10 Best Crypto Exchanges for Day Trading in 2024

Not all cryptocurrency exchanges are created equally. Some are made for buy-and-hold investors, while others are made for trading purists. Our guide focuses on the best crypto exchange for day trading because these volatility chasers need facilities that are unavailable on some exchanges.

In this guide, we explore the crypto day trading exchanges that provide a suitable environment for trading and touch on some day trading rules and strategies for increasing your likelihood of success (or at least reducing your risk of loss).

Best Crypto Exchanges for Day Trading - Our Top 3 Picks

Looking for a quick answer? Here are our top 3 crypto exchanges for day trading.

Best Crypto Exchanges for Day Trading

1. eToro – Best Overall Exchange for Day Trading

2. Binance – Best Crypto Exchange for Day Trading with Futures Contracts

3. Skilling – Best Crypto Exchange for Day Trading Purists

4. Bitstamp – Most Secure Crypto Exchange for Day Trading

5. OKX – Best Integrated Crypto Exchange for Day Trading

6. Coinbase – Simplest Crypto Exchange for Day Trading

7. Capital.com – Best Crypto Exchange for Day Trading Crypto CFDs

8. Bitpanda – Best Crypto Exchange for Day Trading Crypto Indices

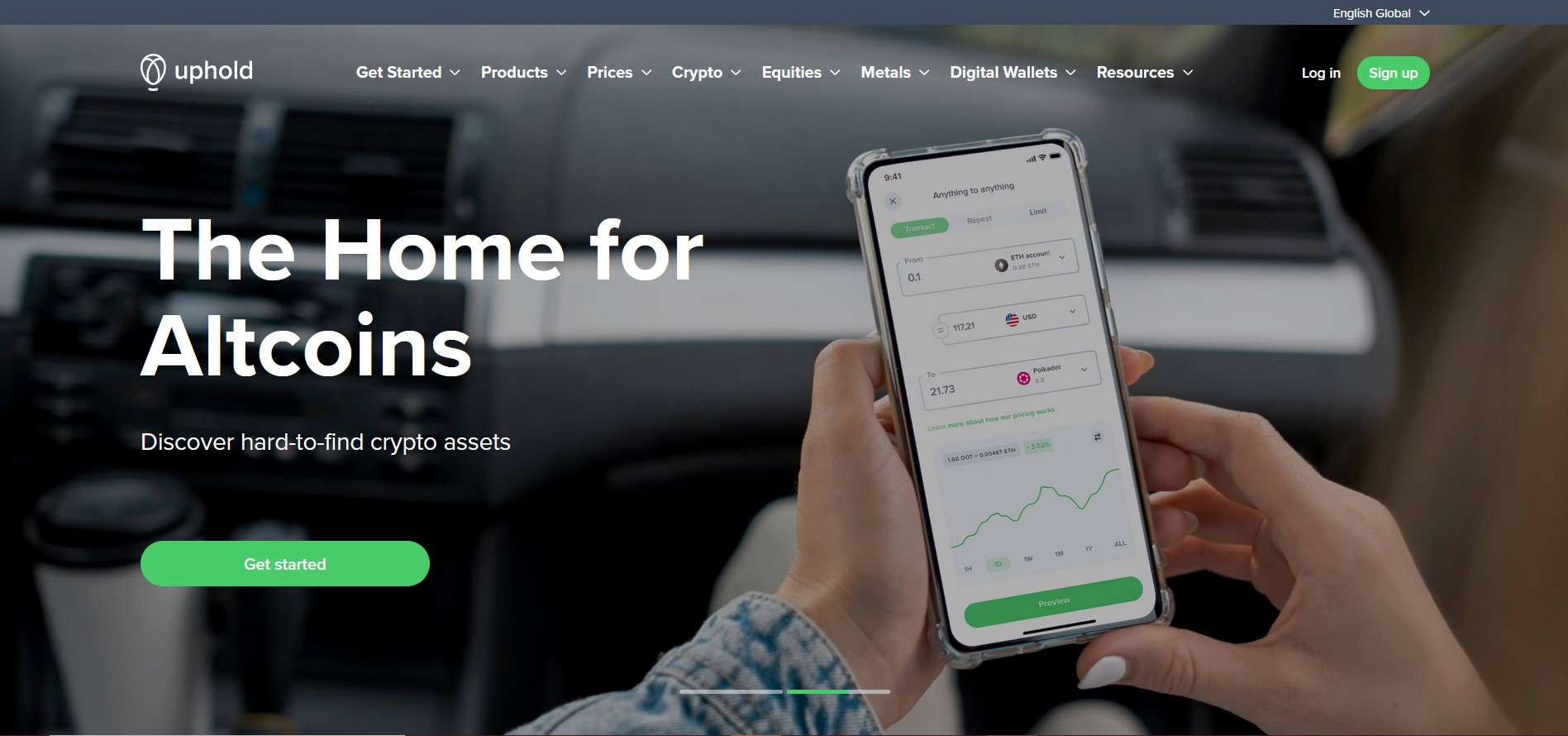

9. Uphold – Best Day Trading Crypto Exchange for Casual Users

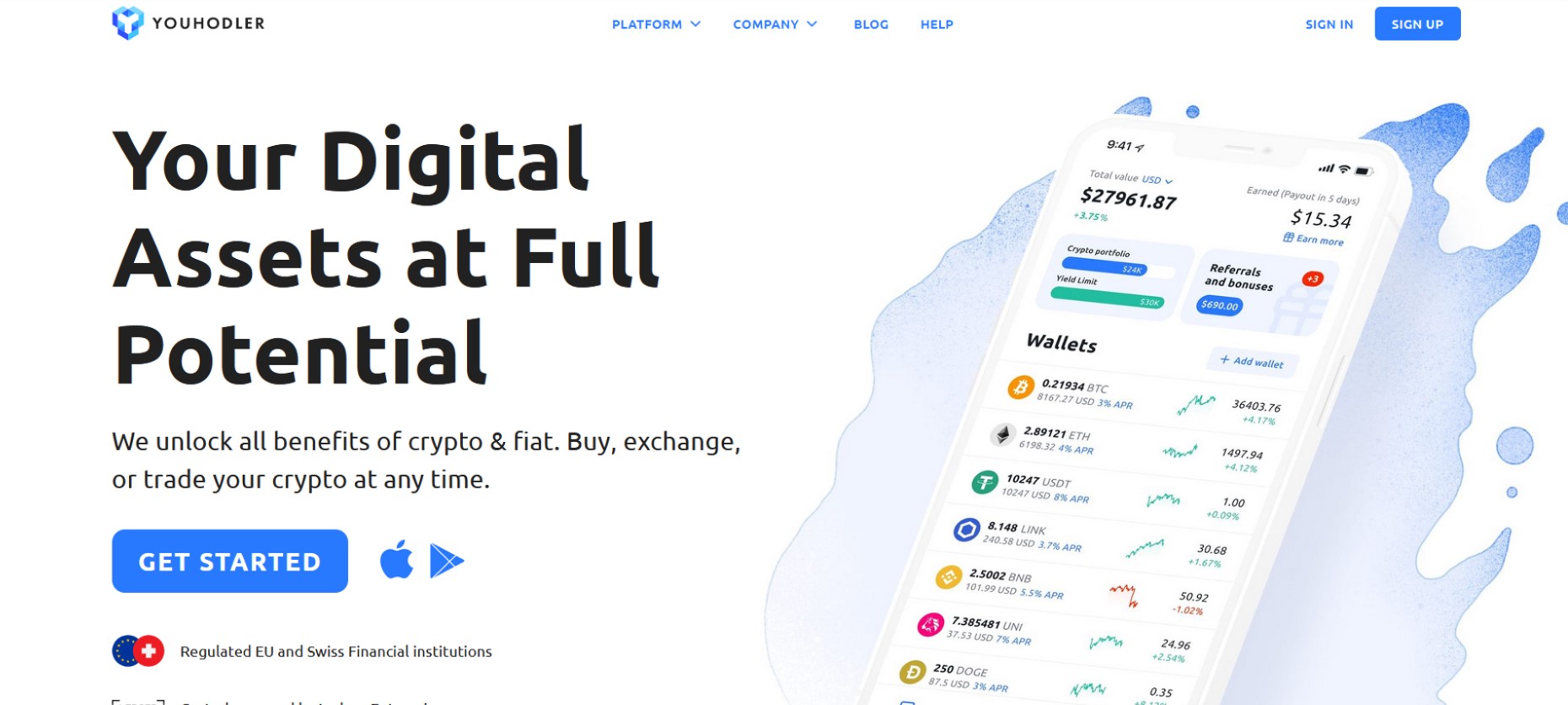

10. YouHodler – Best Crypto Exchange for Non-Day Traders

Best Crypto Exchanges for Day Trading Compared

|

Exchange |

Fees |

Coins |

Regulation |

|

eToro |

1% |

63+ |

FCA, CySEC, AFSL |

|

Binance |

0.10% |

600+ |

AMF |

|

Skilling |

Dynamic |

55+ |

CySEC |

|

Bitstamp |

0.5% |

75+ |

CSSF |

|

OKX |

0.1% |

343+ |

VARA |

|

Coinbase |

1% |

193+ |

FCA |

|

Capital.com |

Dynamic |

400+ |

FCA, CySEC, ASIC |

|

Bitpanda |

0.025% – 2% |

170+ |

FMA, AMF, Czech Trade Authority |

|

Uphold |

0.8% – 1.8% |

250+ |

FinCEN, FCA |

|

YouHolder |

Dynamic |

51+ |

FINMA, ESFS |

Our Top 10 Crypto Exchanges for Day Trading Reviewed

1. eToro – Best Overall Exchange for Day Trading

eToro is our top exchange for day trading because it balances many of the factors we look for in a day trading platform. The most popular feature that got our attention is the copy trading platform which makes day trading easy for non-traders.

