The 14 Hottest Cryptos To Buy Now In 2024

The hottest cryptos to buy are the ones that are on the verge of a rally. They hold potential for gains, either by the strength of the solutions they offer, their tech stacks, or pure hype.

The question now is, of the 10,000+ cryptos in the industry, which ones are most likely to rise? We covered 17 cryptos that command a lot of trading volume, are on the trending list on various aggregators, and have the potential for growth.

Our guide explores what these cryptos are, what they do, and why they are good investment choices right now.

The Hottest Cryptos To Buy In 2024

- Poodlana ($POODL) – Best Lifestyle-Inspired Solana Memecoin

- Solciety ($SLCTY) – Best Politically-inspired Memecoin

- BitBot ($BitBot) – Best New Crypto Trading Bot

- Bitcoin Dogs ($0DOG) – Best Bitcoin BRC-20 Token

- Memeinator (MMTR) – Hot New Memecoin

- Metacade (MCADE) – Hottest Community Platform

- Bitcoin (BTC) – Largest Market Capitalisation

- Ethereum (ETH) – Largest Ecosystem

- Apecoin (APE) – Hot Metaverse Crypto

- Arbitrum (ARB) – Top Scaling Solution

- Render (RNDR) – Hot Rendering Network

- Chainlink (LINK) – Top Oracle Service

- Pepe (PEPE) – Hot LargeCap Memecoin

- Ripple (XRP) – Top Payments Platform

- Sui (SUI) – Upcoming Blockchain Network

Comparing The Hottest Cryptos To Buy Now

|

Cryptocurrency |

Category |

Release Year |

Market Cap |

Blockchain network |

Where to Buy |

| Poodlana ($POODL) |

Community |

2024 |

None yet |

Solana |

|

| Solciety ($SLCTY) |

Community |

2024 |

None yet |

Solana |

|

| BitBot (BITBOT) |

Utility |

2024 |

None yet |

Ethereum |

|

|

Memeinator (MMTR) |

Memecoin |

2023 |

None yet |

Ethereum |

|

| Bitcoin Dogs ($0DOG) |

Gaming |

2024 |

None yet |

Bitcoin |

|

|

Bitcoin |

Layer 1 |

2009 |

$580 billion |

Bitcoin |

|

|

Ethereum |

Layer 1 |

2013 |

$229 billion |

Ethereum |

|

|

Apecoin |

Metaverse |

2022 |

$860 million |

Ethereum |

|

|

Arbitrum |

Layer 2 |

2023 |

$1.40 billion |

Ethereum |

|

|

Render |

Services |

2020 |

$830 million |

Ethereum |

|

|

Chainlink |

Oracle |

2017 |

$2.96 billion |

15+ |

|

|

Pepe |

Memecoin |

2023 |

$599 million |

Ethereum |

|

|

Ripple |

Payment Settlement |

2013 |

$26.50 billion |

Ripple |

|

|

Sui |

Layer 1 |

2023 |

$439 million |

Sui |

Our Top 14 Hottest Crypto To Buy Now Reviewed

Poodlana (POODL) – Lifestyle-Inspired Solana Memecoin

In a sea of flat dog-inspired memecoins with no edge, Poodlana stands out as the creme de la creme of lifestyle, fashion, and class by redefining what it means to be fabulous in the digital age.

Why invest in POODL?

According to a news report from Coindesk, 80% of memecoins’ price growth occurs during Asian trading hours, making the Asian market vital to their success.

POODL is inspired by the Poodle dog breed, the third most popular breed in the Asian region. Considering that most of the strongest memecoins on Solana are tied to real-world narratives, the project can create a strong narrative by keying into the region’s love for the Poodle breed.

Crypto ranking data shows that memecoins popular in Asia tend to perform well globally and reach million-dollar market capitalisations. Some examples are Peipei ($78 million market cap), Biaoqing ($12.97 million market cap), and KFC ($195 million market cap).

By differentiating itself as a high-class memecoin for the fashion elite based on a popular dog breed, POODL can lock into a popular narrative and achieve breakout growth.

Risks in investing in POODL

Most memecoins that try to start (or key into) a popular narrative eventually fail. POODL’s success relies largely on its positioning as a high-class memecoin that is a step above the rest and its fair launch. Like most memecoins, it has no utility and is a risky venture.

POODL has a total supply of 1 billion tokens, 50% of which will be offered for sale in the 30-day presale event starting on July 3rd. After the presale, the token will be listed on Raydium within 60 minutes of the presale close. All tokens will be unlocked and hit the market simultaneously, making the next 30 days the only time investors can get their hands on the token before launch.

