How and where to buy Bitcoin (BTC) 2024

...

Bitcoin is the original cryptocurrency. Launched in 2009 as a means of making peer-to-peer value transactions without the need for an intermediary, Bitcoin has become world famous and has seen an astronomical value increase since its inception.

It is still by far the largest cryptocurrency by market cap and can now be found on the balance sheets of major financial institutions.

If you want to know how to buy Bitcoin in the USA, you’ve come to the right place. We’ll go through the buying process, discuss the best Bitcoin platforms, and provide information on everything else you need to know, from payment options to wallets.

How to Buy Bitcoin USA

The easiest way to buy Bitcoin is to purchase it online from a crypto exchange. Exchanges make it easy to buy and sell Bitcoin and other cryptocurrencies directly from your smartphone, tablet, or computer. Follow the steps below to safely buy Bitcoin.

1. Choose a platform

You can look at factors such as fees, ease of use, and features when deciding which platform to choose. The in-depth reviews in this guide will go through all these things, but if you want to dive in straight away, choose from one of our recommended platforms below.

2. Create and fund an account

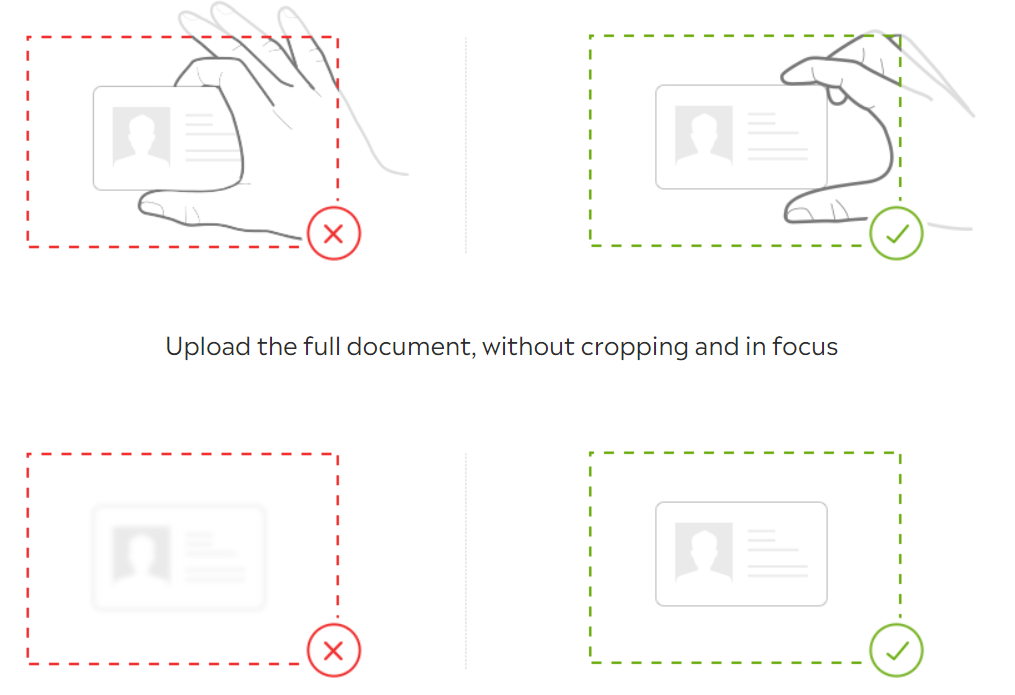

You will need to fill in a few personal details to create an account. Regulated platforms have a KYC process, which means you will need to provide a picture of your photo ID in order to verify your identity. After that, you can choose your preferred payment option on the deposit page to fund your account.

3. Buy Bitcoin

Search the platform for the trading pair for Bitcoin and your deposited currency. Create a market order to buy Bitcoin immediately at the current price, or use a limit order to set a price to buy at in the future. Just enter the amount you wish to purchase Bitcoin at and click the “Buy” button.

Where to Buy Bitcoin in the USA?

What follows are detailed reviews of the best places for buying Bitcoin, explaining the pros and cons of each platform.

1. eToro – Overall Best Place to Buy Bitcoin in the US![]()

eToro has a clear layout that is easy to navigate for beginners, but enough tools and optional features to satisfy seasoned pros as well, which is why we believe it is the best place to buy Bitcoin.

eToro’s USP is its innovative CopyTrader feature. This allows you to automatically replicate the trades of the world’s best Bitcoin traders if you lack experience or simply don’t have time to monitor the market. You can view the percentage return and risk tolerance of other users to find the most suitable BTC trader to copy.