While not purely a crypto day trading platform, new users can get started trading immediately after they verify their accounts, thanks to copy trading, without having to develop the skills necessary to do so, although we do not recommend blindly following others.

Furthermore, the platform makes depositing funds easy by supporting several legacy payment methods. You can deposit money into your account as easily as making a PayPal transaction or a credit card purchase.

We also like that eToro uses CFDs to enable short selling. While longing involves purchasing the underlying asset, you can short-sell without owning the asset. Furthermore, buying and short selling are priced similarly, at 1% per transaction without commissions. Deposits are free at a minimum value of $10 while a $5 fee is charged for withdrawals above $30.

We must admit, the platform’s pricing favors buying, and its structure favors mid-long-term crypto investing. However, if you’re not too crazy about core crypto trading, this may be the exchange for you.

Read our full eToro review here.

eToro Pros

-

63+ cryptos supported

-

$10 minimum deposit (UK and USA)

-

Commission-free trading

-

Copy trading features

-

Well regulated

-

Easy to use

eToro Cons

-

Unavailable in some countries

-

Not as many cryptocurrencies as some crypto-specific exchanges

eToro Features

-

Multi-asset platform

-

Flexible payment methods

-

Global reach

-

Large user base

-

Free deposits

2. Binance – Best Crypto Exchange for Day Trading with Futures Contracts

Binance has one of the largest crypto collections in the industry, making it an ideal destination for volatility chasers. When we used the platform, we found that we had a lot of crypto day trading markets to choose from.

Because of Binance’s global influence, new trading pairs are constantly being added to the list as projects list their best new crypto coins on the crypto exchange. We don’t see its market becoming stale anytime soon for crypto day traders.

For liquidity chasers, Binance processes about $76 billion worth of trades per day. While this number may reduce in bear markets, it is still enough to provide plenty of liquidity for large trading volume.

The exchange’s pricing is also favorable for crypto day traders. At a rate of 0.10% per trade, Binance allows you to trade frequently without racking up a significant bill. This fee is slashed if you hold BNB in your account balance.

Lastly, Binance offers day traders different options. You can use Margin Trading to trade spot coins. You can use Futures contracts to take advantage of crypto asset volatility by longing or shorting coins, or you could use the Grid Trading bot to automate your trades.

You can deposit funds into your Binance account using over 61 major currencies through bank transfers and credit/debit cards. The former comes with a $1 (£1) fee while the latter costs 1.8% of the transaction volume, depending on location.

Read our full Binance review here.

Binance Pros

-

Large coin selection

-

Low fees

-

Advanced trading tools

-

Mobile app

-

24/7 chat support

Binance Cons

-

Could be a bit technical for beginners

-

Faces regulatory hurdles in some jurisdictions

Binance Features

-

Large daily trade volume

-

Segregated accounts for Futures, Spot, and Margin trading

-

High Leverage options for Futures

-

Fast execution speed

3. Skilling – Best Crypto Exchange for Day Trading Purists

Skilling is a crypto broker for crypto trading purists that provides an affordable way to trade cryptos. While investors can take advantage of the crypto trading platform, you won’t see staking features here.

The broker offers access to the best Contracts for Differences (CFDs) for over 55 cryptos. These contracts are financial derivatives trading that track the price of cryptocurrencies. This allows day traders to trade crypto’s price action without owning them.

If you’re a trader who chases crypto volatility, you’ll find that this can sometimes be a more efficient way to trade. And you can at an affordable 0.2% per trade. However, a minimum EUR 100 deposit is required to get started.

You can deposit using several payment methods like bank transfers, PayPal, and even cryptocurrencies like USDT, BTC, and BCH. All deposit methods aside from crypto cost 2.9% of the deposit value. After deposit confirmation, a 1:50 leverage facility is made available.

We like how Skilling’s platform is geared towards crypto traders. Although the broker supports other asset types, it retains the new-age crypto exchange look and feel. The platform also has a fantastic customer service team that is always ready to onboard new day traders.

The platform is regulated by the Cyprus Securities Exchange Commission (CySEC).

