The Top 21 Fastest Growing Cryptocurrencies to Buy in 2024

To maximize your gains from the crypto market, you need to invest in the fastest-growing cryptocurrencies in whichever year or season you find yourself. While most cryptos grow during bull markets, there are those whose growth is faster than the market average.

Even in bear markets, these cryptos may easily bounce back from price declines because of the value their ecosystems provide or due to hype in the crypto market. Whatever the reason for a crypto’s growth, fast-growing cryptos offer investors an opportunity to profit relatively quickly.

We have created a guide for 20 of these cryptos which dives into what they are and why they are good investments.

The Fastest Growing Cryptocurrencies To Buy In 2024

- Poodlana ($POODL) – Best Lifestyle-Inspired Solana Memecoin

- Solciety ($SLCTY) – Best Politically-inspired Memecoin

- BitBot ($BitBot) – Best New Crypto Trading Bot

- Memeinator (MMTR) – Best New Memecoin

- Bitcoin Dogs ($0DOG) –Best Bitcoin BRC-20 Token

- Shiba Memu (SHMU) – Best Marketing Platform

- Chancer (CHANCER) – Fastest Growing Betting Platform

- Alt Signals (ASI) – Fastest Growing Trading Service

- Metacade (MCADE) – Fastest Growing Gaming Community

- Arbitrum (ARB) – Fastest Growing Layer 2

- Polygon (MATIC) – Fastest Growing Scaling Solution

- Render (RNDR) – Fastest Growing Render Network

- Apecoin (APE) – Fast Growing Metaverse

- Lido (LDO) – Leading Liquid Staking Protocol

- Pepe (PEPE) – Fast Growing Meme coin

- Sui (SUI) – Fast Growing Blockchain

- Treasure (MAGIC) – Growing Gaming Infrastructure

- Chainlink (LINK) – Leading Oracle Service

- Ordi (ORDI) – Leading Bitcoin Ordinal

- Rocket Pool (RPL) – Fast Growing Liquid Staking Service

- Ethereum (ETH) – Largest Blockchain Platform

The Fastest Growing Cryptocurrencies Compared

|

Cryptocurrency |

Category |

Blockchain network |

Market Capitalisation |

Where to Buy |

| Poodlana ($POODL) |

Memecoin |

Solana |

None yet |

|

| Solciety ($SLCTY) |

Memecoin |

Solana |

None yet |

|

| Bitcoin Dogs ($0DOG) |

Gaming |

BRC-20 |

None yet |

|

| Memeinator (MMTR) |

Memecoin |

Ethereum |

None yet |

|

|

Bitbot (BITBOT) |

Utility |

Ethereum |

None yet |

|

|

Arbitrum(ARB) |

Layer 2 |

Ethereum |

$1.24 billion |

|

|

Polygon (MATIC) |

Layer 2 |

Ethereum |

$6.53 billion |

|

|

Render (RNDR) |

Services |

Ethereum |

$800 million |

|

|

Apecoin (APE) |

Metaverse |

Ethereum |

$808 million |

|

|

Lido (LDO) |

Liquid Staking |

Ethereum |

$1.94 billion |

|

|

Pepe (PEPE) |

Memecoin |

Ethereum |

$733 million |

|

|

Sui (SUI) |

Layer 1 |

Sui |

$469 million |

|

|

Treasure (MAGIC) |

Gaming Infrastructure |

Arbitrum |

$184 million |

|

|

Chainlink (LINK) |

Oracle |

15+ |

$3.36 billion |

|

|

Ordi (ORDI) |

Ordinal |

Bitcoin |

$155 million |

|

|

Rocket Pool (RPL) |

Liquid Staking |

Ethereum |

$761 million |

|

|

Ethereum (ETH) |

Layer 1 |

Ethereum |

$235 billion |

Our Top 21 Fastest Growing Cryptocurrency Coins Reviewed

Poodlana (POODL) – Lifestyle-Inspired Solana Memecoin

In a sea of flat dog-inspired memecoins with no edge, Poodlana stands out as the creme de la creme of lifestyle, fashion, and class by redefining what it means to be fabulous in the digital age.

Why invest in POODL?

According to a news report from Coindesk, 80% of memecoins’ price growth occurs during Asian trading hours, making the Asian market vital to their success.

POODL is inspired by the Poodle dog breed, the third most popular breed in the Asian region. Considering that most of the strongest memecoins on Solana are tied to real-world narratives, the project can create a strong narrative by keying into the region’s love for the Poodle breed.

Crypto ranking data shows that memecoins popular in Asia tend to perform well globally and reach million-dollar market capitalisations. Some examples are Peipei ($78 million market cap), Biaoqing ($12.97 million market cap), and KFC ($195 million market cap).

By differentiating itself as a high-class memecoin for the fashion elite based on a popular dog breed, POODL can lock into a popular narrative and achieve breakout growth.

Risks in investing in POODL

Most memecoins that try to start (or key into) a popular narrative eventually fail. POODL’s success relies largely on its positioning as a high-class memecoin that is a step above the rest and its fair launch. Like most memecoins, it has no utility and is a risky venture.

