How to Buy Ethereum 2024 - Best Places to Buy ETH

...

Ethereum doubles as the name of the innovative blockchain network that allows developers to build decentralized applications and the name of the platform’s native coin.

The network is a pioneering project that made the blockchain programmable, showing that it could evolve from being just a payment network to providing the essential infrastructure for a thriving ecosystem of financial services, games, and interesting applications.

This guide will show you how to buy Ethereum in the USA, where to buy it, what payment methods to use, compatible crypto wallets, the pros and cons of buying ETH, and its suitability as an investment.

How to Buy Ethereum USA

The easiest way to buy Ethereum is to purchase it online from a crypto exchange. Exchanges make it easy to buy and sell Ethereum and other cryptocurrencies directly from your smartphone, tablet, or computer. Check out our recommended platforms below and follow the steps to safely buy Ethereum.

1. Choose a platform

Start by selecting a crypto exchange where you can buy ETH. It’s useful to find out about a platform’s fee structure and what features they offer before signing up. We’ve shortlisted some of the best platforms for buying ETH further down this page, but you can buy ETH right now by signing up with some of our top choices below.

2. Create and fund your account

Head to the registration page of your chosen platform and fill in all the details required. Before you deposit money, you’ll need to pass Know Your Customer (KYC) regulations which require you to provide a photo ID and personal info to complete the process. Once your account has been verified, select your chosen payment method to make a deposit.

3. Buy Ethereum

Once you have funded your account using USD, using a payment method such as a credit card or debit card, look for the trading pair for ETH and your local currency. You can create a market order to buy ETH at the current price. If you would prefer to specify a price at which to buy ETH in the future, you can create a limit order instead. Simply enter how much you want, and the price you want it at, and place the order.

Where to Buy Ethereum in the US?

1. eToro – Best Overall Place to Buy Ethereum in the US![]()

eToro is popular for its unique Copy Trading feature that allows users to copy the trading and investment decisions of more experienced investors. The platform stands out from its competitors by creating a vibrant community of 25 million users that can learn from one another.

It is also one of the most regulated crypto exchanges with licenses from the Securities and Exchange Commission (SEC) and Financial Industry Regulatory Authority (FINRA) in the United States, the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities & Exchange Commission (CySEC) in Europe, and the Australian Financial Services Licence (AFSL) in Australia.

The platform offers thematic investment portfolios that allow newbies and experienced users to spread their risk by investing in a portfolio of stocks or crypto assets that is built around a theme or industry that they understand. This way, users reduce their risk of choosing one or two digital assets that do not perform well.

Users can buy ETH along with over 75 other cryptocurrencies the broker offers. Transaction fees are ultra-low with a 0% commission for crypto trades thanks to their proprietary blockchain technology called eToroX.

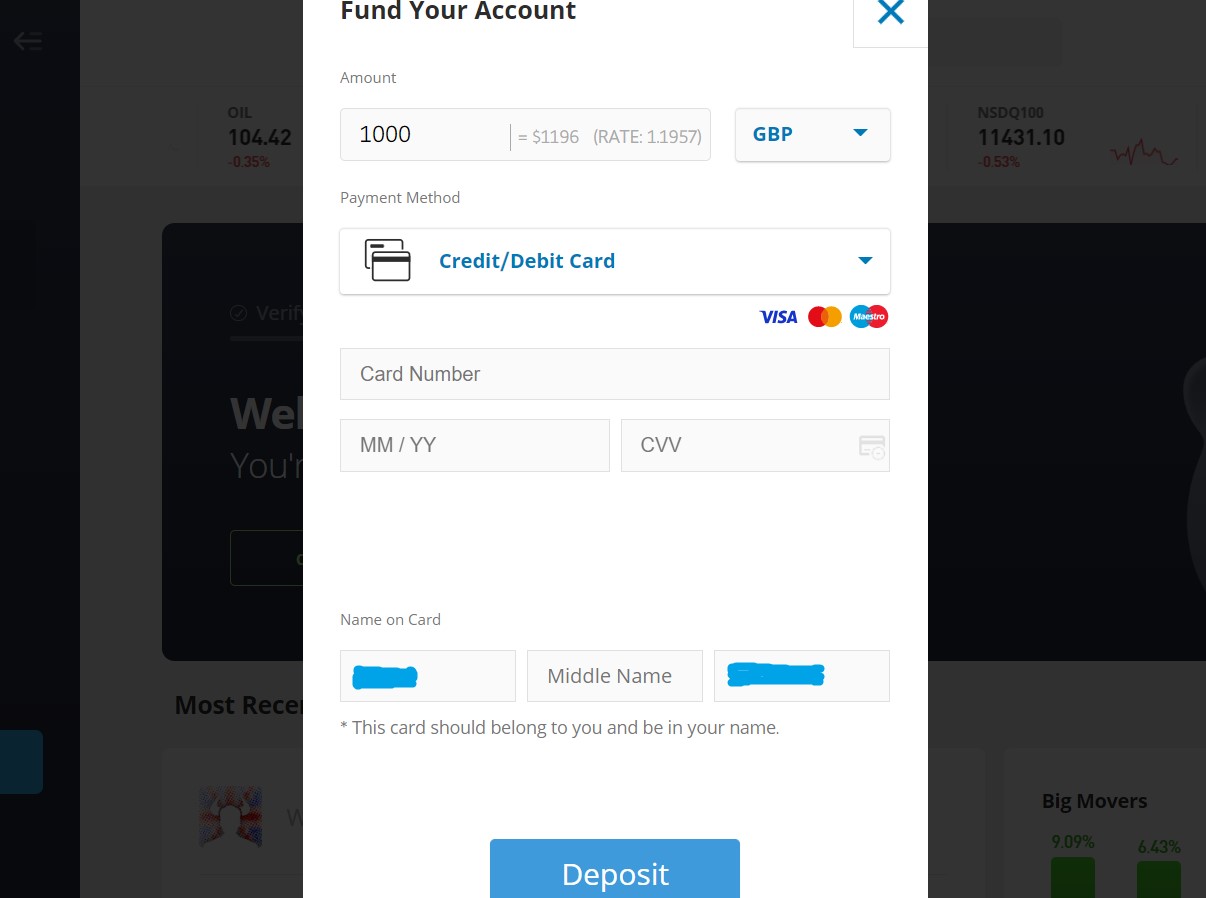

Deposits and withdrawals are favorable to users as they can deposit as little as $10 through several payment channels like credit/debit cards and electronic wallets like PayPal, Neteller, and Skrill. For withdrawals, eToro charges a $5 fee on all transactions above $30 which is, unfortunately, the minimum limit for withdrawals.

eToro does not charge for deposits, but your payment provider may. Bank deposits are subject to a minimum value of $500 while credit cards used for deposits must bear the same name as the account.

For purchasing Ethereum, you’ll need to create an account, and pass KYC by submitting a valid ID and proof of address documents like a utility bill or bank statement.

Read our full eToro review here.