Skilling Pros

-

Cheap Bitcoin spreads

-

2% margin requirement

-

Highly secure and well regulated

-

1:50 leverage facility

-

Supports crypto deposits

Skilling Cons

-

Minimum deposit higher than others

Skilling Features

-

Multi-asset support

-

Flexible funding methods

-

Secure and regulated by multiple agencies

-

Intuitive user interface

4. Bitstamp – Most Secure Crypto Exchange for Day Trading

Bitstamp is one of the oldest and safest crypto exchanges with a strong history of tight security. The exchange uses bank-grade technology to secure its vaults and stores 95% of user funds offline, like a crypt cold wallet.

With Bitstamp, you get access to over 75+ tradable cryptos, 24/7 customer service, and the familiar feel of legacy trading platforms. Therefore they are institutions’ favorites. We love Bitstamp because they designed a platform with experienced traders in mind.

The Pro Trader platform, found by clicking the icon at the top of the screen, are advanced trading tools with a fully functional trading terminal, complete with analytic tools, a steady stream of market insights, and flexible order execution facilities.

The crypto trading platform trading fees are also pocket friendly. The amount you pay depends on your monthly trading volume. A higher trading volume equals lower fees.

At the time of writing, monthly trade volumes under $1000 do not attract trading fees. Monthly trade volumes between $1,000 and $10,000 attract a 0.30%-0.40% trading fee, and the fee decreases with increased volume until a floor of 0.03% for trade volumes above $1 billion.

Deposits are quick and easy with several payment channels available. Day traders can use credit cards, international wire transfers, Faster payments (UK), ACH payments, Google Pay and Apple Pay, and SEPA transfers. Withdrawals also support the same channels.

Credit card transactions, Google Pay, and Apple Pay cost 5% for both deposits and withdrawals. Sepa deposits are free while withdrawals cost €3, ACH transfers are free both ways, and Faster Payments deposits are free while withdrawals cost £2.

Finally, wire deposits cost 0.05% with a minimum of $7.5 (£5) and a maximum of $300 (£250) while withdrawals cost 0.1% with a minimum of $/£25. The minimum deposit amount is $10.

Bitstamp Pros

-

Regulated by the CSSF

-

Implements military-grade security

-

Low minimum deposit requirement

-

Flexible payment methods

-

Transparent fee schedule

Bitstamp Cons

-

High trade fees for smaller amounts

Bitstamp Features

-

High security

-

Deposit insurance

-

Dedicated trading terminal

-

Fast execution speed

-

>95% uptime

5. OKX – Best Integrated Crypto Exchange for Day Trading

OKX is a crypto exchange that prides itself on being a holistic solution for crypto users. It offers crypto trading services as well as NFT marketplace and web3 integrations for users who wish to explore web3.

While the platform may not appear to be trader-centric, it offers various crypto derivatives to day traders from all backgrounds. The exchange’s selection includes Futures, Options, Perpetual Swaps, and even Crypto Indices.

For spot traders, OKX offers over 300 digital assets and cryptos that can easily be swapped at a 0.10% fee. The Convert feature provides a one-touch conversion service for mellow day traders.

If you prefer a more hands-on day trading setup like the best crypto exchanges, trading tools such as the Spot terminal has the charts, tools, order types, and execution speed needed to get you going. More experienced day traders can focus on the trading strategy with crypto derivatives offered and use leverage to magnify their gains (or losses).

OKX charges 0.10% for fiat-crypto exchange transactions, and between 0.06% – 0.10% for trades.

Day traders can buy crypto on OKX using a credit/debit card, a third-party on-ramp like Simplex or Banxa, or through its peer-to-peer marketplace.

Read our OKX review here.

OKX Pros

-

The convert option is free

-

Access to a larger web3 ecosystem

-

Support for up to 30 fiat currencies

-

Several options for growing crypto funds

-

24/7 customer support

-

Large selection of cryptos on the spot market

OKX Cons

-

Unavailable to US residents

OKX Features

-

Supports over 300 cryptos

-

Clean, new-age UI

-

Robust derivative selection

-

OTC trading desk

6. Coinbase – Simplest Crypto Exchange for Day Trading

Coinbase is known for its simplicity. The crypto exchange is a great option for new crypto voyagers, and the same holds true for experienced traders.

The exchange is a great hop-on point for people who are just getting started in the crypto markets with crypto day trading, especially those who don’t have prior investing experience. Its interface is built to be easy to understand and navigate.

You can trade more than 193 digital assets and cryptos with as little as $2, low enough for anyone to try crypto trading without making significant financial commitments.

Coinbase charges 1% for direct conversion. Market orders are usually more expensive, falling anywhere between 0.05% and 0.60%, while limit orders cost anywhere between 0.00% and 0.40%.