POODL has a total supply of 1 billion tokens, 50% of which will be offered for sale in the 30-day presale event starting on July 3rd. After the presale, the token will be listed on Raydium within 60 minutes of the presale close. All tokens will be unlocked and hit the market simultaneously, making the next 30 days the only time investors can get their hands on the token before launch.

To participate in the presale, visit the Poodlana website.

Solciety ($SLCTY) – Best Politically-inspired Memecoin

Solciety is a memecoin project pushing beyond the norm to create a community for all degens. The coin leans into the PolitiFi narrative by presenting itself as an on-chain political party for all memecoin lovers focused on gains, not policies.

Why invest in Solciety?

Memecoins thrive on attention and are built around narratives—the more relevant the theme, the more attention the memecoin garners. Politics is a prominent narrative this year as US elections approach, and Solciety being the first memecoin heralding the political party meta, enjoys first mover advantage.

The project stands on the proven success of Political tokens like Donald Tremp and Joe Boden but differs from them in that it does not lean toward one party but creates a community for everyone.

Furthermore, the project is built on Solana and enjoys the network’s speed, scalability, and growing user base.

Risks in Investing in SLCTY

Like all memecoins, SLCTY risks performing admirably or failing spectacularly. Investors also risk a lack of longevity as most memecoins lose the greater part of their values after the hype around their narrative dies down.

SLCTY’s presale launched on 18 June, and will run for 30 days offering 3 billion tokens to early investors. Visit the Solciety website to participate in the presales.

Bitbot (BITBOT) – Best Crypto Trading Bot

Bitbot is a crypto trading bot that allows you to trade cryptos on-chain using simple text instructions on Telegram. The bot is part of a rising trend of people using bots with instant execution speeds to keep up with institutional traders.

These bots are usually integrated with the Telegram messaging platform, allowing users to control their trading activities using simple commands. Because of their ease, efficiency, and speed, traders can use them to uncover and buy tokens before they launch on major exchanges.

Why invest in Bitbot?

Bitbot offers features that place it ahead of other trading bots. The most pertinent is its emphasis on decentralization. Most Telegram bots hold on to their users’ private keys, creating an attack vector.

We saw this happen with popular bots like Unibot which was hacked in October 2023. The attacker could drain funds from connected wallets because the platform stored its users’ private keys.

Bitbot uses a completely decentralized structure to ensure users are always in charge of their tokens.

Risks in investing in Bitbot

While the bot has utility, the success of its token depends on the company’s ability to attract and retain users, which is usually easier to accomplish during a bull market than a bearish one.

2024 is expected to be bullish thanks to Bitcoin’s halving, however, interest beyond the bull season is yet to be determined.

Bitbot has a total supply of 1 billion tokens, 30% of which will be sold in an upcoming presale event. This presale includes a competition that will reward participants with up to $100,000. To stay current on the presale, visit the Bitbot website.

Bitcoin Dogs ($0DOG) – Best Bitcoin BRC-20 Token

Bitcoin Dogs’ native token, $0DOG, will launch as the first-ever ICO on the Bitcoin blockchain. Thanks to cutting-edge Bitcoin Ordinal technology, Bitcoin Dogs is pushing the boundary of what is being built on the Bitcoin network.

By combining memecoins, NFTs, and Ordinals, this project aims to go where none has gone before along with all who dare to run ahead of the pack. Given the industry’s love for breaking new milestones, this project will attract the interest of people within and outside the Bitcoin community.

Why invest in Bitcoin Dogs?

Bitcoin Dogs keys into strong crypto narratives like BRC-20 and the Bitcoin halving that could place it in investors’ sights, and allow for innovation and significant upside; several BRC-20 projects that have launched have garnered traction from investors and Bitcoin enthusiasts.

Bitcoin Dogs has gone further than most other projects to build the first Bitcoin-native gaming ecosystem with tokens, a planned NFT collection, and even games further down the line.

Bitcoin on-chain metrics data from Dune Analytics show a significant increase in transaction count on the blockchain that started close to the end of January 2023, when Ordinals was launched.

Higher volumes combined with the Bitcoin halving in April 2024 could catalyze significant growth for the network and its most promising projects, like Bitcoin Dogs.

Risks in Investing in Bitcoin Dogs

Bitcoin Dogs is a new project attempting a feat that has never been done before. As such, there are bound to be obstacles that are novel to this project, and a history of token launches shows that plans are hardly ever without hiccups.

$0DOG will be the native token of the Bitcoin Dog ecosystem. It has a maximum supply of 900 million units, 90% of which is allocated to the presale. This means that investors will get the bulk of tokens, making this as close to a fair launch project as possible.

To join this project early, head over to the Bitcoin Dogs website.

Memeinator (MMTR) – Best New Memecoin

Memeinator is a memecoin with a twist. While other memecoins adopt an animal theme, either a dog or frog, Memeinator has chosen to adopt themes from the wildly popular Terminator series. It features terminator dogs that have traveled back in time to dominate the meme market.

Why invest in Memeinator?

