How to Buy Bitcoin With a Credit Card in 2024

...

Bitcoin adoption has grown to a point where you can buy it instantly with a credit card on several platforms and exchanges.

This guide looks into how to buy Bitcoin with a credit card. It unravels the methods, platforms, and services involved in the process. By the end of this guide, you should know all the ways to buy Bitcoin using possibly the most popular and widely accepted payment method in the world.

How to Buy Bitcoin With a Credit Card

The easiest way to buy Bitcoin with a credit card is to purchase it online from one of the top crypto exchanges. Exchanges make it easy to buy and sell Bitcoin with a credit card and other cryptocurrencies directly from your smartphone, tablet or computer. Check out our recommended platforms below and follow the steps to buy Bitcoin with a credit card.

1. Choose a platform

Start by choosing a platform that supports credit card payments. This shouldn’t be hard as major platforms support credit card services like Visa and Mastercard. Any one of our top picks below is suitable.

2. Create and fund your account using a credit card

Head to the sign-up section of your chosen platform and fill the form with your name, contact information, and KYC documents like an ID and a utility bill. Once your account is verified, select your chosen payment method to make a deposit (a credit card).

3. Buy Bitcoin

Once you have funded your account, search for bitcoin with the ticker BTC and your local currency (e.g. BTC/GBP). If your local currency is unavailable, you may use a popular one like USD. However, you may be charged conversion fees. Alternatively, you can buy Bitcoin directly with a credit card without funding your account first. Select “credit card” as a payment option when doing so.

6 Ways to Buy Bitcoin With a Credit Card

1. Binance – Most Flexible Way to Buy Bitcoin with a Credit Card

With over 600 cryptocurrencies in its storehouse, Binance is the largest crypto exchange in the world. It also has one of the widest fiat currency support and offers numerous ways to buy crypto.

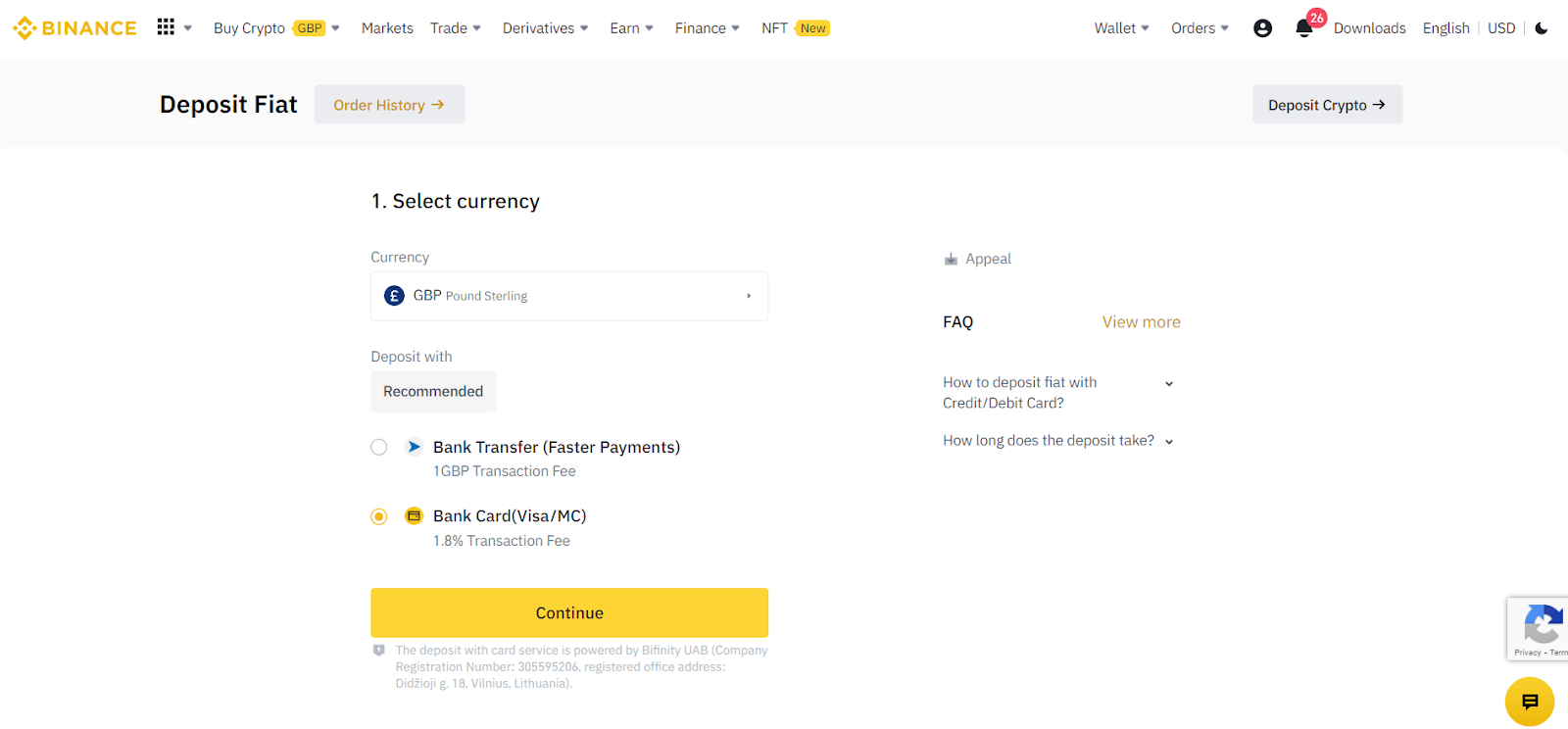

The mammoth exchange also charges some of the lowest conversion and deposit fees in the industry. Fiat-crypto and crypto-crypto conversions cost 0.1%, while deposits with credit cards cost 1.8% of the transaction value.

Binance accepts major credit card companies and supports 60 fiat currencies. Deposits are subject to a minimum of $15 and a maximum of $12,000. For pounds, the range is £15 – £5,000. These limits change with currency, so ensure you check before depositing.

Read our full Binance review here.

How to Buy Bitcoin With a credit card on Binance

1. Open an account

Navigate to the website or download the mobile app available on Android and iOS and click on Register. Create an account by filling in the form with your username, email, and password. Follow the link sent to your inbox to verify your account.

2. Verify your account

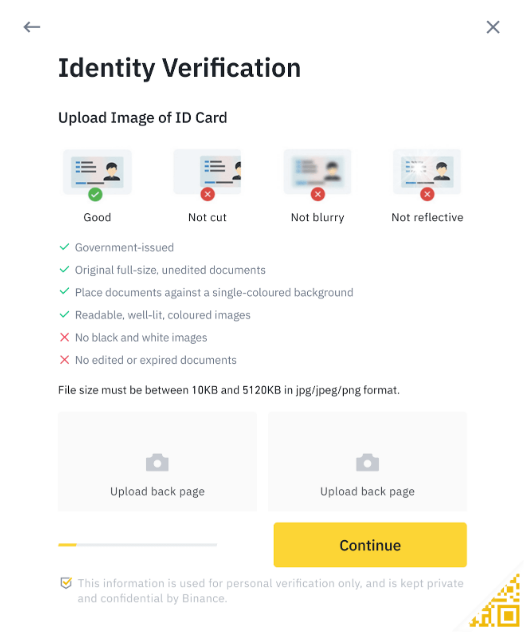

Provide identity and contact details to start using your account in a limited capacity. Finish KYC to remove these limits by sending a valid ID and utility bill.

3. Make a deposit with a credit card

At this point, you can deposit money to your wallet first or buy Bitcoin directly with your credit card. To deposit, navigate to your account wallet and click on “Deposit”. Select the fiat currency you wish to deposit and “credit card” as a payment method.

4. Purchase Bitcoin

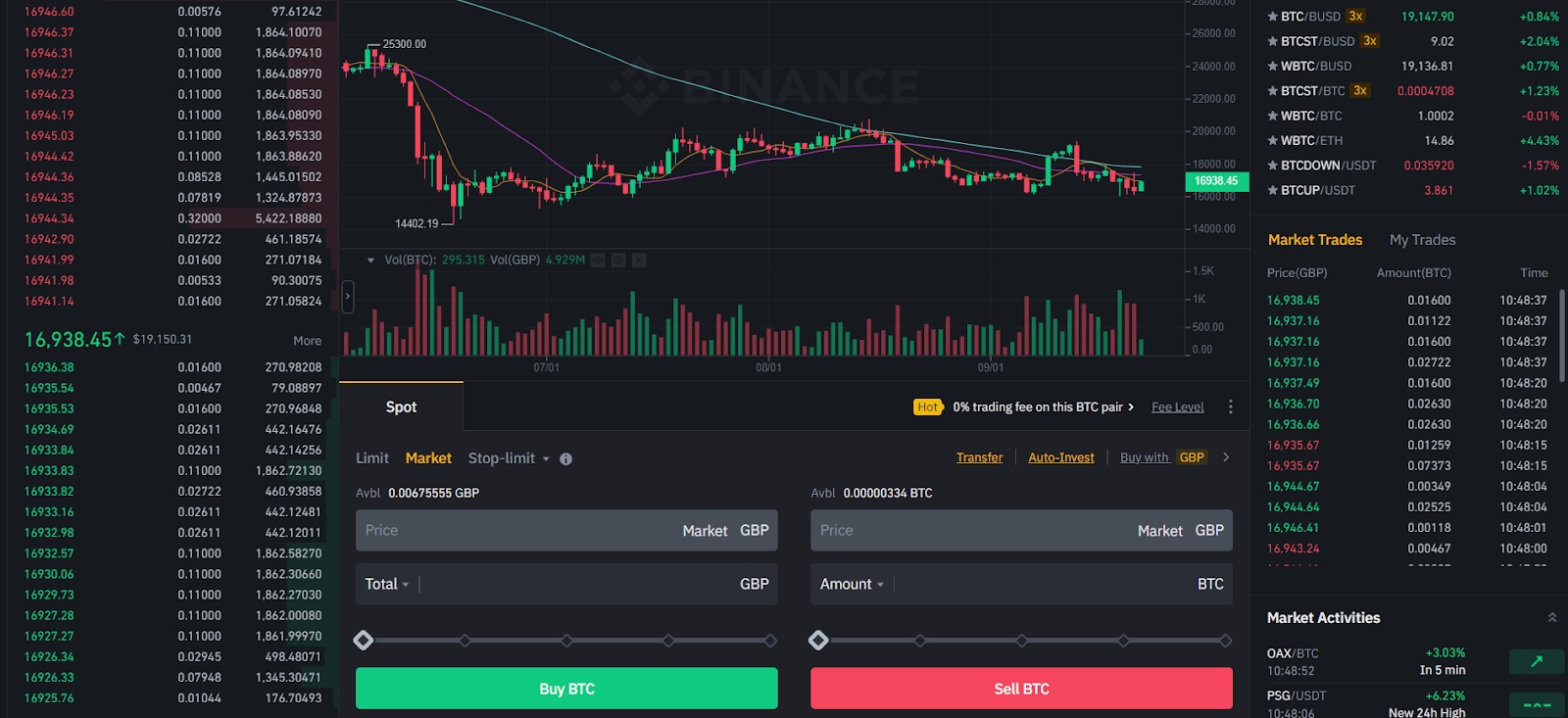

Navigate to the Trade tab and select either Convert or Spot. Convert trades fiat for Bitcoin at the current market price, while Spot loads a fully functional trading terminal where you can set prices below the market price. If Bitcoin’s price falls to your set level, the system will automatically buy at that price.