To participate in the presale, visit the Poodlana website.

Solciety ($SLCTY) – Best Politically-inspired Memecoin

Solciety is a memecoin project pushing beyond the norm to create a community for all degens. The coin leans into the PolitiFi narrative by presenting itself as an on-chain political party for all memecoin lovers focused on gains, not policies.

Why invest in Solciety?

Memecoins thrive on attention and are built around narratives—the more relevant the theme, the more attention the memecoin garners. Politics is a prominent narrative this year as US elections approach, and Solciety being the first memecoin heralding the political party meta, enjoys first mover advantage.

The project stands on the proven success of Political tokens like Donald Tremp and Joe Boden but differs from them in that it does not lean toward one party but creates a community for everyone.

Furthermore, the project is built on Solana and enjoys the network’s speed, scalability, and growing user base.

Risks in Investing in SLCTY

Like all memecoins, SLCTY risks performing admirably or failing spectacularly. Investors also risk a lack of longevity as most memecoins lose the greater part of their values after the hype around their narrative dies down.

SLCTY’s presale launched on 18 June, and will run for 30 days offering 3 billion tokens to early investors. Visit the Solciety website to participate in the presales.

Bitbot (BITBOT) – Best Crypto Trading Bot

Bitbot is a crypto trading bot that allows you to trade cryptos on-chain using simple text instructions on Telegram. The bot is part of a rising trend of people using bots with instant execution speeds to keep up with institutional traders.

These bots are usually integrated with the Telegram messaging platform, allowing users to control their trading activities using simple commands. Because of their ease, efficiency, and speed, traders can use them to uncover and buy tokens before they launch on major exchanges.

Why invest in Bitbot?

Bitbot offers features that place it ahead of other trading bots. The most pertinent is its emphasis on decentralization. Most Telegram bots hold on to their users’ private keys, creating an attack vector.

We saw this happen with popular bots like Unibot which was hacked in October 2023. The attacker could drain funds from connected wallets because the platform stored its users’ private keys.

Bitbot uses a completely decentralized structure to ensure users are always in charge of their tokens.

Risks in investing in Bitbot

While the bot has utility, the success of its token depends on the company’s ability to attract and retain users, which is usually easier to accomplish during a bull market than a bearish one.

2024 is expected to be bullish thanks to Bitcoin’s halving, however, interest beyond the bull season is yet to be determined.

Bitbot has a total supply of 1 billion tokens, 30% of which will be sold in an upcoming presale event. This presale includes a competition that will reward participants with up to $100,000. To stay current on the presale, visit the Bitbot website.

Bitcoin Dogs ($0DOG) – Best Bitcoin BRC-20 Token

Bitcoin Dogs’ native token, $0DOG, will launch as the first-ever ICO on the Bitcoin blockchain. Thanks to cutting-edge Bitcoin Ordinal technology, Bitcoin Dogs is pushing the boundary of what is being built on the Bitcoin network.

By combining memecoins, NFTs, and Ordinals, this project aims to go where none has gone before along with all who dare to run ahead of the pack. Given the industry’s love for breaking new milestones, this project will attract the interest of people within and outside the Bitcoin community.

Why invest in Bitcoin Dogs?

Bitcoin Dogs keys into strong crypto narratives like BRC-20 and the Bitcoin halving that could place it in investors’ sights, and allow for innovation and significant upside; several BRC-20 projects that have launched have garnered traction from investors and Bitcoin enthusiasts.

Bitcoin Dogs has gone further than most other projects to build the first Bitcoin-native gaming ecosystem with tokens, a planned NFT collection, and even games further down the line.

Bitcoin on-chain metrics data from Dune Analytics show a significant increase in transaction count on the blockchain that started close to the end of January 2023, when Ordinals was launched.

Higher volumes combined with the Bitcoin halving in April 2024 could catalyze significant growth for the network and its most promising projects, like Bitcoin Dogs.

Risks in Investing in Bitcoin Dogs

Bitcoin Dogs is a new project attempting a feat that has never been done before. As such, there are bound to be obstacles that are novel to this project, and a history of token launches shows that plans are hardly ever without hiccups.

$0DOG will be the native token of the Bitcoin Dog ecosystem. It has a maximum supply of 900 million units, 90% of which is allocated to the presale. This means that investors will get the bulk of tokens, making this as close to a fair launch project as possible.

