The 7 Best Binance Alternatives in 2024 | Top Competitors Compared

Binance is the largest cryptocurrency exchange in the world with daily trade volumes exceeding $76 billion and a diverse ecosystem. However, as diverse as the exchange’s services are, it isn’t suitable for everyone, and many traders seek Binance alternatives.

Our guide walks you through the most suitable replacements for the behemoth exchange. These cryptocurrency exchanges excel in areas where Binance does not and offer specific benefits to their users.

By the end of this page, you should know which crypto exchanges are good alternatives and what they can do for you.

Best Binance Alternatives - Our Top 3 Picks

Looking for a quick answer? Here are our top 3 crypto Binance alternatives.

Best Alternatives to Binance

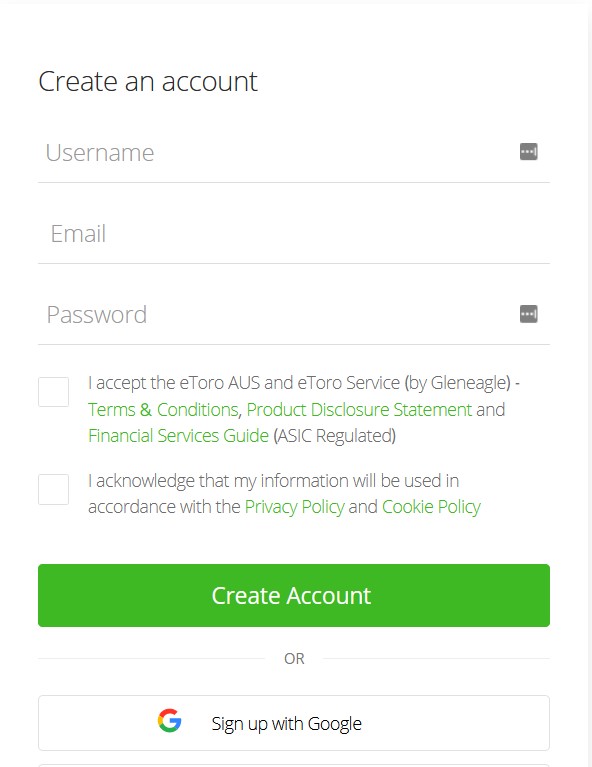