We love Coinbase because it removes roadblocks to funding by allowing users to connect the same bank account for both deposits and withdrawals, smoothing out both processes. Coinbase is easier to use if you reside in the US. Otherwise, you may need to rely on Coinbase alternatives for funding sources which are not as seamless.

You can deposit using PayPal, credit cards, SEPA transfers if in European, Google and Apple Pay if in Europe or the US, and Faster Payments if in the UK.

Read our full Coinbase review here.

Coinbase Pros

-

100+ countries supported

-

User-friendly

-

Secure offline storage

-

193+ cryptos

Coinbase Cons

-

Not as many cryptocurrencies as some competitors

-

High trading fees compared to competitors

Coinbase Features

-

Crypto-backed debit card

-

Staking functionality

-

Lending facilities

-

Vault storage

-

NFT integration

7. Capital.com – Best Crypto Exchange for Day Trading Crypto CFDs

Capital.com is a globally licensed broker that is focused on providing trading and cryptocurrency day trading services to its users across several asset classes.

We love Capital.com because it is trader focused. The broker offers over 456 cryptocurrency contracts across major fiat currencies. These contracts allow you to trade cryptos in both bullish and bearish markets.

The broker also offers a suite of trading tools on its platforms to use. If you’re a traditional trader, you can use the popular MT4 trading terminal or the newer MT5 terminal. Alternatively, you can use the TradingView charting system thanks to its API integration.

These terminals are also cross-platform and can be used as a mobile phone or tablet cryptocurrency app.

When it comes to trading fees, Capital.com charges a spread per lot across three lot sizes: the standard lot (100,000 units), the mini lot (10,000 units), and the micro lot (1,000 units).

For crypto like Bitcoin, the spread is 60 pips, which translates to $600 for a standard lot, $60 for a mini lot, and $6 for a micro lot.

You can deposit funds through a bank transfer, credit card payment, PayPal, or wire transfer, however, a minimum deposit of $20 is required.

Capital Pros

-

Highly regulated

-

Low minimum deposit

-

Commission-free trading

-

Multiple payment channels available

-

Wide crypto contract selection

-

No deposit or withdrawal fees on the broker side

Capital Cons

-

Not available to US clients

-

Crypto CFDs are not available for UK residents

Capital Features

-

Multi-asset support

-

Cross-platform trading system

-

Flexible funding options

-

Commission-free trading

8. Bitpanda – Best Crypto Exchange for Day Trading Crypto Indices

Bitpanda is a European Fintech firm that offers trading services across asset classes like cryptocurrency, stocks, commodities, precious metals, and ETFs.

The platform offers over 170 cryptocurrencies and is highly regulated by several bodies like the Financial Market Authority (FMA) Austria, the French Autorité Des Marchés Financiers (AMF), and the Czech Trade Authority.

We love Bitpanda because of its traditional feel. Day traders who are not used to cryptocurrency trading app platforms may find a home here as its UI resembles those of traditional applications that are geared more towards investing and portfolio management.

However, day traders are not left out as the firm offers a Pro version with a trading terminal and reduced trading fees for crypto assets. While direct fiat-to-crypto conversions cost 2% of the transaction value, the trading terminal charges 0.025% for limit trades.

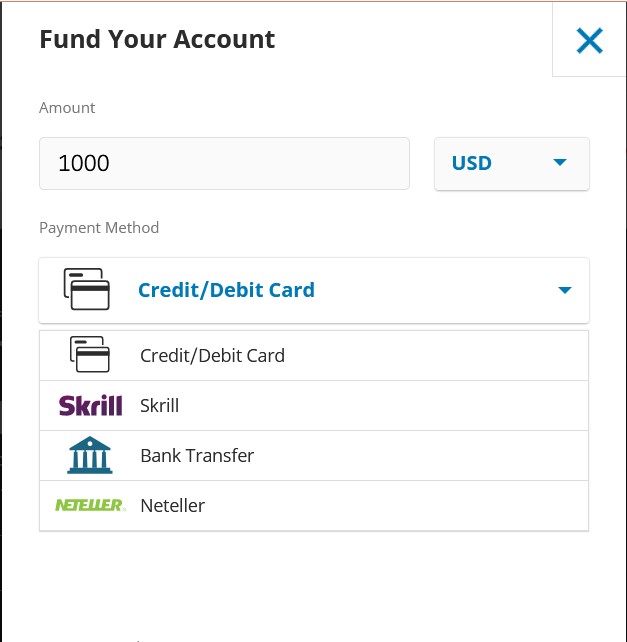

You can deposit funds into your account using payment methods like Skrill, Neteller, bank transfers, credit cards, and SEPA payments. However, the minimum deposit is €25.