To join this project early, head over to the Bitcoin Dogs website.

Memeinator (MMTR) – Best New Memecoin

Memeinator is a memecoin with a twist. While other memecoins adopt an animal theme, either a dog or frog, Memeinator has chosen to adopt themes from the wildly popular terminator series. It features terminator dogs that have travelled back in time to dominate the meme market.

Why invest in Memeinator?

In the memecoin space, virality is the difference between success and failure. Memeinator has employed innovative marketing strategies, an engaging story, and an upcoming suite of products to keep its growing community engaged.

Despite the uncertainty of the memecoin space, Memeinator has displayed the potential to create a community of loyal supporters by offering innovative rewards. One of which is a trip to space on the Virgin Galactic, worth a whopping $250,000.

In the future, the MMTR token will be the key to unlocking the ecosystem which will include exclusive NFTs and an action game.

Risks in investing in Memeinator

Big plans and hype are common tools that memecoins employ to get people onboard, and while Memeinator is making strides, it is still untested. Most memecoins fail, and there is a possibility that Memeinator will as well.

MMTR has a maximum supply of 1 billion tokens, 62.5% of which is on offer in the presale which is currently ongoing. This is suitable as most of the supply will be in the hands of the public, making it less prone to manipulation.

To join the presale, head over to the Memeinator site.

Metacade (MCADE) – Hottest Crypto

Metacade is the hottest crypto on our list because of the strides it is making towards connecting the gaming community across various games and Metaverses.

Why Invest In Metacade?

Metacade is blazing a trail where none others have, at least not at the scale this project intends. The platform will serve as a hub for gamers, builders, thought leaders, insiders, and reviewers to interact.

Community members will also be able to access their favorite games from the member area of the platform, thanks to the integrations with top games which will also serve to feed leaderboards of top games and players.

There will also be a review section for players to write reviews about the games they play. Game builders can then use these reviews as a source of insights when updating or building new games.

Finally, Metacade will also develop GameFi strategies for the games under its purview to enable players to maximize their earnings.

Risks In Investing In Metacade

Metacade will have to lay significant technological groundwork to effectively integrate games from multiple chains, even if they are all EVM based. While this is possible, it is a tall order. Meanwhile, other communities with less features are growing.

The community platform is powered by the MCADE token. It will grant holders access to promotions, tournaments, and campaigns, and will also be used to reward community contributors.

You can buy MCADE on the website.

Bitcoin (BTC) – Largest Market Capitalization

Bitcoin is the most popular crypto on the market. It is the first ever crypto created by the anonymous developer, Satoshi Nakamoto, as a replacement to the current monetary system.

So far, it is being used as a digital store of value thanks to its limited supply, legal tender in countries like El Salvador, and a means for payments in crypto-friendly regions.

Why Invest In Bitcoin?

Bitcoin is on our hottest crypto list because it is still the largest crypto by market capitalization. It is also the most liquid crypto as well as the most decentralized blockchain network.

Because of its provable decentralization. Bitcoin is not under as much regulatory scrutiny as many other cryptos. For example, the crypto has not been named as a security in the latest round of crackdowns by US regulators.

Licensed crypto exchanges can freely offer the opportunity to invest in Bitcoin to their customers without fear of regulatory action against them. This improves investor confidence in BTC as a store of value.

Bitcoin is projected to grow in the next few months as the market approaches a coming bull run, which is usually marked by a Bitcoin halving due in a few months, as of writing. However, this does not serve as financial advice.

Risks In Investing In Bitcoin

There aren’t as many risks to investing in Bitcoin as there are with other cryptos. However, investors need to be on the lookout for regulations in their various countries.

Also, the series of bankruptcies that rocked the industry last year could have a ripple effect as these firms may need to sell off significant Bitcoin holdings to repay creditors, thereby pushing BTC’s price lower and the search to buy Bitcoin cheaply.

BTC is available on pretty much every centralized crypto exchange. However, eToro is our preferred choice.

To learn more about Bitcoin, read our Bitcoin review. Alternatively, you can buy BTC on an exchange like eToro.

Ethereum (ETH) – Largest Ecosystem

Ethereum is the second largest crypto by market capitalization and, like Bitcoin, is a pillar to the crypto industry. The network serves as a general purpose computer that runs decentralized applications. This computer is called the Ethereum Virtual Machine.

Why Invest In Ethereum?

