Ethereum is one of the pillars that hold up the crypto industry as the largest smart contract ecosystem in crypto. As such, its native coin, ETH, is attractive to various new and existing investors. However, with many ways to buy crypto popping up, what is the best way to buy Ethereum?

Our guide tackles just that. We’ve used just about every exchange worth its salt and have narrowed down the best places to buy Ethereum in terms of price, overall experience, security, and even aesthetics.

By the end of this guide, you should know the best place to buy Ethereum. And if you don’t like the cryptocurrency exchange, you’ll know 9 more to try.

The Best Place to Buy Ethereum - Our Top 3 Picks

Looking for a quick answer? Here are our picks for the best places to buy Ethereum.

The Best Places to Buy Ethereum in 2024

1. eToro – Best Overall Place to Buy Ethereum

2. Binance – Best Place for International Buyers

3. Skilling – Best Place for Trading Ethereum

4. Bitstamp – Best Place for the Security Conscious

5. OKX – Most Visually Appealing Option

6. Coinbase – Best Place for US Buyers

7. Capital.com – Best Place for Buying Ethereum CFDs

8. Bitpanda – Best Place for Traditional European Investors

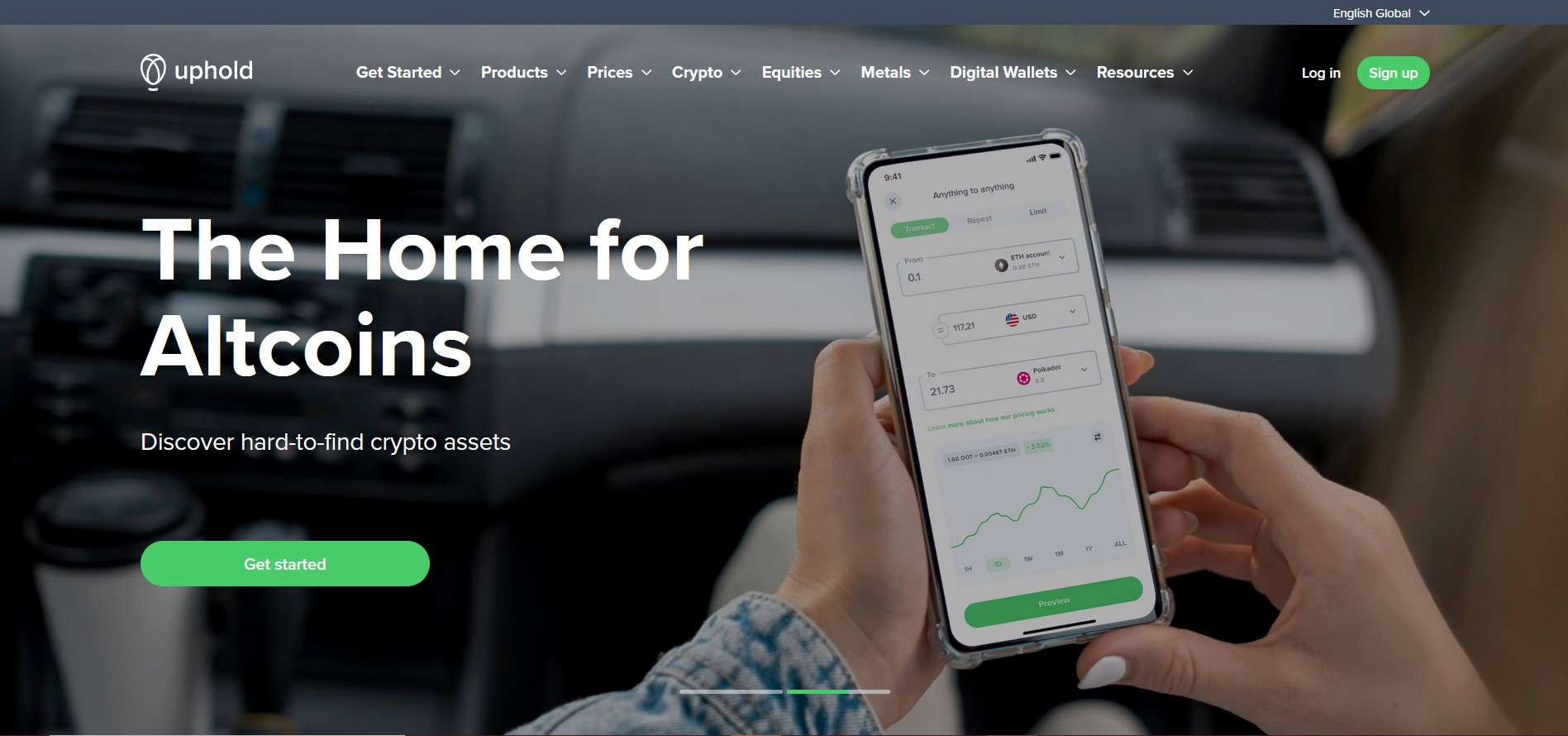

9. Uphold – Best Place for Quick Buys

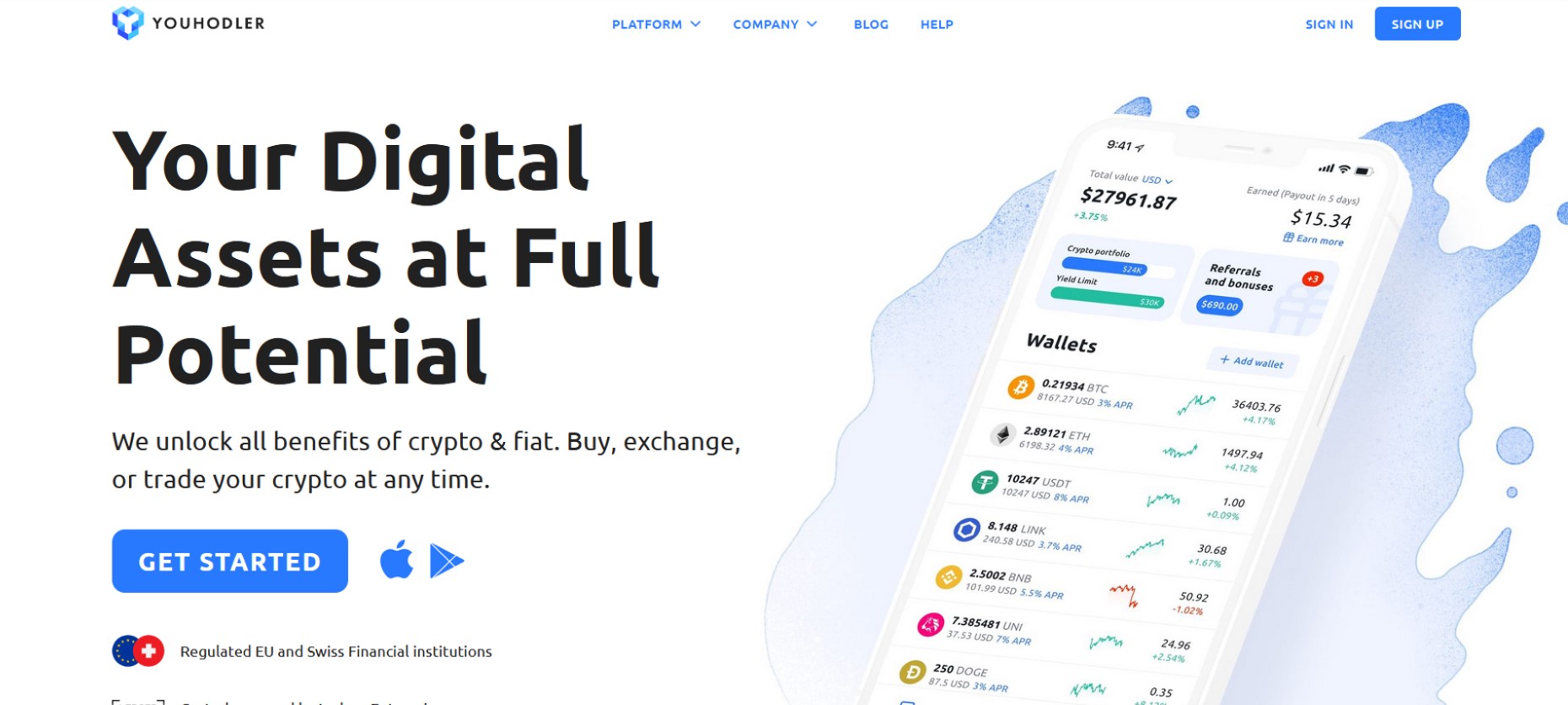

10. YouHodler – An Easy Option

The Best Place to Buy Ethereum Comparison

|

Exchange |

Fees |

Coins |

Minimum Trade |

Regulation |

|

eToro |

1% |

63+ |

$10 |

FCA, CySEC, AFSL |

|

Binance |

0.10% |

600+ |

$10 |

AMF |

|

Skilling |

Dynamic |

55+ |

1,000 units |

CySEC, FSA |

|

Bitstamp |

0.5% |

75+ |

$10 |

CSSF |

|

OKX |

0.1% |

343+ |

$10 |

VARA |

|

Coinbase |

1% |

193+ |

$2 |

FCA |

|

Capital.com |

Dynamic |

400+ |

1,000 units |

FCA, CySEC, ASIC |

|

Bitpanda |

0.025% – 2% |

170+ |

€1 |

FMA, AMF, Czech Trade Authority |

|

Uphold |

0.8% – 1.8% |

250+ |

Varies |

FinCEN, FCA |

|

YouHolder |

Dynamic |

51+ |

Varies |

FINMA, ESFS |

Our Top 10 Best Places to Buy Ethereum Reviewed

1. eToro – Best Overall Place to Buy Ethereum

eToro is an investment platform and crypto exchange with over 25 million users globally. The exchange is well regulated by the Financial Conduct Authority UK (FCA), the Cyprus Securities Exchange Commission (CySEC), and the Australian Financial Services (FSA).