If you prefer to do your own analysis, though, you can check out the news, statistics, and research on Bitcoin that is available on eToro. To ensure you don’t miss anything, you can add Bitcoin to your watchlist and set up price alerts and notifications.

A great thing about eToro is that it is a multi-asset platform. If you want to buy Bitcoin as part of a diversified portfolio, you can also buy over 70 other cryptocurrencies on eToro, as well as other asset types, like indices, ETFs, and stocks.

Creating an account on eToro will only take a few minutes, after which you will have a wide choice of payment options to deposit a minimum of $10. The minimum trade size is also $10. The withdrawal fee is $5 but the trading fees are competitive at 1% plus the spread.

Lastly, eToro is one of the most regulated crypto exchanges, with licenses from the Securities and Exchange Commission (SEC) and Financial Industry Regulatory Authority (FINRA) in the United States.

Read our full eToro review here.

Pros

- Easy to navigate

- Reputable and regulated

- Deposits are free

- Strong security and cold storage

- Wider choice of payment options than many competitors

- Free demo account

- Unique copy trading feature

- Mobile app

Cons

- Not as many coins as some digital currency-specific platforms

- Unavailable in a significant number of countries

2. Binance – Best Place to Buy Bitcoin With Low Fees![]()

Binance takes a spot in our top five as it provides the lowest trading fees on the market. You will only need to pay 0.1% on each trade, or less if you are in a higher loyalty tier. Digital currency deposits are free, as well as some methods of fiat currency deposit and withdrawal, though others incur a fee.

With over 600 other cryptocurrencies, Binance is one of the best platforms if you’re interested in purchasing new and obscure coins in addition to Bitcoin. You can learn all about Bitcoin, blockchain, and trading with the wealth of educational resources available at the Binance academy.

Binance caters to experienced Bitcoin traders, providing customizable charts, indicators, and the ability to trade BTC with leverage. Newbies aren’t left out, however, as Binance’s convert feature makes it simple to swap between coins with a couple of clicks. What’s more, you can earn an estimated 5% APY on your Bitcoin with Binance Flexible Savings.

You can create a Binance account and verify your identity in a matter of minutes, then make a deposit of at least $50 with your chosen payment option. The minimum amount of Bitcoin you can buy is $10, and you will be charged 0.0002 BTC if you want to withdraw it on the Bitcoin blockchain. Read our full Binance review here.

Pros

- Lowest trading fees

- 600+ other coins available (Including Ethereum, Bitcoin cash, Dogecoin, and BNB)

- Advanced tools for trading

- Margin trading

- Interest-bearing savings

- Educational materials

- Mobile app

Cons

- The minimum deposit is higher than other platforms

- Somewhat limited choice of payment methods

- Regulatory issues in certain countries

3. Coinbase – Easiest Way to Buy Bitcoin instantly![]()

Coinbase is the best place to buy Bitcoin instantly if you’re a beginner. This is because the layout is very clear and the buying process is intuitive. Add Bitcoin to your watchlist to stay on top of the market, and easily view your portfolio performance in your dashboard.

You can get into Bitcoin with as little as $2 on Coinbase, and set up automatic regular purchases with the recurring buys feature. Users also have access to customizable charts and more advanced tools and order types through the Coinbase Pro platform.

If you’re still trying to get your head around crypto, Coinbase’s tutorials and guides to crypto basics will help you build knowledge and confidence. Learn and earn campaigns even give you the chance to get crypto for free while completing short lessons.

Coinbase’s cold wallet storage, crypto-insurance, and regulatory licenses should give you peace of mind while buying Bitcoins. Setting up your account takes a few minutes and it is recommended you deposit at least $50. The trading fees on Coinbase are up to 0.6% plus spread, making them fairly competitive, though you could be charged higher fees for certain payment methods. Read our full Coinbase review here.

Pros

- Clear interface

- Intuitive buying process

- 150+ other cryptocurrencies available

- Low trade minimum

- Licensed and secure

- Set up recurring buys

- Earn free crypto in learn campaigns

- Mobile app

Cons

- Higher minimum deposit than some competitors

- High fees for some payment methods

4. Bitpanda – Best Place to Buy Bitcoin Securely![]()

Bitpanda secures all of its users’ crypto assets in cold storage, making it one of the safest places for purchasing Bitcoin. The platform is also compliant with AML regulations, holds all the necessary licenses, and is rated as excellent on Trustpilot.

You can get help with navigating the platform through the Helpdesk and learn all about Bitcoin, crypto, and finance from articles on the Bitpanda Academy and blog.