Ethereum brought cutting-edge technology to the crypto market by introducing smart contracts, the building blocks of decentralized applications, back in 2013. Since then, it has grown to be the largest smart contract-enabled network with over $25 billion in assets as of writing.

While the network once struggled with high network fees and scalability, it recently went through some upgrades to increase its speed and throughput, called the Shapella upgrade. It is now cheap enough for retail participation and is theoretically fast enough to run enterprise applications.

Ethereum blockchain is also home to several other networks that depend on it for security. A prime example are the popular layer 2 solutions like Arbitrum and Optimism. The growth of these networks only adds to the growth of Ethereum itself which will be reflected in the price of its coin, ETH.

Risks In Investing In Ethereum

Ethereum is another crypto that has reached a mature level where factors like competition do not affect price as much. Regulators also do not consider it a security, so it is somewhat safe from direct regulatory scrutiny.

However, regulatory attacks on other industry players may affect ETH’s price as crypto investors will be unwilling to invest in the crypto if they cannot easily trade or sell it.

ETH has an infinite supply, but its emission is offset by token burn on transaction fees. Theoretically speaking, if ETH burned from transaction fees exceeds token emissions, then ETH should be the best crypto to buy as it will increase in value over time.

Data from validator sources show that roughly $1.2 billion worth of ETH is emitted every year as rewards while about $3 billion is burned. So far, burning outpaces emissions.

Read our Ethereum review to learn more about the network or buy ETH on a broker like eToro.

Apecoin (APE) – Hot Metaverse Crypto

Apecoin is the native token for the ecosystem built around Yuga Lab’s NFT collections and Metaverse, collectively called the Yugaverse.

Yuga Labs is the studio behind premium NFT collections like Bored Ape Yacht Club. It also owns the rights to Cryptopunks and Meebits, after buying it from Laravel in 2021. Yuga Labs is valued at $4 billion and is projected to grow thanks to projects like their Metaverse, called Otherside.

Why Invest In Apecoin?

Apecoin’s utility runs deep into the Yugaverse. Taking Otherside as a prime example, the token will serve as the native form of value transfer in the coming Metaverse. Everything will be sold and traded by crypto investors using APE, from land to avatars, tools, and weapons.

Note that land in Otherside is also being sold on OpenSea in ETH.

We are positive about Otherside because it has sealed partnerships from real-world brands like Gucci to bring its fashionable pieces to the Metaverse. The Metaverse has also gathered interest from the crypto community as one that is highly anticipated.

APE will also power other aspects of the Yugaverse. For example, the Apecoin DAO which will be in charge of managing the smart contracts and infrastructure that controls the NFT collections as well as the Metaverse will also be powered by APE.

Risks In Investing In Apecoin

APE is the native token for the Otherside Metaverse which is expected to provide the bulk of its use case. Otherside is just one of several Metaverse projects vying for relevance. It is also not the largest or the longest standing.

While it has made strides in securing partnerships with brands like Gucci, it will need to hold its own against established projects like The Sandbox and Decentraland.

APE token holders will be able to vote on proposals for the future of the ecosystem and take more active roles in the community.

You can buy APE on popular centralized cryptocurrency exchanges like eToro.

Arbitrum (ARB) – Top Scaling Solution

Arbitrum is a layer 2 network built on top of Ethereum that leverages methods called rollups to make transactions of crypto assets faster and cheaper. The network helps Ethereum with scalability by creating an extra computational layer, processing transactions there, and then batch-uploading them to the Ethereum blockchain.

Why Invest In Arbitrum?

The crypto and blockchain space is itching for networks that are as fast and cheap as their Web2 counterparts, and while Ethereum is much faster than it was a few months ago, it still has a long way to go to achieve the speed needed to compete with legacy systems.

Scaling solutions, often called Layer 2 networks, step in to fill the gap. Arbitrum is the largest layer 2 network with a total of $2.09 billion worth of foreign assets through various DeFi apps that run on the network.

The network is constantly growing as there are over 312 crypto projects and protocols running. A few months ago, this number was less than 50.

Risks In Investing In Arbitrum

Arbitrum uses a rollup technology that is fast and speedy. However, a new trend is emerging in the layer 2 space that revolves around the use of zk-rollups. Even Polygon has released a zk-EVM chain.

If this trend solidifies, then Arbitrum may be at a disadvantage as zk-rollups are technologically superior to optimistic rollups, which Arbitrum uses.

The network features a native token called ARB which is used mainly for governance purposes as transaction fees are paid using ETH. There are 10 billion ARB tokens in existence for potential crypto investment opportunities, 1.2 billion of which are currently in circulation.