In the memecoin space, virality is the difference between success and failure. Memeinator has employed innovative marketing strategies, an engaging story, and an upcoming suite of products to keep its growing community engaged.

Despite the uncertainty of the memecoin space, Memeinator has displayed the potential to create a community of loyal supporters by offering innovative rewards. One of which is a trip to space on the Virgin Galactic, worth a whopping $250,000.

In the future, the MMTR token will be the key to unlocking the ecosystem which will include exclusive NFTs and an action game.

Risks in investing in Memeinator

Big plans and hype are common tools that memecoins employ to get people onboard, and while Memeinator is making strides, it is still untested. Most memecoins fail, and there is a possibility that Memeinator will as well.

MMTR has a maximum supply of 1 billion tokens, 62.5% of which is on offer in the presale which is currently ongoing. This is suitable as most of the supply will be in the hands of the public, making it less prone to manipulation.

To join the presale, head over to the Memeinator site.

Metacade (MCADE) – Fastest Growing Gaming Community

Metacade is a platform that hosts a fast-growing community of Web3 gamers, builders, and enthusiasts, and features superior social capabilities that fosters gameplay and togetherness amongst crypto enthusiasts.

Why Invest In Metacade?

Crypto communities are powerful forces that can make or break projects, and Metacade is focused on harnessing the power of that community. Web3 gaming is a prime sector ready for growth as projections show that gaming will be the doorway that will usher much of the world into the Metaverse.

By integrating with several crypto and Web3 games, Metacade can connect players across various gaming ecosystems and Metaverses, acting as a hub or a meta-Metaverse. Community members will be able to connect to their favorite games from their member dashboards.

The platform will also feature leaderboards that track new games, trending games, and the most played games, so players are aware of and plug into vivacious gaming ecosystems. These leaderboards will also track the top players across various games and foster healthy competition and activities.

Developers and game builders are not left out as a reviews section will highlight player experiences within various games, a valuable source of feedback and market survey.

Risks In Investing In Metacade

Metacade’s game integration is limited to games and crypto projects within its own ecosystem. While it can maintain leaderboards that track player activity in games outside the platform, it cannot directly connect to these games, which detracts, somewhat, from the platform’s overall value proposition.

This growing ecosystem is powered by the MCADE token which is available on their website.

Arbitrum (ARB) – Fastest Growing Layer 2

Arbitrum is a Layer 2 network built on top of Ethereum that processes transactions faster and cheaper than the main chain. It is referred to as a scalability solution because its main purpose is to create a computational layer on top of Ethereum that processes transactions, thereby easing some of Ethereum’s blockchain platform transaction load.

Why Invest In Arbitrum?

Arbitrum is the largest and fastest-growing Ethereum scaling solution when it comes to total locked value. The network powers over 300 decentralized applications, a number that was under 150 about a month ago as new applications flock to the speedy and potentially fast-growing cryptos, secure network.

The network can also be trusted as it inherits its proven track record of security from Ethereum, which is trusted as a secure and decentralized blockchain network in the cryptocurrency market.

As of writing, Arbitrum houses $2.09 billion in foreign assets deposited by users and investors on the various DeFi apps on its network within the cryptocurrency market.

The network is governed by a DAO which is powered by the native token, ARB. Holders of the crypto coin can vote on proposals that affect the future of the network and even create proposals, although a significant amount of ARB is required to do so.

Risks In Investing In Arbitrum

Arbitrum is facing competition from blockchain technology networks like zkSync Era which run on zk rollup technology which is reportedly superior to Arbitrum’s technology stack. If zk networks become the norm, Arbitrum could lose market share.

There are 10 million ARB tokens in existence, 1.2 billion of which are currently in circulation.

You can buy ARB on exchanges like Binance.

Polygon (MATIC) – Fastest Growing Scaling Solution

Polygon is another scalability solution that makes transactions faster and cheaper. However, unlike Arbitrum, Polygon runs parallel to Ethereum and is thereby termed a sidechain.

Why Invest In Polygon?

Polygon is the fifth largest, and potentially fastest smart contracts, platform by total locked value in DeFi protocols ($880 million) and is home to over 370 decentralized finance applications. However, this is not our main reason for choosing Polygon.

The “Polygon” that most retail users know is the PoS chain. In truth, the platform is first an infrastructure for creating standalone blockchain networks. The Polygon sidechain is an application of that infrastructure.

Polygon recently launched a second chain called Polygon 2.0 or Polygon zkEVM which is a chain that runs on technology called zero-knowledge proofs (zk proofs) to validate transactions. Zk proofs ensure privacy, decentralization, and scalability.

The company behind this tech plans to create a network of interoperable zk-based layer 2 chains that will all be fast, scalable, and most importantly, connected through Polygon.

As the world integrates further with blockchain tech, the need for effective scaling solutions is growing and Polygon is stepping up to fill that need.

Risks In Investing In Polygon

Polygon was named as a security in the US’ SEC case against Coinbase and Binance. As such, it is being delisted by various digital asset service providers with US clients. Robinhood has already delisted and Revolut also plans to.

