The 8 Best Fiat-to-Crypto Exchanges in 2024

A fiat-to-crypto exchange allows users to convert their cash into cryptocurrency. These fiat-crypto conversions are quite different from trading between cryptos as a party needs to sell the initial crypto that is traded later on.

Hence, these exchanges serve as the first contact for new crypto users. Our guide explores some of the best fiat-to-crypto exchanges around. It uncovers the best exchanges, their deposit and withdrawal methods, how much they cost, and what makes them special when compared to others.

Best Fiat-to-Crypto Exchanges - Our Top 3 Picks

Looking for a quick answer? Here are our top 3 fiat-to-crypto exchanges.

Best Fiat-to-Crypto Exchanges

1. eToro – Best Overall Fiat-to-crypto Exchange

2. Binance – Best Multi-Currency Support

3. Bitstamp – Most Secure Exchange

4. OKX – Best for Direct Crypto Purchases

5. Coinbase – Simplest Fiat-to-Crypto Exchange Interface

6. Bitpanda – Best Exchange for Europeans

7. Uphold – Best Fiat-to-crypto Exchange for Mobile Payments

8. YouHodler – Best Fiat-to-crypto for Bank Deposits

The Best Fiat-to-Crypto Exchanges Compared

|

Exchange |

Fees |

Coins |

Regulation |

| eToro |

1% |

63+ |

FCA, CySEC, AFSL |

| Binance |

0.10% |

600+ |

AMF |

| Bitstamp |

0.5% |

75+ |

CSSF |

| OKX |

0.1% |

343+ |

VARA |

| Coinbase |

1% |

193+ |

FCA |

| Bitpanda |

0.025% – 2% |

170+ |

FMA, AMF, Czech Trade Authority |

| Uphold |

0.8% – 1.8% |

250+ |

FinCEN, FCA |

| YouHolder |

Dynamic |

51+ |

FINMA, ESFS |

Our Top 8 Fiat-to-Crypto Exchanges Reviewed

1. eToro – Best Overall Fiat-to-Crypto Exchange

eToro is one of the most used exchanges in the world with a user base of over 25 million people. Its fiat currency onramp makes it a top choice for the best fiat-to-crypto exchanges.

The exchange incorporates other features that place it high on our list, like free deposits. You do not pay deposit fees for using any of the many supported methods.

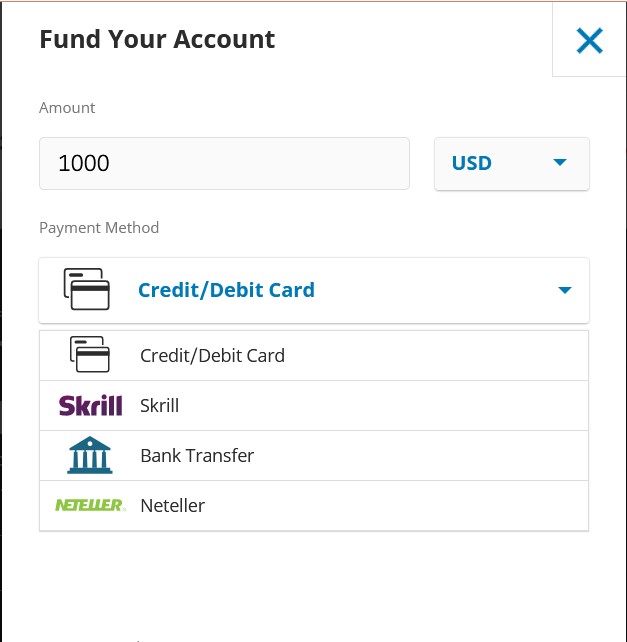

You can deposit using bank transfers, credit cards, PayPal, Skrill, and Neteller, however, you’ll need to send in at least $10. Withdrawal fees are similar but cost $5 for amounts above $30.

There are upper limits for single deposits depending on the payment method used and your geographical region. For example, the maximum single deposit you can make with a credit card is $40,000. With PayPal, Skrill, and Neteller, it is $10,000, while bank transfers are pretty much unlimited, although your bank may impose limits.

Once you have deposited funds, you can trade between the 63+ coins and crypto assets on the exchange at a 1% conversion fee.