Pros of eToro

-

Straight forward signup

-

Access to over 75 crypto assets

-

Access to both coins and CFDs

-

$10 minimum deposit

-

Free deposits on eToro’s end

-

Well regulated

-

Strong social investing features like copy trader

-

Affordable withdrawal fee ($5)

-

Mobile app

Cons of eToro

-

Unavailable to US citizens living outside the US

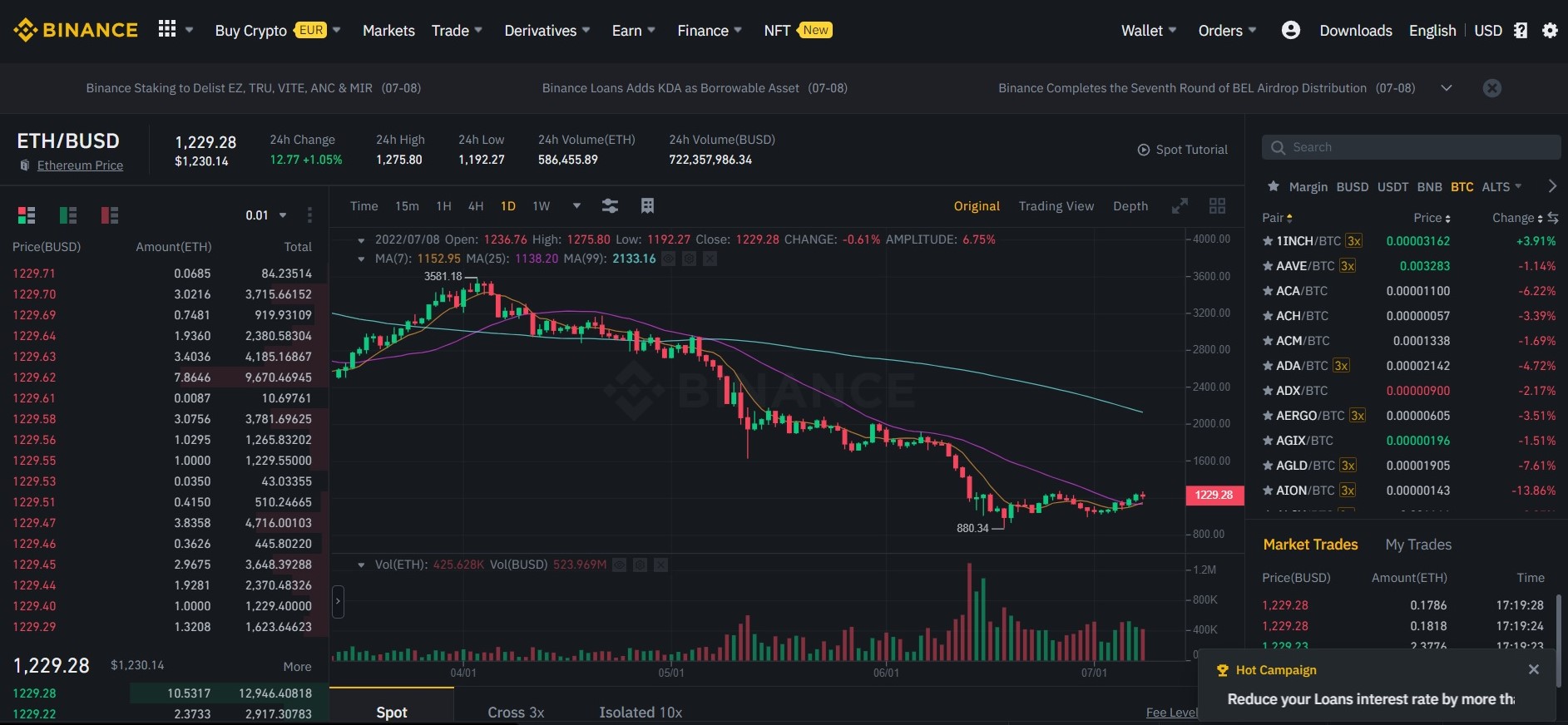

2. Binance – Best Exchange with Cheap Transaction Fees![]()

Binance is one of the largest crypto exchanges in the world with a vast collection of around 600 cryptocurrencies that run the gamut from major coins like Bitcoin and Ethereum to fan tokens like the Manchester City Fan Token, and DeFi gems like JEWEL.

Despite its massive coin selection, Binance’s low transaction fees are where it shines. The exchange charges a modest 0.10% for crypto transactions. If you hold its native coin, Binance Coin (BNB), you pay reduced fees, depending on how much BNB you hold.

When it comes to liquidity, Binance’s $76 billion daily trade volume is more than enough to facilitate large volumes of Ether.

You also have several options when buying ETH. You could use the straightforward Convert feature to buy Ethereum at the current market price. This feature is great for users who want to buy and store Ether.

For more sophisticated buyers, the classic trading terminal gives access to a chart and indicators for studying Ethereum’s price pattern and predicting future movements. And when you’re ready to buy, use the order interface to place dynamic order types like limit orders, market orders ,and OCO orders.

Binance makes depositing funds convenient with its support for about 61 different types of fiat currency through several payment channels like bank wires, bank deposits, SEPA Transfers, credit/debit cards, and third-party channels like Simplex.

Deposit fees vary with currency and payment method but are usually within affordable limits. The highest charges we found were 1.80% for credit card transfers and $15 for US SWIFT transfers.

Read more information in our full Binance Review here.

Pros of Binance

-

Low trading fees at a max of 0.10%

-

24/7 support but mostly through email

-

Affordable deposit and withdrawal fees at a max of 1.80%

-

Supports over 60 fiat currencies

-

Provides advanced trading tools and order types

-

Has a mobile app

Cons of Binance

-

The array of services could be overwhelming to new users

-

Limited crypto selection for US entity

3. Coinbase – Best Exchange for Beginners![Buying Ethereum on Coinbase]()

Coinbase is known for its smooth user interface and clean platform. The US-based exchange excels as a platform for beginners because it is one of the easiest crypto applications to use.

The exchange offers 193 cryptos, a number that is constantly growing as more coins periodically get added. You can find major coins, gaming tokens, and even meme coins within the collection, and US residents will find that it has the largest collection among US-based crypto entities.

Users also enjoy an all-in-one platform with staking and lending services and crypto-backed loans. Traders who wish to set limit orders to buy Ethereum at a lower price than its current market price can do so on the advanced trading platform.

New investors and crypto novices can use Coinbase’s convert interface to directly swap between coins for a flat 1% conversion fee. Trading fees are cheaper at 0.05% – 0.60% for immediate orders (taker fees) and between 0.00% – 0.40% for delayed orders (maker fees).

Depositing and withdrawing funds to/from Coinbase is just as easy as swapping tokens. The exchange supports several payment channels depending on the geographical regions, however, six major regions encompass the rest. They include the United States, Europe, Singapore, Australia, Canada, and the United Kingdom.

US users can choose between Apple Pay, Google Pay, PayPal, bank transfers, and credit and debit cards. To withdraw, users can choose between PayPal, wire transfers, and bank transfers.

Deposit and withdrawal fees vary depending on the payment channel. Credit card transactions cost 2.49% of the transaction value, bank transfers vary depending on the bank, and wire transfers cost $10 for deposits and $25 for withdrawals.

Creating an account is easy. You’ll need an email address and password. You also have to pass KYC using a valid ID and a proof of address documents like a utility bill or bank statement.