Unlike most platforms that offer Bitcoin, Bitpanda is multi-asset, meaning users can invest in stocks, ETFs, crypto indices, and metals, as well as almost 200 other cryptocurrencies. You can even swap directly between different types of assets.

The Bitpanda savings plan allows you to set up recurring BTC purchases. You can also spend your Bitcoin with the Bitpanda Card, and keep up with Bitcoin on the move through the Bitpanda mobile app.

You can set up and verify your Bitpanda account in a few minutes, and there are a variety of payment options you can use to make a deposit of at least $25. A 1.49% premium is included in the price of BTC and the minimum order size is $1.50. The fee for withdrawing Bitcoin is 0.00006 BTC.

Pros

- Simple to use

- Multi-asset platform

- Almost 200 other cryptocurrencies

- Secure and regulated

- Positive reviews

- Variety of payment methods

- Low minimum trade amount

- Educational materials

- Mobile app

Cons

- The only customer support is via email

- Digital currency deposits incur fees

5. Capital.com – Best Place to Trade Bitcoin CFDs![]()

If you’re looking to trade BTC contracts for difference, then Capital.com is the top platform. Trading CFDs means you don’t actually own Bitcoin, so there are no storage concerns, but you can still profit from BTC price movements.

Experienced traders can take advantage of up to 30x leverage, more than 70 technical indicators, price alerts, client sentiment, and AI-powered post-trade analysis. Beginners aren’t left out, however, as they can access financial education through the Investmate app, as well as online courses and trading guides.

In addition to Bitcoin, users can trade CFDs on more than 6,000 assets, including 477 other cryptocurrency pairs, stocks, commodities, forex, and indices. Trading CFDs is a high risk, but Capital.com provides a demo account for practice, as well as risk management tools such as negative balance protection.

The account creation and verification process take a few minutes on Capital.com, and then you can make a minimum deposit of $20 with a wide array of payment methods. There is 0% commission on the platform and no fees for deposits and withdrawals. BTC/USD has a spread of 60 and there are overnight fees that change with volatility. Read our full Capital.com review here.

Pros

- 0% commission

- Fast order execution

- Secure and regulated

- 477 crypto trading pairs

- Risk management tools

- Demo account and educational resources

- Mobile app

Cons

- Only offers CFDs, which are high risk

73.81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

What is Bitcoin?

Bitcoin was launched in 2009 by a pseudonymous person or group known as Satoshi Nakamoto. It was the first cryptocurrency and provided a revolutionary way of transacting value that didn’t require intermediaries.

Bitcoin introduced the world to Proof of Work, a system in which computers compete to validate transactions in a process known as “mining”. This makes the Bitcoin blockchain very secure and miners are rewarded with BTC.

Only 21 million BTC will ever be created, making it a finite resource. This is why many investors view Bitcoin as a store of value, like Gold. Some financial institutions have been investing in Bitcoin in recent years, and the BTC price saw a surge when it was revealed that Tesla had made a significant Bitcoin purchase.

What Payment Methods Can I Use to Buy Bitcoin?

As Bitcoin is the most widely available cryptocurrency, there are many different ways to buy it with fiat currency such as USD. Many Bitcoin exchanges will accept the most popular payment methods, including credit or debit cards, PayPal, and even Bitcoin ATMs, let’s look at them in detail below.

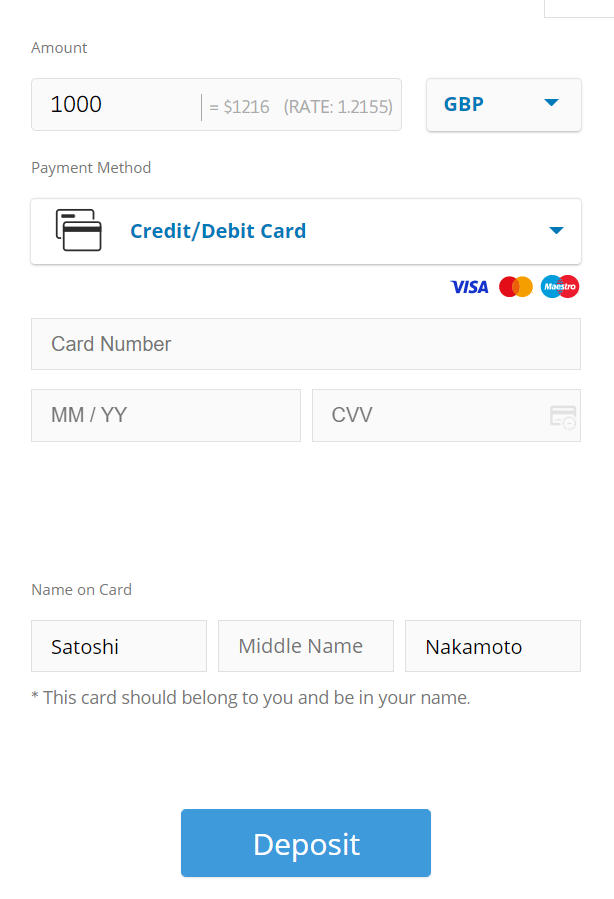

Credit or debit card

Debit or credit cards are fairly widely accepted, providing a convenient way to buy Bitcoin and pay later or in installments.