To learn more, read our full eToro review here.

eToro Pros

-

63+ cryptos supported

-

$10 minimum deposit (UK and USA)

-

Commission-free trading

-

Free deposits and withdrawals under $30

-

Well regulated

-

Supports multiple deposit methods

eToro Cons

-

Unavailable in some countries

-

Not as many cryptocurrencies as some crypto-specific exchanges

eToro Features

-

Multi-asset platform

-

Flexible payment methods

-

Global reach

-

Large user base

-

Free deposits

2. Binance – Best Multi-Currency Support

Binance’s daily trade volume of $76 billion, multi-currency support, and several payment methods, including the largest crypto peer-to-peer marketplace in the world, make it a great option for a fiat-to-crypto exchange.

The exchange is currently the largest in the world, housing a coin selection and crypto assets that exceeds 600 coins and providing support for 80 world fiat currencies. You can deposit to your Binance account using almost any major fiat currency you can know.

When depositing, you can either deposit cash to your account or buy crypto directly with a fiat money payment method. Sometimes, these options are fixed to certain deposit methods and currencies.

For example, when making GBP deposits, you can use a bank card to deposit GBP into your Binance account or use credit cards to buy crypto directly with the fiat currency. The case is not the same for USD.

With USD, you can only deposit cash using a SWIFT transfer. However, you can buy crypto assets directly with credit cards, Google Pay, and Apple Pay.

Binance imposes volume limits for the direct purchase feature, called “Buy Crypto”, depending on the fiat currency used. USD purchases have a minimum limit of $15 and a maximum of $20,000.

For GBP, the limit is a minimum of £15 and a maximum single transaction value of £10,000. For EURO fiat currency, it is between €15 and €12,500. To find out the limit for your fiat currency, visit the website.

Once you have deposited cash or bought crypto, you can trade crypto at an affordable rate of 0.10% per trade.

To learn more, read our full Binance review here.

Binance Pros

-

Large coin selection

-

Multi-currency support for up to 80 fiat currencies

-

Custom deposit methods for several currencies

-

Mobile app

-

24/7 chat support

-

P2p market available as an alternative onramp

Binance Cons

-

Credit card fees are somewhat high at 1.8%

-

Faces regulatory hurdles in some jurisdictions

Binance Features

-

Large daily trade volume

-

Segregated accounts for Futures, Spot, and Margin trading

-

High Leverage options for Futures

-

Fast execution speed

3. Bitstamp -Most Secure Exchange

Bitstamp is a security-conscious cryptocurrency exchange with a fiat currency onramp. It offers 75+ cryptos, cold storage, and an instant purchase feature.

This is one of the safest crypto exchanges that supports eight major payment methods for both cash deposits and instant purchases. Cash deposit methods include Faster Payments, Sepa, and ACH payments, while instant purchase methods include credit or debit cards, Apple Pay, Google Pay, and PayPal.

You may not have access to all these payment methods, depending on your location. For example, European crypto market users may not have access to Faster Payments as it is mainly a UK service.

Deposits for all cash transfer methods are free while withdrawals cost €2 for Sepa and £3 for Faster Payments. Wire deposits cost 0.05% with a minimum of $7.5 (£5) and a maximum of $300 (£250) while withdrawals cost 0.1% with a minimum of $/£25. The minimum deposit amount for the exchange is $10.

On the other hand, direct crypto purchases cost 4% across all available methods. If you intend to use a credit card, note that you may pay extra as your provider may also charge you.

At the time of writing, monthly trade volumes under $1000 do not attract trading fees. Monthly trade volumes between $1,000 and $10,000 attract a 0.30%-0.40% trading fee, and the fee decreases with increased volume until a floor of 0.03% for trade volumes above $1 billion.

To learn more, read our full Bitstamp review here.

Bitstamp Pros

-

Regulated by the CSSF

-

Implements military-grade security

-

Low minimum deposit requirement

-

Flexible payment methods

-

Transparent fee schedule

Bitstamp Cons

-

High trade fees for smaller amounts

-

Payment methods usually unavailable in remote countries

Bitstamp Features

-

High security

-

Deposit insurance

-

Dedicated trading terminal

-

Fast execution speed

-

>95% uptime

4. OKX – Best for Direct Crypto Purchases

OKX is a one-stop shop for crypto traders and investors, as well as web3 explorers and enthusiasts. It features several types of crypto markets, a simple and free conversion service, several crypto derivatives, and a portal to explore web3.

