The 14 Best Long Term Crypto Projects to Invest in 2024

Crypto projects that retain their value over the years tend to return the best gains. Bitcoin and Ethereum are prime examples of some of the best long term crypto projects that have returned roughly 3.2 million percent and 220,222 percent since they started trading.

These are impressive numbers, and while the boat may have sailed for enormous gains on Bitcoin and Ethereum, other projects show the potential for significant value appreciation over the next few months and years.

Our guide explores 15 cryptocurrency investments with the most potential. We explore what they do, why they are important, their strengths and weaknesses, and how these crypto coins operations can increase in value over time.

The Best Long Term Crypto to Invest in 2024

1. Poodlana (POODL) – Best Lifestyle-Inspired Solana Memecoin

2. Solciety (SLCTY) – Best Politically-inspired Memecoin

3. Memeinator (MMTR) – Best Memecoin Community

4. Metacade – Best Web3 Community

5. Ethereum – Best Smart Contract Platform

6. Bitcoin – Most Decentralized Network

7. AAVE – Best Lending Protocol

8. GMX – Best Leveraged Trading Protocol

9. Treasure – Best Gaming Infrastructure

10. Lido – Best Liquid Staking Protocol

11. Biconomy – Best Interoperable Protocol

12. Chainlink – Best Blockchain Oracle

13. Uniswap – Best Decentralized Exchange

14. Osmosis Dex – Best Interoperable Decentralized Exchange

The Best Long Term Crypto Compared

|

Cryptocurrency |

Category |

Market Cap |

Blockchain network |

Where to Buy |

| Poodlana |

Memecoin |

None yet |

Solana |

|

| Solciety |

Memecoin |

None yet |

Solana |

|

| BitBot |

Utility |

None yet |

Ethereum |

|

| Memeinator |

Community |

None yet |

Ethereum, BSC |

|

|

Metacade |

Community |

$19 million |

Ethereum |

|

|

Ethereum |

Layer 1 |

$266 billion |

Ethereum |

|

|

Bitcoin |

Layer 1 |

$580 billion |

Bitcoin |

|

|

AAVE |

Lending |

$824 million |

7+ |

|

|

GMX |

Derivatives Trading |

$468 million |

Arbitrum, Avalanche |

|

|

Treasure |

Gaming Infrastructure |

$171 million |

Arbitrum |

|

|

Lido |

Liquid Staking |

$1.60 billion |

5+ |

|

|

Biconomy |

Interoperability |

$142 million |

2+ |

|

|

Chainlink |

Oracle |

$3.17 billion |

15+ |

|

|

Uniswap |

Dex |

$3.56 billion |

6+ |

|

|

Osmosis |

Dex |

$310 million |

Cosmos |

Our Top 14 Best Long Term Crypto Reviewed

Poodlana (POODL) – Lifestyle-Inspired Solana Memecoin

In a sea of flat dog-inspired memecoins with no edge, Poodlana stands out as the creme de la creme of lifestyle, fashion, and class by redefining what it means to be fabulous in the digital age.

Why invest in POODL?

According to a news report from Coindesk, 80% of memecoins’ price growth occurs during Asian trading hours, making the Asian market vital to their success.

POODL is inspired by the Poodle dog breed, the third most popular breed in the Asian region. Considering that most of the strongest memecoins on Solana are tied to real-world narratives, the project can create a strong narrative by keying into the region’s love for the Poodle breed.

Crypto ranking data shows that memecoins popular in Asia tend to perform well globally and reach million-dollar market capitalisations. Some examples are Peipei ($78 million market cap), Biaoqing ($12.97 million market cap), and KFC ($195 million market cap).

By differentiating itself as a high-class memecoin for the fashion elite based on a popular dog breed, POODL can lock into a popular narrative and achieve breakout growth.

Risks in investing in POODL

Most memecoins that try to start (or key into) a popular narrative eventually fail. POODL’s success relies largely on its positioning as a high-class memecoin that is a step above the rest and its fair launch. Like most memecoins, it has no utility and is a risky venture.

POODL has a total supply of 1 billion tokens, 50% of which will be offered for sale in the 30-day presale event starting on July 3rd. After the presale, the token will be listed on Raydium within 60 minutes of the presale close. All tokens will be unlocked and hit the market simultaneously, making the next 30 days the only time investors can get their hands on the token before launch.

To participate in the presale, visit the Poodlana website.

Solciety ($SLCTY) – Best Politically-inspired Memecoin

Solciety is a memecoin project pushing beyond the norm to create a community for all degens. The coin leans into the PolitiFi narrative by presenting itself as an on-chain political party for all memecoin lovers focused on gains, not policies.

Why invest in Solciety?

Memecoins thrive on attention and are built around narratives—the more relevant the theme, the more attention the memecoin garners. Politics is a prominent narrative this year as US elections approach, and Solciety being the first memecoin heralding the political party meta, enjoys first mover advantage.

The project stands on the proven success of Political tokens like Donald Tremp and Joe Boden but differs from them in that it does not lean toward one party but creates a community for everyone.

Furthermore, the project is built on Solana and enjoys the network’s speed, scalability, and growing user base.

Risks in Investing in SLCTY

Like all memecoins, SLCTY risks performing admirably or failing spectacularly. Investors also risk a lack of longevity as most memecoins lose the greater part of their values after the hype around their narrative dies down.

