The 14 Best Utility Cryptos To Invest In 2024 | Utility Tokens And More

New cryptocurrency projects are being developed and launched faster than most investors can keep track of, with over 26,000 already launched. While the sheer amount of utility tokens and projects provides many great opportunities to investors, the last decade of involvement in the industry has taught us that the best utility tokens offer more attractive long-term gains than traditional cryptos.

What is a utility crypto token? What are the best utility cryptos? And how can I buy one? In this investment guide, we’ll answer those questions and compare the best utility cryptos, as well as the main advantages of each coin, and provide great tips for investors looking to make the most of their crypto investments.

Best Utility Cryptos To Buy In 2024

- BitBot – The Best Utility Crypto for Crypto Robot Trading

- Metacade – The Best Game Utility Crypto with a lot of Utility

- Ethereum – The Overall Best Utility Crypto

- BNB – The High Market Cap Best Utility crypto

- Immutable – The Best layer 2 scalability Utility crypto

- Near Protocol – The Best New Utility Crypto

- Polygon – The Best Utility Crypto for Beginners

- Stacks – The Best Utility Crypto under $1

- Injective – The Best Utility Crypto for DeFi

- Decentraland – The Best Utility Crypto for the Metaverse

- Conflux – The Best Multi-Chain Ecosystem Utility crypto

- Fantom – The Best Utility Crypto for DeFi Developers

- Render Token – The Best utility Crypto for Rendering and Freelancing

- Magic – The Best Interoperable Metaverse Token

Comparing The Best Utility Cryptos

| Utility Token |

Product Or Service |

Minimum Investment |

Where to buy |

|

BitBot (BITBOT) |

Trading |

Not available |

|

|

Metacade (MCADE) |

Gaming |

$10 |

|

|

Ethereum (ETH) |

DeFi |

$1 |

|

|

BNB (BNB) |

Exchange Token |

$1 |

|

|

Immutable (IMX) |

DeFi |

$1 |

|

|

Near Protocol (NEAR) |

DeFi |

$1 |

|

|

Polygon (MATIC) |

Scaling and DeFi |

$1 |

|

|

Stacks (STX) |

Bitcoin DeFi |

$1 |

|

|

Injective (INJ) |

DeFi |

$10 |

|

|

Decentraland (MANA) |

Metaverse and Gaming |

$10 |

|

|

Conflux (CFX) |

dApps and Web 3 |

$1 |

|

|

Fantom (FTM) |

DeFi |

$1 |

|

|

Render Token (RNDR) |

DeFi, Freelance, and GPU lending |

$1 |

|

|

Magic (MAGIC) |

Metaverse, Web 3, and Gaming |

$1 |

Our Top 14 Utility Cryptos To Buy Now Reviewed

BitBot (BITBOT) – Best Crypto Trading Robot

Bitbot is a crypto trading bot that allows you to trade cryptos on-chain using simple text instructions on Telegram. The bot is part of a rising trend of people using bots with instant execution speeds to keep up with institutional traders.

These bots are usually integrated with the Telegram messaging platform, allowing users to control their trading activities using simple commands. Because of their ease, efficiency, and speed, traders can use them to uncover and buy tokens before they launch on major exchanges.

Why invest in Bitbot?

Bitbot offers features that place it ahead of other trading bots. The most pertinent is its emphasis on decentralization. Most Telegram bots hold on to their users’ private keys, creating an attack vector.

We saw this happen with popular bots like Unibot which was hacked in October 2023. The attacker could drain funds from connected wallets because the platform stored its users’ private keys.

Bitbot uses a completely decentralized structure to ensure users are always in charge of their tokens.

Risks in investing in Bitbot

While the bot has utility, the success of its token depends on the company’s ability to attract and retain users, which is usually easier to accomplish during a bull market than a bearish one.

2024 is expected to be bullish thanks to Bitcoin’s halving, however, interest beyond the bull season is yet to be determined.

Bitbot has a total supply of 1 billion tokens, 30% of which will be sold in an upcoming presale event. This presale includes a competition that will reward participants with up to $100,000. To stay current on the presale, visit the Bitbot website.

Metacade (MCADE) – A Revolutionary P2E Platform

Metacade is a new crypto that has garnered a lot of attention within the blockchain gaming ecosystem with its ambitious plan of constructing the world’s largest play-to-earn (P2E) arcade. Metacade welcomes various gaming genres as it hopes to evolve into an ecosystem with the most extensive game library.