You can buy ARB on crypto exchanges like Binance.

Render (RNDR) – Hot Rendering Network

Render is a decentralized cloud platform that connects people who have graphics processing power to spare with people who need it. In simple terms it is one of the best crypto to buy as it helps creators, architects, game developers, video producers, and more to access cheap GPU power thanks to a decentralized crypto exchange network of GPUs.

Why Invest In Render?

The world is edging closer to a mixed reality future with companies like Apple planning to release products like the Vision Pro, next-gen technology in AR and spatial computation.

Technologies like these will make virtual and augmented reality experiences more mainstream, which will create a market for people who create these experiences. The more this market grows, the more important the need for graphics processing power to render these experiences.

We especially like Render because it is not limited to applications within crypto. It can be used by professionals in any industry that handles graphics.

Render offers cheap, scalable access to GPU power as creators do not need to buy or maintain expensive equipment to render their concepts. They simply upload their files to the Render Octane Cloud where it will be rendered in a decentralized way so that no single computer has all their files.

Risks In Investing In Render

Render’s main competition will be competing cloud render services, and while its price point is lower than legacy services, it may end up contending with Nvidia’s GPU cloud computing service, which is technologically superior.

The system will be powered by the RNDR token which will be used as the primary vehicle of value transfer. Creators will buy RNDR to pay for GPU power while nodes (i.e., people providing GPU power) will be compensated with crypto assets using the token.

You can buy RNDR on exchanges like Coinbase.

Chainlink (LINK) – Top Oracle Service

Chainlink is a blockchain infrastructure service that imports data from various off-chain sources in a decentralized and verifiably accurate manner.

It is called an Oracle service that derives its use case from blockchains’ inability to natively connect to data sources of crypto projects that are not on-chain.

Why Invest In Chainlink?

Blockchain networks are not perfect. One of their limitations is that they are isolated systems that cannot connect to data sources outside of themselves. Because of this, decentralized applications have no way to track off-chain data.

Chainlink steps in by connecting to data sources wherever they may be, either on servers outside a specific blockchain network or on other blockchain networks, and importing the required data on-chain.

Thanks to Oracles, decentralized finance applications like GMX or Gains Network can track the price of various cryptocurrencies and even real-world stocks and create decentralized products around them, like perpetuals.

Chainlink is at the forefront of Oracles. With a market capitalization of $2.6 billion, it is the largest decentralized Oracle network and is a key component of various applications.

Risks In Investing In Chainlink

The major risk in crypto investments in Chainlink is the threat of substitution. Other Oracles that are reportedly cheaper to use are emerging. If they steal significant market share, LINK’s growth may be stunted.

We have our eye on Chainlink because of its role in the progression of blockchain technology. As blockchain tech gains more adoption, real-world assets will be tokenized and Chainlink will be relied upon to accurately transmit the real-world value of assets to their on-chain versions.

The network is powered by the LINK token digital currency which is required to use its services.

You can learn more about Chainlink by reading our Chainlink review, or you can learn how to buy LINK on exchanges like eToro.

Pepe (PEPE) – Hot Meme coin

Pepe is a meme coin that has gained popularity and grown in market capitalization within a short period. The meme coins were launched on April 17th 2023 to the cryptocurrency market, and by the first week in May, the meme coins had risen to a market cap of $1 billion.

Why Invest In Pepe?

Unlike the other crypto projects and virtual currencies on our list, there is no fundamental use case for investing in Pepe, unlike a utility token. The project does not use cutting-edge tech or techniques to solve problems nor have an incentive program for holders.

Like most meme coins, the investment case for the best crypto is the strength of the community and the hype around the token that make it the best crypto to buy. Pepe crypto coins meteoric rise is unprecedented, and many believe that it is not yet over as it rose during a bear market.

However, Pepe does have some characteristics that make it as trusted as a meme coin can be for cryptocurrency projects of this type. Firstly, all PEPE tokens are in circulation. There are no token unlocks that could exert pressure on price.

Secondly, PEPE’s launch was fair. All tokens were released at the same time in cryptocurrency markets. None were reserved for team members or early investors. So all large holders bought at market prices.

Lastly, PEPE’s liquidity provider tokens have been burned and its smart contracts renounced. This means that the project’s developers cannot mint new tokens or withdraw liquidity from the decentralized liquidity poosl in the cryptocurrency space.