However, the team has announced some updates in this regard. The planned upgrade to Polygon 2.0 will effect changes to the crypto coins, which may alleviate the regulatory situation and promote investor confidence.

Not much information has been released as of writing, so you may want to check up on these upgrades and how they affect the MATIC token.

To learn more, read our Polygon review. You can buy MATIC on exchanges like Binance.

Render (RNDR) – Fastest Growing Render Network

Render is a decentralized network of GPUs that provide the graphics processing power needed to render videos, architectural drawings, animations, NFT collections, and even entire Metaverses at scale.

It is ideal for anyone who needs graphics power but does not wish to buy or cannot afford expensive equipment.

Why Invest In Render?

Besides the obvious value proposition of providing rendering services at scale and on-demand at a cheaper price point than legacy providers, Render creates opportunities for all participants in the render value chain, making it one of the fastest-growing cryptocurrency assets.

By connecting your GPUs to the network, you can accept jobs, render them and get paid using the network’s native token, RNDR.

Thanks to the decentralized nature of the network, creators do not need to worry about a single computer accessing all their files as the files are split between operators on the network.

Render is one of the fastest-growing crypto projects because the world is moving closer to the Metaverse, which will be a mixture of augmented and virtual reality thanks to technologies like the Apple Vision Pro.

The proliferation of these industries will no doubt increase the demand and frequency of renders and other blockchain technology.

Risks In Investing In Render

The value of RNDR tokens is tied directly to the value of the network and the volume of projects rendered. The network as a whole will face stiff competition from various legacy providers, especially from Nvidia’s GPU computation cloud service.

RNDR can be purchased on crypto exchanges like Coinbase.

Apecoin (APE) – Fast Growing Metaverse

Apecoin is an ecosystem token that plays a vital role in value transfer across the Yugaverse, which is a combination of NFT collections, a DAO, and a Metaverse, all created by Yuga Labs.

Yuga Labs is the studio behind successful NFT collections like the Bored Ape Yacht Club, Mutant Ape Yacht Club, and Bored Ape Kennel Club. The company is valued at $4 billion and is one of the leading entertainment studios in the industry.

Why Invest In Apecoin?

Apecoin is at the heart of Yuga Labs’ efforts. The native token will serve as the main vehicle for value transfer across all of the cryptocurrency project collections and the coming Metaverse, called Otherside.

While the NFT collection is successful, it is the Metaverse that really caught our attention and places Apecoin on the list of fastest-growing cryptos. Otherside has not yet launched but it has already secured partnerships with brands like Gucci that are developing products that will feature in the Metaverse.

Otherside will also feature all of Yuga Labs’ collections as playable characters and will rely on APE as its native currency. Characters, land, weapons, tools, and more in the Metaverse will be traded by token holders using APE.

Risks In Investing In Apecoin

Despite APE’s integration with the Yugaverse, Otherside will be the main source of its utility. The Metaverse project is in direct competition with well-funded projects like Sandbox that have also secured partnerships with a diverse range of several real-world brands.

Otherside is one of the most anticipated Metaverse projects that, if successful, will rub off on the prominent cryptocurrency that is the APE token.

You can buy APE on exchanges like eToro.

Lido (LDO) – Leading Liquid Staking Protocol

Lido is a liquid staking platform that allows Ethereum holders to stake their ETH for a profit without having to tie down funds for a long period. The platform rose to prominence at a time when staked ETH could not be unstaked.

Why Invest In Lido?

To understand Lido’s investment case, you must first understand what liquid staking is.

Staking is the process of locking up funds, usually for the purpose of securing a proof-of-stake (PoS) blockchain. The locked funds are required as an incentive to ensure that nodes behave honestly.

If nodes do not act honestly, their stake is slashed. If they act honestly, they gain a reward and earn passive income on their stake, according to how many blocks they validate. Because of the high barrier of entry for becoming an Ethereum node, operators built pools where ETH holders could contribute for a cut of the profits the node earned for validating transactions on the Ethereum blockchain.

At the time, staked ETH could not be accessed, thereby reducing liquidity needed for other decentralized apps activities, like DeFi. This is where Lido steps in.

The platform issues tokens called liquid staking derivatives that derive their value from the staked ETH they represent. Just like the US dollar was once a proxy for gold, these derivatives are a proxy for the staked ETH.

These tokens can then be used for the activities the original ETH would have been used for if it wasn’t staked. This way, users can earn rewards for securing the Ethereum network while engaging in DeFi activities, and protocols accept the derivatives because they know they are backed by real ETH.

Lido is the leader and a fast growing cryptocurrency in the liquid staking sector with market cap of $1.5 billion and over $14 billion worth of staked ETH. Its derivatives are also the most accepted throughout the industry.

As Ethereum transitions into a full PoS chain, liquid staking is even more important for certain digital assets as the network relies on Lido’s services to maintain security while helping to keep the financial markets liquid.

Risks In Investing In Lido

Lido’s size makes it a point of attack as hackers know that they could get their hands on a share of the $14 billion worth of staked ETH. Also, rewards on Lido do not compound.