However, it does not have a cash deposit option. You cannot deposit cash into your account, you can only buy crypto using one of the supported payment methods which include credit cards, third-party on-ramps like Banxa, and the peer-to-peer exchanges and marketplaces.

The card option lets you use services like Apple Pay, however, there are fiat exchange transaction limits. For example, when buying crypto in GBP, you are limited to a minimum value of £9 and a maximum of £4,148.

For USD, it is between $10 and $5,000, while for EUR, the range is €10 to €4,638. Note that your credit card provider may charge transaction fees.

Once you buy crypto, you can swap between 300+ other coins for free with the Simple Convert feature or trade crypto at a rate between 0.06% and 0.10%.

To learn more, read our full OKX review here.

OKX Pros

-

Free conversions

-

Support for up to 30 fiat currencies

-

24/7 customer support

-

P2p market available as an alternative onramp

-

Large selection of cryptos on the spot market

OKX Cons

-

Unavailable to US residents

-

Only supports credit cards as the official method of payment

OKX Features

-

Supports over 300 cryptos

-

Clean, new-age UI

-

Robust derivative selection

-

OTC trading desk

5. Coinbase – Simplest Fiat-to-Crypto Exchange Interface

Coinbase is a great fiat-to-crypto exchange onramp because of its simplicity. It is often a starting point for new crypto voyagers in the 100+ countries that it operates. Asides from being easy to use, the exchange provides FDIC insurance of up to $250,000 on crypto deposits per account.

We must admit that with Coinbase, payments are more straightforward if you live in Canada, Singapore, Europe, the UK, or the US. This is because the payment methods for these regions are clearly laid out in the exchange’s FAQ section.

When it comes to funding transactions, you can either buy and sell crypto directly with your payment method (e.g., a bank account), or deposit and withdraw fiat currency cash from your account.

Canadian users can use a bank transfer and PayPal to buy and sell crypto, respectively. They cannot deposit or withdraw money. Singaporean users can only use credit/debit cards to buy and sell crypto.

European users can use Sepa Payments to add and withdraw cash from their accounts, 3D secure cards to buy crypto instantly, Instant cards to cash out immediately, Sofort to add cash within 8 business days, PayPal to cash out instantly, and Google and Apple Pay to exchange fiat currency to buy crypto instantly.

Users in the UK using this fiat-to-crypto exchange can use a bank transfer to add cash to their accounts, Faster Payments to deposit and withdraw large cash amounts, 3D Secure cards to withdraw money from their accounts, and PayPal to withdraw funds instantly.

US users can use ACH payments to buy crypto and add or withdraw cash from their accounts, instant bank withdrawals to withdraw small amounts, debit cards to buy crypto and withdraw cash, wire transfers to deposit and withdraw large amounts, PayPal to buy crypto and withdraw small amounts, and Apple and Google Pay to buy small amounts of crypto.

Once your account has been funded or you have bought crypto, you can convert fiat currency in your account between the 193+ cryptos and digital assets that Coinbase supports at a 1% conversion fee to convert fiat.

To learn more, read our full Coinbase review here.

Coinbase Pros

-

100+ countries supported

-

Supports popular payments methods, including mobile

-

Low minimum deposit requirements

-

193+ cryptos

Coinbase Cons

-

Payment methods not friendly to remote countries

-

High trading fees compared to competitors

Coinbase Features

-

Crypto-backed debit card

-

Staking functionality

-

Lending facilities

-

Vault storage

-

NFT integration

6. Bitpanda – Best Exchange for Europeans

Bitpanda is a European fiat-to-crypto exchange that offers a traditional approach to crypto investing by allowing users to manage their cryptos and digital assets as a portfolio and diversify into other asset types like commodities and stocks.

The fiat deposits available depend on the exchanging fiat currency being used. The supported major fiat currencies are the Euro (EUR), US dollar (USD), Swiss franc (CHF), British pound (GBP), Turkish lira (TRY), Polish zloty (PLN), Danish krone (DKK), Swedish krona (SEK), Hungarian forint (HUF), and the Czech koruna (CZK).

We’ll cover the traditional currency, GBP, how to deposit funds and withdrawal limits.

Funding methods include Sepa transfers, Skrill, Neteller, bank transfers, Rapid transfers, and credit cards to buy crypto. Skrill/Neteller transfers are subject to a daily deposit limit of £8,948 and a withdrawal limit of £89,948. Every week, the deposit limit is £268,442 while the withdrawal limit is £1.7 million. Overall, you can deposit and withdraw a lifetime value of roughly £8.9 million using this method.