Pros

-

Low trading fees at a max of 0.10%

-

24/7 support but mostly through email

-

Affordable deposit and withdrawal fees at 1.80%

-

Supports over 60 major fiat currencies

-

Provides more than one way to buy Bitcoin

-

Has a mobile app

Cons

-

The array of services could be overwhelming to new users

-

Limited crypto selection for US entity

Why we chose Binance

Binance is a one-stop shop for all crypto-native users. It offers several ways to buy Bitcoin and provides avenues to put your coin to work to generate returns. It also supports more currencies than most other exchanges.

2. Coinbase – Easiest Way to Buy Bitcoin with a Credit Card

Coinbase is built with beginners in mind. Its user interface is easy to navigate, its processes are beginner-friendly, and it supports major payment channels, including credit cards.

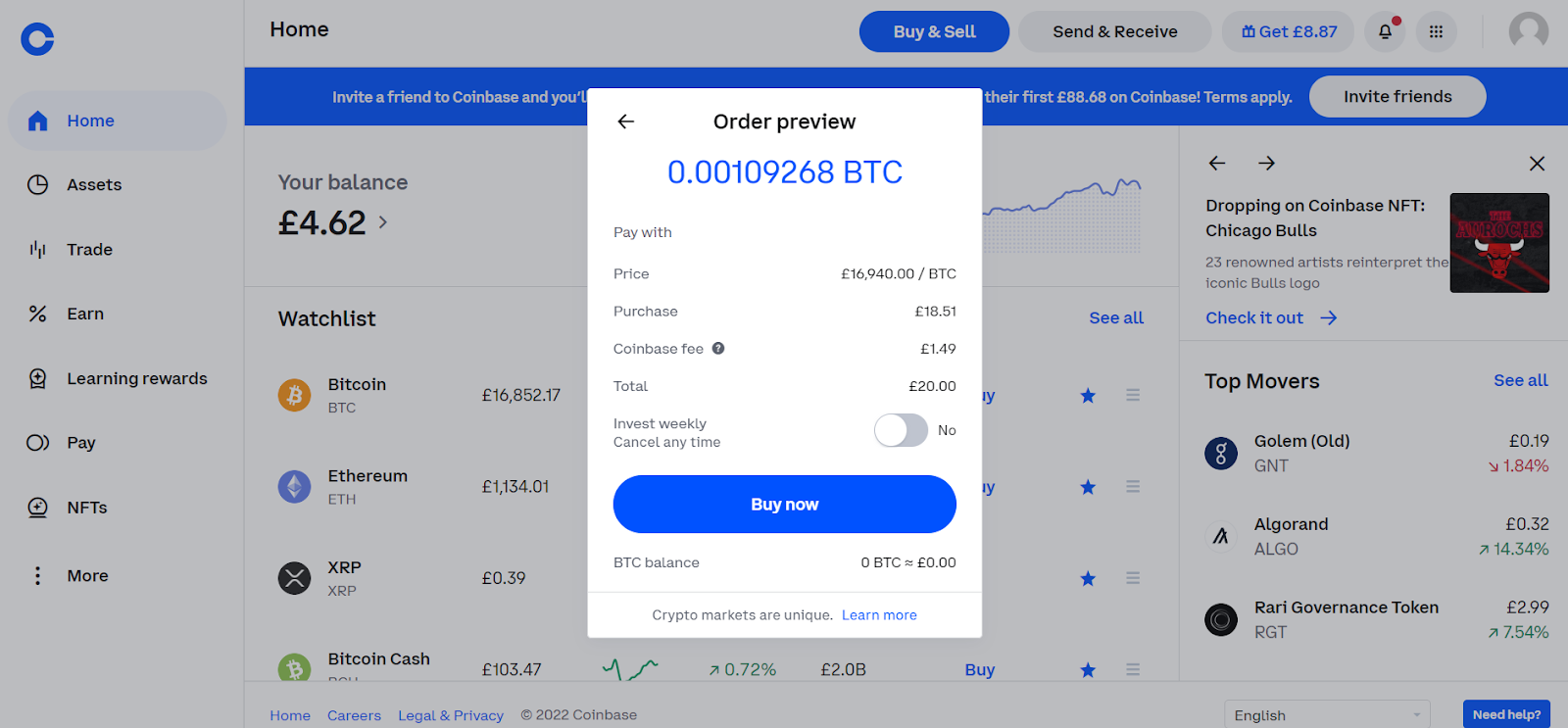

New investors and crypto novices can use Coinbase’s Convert interface to swap between coins at a flat 1% rate. Alternatively, they can use the trading terminal which charges a much cheaper 0.05% – 0.60% rate for immediate orders (taker fees) and between 0.00% – 0.40% for delayed orders (maker fees).

Credit card deposits and withdrawals cost 2.49% of the transaction value and are available for US citizens. International deposits and withdrawals may be processed using other payment channels.

Read our full Coinbase review here.

How to Buy Bitcoin With a credit card on Coinbase

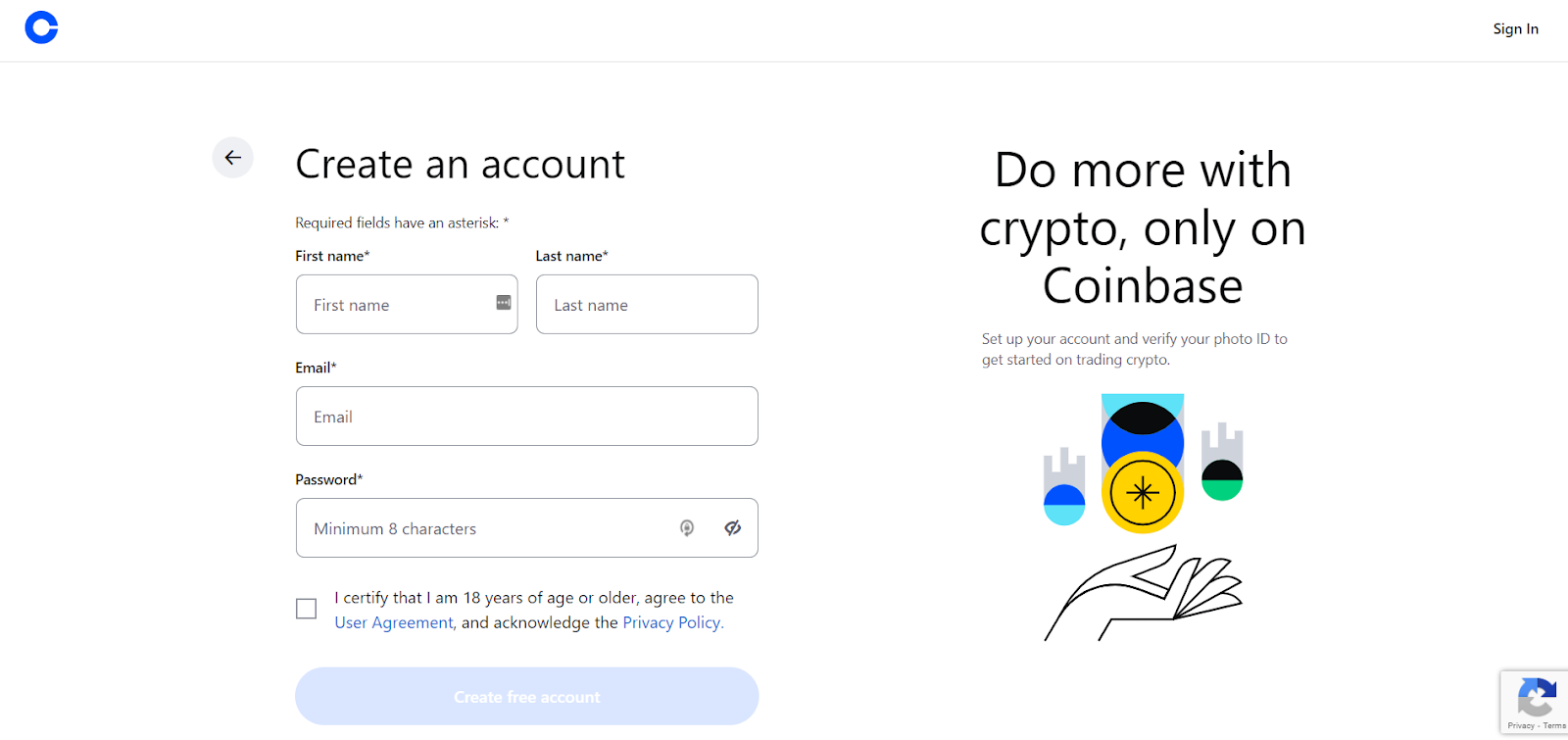

1. Open an account

Navigate to the website or download the mobile app available on Android and iOS and click on Get Started. Create an account by filling in the form with your username, email, and password. A verification email will be sent to your inbox.