Metacade is building one of the most comprehensive gaming ecosystems in all of crypto. In addition to allowing gamers to earn while playing, the Metacade ecosystem has included job offers for gamers who dream about building or advancing their careers in gaming.

MCADE, the utility token of the Metacade ecosystem gives holders the opportunity to earn extra passive income whilst investing in the future of Metacade via staking. The staking mechanism will also serve as an important part of securing the Metacade network, making it one of the more popular utility tokens available.

Why Invest In MCADE

As the utility crypto that facilitates all value exchanges and powers the rewards system within the largest P2E arcade ecosystem, MCADE ranks highly among utility cryptos. Market experts have predicted that the scope of the Metacade ecosystem would cause MCADE to soar in price.

Risks In Investing In MCADE

As a relatively new utility crypto, MCADE is exposed to the volatility of the crypto market amidst its regulatory struggles. In addition, the Metacade team has a lot of work to do for MCADE to live up to the expectations that precede its launch.

Ethereum (ETH) – The Hub to DeFi and dApps

Ethereum launched smart contracts in 2015, introducing the blockchain technology space to the development of decentralized applications (dApps), Web 3, Non-Fungible Tokens (NFTs), and the broader decentralized finance (DeFi) ecosystem. Via smart contracts, projects are also able to issue some of the best utility tokens on the Ethereum network based on the ERC-20 standard.

The development of smart contracts on Ethereum has made it the largest and most active blockchain technology network today. Its utility crypto coins, ETH performs various functions within the Ethereum ecosystem including payment of network fees, issuance of tokens, accessing products and services, and interacting with dApps, among others. Outside the network, ETH is used for financial transactions and can be held as a store of value.

Why invest In ETH

As the utility token of the pioneer smart contract platform, ETH is one of the most secure digital assets to invest in and utility tokens to buy. ETH also has the most use cases among all utility tokens, making it a good buy option. With the recent upgrade to improve the scalability of the Ethereum network, crypto market analysts are bullish about ETH, predicting that it could become the next major store of value in crypto.

Risks In Investing In ETH

The volatility of the cryptocurrency market is the major risk associated with investing in ETH. However, the growing competition the Ethereum blockchain is facing in the DeFi space could also impact the price of the ETH utility coin in the long run.

You can buy Ethereum on crypto exchanges like eToro

BNB (BNB) – An Imminent Blue-chip Token

BNB, formerly known as Binance Coin, are the utility crypto coins that power the BNB Chain ecosystem, the blockchain on which Binance’s cryptocurrency exchange operates. The utility tokens are used as the primary currency on the Binance Launchpad for the issuance of other crypto utility tokens and the launch of projects on the BNB Chain.

BNB grants holders of their utility crypto coins access to the BNB Chain and the products and dApp services within the ecosystem. Holding their own utility token, BNB, gives users of Binance trading discounts on the exchange, along with reduced transaction fees and access to exclusive features, a tangible value.

Why Invest In BNB

The historic performance of BNB along with the success of the Binance exchange makes it one of the best utility tokens to invest in. Binance regularly burns BNB coins (removes them from circulation), making the native token as an asset, deflationary. The scarcity that ensues as the total supply of BNB utility tokens reduces, could also drive the price of the utility coin higher.

Risks In Investing BNB

The price of the BNB utility tokens is often affected by the performance of its parent exchange, Binance. With the recent regulatory uncertainty surrounding Binance, investing in utility tokens to buy like BNB poses significant risks.

Immutable (IMX) – A Layer-2 Solution For Gamers

Immutable is marketed as the first layer-two scaling solution designed for gamers on the Ethereum blockchain. While retaining Ethereum’s unparalleled security architecture, Immutable implements StarkEx zero-knowledge rollups (ZK rollups) making it capable of processing up to 9,000 transactions per second (TPS), compared to the 30 TPS of the layer 1 Ethereum blockchain. Immutable also provides tools that make it easy for developers to build on the network.

IMX, the utility tokens of the Immutable ecosystem, is used to purchase in-game assets, access game features on the network, and reward developers building on the network, as well as traders, and marketplaces that support the network. IMX are the best utility tokens to use as they are also used to pay trading fees and staking to earn rewards.