The fees involved are the main drawback to using credit cards—there’s a 1.8% fee for credit card purchases on Binance and a 2.49% fee on Coinbase. Different platforms will accept different types of cards. Most will accept Mastercard, Visa and Maestro, less commonly accepted is American Express (Amex). Learn how to buy Bitcoin with American Express.

The best place to buy Bitcoin with a credit or debit card is eToro, where deposits are free. Find out more about how to buy Bitcoin with a credit card.

Bank transfers

Using a bank transfer to make a deposit is often the cheapest method to buy Bitcoin. You can do so for free on Coinbase and Capital.com, or for a $1 fee on Binance.

If your platform supports Faster Payments, as Coinbase and Binance do, then you can receive your bank account funds and start trading with them almost immediately.

Here’s more on how to buy Bitcoin with a bank account.

PayPal

PayPal is a fast and safe payment method but is less widely accepted by crypto platforms.

US users can use PayPal on Coinbase to buy BTC for a 3.99% fee or make a deposit for a 2.5% fee. PayPal deposits on eToro are free.

You can also instantly buy Bitcoin directly on the PayPal platform, but there are fewer features and tools available and the fees can be significant for small purchases. Learn more about how to buy Bitcoin with PayPal.

Cash via Bitcoin ATM

There are thousands of Bitcoin ATMs all over the world. A lot of them look like regular ATMs—keep an eye out for the Bitcoin logo, or find one near you on this map.

You will need to set up a crypto wallet first to send your coins to. The Bitcoin ATM will need your phone number to verify your identity, and then you can pay with cash or a debit card.

Buying Bitcoin with paysafecard

It’s possible to buy Bitcoin with a paysafecard but it’s a little harder to find crypto exchanges that accept this as payment. Peer to Peer (P2P) Exchanges are more likely to offer deposits or payments via a Paysafecard.

These types of exchanges let people buy directly from one another. One such example is Paxful . If your looking to buy Bitcoin anonymously then a combination of a Paysafecard and a P2P exchange can be the way to go.

Here’s more on how to buy Bitcoin with paysafecard.

Buying Bitcoin with Google Pay or Apple Pay

As with the above method, it is possible to use both Apple and Google pay to make deposits. Again this payment method is popular on Peer to Peer (P2P) exchanges like Paxful.

Here’s more on how to buy Bitcoin with Google Pay and Apple Pay.

Buying Bitcoin with Skrill

Skrill is a similar payment platform to that of Paypal, but less widely accepted due to it being established more recently. Our top recommended broker and exchange platform eToro offers Skrill as a means of deposit.

Here’s more on how to buy Bitcoin with Skrill.