SLCTY’s presale launched on 18 June, and will run for 30 days offering 3 billion tokens to early investors. Visit the Solciety website to participate in the presales.

Bitbot – Best Crypto Trading Bot

Bitbot is a crypto trading bot that allows you to trade cryptos on-chain using simple text instructions on Telegram. The bot is part of a rising trend of people using bots with instant execution speeds to keep up with institutional traders.

These bots are usually integrated with the Telegram messaging platform, allowing users to control their trading activities using simple commands. Because of their ease, efficiency, and speed, traders can use them to uncover and buy tokens before they launch on major exchanges.

Why invest in Bitbot?

Bitbot offers features that place it ahead of other trading bots. The most pertinent is its emphasis on decentralization. Most Telegram bots hold on to their users’ private keys, creating an attack vector.

We saw this happen with popular bots like Unibot which was hacked in October 2023. The attacker could drain funds from connected wallets because the platform stored its users’ private keys.

Bitbot uses a completely decentralized structure to ensure users are always in charge of their tokens.

Risks in investing in Bitbot

While the bot has utility, the success of its token depends on the company’s ability to attract and retain users, which is usually easier to accomplish during a bull market than a bearish one.

2024 is expected to be bullish thanks to Bitcoin’s halving, however, interest beyond the bull season is yet to be determined.

Bitbot has a total supply of 1 billion tokens, 30% of which will be sold in an upcoming presale event. This presale includes a competition that will reward participants with up to $100,000. To stay current on the presale, visit the Bitbot website.

Memeinator (MMTR) – Best Memecoin Community

Memeinator is a memecoin with a twist. While other memecoins adopt an animal theme, either a dog or frog, Memeinator has chosen to adopt themes from the wildly popular Terminator series. It features terminator dogs that have travelled back to dominate the meme market.

Why invest in Memeinator?

In the memecoin space, virality is the difference between success and failure. Memeinator has employed innovative marketing strategies, an engaging story, and an upcoming suite of products to keep its growing community engaged.

Despite the uncertainty of the memecoin space, Memeinator has displayed the potential to create a community of loyal supporters by offering innovative rewards. One is a trip to space on the Virgin Galactic, worth a whopping $250,000.

In the future, the MMTR token will be the key to unlocking the ecosystem, including exclusive NFTs and an action game.

Risks in investing in Memeinator

Big plans and hype are common tools that memecoins employ to get people on board, and while Memeinator is making strides, it is still untested. Most memecoins fail, and there is a possibility that Memeinator will as well.

MMTR has a maximum supply of 1 billion tokens, 62.5% of which is on offer in the currently ongoing presale. This is suitable as most of the supply will be in the hands of the public, making it less prone to manipulation.

To join the presale, head over to the Memeinator site.

Metacade (MCADE) – Best Web3 Community

Metacade is a Web3 community platform that focuses on various participants in the crypto token gaming sector, from players to builders, game bloggers, and more.

The platform provides a space for gaming fans and enthusiasts to congregate and interact. Its value is in the experience it provides for gamers outside the worlds and metaverses of individual games.

The platform is powered by the MCADE token which is an original cryptocurrency used to reward users and token holders who participate in challenges, contribute to the ecosystem, and vote on proposals for greater value.

Why Invest In Metacade?

What Metacade aims to achieve has not been done on the level that the platform envisions. While some social gaming communities exist, they are usually limited to scholarship programmes and guilds, and often leave out the more social aspects of gaming.

Metacade, on the other hand, focuses heavily on the power of social interactions. The platform connects to various popular crypto games, allowing its members to access the best games from one platform.

It also leverages these integrations to maintain leaderboards of the top players across various games, fostering healthy competition among its members. Players can see which games are hot right now and plug into those communities.

Game builders aren’t left out as a review section provides them with first hand accounts of players’ experiences with their games. They can use these reviews as an information source for making improvements.

Risks In Investing In Metacade

Metacade is a new project that is exploring an untapped space. Perhaps the reason this space has not been explored is because of the technological requirements of integrating with various games. If this is the case, Metacade will need to overcome various technological and interoperability challenges to truly reach its potential and for tremendous growth.

Also, gaming and even the best Metaverse tokens are usually the first to be dumped in bear markets.

You can Buy Metacade here.

Ethereum (ETH) – Best Smart Contract Platform

Ethereum is a household name in the world of crypto. The pioneer smart contract network has been around since 2013 and has survived multiple market cycles because of its fundamental contributions to the proliferation of crypto technology and its importance to the industry and Ethereum-based cryptocurrency.

Ethereum is a general-purpose blockchain network that powers tens of thousands of decentralized applications, spanning from DeFi apps, to games, and entire Metaverses. It has a total value of about $32 billion locked in its many decentralized finance applications, and even more in other non-finance related protocols.

Why Invest In Ethereum?

Ethereum has long-term potential because its operating system, the Ethereum Virtual Machine is one of the most widely used in the industry. New blockchain networks adopt this system when creating their own technology.

Secondly, Ethereum is one of the most decentralized blockchains after Bitcoin with more than 9,000 nodes around the world working to secure the network.

Thanks to the recent Shapella upgrade, the network now processes a theoretical 100,000 transactions per second and is expected to become faster as time goes on.

In the last bull market, the network’s native token, ETH, reached a high of $4,000, and that was when the network experienced scalability issues and high transaction costs (gas fees) for so many cryptocurrencies that excluded several retail participants.