You can buy LDO on exchanges like Coinbase.

Pepe (PEPE) – Fast Growing Meme coin

Pepe is a meme coin that has experienced probably the most meteoric rise of so many cryptocurrencies in the last few years. The meme coin was launched on April 17th and rose to a market cap of $1 billion three weeks later.

Why Invest In Pepe?

The only investment cases for early investors for meme coins are community engagement and hype, and Pepe has those in reserves. It is believed to be the meme coin to lead the meme coin rally in the next bull run, similar to what other fast-growing crypto such as Dogecoin and Shiba Inu did in the 2020/2021 bull run.

While Pepe has fallen significantly from its $1 billion market cap peak to a smaller but still significant $380 million market cap, it still retains the interest of investors and has remained on the list of top-trending tokens for several weeks.

For the cautious investor with a risk tolerance, Pepe is listed on several major crypto exchanges like Binance, Kucoin, OKX, Gemini, and ByBit. Its smart contracts have been renounced, meaning that the developers cannot make any changes, like minting new tokens.

Risks In Investing In Pepe

Pepe has no underlying utility. Its price is held up by hype and the expectation that it may one day overtake Dogecoin as the largest meme coin. If this sentiment changes at any point, PEPE’s price will crash.

All PEPE tokens are also in circulation as they were all released at launch, hence no sell pressure from “secret developer stashes” is ever expected.

You can buy PEPE on exchanges like Binance.

Sui (SUI) – Fast-Growing Blockchain

Sui is a layer 1 blockchain network that provides the infrastructure for developers to build scalable decentralized applications. It is not unlike Ethereum in its aims and functions, however, it differs significantly in its technological makeup.

Why Invest In Sui?

Ethereum is still not as fast as it needs to be to compete with Web2 systems. For example, Ethereum 2.0 can process 30 transactions per second, PayPal can process 193, while VISA can process 1,700 transactions within the same time. Clearly, Ethereum still has some ways to go.

This is where solutions like Sui come in. This blockchain has a theoretical speed of 120,000 transactions per second, however, we must mention that in practice, this number is usually much lower.

Nonetheless, it is still significantly faster than Ethereum thanks to its parallel processing capabilities that allow it to process multiple transactions simultaneously. Ethereum is, however, more decentralized.

Sui also stands out from Ethereum with its programming language. While Ethereum uses the Solidity programming language, Sui uses a language called Move that allows developers to create assets that live natively on the blockchain without being placed inside smart contracts. Essentially, it is a better way of handling on-chain assets.

Risks In Investing In Sui

Sui is a new blockchain network in a sea of new blockchain networks, and unlike Ethereum that has cemented its position as a pillar of the industry, Sui will need to compete to get to Solana’s position, at the very least.

Sui’s native coin is called SUI and is needed to access the power of the blockchain network.

You can buy SUI on major exchanges like Coinbase.

Treasure (MAGIC) – Growing Gaming Infrastructure

Treasure is a gaming project on Arbitrum that provides the infrastructure needed to run an interconnected ecosystem of interoperable games. The platform also provides various important GameFi structures like an in-game marketplace and exchange.

Why Invest In Treasure?

Treasure is the largest gaming project on the Arbitrum network with a total marketplace volume of $271 million, 10+ games, a community of 100,000 players, and 344,000 unique token holders.

The platform contributes a huge share of the liquidity for gaming tokens on Sushiswap, and contributes 95% of all NFT transactions on Arbitrum, and has enjoyed significant returns of a 101% growth in weekly active users quarter-on-quarter.

Treasure provides a shared infrastructure for building games on Arbitrum. Its main appeal to early investors is the interoperability features that the games it powers inherit. Games built on Treasure all use the same protocols, types of NFTs, and communication networks.

Because of this, game builders can come together and create character journeys that span multiple games. Imagine playing game A, but needing to defeat a villain in Game B before being able to unlock a sword in game C.

The platform comes with an in-built decentralized exchange, called MagicSwap, that allows peer-to-peer transactions between players and game developers to swap between the various game tokens within the ecosystem. Players can also trade NFTs on an inbuilt NFT marketplace called Trove which serves as the primary center for exchanging in-game items and discovering new games.

Risks In Investing In Treasure

Treasure’s ecosystem is in direct competition with established Metaverses like The Sandbox and Decentraland. Plus, some investors prefer the sound and feel of a “Metaverse” to an ecosystem of interoperable games.

The Treasure ecosystem is powered by the MAGIC token. All items in the marketplace are priced in MAGIC and game developers must use it when building on Treasure’s infrastructure.

You can buy MAGIC on Binance.

Chainlink (LINK) – Leading Oracle Service

Chainlink is a decentralized service that connects to off-chain data sources and imports data on-chain to power smart contract functions. This service is called an Oracle and is necessary because smart contracts cannot connect to data sources outside of their blockchain networks.

Oracles provide the data that applications like decentralized exchanges need to function properly. It does this in a decentralized way and ensures that the data imported is provable and accurate.

Why Invest In Chainlink?