Bitpanda Pros

-

Highly secure and regulated

-

Familiar interface for traditional investors

-

Simple, easy-to-use platform

-

Low €25 minimum deposit and withdrawal requirement

-

0.025% fee with the trading platform

Bitpanda Cons

-

Conversion fee applied to deposits other than EUR

-

Withdrawal is via bank account only

Bitpanda Features

-

Innovative crypto indices

-

Portfolio management features

-

Crypto-backed cards

-

Trading terminal

9. Uphold – Best Day Trading Crypto Exchange for Casual Users

Uphold is a multi-asset digital platform that allows investors and day traders to buy and sell crypto assets, stocks, and metals in a simple way, and manage them as part of a portfolio.

We like Uphold because of its pricing structure. All trading fees associated with a trade are summed and locked in before you hit the trade button. So, what you see is what you get charged, nothing more.

Also, this low fee crypto exchange has a smart route function that allows day traders to convert from any coin to any other coin within the Uphold exchange in one step. The norm is that there are fixed pairs that you can trade between, so trading one exotic coin for another would involve more than one trade in most cases. Not anymore.

With Uphold, you only transact once, and this can save money that would have originally been spent on trading fees for multiple trades. This comes in handy when day trading between the platform’s 250+ cryptocurrencies.

Trading fees on Uphold range between 0.8% and 1.2% as a spread on BTC and ETH if you live within the US, UK, or Europe. For residents of other countries, the spread goes up to 1.8%. Note that these figures are for BTC and ETH as they are two of the most widely traded cryptos for crypto exchanges and day trading.

Other cryptos have variable spreads that change with market volatility.

Uphold Pros

-

Transparent fee structure

-

Secure and registered

-

Wallet features for long-term storage

Uphold Cons

-

Equities not available in the US

-

Bank transfers only work for US, UK, and Europe

-

Fees high compared to competitors

Uphold Features

-

One-click trade between any two coins

-

Automated trading facilities

-

Crypto-backed debit card

-

Multi-asset platform

10. YouHodler – Best Crypto Exchange for Non-Day Traders

YouHodler is an all-in-one platform for buying, selling, trading, staking, and lending crypto assets. It prides itself on providing a platform that allows users to make the most of their cryptos.

We like YouHodler because it is unique. Unlike other crypto exchanges on this list that provide fully functional trading features, YouHodler’s exchange is a simple convert interface that swaps coins.

The exchange is not for day traders, but it’s so easy to use that it’s worth a go if you’re not a hardcore trader. The only hangup is that you cannot set limit orders, which shouldn’t be a problem if you’re not a day trader.

You can deposit using bank transfers, which are free unless you make a SWIFT transfer which cost $25 or £20 per deposit. Bank wires are also subject to a minimum of $/£/€100 and could take anywhere between 2 to 5 business days.

Alternatively, you can use bank cards which come with a 1% fee, AdvCash which also costs 1%, or a bank card using AdvCash which costs 4.5%. Crypto deposits are free.

Conversion fees depend on the size of your conversion and the currencies in question, so they can be quite dynamic. Luckily, they are always displayed before you convert so you’ll always know how much you’ll pay.

YouHodler Pros

-

Universal conversion between multiple coins

-

Intuitive user interface

YouHodler Cons

-

Non-standard conversion fees

-

Unavailable to US residents

YouHodler Features

-

Wallet for long-term storage

What is Crypto Day Trading?

Crypto day trading involves buying and selling crypto coins, contracts, or derivatives within the best time to trade crypto over the span of 24 hours. The trades executed are opened and closed within one trading day.

Day trading strategies generally leverage market volatility to make tiny profits frequently, and the rules are not different for crypto. Day traders depend on crypto’s volatility to make profit; however, this volatility is often small and yields tiny profits.

Therefore day trading is a numbers game. The more trades you can execute, the higher your chances of making a decent daily profit when the outcomes of all trades are summed.

Usually, you’ll see day traders opening several trades within a 24-hour period hoping to make as many small gains from each one as they can.

What Fees are Involved?

The major fee to look out for when day trading is your broker’s trading fees which could be charged as a commission, spread, or both. While broker trading fees may seem small to the ordinary investor, tiny pip or (percentage) differences could easily accumulate to a significant bill given the number of daily transactions an average day trader makes.

Usually, day traders go for crypto exchanges with minimal fees. Some traders choose brokers who charge commissions and use raw spreads as every little percentage counts when it comes to day trading.

The next set of fees for day traders to look out for are financing fees, which depend on your exchange and payment provider(s). These fees include deposit, withdrawal, account maintenance, software licensing and the like.