Now that these issues are being addressed, the network is expected to grow exponentially. ETH trades at $2,100 as of writing after reaching a 52-week high of $3,000 in April 2022 and low of $995 in June 2022.

Risks In Investing In Ethereum

Ethereum is not immune to macroeconomic events and staking conditions. Key policy decisions could upend ETH’s existing market structure while a skewed staker ratio could cause sell pressure.

You can buy Ethereum on exchanges like eToro. To learn more, you can read our Ethereum review.

Bitcoin (BTC) – The most Decentralized Network

The pioneer as the first cryptocurrency has come a long way but still has a long way to go. As the most decentralized, secure, provably limited, and censorship-resistant network, Bitcoin has earned its moniker as “Digital Gold”.

The network has over 10,000 full nodes spread around the world that work to keep it secure and decentralized. The nodes are compensated with Bitcoin for processing transactions, a process known as crypto mining.

Bitcoin has a total supply of 21 million coins, 19.3 million of which have already been mined. However, thanks to events like the Bitcoin halving, which is when the network slashes the Bitcoin mining reward in half every four years, the remaining Bitcoin will not be mined until the year 2140.

Why Invest In Bitcoin?

Several analysts have projected that Bitcoin will reach a price as high as $250,000, with the most extreme prediction placing the crypto at $1,000,000 per coin. Whether these predictions come to pass, the fact remains that several retail and institutional players invest in Bitcoin because of its long term prospects.

Also, several projects are beginning to build layer 2 solutions to bring smart contract functionality to the blockchain in a bid to stimulate decentralized financial activities on the network.

Risks of investing in Bitcoin

BTC, like Ethereum, is beholden to macroeconomic events like policy decisions and other events that affect the strength of the URisks in investing inS dollar.

You can buy Bitcoin on exchanges like eToro. To learn more, read our Bitcoin review.

Aave (AAVE) – Best Lending Protocol

Aave is the premiere lending protocol across four blockchain networks, although the money market protocol operates across 7 total blockchains. This protocol facilitates lending between crypto holders.

The premise is simple: you deposit collateral, vis-a-vis crypto, into a supply pool and borrow against the market value of the collateral (other cryptocurrencies). You are charged interest on the amount borrowed which is calculated daily but displayed yearly and is based on the utilization of the specific pool you borrow from.

Provided you don’t borrow more than 75% of your collateral’s market value, you should be safe. If not, your position may get liquidated.

Investors could add tokens to the supply pool to lend out to others and earn passive income returns for doing so.

Why Invest In AAVE?

AAVE is the third largest DeFi application in the entire crypto industry with a total value locked of $6.5 billion and a market cap of $1.19 billion. Its tokenomics are quite solid compared to most cryptocurrencies with a total supply of 16 million tokens, 14 million of which are already in circulation.

Borrowing on AAVE can be cheaper than obtaining a traditional loan, and it definitely is easier. Rates are usually well below 10%, sometimes even below 2%, based on market volatility and pool utilization.

As the protocol expands to other blockchains, its TVL could grow exponentially and be reflected in the price of its tokens, making it a strong portfolio for any investors.

Risks In Investing In Aave

Aave’s most pertinent risk is that its token only functions as a tool for governance. Hence, there isn’t much reward from holding it aside from the right to vote on proposals, a use case that is not as appealing to the average investor.

AAVE trades at $83 as of writing with a 52-week high of $186 in April 2022 and a low of $46 in June 2022. To learn more, read our AAVE review. You can buy AAVE on an exchange like eToro

GMX (GMX) – Best Leveraged Trading Protocol

GMX is a protocol that allows users to trade crypto derivatives, called perpetuals, which are like Futures contracts that never expire (thus the term perpetual) in a decentralized manner.

Before GMX, most crypto perpetual trading was done on centralized exchanges like Binance and FTX. However, since the fall of FTX, crypto-savvy traders have sought decentralized exchanges with futures offerings. GMX is one of such solutions and is a market leader in that regard.

Why Invest In GMX?

Built on the snappy Arbitrum network (and now extended to the Avalanche network), GMX allows you to trade the best cryptocurrencies such as ETH, BTC, LINK, and UNI with up to 50x leverage. This means that you can deploy capital that is 50 times more than your deposit.

You can also open both long and short positions from a decentralized protocol that does not, at any point, have custody of your tokens.

GMX charges a borrow fee for leveraged positions that is expressed as a percentage per hour (i.e., 0.001%/h) and allows you to set market, limit, and trigger orders.

The protocol currently has 230,000 total cryptocurrency market users and has processed a total of $107 billion, $128 million of which it has earned as trading fees. A portion of all revenue is distributed to GMX stakers at a current yield of 4.76% per year, highlighting it as one of the best staking crypto.

GMX has one of the highest staking percentages, with about 78% of all GMX in existence currently being staked.

The protocol has a total value locked of $687 million and market cap of $759 million. Its token, GMX, has a maximum supply of 13 million tokens, 8.6 million of which are in existence and circulation.

Risks In Investing In GMX

GMX’s tradable securities are limited to four pairs, BTCUSD, ETHUSD, UNIUSD, and LINKUSD. Meanwhile, platforms like Gains Network have over 30 available pairs.