1. eToro – Best Overall Binance Alternative

2. Skilling – Best Alternative for Crypto Derivatives

3. Bitstamp – Most Secure Alternative

4. OKX – Best Alternative for Web3 Users

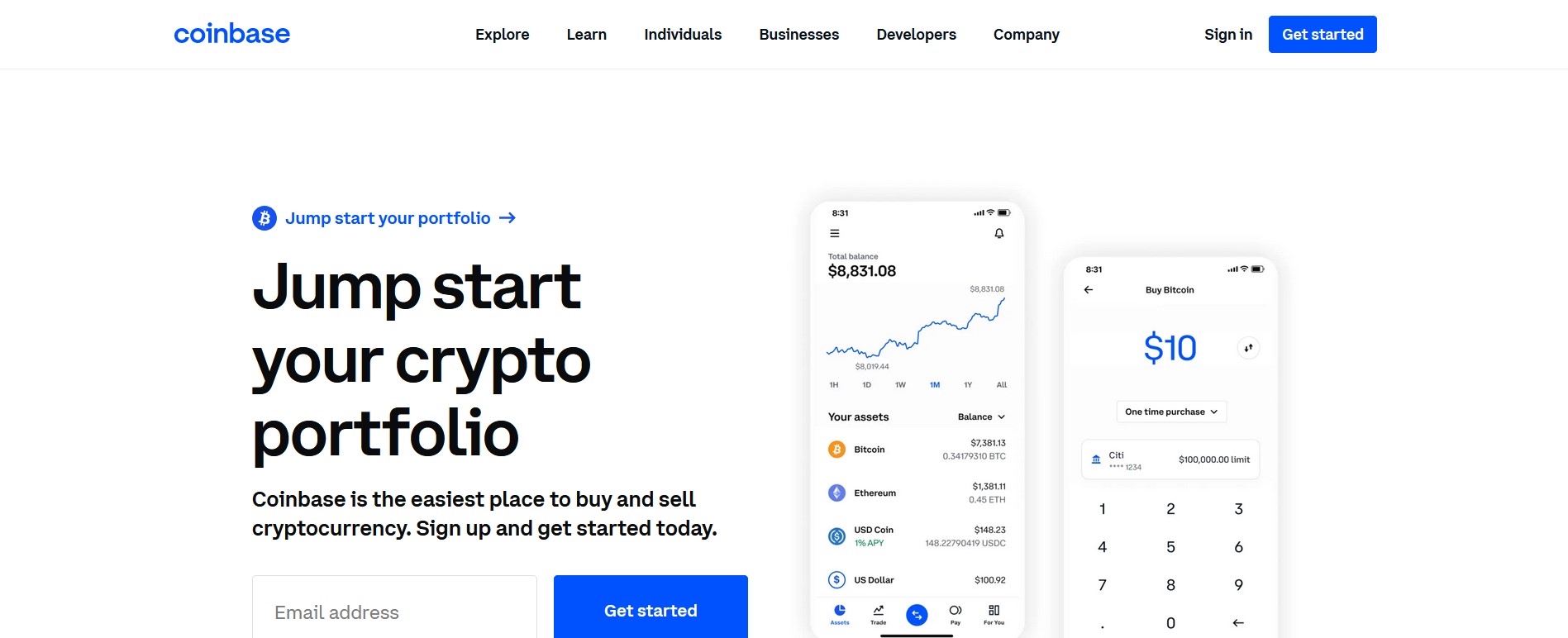

5. Coinbase – Best Alternative for US Users

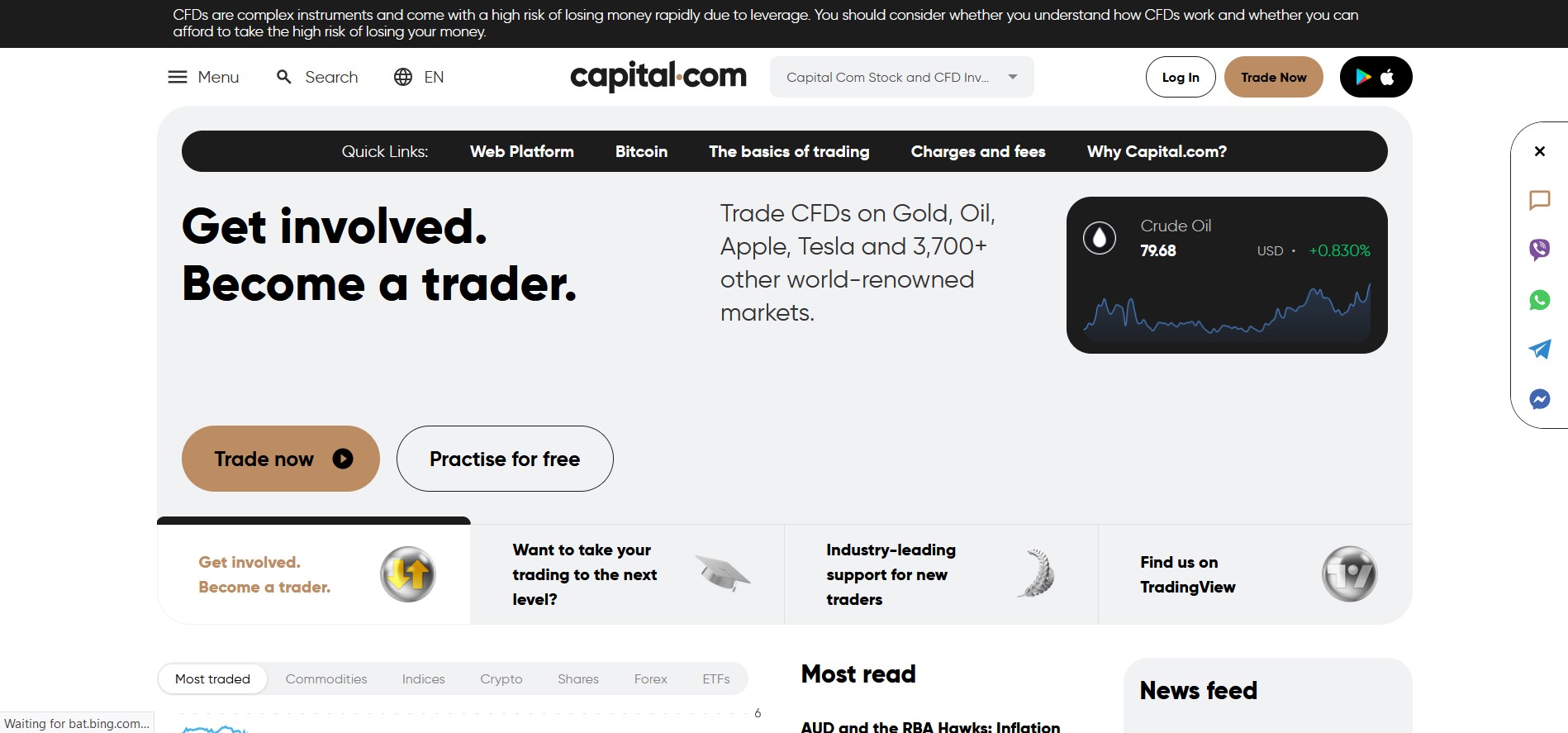

6. Capital.com – Best Alternative for Core Traders

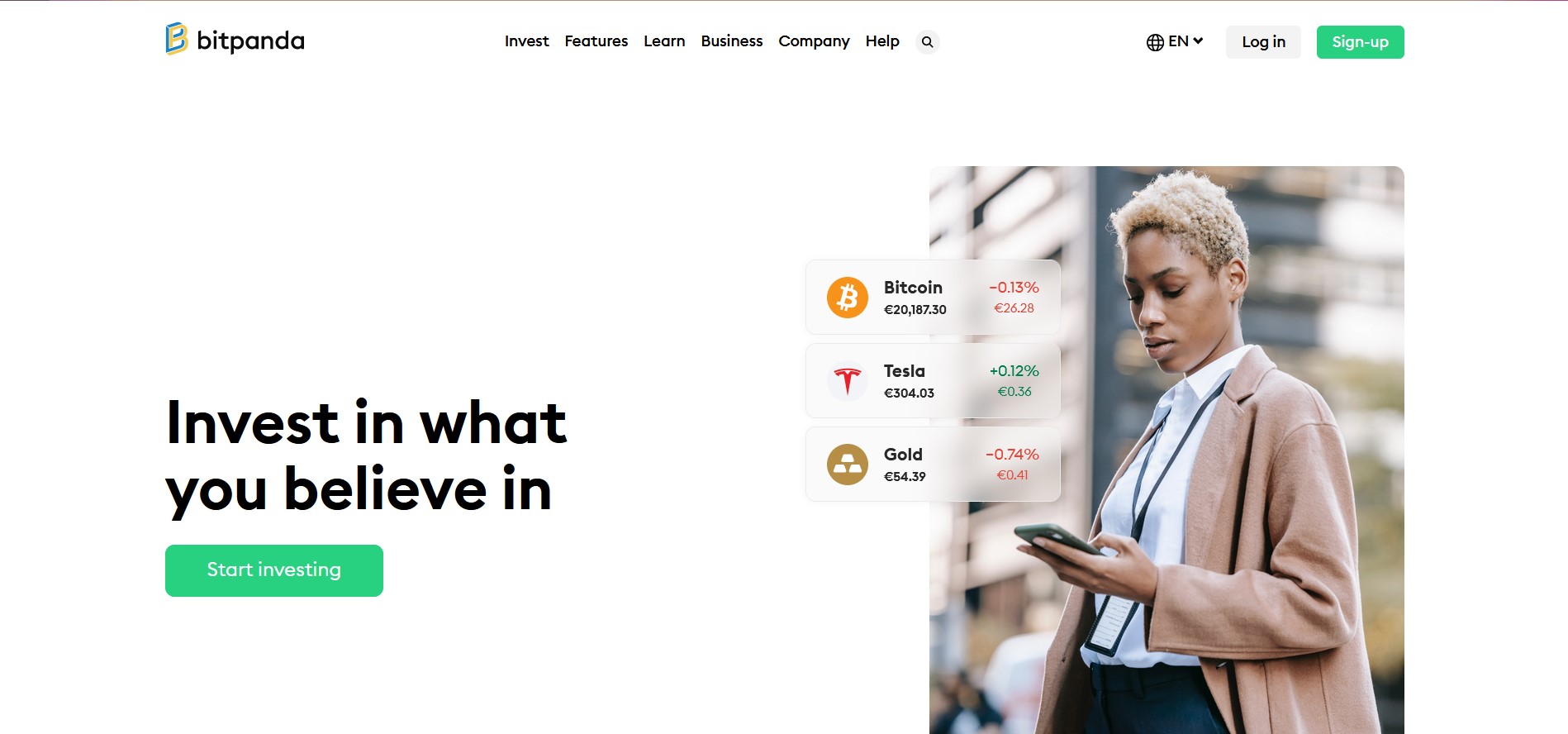

7. Bitpanda – Best Alternative for European Users

Our Best Binance Alternatives Compared

|

Exchange |

Fees |

Coins |

Regulation |

|

eToro |

1% |

63+ |

FCA, CySEC, AFSL |

|

Skilling |

Dynamic |

55+ |

CySEC, FSA |

|

Bitstamp |

0.5% |

75+ |

CSSF |

|

OKX |

0.1% |

343+ |

VARA |

|

Coinbase |

1% |

193+ |

FCA |

|

Capital.com |

Dynamic |

400+ |

FCA, CySEC, ASIC |