How to Buy Bitcoin - Step-by-Step Guide

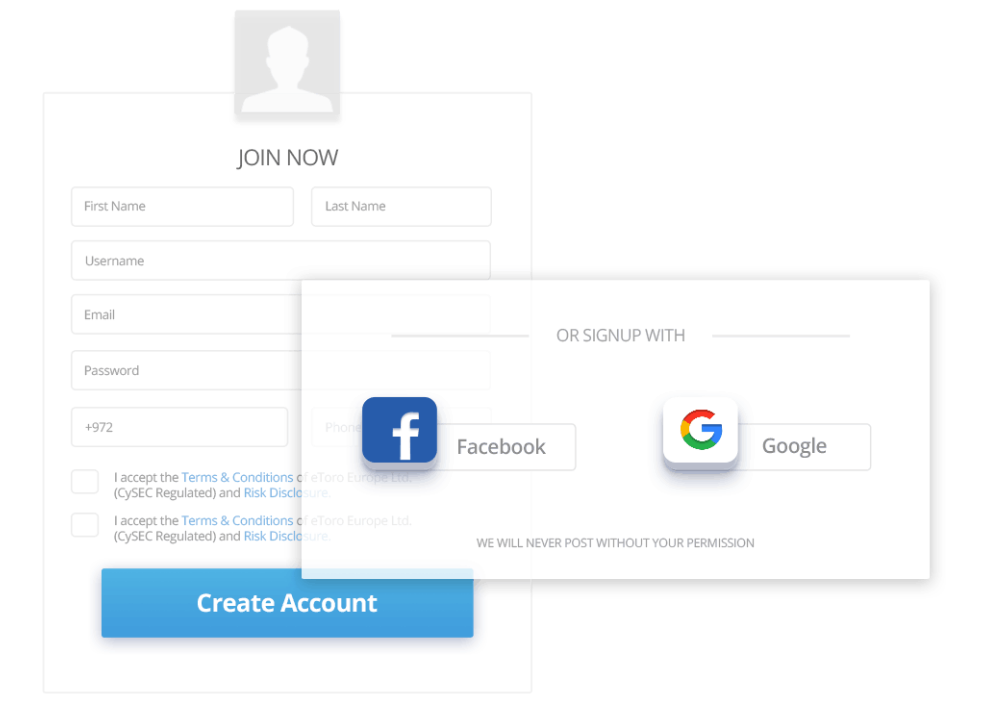

It’s very simple to buy Bitcoin on eToro . Here’s how.

-

Create a free account

You will need to fill in the registration form with your email address, username, and password once you click on the “Join Now” button on the homepage. Tick the box to confirm that you accept the terms and conditions, and then click on “Create Account”.

-

Verify your account

You can verify your email address by clicking on the link emailed to you. Then you will need to complete your profile by providing your name, date of birth, contact details, and proof of identity. You will also be asked questions about your investing experience.

-

Make a deposit

Once you click on “Deposit Funds”, you can enter the amount that you want to deposit. Using the dropdown lists, choose your local currency and preferred payment method. Fill in any details required to complete the payment and click the “Deposit” button.

-

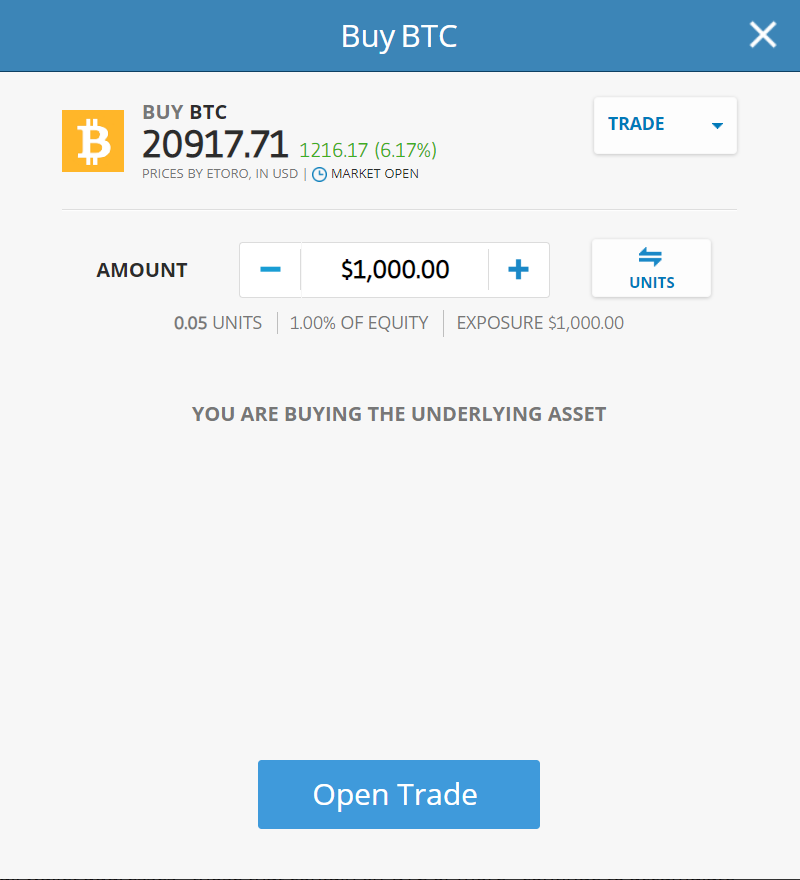

Buy Bitcoin

Use the search bar at the top to find Bitcoin and hit the “Trade” button. You can switch from Trade to Order at the top if you want to Buy Bitcoin once it reaches a certain price. Otherwise, just fill in how much you want and click on “Open Trade”.

Ways to Invest in Bitcoin

You can use different strategies to invest in Bitcoin, depending on your goals, skills, and amount of free time. Some of the most common are detailed below.