GMX trades at $88 as of writing with a 52-week low of $13 in June 2022 (it is at its 52-week high as of writing).

You can buy GMX on exchanges like Binance.

Treasure (MAGIC) – Best Gaming Infrastructure

Treasure is a gaming infrastructure project built on the Arbitrum network. It is a protocol that helps game developers to easily build games by providing a base layer for development, a marketplace for in-game items, and a Dex for in-game currency.

Why Invest In Treasure?

Treasure’s real appeal is its interoperability across games. Using this protocol, game developers can collaborate with one another to create player stories that span multiple games.

In-game items like weapons, tools, Non Fungible Tokens, and even avatars can easily be moved within games, enabling an ecosystem of interconnected games, richer lores, and deep liquidity for the Dex, called MagicSwap.

So far, Treasure has a total marketplace volume of $271 million across 10+ games with a player community that is 100,000+ strong. Its native token, MAGIC, is held by at least 344,000 unique wallets making it one of the best crypto gaming coins available.

Risks In Investing In Treasure

Treasure’s infrastructure is somewhat similar to what the top Metaverse crypto projects like The Sandbox and Decentraland do. Game builders can simply move to Sandbox and get the same infrastructure as Treasure offers but with a wider community.

MAGIC has a total supply of 350 million tokens, 213 million of which are already in circulation. This places its market cap at $295.37 million. The token trades at $1.53 as of writing with a 52-week high of $2.21 in April 2022 and a 52-week low of $0.22 in July the same year.

You can buy MAGIC on exchanges like Binance.

Lido (LDO) – Best Liquid Staking Protocol

Lido is the leading liquid staking protocol which was originally built on the Ethereum blockchain, but has expanded to four other blockchain networks. With Lido, you can stake Ethereum’s ETH. Polygon’s MATIC, and Solana’s SOL for a yearly return while protecting the resective networks.

Lido is important because the crypto industry has pretty much moved to proof-of-stake (PoS) blockchains which require node operators to lock up funds (usually the blockchain’s native coin) as an incentive to act honorably.

These locked coins are usually removed from the ecosystem, decreasing the total supply which could otherwise be used for more profitable DeFi activities. However, securing the blockchain is also paramount.

Liquid staking protocols issue proxy tokens, called staking derivatives, that are backed by the value of the staked coins. These derivatives can be used across the blockchain for trading and DeFi activities while the real coins remain staked to secure the blockchain.

Risks In Investing In Lido

Liquid staking protocols as large as Lido become an attack surface as its smart contracts contain millions of ETH and a breach could mean the loss of significant funds. If this happens, Lido would lose the trust of investors.

These protocols became popular when Ethereum began its move to a Proof of Stake blockchain and required that a substantial amount of ETH be staked.

Why Invest In Lido?

Liquid staking is not going away anytime soon as it has proven to be capital efficient and sustainable, and Lido leads the industry with a market cap of $2.2 billion and a total value locked of $12.75 billion.

Lido is also the largest protocol in crypto by TVL and, unless something fundamental occurs, like a black swan event, we don’t see that changing anytime soon.

The protocol’s native token, LDO, has a total supply of 1 billion tokens, 870 million of which are already in circulation. It trades at a token price of $2.55 as of writing with 52-week highs and lows of $3.66 in April 2022 and $0.44 in July the same year.

You can buy Lido on exchanges like Coinbase.

Biconomy (BICO) – Best Interoperable Protocol

Biconomy is an interoperability protocol that allows developers to create chainless applications that can connect to any blockchain it needs to operate as smoothly as regular applications.

The major problem that Biconomy solves is one of interoperability and user experience. Decentralized applications are not known to have the smoothest user experience. Some are downright complicated, involving several steps which could result in a loss of funds for inexperienced users, especially when cross-chain transfers are involved.

Why Invest In Biconomy?

However, with Biconomy, developers can build applications that are composed of modules that do not live on only one blockchain. These modules can connect and make calls to several blockchains.

This creates a seamless experience where users do not have to worry about or track which blockchain they are on, just like end users do not track which servers host the services they enjoy.

Risks In Investing In Biconomy

Biconomy is not as popular as other interoperability projects like Layer Zero or Cosmos. If history has proved in crypto, it’s that a project also needs to be popular to gain mass adoption.

The Biconomy ecosystem is powered by the BICO token, which has a total supply of 1 billion units, 490.28 million of which are already in circulation. It trades at $0.42 as of writing with 52-week highs and lows of $1.46 in April 2022 and $0.26 in November of the same year.

You can buy BICO on Exchanges like eToro.

Chainlink (LINK) – Best Blockchain Oracle

Chainlink is a decentralized blockchain agnostic oracle provider. It is the leading provider of off-chain data with a growing use case as the crypto industry integrates closely with the real one.

Blockchain Oracles are services that get verifiably accurate off-chain data and bring it on-chain. They are necessary because blockchain networks are isolated systems that would otherwise be closed off from the rest of the world.

The importance of off-chain data is most evident in decentralized finance protocols and products like synthetics which track the price of real world securities like stocks and tokenized assets.

As cryptocurrency and blockchain-based assets further integrate with real word assets, the need for oracles will intensify.

Why Invest In Chainlink?

A new type of stablecoin which uses oracles to transport real world reserve data is slowly rising to prominence. If this type of stablecoin is accepted, then Chainlink would have found another quintessential use case for its services.