Why Invest In IMX

IMX is the utility token that powers a fast-growing network for gamers and developers. Immutable has established itself as one of the leading gaming networks by offering gamers, developers, and creators of Non-Fungible Tokens (NFTs) enjoy gas-free transactions. IMX utility tokens have shown good growth potential, especially as the Immutable network continues to grow.

Risks In Investing IMX

The volatility of the cryptocurrency market is the major risk associated with investing in IMX. As a utility token of a functional ecosystem, IMX is generally considered a low-risk investment asset.

You can buy IMX on crypto exchanges like eToro

Near Protocol (NEAR) – The Utility Token Behind One of the Fastest Blockchains

Near Protocol is an emerging layer-1 blockchain that solves some of the limitations of traditional blockchain technology networks including low transaction speeds, low throughput, and poor interoperability. Near protocol is popular for being one of the fastest blockchains, capable of processing up to 100,000 TPS.

The high throughput and interoperability of Near Protocol make it ideal for the deployment of mainstream dApps and DeFi protocols. The goal of the project is to become the operating system (OS) for an open, decentralized web. Its utility tokens NEAR is used for staking, paying transaction fees, accessing products within the ecosystem, as collateral, and incentivizing nodes on the network.

Why Invest In NEAR

NEAR powers a high-performance blockchain that has been gaining a lot of attention in recent times. As a result, the crypto projects protocol has found several use cases, including its latest partnership with Alibaba. As more products and services are launched on Near Protocol, the utility, and value of the native utility token NEAR, are expected to increase.

Risks In Investing NEAR

NEAR is a highly volatile utility coin asset that experiences huge price swings. In addition, because blockchain interoperability is still a developing sector, the NEAR blockchain is frequently attacked by cybercriminals.

You can buy NEAR on crypto exchanges like Coinbase

Polygon (MATIC) – Ethereum-Based Platform For Scaling

Polygon is popular for being the first well-structured Ethereum scaling and infrastructure. The speed of the Polygon blockchain, at 65,000 TPS and a block confirmation of under two seconds, quickly made it one of the most widely used networks. The cheap transaction and gas fees of Polygon also contributed to its early adoption.

The network has now evolved into a network for building dApps to solve the multi-chain interoperability problem. MATIC is the underlying utility tokens of the network and is used to access protocols on Polygon, build dApps, staking to participate in securing the network, and these utility tokens serve to bridge other chains to Polygon.

Why Invest In MATIC

MATIC powers one of the fastest-growing communities and developer bases in crypto. The utility of the platform has helped to drive its adoption and usage, and could further push the value of MATIC higher. The vast use cases of MATIC make it a crypto investment with great upside potential.

Risks In Investing MATIC

The volatility of the cryptocurrency market is the main risk associated with the token sales and investing in MATIC, like most utility tokens. Polygon also operates in a highly competitive market.

You can buy Polygon on crypto exchanges like eToro.

Stacks (STX) – Bitcoin Layer For Smart Contracts

The DeFi ecosystem originated on Ethereum and for long was incompatible with Blockchain. Stacks launched in 2017 as a smart contract programming layer for Bitcoin. Built on top of the Bitcoin blockchain, Stacks allowed developers to build and deploy smart contracts, introducing dApps and NFTs to the Bitcoin blockchain.

The Stacks network is secured by the entire hash power of Bitcoin, giving it Bitcoin finality, but implements a microblock infrastructure for increased transaction throughput and speed. Its utility tokens, STX, serves as the fuel for driving smart contracts on the Bitcoin network. STX is also used to reward crypto miners for securing the network.

Why Invest In STX

With the Bitcoin DeFi ecosystem only growing, Stacks is in a commanding position to unlock the potential $500 billion sector within Bitcoin transactions and is one of the utility tokens to buy. Since STX powers the implementation of smart contracts on Bitcoin, these utility tokens are forecasted to rise as the adoption of Stacks increases.

Risks In Investing STX

STX is generally considered to be a great investment option and one of the crypto utility tokens but poses a significant risk as a high-volatility asset.

You can buy Stacks on crypto exchanges like Coinbase

Injective (INJ) – Layer-1 Blockchain For DeFi Applications

Injective Protocol is a blockchain network built specifically to offer decentralized financial services. Through its interoperable, high-scalability blockchain network, Injective Protocol offers decentralized spot exchanges, derivatives exchanges, lending protocols, prediction markets, and more dApps.