Risks In Investing In Pepe

Pepe crypto coins have no fundamental value whatsoever, and crypto investors can easily move onto a new meme coin and leave PEPE in obscurity.

There are no risks of rug pulls or honey pots now or in the future. You can buy PEPE on the Binance cryptocurrency exchange or decentralized exchanges like Uniswap.

Ripple (XRP) – Top Payments Platform

Ripple is a company that offers a decentralized network that settles international payments in real-time. The company is incorporated in the US and already has a customer base of institutions and businesses.

Why Invest In Ripple?

Before making a case for Ripple, we must mention that the company has an open case in court against the US’ SEC. The regulator sued the company on claims that it offered unregistered securities to US citizens, thereby breaking federal law.

The sale of unregistered securities referred to in the SEC’s claim is XRP’s ICO held back in 2012.

XRP is currently delisted from US cryptocurrency exchanges but is available on global exchanges as the company fights to clear itself of all charges. The legal battle started in 2020.

However, despite Ripple’s legal woes, its network and solution are rock solid. Companies can process payments in real-time from various parts of the world. The alternative would be waiting several days for networks like SWIFT to process payments.

Big banks like JP Morgan have begun testing blockchain-based real-time payment settlement networks, which shows that Ripple’s solution is a viable future for international payments and asset transactions with the XRP ledger consensus protocol.

Risks In Investing In Ripple

Banks building their own cross-country blockchain-based settlement networks have both positive and negative connotations for Ripple. On one hand, it validates Ripple’s use case. On the other hand, it creates stiff competition.

If banks implement their own global digital settlement networks, they can easily port their institutional clients, which will take a chunk out of Ripple’s client base.

You can learn more about Ripple and the XRP token by reading our Ripple review. Alternatively you can buy XRP on a broker like eToro.

Sui (SUI) – Upcoming Blockchain Network

Sui is a layer 1 blockchain network that plays the same role as Ethereum’s blockchain platforms, i.e. providing decentralized alternatives for a scalable platform for developers to build applications. However, it does not yet possess the same size or operate on the same scale as Ethereum.

Why Invest In Sui?

Sui is termed a Solana killer i.e., a blockchain network that has the potential to replace Solana. This is important because Solana is the first non-EVM blockchain to achieve success as a viable alternative to the Ethereum cryptocurrency project.

While there are various layer 1 networks, most are built using the Ethereum Virtual Machine and are often referred to as an extension of Ethereum. Solana blockchain was built using an entirely different system and showed that blockchain platforms with different programming languages can be successful.

Now, a race is on to build the next big scalable blockchain platforms that do not rely on the EVM. Sui is one of the networks at the forefront of this endeavor with its horizontal scaling capabilities, native support for on-chain assets, and a programming language that is easy to use.

The Sui blockchain is particularly great for games as its horizontal scaling feature can keep up with increasing transaction loads without a corresponding increase in transaction cost, a problem most blockchain networks are yet to solve.

Risks In Investing In Sui

There are several layer 1 chains in development that boast impressive speeds and features. Sui is just one of them and will have to battle against other chains in its class as well as layer 2 solutions for dominance.

If history has taught anything, it’s that the most technologically capable chains do not always emerge winners.

The Sui network is powered by the SUI coin which was recently launched and is available on popular centralized trading platforms like Coinbase.

What is the Hottest Crypto to Buy Now?

The hottest crypto on our list right now is Piggy Bankster, because of its ability to tap into new and engaging narratives in the community-driven meme coin space, and because of its potential to achieve truly viral growth on the back of this community support.

The others on our list are just as hot, including Bitbot, a self-custodial crypto trading bot, and Chancer, which provides a better, decentralized way to bet on virtually any event with a trackable outcome.

How to Find the Hottest Crypto to Buy Now

Lock On to Developing Trends

Hot cryptos are usually in season because they are at the forefront of or benefit from a hot trend. A trick to finding them is to realize that the crypto market always follows trends. At the start of the year, it was artificial intelligence which saw a rally in AI cryptos.

Then, it was the Ethereum upgrade that saw ETH rally, then meme coins pumped as a meme coin rally, brought on by Pepe, ushered in a new set of meme cryptocurrency trends.

To find hot cryptos, seek out hot trends.

Use Social Media

Social media sentiment is a good way to find tokens and digital currencies that people are talking about. However, exercise caution as tokens that are fast declining can also create a similar buzz. Tools like Lunar Crush can help you find trending tokens on Twitter.