The Chainlink network of decentralized oracles is powered by the native token, LINK, which has a total supply of 1 billion units, 517 million of which are already in circulation. The token is used to pay for its data services. As long as its services are needed, its token will retain value.

Risks In Investing In Chainlink

Chainlink is a leading Oracle provider and can be expensive, especially for bootstrapped projects. Smaller, cheaper Oracles are springing up to capture projects that cannot afford Chainlink.

LINK trades at $8 as of writing with 52-week highs and lows at $14.04 in April 2022 and $5.47 in December of the same year. You can buy LINK on an exchange like eToro.

To learn more, read our Chainlink review.

Uniswap (UNI) – Best Decentralized Exchange

Uniswap is a decentralized exchange with a market capitalization of $4.6 billion as of writing, a multichain presence, a total traded volume of 41.4 trillion, and integrations with over 300 other decentralized applications.

The leading decentralized exchange is the fifth largest dApp with a total locked value of $4.41 billion. It is the go-to place for swapping between the 100+ listed tokens at low fees and with minimum slippage.

Why Invest In Uniswap?

We love Uniswap because we don’t think that it is going away anytime soon. The exchange has been able to grow beyond the Ethereum main net to other networks like Arbitrum, Polygon, Optimism, Binance Smart Chain, and Celo.

It also has an NFT integration that allows you to track collections across various marketplaces. Its dashboard displays the prices of your favorite collections across various NFT marketplaces.

Its integrations also include fiat onramps like Banxa that allow you to buy crypto with fiat within Uniswap, which is useful for users who do not wish to create accounts with conventional exchanges.

As Ethereum scales and more participants enter the industry, Unsiwap, which has already won the trust of crypto users, whales, and institutions, will be in a prime position to grow.

Risks In Investing In Uniswap

Uniswap is only available on six blockchain networks, Ethereum, Arbitrum, Polygon, BSC, Celo, and Optimism. There are several blockchain networks with potential that Uniswap has not tapped into.

If other dexes get there first, they could steal potential market share from Uniswap. Given that UNI is primarily used for governance, a decline in market share could make the token less attractive.

The Dex’s native token, UNI, is used for governance purposes. While it does not have as much utility as some others, the value of the exchange is bound to rub off on the token.

UNI has a total supply of 1 billion tokens, 753 million of which are already in circulation. It trades at $46.33 as of writing with 52-week highs and lows of $9.54 in April 2022 and $3.61 in June 2022.

You can buy UNI on exchanges like OKX. To learn more, read our Uniswap review

Osmosis Dex (OSMO) – Best Interoperable Decentralized Exchange

Osmosis is a liquidity protocol on the Cosmos ecosystem of blockchains. It is called the interchain liquidity lab because it holds liquidity pools for various independent blockchains within Cosmos.

It also provides infrastructure for others to build decentralized applications that help manage and provide liquidity across several blockchains. Its premier application, Osmosis Dex is an automated market maker and decentralized exchange that allows people to swap coins.

Why Invest In Osmosis?

Osmosis has immense potential as the largest interchain Dex because it solves the problem of interoperable decentralized finance. By providing pools for several blockchains, it creates deep liquidity markets, while other Dexes usually fragment markets when expanding to other chains.

Liquidity providers also benefit from Osmosis as they can consolidate their funds into pools that receive the combined volumes from several different blockchain users, leading to more volumes and higher revenues.

The Osmosis Dex has a total locked value of $185 million and a market capitalization of $494 million. Its native coin, OSMO, has a maximum supply of 1 billion units, 566 million of which are already in circulation.

Risks In Investing In Osmosis

Osmosis is the leading Dex for the interchain, but most retail users are not on the interchain. Hence, the Dex receives smaller volumes than its counterparts on layer 2 networks. Also, its token, OSMO, has inflationary mechanics built in as it is used to boost liquidity provider rewards.

OSMO trades at $0.87 as of writing with 52-week highs and lows of $0.58 in April 2022 and $0.68 in January 2023.

You can buy OSMO on exchanges like Binance.

What is a Long Term Crypto Investment?

A long term crypto investment is one that is held for an extended period, usually more than a year. The goal with these investments is to make an overall return in the long term regardless of fluctuations or periods of extreme volatility in the short term.

Hence, the strategies and thinking behind long term investments differ from short term investments or speculation. For example, volatility isn’t a key consideration while market capitalization is as you’d want to look into more established projects.

Ultimately, the goal is to identify cryptos that have the best chances of being around in the next 5-10 years.

What is the Difference Between Long Term Crypto Projects and Short Term Crypto Projects

Technically speaking, there are no long term and short term crypto projects. All crypto projects usually present a long term growth plan and sustainability. However, not all projects survive. In truth, many of them die out within the first five years.

The categorizations of long and short term are used by investors to gauge which projects are more likely to survive. Hence, long term projects are crypto protocols, blockchains, infrastructure, and decentralized applications that have good long term prospects.

They usually have a track record of delivering value to users which, in the crypto space, means tens of thousands of daily active users and the ability to generate profits for all stakeholders (i.e. miners, liquidity providers, etc).

Most importantly, they are projects that have growing adoption, which involves solving real problems in sustainable ways. For example, Bitcoin is the first provable digitally scarce resource. This is important because it makes it an asset that one can hold.