Read our full Coinbase review here.

Pros of Coinbase

-

Easy-to-use

-

Robust coin collection for a US entity

-

Over 100 countries supported

-

Educational resources for beginners

Cons of Coinbase

-

Support articles can be fuzzy about fees

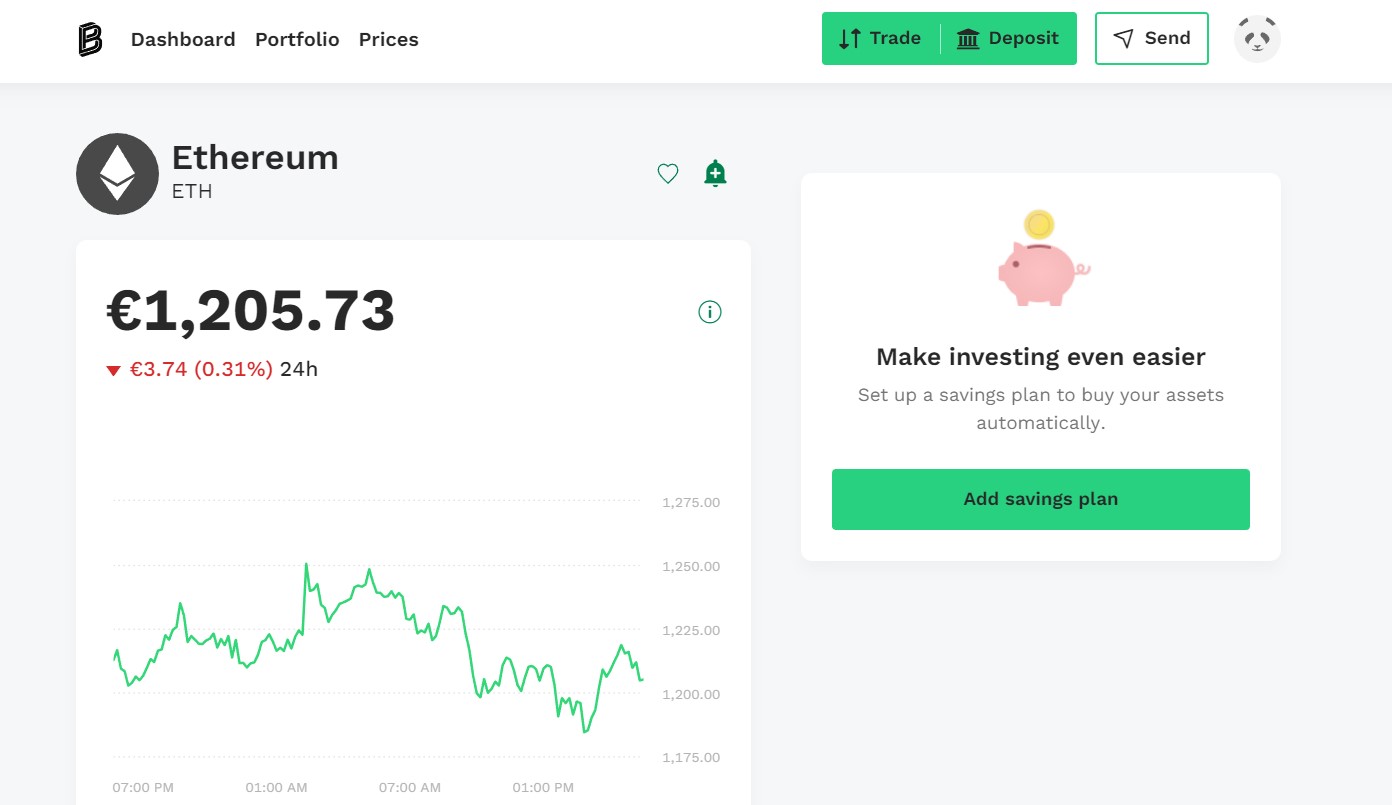

4. Bitpanda – Best Exchange for Traditional Investors![Buying Ethereum on Bitpanda]()

Bitpanda is a fintech firm known for its conventional feel, one that traditional investors are used to, making it an ideal way for them to enter the crypto space. This platform is geared toward helping investors manage their portfolios as a whole.

The platform’s most unique feature is its crypto indices that work like traditional ones in benchmarking the performance of certain sectors. These indices are composed of the top coins in the seven sectors they track.

They include the BCI Infrastructure index composed of 5 strong infrastructure projects, the BCI DeFi Leaders index composed of 5 top DeFi coins, the BCI Metaverse index composed of 5 top metaverse tokens, the BCI Smart Contracts index composed of 14 top smart contract blockchains, the BCI 5 index composed of the 5 most capitalized coins, the BCI 10 index composed of the 10 most capitalized cryptos, and the BCI 25 index composed of the 25 most capitalized cryptos.

Traditional investors can put money into any of these indices and enjoy growth in the sectors they track. If the market doesn’t perform favorably, they don’t lose as much as they would have if they invested in one or two coins.

For investors with a long-term horizon, Bitpanda offers a savings plan that automatically buys a set amount of Ether periodically once connected to a credit card. This way, investors can develop a set-it-and-forget-it investment schedule for Ethereum and accumulate the coin over long periods.

Deposits and withdrawals on Bitpanda are done in Euro, US dollar, British pound, Swiss franc, Danish krone, and Turkish lira through credit cards, bank transfers, SEPA transfers, Skrill, Neteller, and some region-specific channels.

Transaction fees are an affordable 1.49% for crypto transactions and are already priced into the cryptos on the in-built exchange. Traders pay a maximum of 0.10% for delayed trades (maker fees) and 0.15% for immediate trades (taker fees).

Finally, Bitpanda is licensed and regulated by the Financial Market Authority (FMA) Austria, the French Autorité Des Marchés Financiers (AMF), and the Czech Trade Authority.

Bitpanda Pros

-

Lists 170 cryptocurrencies

-

Innovative crypto indices

-

Automated crypto savings

-

Simple, easy-to-use platform

-

€25 minimum deposit and withdrawal

-

Pro platform for advanced traders

-

Well regulated

Bitpanda Cons

-

Supports only 8 types of fiat currency

-

Limited crypto products (no crypto card or lending service)