Aside from a good standing with the law, eToro offers several benefits to its users like the copy trading feature that allows you to copy the trades of more experienced users. You can also view their trade history to see their portfolio’s performance to help you decide who you wish to copy.

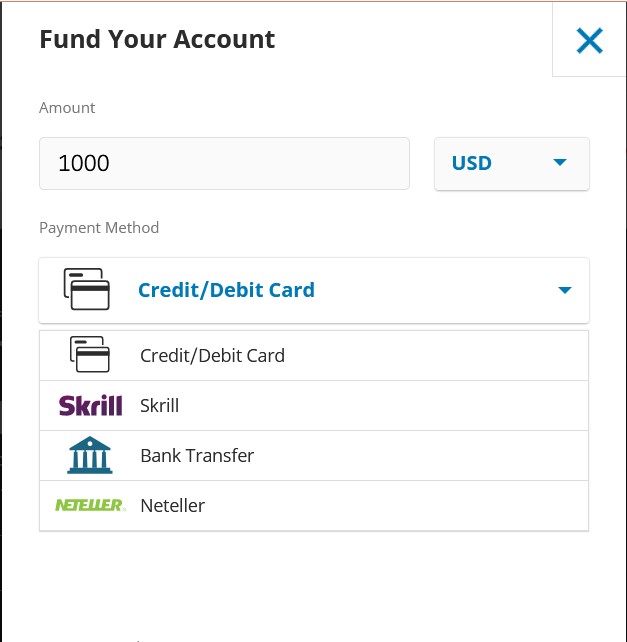

Funding your account on eToro is easy as the platform supports several deposit and withdrawal methods like bank transfers, credit cards, Sofort Banking, Skrill, Neteller, PayPal, Payoneer, and even crypto deposits.

The exchange offers over 68 coins including ETH, majors like BTC, BNB, Ripple, USDT, and even some meme coins like Doge and Shiba Inu. Trading fees cost $1 per trade regardless of size, although a minimum deposit of $10 is needed to get started.

Funding fees are also quite affordable as the exchange does not charge for deposits while it charges $5 for withdrawals above $30.

To learn more, read our full eToro review.

eToro Pros

-

Well regulated

-

Easy to use

-

Copy trading features for newbies

-

Over 63 supported cryptos

eToro Cons

-

$10/month inactivity fee after one year of inactivity

eToro Features

-

Multi-asset support

-

Flexible funding methods

-

Global reach

-

Large user base

2. Binance – Best Place for International Buyers

Binance is the largest exchange by volume (about $70 billion transactions per day) and has one of the widest crypto selections in the industry. Ethereum, along with about 600 other cryptos are available to buy and trade on the world’s leading exchange.

Binance is a particularly good option because of its flexibility where funding is concerned. The exchange supports over 60 fiat currencies and various funding methods which are usually custom to the currencies chosen.

For example, if you choose to deposit in EUR, you’ll be presented with an EU bank account to transfer funds to. And on the off chance that bank transfers are unavailable for your chosen currencies, a list of available methods will be displayed.

The most recurring methods are bank transfers, credit card payments, and third-party onramps like Banxa or Simplex. Bank transfers cost roughly $1 while credit card payments cost 1.8% of the total transaction value.

Once you have deposited funds, you can convert directly to Ethereum at market price by using the quick Convert feature, or buy Ethereum at a predetermined price either above or below the current market price using limit orders in the trading terminal.

The trading fee is one of the lowest in the industry at 0.10%.

To learn more read our Binance review.

Binance Pros

-

Wide coin selection

-

Flexible funding methods

-

Multiple trading modes

-

Liquid markets

Binance Cons

-

Often faces regulatory hurdles

-

Binance Global is unavailable to US citizens

Binance Features

-

Large volumes

-

Futures trading facilities

-

Vanilla options

-

NFT marketplace

3. Skilling – Best Place for Trading Ethereum

Skilling is a CFD broker that makes crypto trading as easy as possible. It features several major (and some minor) crypto pairs as Contracts for Differences (CFDs) that can be traded.

CFDs are financial derivatives that track the price of underlying assets. These instruments are made to be traded in proxy of the real asset and are geared towards people who wish to profit from the asset’s price action without owning it.

Hence, crypto CFDs make trading cheaper and more efficient and are popular in traditional finance.

Crypto’s volatility provides an opportunity for traders to make money and Skilling is here to move the process along.

Users get access to 55 crypto CFDs and a 1:50 leverage facility, which means that you can trade up to 50x the value of the capital you deposit.

Funding is done through bank transfers and PayPal, and attracts a flat 2.9% charge. You can also fund your account using cryptocurrencies like USDT and BTC without paying the funding charge. The minimum you can deposit is $100. Once you are set up, you can begin trading Ethereum.