Ethereum runs the most used operating system in crypto. As long as there are decentralized applications to be run, there will be a need for a system to run them.

Short term projects, on the other hand, offer products/services that are more of band aids than sustainable solutions. Many of them ride on popular trends, achieve massive success very quickly, and then fade just as fast.

Memecoins are a good example of this. Most memecoins achieve astronomical growth within the first few weeks and months of their release, often increasing their value by 100x or 1000x. But once the hype fades, they crash, losing almost 100% of their value, never to rise again.

How to Look at the Potential of a Long Term Crypto Project

No crypto project is guaranteed to be a profitable long-term investment, no matter how sound they seem. However, there are some common characteristics that most long-term projects share. We discuss them below.

Sustainable Solution

All long-term crypto projects proffer sustainable solutions to the real problems. While it’s easy to focus on the solution, you should also consider the problem. Innovative solutions to small insignificant problems end up being just as small and insignificant.

Over the years of our time in crypto, we’ve seen that projects that create sustainable solutions to the issues of liquidity management, secure scaling, yield generation, and decentralized trading/exchange tend to perform well.

Real World Application

Real world application is another good indicator of long-term performance. If a project can fill in a need that is not exclusive to the crypto industry, then it has a much better chance of being around for the long haul.

A good example of this is Ripple. Despite their overly drawn out case with the United State’s exchange commission, SEC, their global instant settlement system is sorely needed in international trade and finance.

Mainstream Adoption

The goal of all crypto is mainstream adoption, to replace legacy systems with more efficient, decentralized ones. Projects that achieve this live longer and perform better.

Take Bitcoin, for example, its blockchain is old and clunky but it remains the premiere crypto because of its decentralized nature, but mostly because institutions have adopted it as “digital gold”.

It is usually the first point of contact for institutions looking to add crypto to their balance sheet. This is a level of adoption that is keeping it afloat and accepted as the leading crypto.

Tokenomics

We mention tokenomics because a project could have fantastic technology but still be financially ruined by bad tokenomics. When there are too many tokens, projects come off as scammy.

The way the tokens integrate with the project ecosystem is also important. A token is meant to be a vehicle for capturing and transporting value within an ecosystem, and between various ecosystems.

To achieve this, tokens must be carefully designed. Considerations for inflation and scarcity must be factored in, depending on the project.

While there is no best tokenomics model, look out for projects that have tokens “just to have them”. Always ask if the tokens play a vital role in the growth and operations of their ecosystems.

Are There any Benefits to Investing in Long Term Crypto Projects?

Diversification

Cryptocurrencies, being digital assets, offer a way to diversify your portfolio. As crypto becomes more mainstream, crypto assets will become a bigger part of an asset class, if it doesn’t become an asset class itself.

By investing in crypto, you add another asset that could grow exponentially and also protect your portfolio from possibly declining sectors and assets.

Liquidity

Crypto assets (aside NFTs) are highly liquid, and because of their decentralized nature, you can easily sell them when you need cash. You can also move them across wallets and borders to where you need them the most.

Inflation Cover

In the long term, crypto assets that perform well beat inflation, some by ten and hundred folds. Bitcoin is often called an inflation hedge and has been used by institutions to protect their cash against inflation.

Potential High Returns

Cryptos like Ethereum have achieved impressive returns over the years. While it is volatile and can fall significantly, its price history has proven that if you hold on long enough, you can make a lot of money compared to what you put in, but only for fundamentally sound projects that achieve adoption.

Is Cryptocurrency a Good Long Term Investment in General?

Crypto has not been around for long enough to make a generalized assumption about the market like that of stocks. The only cryptos known to be viable long-term investments are Bitcoin and Ethereum, mostly because of the quintessential roles they play to the industry.

If any insight on the longevity of crypto can be drawn from Bitcoin and Ethereum, it is that the more essential a crypto is to the survival and proliferation of the industry as a whole, the more likely it is to stand the test of time.

Hence, cryptocurrency can be a good long-term investment if it continues to fulfill a quintessential need in the industry.

Things to Consider About Yourself When Choosing Your Next Crypto Project to Invest in

Risk Tolerance

The first thing to consider is your tolerance for risk. If you find that you are risk averse, you may want to stick with blue chip cryptos that have a track record of performing well over long periods.

The best options for the most risk averse are Bitcoin and Ethereum as they are the two most capitalized and the two longest running cryptos. However, truly risk averse investors may want to consider investment outside cryptos, like traditional currencies.

Psychological Discipline

The crypto market is volatile and as such often fluctuates wildly. It requires psychological discipline to hold on to investments, especially in bear markets when even blue chip cryptos can lose 50% of their value.

Comprehension

As an investor, you should refrain from investing in ventures you do not understand. That being said, the realities of the crypto industry can be complicated to the average person. Luckily, you do not need to understand code to make investment decisions. You only need to understand the reasons behind the technologies being built, the factors (both internal and external) that affect their growth, and how the industry reacts to them.

4 Tips for Investing in Long Term Crypto

1. Focus On Long Term Trends

Long-term investments are driven by long-term trends. These trends are often tied to the future of the industry as a whole.

An example is interoperability. It is believed that, just like Web2, the future of Web3 crypto applications will be either chainless, omnichain, or interchain, meaning that the blockchain that powers applications will fade into the background just as the servers that host legacy applications are not a concern for the end user.