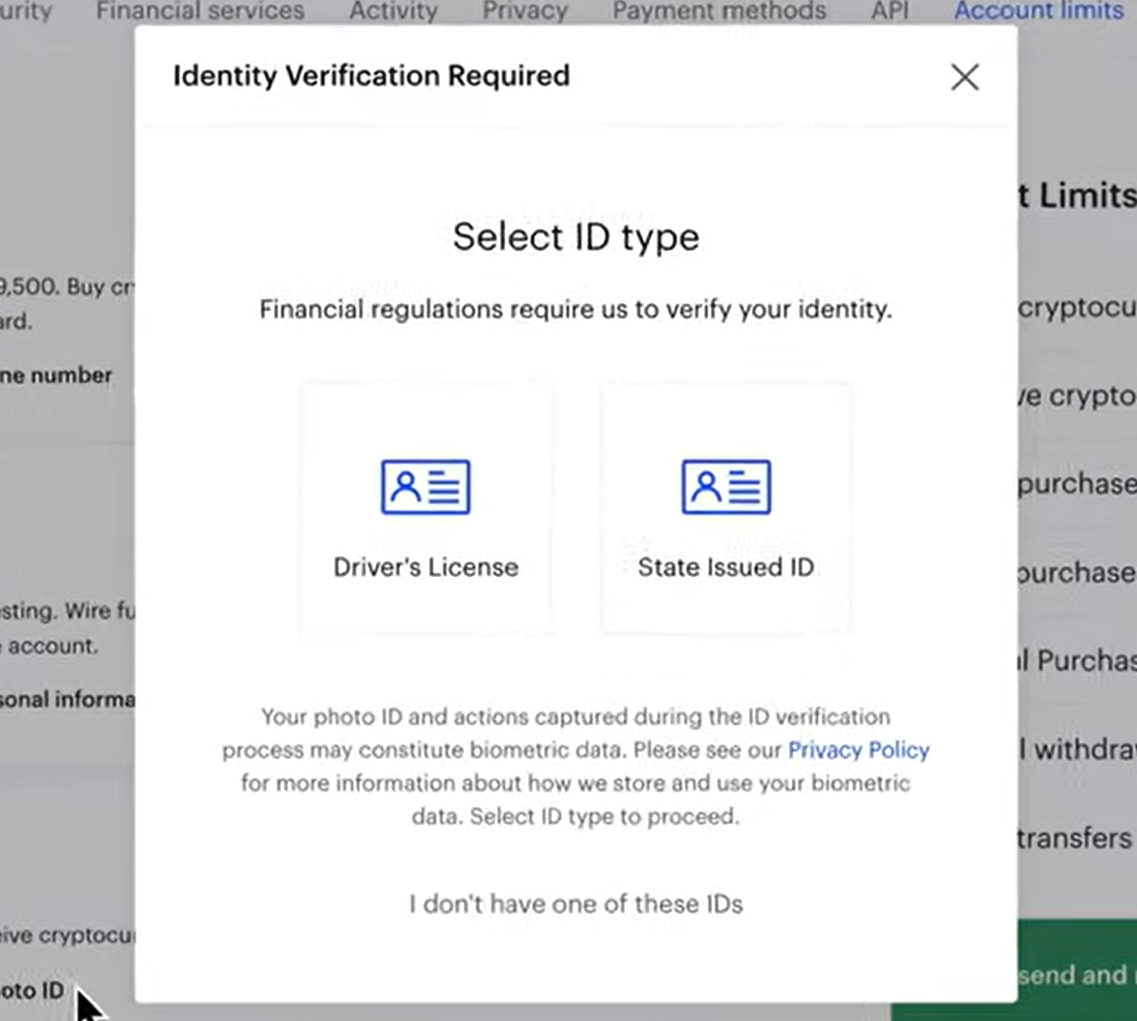

2. Verify your account

Click on the link in the email to verify your account, after which you’ll have to pass KYC by providing identity and contact details like a valid ID and utility bill.

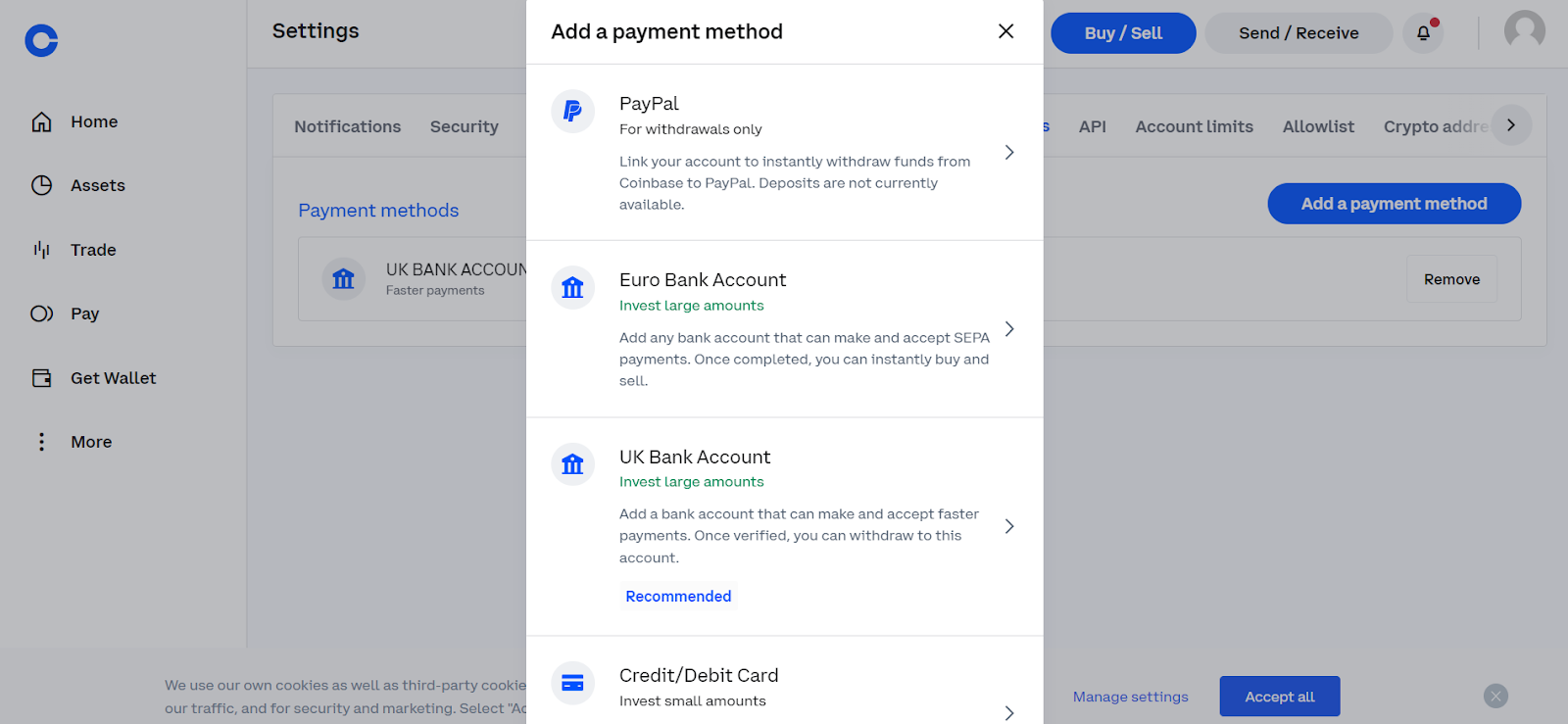

3. Make a deposit with a credit card

Select the credit card option as a deposit method and enter the amount to deposit. The minimum trade size is $2, however, a $50 minimum deposit is advised.

4. Purchase Bitcoin

Navigate to the Explore tab and search for Bitcoin. The page will show a chart and three options: Buy, Sell, and Convert. Select buy to use your credit card directly or your wallet balance.

Pros

-

Provides services to 100+ countries

-

User-friendly

-

Earn free crypto through learning campaigns

-

Secure offline storage

-

Educational resources

Cons

-

Credit card withdrawals is not supported for certain regions in Europe

Why we chose Coinbase

Coinbase makes it easy for people with very little crypto knowledge to get started. They incentivize learning by offering learn-to-earn programs that reward users with crypto for learning blockchain fundamentals.

3. Bitpanda – Best Way to Buy Bitcoin with a Credit Card for Traditional Investors

Bitpanda is a fintech firm with roots in traditional markets and branches in crypto. It offers traditional investors unfamiliar with crypto a way to add it to their portfolios.

The platform helps investors manage their portfolios holistically and offers crypto indices that investors can invest in if they do not wish to pick individual cryptos.

Deposits and withdrawals on Bitpanda can be made in Euro, US dollar, British pound, Swiss franc, Danish krone, and Turkish lira through credit card providers like Visa and Mastercard for most regions.

Conversion fees are 1.49% for crypto transactions and are priced into the coins on the in-built exchange. Alternatively, users can use the trading terminal and pay a maximum of 0.10% for delayed trades (maker fees) and 0.15% for immediate trades (taker fees).

Finally, Bitpanda is licensed and regulated by the Financial Market Authority (FMA) Austria, the French Autorité Des Marchés Financiers (AMF), and the Czech Trade Authority.

How to buy Bitcoin with a credit card on Bitpanda

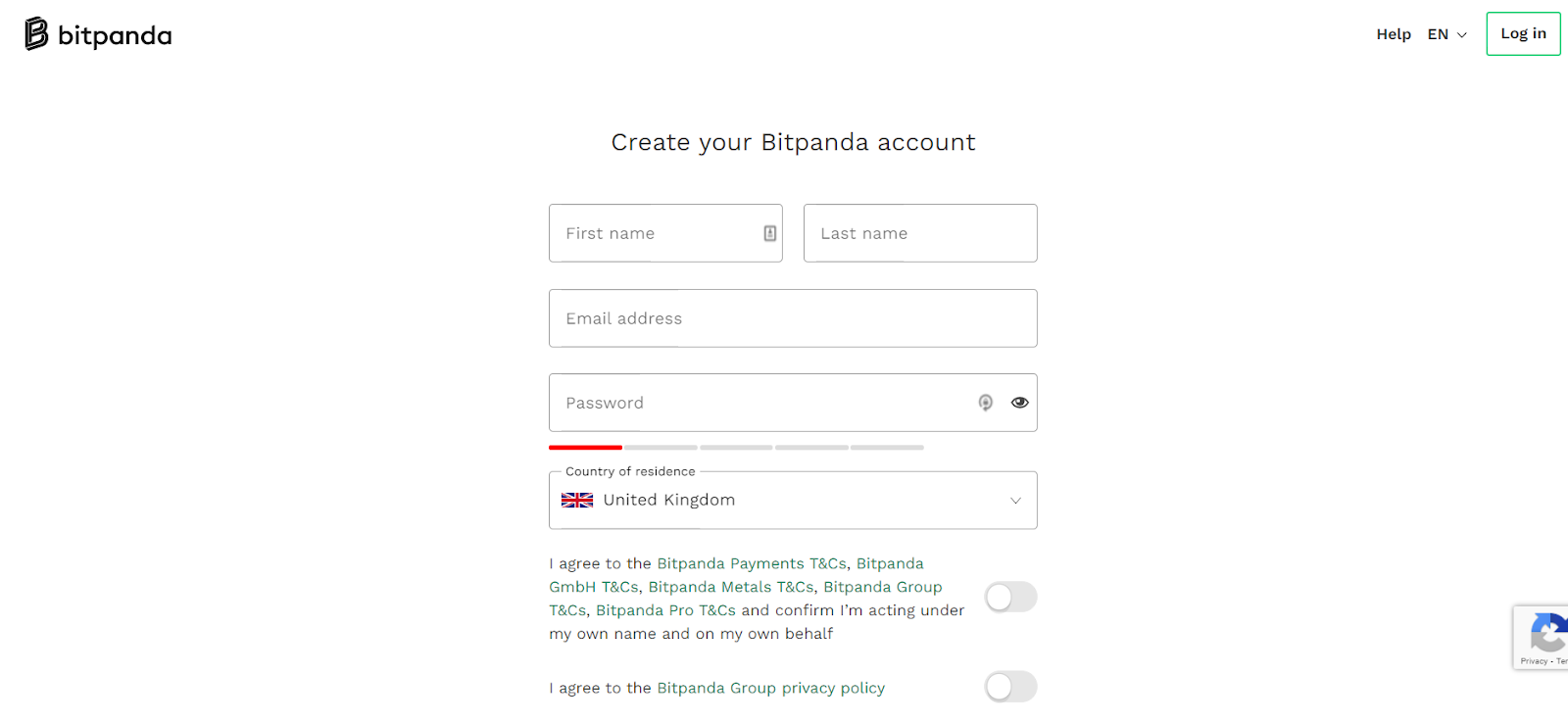

1. Open an account

Navigate to the website and click on Sign-up. Create an account by filling in the form with your username, email, and password and wait for a verification link in your inbox.