Chainlink is the leading Oracle provider with a market capitalization of $2.7 billion and a user base consisting of large DeFi projects like AAVE, Synthetix, Compound, and ENS. It has powered over $7 trillion worth of transactions through several price feeds on various crypto networks and Defi apps.

As finance further integrates with blockchain technology, the need for asset tokenisation will become more pertinent. Services like Chainlink that provide accurate, real-time price feeds to various blockchain applications will become even more important than they are now.

Furthermore, the protocol offers a Cross-Chain Interoperability Protocol (CCIP) that allows decentralized applications to communicate with various chains seamlessly. As interoperability is a major long-term trend, we expect that Chainlink will remain relevant.

Risks In Investing In Chainlink

Chainlink is not the only Oracle service with unique features and newer projects are opting for smaller, cheaper providers.

Chainlink is powered by the LINK token which is used to access its services. If the demand for Chainlink grows, so does its token’s price.

To learn more, read our Chainlink review or buy LINK on exchanges like eToro.

Ordi (ORDI) – Leading Bitcoin Ordinal

Ordi is a leading token built on the Bitcoin blockchain. It is called a BRC-20 token, which is a new token standard made possible by a recent technological advancement, called Ordinals, that allow developers to inscribe data into Bitcoin blocks.

Why Invest In Ordi?

Ordinal technology is powering a new wave of use cases for blockchains like Bitcoin, Dogecoin, and even Litecoin which were once thought to have one function: to send money and make payments in a decentralized and immutable manner.

One of these use cases is the creation of token standards on non-smart contract enabled blockchains. This application on the Bitcoin blockchain led to BRC-20 tokens like Ordi and several others.

The major appeal of tokens like ORDI is the potential for the proliferation of decentralized finance on the most decentralized and secure blockchain, Bitcoin.

Ordinals is already one of the fastest growing technologies in the crypto industry and ORDI is positioned to benefit from this growth.

Risks In Investing In Ordi

Ordinals have not yet proven that they can be taken as seriously as altcoins as the technology is still developing and the range of utility is limited. There is still a risk that all inscription tokens fade into oblivion as the industry moves forward from Ordinals.

Like Bitcoin, ORDI has a token supply cap of 21 million tokens, all of which are already in circulation. Hence, no supply pressure is to be expected.

You can buy ORDI on exchanges like Coinbase.

Rocket Pool (RPL) – Fast Growing Liquid Staking Service

Rocket Pool is a fast growing liquid staking platform that offers a way to earn more yields from staking Ethereum. Like Lido, the platform issues derivatives that can be used across DeFi applications.

Why Invest In Rocket Pool?

Rocket Pool is large enough to be taken seriously but still small enough to grow significantly. It also runs a more decentralized structure than Lido.

Lido holds a massive amount of Ethereum in its validator pools and this inadvertently makes it a single point of failure, which runs contrary to the ethos of decentralization.

Not only does Rocket Pool provide a way to decentralize the whole concept of Ethereum liquid staking, it has also structured its platform to promote that decentralization. Users who stake with Rocket Pool also have the option to run a node with the platform.

The barrier to running a Rocket Pool node is much lower than that of the Ethereum mainnet as would-be node operators have to put up only 8 ETH compared to the 32 ETH required to operate a node directly on the mainnet.

As of writing, 731,000 ETH is staked with Rocket Pool through over 2,800 nodes run by various people. Node operators earn a passive income with a higher APR than stakers.

Risks In Investing In Rocket Pool

Rocket Pool still runs a smart contract risk as an attack could mean the loss of funds that the platform may not necessarily be able to replace.

Rocket Pool’s network is powered by the RPL token which is used to reward node operators and to participate in the Oracle DAO.

You can buy RPL on exchanges like Binance.

Ethereum (ETH) – Largest Blockchain Platform

Ethereum is the largest smart contract platform with over $24 billion in foreign assets in the many decentralized applications that run on the network. It powers thousands of applications from Metaverses, to DeFi, games, NFT collections, and more, and is a pillar of the entire crypto industry.

Why Invest In Ethereum?

Ethereum provides immense value to the crypto industry. Its smart contract language, Solidity, is still the most used programming language in crypto as it powers several layer 2 networks, like Arbitrum, which in turn power hundreds of crypto applications.

While some may see Ethereum as a giant without much room left for growth, the network still has a lot to accomplish as the upgrades that it underwent over the last several months has improved its speed and scalability and transitioned it to a more energy-efficient chain.

Now, with a theoretical throughput of 100,000 transactions per second, Ethereum should be able to power enterprise applications.

We must mention that Ethereum is not all the way fast and cheap and transaction fees can still run high, however more upgrades are coming and layer 2 networks are rising to pick up the slack.

We do not see Ethereum failing anytime soon as it continues to cement itself as an all-purpose computational layer of the crypto industry.

Risks In Investing In Ethereum

There is a rise of new-age layer 1 blockchain networks like Ethereum that are technologically superior and are better equipped to run games and compute-heavy transactions. Some of these new chains also come with integrated decentralized storage layers.

We don’t see these networks displacing Ethereum, however, they could take away market share.