To learn more, read our Skilling review.

Skilling Pros

-

Supports crypto deposits

-

Well regulated

-

Small CFD spreads

-

Leverage facility

-

2% margin requirement

Skilling Cons

-

Higher funding charge than several competitors

-

$100 minimum deposit higher than others

Skilling Features

-

Multi-asset support

-

Crypto deposit support

-

Intuitive user interface

4. Bitstamp – Best Place for the Security Conscious

Bitstamp is a crypto exchange that has caught the eye of several institutional clients because of its long standing reputation as a secure and reliable trading platform. The exchange has a history of 11 years’ service and 99% uptime.

We like Bitstamp because it emphasizes security more than possibly all the other platforms on this list. This is a safe exchange that uses military grade technology to secure its network and platform. It also stores 955 of all user deposits in cold wallets to reduce possible attack vectors.

This makes it ideal for people who wish to keep crypto on an exchange for a long period.

Bitsamp offers over 75 tradable cryptocurrencies including Ethereum at a fee between 0.3% and 0.4% per transaction. However, the higher your monthly trade volume, the lower your transaction fees.

Funding is done through credit cards, wire transfers, Faster Payments (UK users), ACH, Google Pay and Apple Pay, and SEPA transfers (EU users).

Visit the payments page for more information about payment costs and limits, however, wire transfers cost 0.05% of transaction value but must be a minimum of $7.5. ACH transfers are free, while SEPA costs €3 per withdrawal.

To learn more, read our Bitstamp review.

Bitstamp Pros

-

Military grade security

-

Well regulated

-

Secure storage solution

-

Low minimum deposit

Bitstamp Cons

-

Higher trading fees than several competitors

Bitstamp Features

-

Deposit insurance

-

Fast execution speed

-

95% uptime

-

Dedicated trading terminal

5. OKX – Most Visually Appealing Option

OKX is an exchange known for vivid colors, pleasant aesthetics, and holistic approach to crypto. From our time using it, the cryptocurrency exchange seems to provide a holistic experience by combining the functionalities of an exchange and a Web3 portal into one trading platform.

For crypto investors and traders, the exchange offers over 300 cryptos including Ethereum. It also offers various ways to acquire the crypto. For example, you can use the Quick Convert function which is occasionally free but otherwise costs 1%.

To set the prices you wish to buy Ethereum at, you can use the limit orders in the trading terminal to set trigger orders. Trading with the terminal is much cheaper than with the Convert feature at 0.06% to 0.10% per trade.

Funding works a little different on OKX. Firstly, you cannot deposit cash to the platform, you can only buy crypto directly with a credit card or a third party service like Simplex. You can, however, deposit cryptocurrency.

Alternatively, you can buy crypto through the exchange’s peer-to-peer (p2p) marketplace.

OKX Pros

-

Supports 30 fiat currencies

-

Uninterrupted customer support

-

Robust crypto derivatives

-

Crypto saving options

OKX Cons

-

No cash deposits

-

Unavailable to US residents

OKX Features

-

Wide crypto support

-

Aesthetic user interface

-

Derivative trading facilities

6. Coinbase – Best Place for US Buyers

Coinbase is a US crypto exchange that is a great option for beginners who wish to buy Ethereum but are not interested in much of the other features, trading facilities, or instruments that crypto exchanges tend to offer.

With a collection of over 193 cryptos and a minimum trade size of $2, Coinbase is easily the go-to exchange for many citizens for crypto investing.

Funding options are straightforward and well outlined. The accepted methods are ACH payments, credit card payments, PayPal, and wire transfers. ACH payments are free for both deposits and withdrawals, wire transfers cost between $10 – $25, while credit card payments cost 2.49% of transaction value.

Trading fees cost 1% for direct conversions and between 0.05% and 0.60% for limit orders. When you’ve bought Ethereum, you can store it on the platform and earn yield or in a vault if you intend to hold it for a long period.

To learn more, read our Coinbase review.

Coinbase Pros

-

Well regulated

-

Simple UI suitable for beginners

-

Low transaction fees

-

Vaults for earning yield

Coinbase Cons

-

Limited deposit methods

-

Not suitable for users in remote regions

Coinbase Features

-

Custody services

-

Earn Vaults

-

Professional trading terminal

7. Capital.com- Best Place for Buying Ethereum CFDs

Capital.com is a global broker that offers CFDs across various markets and asset classes. It is not a regular cryptocurrency exchange. Instead, it is a traditional broker that offers crypto CFDs.

It is a good choice for traditional traders who wish to profit from Ethereum’s volatility without owning the underlying assets or signing up with a conventional crypto exchange. With Capital.com, traders can trade crypto price action from a highly regulated platform.

Capital.com offers over 456 crypto CFD pairs to traders in its countries of operations. These CFDs are traded in lots with the smallest being a micro lot i.e.1,000 units of the quoted currency.

