The 9 Best Crypto Apps in 2024

In little over a decade of their existence, cryptocurrencies have made their mark on the financial landscape.

Fast and secure, digital coins and tokens offer a better alternative to users—from investment and trading to paying for products and services.

There are many cryptocurrency apps created today that serve a variety of purposes, but the sheer number in existence can confound a person in selecting the right one.

Your worries are over as this guide will list some of the best cryptocurrency apps in 2024, inspecting each for their benefits and features.

Best Cryptocurrency Apps - Our Top 3 Picks

Looking for a quick answer? Here are our top 2 recommended crypto apps to use for buying and selling cryptocurrency.

The Best Cryptocurrency Apps - Key Metrics

Top Cryptocurrency Apps - Why They Made the Cut

Best Crypto Apps Reviewed

What Is a Cryptocurrency App?

Cryptocurrencies are just digital numbers recorded in a complex ledger called a blockchain. As such, to interact with the coins, and buy and spend them, requires the use of apps.

Several apps offer different kinds of information related to cryptocurrencies, such as their price movements and news. The rise of decentralized finance (DeFi) has also led to complete lending and borrowing ecosystems using smart contracts that can only be accessed through apps.

How Do Crypto Apps Work?

As interfaces for accessing information and the cryptocurrencies themselves, these apps work by creating a front-end UI that people can use. The apps come in different versions, each designed for a specific operating system. The first step is to find the app that will work with your platform (iPhone or Android device etc.).

Many app developers also create the same app for different platforms, so if you have two or more different devices, you will be able to use the same type of app. Apps such as price tracking and news apps, can be simply downloaded and run. Registration may not be a part of it at all.

However, if a cryptocurrency app is designed for handling finances, such as wallets, crypto exchanges, etc, these will require the user to register themselves. Typical registration requires the users to create their login credentials: a username and a password.

Depending on the app, a person’s email address itself may be used as a username. The app may also use the email address to send a security code/link to verify the user.

If you are creating a cryptocurrency wallet, the registration process might end at this point, giving you access to your newly created crypto wallet. Wallet owners will need to fund their crypto wallets and that is possible by going to the deposit option and copying the public key provided.

This key is the identification of the wallet and needs to be sent to any person who wishes to transfer the cryptocurrency to the wallet owner. Once the wallet is funded, the cryptocurrency will be reflected in the balance.

Wallet holders are also able to send cryptocurrencies. They need to navigate to the Deposit or Transfer option. Transferring cryptocurrencies involves entering three different sets of information: the number of coins, the public address of the recipient wallet, and the transaction fee.

Several crypto wallet apps support multiple cryptocurrencies, so it is paramount to make sure that the right wallet address is selected. Sending a cryptocurrency to another blockchain will result in the coins being lost.

Cryptocurrency exchanges are also registered on more or less the same principle as any other crypto app. However, since these apps have serious money matters involved, they require users to pass KYC and AML checks as per regulations.

The KYC can be integrated into the registration process or after it. Exchanges can even have a step-wise KYC, where certain levels are defined based on the trading volume of the user. Each level unlocks enhanced crypto trading, deposits, and withdrawals.

KYC process, although varying from app to app and regulators, requires some basic documentation such as:

- Official ID, issued by the government.

- A copy of a recent utility bill with the name and address clearly mentioned or any other document showing the registered address of the user.

- Proof of income to trace the funding of the cryptocurrency exchange account.

The exchanges might ask for more information, subject to the locality of the trader and the app developers.

We would like to mention that there are crypto exchange apps that advocate the privacy of their traders and require no KYC checks at all. Though this can be very attractive for people who are uncomfortable with handing over their personal information, the risks of these cryptocurrency exchanges being crypto scams are very high.

Requiring no KYC, these apps are probably not registered with any regulatory firm and therefore, are not bound to protect their users’ digital assets. The developers can run away with the digital currencies of their users. Keeping themselves anonymous under the garb of privacy for all, they will also be untraceable.

The funding process of a crypto exchange app is very similar to a crypto wallet or crypto wallet app, with the funds being deposited through the given public address of the relevant crypto. Some cryptocurrency trading apps also offer fiat currency support and can accept bank transfers, wire transfers, and/or credit cards plus debit cards.