Ethereum’s ETH has a theoretical infinite supply, however, provided the tokens burned exceed the yearly emissions, it should retain its deflationary characteristics.

Read our Ethereum review to learn more, or buy ETH on exchanges like eToro.

What is the Fastest Growing Cryptocurrency?

The fastest growing cryptocurrency on our list is Piggy Bankster. We are interested in Piggy Bankster because it taps into community meta narratives and offers the opportunity for truly viral growth.

Of source, Piggy Bankster’s growth potential does not eliminate the fact that it is still a new and largely untested project. You should not invest without being aware of the risks involved with both new projects and projects in the gambling space.

How to Pick the Fastest Growing Cryptocurrencies

Start With the Fastest Growing Sectors

The easiest way to find the fastest-growing cryptos is to monitor the fastest-growing sectors. Logically, sectors that are growing quickly will have cryptos that are as well. When searching, keep popular trends in mind, both global and crypto-specific.

For example, AI technology is a big global trend this year and we’ve seen AI cryptos rally. Layer 2 scaling has also been a big crypto-specific trend and we’ve seen tremendous growth in projects like Arbitrum, Optimism, and even the rise of zk networks.

Finding fast-growing sectors and selecting the top projects in them is a good start.

Monitor Growth Metrics

Because a sector is growing doesn’t mean that all cryptos in it will grow. There are only so many blockchain platforms one can build on. There are only so many applications people can use. In the end, most cryptos will fade into obscurity.

Keep an eye on growth metrics like daily active wallet addresses, developer activities, transaction volume, and even social media buzz.

Remember Where the Market is

The crypto market moves in cycles. Bull periods are characterized by increasing prices of cryptos and participation from retail and institutional investors, while bear markets are characterized by declining prices of tokens and scaled-down participation.

If you decide to invest in a bear market (which could have its merits), growth metrics may be skewed to the low end because of the market cycle. If you make decisions based on the toned-down metrics in a bear market, you may miss out on gems.

The Benefits of Investing in the Fastest Growing Crypto

Profit Potential

The fastest-growing cryptos are more likely to return profit sooner rather than later, which is appealing for most investors. The speed of growth could also mean a first-mover advantage which could help cement a cryptos’ position as the leader of a sector.

Dry Powder

Dry powder is a term used in finance to refer to cash reserves ready to be deployed into assets when opportunities arise. Because investments can span a long horizon (anything above a year is long-term), investors need to keep track of their dry powder so they don’t end up deploying all their funds in one go.

Fast-growing cryptos are more likely to yield profit faster and can consolidate investor’s dry powder in the short-mid term, enabling them to store up enough to focus on long-term crypto investments in their cold wallets.

The Potential Drawbacks of Investing in the Fastest Growing Crypto

Volatility

The speed of a crypto’s growth can be reflected in its price which could run up very quickly, creating an imbalance that must be corrected by an equally quick fall. Investors who do not understand this could inadvertently buy these cryptos at the wrong time.

Pump And Dump Schemes

Not all fast-moving cryptos are good investment options. Remember that investing and trading are not the same. Cryptos with no utility, like many meme coins, can run up quickly (the pump) and fall even farther than when it drops (the dump).

While the cryptos on our list belong to projects that are fundamentally sound, not all fast-growing cryptos out there do.