Trading fees depend on the bid-ask spread of the pair being traded. In our experience, the spread for Ethereum hovers around 5 pips which translates to $50 for a standard lot, $5 for a mini lot, and $0.5 for a micro lot.

Deposits can be made using credit cards, bank transfers, PayPal, and wire transfers. They are free but are subject to a minimum of $20.

To learn more, read our Capital.com review.

Capital.com Pros

-

Highly regulated

-

Commission- free trading

-

Wide contract selection

-

Flexible funding methods

Capital.com Cons

-

Unavailable to US clients

Capital.com Features

-

MT4/MT5 trading terminals

-

Multi-asset support

8. Bitpanda – Best Place for Traditional European Investors

Bitpanda is an European fintech firm that offers investment and trading services through its investment platform. Unlike regular crypto exchanges like Binance or Bitstamp, Bitpanda takes a traditional financial approach to cryptos.

The platform allows investors exposure to crypto assets while managing their portfolio as a whole. It also offers innovative crypto indices that track the major cryptos in outlined sectors, giving investors exposure to entire crypto sectors without having to pick individual coins.

Bitpanda is regulated by the Financial Market Authority (FMA) Austria, the French Autorité Des Marchés Financiers (AMF), and the Czech Trade Authority, and is compliant with Anti-Monetary Laundering (AML5) policies.

Investors get access to a selection of over 170 cryptocurrencies at a 2% fiat currency-to-crypto conversion fee. If the fees are a deal breaker, you can use the platform’s Pro Trader terminal which charges a record-breaking 0.025% for limit orders.

Deposits can be made using SEPA payments, Skrill, Neteller, and Credit cards. However, users outside the Eurozone may have more limited options. Specific fees and limits can be found on the payments page, but, as usual, credit card payments are the most expensive at 1% – 3% of transaction value.

To learn more, read our Bitpanda review.

Bitpanda Pros

-

Low €25 minimum deposit and withdrawal limit

-

Simple, familiar interface

-

Low limit order fees

-

Highly regulated

Bitpanda Cons

-

Withdrawals are via bank account

Bitpanda Features

-

Portfolio management features

-

Crypto indices

-

Crypto-backed cards

-

Pro trading terminal

9. Uphold – Best Place for Quick Buys

Uphold is an investment platform that offers users a way to buy cryptocurrencies and easily manage them as part of a portfolio. It is another platform that has made strides to merge crypto investing with regular investing.

The investment platform is registered with the Financial Crimes Enforcement Network (FinCEN), the Financial Conduct Authority (FCA), and the Bank of Lithuania.

The platform has a straightforward pricing structure that displays the cost of each trade before you execute so you know how much it costs. For major cryptos like Bitcoin and Ethereum, the price is usually between 0.8% and 1.2% for US, UK, and European users and 1.8% for the rest of the world.

However, smaller coins and exotics do not have a definite price range and are affected by the broader crypto market volatility and trading volume.

Uphold also has a smart routing function that allows you to directly swap between any two coins in the platform’s collection of over 250 cryptos. This is in contrast to conventional exchanges that have fixed trading pairs. You can swap between exotics in one go, saving transaction costs for your cryptocurrency investment.

Deposits can be made using credit cards, US bank account transfers, wire transfers, SEPA transfers, Google Pay, and Apple Pay. You can find more information on the funding page.

Uphold Pros

-

Well regulated

-

Transparent fees

-

Long term storage options

Uphold Cons

-

Limited deposit methods for non US, UK, and EU users

-

High fees compared to competitors

Uphold Features

-

Multi-asset support

-

Smart order routing

-

Automated trading facilities

-

Crypto-backed debit card

10. YouHodler – An Easy Option

YouHodler is a crypto exchange featuring a suite of services that provide a holistic financial experience for crypto investors. It allows crypto holders to do more with their crypto assets and currencies after they get it.

We love the platform because it is straightforward. The exchange feature is an easy one to use. Input the coin and the volume you wish to swap as well as the coin you wish to swap it for. The equivalent volume will be displayed based on current market prices. Hit Swap.

Conversions on YouHodler are always at market prices, limit orders are unavailable. Swap fees range between 0.2% to 0.5% depending on the cryptos being traded. Major cryptos like Ethereum tend to be cheaper than more exotic crypto assets.

Once you’ve bought Ethereum, you can lend it for a yearly return or store it on the platform’s crypto wallet.

To learn more, read our YouHodler review.

YouHodler Pros

-

Universal conversion between multiple coins

-

Intuitive user interface

YouHodler Cons

-

Non-standard conversion fees

-

Unavailable to US residents

YouHodler Features

-

Wallet for long-term storage

-

Innovative investment product

-

Instant stablecoin exchange

What is Ethereum?

Ethereum is a blockchain network that serves as a general purpose layer for the development of decentralized applications. It can be likened to an operating system, like Windows or Linux, that allows developers to build applications.

It was created by Vitalik Buterin, Gavin Wood, and a host of other developers, and launched in 2013.

