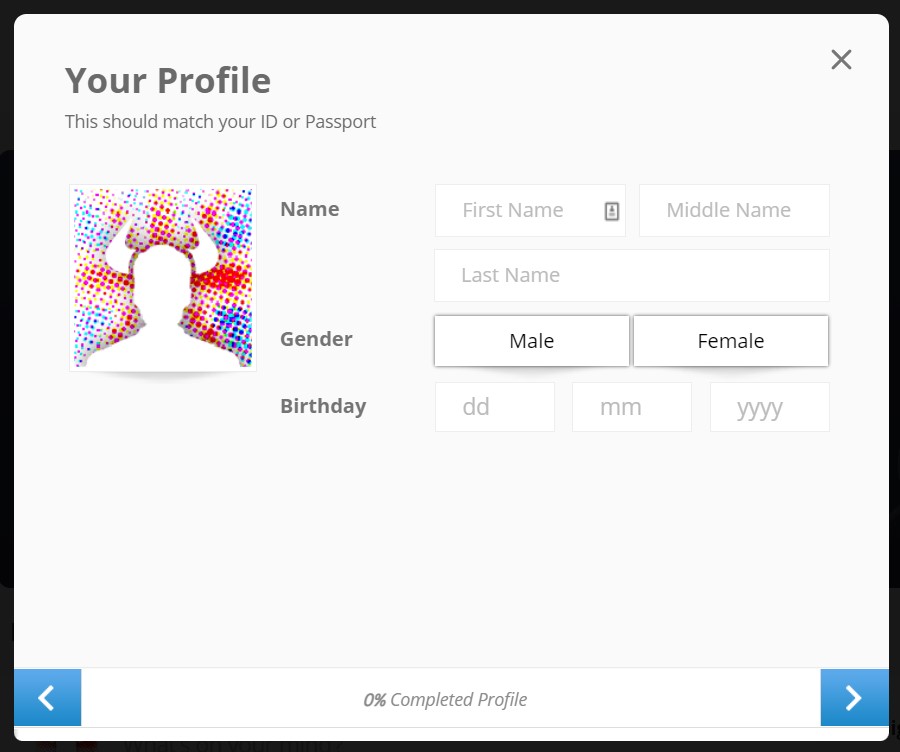

2. Verify your account

You will be emailed a link that you’ll need to click to verify your email address. After that, you’ll need to complete your profile with details such as your full name, date of birth, address, and information about your investing experience. You may then be asked to upload an image of a photo ID such as a passport or driving licence.

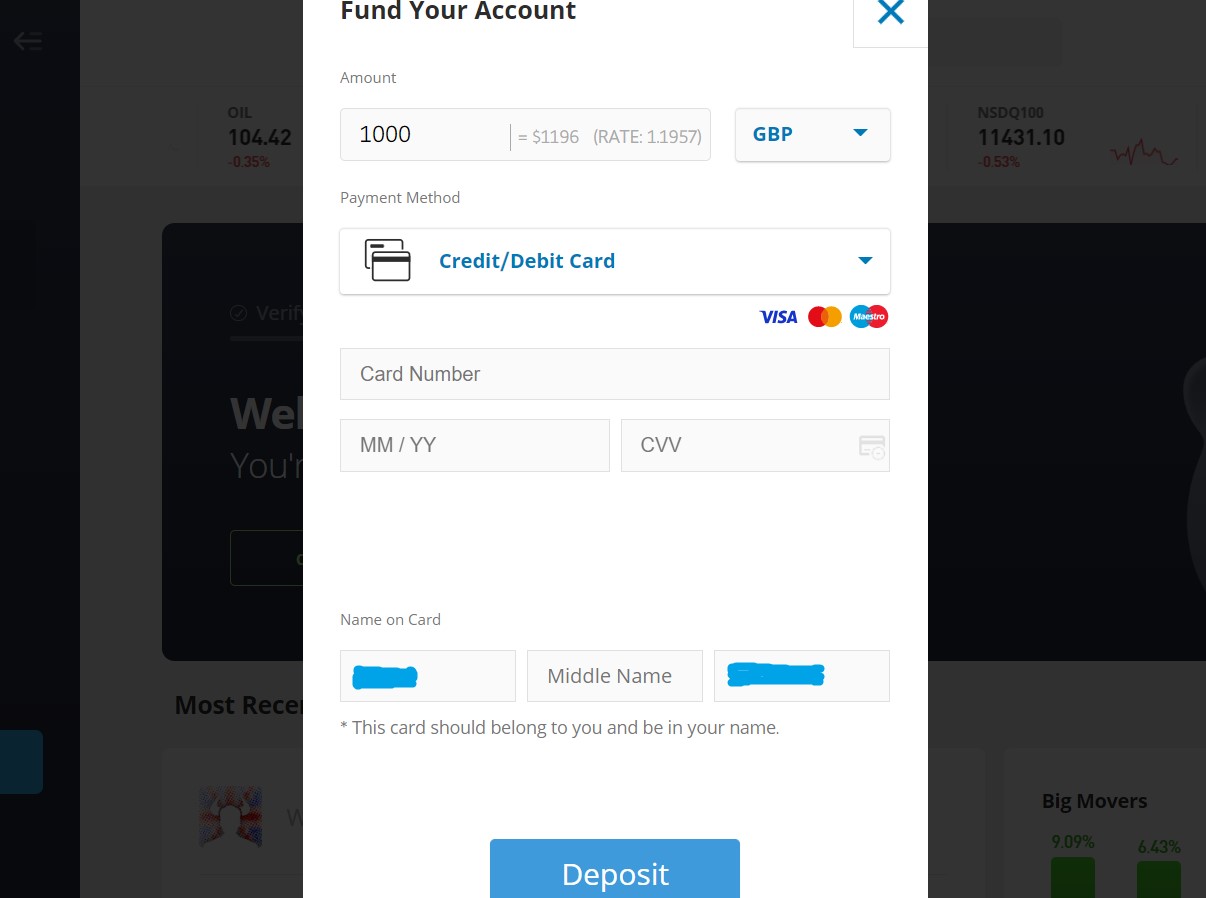

3. Make a deposit

Click on the “Deposit Funds” button and fill in the amount you wish to transfer. You can select your local currency and a preferred payment method from the dropdown lists. Then you will just need to provide any payment information required to complete the transaction.