Once the cryptocurrency exchange account is funded, the users can trade cryptocurrency by selecting their required fiat or crypto trading pair and using the available order options. If a trader desires to withdraw crypto assets, they can do so by heading to the Crypto Wallets section and requesting a transfer just like they would do in a crypto wallet app.

Different Types of Crypto Apps

While there is some cross-over with crypto apps, there are actually a few different types of cryptocurrency apps, each that will serve a different purpose for cryptocurrency investors.

- Exchange apps: Facilitates the buying, selling, and trading of cryptocurrency on an exchange.

- Wallet apps: Enable users to store their crypto securely and manage it.

- Trading bots: These apps use various algorithms to trade crypto, otherwise known as crypto trading bots, to execute trades on your behalf.

- Portfolio tracking apps: Allows traders to track the overall performance of their crypto investments.

- Payment apps: These will allow crypto users to make purchases with their cryptocurrencies or enable conversions to fiat currency for everyday transactions.

Pros and Cons of Cryptocurrency Apps

Pros

- Up to date information on the latest happenings in the crypto world.

- DeFi apps provide better options for investing than fiat or securities.

- Fast transfer of monetary value to any other person around the world.

- Portfolio diversification.

Cons

- Crypto trading apps can be a bit difficult to navigate or use for an average user.

- Due to high volatility and fluctuation between exchanges, price tracker apps can have different values for the same cryptocurrency.

Key Things to Consider When Choosing a Cryptocurrency App

Features and Tools

All of the crypto apps reviewed here can be used to buy and sell cryptocurrencies, but they may have simple, intuitive buy-and-sell crypto tools aimed at beginners, or cater to pros with more advanced trading tools such as customizable charts, indicators, and leverage. Some apps even provide both.

If you want to do more than find the best app to buy crypto, there are plenty of other features you can check for, such as staking, borrowing, interest-bearing savings accounts, and NFT support. Some apps may even have features not offered anywhere else, such as eToro’s unique copy trading feature.

Choice of Cryptocurrencies

There are many, many thousands of cryptocurrencies in existence, but no app supports the trading of all of them. It’s worth checking which coins are supported before choosing an app to use, especially if there are specific coins you want to trade.

Binance, for example, has one of the most comprehensive lists of supported coins, with over 600, including many new and obscure cryptocurrencies. If, however, you’re only looking to trade the more established coins, you might prefer an app with fewer supported coins that meets your other needs.

Fees

For apps to provide a service, they must charge their users fees. It’s never nice to be hit with unexpected fees when you make a trade, so find out in advance what costs you can expect from your app.

Broker apps typically charge commission and/or spread on each trade. The commission is a fee that you will pay on top of your trade and may be a flat fee or a percentage of the trade amount. Spread is the difference between the bid price and the ask price and so will already be factored into the price quoted for your sale or purchase.

Exchange apps typically charge a trading fee or transaction fee on each trade. This is very similar to commission and may be a flat fee or a percentage of the trade amount.

There may also be fees for making deposits and withdrawals. Some apps charge for both while some charge just for withdrawals. The size of the fee may vary depending on the currency and payment method used.

You should be able to find out from the app website whether there are any other fees that may apply, such as account management fees, inactivity fees, conversion fees, or fees for using other services within the app. Remember the best crypto exchange apps are not always the ones with the lowest fees.

Regulation and Security

You don’t want the funds you entrust to the app to get lost or stolen, which is why it is worth finding out about the app’s regulations and security to get an indication of how safe your digital assets will be.

Many apps keep a large proportion of their crypto assets in offline cold wallets, which is the most secure storage option. Other security features to look out for include two-factor authentication, anti-fraud technology, and asset insurance.

You can also find out whether and where the app is regulated. A regulated app is more likely to use industry best practices and security to keep its customers and their funds safe.

Payment Methods

Ideally, you want to use an app that will let you use your preferred payment method. Debit and credit cards are widely accepted payment methods on crypto apps, as are bank transfers. You may find there are other methods accepted, such as PayPal, Skrill, Neteller, Google Pay, and Apple Pay.

User Experience

If you’re going to be using an app regularly, a good user experience is important. This is subjective and may mean different things for different people, such as a clear layout, easy navigation, and no technical issues that make the app lag or crash.

Customer Service

If you have problems or questions about using the app, you may have to get in touch with customer service. The support offered may include chatbot, video tutorials, explanatory articles, FAQs, phone, and email support. You can check reviews and forums to find out what other users think of the customer service offered by a particular app.