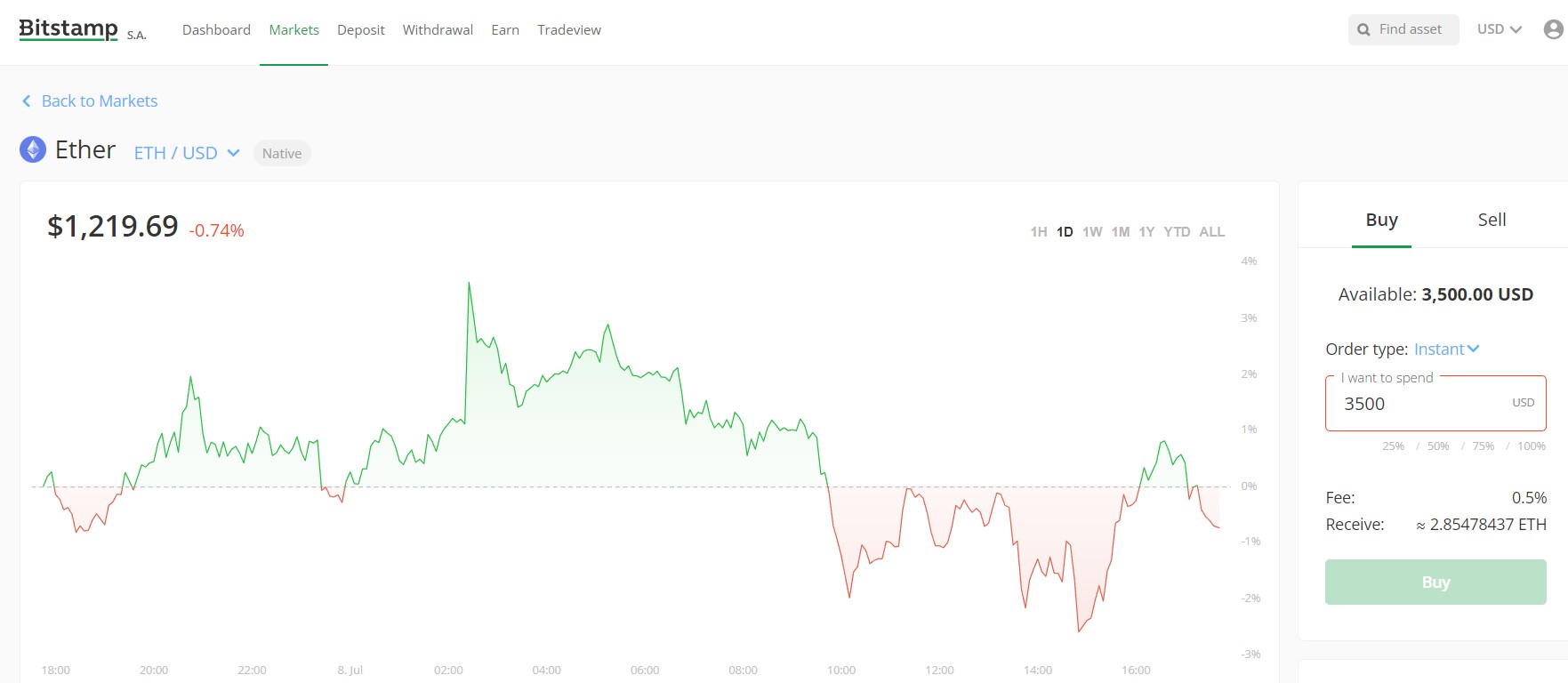

5. Bitstamp – Best Exchange for Reliability![Buying Ethereum on Bitstamp]()

Bitstamp is an enduring crypto exchange best known for its reliability, collection of over 75 cryptos, institutional-grade security, and 24/7 customer service. If you want an exchange that has a track record of always being around, Bitstamp is the place to go.

The platform’s interface is clean, straight to the point, and more conventional than regular crypto interfaces, making it suitable for both traditional and novel investors. The simple platform is packed with a powerful trading terminal, staking services, and an accompanying mobile app to help manage portfolios on the go.

Investors can easily swap between coins at market cryptocurrency prices without using the trading terminal while traders can access the industry standard trading platform to set dynamic order types.

Trading fees are slightly higher than some competitors at 0.50% for trades under $10,000. However, higher volumes attract lower fees.

Deposits are quick and easy with payment channels like SEPA transfers, credit or debit cards, international wires, and bank transfers. Withdrawals also use the same channels.

Bitstamp transfer fees are affordable at 5% for credit cards, free for ACH, Faster Payments, and SEPA, and 0.05% for international wire. Withdrawal fees include €3 for SEPA, £2 for Faster Payments, free for ACH, and 0.1% for international wire.

To create an account, you’ll need an email address and KYC documents like an ID card and a utility bill.

Bitstamp Pros

-

Strong reputation for being reliable

-

Institution-grade security

-

$25 minimum deposit

-

Mobile app for on-the-go trades

-

24/7 customer service

-

Transparent fees

Bitstamp Cons

-

Higher trading fees than most competitors

-

Limited deposit and withdrawal methods

What Is Ethereum?

The Ethereum blockchain is programmable and can be used to build and access decentralized applications (dApps)—apps that run on the blockchain. This has created an open internet of services that anyone with a wallet can use. Ethereum has become home to a system of decentralized finance (DeFi), which is services such as decentralized applications or decentralized exchanges (DEXs), lending, and yield farming that don’t require a central authority.

This is possible thanks to Ethereum’s innovation of blockchain-based smart contracts, which are computer programs that execute automatically when certain conditions are met, removing the need for intermediaries between users.

Ethereum also has token standards that enable the creation of new tokens that are hosted on the Ethereum network. These include thousands of other cryptocurrencies and non-fungible tokens (NFTs).

The project’s native token is Ether (ETH), which is needed to pay for transaction costs known as “gas”. Transferring tokens, accessing dApps, and deploying smart contracts all incur gas fees, while ETH can also be used for sending payments and staking.

What Payment Methods Can I Use to Buy Ethereum?

Several payment methods can be used to buy Ethereum, however, they differ in various ways. Some payment methods work better in certain regions and with certain currencies, some are faster, and others are cheaper. Here are some of the payment methods you can use to buy Ethereum.

Getting Ethereum with Credit or Debit Card

Credit card or debit cards are the most widely accepted purchase and deposit method for Ether, but it is also one of the most expensive. The cost of using credit cards varies with the platform, but we found that you can buy Ethereum with a credit card on Binance for 1.80%. Coinbase charges around 3.99% while eToro doesn’t charge a fee to deposit using credit cards.

Bank Account Transfer

Bank account transfers are a good method for crypto exchanges that have a local presence. However, it is beholden to the financial regulations in countries. For example, bank account transfers could take days to clear in the US and are not supported in countries like Nigeria.

Bank account transfers cost $1 on Binance, and 1.49% on Coinbase, and are free on eToro but subject to a minimum of $500. ACH transfers are free on virtually all platforms that support it, like Coinbase and Binance

Buy ETH with PayPal

PayPal is the leading electronic wallet payment method, however, it is not available for users outside the EU, UK, US, Canada, and Australia for most brokers, it is accepted in most peer-to-peer (p2p) marketplaces. You can now also buy Ethereum directly through your Paypal account, simply log in and you should see the option.

You can buy Ethereum with PayPal on Coinbase in the US or on Binance’s p2p market at no cost.

Purchasing Ether with Skrill

Skrill is another online wallet provider that is widely accepted, but mostly on p2p marketplaces. If you want to buy Ethereum directly with Skrill, head to eToro.

SEPA Transfers

SEPA transfers are for users in the UK and Eurozone. It is one of the cheapest methods of buying crypto and is accepted by virtually all exchanges that operate in Europe. Exchanges like Bitstamp do not charge for SEPA transactions while Binance charges €1.

How to Buy Ethereum USA - Step-by-Step Guide

Our tutorial focuses on purchasing Ethereum on eToro as it is our overall best place to buy because of its straightforward signup process, global reach, and affordable fees. To buy Ethereum instantly on eToro, follow these steps.