Injective Procol stands out from most other DeFi platforms as it features cross-chain margin trading, derivatives, Forex (FX), synthetics, and futures trading. The network and its dApps are compatible with Cosmos, Ethereum, Polygon, Solana, Aptos, Avalanche, and more via a Wormhole.

Why Invest In INJ

The INJ native utility token plays an important role in the ecosystem including in governance, collateralization, value exchange across networks, protocol security, incentives, and market making. In the first half of 2023, the value of INJ increased by more than 500% and still has an immense ceiling for growth, ensuring that these are utility tokens to buy for the future.

Risks In Investing In INJ

INJ holds the same risk as even the best utility tokens, as a highly-volatile asset. In addition, INJ is also in the highly competitive Web 3 sector, which means the team would need to put in extra effort to remain relevant amongst the many utility tokens.

You can buy Injective on crypto exchanges like Binance

Decentraland (MANA) – A Leading Metaverse Platform

Decentraland (MANA) is one of the oldest Metaverse crypto platforms, launched in 2017 following a $24 million ICO. It is one of the most developed virtual worlds where users can create, test, and monetize content. Decentraland has evolved into a platform for virtual worlds, with many leading names in the entertainment industry hosting virtual events on its platform.

Decentraland is managed by community members, with MANA acting as the unit of ownership and tangible value in the platform. In addition, MANA is used to purchase land in the Metaverse, as well as pay for in-game items and services within the Decentraland virtual world.

Why Invest In MANA

The Metaverse is a concept that is expected to grow bigger with more adoption as the years’ progress. With MANA an important Metaverse, the token is predicted to rise in adoption and value. This makes MANA the best utility tokens for a good long-term investment option.

Risks In Investing In MANA

Like every emerging concept, competition in developing the Metaverse is stiff and the end product could differ from what we have today. This poses a risk for investors looking to hold MANA tokens over long periods.

You can buy Decentraland on crypto exchanges like eToro

Conflux (CFX) – A Scalable Layer-1 Blockchain for dApps and Web3 Infrastructure

Conflux is a new blockchain project that is building a multi-chain ecosystem where developers, communities, and markets will be able to connect globally across borders and protocols. Conflux is the first regulated blockchain project operating in China, earning it the title of the Chinese Ethereum.

Like Ethereum, the Conflux blockchain powers decentralized applications (dApps), e-commerce, and Web 3.0 infrastructure, but is more secure and offers better scalability of up to 6,000 transactions per second. CFX is the utility coin of the network and is used for incentivizing network miners and for paying transaction fees.

Why Invest In CFX

The prospects of bridging the Asian market back to the Western world have made Conflux (CFX) one of the most sought-after investments and best utility coins in all of crypto. In the first half of 2023, the price of CFX has increased by more than 900% and could rise even further as Conflux spreads its tentacles as the only regulated Chinese blockchain.

Risks In Investing In CFX

The volatility of the crypto market is one risk to consider when investing in CFX. The other is the current uncertainty of China’s regulatory stance. While this can be an advantage, a harsh regulatory stance could force the price of CFX lower.

You can buy Conflux on crypto exchanges like Binance

Fantom (FTM) – A Fast Smart Contract Platform for DeFi

Fantom is a fast-rising project that proposes an innovative solution to the blockchain trilemma – decentralization, security, and scalability. Fantom uses a unique permissionless protocol and asynchronous Byzantine Fault Tolerance (aBFT) for enabling users to process transactions in a decentralized and secure way that speeds up the whole process.

The Fantom blockchain boasts speeds of up to 10,000 TPS with a block time of 1-2 seconds. Fantom is compatible with Ethereum and supports the development of DeFi protocols and applications, with more than 200 projects currently running on its blockchain. Its utility token, FTM, is used for exclusive access to staking, voting, making payments, and paying transaction fees on Fantom.

Why Invest In FTM

Fantom has been growing in popularity in the DeFi space thanks to its Ethereum compatibility and highly-scalable network. As the adoption of Fantom continues to increase, the price of FTM is predicted to increase alongside.

Risks In Investing In FTM

Buying utility tokens like FTM, like every other cryptocurrency, carries inherent risks due to its volatility and being a relatively new concept.

