The Next Big Cryptos to Explode in 2025

The next big crypto in 2025 is one that proffers innovative and sustainable solutions to important problems in the industry, and investors who get in early could reap significant rewards.

So how do you know which projects will make it big? Read on to find out.

Our guide covers 16 of the next cryptos to grow exponentially within a year. We uncover what these cryptos are, what they are about, and why you should invest in them.

The Next Big Cryptos in 2025

The Next Big Cryptos Reviewed

What is the Next Big Crypto Set to Explode?

We cannot definitively tell you the next big crypto set to explode. However, we can identify sectors that have immense growth potential and list leading projects within those sectors, which is what we did in our list above with thorough research.

Some of the sectors to watch include memecoins, decentralized storage, scalable layer 1 solutions, Ethereum layer 2 solutions, DeFi, decentralized IDs, interoperability, and gaming.

For example, Piggy Bankster is a Solana memecoin that taps into internet meta narratives and is gaining a lot of community interest and media coverage because of that. A project like this has the potential to be the next big crypto after a comprehensive analysis.

How Do You Spot the Next Big Cryptocurrency?

The best way to spot the next big cryptocurrency is to evaluate in terms of the larger narrative. The crypto market moves in narratives, some are short term and some are long-term.

Firstly, identify the timeline of your narrative. Long-term narratives may not result in significant price fluctuations in the short term. However, short-term narratives do.

A good example of a short-term narrative is the AI boom experienced at the start of 2023. Thanks to the success of ChatGPT, AI tokens began to soar with significant price fluctuations as they were propelled by the narrative.

The largest crypto AI projects, Singularity.net and Fetch.AI, rose 1300% from $0.04 to $0.66 and 549% from $0.09 to $0.6, respectively.

Keep your ears to the streets to catch developments early before the other cryptocurrencies in that sector move.

Why You Should Consider Investing the Next Big Crypto

The rationale for investing in the next big crypto is straightforward, big moves equals big money. If you get in early enough with substantial capital, you could end up making some of the life changing gains that are often talked about in the industry.

This is not to get your hopes up, but to highlight the possibility and potential reward of getting in early on developing trends.

What Typically Causes an Explosion in a Crypto’s Price?

Demand and Supply

The first and most prevalent cause of price spikes are the market conditions of demand and supply. When a token is in high demand but has limited supply, its price is bound to rise. When the opposite is the case, prices tend to fall.

Project Developments

Project developments can reignite fresh interest in a token. This could be a change to the project’s tokenomics, the launch of a new service or offering, news of funding or the acquisition of other projects.

Note that the same could have the opposite effect. For example, news of a hack or crypto scam could cause investors or the growing community to dump their tokens.

Market Sentiments

During crypto bull markets, everything rises, oftentimes regardless of underlying value or long-term prospects. A general positive market sentiment could cause a token or entire investment to rise. However, you need to be careful because once the sentiment dies down, so does the token.

Things to Keep in Mind When Investing

Entry Price

The price you buy cryptos at is important because it is the difference between “life-changing” gains and “a nice vacation” gains. Low price points allow you to buy more of a winning token for less.

For example, a $1000 investment in Binance Coin in 2017 would yield roughly 65000% at today’s prices, which is roughly $65,000. Compare that to a $4000 total value investment in 2021 which would yield roughly 800%, $32,000.

Long Term Prospects

The long-term prospect of any cryptocurrency project you wish to invest in is important as it is what will determine whether the project will live long enough to generate a return on your investment. One way to determine a project’s longevity is to consider the problem it solves.

If the problem is vital and perpetual i.e. is important to the industry and is always in demand, then the project that offers the best solution has a decent chance at making it long-term. The best solutions to unimportant problems don’t matter.

Market Cycle

Where you are on the market cycle should also influence your investment decisions. The rule is to exercise caution and avoid investing at the height of the bull market, which is a trap that people fall into because they invest when the news is permeated with stories of crypto millionaires.

Unsurprisingly, this is also the time where the market is at its peak, and is about to pop. Investments made at this time could lose value and take years to break even.

The ideal time to make investments is close to the end of a bear market. As Warren Buffet says, be greedy when people are fearful and fearful when people are greedy.

How to Buy the Next Big Crypto

To buy the next big crypto, you need to sign up on an exchange. Our top pick is eToro, but you can use any that is secure and convenient. To get started:

1. Open an Account

Go to the eToro website and click on the Start investing icon to create an account. You can download the mobile app from the Play Store/App Store and click on Sign up. Fill out the form with your full name, email address, and password.

2. Verify Your Account

Verify your account by setting up your profile and submitting KYC documents like a valid government ID and proof of residence document like a utility bill.

3. Deposit Funds

Once your account has been verified, deposit funds by choosing a payment method on the left pane of the page. Set the amount you’d like to deposit.