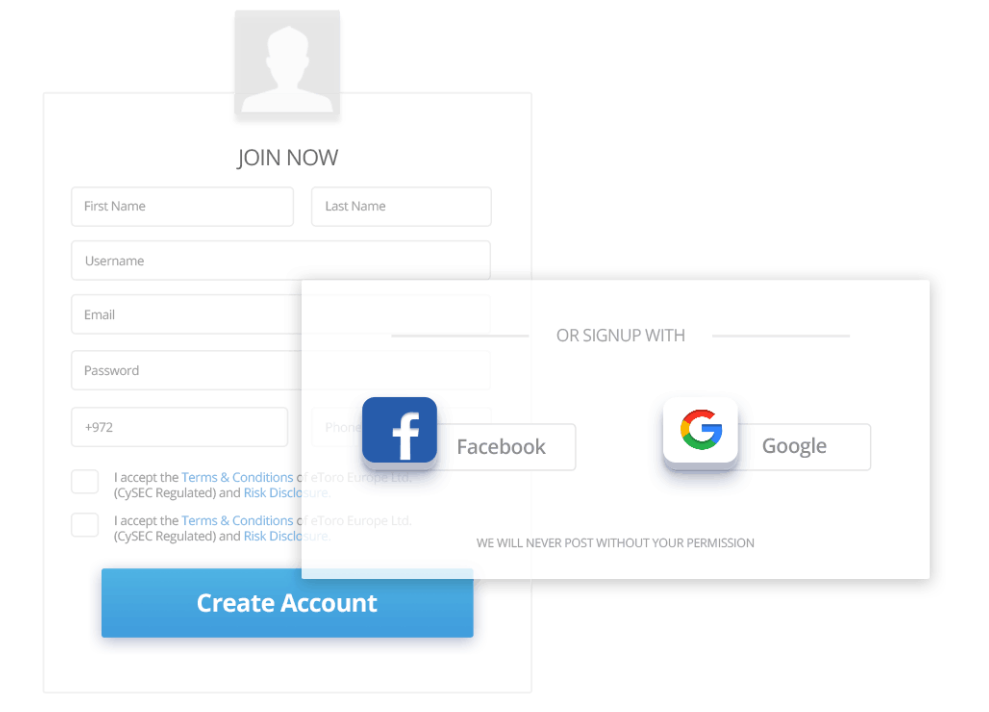

Step 1: Create an eToro account

Go to the eToro website and create an account by clicking on the Start Investing button on the homepage. Fill in your details on the signup form that pops up. You can sign up with your email address and phone number, your Google account, or your Facebook profile.

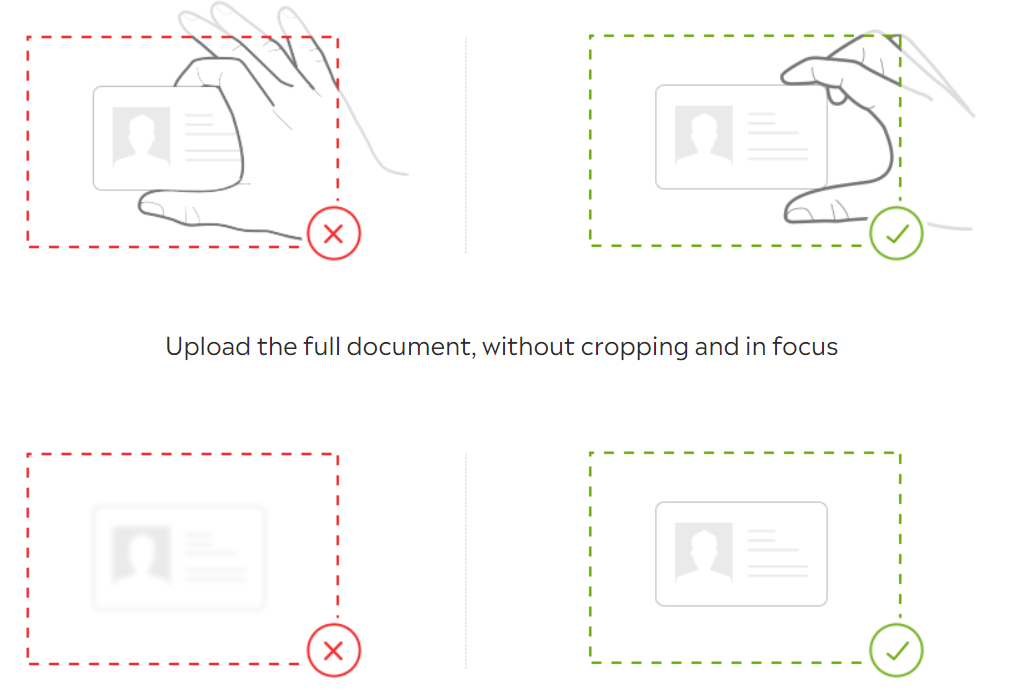

Step 2: Complete your profile and pass KYC

After creating your account, you’ll need to pass KYC by completing your profile and uploading the required documents, usually a valid form of ID and a proof of address document. When uploading your details, ensure that your ID is visible, not covered by your hand.

Step 3: Fund your account

You’ll need a minimum of $10 to fund your eToro account. You can either deposit via a bank transfer, credit card, Skrill, or Neteller.