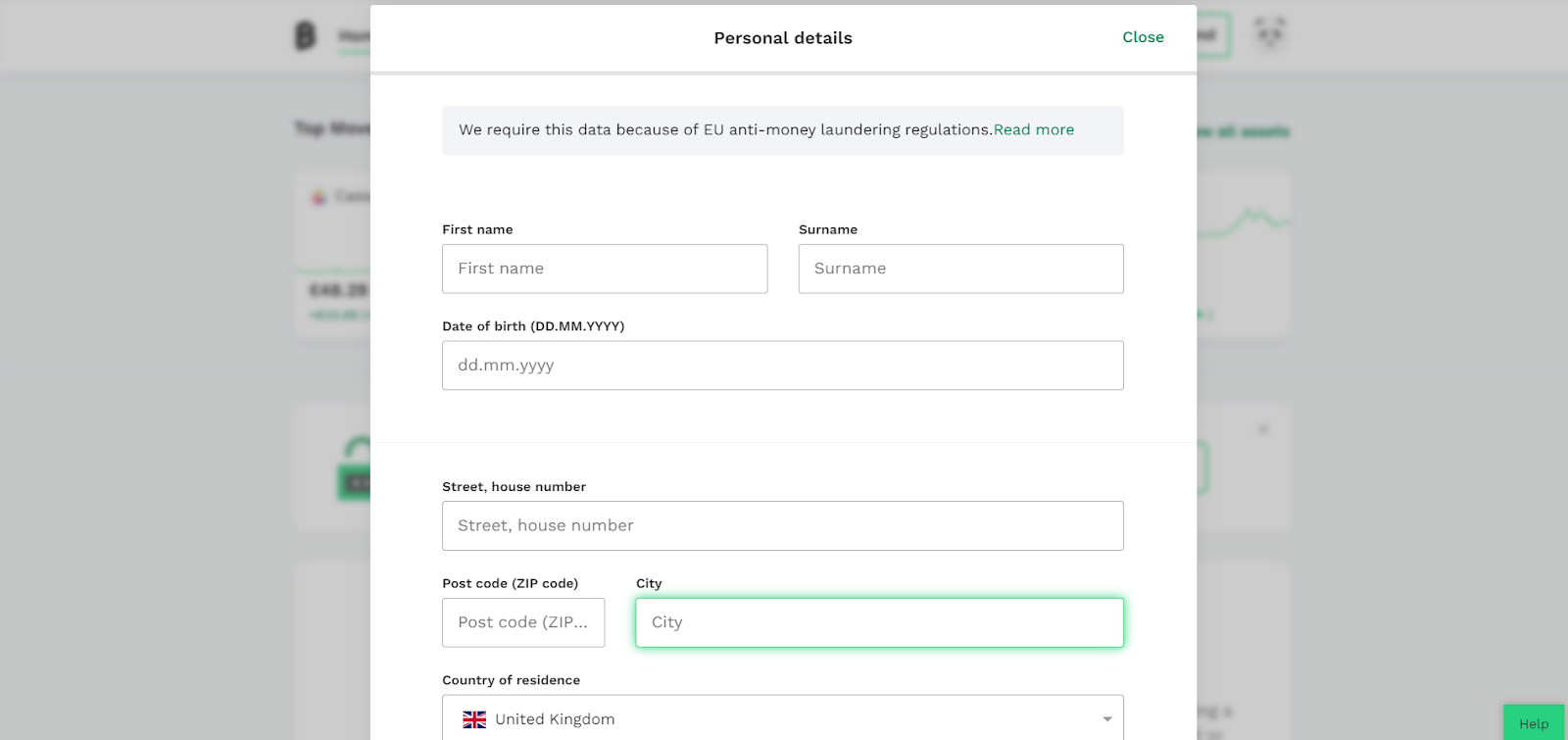

2. Verify your account

Click on the link in the email to verify your account. Complete your registration by submitting personal details, a valid ID, and a utility bill.

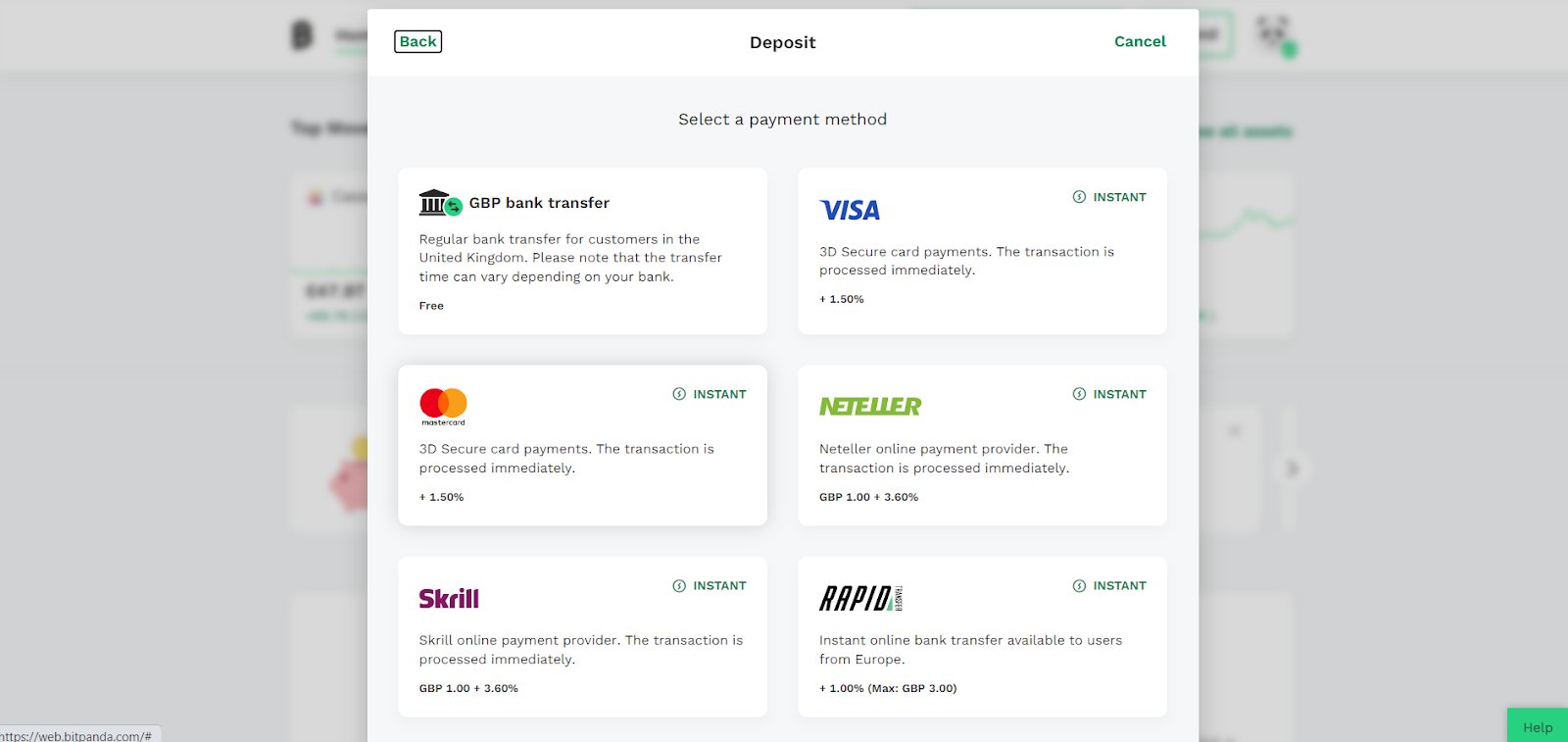

3. Make a deposit with a credit card

Select the credit card option as a deposit method and enter the amount to deposit. VISA and Mastercard deposits are instant but cost 1.50%.

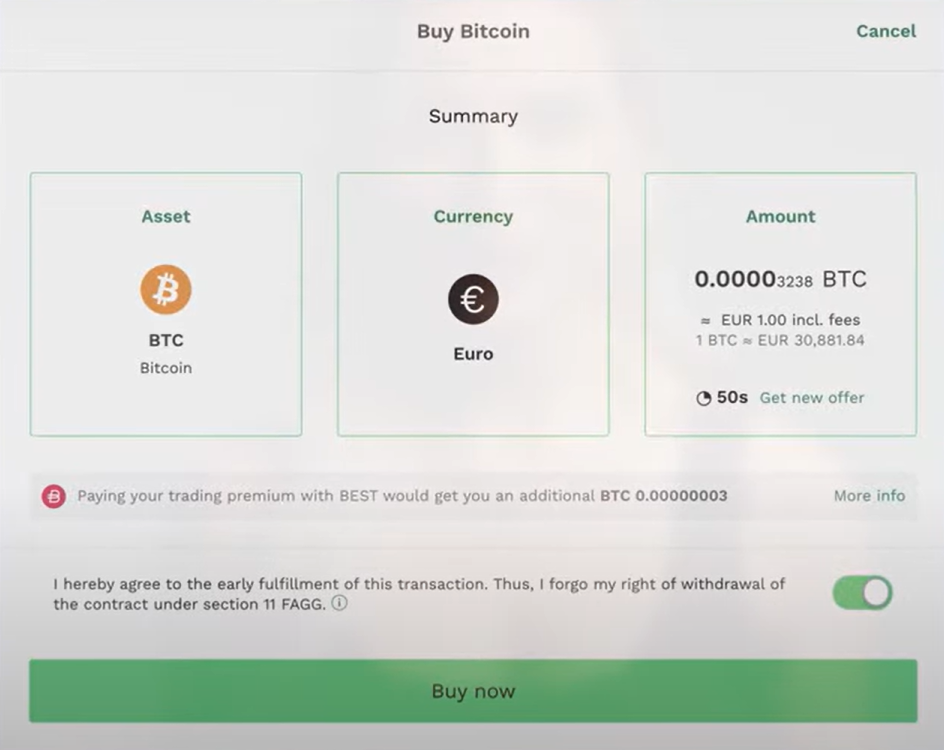

4. Purchase Bitcoin

Navigate to the Invest section and search for Bitcoin. Select the amount you want and the price you want it. Confirm your choice and click on Buy Now to complete the transaction.