What is one of the most important things to look for when comparing the best crypto apps?

"Identify what your needs are and find the platform that is the best fit for what you require. That’ll depend on what you’re looking to do, which could be earning interest, trading, borrow/margin, or secure custody. I would strongly recommend finding a place where most of your needs could be accommodated in one place. This will come in handy when the temperature heats up and the market is volatile. In those situations, it might be very slow to move assets around – due to network congestions and other circumstances – which can prevent you from achieving the best results and protecting your funds."

Hristiyan Hristov

Account Management Team Lead at Nexo

How to Use a Crypto App

Once you’ve chosen a crypto app, the next thing you need to know is how to use it. It’s easy to get started with an app such as eToro—you can just follow these simple steps.

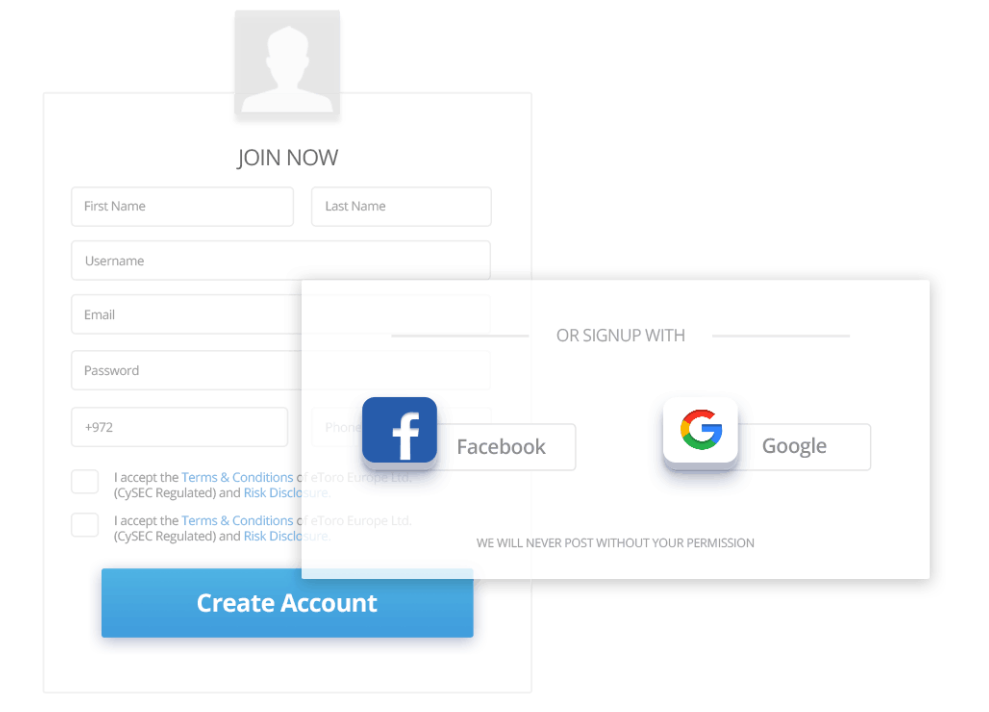

1. Open an Account

To create an account, you can click on the “Sign Up” button on the website, which will take you to an electronic registration form. Fill in any details requested, such as name and email, and accept the terms and conditions.