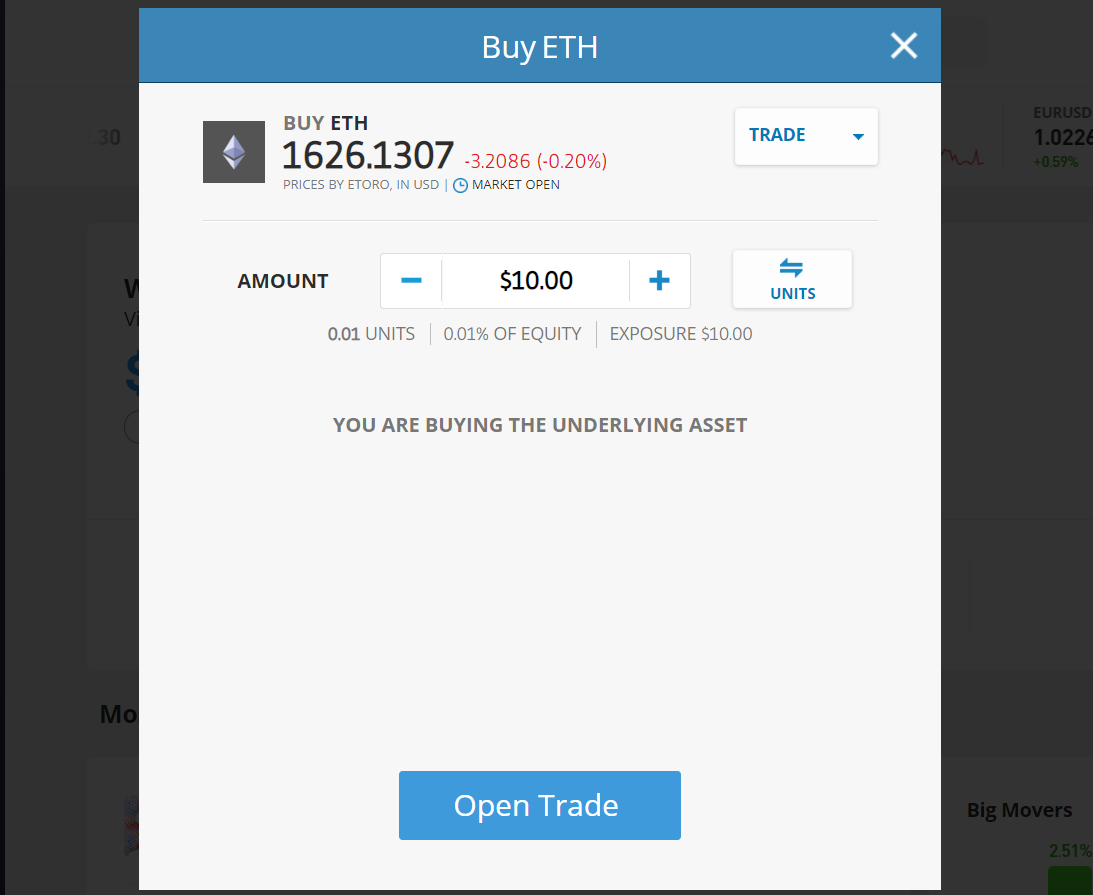

Step 4: Search and Purchase Ethereum

Search for Ethereum in the search bar and click trade now. In the new window, click on Trade. Input the amount of Ethereum you wish to buy and click on Open Trade.

Ways to Invest in Ethereum

Investors differ in the way they buy ETH. Some purchase it for the long term while others prefer to sell it for a profit as soon as possible. How you invest in ETH will depend on your aims and experience, as we’ll see below.

Buy and Hold Ethereum

The simplest Ether investment strategy to follow is to buy and hold, which involves exactly what you would expect- buy Ether and add it to your investment portfolio. This requires very little skill, hardly any of your time, and is popular with people who believe ETH will become more valuable over time.

Ethereum is gradually transitioning to a Proof of Stake network, which will be secured by staking rather than mining, which currently secures the network. In the meantime, long-term ETH holders can stake their tokens in the ETH 2.0 contract to earn staking rewards. This can make Ethereum work almost like a passive income.

While buying is best done with online crypto exchanges or brokers, there are some Ethereum ATMs that allow you to purchase and sell ETH at real-world locations using fiat currency.

Trade Ethereum

Ether also lends itself to trading within the crypto market as its price is highly volatile. This means that traders can take advantage of price changes by buying and selling ETH over shorter time frames to generate profits more frequently. Like buying and trading stocks, this will take up more of your time, and may require skills such as technical analysis.

If you want to trade with your tokens regularly, transferring them from a private wallet every time can be cumbersome. Web wallets tend to be less secure than hardware or software wallets but are more convenient for traders and are provided for free by cryptocurrency exchanges.

Trading does not necessarily mean buying Ethereum with fiat currencies alone, some times traders will find better strategies when they trade coin to coin or C2C. This way, you could take advantage of price fluctuations across other cryptocurrencies.

Mine or Stake Ethereum

Mining is usually reserved for the technically savvy as it requires specific equipment and expertise to ensure nodes always run properly. However, the coming Ethereum 2.0 has created an opportunity for the regular Joe to profit from mining, called staking.

Staking is a way to earn rewards for securing a blockchain network, in this case, Ethereum. By delegating your Ethereum to stake pools, you can earn a yearly return in the form of more ETH.

However, you need to already have ETH which will be locked while staking until Ethereum 2.0 is fully operational.

Choosing an Ethereum Wallet

You’ll need a place to store Ether, especially if you plan to hold it for a long period, or when wishing to send or receive ETH. This is where an Ethereum wallet comes in handy. When choosing a crypto wallet, remember to check security, ease of use, compatibility, and reputation. If you’re using a wallet where you have the private key be sure to keep it safe and separate from the wallet. the same applies to passwords for your exchange accounts.

Ethereum Software Wallets

This type of wallet is sometimes called a hot wallet as they are almost always connected to the internet, they can be divided up into the following:

-

Web wallets: These wallets come either as a browser extension, web app, or centralized exchange. They can be non-custodial where you maintain control of your funds at all times or custodial where an entity holds your funds. These wallets are ideal for people who trade assets often and do not store large amounts of ETH. Some examples of web wallets are those belonging to the platforms listed above.

-

Mobile wallets: Mobile wallets provide a way to interact with your cryptos from anywhere. You’re good to go once you download them on your phone and set them up. Mobile wallets that support Ethereum include the Exodus wallet, Coinbase wallet, and the MetaMask mobile wallet.

-

Desktop wallets: These wallets are downloaded and run on a computer and store your private keys on your system. Popular desktop wallets include Exodus and Atomic.

Physical and Hardware Wallets

Opposite to hot wallets, hardware and physical wallets are sometimes called cold wallets as they don’t connect to the internet or only when required.

-

Hardware wallets: These wallets are physical devices that store your private keys offline, making it exceedingly difficult for intruders to access your crypto wallet. This feature makes it the most secure form of crypto storage for large sums. Popular hardware wallets include Ledger, BitBox, and Trezor.

-

Paper wallets: Paper wallets are wallets where the private and public keys are printed on a piece of paper and kept offline. They have mostly been discontinued since the rise of hardware-type wallets.

Wallet combinations

Some wallets are compatible with others. For example, the Ledger wallet can be used with MetaMask to transfer coins directly from the hardware wallet when interacting with dapps.

Is Ethereum a Good Investment?

Whether or not Ethereum is a good investment depends on your goals, expectations, and time horizon. However, when deciding, keep these points in mind:

Firstly, the Ethereum network is the largest blockchain ecosystem in existence today with a total value locked of $48 billion, down from an all-time high of $151 billion because of a downtrend. It powers hundreds of DeFi applications, games, NFTs, decentralized VPN services, decentralized computing services, and many more.

The value of the underlying technology remains unquestioned, even in bear markets. And as the ETH coin captures that value, it remains a viable investment in the long run that will continue to grow as the technology expands and crypto gains mainstream adoption.

Secondly, the network was built by people with serious technical chops like Gavin Wood, a Ph.D. in Computer Science who worked at Microsoft before co-founding Ethereum. Gavin built several technologies for Ethereum, like its smart contract language, and later went on to found Polkadot, the first multi-chain solution of its kind.

Other prominent founders are Vitalik Buterin, Charles Hoskinson who went on to build the Cardano blockchain, Joseph Lubin who later founded ConsenSys, and Anthony Di Lorio who founded Decentral. These men are all thought leaders in the space who have founded very successful enterprises.

Thirdly, as Ethereum evolves and merges into Ethereum 2.0, it will move away from the proof-of-work model to a proof-of-stake mechanism which will dramatically slash its power requirements, making it faster and cheaper to use. The high transaction fees Ethereum is currently known for will be significantly reduced and retail users will be able to participate in the ecosystem.

The influx of new retail users will increase the demand for ETH as they interact with applications.