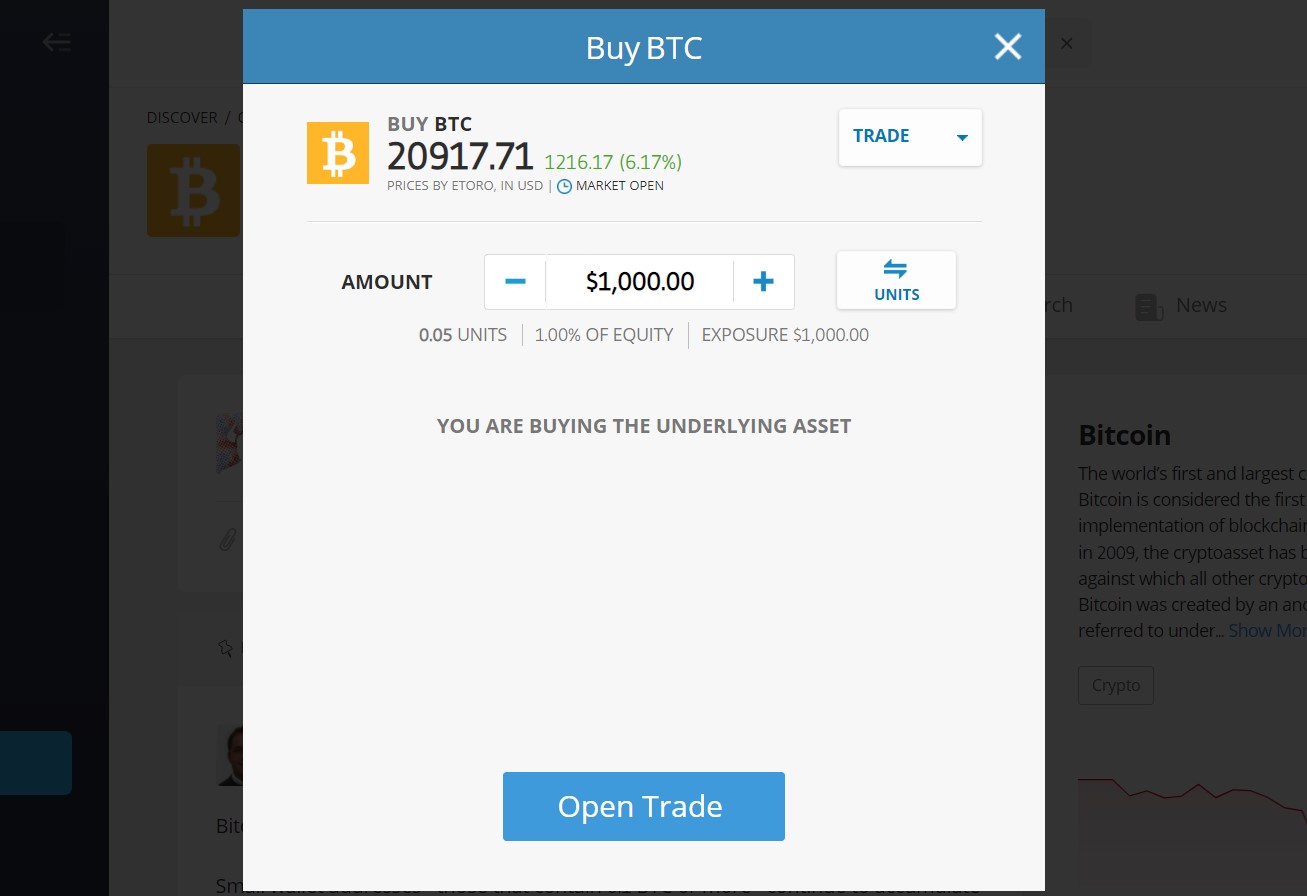

4. Buy Bitcoin

Find Bitcoin by using the search box at the top, and clicking the “Trade” button. If you want to buy BTC once it reaches a specific price, you can switch from Trade to Order. Otherwise, just enter the amount you want and click “Open Trade” to buy Bitcoin immediately.

Final Thoughts on the Best Places to Buy Bitcoin

There are a lot of considerations when it comes to finding the best place to buy Bitcoin, such as security, fees, features, and user experience. We’ve already shortlisted and reviewed the top 11 platforms in this guide to save you valuable time on research.

Our conclusion is that eToro is the overall best place to buy Bitcoin in 2024. This is because it is a secure and regulated platform with transparent fees, free deposits, and unique social investing features. The buying process is very intuitive for beginners, while the research and trading tools also cater to more experienced traders.

It’s fast and simple to create an account and purchase BTC on eToro, as you can see from the walkthrough above. Once you’ve signed up, you can buy Bitcoin in a couple of clicks.

Methodology - How We Picked the Best Places to Buy Bitcoin

We aim to provide information that you can trust. To achieve this, we have various quality control processes. Each platform we review is rigorously researched and tested to ensure we only provide you with the best recommendations.

Some of the things we test when researching a platform include the registration process, how to make a deposit, available assets, types of trading supported, user experience, regulation, security, fees, features, educational resources, and customer support. You can find out more about our testing process here.