Pros

-

Regulated, complies with AML requirements

-

Leading-edge crypto indices

-

Simple, easy-to-use platform

-

€25 minimum deposit and withdrawal

-

Comprehensive learning materials

-

Automated crypto savings

-

Pro platform for advanced traders

Cons

-

Limited support for fiat currencies (only 8 supported)

Why we chose Bitpanda

Bitpanda adopts a holistic approach to managing cryptos i.e., as part of a portfolio that is either all crypto assets or mixed with traditional ones. Investors can monitor and manage this portfolio to achieve optimal financial performance.

4. Capital.com – Best Way to Buy Bitcoin CFDs with a Credit Card

Capital.com is a global broker focusing on CFD trading and providing access to over 450 crypto contracts, including Bitcoin and several major fiat currencies.

It is licensed by the Financial Conduct Authority (FCA), Australian Securities and Exchange Commission (ASIC), Cyprus Securities and Exchange Commission (CySEC), and the Financial Services Authority of Seychelles (FSA).

Contracts for differences (CFD) are financial derivatives that mimic the price action of an underlying asset. Traders use them to benefit from the price action of certain tradable assets without owning them, like cryptos, stocks, and currency pairs.

The broker allows deposits with credit cards like VISA and Mastercard, among other methods. A minimum deposit of $20 is required to get started. The website claims that its deposits and withdrawals are free, but payment providers may charge you.

Capital.com charges variable spreads on its crypto contracts. However, at the time of writing, the Bitcoin spread was 66 pips, i.e. $660 per 100,000 units (lot), $66 per 10,000 units (mini lot), and $6.6 per 1,000 units (micro lot).

How to Buy Bitcoin With a Credit Card on Capital.com

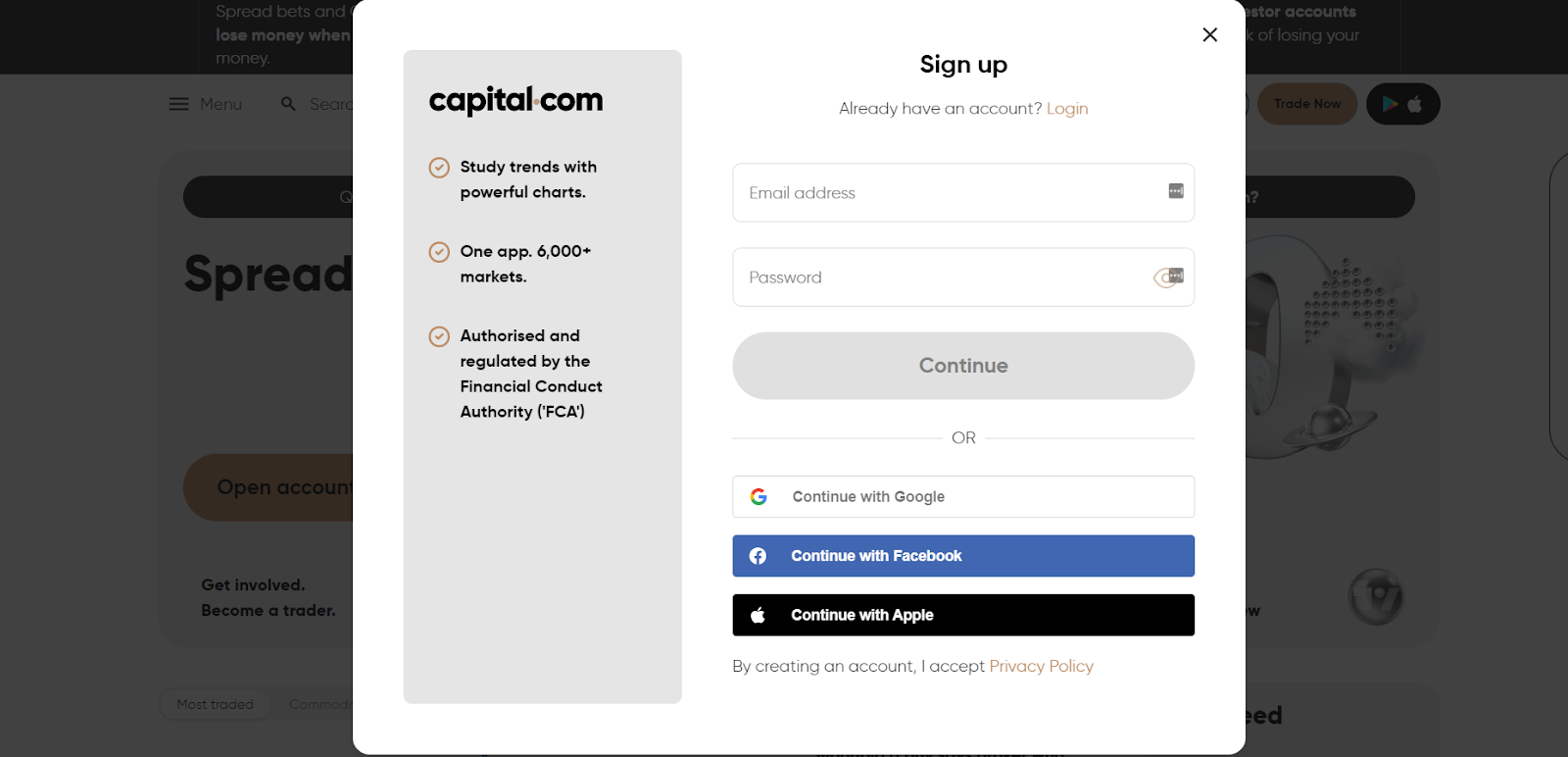

1. Open an account

Navigate to the website and click on Trade Now. Create an account by filling in the form with your email and password and waiting for a verification link in your inbox.

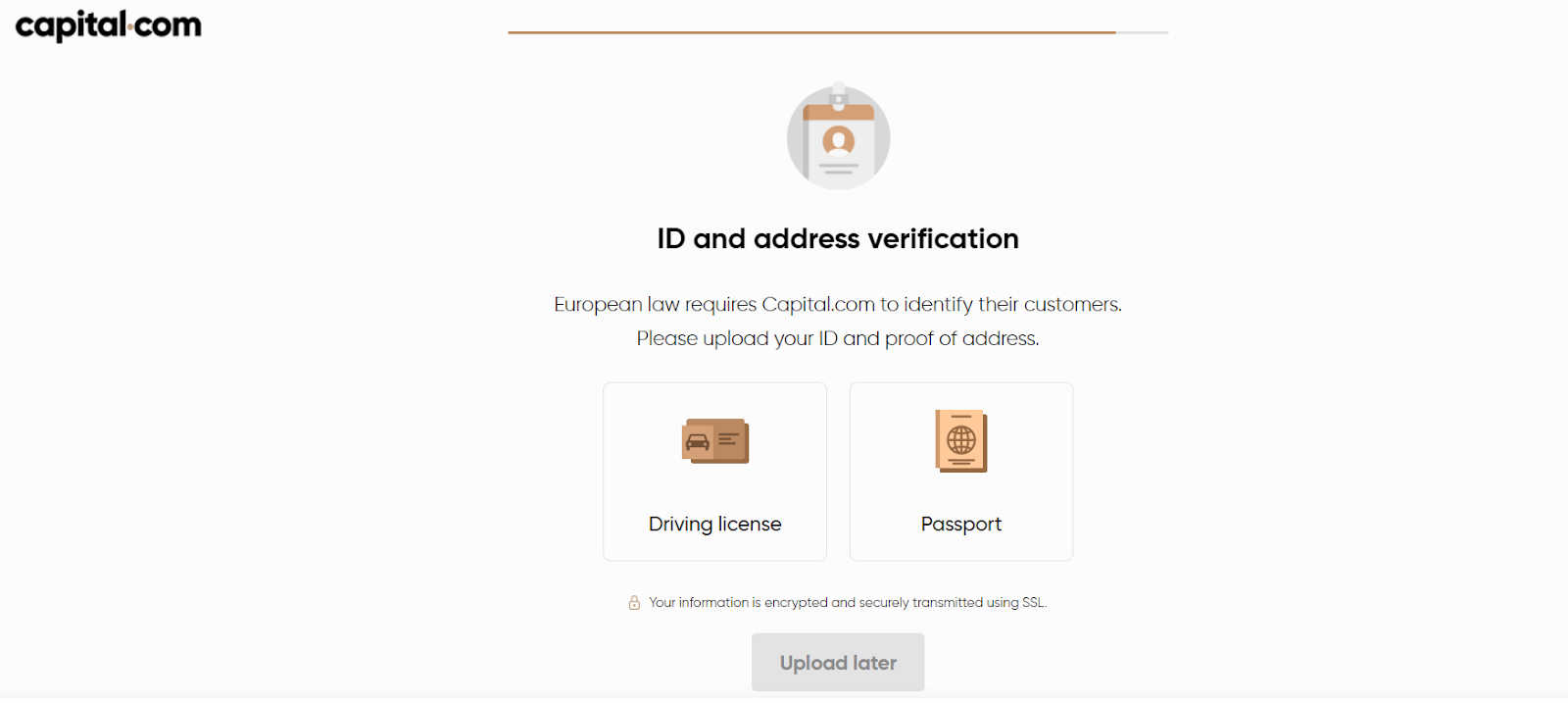

2. Verify your account

Click on the link in the email to verify your account. Complete your registration by submitting personal details, a valid ID, and a utility bill.