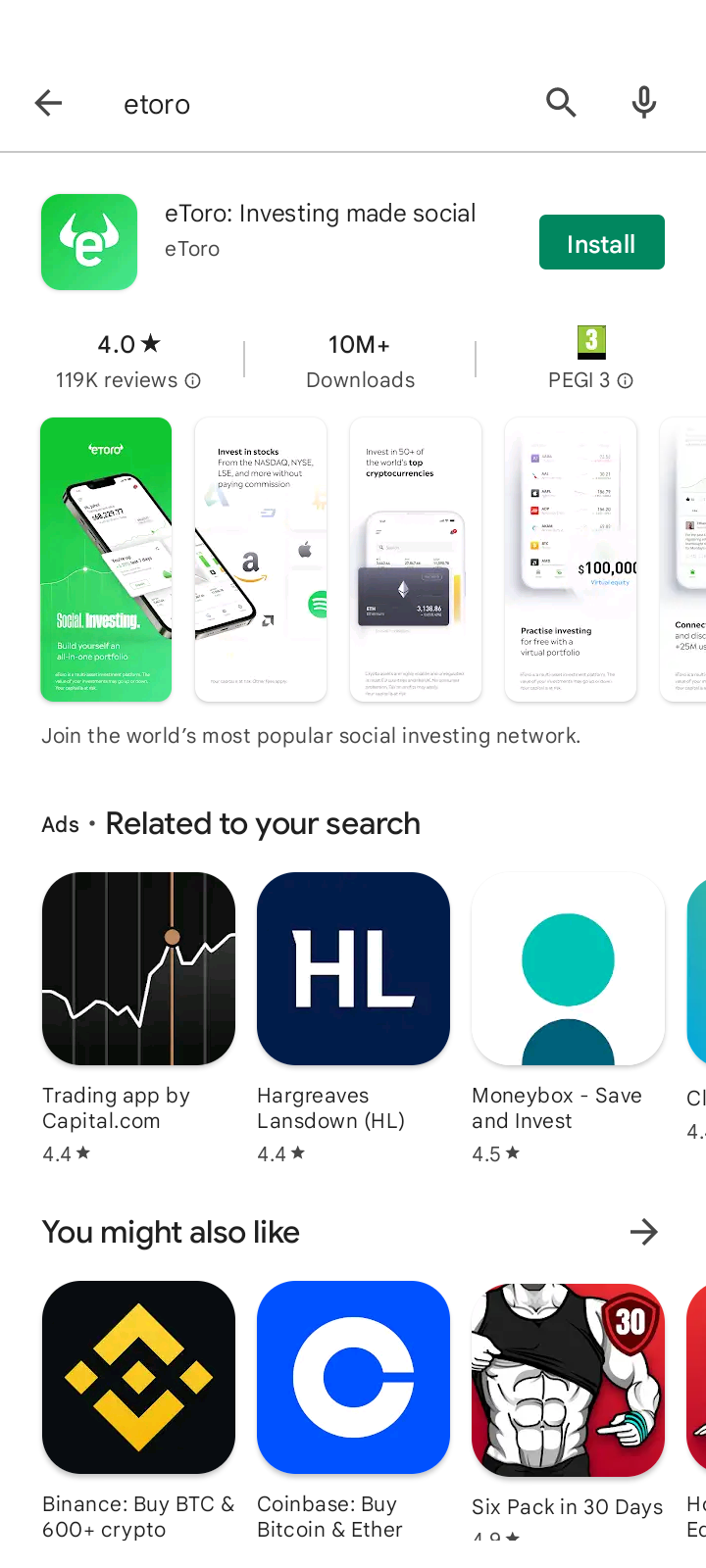

2. Download the app

Go to the App Store or the Google Play store on your mobile device and search for the app you want. Now simply tap the “Install” button to download the app onto your phone.