|

Bitpanda |

0.025% – 2% |

170+ |

FMA, AMF, Czech Trade Authority |

Our Top 7 Best Binance Alternatives Reviewed

1. eToro – Best Overall Binance Alternative

eToro is our top choice as the best Binance alternative because it provides an environment for crypto investors to get started, grow with others, and benefit from the expertise of peers.

One of the exchange’s most loved features is Copy Trading which allows you to copy the investment decisions of more experienced users. And seeing as eToro has over 25 million users worldwide, that’s a lot of combined experience in this crypto trading platform.

You can start making sound investment decisions immediately after verifying your account thanks to the copy trading platform feature. Furthermore, you can see the success rates of various users before copying their strategies so you know you’re copying successful strategies.

eToro also has a thematic investment feature that bundles various cryptos into themes and tracks the prices of the cryptos under each theme.

For example, a metaverse theme is composed of metaverse coins, and you can invest in the overall sector, like with an ETF.

This allows you to invest in sectors or narratives that you believe to be important or profitable without having to choose individual coins.

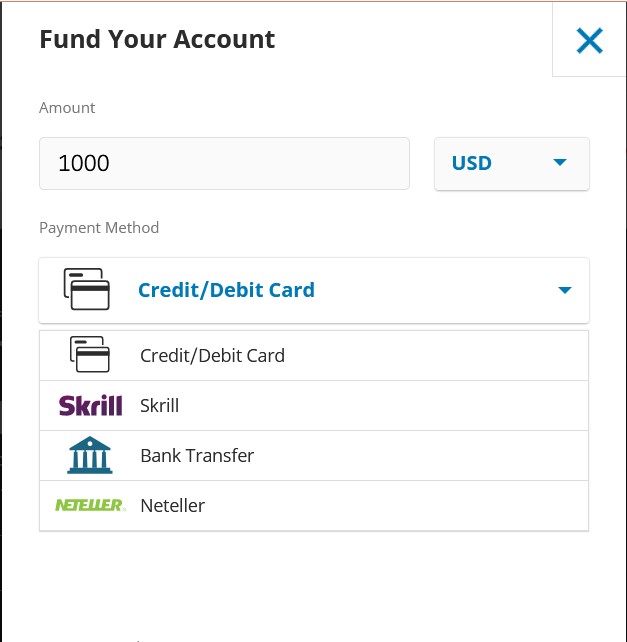

The platform makes funding easy by offering free deposits through payment methods like bank transfers, credit card payments, Skrill, Neteller, PayPal, and even crypto deposits. Withdrawals are free for amounts below $30, beyond which a $5 charge is imposed, while conversions cost 1% of the volume.