Buy and Hold Bitcoin

This is the simplest strategy there is—anyone can buy Bitcoin and hold onto it, regardless of how much skill or free time they have. This is a popular Bitcoin investment strategy as there is a capped supply of BTC, so it won’t be devalued by inflation in the same way that fiat currencies are.

Investors who bought Bitcoin a long time ago and held onto it have seen astronomical returns. If you believe the value of Bitcoin will increase over time, this could be an easy way to make a profit.

Trade Bitcoin

The volatility of BTC’s price means traders can also buy and sell Bitcoin on a much shorter time scale to generate frequent profits. Technical analysis skills come in handy for trading and it requires a greater time commitment.

One way of trading Bitcoin is through CFDs. These allow you to speculate on the price of BTC without actually purchasing it. You can trade CFDs including Bitcoin on eToro and Capital.com.

Mine Bitcoin

Mining is another way to acquire Bitcoin. You will require specialist hardware though, which can be costly. Most individual miners join a mining pool to ensure a regular income. A simpler option is to pay for cloud mining services from a provider such as CCG Mining . You can find out everything you need to know on our Bitcoin mining page.

Choosing a Bitcoin Wallet

There are many different types of Bitcoin wallets to suit different needs. They can be split up into different ways.

Sometimes you may hear the terms cold and hot wallets. Hot wallets are connected to the internet most of the time while cold wallets aren’t connected or only on odd occasions. A general rule of thumb is that most software wallets will be hot wallets.

The information below should help you find the personal wallet that’s right for you.

Bitcoin Software Wallets

- Web wallet: Web wallets are the most convenient wallets for traders and small-time investors. These online wallets are always connected and can be a target for hackers, which is why it is important to choose a secure and regulated platform, such as eToro, which provides a free web wallet.

- Mobile wallet: Mobile wallets are convenient apps that you can download onto your smartphone. Bitcoin.org’s top recommendations for mobile wallets are Bitcoin Wallet for Android and Unstoppable for iOS devices.

- Desktop wallet: Desktop wallets are downloaded onto your computer and tend to be fairly secure. Bitcoin Core is the most popular full node wallet, but most crypto desktop wallets can be used to store Bitcoin.

Physical and Hardware Wallets

- Hardware wallet: These are popular with long-term holders and large-scale Bitcoin investors as they are the most secure, albeit expensive. The most popular Bitcoin hardware wallets are Trezor, BitBox, and Ledger.

- Paper wallet: You can create a paper wallet with a private and public key generator—just write down or print the character string or QR code. This isn’t a safe way to store Bitcoin, though.

Wallet Combinations

Using more than one wallet in combination can be useful if, say, you want to trade some Bitcoin and buy and hold some Bitcoin with a web wallet and hardware wallet, respectively. If you use the Ledger hardware wallet, you can also download the Ledger Live app to manage your Bitcoin more easily.

Is Bitcoin a Good Investment?

Only you can decide whether investing in Bitcoin is the right choice, but let’s go over some factors that you might want to take into consideration.

Bitcoin is the most well-known cryptocurrency and by far the largest by market capitalization. It is a starting point for many investors when they first get into crypto—and for good reason. Bitcoin has established itself as one of the leading crypto assets, with more than a decade of history. Although all cryptocurrencies are a risk-on investment, Bitcoin is considered to be one of the safer coins to invest in.

Many Bitcoin users are attracted to the coin by its technology and economics, which were seen as revolutionary when it launched. Fiat currencies experience inflation and are controlled by central banks and governments. Bitcoin, on the other hand, has a max supply that can never be breached and is decentralized, meaning it’s beyond the control of authorities.

Bitcoin is accessible—it is supported by practically every crypto exchange and wallet, and there are plenty of ways to buy it. There are also a number of ways to spend it without selling Bitcoin, as an ever-growing number of businesses accept BTC as payment for goods and services. Some countries are even starting to accept Bitcoin as legal tender.

Bitcoin’s robust hashing algorithm and Proof of Work system make it one of the most secure blockchains to use. It is also popular with people who value privacy, as Bitcoin can still be used somewhat anonymously.

Throughout Bitcoin’s history, its dramatic price rises have provided investors with incredible returns. More and more institutions are making significant investments in Bitcoin, which could ultimately reduce the supply available on the market.

All of these factors mean a strong, and potentially growing, demand for Bitcoin, which could lead to price appreciation and make BTC a very good investment.

Is it Legal to Buy Bitcoin in USA?

There are no laws against buying Bitcoin in the US. There is no clear regulation for crypto in the United States. However, regulatory agencies such as the Securities and Exchange Commission oversee some of the activities in the market.