You can buy Fantom on crypto exchanges like eToro

Render Token (RNDR) – The Utility Token at the Heart of the Scalable and Efficient Blockchain, Render

Render Token is the utility token of the Render Network, a blockchain platform that seeks to create an efficient, powerful, and widely-scalable rendering network. The Render Network has a unique value proposition that connects individuals who have idle GPUs to process the renders with others looking to perform render jobs with the dormant GPU power.

Owners of idle GPUs register “Node Operators” while users in need of rendering are called “Creators.” The Render Network also facilitates the crowdsourcing of 3D projects and digital asset trading. Node operators earn Render Token (RNDR) when they accept rendering jobs from creators. RNDR is also used to pay for the creation of animations, motion graphics, and VFX renderings on the network.

Why Invest In RNDR

The Render Network is on a mission to revolutionize the 3D rendering industry, with its top utility tokens, Render Token (RNDR) playing an important role. The efficiency of the Render Network has made it a success among creators, causing a price rise for RNDR. As the utility tokens increase and the network grows even further, many expect the price of RNDR to also increase.

Risks In Investing In RNDR

There are several risk factors to consider when investing in RNDR. The volatility of the asset and the growing concern that artificial intelligence (AI) could replace the need for GPU-based rendering pose significant risks for RNDR investors.

You can buy Render on crypto exchanges like Coinbase

Magic (MAGIC) – A Cross-Metaverse Cryptocurrency That Bridges Web3 and Gaming Communities

Web 3 is often referred to as the decentralized future of the Internet. However, like the blockchain, many Web 3 projects are built independently. The Treasure ecosystem was created to solve this problem, acting as a bridge to connect games, their players, Metaverse platforms, and communities, all within Web 3.

Its utility token, MAGIC, serves as a cross-metaverse currency that links together separate Web 3 and gaming communities. MAGIC is used to purchase NFTs and access services across all the supported Metaverses and networks. MAGIC also acts as a reserve currency for Treasure’s Metaverse developed by Magic.

Why Invest In Magic

Serving as a cross-Metaverse currency gives MAGIC almost unlimited use cases, which could positively affect the price of these as the best utility tokens. As the development of the Metaverse intensifies and Magic integrates more networks into its platform, the value of MAGIC is predicted to increase.

Risks In Investing In Magic

Treasure is in direct competition with the best utility tokens from major Metaverse projects like Sandbox and Decentraland as the infrastructure they offer achieves the exact same result.

As of writing, Treasure powers 10 games that have a combined player base exceeding 100,000. The platform features the MAGIC token that is used as the major crypto coin on the NFT marketplace.

You can buy MAGIC on exchanges like OKX.

What are Utility Cryptos?

Utility cryptos also known as ‘user tokens’ are digital assets or tokens created to perform specific actions within the blockchain of a certain project often based on Ethereum’s ERC-20 standard. A major characteristic of utility tokens is that they are not minable, but pre-mined (created all at once) and distributed as the creators decide.

Unlike traditional cryptocurrencies like Bitcoin and Ethereum, utility cryptos are often created to give their holders access to products, services, and features within a blockchain network, including discounts, rewards, an exclusive payment method and voting rights. The top utility tokens cannot be classified as a security because they do not give holder rights of ownership to a project.

How Do You Use Utility Cryptos?

The use of a utility token is often limited to the blockchain which it was created for. This means that the usage of utility cryptos depends on the blockchain platform where they were created. Below are some of the major ways you can use utility cryptos:

Access To Services

One of the main ways many utility tokens are used is to grant holders access to the functionalities of a blockchain project. For example, holders of utility tokens are granted access to store or retrieve data from a decentralized cloud storage blockchain platform. Without the utility token, these services won’t be available.

Interoperability

For interoperable blockchains, the utility crypto of that network serves as the means of exchange, value transfer, and interaction between other networks. For example, users of the Chainlink blockchain must hold the LINK before they can interact with other supported networks.

Discounts and Rewards

This use of utility cryptos is common on centralized and decentralized exchange platforms. Cryptocurrency exchanges often issue utility tokens that grant holders access to exclusive discounts, lower trading fees, or extra benefits within their platforms. These privileges are not available to non-token holders.