To learn more, read our full eToro review here.

eToro Pros

-

Commission-free trading

-

Copy trading features

-

Support for over 63+ cryptos

-

Well regulated

-

Low minimum deposit ($10)

-

Easy to use

eToro Cons

-

Unavailable in some countries

-

Not as many cryptocurrencies as some crypto-specific exchanges

eToro Features

-

Free deposits

-

Multi-asset support

-

Flexible payment methods

-

Global reach

-

Large investment community

2. Skilling – Best Binance Alternative for Crypto Derivatives

Skilling is a crypto broker that deals crypto derivatives called Contracts for Differences which mimic the price action of the cryptos they represent. For example, a BTC-USD CFD moves just like the underlying pair.

These derivatives can be traded in place of the underlying assets, and because crypto traders don’t have to buy the assets, the cost of trading is cheaper. Skilling is geared more towards core traders who are more interested in profiting from crypto price movements than owning them.

The CFD broker offers access to crypto CFDs for over 55 major cryptos at an affordable 0.2% per trade. However, a minimum $100 deposit is required to get started.

You can deposit a FIAT currency such as USD, GBP, or EUR with bank transfers, PayPal, and even cryptocurrencies like USDT, BTC, and BCH. All deposit methods cost 2.9% of the deposit amount, aside from direct crypto deposits.

After you deposit, you can trade using a 1:50 leverage, which means that you can open trades that are up to 50x more than your capital. Experienced traders use leverage to increase their profit margins, however, it can also have the same negative effect i.e. wipe out your capital when used recklessly.

To learn more, read our full Skilling review here.

Skilling Pros

-

Healthy margin requirement (2%)

-

Highly secure and well regulated

-

1:50 leverage facility

-

Cheap crypto spreads

-

Supports crypto deposits and withdrawals

Skilling Cons

-

Minimum deposit higher than others

Skilling Features

-

Multi-asset support

-

Secure and regulated by multiple agencies

-

Flexible funding methods

-

Intuitive user interface

-

Responsive customer support

3. Bitstamp – Most Secure Binance Alternative

Bitstamp is known for its security. It may not have a perfect record, but its security is tighter than most crypto exchanges. And while the exchange may not be as suitable for beginner crypto traders as some others on our list, it is still a great Binance alternative.

Bitstamp gives you access to over 75+ tradable cryptos, a professional trading terminal, 24/7 customer service, and minimal fees for trades below $1000.

If you’re used to trading on Binance, then you’ll find a home with Bitstamp as its Pro Trader platform comes with advanced features like analytic tools, a steady stream of market insights, and flexible order execution facilities, great for professional traders.

Trading fees are also quite attractive. You don’t get charged for monthly volumes below $1,000. Monthly trade volumes from $1,000 attract fees, but in decreasing order with increased volumes, so the more volume you trade, the less fees you pay.

The highest fees you pay is between 0.30% – 0.40% on monthly volumes between $1,000 and $10,000.

You can fund your account with a credit card at a 5% cost, ACH payment, Google Pay and Apple Pay (5%), Faster payment (UK), international wire transfer, and SEPA transfer. Withdrawals also support the same channels but cost €3 for Sepa payments and £2 for Faster Payments.

For bank transfers, wire deposits cost 0.05% with a minimum of $7.5 (£5) and a maximum of $300 (£250) while withdrawals cost 0.1% with a minimum of $/£25. The minimum deposit amount is $10.

To learn more, read our full Bitstamp review here.