To fully understand how the Ethereum platform works, you must first understand how blockchains work. A blockchain is a distributed ledger that records transactions in a way that cannot be altered once recorded, this feature is called immutability.

The ledger is distributed because it is not hosted on one computer or server, but on thousands of computers (over 9,000) simultaneously. Thus, no single entity has total control over the network, this is an important feature of the Ethereum blockchain networks.

The computers all communicate with one another and agree on a method for validating transactions. This method is called a consensus mechanism and is simply a way for all computers to agree on what serves as “truth” or authentic transactions.

Ethereum took blockchain networks further by being the first to develop a special type of code called smart contracts that allow people to make agreements using the blockchain’s immutability.

These smart contracts allowed people to do more with blockchains than record transactions, and formed the building blocks of the decentralized Web3 we see today.

The Ethereum network has a native coin by the same name, i.e. Ethereum, although it is popularly called Ether. The coin is used to pay for transaction fees on the network when someone will buy or sell Ethereum, and these fees are required for everything from building applications to interacting with them.

Ether is also used to pay node operators, i.e., the computers that keep the network running. Ethereum’s consensus mechanism is called a Proof-of-stake (PoS) mechanism and requires computers to stake (lock up) Ether before being allowed to process transactions.

This is done to incentivise node operators to act honestly. If they act dishonestly, their staked Ether gets slashed in half. The minimum amount for a stake is 32 ETH which is roughly $59,000 as of writing.

Ether acts as the main vehicle for transmitting value between various actors within the Ethereum blockchain ecosystem. The more valuable the network becomes, the more expensive Ether becomes.

Where to Buy Ethereum

If you’re looking to buy Ethereum right now, there are three major places to get it from. They are exchanges, brokers, and decentralized marketplaces.

Cryptocurrency Brokers

Cryptocurrency brokers are usually traditional brokers or firms that offer cryptocurrencies. They are fintechs or investment platforms that offer more traditional investment assets like stocks and commodities and simply add cryptocurrency as one of their offerings.

They are usually well regulated with standardized operations, but have limited coin selections as crypto exchange is not their main business. Brokers appeal more to traditional investors who wish to gain some cryptocurrency exposure.

Cryptocurrency Exchanges

Cryptocurrency exchanges are crypto-native companies that specialize in providing exchange services for crypto users. They are like the crypto version of the New York Stock Exchange, but they only list cryptocurrencies.

Their coin selections are usually quite large and they often support various funding methods. For example, Binance supports deposits in 65 fiat currencies.

Cryptocurrency exchanges are usually better options for crypto native investors and traders who are actively involved in the space. Their fees are usually lower than brokers and their interface is better tuned for handling crypto.

However, many of them face regulatory hurdles as various countries are still in the infancy of crypto regulations.

Decentralized Marketplaces

Decentralized marketplaces include decentralized exchanges and other places that bring people together to trade directly with one another. In this case, peer-to-peer marketplaces are the most viable options for beginners.

Peer-to-peer (p2p) marketplaces are a sort of exchange where people trade directly with one another. They list the crypto they are willing to buy or sell (in this case, Ether), the volume, how much they are willing to trade at, and their preferred payment method.

People who wish to trade can then send money to the counterparty using their preferred payment method and get their crypto once payment has been confirmed. Usually, an escrow system is used to ensure that counterparties do not act fraudulently.

P2p marketplaces allow people to trade using payment methods that may not be accepted by exchanges and brokers. It is a good option for people in nations where crypto is opposed.

Differences Between Brokers and Exchanges

| Cryptocurrency Exchanges | Cryptocurrency Brokers |

| Wide coin selection | Limited coin selection |

| Well regulated | Highly regulated |

| Can also offer other assets | Always offers other assets |

| Low transaction fees | Higher transaction fees |

What to Look for in a Place to Buy Ethereum

There are suitable places to buy Ethereum outside our list as we only cover the best. You may want to know what to look out for when choosing a place to buy Ethereum, on the off chance that the places on our list are unavailable to you.

Fees

The fees a platform charges determine how cheap or expensive it is to buy Ethereum. There are three major types of fees to look out for: platform fees, funding fees, and trading fees.

Platform fees are charged by the exchange or broker for account related activities like maintenance, opening, closing, and inactivity. Cryptocurrency exchanges do not usually charge platform fees, however, eToro charges an inactivity fee of $10 per month after one year of inactivity.

Funding fees are charges incurred when depositing and withdrawing from your account. Funding fees differ with exchange and funding methods. However, credit card deposits are usually the most expensive across the board.

Also, you may encounter situations where you get charged by both the exchange and your payment provider. In this case, you’ll want a platform that doesn’t charge deposit fees.

Lastly, trading fees are the charges involved in converting your fiat currency or crypto to ETH. The lowest on our list is Binance at 0.10%.

Note that the cheapest exchange would be the one with the lowest overall fees. One exchange may have low deposit fees but high trading fees, while another could have a high trading fee but offer free deposits.

