The 12 Best Cryptocurrency to Invest Today for Short Term in 2024

There are two major ways to make money from buying and selling cryptocurrencies. You can either invest over long periods or trade within short periods. While long term investments are usually easier, this guide focuses on which crypto to buy today for short term trading.

We will cover the cryptos to focus on if you wish to trade, the various trading styles you can adopt in the cryptocurrency market, and how to get started.

Which Crypto to Buy Today for Short Term in 2024

1. Bitcoin – Best Blue Chip Crypto

2. Ethereum – Best Smart Contract Crypto

3. Binance Coin – Best Layer 1 Crypto

4. Dogecoin – Best Memecoin

5. Ripple – Best Settlements Crypto

6. Arbitrum – Best New Crypto

7. dYdX – Best DeFi Crypto

8. Solana – Best Non-EVM Smart Contract Blockchain

9. Polygon – Best Sidechain

10. Chainlink – Best Infrastructure Crypto

11. Polkadot – Best Interoperable Crypto

12. Optimism – Best Rollup Crypto

Best Cryptocurrency to Invest Today for Short Term Comparison

|

Cryptocurrency |

Category |

24h Trade Volume |

Exchanges Listed |

|

Bitcoin |

Layer 1 |

$14 billion |

20+ |

|

Ethereum |

Layer 1 |

$8 billion |

15+ |

|

Binance Coin |

Layer 1 |

$736 million |

13+ |

|

Dogecoin |

Memecoin |

$434 million |

13+ |

|

Ripple |

Payments |

$1.2 billion |

12+ |

|

Arbitrum |

Layer 2 |

$677 million |

13+ |

|

dYdX |

DeFi |

$120 million |

13+ |

|

Solana |

Layer 1 |

$403 million |

15+ |

|

Polygon |

Sidechain |

$354 million |

15+ |

|

Chainlink |

Oracle |

$240 million |

14+ |

|

Polkadot |

Interoperability |

$161 million |

13+ |

|

Optimism |

Layer 2 |

$121 million |

11+ |

12 Best Cryptocurrency to Invest Today for Short Term Reviewed

1. Bitcoin (BTC) – Best Blue Chip Crypto

Bitcoin is the most traded cryptocurrency on the cryptocurrency market after Tether with a daily trade volume around $14 billion. As the first and dominant cryptocurrency, it is one of the best for crypto traders as it is available on most exchanges and has deep liquidity.

When it comes to volatility, Bitcoin’s price is not as volatile as other cryptos on this list. Aside from black swan events, massive selloffs, and bull markets, you’d hardly see Bitcoin make moves on the crypto market of 10% within a day.

However, this doesn’t mean that it cannot grow (or decline) by that amount within a week as several institutional players move millions in and out of the cryptocurrency on a regular basis. As of writing, Bitcoin is up 64% on the year.

You can trade Bitcoin on the best crypto exchanges around as any serious crypto exchange lists the premiere crypto and some even offer derivatives that you can use to magnify your profit.

To learn more, read our Bitcoin review, alternatively, you can dive right in and buy Bitcoin on eToro.

2. Ethereum (ETH) – Best Smart Contract Crypto

Ethereum is the second largest and third most traded cryptocurrency with a market capitalization of $221 billion and a daily trade volume of $8 billion.

Like Bitcoin, it enjoys golden status as the premiere smart contract blockchain technology powering over 1,000 decentralized applications ranging from games, to decentralized finance applications, Metaverses, NFTs, Web3 services, Oracles, and more.

Because of this, various players in the market, from whales to institutions and retail traders, are attracted to the coin. There are various certified structured products built around Ethereum like the Grayscale Ethereum Trust which is an ETF that tracks the coin’s price.

Ethereum’s price is more volatile than Bitcoin and can make moves close to 10% on a daily basis, although this does not mean it happens often. In our experience, Ethereum is best viewed on a weekly time frame where candles represent moves on crypto markets between 8% and 25% on average.

Another advantage Ethereum has is its deep liquidity on various exchanges. Ethereum is usually one of the first coins centralized crypto exchanges list, after Bitcoin.

Read our Ethereum review to learn more about the network and its coin. You can buy Ethereum on exchanges like Binance.

3. Binance Coin (BNB) – Best Layer 1 Crypto

Binance Coin doubles as the native token of the Binance exchange, the world’s leading centralized cryptocurrency exchange and the native coin of the Binance Smart Chain, the blockchain technology network created by Binance.

It is the second most used blockchain technology network after Etherum, with a market capitalization of $52 billion, a total value locked of $4.62 billion, and over 500 decentralized applications operating on the network.