Bitstamp Pros

-

Regulated by the CSSF

-

Implements military-grade security

-

Low minimum deposit requirement

-

Flexible payment methods

-

Transparent fee schedule

Bitstamp Cons

-

High trade fees for smaller amounts

Bitstamp Features

-

Deposit insurance

-

Fast execution speed

-

Dedicated trading terminal

-

High security

-

>95% uptime

4. OKX – Best Binance Alternative for Web3 Users

OKX is a crypto exchange that acts as a portal to the decentralized web. You can trade crypto coins and a wide range of derivatives on the exchange, and then transform the exchange into a wallet with which you can experience the best parts of web3.

So far, OKX is one exchange that best matches the full range of Binance’s services.

When it comes to trading, you can start by buying crypto. Unfortunately, the platform does not allow cash deposits, so you’ll need to make a direct purchase using either a credit card, the peer-to-peer market, or a third-party onramp like Banxa.

Once you have some crypto, you can convert it to other cryptos using the direct conversion method or trade it by setting limit orders.

OKX offers over 300 cryptos at a 0.10% conversion fee. Traders can focus on the trading terminal, which comes with various order types and some analytics tools, to set limit orders for a trading fee between 0.06% and 0.10%.

More advanced readers and cryptocurrency traders can play around with the various crypto derivatives that this crypto exchange offers.

OKX Pros

-

Simple conversions are free

-

Supports up to 30 fiat currencies

-

Access to a larger web3 ecosystem

-

Several options for growing crypto funds

-

24/7 customer support

OKX Cons

-

Unavailable to US residents

OKX Features

-

Extensive crypto support (300+ cryptos)

-

Robust derivative selection

-

Clean, new-age UI

-

OTC trading desk

5. Coinbase – Best Binance Alternative for US Users

If you live in the US, Coinbase is a great Binance alternative as the cryptocurrency exchange features a user interface that makes buying and managing crypto easy.

The exchange supports payment methods that are available to the average citizen. You can deposit funds into your account through a bank account transfer, PayPal, and mobile services like Apple Pay and Google Pay.

While transferring funds, you can either add/withdraw cash from your account or buy/sell digital currencies directly. For example, you can add and withdraw cash with a bank transfer in the US and then convert it to crypto, or you can buy crypto directly with Apple and Google Pay.

Non-US users can still use Coinbase as the exchange operates in more than 100 countries. UK users can fund their accounts using Faster Payments while EU users can use SEPA transfers or mobile solutions.

Coinbase is also one of the largest cryptocurrency exchanges in the US by coin selection. The exchange offers its users over 193 cryptos with a minimum trade as low as $2.

Trading fees on Coinbase is 1% for direct conversions, 0.05% – 0.60% for market orders on the trading terminal, and between 0.00% – 0.40% for limit orders.

To learn more, read our full Coinbase review here.

Coinbase Pros

-

Wide geographical reach

-

User-friendly interface

-

Satisfactory crypto selection

-

Secure offline storage

Coinbase Cons

-

Not as many cryptocurrencies as some competitors

-

High trading fees compared to competitors

Coinbase Features

-

Vault storage facilities

-

Crypto-backed debit card

-

Lending facilities

-

Staking functionality

-

NFT integration

6. Capital.com- Best Binance Alternative for Core Traders

Capital.com is a broker that focuses on providing services, access, and securities to traders. Unlike other alternatives on our list, Capital.com is a traditional broker that dabbles in the crypto markets by providing CFDs.

While it is not the only alternative that offers these contracts, its 456 crypto CFDs is the largest selection on our list and includes various coins and major fiat currencies.

The broker also offers traditional (and proven) trading terminals that conventional traders are used to. These are, of course, the MT4 and MT5 trading software. It is also integrated with the popular charting software, TradingView, to allow traders set positions from within the charting software.

Capital.com’s cryptocurrency trading terminals are cross platform, meaning that they can be used on a desktop, mobile phone, or tablet.

To begin your margin trading, futures trading or even standard crypto trading, you’ll need to first deposit capital into your account. You can do this through a bank transfer, credit card payment, PayPal transfer, or a wire transfer. The broker does not charge for deposits or withdrawals, but your service provider may.

Crypto trading fees depend on the coin. For example, the fee for trading Bitcoin is a 60 pip spread which changes depending on the lot size used. For the three main lot sizes, each trading fee includes $600 for a standard lot, $60 for a mini lot, and $6 for a micro lot.