Credit cards are limited to £2,237 a day and do not support withdrawals, while bank transfers are limited to a daily deposit limit of £447,404 and a withdrawal limit of £4.4 million. Visit Bitpanda’s website for more information on payment methods and limits.

With over 170 cryptocurrencies on this reliable exchange, you’ll have options to choose from and swap at a 2% direct conversion fee.

Note that the minimum deposit is €25 while the minimum trade value is €1 or its equivalent in your chosen currency.

To learn more, read our full Bitpanda review here.

Bitpanda Pros

-

Low minimum deposit and withdrawal requirement (€25 )

-

Highly secure and regulated

-

Simple, easy-to-use platform

-

High deposit and withdrawal limits

-

Multi-currency support

Bitpanda Cons

-

Conversion fee applied to non-EUR deposits

-

Withdrawal is via bank account only

-

Support limited to European currencies

Bitpanda Features

-

Innovative crypto indices

-

Portfolio management features

-

Crypto-backed cards

-

Trading terminal

7. Uphold – Best Fiat-to-Crypto Exchange for Mobile Payments

Uphold is another multi-asset exchange that adopts a portfolio-centered method to manage cryptocurrency investments. The exchange’s fiat money onramp as well as its other features place it on our list of top fiat-to-crypto exchanges.

Buying cryptos or making deposits to Uphold is straightforward as the crypto exchange supports only three payment methods: bank transfer, mobile payments (Google and Apple), and credit cards. You can either buy cryptos directly or deposit fiat currencies to your account balance.

You can deposit cash using your bank account, however, it must be either a US, EU, or UK account. You can buy cryptos directly using a credit card, Google Pay, or Apple Pay.

For withdrawals, the only option available is a bank account which must fulfill the criteria listed above.

Once you get some cash into your Uphold account, you can convert between 250+ cryptos and digital currencies at a fee of 0.8% – 1.2% for BTC and ETH.

To learn more, read our full Uphold review here.

Uphold Pros

-

Simple deposit methods

-

Secure and registered

-

Wallet features for long-term storage

Uphold Cons

-

Limited to US, UK, and EU users

-

Limited withdrawal options

-

Bank transfers only work for US, UK, and Europe

-

Fees are high compared to competitors

Uphold Features

-

One-click trade between any two coins

-

Automated trading facilities

-

Crypto-backed debit card

-

Multi-asset platform

8. YouHodler – Best Fiat-to-Crypto Exchange for Bank Deposits

YouHodler presents a holistic approach to crypto management by offering investing, lending and staking services, and a fiat onramp.

You can either top up your YouHodler account with cash or buy crypto directly using a supported method. For depositing fiat currency in cash, you can use a bank transfer, SWIFT transfers, Apple Pay, credit cards, and Adv Cash.

You can only withdraw cash from your account to either a bank account or your credit card.

Bank wires are usually free but require proof of address verification. The transaction also takes between 1-3 business days to complete. If you want a faster method, you can use a bank card which is instant but costs 1% and only works with EUR and USD.

Bank transfers also include SWIFT transfers which cost $25 (or £20) per deposit and can take up to 5 business days to reflect with this crypto exchange.

Apple Pay is another quick method that costs 1%, however, it is only available to users in the EU, only works with EUR and USD, and requires that dollar cards be issued in the Eurozone.

Meanwhile, AdvCash works with either a bank card or the AdvCash wallet. While both options are instant, however, deposits with credit cards cost 4.5% while those with the native wallet costs 1%.

Withdrawals work with bank transfers and credit cards. You can withdraw cash to your bank account at a 1.5% fee at a minimum of $70. This means that the amount you withdraw has to be large enough that the minimum fee is $70.

Other withdrawal fees include €55 for SWIFT, €5 for Sepa, and 0.15% for GBP and CHF (£55, ₣55 minimums).

For credit cards, the fee is between 3% – 3.5% or $1 – $5.

To learn more, read our full Youhodler review here.

YouHodler Pros

-

Free bank deposits

-

Supports mobile payment via Apple Pay

YouHodler Cons

-

Steep fees for SWIFT transfers

-

Limited currency support

YouHodler Features

-

Wallet for long-term storage

-

Single-click conversions

CoinbaseBinance’seToro

What is a Fiat-to-Crypto Exchange?