Depending on how frequently you deposit and withdraw funds, financing fees can accumulate and eat into your day trading capital, so ensure that you are comfortable with them and you plan your cash movements.

What is the Best Crypto for Day Trading?

There is no one best crypto for day trading. Instead, there are factors that make certain cryptos more suitable than others for crypto day trading strategies.

The most prominent is trading volume. The best crypto exchanges for day trading have sufficient daily volumes to allow crypto traders to enter and exit positions successfully. A high volume also indicates enough liquidity to open positions without moving the market.

For example, crypto market data suggests that it takes about $80 million to move Bitcoin’s price by 1%. This is a good thing as day traders know that a $500,000 day trade will not affect the natural progression of the market.

The next is the crypto’s ability to range or trend. While this usually comes with high volatility, cryptos that either trade within a sideways channel or move significantly up or down, especially on lower time frames, are better for day trading.

Crypto Day Trading Strategies

Ready to start day trading? Here are some cryptocurrency day trading strategies you can try out.

News Trading

News trading involves anticipating how the market will react to certain news reports and events and trading accordingly. Some of these news events are periodic and can be planned for, like inflation reports and interest rate policy announcements.

The first question to ask when using this strategy is how a certain turn of events will affect the market. For example, will an interest rate increase affect crypto prices positively or negatively?

Then, carry out some research to see where the market is leaning. This is usually reflected in charts, but you can never be too sure.

Next, ask if the market has already priced in the news. An opportunity opens if the market has not fully priced the news in its valuations.

Range Trading

Range trading is a simple trading strategy, especially for day traders, that involves marking out the highest and lowest price range a crypto can get to within a certain period (ideally a day) and trading according to that on crypto exchanges.

You’ll need to carry out research and use indicators like the Average True Range to achieve this. Because you’re trading on a small time frame, price action will usually fluctuate between the high and low points.

However, this strategy only works on a range-bound or sideways market, not a trending one.

Mean Reversion Trading

Mean reversion trading works on the principle that a security’s price action will always revert to its historical mean no matter how high or low it rises or falls. Your job as a trader is to find out where that mean is and when the market is about to reverse.

It’s important to do your analysis on a small enough time frame that the reversion happens within a trading day. You may not use this strategy every day as price action may not revert within a trading session.

Money Flow Trading

Money flow trading involves using the Money Flow Index indicator to gauge the amount of money flowing into and out of crypto. This helps you predict whether a price increase or decrease is incoming.

Usually, an increase in inflow precedes an uptrend while a decrease precedes a downtrend.

Crypto Day Trading Rules

Stick to Lower Time Frames

Because you’re looking to close your trades within one trading session, you should stick to lower time frames. If you’ve chosen the right crypto, you should still have enough volatility and volume on smaller time frames to make a profit. Stick to time frames from 5m to 1h (5 minutes to 1 hour).

Watch the News

News releases can upend the ongoing market trend. Unless you plan to use the news trading strategy, it’s best to stay away from the market on days that major reports are released.

Use Technical Analysis

When trading on small time frames, you rely heavily on technical analysis. Get familiar with indicators and chart patterns. Also, don’t get pulled into the trend of filling up your screen with confusing lines and unnecessary indicators, two or three good ones are fine.

Chase Volatility

Volatility, in many ways, determines how much you can possibly make. Cryptos that aren’t volatile don’t provide profitable opportunities for day traders. You can measure volatility using an indicator called Bollinger Bands.

Use Screeners

Day traders aren’t worried about fundamentals. They don’t care about crypto’s legitimacy, or whether its tokenomics is sound. As such, they have a lot more options which could be overwhelming.

Learn to use crypto screeners to narrow in on coins that meet predefined criteria i.e., are ready for day trading.