Governance and Voting

As a member of a cryptocurrency platform, you can use their utility crypto to participate in the decision-making process of the platform via voting. Holders of utility cryptos are granted rights within a platform to vote on governance proposals and make changes to the protocol.

Are Utility Cryptos a Good Investment?

Utility cryptocurrencies are generally considered good investment options for investors seeking gains over long periods. However, as with every investment, how good an investment is in a utility token would depend on several factors.

The factors that determine how good an investment in a utility token would be are:

- The utility and demand of the crypto are key factors that influence its performance. Utility cryptos that aim to solve key problems and are in high demand are often considered better investments than those with next to no use cases.

- The development and adoption of the platform are essential factors in determining the value of a utility token over long periods. A utility token for a well-developed platform with a competent team would often provide a better investment than a struggling platform.

- Because cryptocurrencies are still in their early stages, the future potential of a platform can also determine how an investment in its utility token can be classified. Some projects are currently projected to grow in adoption, making their utility cryptos a good investment.

Things to Consider Before You Buy Utility Cryptocurrencies

Investors are always advised to do their own research and consider several factors in order to make informed investment decisions. Below are important factors to consider when buying utility cryptocurrencies:

The Project

Before buying a utility crypto, an investor should conduct thorough research to understand the project, its technology, the problem it aims to solve, the development team, and the roadmap. This would give the investor an idea of the overall viability of the utility crypto.

Security and Auditing

Investors should take out time to access the auditing of the platform and the security measures put in place to keep funds safe. Investors can look for platforms that rate the smart contract security audits and security of crypto projects to help avoid potential risks.

Liquidity

Liquidity here refers to the ease with which you can sell a utility crypto. Investors should assess the liquidity of even the best crypto utility tokens and its project to ensure it has adequate liquidity and is listed on reputable exchanges where you can sell the utility token.

The Tokenomics

The supply and demand characteristics (tokenomics) of utility cryptos play important roles in their success. Investors should consider the distribution, issuance, inflationary, or deflationary aspects to get an idea about its chances of success.

Risk Management

Another important factor investors should consider is their risk tolerance and investment strategy. Before investing, it is important to determine how much and for how long you want to invest in a project.

Utility Coins Vs Utility Tokens

While they are often used interchangeably, utility coins and utility tokens refer to different types of assets in cryptocurrency. Below are the major differences between utility coins and utility tokens:

|

Utility Coins |

Utility Tokens |

| Utility coins are independent digital assets operating on their own blockchain | Utility tokens are digital assets that operate on existing blockchains, the most popular being Ethereum |

| They can exist alone as alternatives to fiat currencies | They are created to work with a platform or a decentralized application (dApp) |

| They are often used as a means of value transfer within the network | Their basic function is to provide access to specific products and services |

| Examples are Ethereum and Binance Coin | Examples are Basic Attention Token, Maker, and Chainlink |

Things That Impact the Price of Utility Cryptos

The factors that impact the price of utility cryptos include:

- The level of utility and adoption of a platform impacts the price of its utility crypto. The higher the utility and adoption, the higher its price tends to be.

- Demand: the higher the demand for utility cryptos, the higher their prices tend to be.

- Investor sentiment and market trends are crucial factors that impact the prices of utility cryptos. Investors being bearish often translates to declining prices for utility cryptos.

- The presence of competing platforms and rivals often impacts the price of utility cryptos. However, platforms with unique use cases often perform better than the average platform.

- The sentiment of the broader cryptocurrency market also affects the price of utility cryptos.

How to Buy the Best Utility Crypto

Now we know the best utility crypto, how do you make your first ETH purchase?

Step 1: Find the Right Crypto Exchange

Ethereum (ETH) is one of the most popular cryptocurrencies today and is available on most crypto exchanges, both centralized and decentralized. However, you would need to find a reliable exchange that provides a safe, secure, and cheap way to purchase ETH. Also, check to ensure the exchange is supported in your country. For this review, we will purchase ETH on eToro.