To ensure that your investment is safe at all times, we recommend buying bitcoins from a regulated exchange or broker. They provide better security for your funds and a safer trading environment.

Where Can I Use Bitcoin in the USA?

Bitcoin has gained massive adoption in the United States. Cryptocurrency is accepted as a payment option by some major retailers such as Microsoft. Home Depot, Namecheap, Starbucks, Overstock, AT&T and more.

Currently, there are over 21,000 Bitcoin ATMs in the United States. It is the country with the highest number of Bitcoin ATMs in the world. With Bitcoin ATMs in virtually every city across the country where you can buy, sell and transfer BTC with ease.

What mistake should users avoid when attempting to buy cryptocurrency?

"Don't focus too much on the price of a cryptocurrency. Crypto is one part, but the blockchain behind it is the key and bigger part of understanding the difference between a good cryptocurrency and a bad cryptocurrency. If you know what makes Bitcoin so unique, you will understand the future. Getting into crypto is mostly an investment in your future. By getting your feet wet carefully (without getting sucked into greed-driven frantic trading or leveraging) you can make sure you will be part of the new future of money rather than being left behind."Joerg Hansen

CEO of Caiz Development GmbH

Should I Buy Bitcoin Now? - Things to Consider Before Buying Bitcoin

The above section should help you decide whether to buy Bitcoin or not, but here are a few more practicalities to consider.

Bitcoin Fees & Regulations

When using the blockchain to make Bitcoin transactions, there are network fees involved. When the network is busy, these fees can get pretty high. However, you often don’t need to worry about these fees when using a platform, as eToro and many other platforms charge a fixed fee.

Your platform may charge other fees, however, such as deposit and withdrawal fees. These can vary depending on the payment method. Other fees to watch out for include account management fees and inactivity fees.

The SEC doesn’t consider Bitcoin a security in the US, while in the United Kingdom all cryptocurrencies are unregulated. It is perfectly legal to buy Bitcoin in both countries, but crypto platforms have to comply with AML regulations. This means you will need to verify your identity to buy Bitcoin on a regulated platform.

Bitcoin Price

The price of Bitcoin is affected by a great number of factors, many of which have been discussed in the previous section. Bitcoin also affects the price of other cryptocurrencies due to its huge market dominance. Its price history has been characterized by major surges followed by huge crashes approximately every four years, which appears to correlate with halving events (when the block reward for miners is halved).

The price of Bitcoin has increased dramatically since its inception, which is why it is popular with buy-and-hold investors. It is also more volatile than traditional financial instruments, making it suitable for trading too.

Traders and investors may aim to predict the price of BTC to help them decide when to buy or sell Bitcoin. The future price of Bitcoin may be affected by long-term market cycles, institutional investment, news, hype, and broader economic conditions.

Buying Bitcoin Safely & Securely

The safest way to buy Bitcoin is through a platform that is regulated. These platforms often have the strongest security features, such as encryption, insurance, and offline storage. You should always enable two-factor authentication if you have the option.

Make sure you use a strong and unique password to create an account. It is best to update your passwords regularly. You should also be careful about any emails you receive and check that they are really from your platform to avoid scams.

Make sure you store your Bitcoin somewhere safe. Spending money on a hardware wallet will provide you with the best security for your Bitcoin investment. Store your seed phrase in a safe place to ensure you will never lose access to your wallet, and never share your private key with anyone.

Selling Bitcoin

Depending on your reasoning for buying it in the first place you might not want to sell Bitcoin. It’s enviable however that with some trading strategies you’re going to need to sell your Bitcoin. Different platforms will obviously have different ways of doing this but for the most part, selling Bitcoin is similar to buying it.

As an example, if you’re using eToro, firstly go to your portfolio and select Bitcoin, and you will see the individual position breakdown. Click on the red icon that looks like a cross then click “Close”

Another example for the cryptocurrency exchange Coinbase is to firstly select Bitcoin from your assets, click on “trade” then “Sell BTC”, now enter the amount you wish to sell, click “preview sell” and finally press “sell now”

What Other Platforms Can I Buy Bitcoin On?

Bitcoin is the most ubiquitous cryptocurrency, so there are plenty of places to buy it. Some of the most popular platforms to buy Bitcoin in the USA are discussed below.

Can I Buy Bitcoin on eToro?

Yes. Bitcoin is available on eToro where deposits are free and you can use CopyTrader to replicate the trades of other BTC traders. See the step-by-step guide above to find out how to purchase Bitcoin on eToro.

Can I Buy Bitcoin on Coinbase?