How to Buy the Fastest Growing Crypto Now

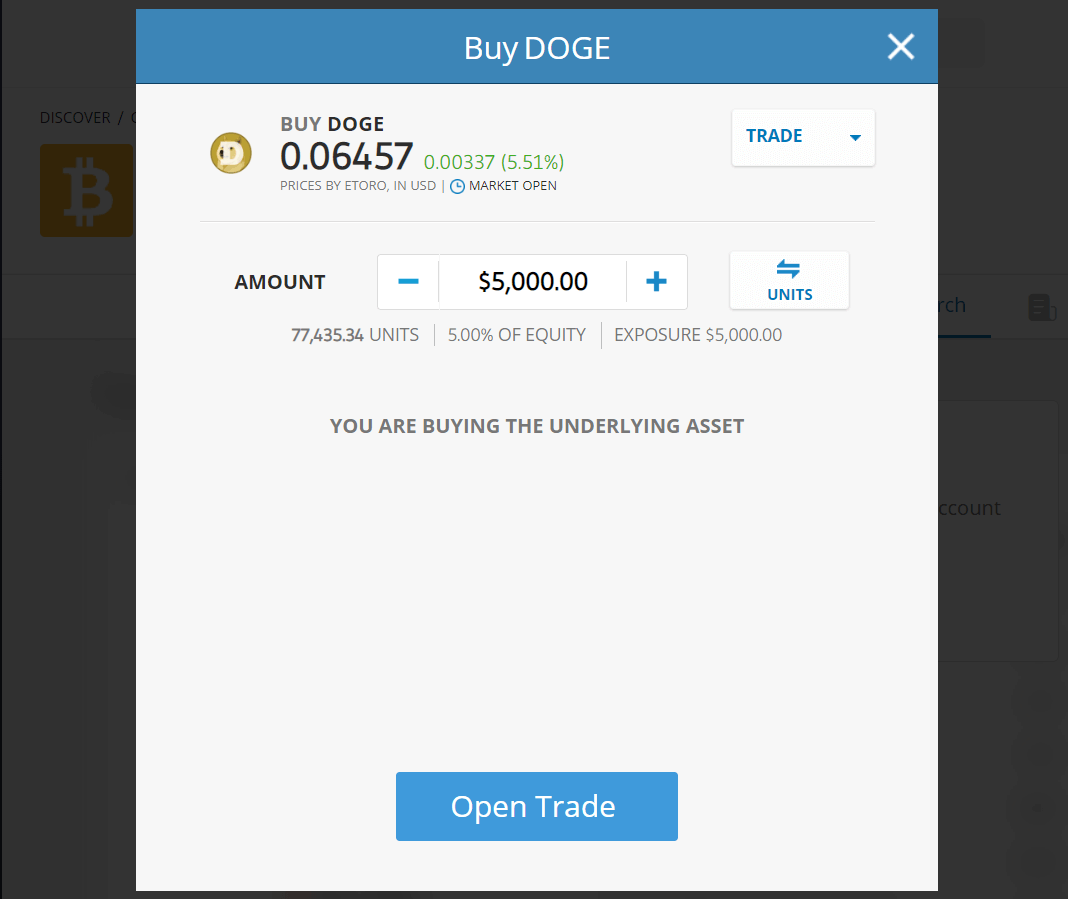

This guide shows you how to buy the fastest-growing cryptos on an exchange like eToro.

1. Open an Account

Navigate to eToro on your computer and click on the Start Investing icon. You can also download the app from the Play store or App store. Fill out the form with your full name, email address, and password.

2. Verify Your Account

Set up your profile and submit KYC documents like a valid government ID and proof of residency like a utility bill.

3. Deposit Funds

Once your account has been verified, deposit funds by using any of the available payment methods. Choose a convenient method and set the amount you’d like to deposit.

4. Buy A Fast Growing Crypto

Once your account is funded, search for any of the cryptos mentioned in the Discover tab (or anyone you like). An interface like the one below should load. You can then set your parameters and buy.

Where to Buy the Fastest Growing Crypto Coins

To get your hands on new fast growing cryptos like Solciety you’ll have to purchase them directly on their websites using a crypto wallet. We created a guide to help you do that.

Step 1: Download a Wallet

We used the MetaMask wallet for this guide. Download the wallet app on your phone or use the web platform via a browser extension on your laptop. Create a new wallet. Ensure you keep your seed phrase safe and offline.

Step 2: Buy Some Crypto

You’ll need Solana to buy new Solciety tokens. Buy some on an exchange like eToro and transfer to your wallet, or use a fiat onramp on the wallet app. You can connect to a merchant on the Binance p2p market directly from the wallet app.

Step 3: Connect Wallet

Navigate to Solciety’s website and connect your wallet to join the presale. You can do this from the in-built browser on the mobile app. Buy SLCTY tokens using Solana. Ensure you have enough to pay for gas fees.

Step 4: Wait to Claim

You’ll need to wait until the presale is over to claim your tokens.

Latest Fastest Growing Cryptos News

- Chainlink integrates price feeds with Celo blockchain as the data provider continues to expand its services.

- Otherside metaverse set to launch a beta game in 2023 called The Persistent World which will be a virtual universe where players can program and play games.

- Blockchain payments integration is being pushed forward thanks to a new wave of applications that run on layer 2 networks like Arbitrum.

Final Thoughts on the Fastest Growing Cryptocurrency

We explored the fastest growing cryptocurrencies in 2024 and chose Piggy Bankster as our top choice because of its potential for a truly viral growth trajectory.

Nonetheless, all the cryptos mentioned are fast growing, although some are growing faster than others due to major trends.

Remember to watch for volatility when choosing which crypto to invest in and to avoid pump and dump tokens with no utility.

To invest in cryptos now, visit an exchange like eToro.

Methodology - How We Picked The Fastest Growing Cryptos

The cryptos covered in this guide were chosen through rigorous research. We paid attention to utility, reputation, hype, and growth potential.

The tokens listed are the best we found in the various categories we listed them. For example, we listed Treasure as the fastest-growing gaming infrastructure because it is the largest gaming crypto on Arbitrum and its platform experiences quarter-on-quarter growth.

Check out our why trust us and how we test pages for more information on our testing process.

Additional Crypto Coin Reviews

- Best Cryptos to Buy now

- Best ICOs

- Best Crypto Presales

- Best New Cryptos

- Best Metaverse Crypto Coins

- Best ERC-20 Cryptos

- Top Gaming Cryptos

- Best Staking Cryptos

- Best GameFi Crypto Tokens

- Best Long Term Crypto

- Best Cheap Cryptos

- Best Web3 Crypto

- Best Penny Cryptos

- Best Utility Cryptos

- Best Altcoins

- Best Meme Coins

- Best DeFi Projects

- Hottest Cryptos to Buy

- Next Big Crypto

- Best AI Cryptos