Lastly, institutional interest in Ethereum has been steadily growing as institution-based holdings of Ethereum were up 19% in Q3-2021, according to SEC filings. Institutions with crypto holdings include the Rothschild Investment Corp, Ark Invest, Standard Chartered, JP Morgan, Goldman Sachs, Fidelity, and Black Rock.

These institutions prefer to hold Bitcoin and Ethereum, citing them as the two coins with the most stability and potential.

What are the Pros & Cons of Buying Ethereum?

When it comes to investing in any context, it’s crucial you have a clear understanding of both the benefits and potential for return, along with the associated risks to investment.

Such transparency will help you make wiser decisions when investing in ETH and cryptocurrency, negating potential losses when you buy and sell.

Ethereum is a slightly different proposition to Bitcoin, as the blockchain houses many different business ventures and ideas. This means that the de facto cryptocurrency of the Ethereum network (Ether) is used for far more than just payments between individuals and companies.

With this in mind, we’ve looked at both the pros and cons of buying Ethereum;

Pros

- Conventional currencies like the Pound, Euro and Dollar are all governed by a central institution. When a national institution makes the decision to lower or raise interest rates, the associated currency experiences significant changes in value almost immediately. Unlike conventional fiat currencies, Ethereum is not governed by a central authority and is therefore immune to such volatile value changes. This is known as ‘decentralisation’.

- Sole-ownership of holdings and the potential for anonymous trading make Ethereum an enticing investment prospect.

- Ethereum is a blockchain that runs not just a cryptocurrency, but many different things. Want to invest in collectable digital pets? Ethereum has this. Want to buy an ICO token? Ethereum has this. Overall, if Ethereum is becoming the blockchain of choice for all of these projects, the value of the currency is more likely to go up and up over a longer period of time.

- Smart contracts. These things completely opened up a new way for people to invest in new projects and businesses. ICOs are all ran on the Ethereum network, meaning the currency is going to be vital to the eventual growth of the cryptocurrency market.

Cons

- Newcomers to cryptocurrency might not be prepared for the slightly advanced nature of the Ethereum network. Bitcoin is a far easier prospect to understand; one blockchain, one currency, one idea. Buying Ethereum isn’t just an investment in the actual asset, but also a vote of confidence for the wider Ethereum network. It’s a complicated world and needs to be understood well in order to profit properly.

- A lack of regulation in the crypto sector has implications for buying Ethereum. With no governing bodies overseeing things, there’s always the chance of prices suddenly soaring or crashing considerably. However, you can trade on Ethereum’s price with fully regulated brokers – this then mitigates your risk when dealing with cryptocurrencies like Ethereum.

- Although Ethereum has a lot more technical advancement over Bitcoin, its value isn’t as well understood. This can cause the price to fluctuate solely based on news rather than changes in technology.

What mistake should users avoid when attempting to buy cryptocurrency?

“Many people go into crypto thinking that they will make their fortune overnight. This is not the case. Plan for the long term. Find a project that you believe in and that aligns with your values. And don’t make the mistake of not doing your own research. Going all in is a rookie error. Only ‘invest’ what you can afford to lose. Crypto is extremely volatile, and as with all investments, there are winners and losers – unfortunately, many will lose. The worst mistake a user can make is panic buying and selling. Have a plan, and stick to it. As a wise person once said… plan the trade and trade the plan.”Nimantha Siriwardana

Co-Founder & CTO of Metacask

Should I Buy Ethereum Now? - Things to Consider Before Buying Ethereum

Knowing when to buy a coin can save time and get you in at a favorable price. If you’ve decided that Ethereum is a good investment, consider these factors before buying.

Ethereum Fees & Regulations

Purchasing Ethereum comes with network fees that are currently too expensive for retail investors because the network isn’t scalable. However, after the “merge” which will take place in August 2022, Ethereum should be cheaper and faster. This will increase the demand for ETH as more users use it to pay for transactions.

Crypto exchanges also charge exchange fees when selling crypto which can be found in the Where to Buy Ethereum section of this page. Exchange fees are usually quite cheap with some completely subsidizing swaps.

Finally, crypto remains largely unregulated in many parts of the world. However, in the UK, there are no laws against holding tokens and major brokers like eToro are regulated by the Financial Conducts Authority. You may have to pay taxes on any money made when you buy and sell. An example is capital gains tax in the UK. The same applies to the US and the Eurozone.

Ethereum’s Price

The Ethereum price, like many other tokens, can move significantly within a short period (price volatility), however, you can predict its price movements by watching the market trend and past performance, Bitcoin has a huge impact on the entire market so if Bitcoin is trending up, it is highly probable that Ethereum is also.

New developments in the project and regulatory changes also affect ETH’s price. For example, an upgrade in Ethereum’s scalability (via the “merge”) could improve its price.

Check out our dedicated Ether price and Ether price prediction pages for more detailed information.

Buying Ethereum Safely & Securely

Newbies who don’t have a lot of technical expertise should stick to reputable centralized exchanges. These platforms invest significant effort into securing their client’s funds and preventing fraud.

Ensure you have two-factor authentication set up and use strong passwords, preferably ones with alphanumeric characters. Avoid obvious things like birthdays or the name of your favorite child.

When you have purchased Ethereum, you’ll need a safe place to store it. Centralized exchange wallets are a good short-term option. If you plan to hold for years, a hardware wallet is ideal. Ensure that your private keys are always kept offline, do not save a screenshot on Google Drive or iCloud.

3 Tips to Buy Ethereum

We have three main tips to share with you regarding the purchase of Ethereum, although you can easily apply them to any crypto out there and even other assets. Those are as follows:

Choose the Right Time and Do Your Own Research

Our first tip is to think for yourself. Never invest due to someone else’s advice to do this or don’t do that. It is easy to follow someone else’s lead and make a mistake. Do your own research, and pick the best time to buy, which is typically when the price is as low as it will go — once again, according to your own research and assessment.

Comparing Costs to Buy Ethereum

We mentioned this briefly before, but let’s make it official — don’t just use the first broker or exchange that you come across. They all offer different rates, fees, and other aspects that matter to you, as a trader. Compare their deals and offerings, and choose the one that will help you make (and keep) the most money.

Safety and Security

Lastly, never underestimate safety and security. That means securing your wallet, using proper security software to protect your information, don’t write down the wallet’s private key on your phone or PC, don’t avoid two-factor authentication because it is bothersome to type in a code sent to your phone every time you log in, and alike.

Avoiding these will save you literal seconds, and can end up costing you thousands of dollars if your account or wallet gets compromised.

Is it Legal to Buy Ethereum in the USA?

Buying cryptocurrencies such as Ethereum is completely legal in the USA. However, the SEC requires projects and platforms offering digital assets to follow specific guidelines. The regulators are pretty keen to protect investors from fraudulent projects.

As you will see in the section below, plenty of platforms allow you to purchase ETH if you reside in America. As a trader, you are likely to be taxed by the IRS for any income made from the activity. Therefore, it’s always good to keep a detailed record of your trades.

Where Can I Use Ethereum in the USA?

There are plenty of businesses that accept crypto in the USA, and spending your ETH should not be an issue. The nation leads when it comes to embracing technology, and even regulators are pretty careful not to stifle innovation.