How to Day Trade on Crypto Day Trading Platforms- Step-by-Step Tutorial

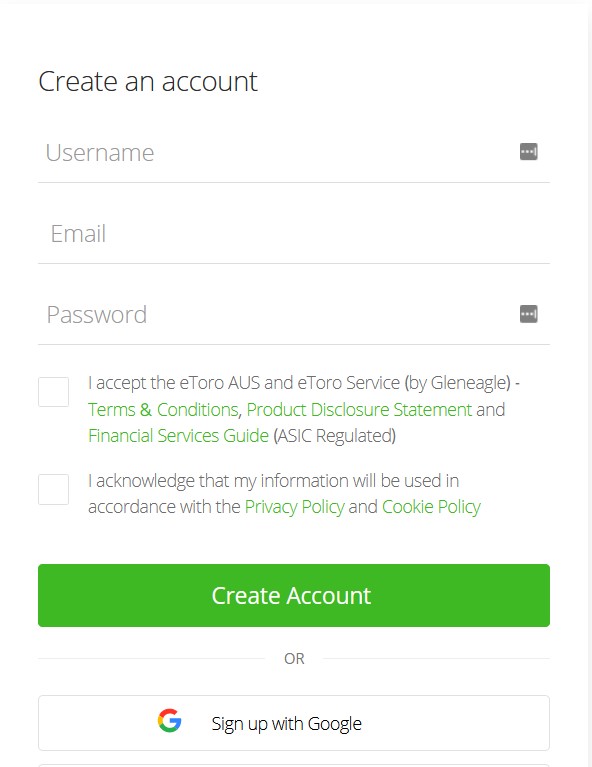

1. Open an Account

Navigate to the eToro website and click on the Start investing icon to begin. Alternatively, you can download the mobile app from the Play Store/App Store and click on Sign up. Fill out the form with your full name, email address, and password.

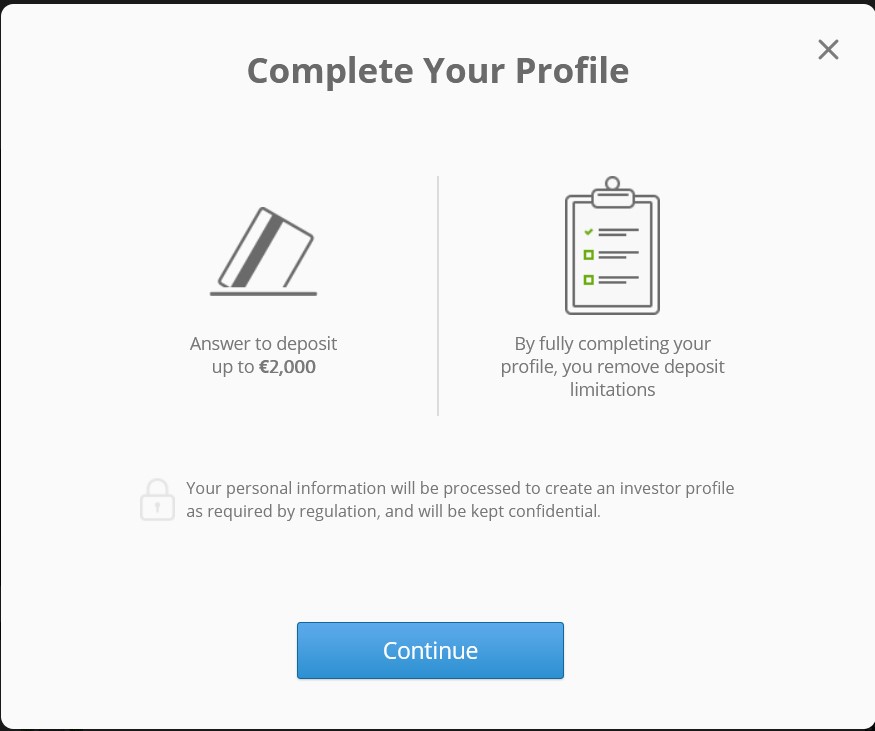

2. Verify Your Account

Verify your account by submitting KYC documents like proof of ID (National ID or driver’s licence) and proof of residence (utility bill). Then, finish setting up your profile.

3. Make a Deposit

Once your account has been verified, click on Deposit funds on the left pane of the page. The deposit options available will be displayed. Choose one and set the amount you’d like to deposit. Note that the minimum is $10.

4. Load Crypto Charts

Once your account is funded, search for any crypto in the Discover tab. An interface like the one below should load. You can carry out your analysis on the chart or use external charting software. Set your parameters, like a buy or sell price and set your order.

Latest Crypto Day Trading News

-

Crypto spot trading volume rose by 16% in June with derivatives trading volume also increasing.

-

Binanace has delisted 40 trading pairs specifically for advanced trading pairs.

Final Thoughts

We explored the best exchanges for day trading and chose eToro as our first choice because of its copy trading features, social community, and ease of use.

While all the exchanges are great options for traders, core traders whose main goal is to profit from price action may want to check out more trading-focused platforms like Skilling and Capital.com.

Remember to check the fee structure of the exchange you choose to ensure it is conducive for frequent trades of the next cryptocurrency to explode.

To start day trading with eToro, visit their website.

Methodology - How We Picked the Best Crypto Exchanges for Day Trading

The platforms covered in this guide were chosen through rigorous testing, research, and reviews. We paid attention to security, transparency, reputation, trading fees, deposit and withdrawal methods, coin selection, and trading facilities.

The platforms listed are the best we found in the various categories we listed them. For example, we found that Skilling had a great platform for core trading, and hence named it the best cryptocurrency exchange for trading purists.

Check out our why trust us and how we test pages for more information on our testing process.