Yes. It’s easy to work out how to buy Bitcoin on Coinbase as the platform is very beginner-friendly. Just link a payment method and click the “Buy / Sell” button at the top to get started.

Can I Buy Bitcoin on Binance?

Yes. There are options for how to make a Bitcoin purchase on Binance—beginners can use the simple convert feature while more advanced users can access charts and indicators through the spot trading feature.

Can I Buy Bitcoin on Robinhood?

Yes. How to buy Bitcoin on Robinhood is pretty straightforward. Once you’ve signed up, just find the Bitcoin page, enter how much you want, and click confirm to purchase Bitcoin.

Can I Buy Bitcoin on Trust Wallet?

Yes. Once you download the app, how to purchase Bitcoin on Trust Wallet will be a simple process. Go to Bitcoin, tap the “Buy Bitcoin” button, and fill in your payment details for your desired amount.

Can I Buy Bitcoin on Crypto.com?

Yes. If you want to know how to buy Bitcoin on Crypto.com, just download the app and go to your BTC wallet. Then you can enter how much you want and complete the payment.

Can I Buy Bitcoin on Uniswap?

No. If you can’t work out how to buy Bitcoin on Uniswap, that’s because Uniswap only supports Ethereum-based tokens. However, you can buy Wrapped Bitcoin (WBTC). You will need to buy another token like ETH or USDT first to swap for it, which you can do on a platform such as eToro.

Can I Buy Bitcoin on MetaMask?

No. If you’re wondering how to buy Bitcoin on MetaMask, unfortunately, Bitcoin is not one of the blockchains MetaMask supports. However, you can buy WBTC by clicking “Buy” and filling in the amount and token.

Final Thoughts

There are a lot of aspects to consider when buying Bitcoin, from which payment method to use, to when to buy it, to which strategy to employ. First and foremost, however, you will need to decide which platform to sign up with.

The ubiquity of Bitcoin means you have a lot of choices, but our top recommendation is eToro. This is because it is a reliable, regulated platform with unique features and competitive fees. You can see how easy it is to buy Bitcoin on eToro from the step-by-step guide above.

Frequently Asked Questions

The best time to buy Bitcoin will depend on your strategy. If you intend to hold for the long term, the exact timing isn’t that important, while a dollar-cost averaging strategy will mean making regular purchases, which you can set up automatically on Coinbase.

Once you’ve downloaded the app and funded your account, you can buy Bitcoin on Cash App by going to the Bitcoin tab, tapping “Buy BTC”, entering the amount you want, and then providing your PIN.

Yes. Unlike shares, Bitcoin and other cryptocurrencies are fractional. This means that you don’t need to have enough money to buy a whole number of coins—you can buy a tiny fraction of a Bitcoin instead.

You can buy a small fraction of a Bitcoin, and the minimum amount you can spend will depend on the platform you use. eToro, for example, lets you buy a minimum of $10 worth of Bitcoin, while on Coinbase you can buy as little as $2.

Beginners can buy Bitcoin by signing up with a user-friendly platform. Coinbase is our top choice for beginners as it makes the buying process very simple. Meanwhile, eToro’s intuitive interface means it is also a great place to buy Bitcoin for beginners.

You can purchase however much Bitcoin you like, though you should never spend more on it than you can afford to lose. You just need enough money to meet the minimum requirements for deposit and purchase sizes on your chosen platform. These are both $10 on eToro.

Related Content

Cronos (CRO)

Celsius (CEL)

SushiSwap (SUSHI)

Hamster (HAM)

Stratis (STRAT)

Libra (LIBRA)

Top Bitcoin Stories

Bitstamp to distribute Mt. Gox BTC from July 25

24 July 2024 Bitstamp plans to distribute Mt. Gox Bitcoin and Bitcoin Cash as from Thursday, July 25. The exchange…

Bitcoin hovers near $66.5k as Mt.Gox users ‘choose to hodl’

24 July 2024 Bitcoin price still hovers above $66k despite Mt. Gox repayments. Analysts say on-chain data shows most BTC…

Swan Bitcoin halts IPO plans and shuts down mining operations

22 July 2024 Swan Bitcoin delays IPO plans due to shutdown of its mining operations. CEO cites reduced revenue from…

Mark Cuban: Inflationary Pressure Could See Bitcoin Become Global Reserve

18 July 2024 Inflationary pressure and geopolitical uncertainty could see Bitcoin become a global reserve currency, states Cuban The billionaire…

StarkWare verifies first zero-knowledge proof on Bitcoin

17 July 2024 StarkWare has verified the first zero-knowledge (ZK) proof on the Bitcoin. It’s part of the core Starknet…