A Fiat-to-Crypto exchange is an exchange that specializes in converting various fiat currencies into cryptocurrencies and other digital assets. Fiat currencies here refers to legal tender i.e. USD, GBP, EUR, and other legal currencies used in various countries.

These exchanges can also offer crypto-to-crypto exchanges, like the ones on our list, or act solely as an on-ramp service. Usually, they support one or more traditional forms of payment like a bank transfer, credit or debit card payments, or electronic money services like PayPal crypto exchanges.

How Do the Best Fiat-to-Crypto Exchanges Work?

The best fiat-to-crypto exchanges store cryptocurrencies in their vaults and then sell them to users. In many ways, they act like crypto brokers with processes that are pretty straightforward in most cases.

The safest crypto exchanges either buys cryptocurrency, stores them, and then sells it to users upon request or routes them directly to counterparties who can. Either way, the exchange has the facility to receive payments.

You create an account with the fiat-to-crypto exchange, which usually comes with a good crypto wallet and fiat wallet that can receive any number of fiat currencies, based on the crypto exchange. When you’re ready to buy some crypto, you send funds to your fiat wallet using one of the exchange’s supported payment methods.

Afterwards, you should be able to start converting fiat currency to crypto, usually using a Convert feature. Alternatively, you can buy crypto directly without having to first deposit cash.

Key Things to Consider When Choosing an Exchange for Fiat-to-Crypto

Security

Security is always the first consideration where crypto is concerned. The platform you choose should comply with the latest industry security standards. In this case, an ISO certification should suffice.

Also, look out for two-factor authentication (2FA). This is a second line of defense that protects your account if an intruder gets a hold of your password through a common crypto scam.

Payment Methods

The supported payments are probably the next most important factor to consider when choosing the best fiat-to-crypto exchanges. Because you will use it periodically, you need to choose a method that is cheap and easily accessed.

Payment methods for a fiat exchange like bank cards are usually widely accepted but are usually the most expensive. Local bank transfers are accepted for major regions like the US or UK, but cannot be depended upon for remote countries to convert fiat.

Whichever method you choose, ensure it is continuously accessible, cheap, and legal in your location.

Currencies Supported

When choosing between fiat-to-crypto exchanges, ensure it supports several currencies to avoid having to jump between multiple crypto exchanges or send coins between wallets.

Global crypto exchanges usually have wider coin selections but less local-friendly options while regional/local crypto exchanges have friendlier deposit options but smaller selections of digital currencies.

The trick would be to balance both by finding a crypto exchange whose funding method is acceptable with a wide enough coin selection.

Regulatory Status

Your choice of fiat-to-crypto exchange must be well-regulated in your region. Governments have legal say over which entities are allowed to use their currencies, especially within their territories.

If you intend to make deposits from a foreign currency account, ensure that the decentralized crypto exchange is legally allowed to do business in the currency’s originating country, just in case your transfer is routed through domestic banks.

How to Use a Fiat-to-Crypto Exchange - Step-by-Step Tutorial

1. Open an Account

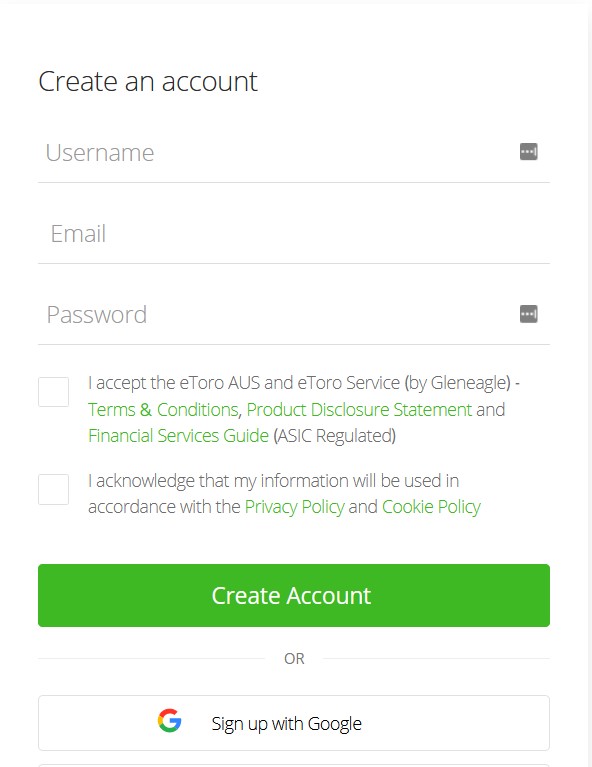

Navigate to the eToro website and click on Start investing. Fill out the form with your full name, email address, and password.