The projects that usher in this chainless future are good options for long-term investments. However, note that knowledge about the future of technology does not automatically translate to good investment decisions.

Because you know that interoperability is the future doesn’t make choosing a sound crypto easier. So, ensure you really get your hands into research to find sound projects.

2. Do Not Speculate

Many people confuse investing with speculating. Buying cryptos with an expectation of a price increase is not investing, regardless of the time scale it is carried out. Choosing projects that can guarantee principal safety with a healthy return is investing.

Unfortunately, due to the highly speculative nature of crypto, principal safety is never guaranteed. However, investors can work around this by only buying cryptos whose platforms have displayed a track record of solving important problems, and have an advantage over others within its category.

A prime example is Bitcoin. It is the standard for decentralized payments and has an edge as the most decentralized and secure crypto network. The coin also has a track record of making good returns in the long term.

Investing in Bitcoin for these reasons goes more in line with the rules of investing.

3. Remember That Long Term Means Long Term

While there could be short-term investors who invest based on short-term selectivity, which essentially means buying a crypto-based on some new development or event which will give it an advantage over others in the short term, most investments are long-term.

When investing in long-term crypto, maintain a long-term horizon. For example, the crypto market moves in a four-year cycle with two bullish years and two bearish years. An investor can use this knowledge to accumulate solid cryptos during the bear years.

During the period of accumulation, the market will remain bearish, which may prevent his investments from returning positive yields for several months. The investor with a long-term horizon understands that the bull market is two years away.

4. Maintain Balance

An important aspect of investing is maintaining balance between the positions in your portfolio. It is advisable to use formulas to determine how much of a type of crypto you wish to have in your portfolio.

For example, you could decide that you want your portfolio to be made up of 40% large-cap cryptos, 30% mid-cap cryptos, and 20% layer 2 cryptos, and 10% memecoins. During the course of the year, price fluctuations may disrupt the proportions of the various types of cryptos in your portfolio.

It is left to you to buy and sell as required to maintain this balance.

Why Should You HODL a Long Term Crypto Investment?

Cryptocurrencies have proven to be highly profitable if you choose the right projects and hold on long enough. Projects like Bitcoin, Ethereum, and Uniswap have returned immense gains over the years.

Furthermore, the world is becoming more digital, and digital ledger technology is powering new ways of doing business and carrying out finance. As such, new types of digital assets are being created.

The projects we have listed capture value across various sectors of the crypto space. They are the leaders in their various categories and have strong tokenomics, value offerings, and display potential to grow exponentially as the crypto sector gains mainstream adoption.

What Determines the Price of Long Term Crypto Investments?

Supply And Demand

Market forces of supply and demand exert a significant influence on crypto price discovery. The premise is pretty straightforward. When there’s demand for a crypto but not corresponding supply (which could be the case for cryptos with limited supply), price rises. When the reverse is the case, price falls.

Market Cycle

Where the market is on its cycle also affects the general price trend of cryptos. We mentioned earlier that the crypto market acts on a 4-year cycle with two bullish and two bearish years.

The bullish years are characterized by a general rise in the price of cryptos while the bearish years are characterized by a general decline in crypto prices.

Narrative

The crypto market is affected by narratives which often cascade into short and long-term trends. We’ve found that there are usually a few narratives that take precedence over others every year. In 2021, it was no fungible tokens and the Metaverse. In 2023, it is layer 2 scaling solutions.

Cryptos on the forefront of growing narratives tend to perform better than the average market. However, this depends on how investors perceive the narrative. For example, the proliferation of AI technology is positive, crypto crackdown by regulatory agencies is not.

How to Buy Long-Term Cryptos

You can buy long term cryptos on cryptocurrency exchanges. Our top pick is eToro, but you can use any that is secure and convenient. To get started:

1. Open an Account

Go to the eToro website and create an account by clicking on the Start investing icon. You can download the mobile app from the Play Store/App Store and click on Sign up. Fill out the form with your full name, email address, and password.

2. Verify Your Account

Verify your account by setting up your profile and submitting KYC documents like a valid government ID and proof of residence document like a utility bill.

3. Make a Deposit

Once your account has been verified, click on Deposit funds on the left pane of the page. Available payment options will be displayed. Choose a convenient method and set the amount you’d like to deposit.