It’s possible to buy coffee, shop online using ETH, and pay for services using the coin, for example, pay a freelancer for any services with ETH. Also, you can sell your coins at an ATM for fiat or convert your holding into fiat using various platforms and spend the money as you like.

The USA has the most crypto ATMs compared to any other nation with over 21,000 machines that allow the purchase and sale of over 10 cryptocurrencies including ETH quickly. New York has the most machines with over 2,800, followed by Saint Louis 2,374, Georgia 2,114, San Diego 1,841, and Miami 1,811.

Selling Ethereum

No matter which trading strategy you decide to you use there may become a time when you wish to sell Ethereum, whether that be to fiat currency or other cryptocurrencies.

Selling on most platforms is a straightforward process differing only slightly from the buying process. An example for Toro you have to select Ethereum from your portfolio and then click the button which reads “close”.

Another example for Coinbase, select Ethereum from your assets, click trade, then click “Sell ETH”, enter the amount, select “preview sell” and finally press “sell now”.

What Other Platforms Can I Buy Ethereum On?

There are several platforms you can buy Ethereum on, so much so that newbies often run into problems deciding which to choose. We listed the most popular exchanges and answered questions on whether or not you can purchase ETH Ethereum on them.

Can I Buy Ethereum on eToro?

Yes. You can buy Ethereum on eToro by first creating an account, passing verification, and connecting a funding method. You can then search for and buy Ethereum. A more detailed guide is available above.

Can I Buy Ethereum on Coinbase?

Yes. You can buy Ethereum on Coinbase by creating an account and connecting a credit card or bank account. Coinbase makes it particularly easy to buy Ethereum.

Can I Buy Ethereum on Binance?

Yes. You can buy Ethereum on Binance by following the same steps as above to create an account. Binance supports multiple currencies, more than most exchanges.

Can I Buy Ethereum on Robinhood?

Yes. US users can buy Ethereum on Robinhood. Simply download the mobile app, create an account, fund it and buy Ethereum.

Can I Buy Ethereum on Trust Wallet?

Yes. the Trust wallet connects to decentralized exchanges where you can purchase Ethereum. Alternatively, you can use its in-built swap feature to buy Ethereum instantly. However, you’ll need other tokens, like USDT or BNB, to swap for ETH.

Can I Buy Ethereum on Crypto.com?

Yes, you can buy Ethereum on Crypto.com. Download the app, create an account, pass KYC, and add a funding method, they accept Apple pay. Then access the in-built exchange and purchase Ethereum.

Can I Buy Ethereum on Uniswap?

Yes, however, Uniswap is a decentralized exchange so you’ll need a decentralized wallet like MetaMask to use it. Go to the Uniswap website, connect your wallet and swap an already owned crypto, like USDT, for ETH.

Can I Buy Ethereum on Metamask?

Yes, you can buy Ethereum on MetaMask. You can either connect to a decentralized exchange or use the in-built swap feature.

Final Thoughts

The Ethereum blockchain network enables the deployment of decentralized applications. It is currently the largest blockchain ecosystem with an all-time high value locked of $151 billion. Ethereum (ETH) is the native coin that powers the ecosystem.

There are several places to buy Ethereum, however, eToro is our top choice because it is well regulated, has a large user base of 25 million users, and allows traders to copy the trades and investment decisions of more experienced users.

If you wish to purchase Ethereum immediately, go to the eToro website, sign up for an account, submit KYC documents (ID card and utility bill or bank statement), and add a funding method like a credit card, bank account, or electronic wallet like Skrill. We have a more detailed step-by-step process above.

Before buying ETH, you should consider whether or not it is a good investment. Ethereum has a few factors that make it viable in the long term. The fact that it is a robust ecosystem built on solid technology is just two of the reasons why it is worth looking into.

Other reasons include the fact that major institutions like Goldman Sachs, BlackRock, and Fidelity hold ETH in their portfolio and that the coming Ethereum 2.0 upgrade will make the network accessible to retail users, increasing demand for the coin.

After buying, ensure you store your coins in a secure crypto wallet. You can use a crypto exchange wallet like that of eToro or Binance if you trade cryptocurrency often. If you plan to hold a significant amount of ETH for a long period, a hardware wallet is the safest option.

Frequently Asked Questions

Yes. You can sign up to eToro immediately, fund your account, and buy Ethereum ETH.

You may buy Ethereum because of its long-term potential. After the Ethereum 2.0 upgrade, a portion of the ETH supply used for transaction fees will be burned (taken out of circulation forever). Although Ethereum 2.0 will have inflationary mechanics, if the demand for the coins outpaces the yearly inflation, ETH may increase in value over time.

Yes. Centralized exchanges pair several currencies with Ethereum so you can buy using USDT, USDC, DAI, BTC, and many more.

You’ll need a cryptocurrency exchange account. To get verified, you’ll need a government-issued ID and proof of address documents like a utility bill or bank statement. After purchase, you’ll need a wallet to store ETH.

Yes. You can buy Ethereum on PayPal if you live in the US. However, you can buy ETH with PayPal on p2p markets on exchanges like Binance.

The easiest way depends on your location and the payment channels available to you. However, we’ve found that most people find Coinbase the most straightforward of the bunch.

That depends on your goals and expectations. There are pros and cons of purchasing Ethereum, but ultimately, you must decide for yourself. However, to help with your decision, check out the section that talks about Ethereum as an investment.

How Much Ethereum you can buy depends on the cryptocurrency exchange you use. For example, the minimum amount that can be purchased on Binance is $10 worth of ETH. On eToro, it is also $10. However, decentralized exchanges have no minimum limit.

Ethereum 1.0 has about 80 million coins. However, after the upgrade, Ethereum will have no upper limit. Instead, yearly inflation will be implemented. This will make ETH an inflationary coin that naturally loses value every year. However, there is also a burn program that takes a portion of ETH used to pay for transactions out of circulation.If the amount taken out of circulation exceeds the yearly inflation, then ETH will increase in value. Ultimately, if demand outpaces supply, ETH will continue to rise in the long run.

Related Content

Cronos (CRO)

Celsius (CEL)

SushiSwap (SUSHI)

Hamster (HAM)

Stratis (STRAT)

Libra (LIBRA)

Ethereum News

US SEC approves Ethereum ETFs, Grayscale spot Ether ETFs launch on NYSE Arca

23 July 2024 US SEC approves Ethereum ETFs after years regulatory process. Grayscale has launched two spot Ether ETFs on…

SEC directs final S-1 submissions for Ether ETFs with target launch on July 23

15 July 2024 SEC mandates final S-1 filings for Ether ETFs by July 16, launch set for July 23. Invesco,…

Dough Finance flash loan attack: What we know so far

12 July 2024 Dough Finance lost $1.8M in a flash loan attack due to smart contract vulnerability. Attacker exploited unvalidated…

Ethereum Name Service (ENS) price jumps on rebranding news

28 June 2024 Ethereum Name Service rebranding has sparked market excitement ENS has surged by 8.48% to $28.46 over the…

SEC chair says S-1 approvals for spot Ether ETFs in the summer

13 June 2024 SEC Chair Gary Gensler told lawmakers on Thursday that he sees spot Ethereum ETFs’ S-1 filings approval…