Why You Should Invest in the Hottest Crypto to Buy Now

Growth Potential

Virtual currencies that receive a lot of buzz can return outsized gains. A prime example is Pepe, which reportedly turned an investor’s $250 into $1 million in just four days. Twitter is littered with stories of early investors who cashed out big by jumping on trends and crypto presales early.

Potential Gold Mine

Sometimes, the hottest crypto today could become a good long term source of value. However, this is not a rule as the last time Bitcoin was hot was at the 2021 bull market when it was $60,000. It has since lost over 50% of its value.

However, hot cryptos can still grow to establish themselves as pillars in their categories, and investors who get in early enjoy outsized gains.

Are There Any Risks to Buying the Hottest Crypto Now?

Trend Reversal

The most pertinent risk to buying the hottest cryptocurrency trend is that most retail investors hear about a hot crypto at the peak of its run. There’s a popular saying in crypto that goes along the lines of “when your mom or uncle tells you that a particular coin is mooning, that’s a sign that it’s time to sell.”

A good example is Pepe. By the time most people heard about Pepe, it was already around the $1 billion market cap. It has since fallen to a $380 million market cap.

Short Term Fad

Hot cryptos can be short term fads that peak quickly and eventually fade away. This is most prominent among meme coins but also occurs in other crypto categories, like utility tokens. To battle this, you must ensure that you carry out fundamental research to determine whether a hot crypto has a utility value, like a governance token ability.

Things to Consider When Investing in the Hottest Crypto

- The source of the hype: Some trends are driven largely by emotion. If this is the case, then the cryptos made hot by these trends will quickly lose value once the emotions pass.

- Sustainability: Sustainability is key as only the most sustainable projects survive. If the project’s solution seems temporary, or its tokenomics unsustainable, then eventually, it will fail.

- Length of trend: If you’re not plugged into the crypto space, you’ll most likely hear about cryptos when they are reaching their peak. In this case, you’ll need to be careful. First check price historicals to gauge how long the crypto has been rallying.

- Check community: You can tell a lot about a crypto by the activities of its community members. Join crypto discord groups and follow updates on Twitter to gauge whether communities are dedicated.

How to Buy the Hottest Crypto Now

This guide shows you how to buy the hottest cryptos on an exchange like eToro.

1. Open an Account

Navigate to the eToro website and click on the Start Investing icon or download the mobile app from the Play Store/App Store and click on Sign up. Fill out the form with your full name, email address, and password.

2. Verify Your Account

Set up your profile and submit KYC documents like a valid government ID and proof of residence document like a utility bill.

3. Deposit Funds

Once your account has been verified, deposit funds by using any of the available payment options. Choose a convenient method and set the amount you’d like to deposit.