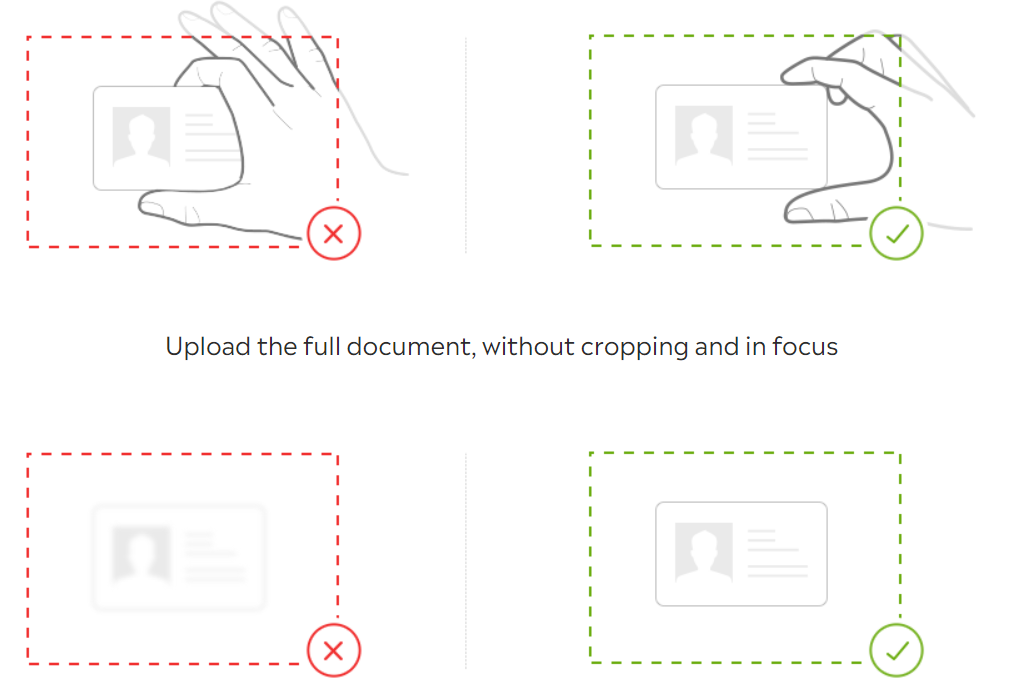

3. Verify Your Account

Before you can start using the app, you’ll need to verify your account by providing proof of identity, such as a passport, driving license, or other government-issued photo ID, and proof of address, such as a bank statement, bill, or tax letter.

You will need to provide clear photos of the documents, which you can do through the app.

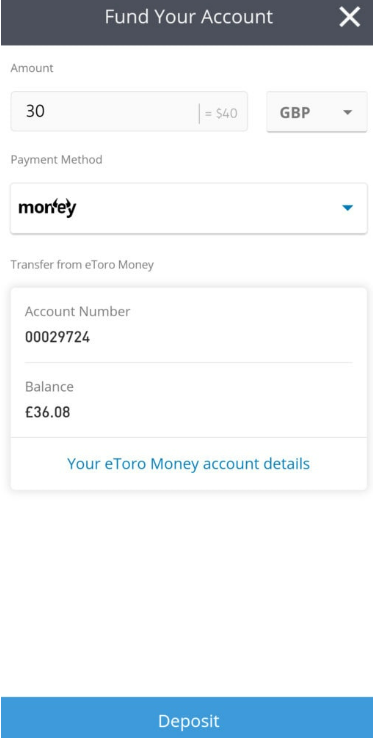

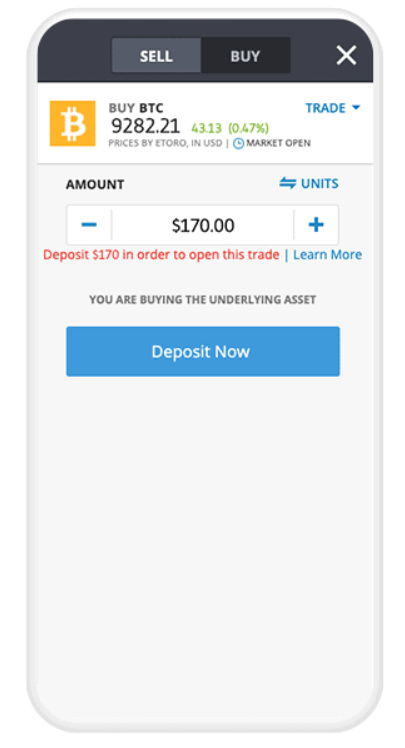

4. Make a Deposit

Tap the “Deposit Funds” button in the app, type in the amount you wish to transfer and select the currency. Then you can choose your preferred payment method, such as bank wires, credit or debit card and hit the “Deposit” button.

5. Purchase Cryptocurrency

In the app, search for the cryptocurrency you wish to purchase. Go to the “Buy” tab and enter the amount you want in either fiat or crypto. Now you can simply hit the “Buy” button to make your first purchase.

Final Thoughts on the Best Crypto Apps

Crypto apps are a great and convenient way to trade cryptocurrencies and stay on top of the crypto market prices wherever you are. Although there are a great number of the best crypto apps available, this article should have helped you narrow them down to the safest and most useful options.

There are lots of important factors to consider before signing up for a crypto app, from features and supported cryptocurrencies to fees and security. eToro is our top choice of crypto app providers as it is one platform that ticks all the boxes.

Its competitive fees and low minimum trade amount make it affordable, while top-tier security practices and regulations make it safe to use. With dozens of the most popular cryptocurrencies (as well as many other types of assets) and social investing features you can’t get anywhere else, eToro has it all.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.