Security

Security is quintessential to crypto and is the first consideration when looking for a place to buy Ethereum. When choosing an exchange, look out for security certifications like the one from ISO.

Also look out for platforms with extra security features like two-factor authentication (2FA) which restricts access to your account even with your password.

The platform should also be one that uses cold wallets to store most of its deposits, and most of the exchanges on our list already do this. For example, Bitstamp keeps 95% of user deposits in cold wallets.

Usability

Ease of use can be relative. Expert traders may find complicated interfaces easy to use, while newbies will not. Hence, the ideal crypto platform should be understandable to anyone with a working knowledge of web surfing.

Some places on our list are known for being easy to use. Coinbase is one such example. Its interface and crypto services are simple enough for newbies to wrap their head around.

Another aspect of usability is accessibility. The platform should have a mobile app for conversions on the go.

Payment Methods

The supported payment methods are another important consideration. Your chosen exchange should support payment methods that you can easily use, especially if you intend to buy ETH frequently.

The fees charged for funding should also be small enough that it allows you to buy crypto often without paying a small fortune.

Asset Selection

While this guide is focused on Ethereum, your chosen exchange should list other cryptos. The more the merrier.

Exchanges usually list more cryptos than brokers, and global exchanges like Binance usually have the largest selections. Regional exchanges list fewer cryptos than global ones but still significantly more than brokers.

How to Store Your Ethereum

Ethereum, like other cryptos, is stored in a crypto wallet. However, there are two major ways to store your Ethereum based on custody structure and the security concerns.

Custody Structure

When it comes to the custody structure, you can store ETH in a custodial wallet or a non-custodial wallet, which could be likened to storing them in a centralized manner or in a decentralized manner.

Custodial wallets are on platforms like brokers and exchanges where you entrust your assets to third parties to hold them for you. For example, when you keep ETH in your Binance account, you are entrusting the company to hold your crypto for you.

Non-custodial wallets are self hosted wallets that give you total control over your crypto. They also saddle you with the responsibility of keeping them safe. These wallets can be downloaded as browser extensions, desktop applications, or mobile apps.

They store your private keys on your device and give you a seed phrase for wallet recovery, on the off chance that you lose your device.

Security Concerns

When considering security, there are two ways to store your Ethereum, on hot wallets or cold wallets. The major difference between them is where your private keys are stored.

Hot wallets store your private keys on your device. Most decentralized wallets are hot wallets. The problem with this is that your device is connected to the internet and can be breached by hackers.

Cold wallets, on the other hand, store your private keys on a secure chip away from the internet. This way, breaching the chip is exponentially harder for hackers, and in most cases, they’ll need to get their hands on your specific hardware.

The only drawback to cold wallets is that they are not as accessible as hot wallets, which are always connected to the internet even when on the go.

Ways to Buy Ethereum

There are several methods with which you can buy Ethereum. Exchanges usually support various payment methods depending on your country. However, we will cover the three major methods.

Bank Cards

Bank cards include credit and debit cards issued by banks and powered by either Mastercard, VISA, Discovery, or American Express. They are perhaps the most popular method of buying Ethereum, however, they can be expensive.

To buy Ethereum with a credit card, first ensure that your exchange supports the payment method. Next, find out how much it costs. Credit card transactions are instant but are usually expensive compared to other methods of payment.

Bank Transfers

Bank transfer is a popular method of buying Ethereum, but is one that is often limited by geographical constraints and jurisdictional regulations.

To buy crypto with a bank account, you must first ascertain that your chosen exchange supports bank transfers from your country and in your currency. In some cases, you may be able to transfer from one currency to another, but that usually comes with extra charges.

Bank transfers can also take a while to process (5 working days in the US), but usually have higher limits than credit card payments. Some exchanges let you deposit up to $500,000 in a single bank transfer. The same is not the case for credit cards.

PayPal

PayPal is the most popular electronic money transfer service that combines benefits of both credit cards and bank transfers. Its transactions are quick and it lets users store cash like a bank account.

To buy Ethereum with PayPal, ensure that the exchange accepts PayPal as a payment method. The remainder of the process is the same as any regular PayPal payment transaction. PayPal is a good option for people in regions where banks do not support crypto payments.

Is Ethereum a Good Investment?

Ethereum can be a good investment depending on your investment goals. However, we’ll give cases for and against Ethereum as an investment to help you come to a decision.

Decentralization

Ethereum is the second most decentralized crypto network, after Bitcoin. It has over 9,000 node operators powering its blockchain while keeping it decentralized.

As such, the network is impervious to government sanctions, jurisdictional regulations, and much of the bureaucratic tape that surrounds traditional banking systems. The network is also cheaper to use than traditional cloud computing networks as its infrastructure is not managed by one company.

These qualities make Ethereum an extremely resilient and valuable digital currency.

Long Term Capital Appreciation

Crypto are very volatile assets, however, over the long term, some of them have returned impressive yields. Since Ethereum started trading around 2015, it has returned around 220,222% as of writing. Bitcoin has done something similar, around 3.2 million% since trading around 2011.