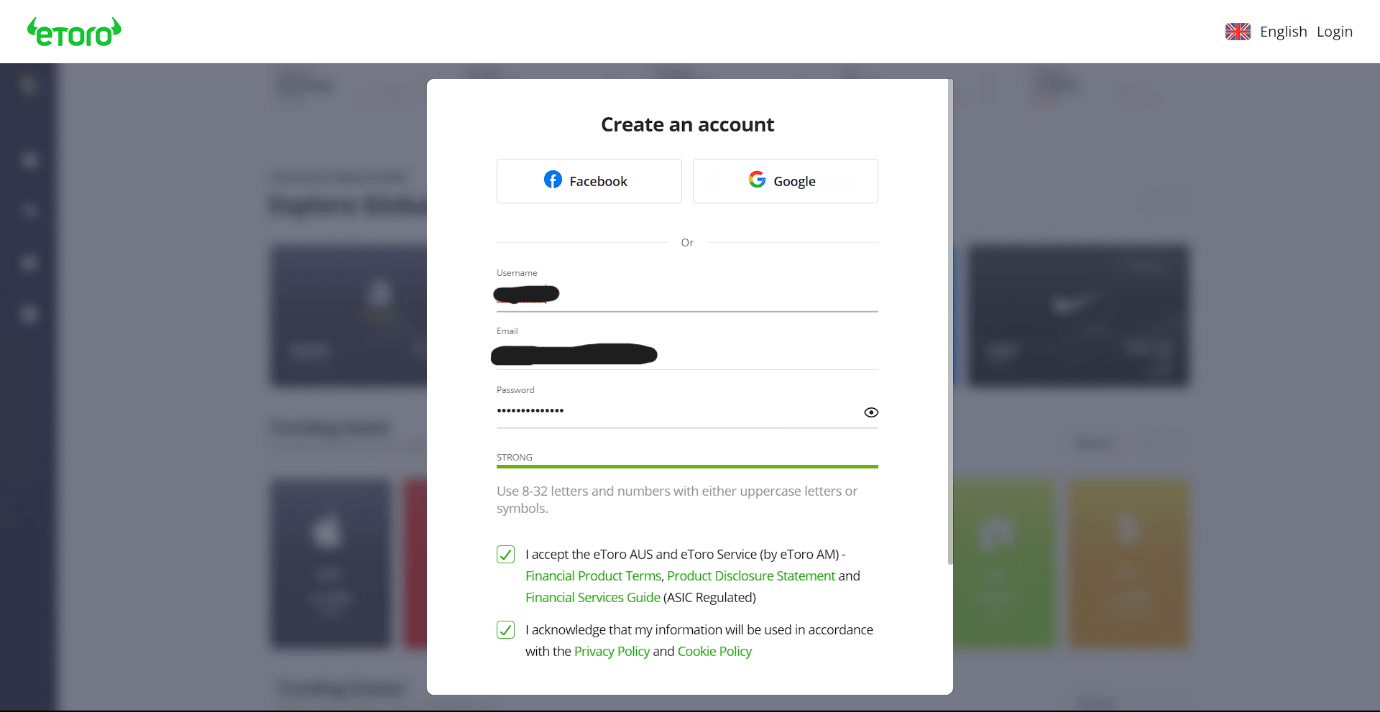

Step 2: Open an Account

To open an account, visit the official eToro website and click on the sign-up option. Fill in your email, preferred username, and password (recommended you use passwords with an uppercase, lowercase, number, and symbol). Alternatively, you can sign-up using your Facebook or Google accounts. Select the agreements and click on Create Account.

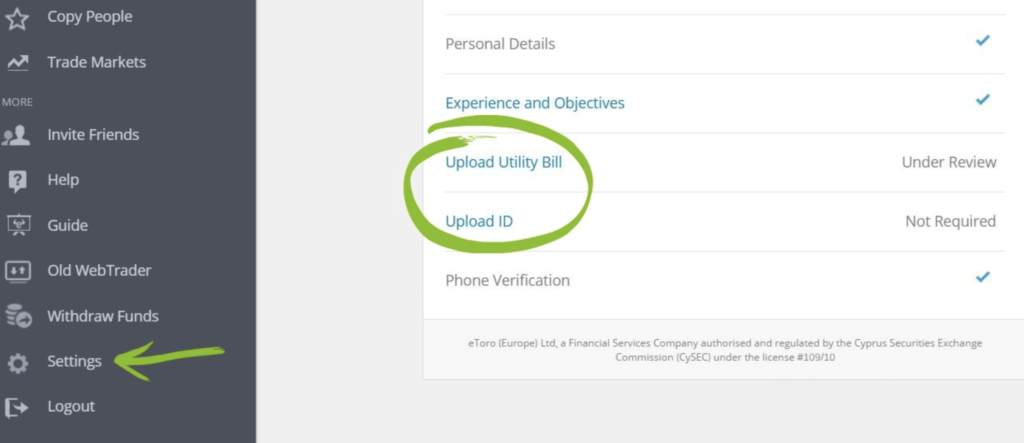

Step 3: Verify Your Account

eToro would send a six-digit verification code to your email to activate your account. After activating your account, eToro would require you to verify your account for extra security. To verify your account, you would be required to upload a valid proof of identity (passport, driver’s license) and proof of address (bank/credit card statement, internet bill). This can be found in the settings option.