2. Verify Your Account

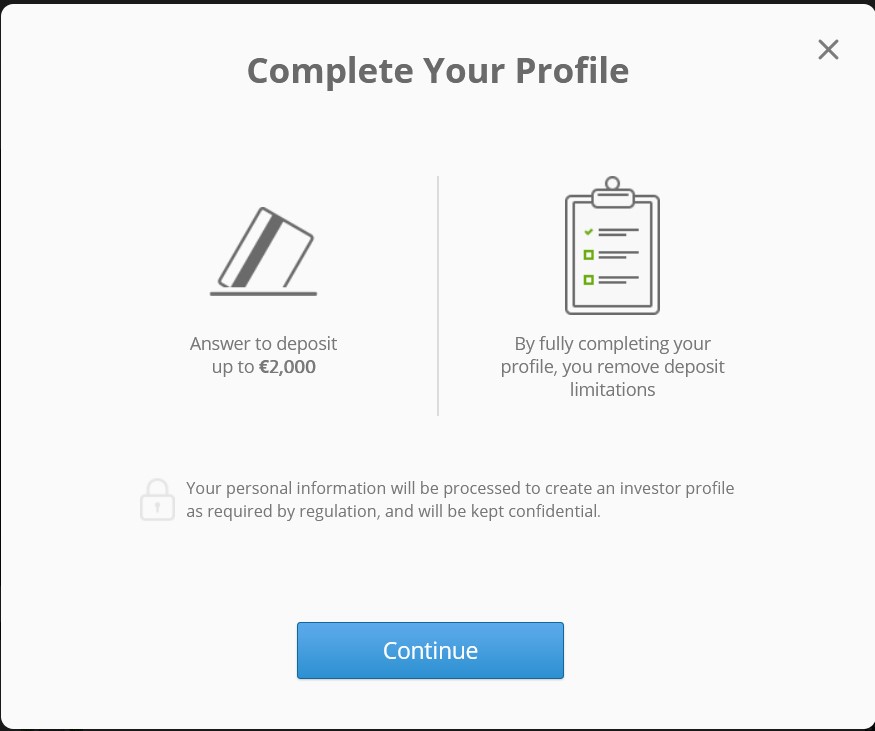

Verify your account by submitting KYC documents like proof of ID (National ID or driver’s licence) and proof of residency (utility bill). Then, finish setting up your profile.

3. Make a Deposit

Once your account has been verified, click on Deposit funds on the left pane of the page. The deposit options available will be displayed. Choose one and set the amount you’d like to deposit. The minimum is $10.

4. Load Crypto Charts

Once your account is funded, search for any crypto in the Discover tab. An interface like the one below should load. You can carry out your analysis on the chart or use external charting software. Set your parameters, like a buy or sell price and set your order.

Final Thoughts on the Best Fiat-to-Crypto Exchanges

We explored the best fiat-to-crypto exchanges around and chose eToro as our overall best because of its free deposit and withdrawing fiat currency facility, multiple deposit methods, and worldwide availability thanks to its large user base.

Nonetheless, we understand that other exchanges have features that may appeal more to certain readers, so we made sure all the ones on our list are good and proven.

Ensure to always be security conscious when using a crypto exchange, and to always pick one with a payment method that works for you, especially if you plan on making recurring purchases with that particular crypto exchange.

To begin buying crypto with our top choice, visit the eToro website and sign up.

Methodology - How We Picked the Best Fiat-to-Crypto Exchange

The fiat-to-crypto exchange platforms covered in this guide were chosen through rigorous testing, research, and reviews. We paid attention to security, transparency, reputation, funding fees, deposit and withdrawing fiat currency methods, and coin selection.

The platforms listed are the best fiat-to-crypto exchange platforms we found in the various categories we listed them. For example, we found that Binance supports the highest number of fiat currencies, so we named it the best fiat-to-crypto exchange option for multi-currency support.

Check out our why trust us and how we test pages for more information on our testing process.