We must mention that not all cryptos achieve this. In fact, most cryptos eventually fall to zero, however, Ethereum has proven its ability to return positive yields in the long term.

Yield Generation

Thanks to Ethereum’s proof-of-stake network, holders who stake their Ethereum can earn a 4% return per year. While this isn’t impressive as far as yields go, it can be significant if you intend to hold your Ethereum for years.

Portfolio Diversification

Ethereum can be used as a means to protect your investment portfolio by diversifying it. Digital assets are quickly becoming a recognised asset class to invest money, one that could provide a significant upside to your portfolio or a counterbalance for positions and assets in industries that may be on a decline.

Volatility

Volatility is one of the major risks of buying Ethereum and other crypto assets. The coin has been known to double its price in one year, and then lose over 50% of that value the next year. While this volatility may present an opportunity for traders and margin trading, investors could lose significant portions of their capital if they buy in at the wrong time.

Regulations

Cryptocurrency as a whole has been the recipient of some harsh regulations. For example, Bitcoin mining is banned in China, banks in Nigeria are banned for processing cryptocurrency transactions, and US regulators are actively fighting against stablecoins.

This creates uncertainty for coins like Ethereum as coordinated jurisdictional laws could make it very hard or very expensive to hold the crypto.

How to Buy Ethereum

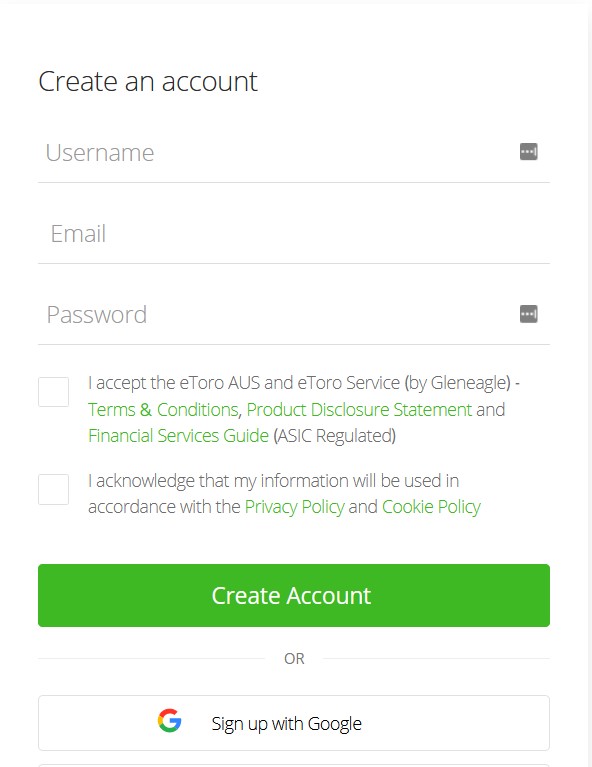

You can buy Etheruem at any of the places on our list. For this guide, we used eToro, our top choice.

1. Open an Account

Click on the Start Investing button on the homepage to get started or download the mobile app if it is more convenient. Fill in your details on the signup form to create an account and wait for a verification link.

2. Verify Your Account

Verify your account by completing your profile and uploading KYC documents like your National ID and proof of residence (utility bill).

3. Make a Deposit

Once your account has been verified, deposit funds by going to the Deposit tab on the left pane of your account. Choose a suitable deposit method and the amount you’d like to deposit.

4. Buy Ethereum

Search for Etherum in the Discover tab. An interface like the one below should load. You can buy immediately at market price or set a price you’d like to buy at.

Latest Ethereum News

-

Ethereum’s Shanghai Upgrade Is Complete, Starting New Era of Staking Withdrawals

-

Ethereum Seeks to Increase the Validator Limit from 32 ETH to 2,048 ETH

Final Thoughts on the Best Places to Buy Ethereum

We explored the best places to buy Ethereum and chose eToro as our overall option because of its strong regulatory compliance, vibrant ecosystem, cheap funding fees, and copy trading features.

However, all the places in our guide are suitable for various types of investors and traders wanting to start their Ethereum investment or even looking to purchase some for Ethereum gambling sites. For example, if you are a core trader looking to take advantage of Ethereum’s volatility, then Skilling and Capital.com are the best options.

If you are looking to invest in Ethereum for a significant period, then Bitstamp is a great option as it uses military grade security and stores 95% of user funds in cold wallets.

To purchase Ethereum, visit eToro.

Methodology - How We Picked the Best Places to Buy Ethereum

The platforms covered in this guide were chosen through rigorous testing, research, and reviews. We paid attention to security, transparency, reputation, trading fees, deposit and withdrawal methods, coin selection, and trading facilities.

The platforms listed are the best we found in the various categories we listed them. For example, we found that Binance had the most flexible deposit methods, so we listed it as the best option for international buyers.

Check out our why trust us and how we test pages for more information on our testing process.