Step 4: Make a Deposit

When your account has been verified, you can continue to make a deposit using one of the different options offered on eToro. To buy Ethereum (ETH) on eToro, you would need fiat in your account. You can deposit supported fiat currencies in your new eToro wallet using Credit/Debit Cards, bank transfers, PayPal, Neteller, Skrill, Rapid Transfer, and iDEAL.

Step 5: Purchase Crypto

Depending on the payment method available in your region, you can get your funds immediately or after several days. Once the fund is available on your eToro account, you can easily make your first ETH purchase. To do this, navigate to the Ethereum page, click on invest, choose how much ETH you want to buy, and make your first purchase.

Where to Buy New Coins

Emerging cryptocurrencies, unlike established ones, are usually purchased via their websites and not through exchanges. In order to be early and enjoy significant gains, new coins are purchased before they are listed on exchanges.

On the other hand, you can also purchase new and established cryptocurrencies on top exchanges when they are listed there. Nevertheless, purchasing via the project’s website by connecting a wallet might be the best bet. The subsequent paragraphs will explain how you can purchase new coins.

See below.

Step 1: Download A Wallet

MetaMask is one of the most popular software wallets in the crypto space. To buy a new coin, the first step is to download MetaMask and create a wallet. The created crypto wallet will allow you to participate in the Chancer presale as the liquidity you will need can be stored there.

Step 2: Buy Some Crypto

After downloading and creating a crypto wallet, you can now proceed to buy some cryptocurrencies to facilitate the purchase of CHANCER tokens. The cryptocurrencies you need to purchase to participate in the Chancer presale include BNB, BUSD, ETH, or USDT.

Step 3: Connect Your Wallet

To connect your newly created and funded wallet, first navigate to the Chancer homepage. Next, select the cryptocurrency you will be using to facilitate the transaction, either BNB, BUSD, ETH, or USDT, and specify the amount. Finally, click on “Connect Wallet” to link your MetaMask wallet to the website.

Step 4: Wait to Claim Your Crypto

Your purchased $CHANCER tokens will be available to claim only after the presale ends. The details about the token claim will be provided once the presale is close to its end. Once it is available for claim, you should navigate to the official website to claim yours.

Final Thoughts On The Best Utility Cryptos To Buy

Utility tokens are considered great investment opportunities because they offer the potential for solid long-term gains. The best utility crypto to buy is one that is part of a functional ecosystem with great adoption, thus, providing investors the potential for solid long-term gains. However, choosing the “best” utility crypto to buy would often depend on an individual’s investment goals, rather than its value proposition.

Methodology - How We Picked The Best Utility Crypto

Careful consideration and research were involved in choosing the best utility crypto. For this guide, we put into consideration the project in which it operates, the utility and use cases of the crypto, its market potential, the development team, platform security, regulatory compliance, its adoption rate, tokenomics, and supply of the tokens. These are the key factors involved in selecting the best utility cryptos. For more information about the process of selection, check out ‘How we test’ and ‘Why trust us’ to understand how we picked the best utility cryptos.

Additional Crypto Coin Reviews

- Best Cryptos to Buy now

- Best ICOs

- Best Crypto Presales

- Best New Cryptos

- Best Metaverse Crypto Coins

- Best ERC-20 Cryptos

- Top Gaming Cryptos

- Best Staking Cryptos

- Best GameFi Crypto Tokens

- Best Long Term Crypto

- Best Cheap Cryptos

- Best Web3 Crypto

- Best Penny Cryptos

- Best Altcoins

- Best Meme Coins

- Best DeFi Projects

- Hottest Cryptos to Buy

- Next Big Crypto

- Best AI Cryptos

- Fastest Growing Cryptocurrencies