4. Buy Crypto

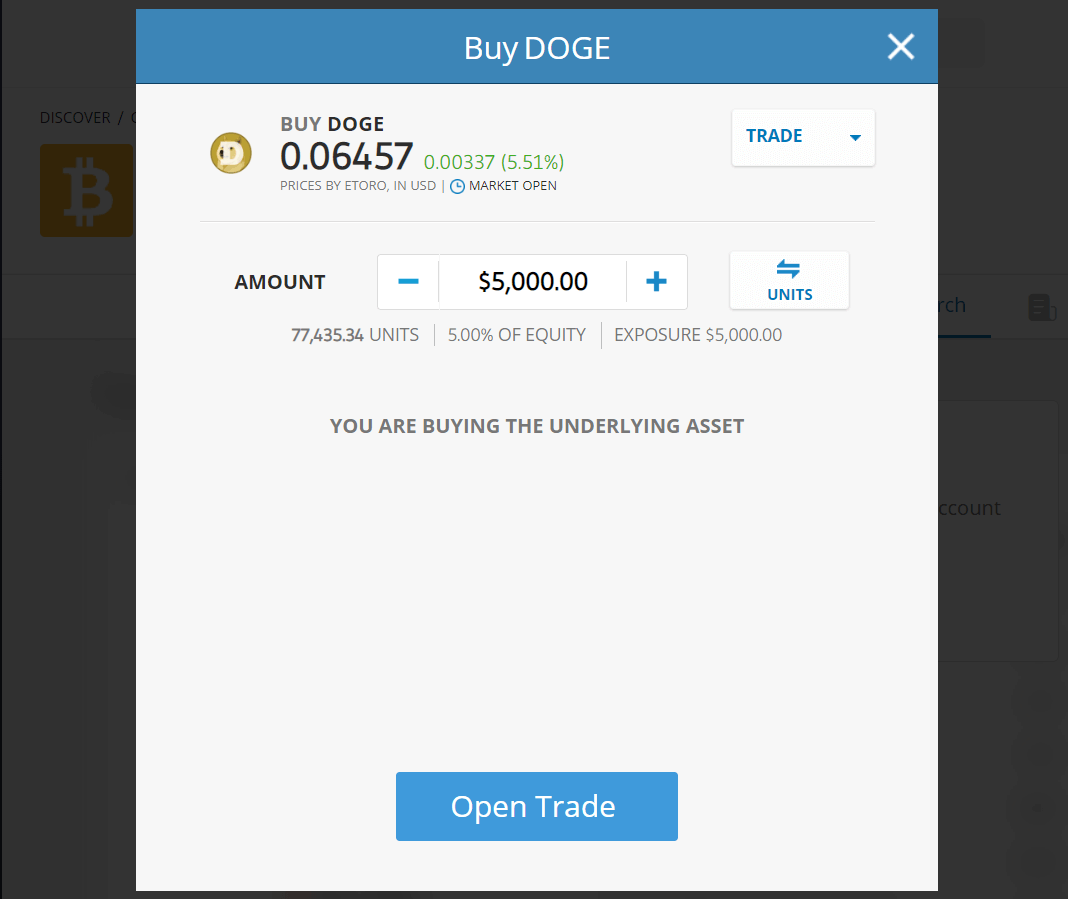

Once your account is funded, search for any of the cryptos mentioned in the Discover tab. An interface like the one below should load. You can then set your parameters and buy.

Where to Buy the Next Big Coins

To get your hands on new coins like Solciety that could be big cryptos but are not yet listed on exchanges, you’ll have to purchase them directly on their websites using a crypto wallet. We created a guide to walk you through this process.

Step 1: Download a Wallet

We used MetaMask for this guide. Download MetaMask on your phone or as a browser extension on your laptop and create a new wallet. Ensure you keep your seed phrase safe and offline.

Step 2: Buy Some Crypto

You’ll need SOL to buy new Solciety tokens. Buy some on an exchange like eToro and transfer to your wallet, or use a fiat onramp on the MetaMask web interface to buy with a credit card.

Step 3: Connect Wallet

Navigate to Solciety’s website and connect your wallet to buy $SLCTY using SOL. Ensure you have enough to pay for gas fees.

Step 4: Wait to Claim

You’ll need to wait until the presale is over to claim your tokens.

Latest Next Big Crypto Projects News

- Developers are bullish on Sui as its horizontal scaling features make it suitable foor games

- Crypto firm Ripple buys a Swiss crypto custody firm as the SEC’s crackdown forces more crypto companies to consider moving overseas

- Metacade Starts developing games as the platform’s token, MCADE, gets listed on major exchanges

- AltSignals new cryptocurrency presale Hits $585k as investors buy into its value proposition

Final Thoughts On The Next Big Crypto To Invest In

We explored the next big cryptos to invest in and chose Arbitrum as our typo choice because it is the largest layer 2 scaling solution and has serious institutional backing.

Nonetheless, any of the other cryptos listed are good contenders as they are all at the forefront of growing sectors, have sound technologies and use cases, and have competitive edge.

Remember that investments in the next big cryptos are investments in the future of that industry, so ensure that you key into long term narratives with robust tokenomics and that you are not at the peak of a bull market.

To invest in cryptos, you’ll need a low fee exchange whose charges are affordable, especially for frequent purchases. Our top choice is eToro, but several others, like Binance, Coinbase, and Bitstamp, are also suitable.

Methodology - How We Picked The Next Big Crypto To Buy

The projects covered in this guide were chosen through rigorous research. We paid attention to security, reputation, tokenomics, competitive edge, and growth potential.

The tokens listed are the best we found in the various categories we listed them. For example, we listed Metacade as the next big Web3 community because it is building a hub that integrates several games and creates an environment where various stakeholders in the gaming community can interact.

Check out our why trust us and how we test pages for more information on our testing process.

Additional Crypto Coin Reviews

- Best Cryptos to Buy now

- Best ICOs

- Best Crypto Presales

- Best New Cryptos

- Best Metaverse Crypto Coins

- Best ERC-20 Cryptos

- Top Gaming Cryptos

- Best Staking Cryptos

- Best GameFi Crypto Tokens

- Best Long Term Crypto

- Best Cheap Cryptos

- Best Web3 Crypto

- Best Penny Cryptos

- Best Utility Cryptos

- Best Altcoins

- Best Meme Coins

- Best DeFi Projects

- Hottest Cryptos to Buy

- Best AI Cryptos

- Fastest Growing Cryptocurrencies