4. Buy Crypto

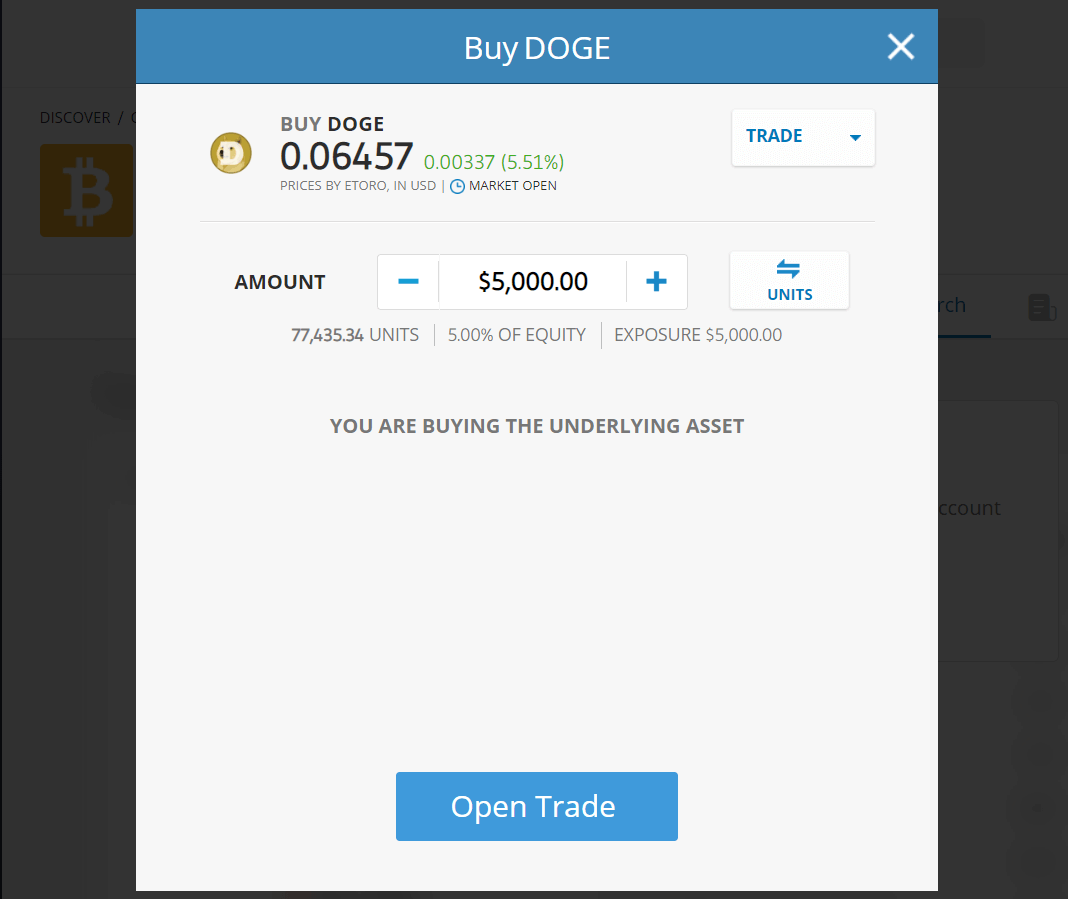

Once your account is funded, search for any of the cryptos mentioned in the Discover tab, we used Ethereum. An interface like the one below should load. You can then set your parameters and buy.

Where To Buy New Hot Coins

For coins like Solciety that aren’t out yet but are already creating a buzz, you’ll have to buy them directly on their websites using a crypto wallet. This guide shows you how.

Step 1: Download A Wallet

For this guide, we used MetaMask. Download MetaMask on your phone as a mobile app or on your laptop as a browser extension and create a new wallet. Ensure you keep your seed phrase safe and offline.

Step 2: Buy Some Crypto

You’ll need some SOL to buy Solciety. You can buy on an exchange and transfer to your wallet or use a fiat onramp like Simplex.

Step 3: Connect Wallet

Navigate to Solciety’s website and connect your wallet to buy SLCTY using SOL. Ensure you leave enough to pay gas fees.

Step 4: Wait To Claim

You’ll need to wait until the presale is over to claim your tokens.

Latest Hottest Crypto to Buy News

- Bitcoin and Ether stand their ground this week while Altcoins tumble because of the SEC’s attack on Coinbase and Binance.US

- Institutional interest in Chainlink grows as the network sees huge whale transactions

- Data shows that more capital is flowing away from Ethereum and onto Arbitrum as the largest layer 2 remains an attractive destination for investors

- Canada’s Largest University becomes an XRP validator in a new partnership with Ripple

Final Thoughts on the Hottest Crypto to Buy Now

We explored the hottest cryptos to buy now and chose Piggy Bankster as our top choice. However, all the cryptos on this list are good options as they have strong fundamental value, and in the case of Pepe, it is a new trusted memecoin.

While the cryptos on our list are trusted because we’ve done the research, remember to always gauge community involvement, check on sustainability, and avoid buying cryptos at the top of their trends when the hype is hottest.

You may want to read our guide on how to invest in cryptos to get a better understanding of the investment process.

Methodology - How We Picked the Hottest Crypto to Buy Now

The cryptos covered in this guide were chosen through rigorous research. We paid attention to utility, reputation, community, hype, and growth potential.

The tokens listed are the best we found in the various categories we listed them. For example, we listed Piggy Bankster as the hottest betting crypto because of its viral growth potential.

Check out our why trust us and how we test pages for more information on our testing process.

Additional Crypto Coin Reviews

- Best Cryptos to Buy now

- Best ICOs

- Best Crypto Presales

- Best New Cryptos

- Best Metaverse Crypto Coins

- Best ERC-20 Cryptos

- Top Gaming Cryptos

- Best Staking Cryptos

- Best GameFi Crypto Tokens

- Best Long Term Crypto

- Best Cheap Cryptos

- Best Web3 Crypto

- Best Penny Cryptos

- Best Utility Cryptos

- Best Altcoins

- Best Meme Coins

- Best DeFi Projects

- Next Big Crypto

- Best AI Cryptos

- Fastest Growing Cryptocurrencies