To learn more, read our full Capital.com review here.

Capital Pros

-

Highly regulated

-

Low minimum deposit

-

Multiple payment channels

-

Wide crypto contract selection

-

No deposit or withdrawal fees on the broker side

Capital Cons

-

Not available to US clients

-

Crypto CFDs are not available to UK residents

Capital Features

-

Cross-platform trading system

-

Multi-asset support

-

Flexible funding options

-

Commission-free trading

7. Bitpanda – Best Binance Alternative for European Users

Bitpanda is a European Fintech firm that offers investment and trading services across various asset classes like cryptocurrency, stocks, commodities, precious metals, and ETFs.

It is a great option for users who seek a Binance alternative to manage their crypto portfolio.

The investment platform is better suited to European users as it supports deposits and withdrawals in the currencies of several nations in the Eurozone. The currencies supported include the EUR, USD, GBP, DKK, TRY, PLN, SEK, HUF, and CZK.

Deposit methods differ with currency. Some currencies use popular payment solutions within their regions, like how the Euro can be transferred with Sofort. However, some popular methods cut across several currencies like bank transfers, credit card payments, and electronic wallets.

For withdrawals, a combination of credit card payments and electronic wallets (Skrill, Neteller) are usually available.

Once you’ve deposited capital to your account, you can buy cryptos at a 2% conversion fee. You can get reduced fees, typically 0.025%, if you use the trading terminal that comes with the platform’s Pro version.

To learn more, read our full Bitpanda review here.

Bitpanda Pros

-

Familiar interface for traditional investors

-

Simple, easy-to-use platform

-

Low €25 minimum deposit and withdrawal requirement

-

0.025% fee with the trading platform

-

Highly secure and regulated

Bitpanda Cons

-

Conversion fee applied to deposits other than EUR

-

Withdrawal is via bank account only

Bitpanda Features

-

Innovative crypto indices

-

Portfolio management features

-

Crypto-backed debit cards

-

Trading terminal

-

Multi-asset support

Why Use a Binance Alternative? Binance Drawbacks

While Binance is a good cryptocurrency exchange platform to use, it is not perfect. It has a few shortcomings, either in absolute terms or when compared to others. Any one of these drawbacks may be a reason to move to an alternative.

Regulatory Hurdles

Binance is known to face regulatory issues in various jurisdictions every now and then. In some cases, they have been ordered to cease operations in certain countries, like the case with Binance ceasing activities in the UK. There have also been reports of the cryptocurrency exchange being investigated for money laundry practices.

While these have not affected the exchange’s service delivery, it is enough to scare off conservative investors from this cryptocurrency trading platform. In this case, you may want to stick with exchanges that are known to work hand-in-hand with regulators, like Coinbase.

User Interface

Binance offers a lot of services, from conversions to staking crypto coins, automated trading, NFT listings, options, and a host of more. Hence, the cryptocurrency exchange interface is an amalgam of services and products that new users could find confusing.

Although there is a lite version of the mobile app, called Binance Lite, it lacks the features that users can grow into. In the end, moving from the Lite version to the Pro would still prove difficult for new users on this crypto exchange platform.

In this case, a crypto exchange alternative like eToro will be a suitable choice as its interface is easy to navigate, despite its features.

Deposit Fees and Methods

While Binance supports numerous fiat currencies, it is not as liberal with the official payment methods it supports. For most currencies, you’ll have to stick with either a SWIFT transfer or a credit card payment, both of which are expensive, especially for frequent purchases.

While the cryptocurrency exchange runs a robust peer-to-peer (p2p) marketplace, it is not as quick as payment methods that competitors offer, and is more prone to fraudulent behavior. In this case, an alternative like eToro is suitable as it supports various payment methods and does not charge for deposits.

Key Things to Consider When Choosing a Binance Alternative

Security

Security is paramount where crypto and digital assets are concerned. Whichever cryptocurrency exchange platform you choose should be at the forefront of security. It should have all the relevant security certifications and must be up to date.