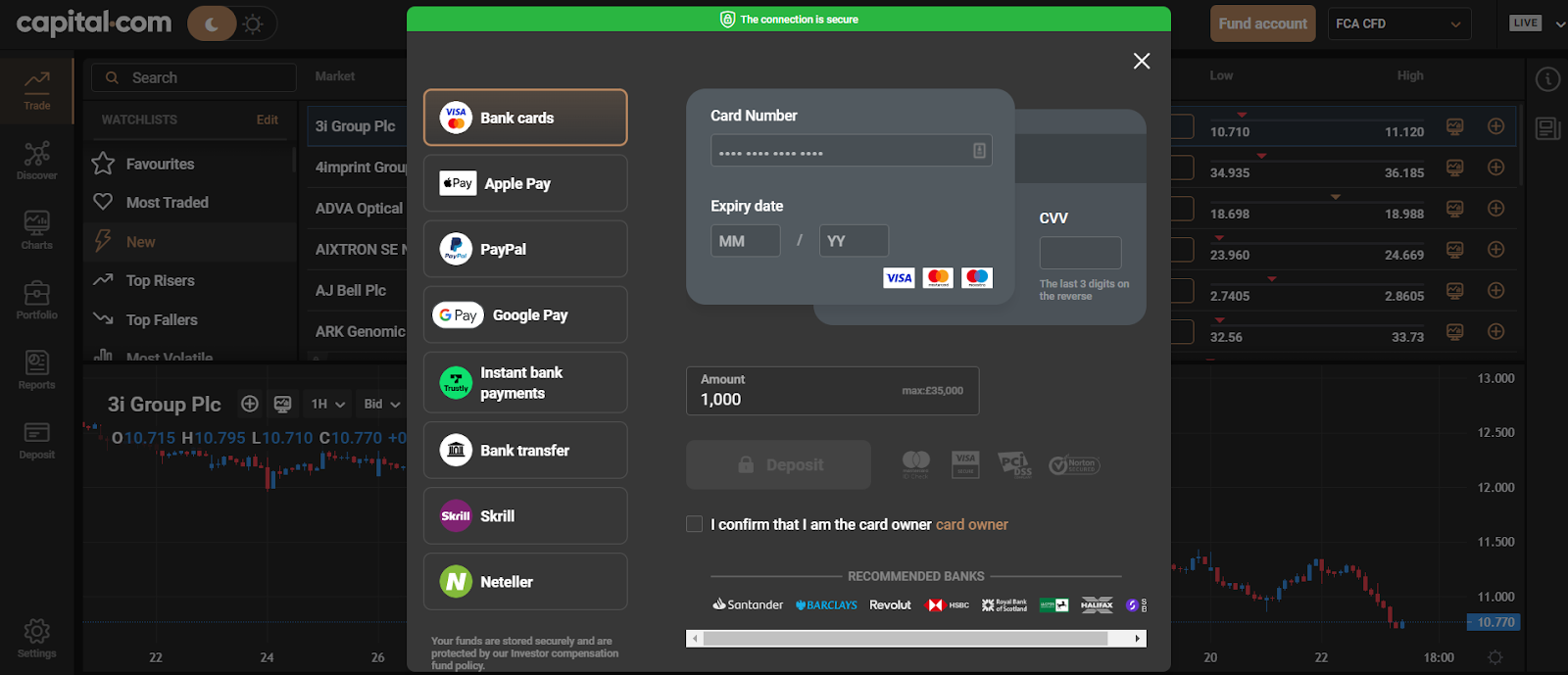

3. Make a deposit with a credit card

Select the bank card option as a deposit method and enter the amount to deposit. Capital.com supports VISA, Mastercard, and Maestro.

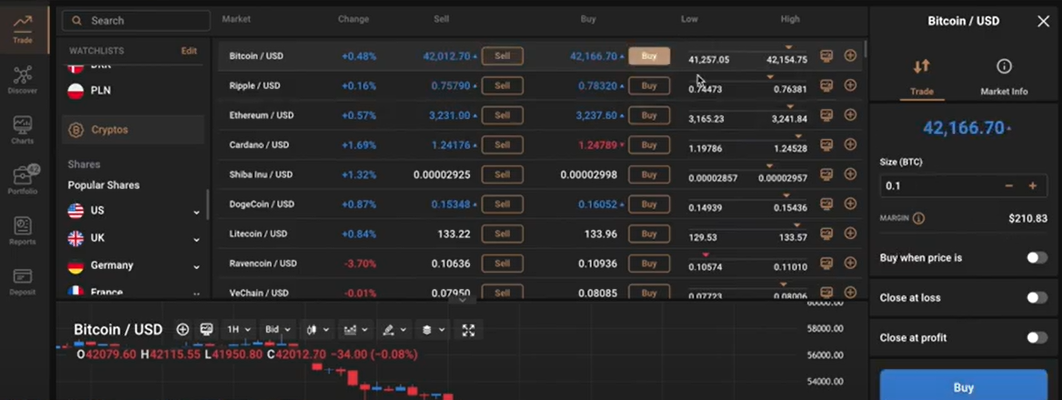

4. Purchase Bitcoin

Search for Bitcoin using the search bar. Select the trade size you wish to buy and the price you want. Confirm your choice and click on Buy to complete the transaction.

Pros

-

Low minimum deposit of $20

-

Commission-less CFD trading

-

Highly regulated

-

No deposit or withdrawal fees on the broker side

Cons

-

Not available to US clients

-

Crypto CFDs are not available for UK residents

Why we chose Capital.com

Capital’s favorable spreads, commissionless trading, and low deposit fees make it a cheap option for buying Bitcoin CFDs. The platform does not charge for credit card deposits or withdrawals.

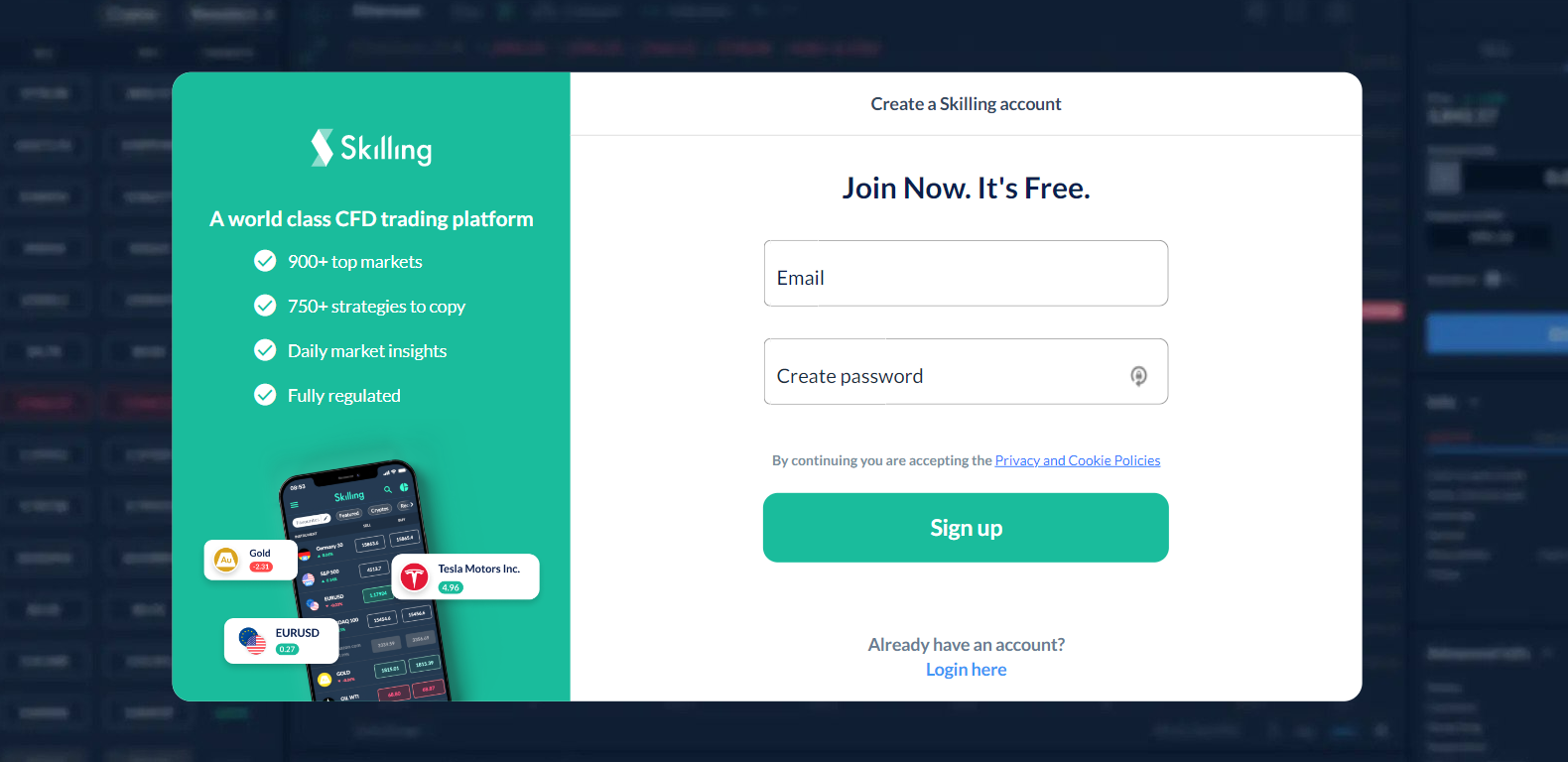

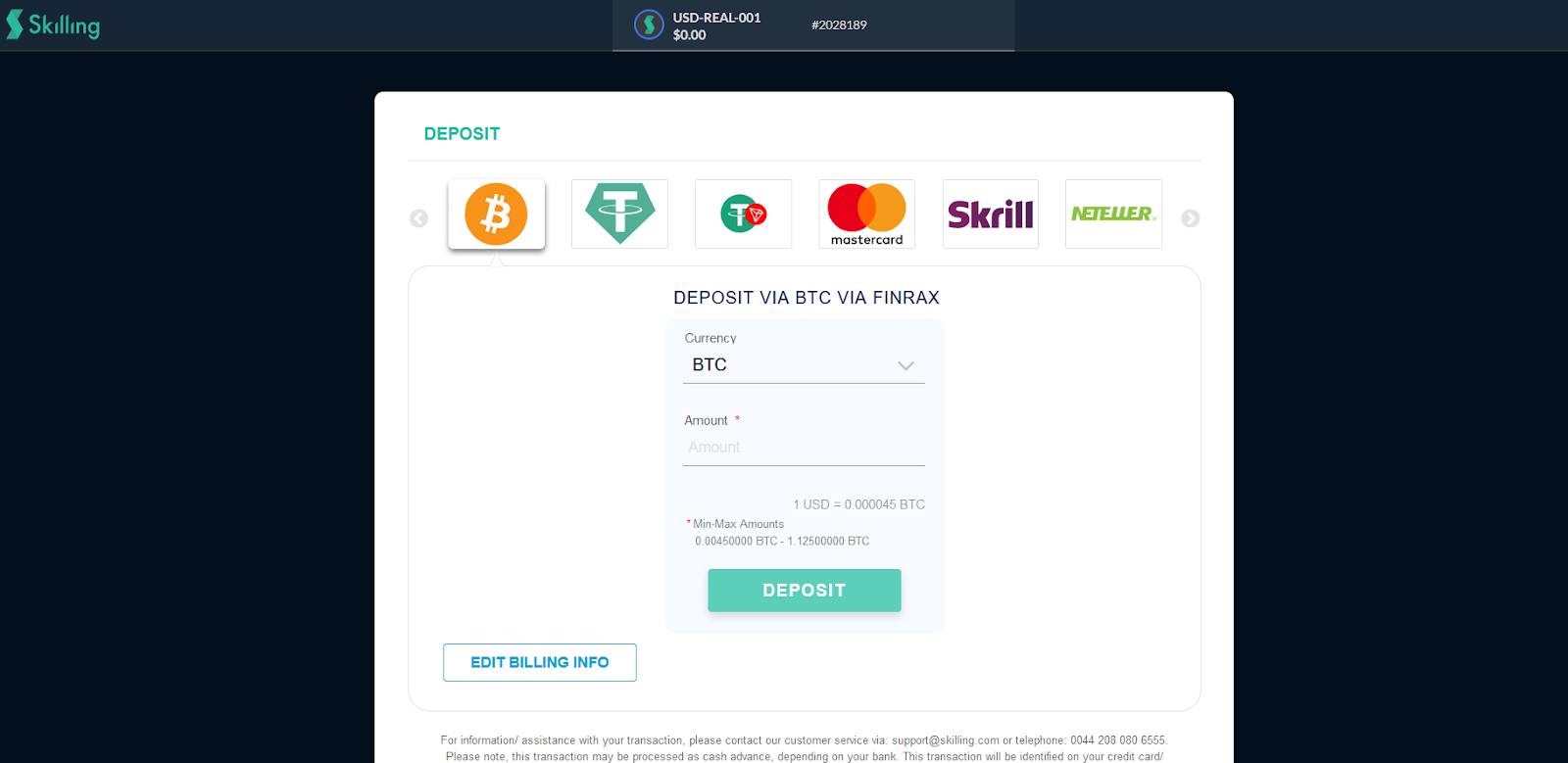

5. Skilling – Cheapest Way to Buy Bitcoin with a Credit Card

Skilling is a broker that offers several tradable securities like stocks, currency, pairs, indices, and cryptocurrencies. It is most popular for its 50x leverage on Bitcoin CFDs.