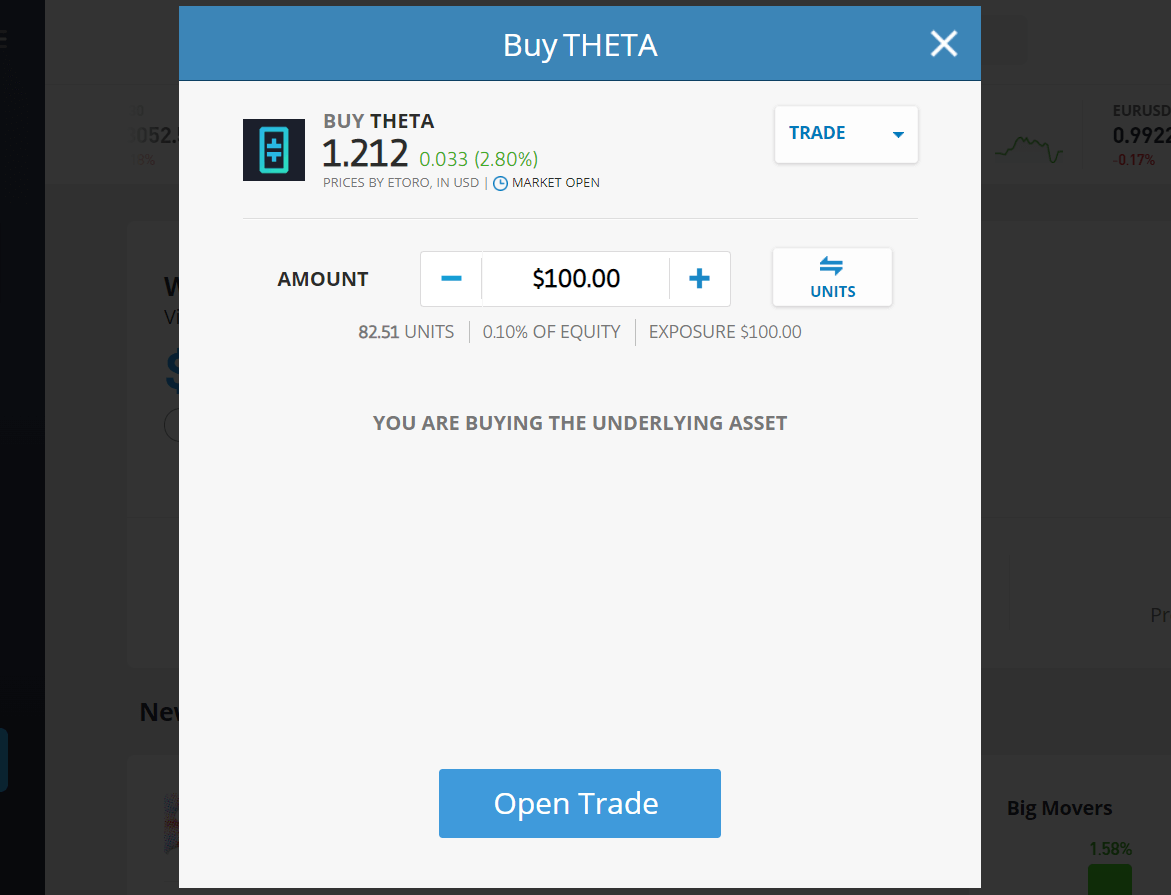

4. Buy Crypto

Once your account is funded, search for any of the cryptos mentioned in the Discover tab. An interface like the one below should load. You can then set your parameters and buy.

Where to Buy the Best Long Term Cryptos

To get your hands on new coins with good long term prospects like Chancer, you may need to go directly to the crypto’s official website. You’ll need a crypto wallet like MetaMask. We created a guide to walk you through this process.

Step 1: Download a Wallet

Download MetaMask on your phone or as a browser extension on your laptop and create a new wallet. Ensure you keep your seed phrase safe and offline.

Step 2: Buy Some Crypto

You’ll need BNB to buy new Chancer tokens. Buy some on an exchange like eToro and transfer to your wallet, or use a fiat onramp on the MetaMask web interface to buy with a credit card.

Step 3: Connect Wallet

Navigate to Chancer’s website and connect your wallet to join the presale. Buy CHANCER tokens using BNB. Ensure you have enough to pay for gas fees.

Step 4: Wait to Claim

You’ll need to wait until the presale is over to claim your tokens.

Latest Long Term Crypto Project News

- Bitcoin Struggles as U.S. Regulators levy harsh actions against crypto firms

- The crypto division of French bank, Societe Generale, introduces a Euro stablecoin on the Ethereum network

- Decentralised exchange, Uniswap, has voted to launch a version of the Dex on Polygon’s new zkEVM network

Final Thoughts on the Best long Term Cryptos

We explored the best long term crypto projects and chose Ethereum as our top choice because of its positions as the leading smart contract platform and the largest ecosystem in the industry. It has laid a quintessential foundation for all of crypto and is the most widely used operating system, even being adopted on new chains.

We believe that Ethereum has room for immense growth as the crypto industry garners mainstream adoption. However, Ethereum has already returned some astronomical gains and we do not see it returning yields in the 10,000% range.

Projects that are primed to make impressive returns include Biconomy, Lido, and Osmosis.

If you wish to invest in crypto, you can do so using a crypto exchange like eToro.

Methodology - How We Picked The Best Long Term Cryptos

The projects covered in this guide were chosen through rigorous research and reviews. We paid attention to security, transparency, reputation, tokenomics, competitive edge, and long term prospects.

The tokens listed are the best we found in the various categories we listed them. For example, we listed Chainlink as the best blockchain oracle because it is the most used and respected provider of off-chain data in the industry.

Check out our why trust us and how we test pages for more information on our testing process.

Additional Crypto Coin Reviews

- Best Cryptos to Buy now

- Best ICOs

- Best Crypto Presales

- Best New Cryptos

- Best Metaverse Crypto Coins

- Best ERC-20 Cryptos

- Top Gaming Cryptos

- Best Staking Cryptos

- Best GameFi Crypto Tokens

- Best Cheap Cryptos

- Best Web3 Crypto

- Best Penny Cryptos

- Best Utility Cryptos

- Best Altcoins

- Best Meme Coins

- Best DeFi Projects

- Hottest Cryptos to Buy

- Next Big Crypto

- Best AI Cryptos

- Fastest Growing Cryptocurrencies