The exchange should also have two-factor authentication enabled to protect against attackers and other crypto scams, who manage to obtain sensitive information like passwords.

Payment Methods

What you’re aiming for here are cryptocurrency exchanges that support payment methods that are easier to use than Binance, or at least cheaper.

Binance supports SWIFT transfers, credit card payments, and some third-party onramps like Simplex. Other exchanges in consideration should offer these and more. Look out for exchanges that support payment methods that are specific to your region.

For example, European users may want to look out for exchanges that support Sepa transfers, while US users may want to look out for Apple or Google Pay.

Currencies Supported

Searching for exchanges that support more fiat to crypto currency payments than Binance is a tall order as the exchange supports 80 currencies. Thankfully you don’t have to. You should be fine as long as an exchange accepts deposits in your native currency or in the currency of a foreign account that you control.

If you live in major regions like the US, UK, EU, Japan, and Singapore, this isn’t a concern as pretty much all major exchanges and trading platforms support currencies from your region. However, users and experienced traders in remote countries may need to keep an eye out.

Regulatory Status

To maintain a healthy measure of safety, focus on exchanges that are regulated in your region. Not all global exchanges are regulated in all the regions they operate in. Binance once ran into trouble with the government of Israel in this regard.

For example, US users can rest easy using Coinbase because it is regulated in their region. Bitpanda users in Europe can also use the exchange freely because it is regulated in the region.

Regulations are especially important for making deposits as countries can exert some level of control over who uses their currencies.

Asset Selection

You’ll want to find an exchange that offers a wide enough selection of cryptos and crypto assets if you want to replace Binance. The exchange you choose doesn’t need to have more coins than Binance, especially because Binance has the second largest selection in the industry.

Instead, focus on exchanges that have the major coins, ideally the top 20 coins and then some other digital assets. Keep in mind that local exchanges have much smaller selections and even some global exchanges do not prioritize a large selection. eToro, for example, is used in various countries but does not offer up to 200 coins.

Provided an exchange has the major coins, some exotics including meme coins, and some sector-specific tokens like storage tokens or metaverse tokens, you should be fine.

If you’re looking for NFT support, then it becomes a different ball game and you may need to adjust your criteria. Unfortunately, that is outside the scope of this guide.

Fees

The ideal cryptocurrency exchange platform should cost less than Binance, or at least the same for more flexible deposit methods. Binance charges 1.8% for credit card purchases. This should be your benchmark.

An exchange like eToro does not charge for deposits, and only charges $5 for withdrawals above $30 for your crypto assets. Many of the exchanges on our list charge more affordable funding fees.

How to Use Our Preferred Binance Alternative - Step-by-Step Tutorial

1. Open an Account

Navigate to the eToro website and click on Start investing. Fill out the form with your full name, email address, and password.

2. Verify Your Account

Verify your account by submitting KYC documents like proof of ID (National ID or driver’s licence) and proof of residency (utility bill). Then, finish setting up your profile.

3. Make a Deposit

Once your account has been verified, click on Deposit funds on the left pane of the page and choose your preferred method. Set the amount you’d like to deposit. The minimum is $10.

4. Load Crypto Charts

Once your account is funded, search for any crypto in the Discover tab. An interface like the one below should load. You can carry out your analysis on the chart or use external charting software. Set your parameters, like a buy or sell price and set your order.

Final Thoughts on the Best Binance Alternatives

We explored the best Binance alternatives and found eToro to be the best overall options because of its free deposit methods, vibrant and large community, thematic investing, and copy trading features.

All of the exchanges on our list are great alternatives, however, some lean more to certain areas than others, which is why we indicated what they are the best at.

To begin investing with our top choice, visit eToro and sign up for an account.

Methodology - How We Picked the Best Binance Alternative

The digital currency exchange platforms covered in this guide were chosen through rigorous testing, research, and reviews. We paid attention to security, transparency, reputation, funding fees, deposit and withdrawal methods, and coin selection.

The platforms listed are the best we found in the various categories we listed them. For example, we found that Bitpanda supports fiat currencies for European nations, so we named it the best alternative for European users.

Check our why trust us and how we test pages for more information on our testing process.