The exchange does not charge fees for credit card deposits or withdrawals with VISA and Mastercard. It is regulated by the Financial Services Authority (now the FCA) and the Cyprus Securities Exchange Commission (CySEC). It also implements industry-standard security protocols to safeguard user funds.

Bitcoin trading attracts a spread markup of about 0.2%.

Read our full Skilling review here.

How to Buy Bitcoin With a Credit Card on Skilling

-

Open an account

Navigate to the website and click on Sign-up to get started. Create an account by filling in the form with your email and password. Wait for a verification link which will be sent to your inbox.

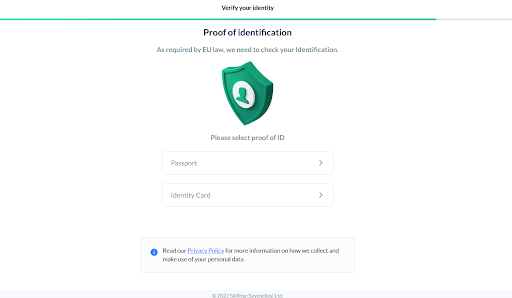

2. Verify your account

Click on the link in the email to verify your account and complete your profile by submitting personal details like a valid ID and utility bill. A customer care representative will usually call to assist with any issues.

3. Make a deposit with a credit card

Select credit card as a deposit method and enter the amount to deposit, the minimum is $100. VISA and Mastercard deposits are instant and free.

4. Purchase Bitcoin

Search for Bitcoin and set the amount you want and the price you want it. Confirm your choice and click on Buy to complete the transaction.

Pros

-

Offers 50x leverage

-

Cheap Bitcoin spreads

-

Highly secure and well-regulated

-

Free deposits and withdrawals for credit card payments

Cons

-

$100 deposit minimum higher than others

Why we chose Skilling

Skilling is a well-regulated broker with an impressive leverage facility and free deposit methods. It is ideal for clients who wish to gain leveraged exposure to Bitcoin’s price movement.

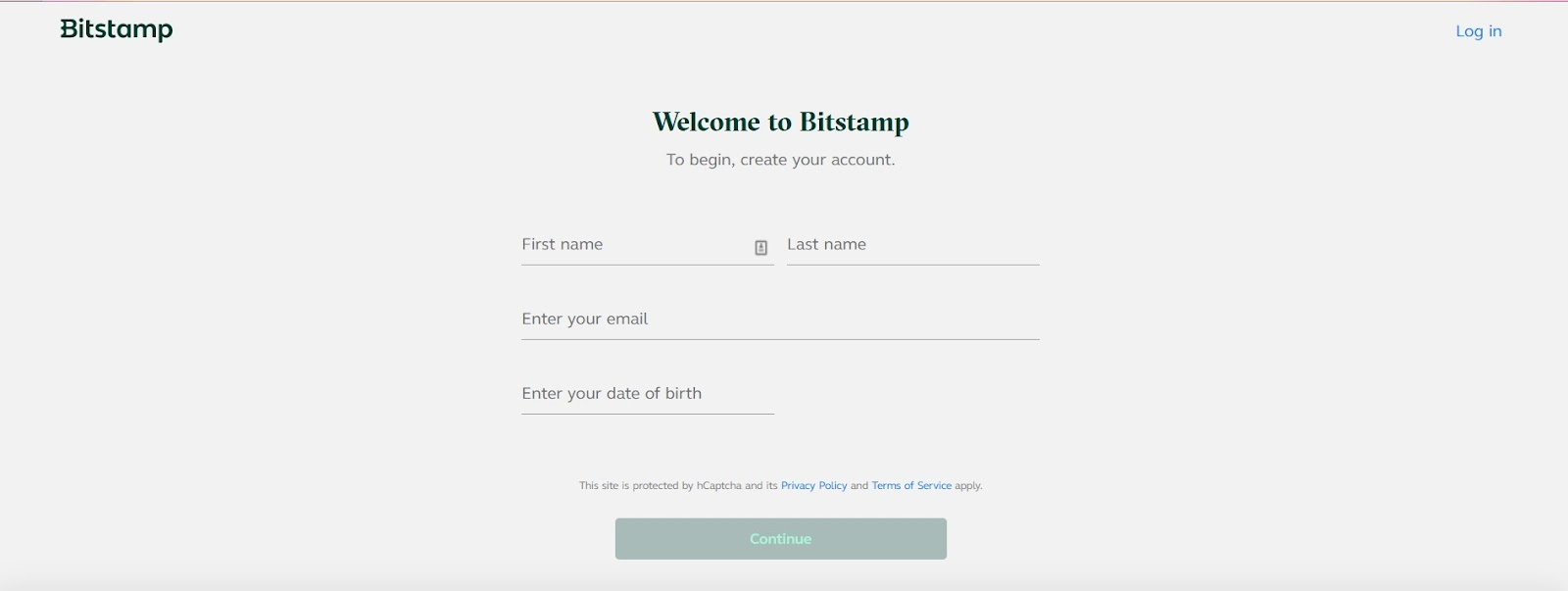

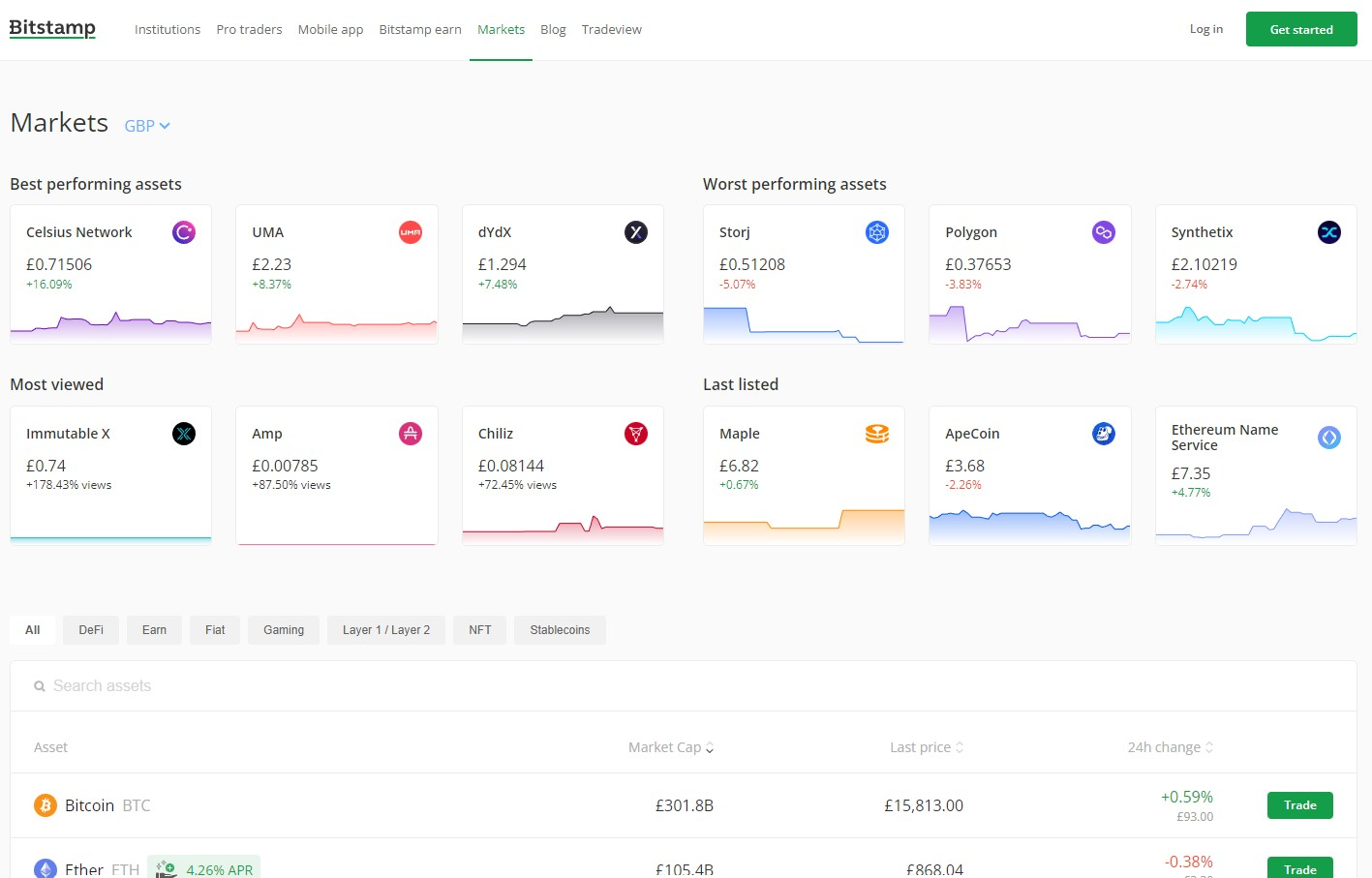

6. Bitstamp – Most Secure Way to Buy Bitcoin with a Credit Card

Bitstamp is one of the oldest exchanges with a reputation for being reliable. It offers institutional-grade security, 24/7 dedicated customer support, and a collection of over 70 cryptos.

Bitcoin purchases on the exchange attract a 5% fee for credit cards. Withdrawals with this method are not supported. Deposits in either USD, GBP, or EUR are accepted and are subject to a $25 minimum.

How to Buy Bitcoin With a credit card on Bitstamp

1. Open an account

Navigate to the website and click on Get Started. Create an account by filling in the form with your name, email, and date of birth. Wait for a verification link which will be sent to your inbox.

2. Verify your account

Click on the link in the email to verify your account. Complete your registration by submitting personal details, a valid ID, and a utility bill.

3. Make a deposit with a credit card

Select the instant purchase option as a deposit method, choose Bitcoin as the purchase currency, and enter the amount to buy. VISA and Mastercard deposits are instant but cost 5%.

Pros

-

Implements institutional-grade security

-

Low minimum deposit requirement

-

Transparent fee schedule

-

24/7 dedicated customer support

Cons

-

High trade fees for smaller amounts

Why we chose Bitstamp

Bitstamp’s reliability is a deciding factor as the exchange’s service level over the years, combined with top-of-the-line security, makes it one of our choices.

Why Should I Buy Bitcoin With a Credit Card?

Convenience

Everyone knows the convenience credit cards offer. Buying Bitcoin with a credit card is straightforward once you have registered with an exchange. However, this convenience comes at a cost. Purchasing Bitcoin with a credit card isn’t one of the most economical methods.

While convenient, credit cards are not suitable for frequent transactions, due to the fees. But if the Bitcoin price rises, a single credit card transaction fee wouldn’t be an issue for most.

Security / Safety

Credit card technology has come a long way since its inception. Now, we have 3D secure cards that add an extra layer of security by requiring users to authenticate transactions before processing them.

Transaction limits can also be imposed on cards to ensure that large sums of money are not processed without your permission.

Speed (deposit time)

Credit card payments are one of the fastest in the world, often processing transactions within seconds. For crypto platforms, credit card payments are usually the instant payment method.

And thanks to global networks set up and maintained by providers like VISA and Mastercard, almost anyone from any country can carry out credit card transactions.

Affordability

While credit card payments are not the cheapest (actually, they are usually among the most expensive), they are more affordable for international payments than SWIFT and wire transfers.

The average SWIFT transfer costs 3% – 5% for big banks, while the average credit card processing fee costs 1.29% for VISA and 1.39% for Mastercard, 1.58% for Discover, and 1.5% for American Express.

Ease of Use

Credit card transfers are easier to make than some local options. It is more convenient for cross-border payments than bank or wire transfers. It, along with bank transfers, are among the most popular payment methods available globally.

Improve credit score

Credit cards can help improve your credit score provided you pay your debts at the end of the month. You can buy Bitcoin using a credit card and settle the debt at the end of the month. Doing this improves your credit score, granting access to more funds at better rates.

Credit card companies also give rewards for settling debts on time, like cashback, miles, or even gift cards.

Buying Bitcoin Direct vs Crypto Exchange vs P2P vs Broker

Buying Bitcoin Direct

Buying Bitcoin directly from people may help you maintain anonymity but is fraught with risks. The most prominent is that the legitimacy of the counterparty is not guaranteed. Also, transfers can be limited to other credit card accounts and a small amount.

Buying directly with credit cards can also be less secure as the counterparty may not invest much in platform security. The range of altcoins to buy from may be limited to a few popular coins, reducing opportunities to make profitable investments.

Crypto Exchange

Buying Bitcoin with a credit card on an exchange is easy and secure, especially within a regulated environment. Most large exchanges usually have two purchase options with credit cards. You can either buy the Bitcoin directly through the platform or fund your account with your credit card and use your balance to buy Bitcoin.

Whichever you use, the cost and the time to process the transaction are usually the same.

Brokers

If you prefer to go through a crypto broker or OTC desk to gain Bitcoin price exposure, ensure they are fully compliant with regulations. These regulations are in place to ensure you can trade safely and securely.

Buying Bitcoin Anonymously Using a Credit Card

It is not currently possible to buy Bitcoin anonymously with a credit card. You generally only have a couple of options to buy Bitcoin anonymously. One is to buy through a Bitcoin ATM, the other is to arrange to purchase Bitcoin anonymously on peer-to-peer exchanges.

Unfortunately, Bitcoin ATMs do not offer credit cards as a payment method due to double-spend concerns.

Peer-to-peer exchanges are also not an option as purchases made with a credit card will unavoidably leave traceable records. As a result, we do not believe it is possible to buy Bitcoin anonymously with a credit card.

Buying Bitcoin Without Verification Using a Credit Card

It is not currently possible to buy Bitcoin using a credit card without first verifying your identity. This is because online purchases require sensitive details like your credit card number and CVV code.

Regulated exchanges or brokers must ensure that the credit card user, owner, and account owner are the same person. Account verification helps them do so.

Pros and Cons of Using a Credit Card to Buy Bitcoin

Pros

- Convenience - one of the most painless payment methods available

- Growing acceptance - more and more exchanges are offering credit cards as a payment option

- Fast processing - credit cards are faster than most payment methods

- Secure - credit cards aren't linked to your bank account so they provide an extra layer of security

- Buyer protections - credit cards offer fraud protection like chargebacks

- Rewards - using your credit card through PayPal can earn rewards

Cons

- Expensive - credit cards have high fees and interest that accrue on purchases

- Not always accepted at cryptocurrency exchanges

- Convenience fees and surcharges from merchants

- Not anonymous

How Much Does It Cost to Buy Bitcoin Using a Credit Card? - What Are the Fees?

When setting out to buy Bitcoin with a credit card, the first thing you will need to consider is the cost of the transaction.

Fees for buying Bitcoin with a credit card vary depending on your bank, jurisdiction, and the exchange or broker you are using. In general, exchanges will charge an additional processing fee under 4%.

Merchants are allowed to charge convenience fees for using a credit card, but only if it is a specialty payment channel for the business, not one that forms the majority of payments to the business.

Some larger exchanges charge below 4% fee for buying Bitcoin with a credit card. Buying crypto from a foreign platform may come with a foreign transaction fee. It is important to confirm all credit card fees with your bank before proceeding.

Is Using a Credit Card the Best Way to Buy Bitcoin?

The reality is there is no best method to buy Bitcoin. Credit Cards may not be the best payment method, but they might be the easiest and fastest. However, situations may arise where using a credit card is infeasible. In those cases, these alternative payment methods can be used instead.

Bank transfer

Bank transfers to buy Bitcoin are just as popular as credit cards as the majority of users in developed countries have bank accounts. Local transfers are cheap and fast, and several global brokers have local accounts in popular regions. However, international transfers can get expensive and take several days to clear.

Neteller

Neteller is an electronic wallet and payment platform that allows users to make international payments using their bank accounts or credit cards where it would have otherwise been infeasible or would have taken several days. Using Services like Neteller for buying Bitcoin are growing as a viable payment method as it gathers more users globally.

Paysafecard

Paysafecard is a semi-anonymous way to buy Bitcoin, provided the cards are bought physically without creating an account on the online platform. Paysafecard can be used to purchase Bitcoin on peer-to-peer markets that do not require account verification.

Paypal

PayPal is a global leader in electronic wallet services. It is also an instant payment method as its transactions are fast. It may not be as widespread as credit cards, but it offers a cheaper payment method at a comparable transaction speed. You can buy Bitcoin with Paypal directly or through a broker or exchange.

Apple Pay

Apple Pay is a digital payment service for Apple users. It has grown in popularity in the last few years and is being added to the list of payment methods for a growing number of exchanges and brokers. Apple Pay also works with credit cards and bank accounts to move money across borders during international transactions. There are some platforms that allow you to buy Bitcoin with Apple Pay.

Google Pay

Google Pay is the Android version of Apple Pay. It allows users to pay for items in-store or online without divulging their payment details. Google Pay can be used to buy Bitcoin as it works with a number of crypto exchanges and is growing in adoption as the mobile internet grows.

What Should I Look For in a Platform When Buying Bitcoin With a Credit Card?

Low withdrawal and deposit fees

Credit card fees are usually one of the highest among crypto platforms, usually only surpassed by wire transfer fees. Some platforms charge fees for credit card payments, and some don’t. Those that do usually add their fees to the charge the payment provider levies to process the transaction.

Ensure that the platform charges minimal credit card fees for deposits and withdrawals. For example, eToro does not charge for credit card transactions while Binance charges 1.8%.

Speed of platform

While credit card transactions are usually instant, how fast your payment goes through depends on the platform’s ability to clear the transaction quickly from their end.

Reputation of platform

Platforms known for fraud, multiple hacks, and leadership getting into trouble with the law should be approached with caution. While not all hacks mean the platform is sketchy, it does mean that they have not implemented the best security measures they can. Approach platforms with a bad reputation with caution.

Security

Crypto platforms deal with smart contracts and a lot of digital assets. Weak smart contracts are often hacked, and the industry is rife with tales of breaches and theft. The absence of a platform breach is a usually good sign of tight security, especially when that exchange has been in business for several years.

Licenses and regulations

As countries develop crypto legislation and policies, exchanges must adapt to remain on the good side of the law. Defaulting exchanges may be forced to cease operations immediately, placing user funds at risk. Ensure the exchange of your choice is licensed in the country(ies) it operates.

Final Thoughts on How to Buy Bitcoin With a Credit Card

Buying Bitcoin with a credit card is a simple and straightforward process albeit one with a higher cost. However, it still remains one of the cheapest for cross-border payments.

eToro is our top pick as the overall best place to buy Bitcoin using a credit card as it does not charge deposit or withdrawal fees. It is also highly regulated and has a minimum deposit requirement of $10, cheap compared to some others.

Credit card charges can add up for frequent transactions and is, thus, more suitable for infrequent and large transactions.

Methodology - How We Picked the Best Platforms to Buy Bitcoin With a Credit Card

The platforms covered in this guide are derived through rigorous testing, research, and reviews. We paid attention to security, transparency, reputation, deposit and withdrawal fees, and time in the game.

The platforms listed are the best we found in the various categories we listed them. For example, Binance was one of the most flexible ways to buy Bitcoin with a credit card because it supports over 70 fiat currencies.

Check out our ‘why trust us’ and ‘how we test’ pages for more information on our testing process.

Frequently Asked Questions

Top Bitcoin Stories

Bitstamp to distribute Mt. Gox BTC from July 25

24 July 2024 Bitstamp plans to distribute Mt. Gox Bitcoin and Bitcoin Cash as from Thursday, July 25. The exchange…

Bitcoin hovers near $66.5k as Mt.Gox users ‘choose to hodl’

24 July 2024 Bitcoin price still hovers above $66k despite Mt. Gox repayments. Analysts say on-chain data shows most BTC…

Swan Bitcoin halts IPO plans and shuts down mining operations

22 July 2024 Swan Bitcoin delays IPO plans due to shutdown of its mining operations. CEO cites reduced revenue from…

Mark Cuban: Inflationary Pressure Could See Bitcoin Become Global Reserve

18 July 2024 Inflationary pressure and geopolitical uncertainty could see Bitcoin become a global reserve currency, states Cuban The billionaire…

StarkWare verifies first zero-knowledge proof on Bitcoin

17 July 2024 StarkWare has verified the first zero-knowledge (ZK) proof on the Bitcoin. It’s part of the core Starknet…