BNB is a great choice for crypto traders for short term gains because of its daily trade volume of $736 million, enough liquidity for large position sizes. The coin is also listed on several crypto exchanges, so you have enough options to choose from.

Binance Coin is a little more stable than Ethereum and Bitcoin. The Bollinger Bands indicator shows that its price action is not as volatile as some larger capitalized stocks as it has traded mostly in a range even as Bitcoin rose 64% in 2023.

You can still catch some significant moves with BNB, however, you may have to wait for strong market moves like the ones seen during bull or bear market rallies. Luckily, several crypto exchanges offer derivatives for pure crypto traders to take advantage of bear markets.

Read our Binance Coin review to learn more. You can buy BNB on exchanges like Coinbase.

4. Dogecoin (DOGE) – Best Memecoin

Dogecoin is the best crypto memecoin with a market capitalization of $10.9 billion and a 24-hour trade volume of $434 million. While originally created as a joke, it has led a movement in the cryptocurrency markets that proliferated into the creation of a new category of cryptocurrencies. Now, every blockchain technology network has its own memecoins for crypto investors to choose from.

As a trading coin, Dogecoin is a great option for short term gains as it is known for its volatility. Memecoins in general are known for their ability to increase in value several times over within a very short period.

On the flip side, these crypto assets can also lose value just as quickly, and the crypto industry is rife with stories of people generating wealth (and losing it) through memecoins.

Dogecoin’s price, in particular, responds to tweets from Twitter and Tesla CEO, Elon Musk, making this crypto asset more volatile as there is no way to predict what or when Elon will tweet. Usually, if Elon tweets positive things about Dogecoin, the crypto market responds and its price surges. If negative, its price falls.

Traders can expect daily movements between 2% and 20% for this crypto project depending on market conditions. To learn more, read our Dogecoin review.

You can buy DOGE on exchanges like Bitstamp. If you’d prefer another exchange, read our guide on where to buy Dogecoin for more options.

5. Ripple (XRP) – Best Settlements Crypto

Ripple is a payments settlements system that provides instant settlement for international banking and payments transactions. It is one of the few crypto projects that has achieved real-world adoption by institutions and businesses.

The Ripple system is powered by the XRP token which has a market capitalization of $24 billion and a daily trade volume of $1.2 billion.

In recent times, the company has been embroiled in a legal battle with the United States’ SEC over the sale of XRP tokens in the US, which the regulators view as an unregistered security.

Because of this, it was delisted from several US crypto exchanges and suffered significant price declines in the crypto market. Nonetheless, it is still one of the most traded coins by volume as Ripple continues to provide settlement services to businesses worldwide.

With XRP, you can expect to see 1% – 5% daily moves during periods of low volatility on the crypto market and as high as 25% per day moves during periods of high volatility. News about Ripple’s case with the SEC tends to have significant effects on its price action.

Read our XRP review to learn more about the cryptocurrency. You can buy XRP on exchanges like Bitpanda.

6. Arbitrum (ARB) – Best New Layer 2 Crypto

Arbitrum is a new cryptocurrency that launched in March 2023, but has already grown to become one of the most traded crypto assets with a 24-hour trade volume of $677 million on more than 13 major crypto exchanges and several decentralized exchanges.

The layer 2 network is the largest network on Ethereum blockchain technology at a market capitalization of $1.6 billion as of writing, a total value locked of $2.14 billion, and over 260 decentralized applications.

One unique reason why Arbitrum’s ARB made our list is its growth potential. It is up there as a contender for the best cryptocurrency to invest with for both long term buys and short term gains trades.

With ARB, you can expect daily moves between 2% and 10%, and up to 25% during high volatility periods. While the token’s liquidity may not be as deep as some others on this list, there is enough for large positions, provided these positions are not eight figures (i.e. above $10 million), or else you risk moving the crypto market.

You can buy ARB on exchanges like Binance.

7. dYdX (DYDX) – Best DeFi Crypto

dYdX is a decentralized trading platform built on Starkware for speed and scalability. It is one of the most capitalized DeFi coins at a market cap of $387 million.

Despite being the 9th largest Dex token by market capitalization, dYdX made it to our list for the best cryptocurrency to invest in because it outranks other Dexes in terms of trade volume. The DYDX token has a daily trading volume of $120 million.

We attribute this to this promising crypto assets protocol which is more advanced than many others. It features an on-chain order book, dynamic order types, trading rewards, and doesn’t charge crypto gas fees for trades.

Volatility for DYDX in the crypto world depends on prevailing market conditions. Periods of low volatility are characterized by moves between 4% and 9% on a daily basis, and between 13% and 26% during high volatility periods.

Like many other blue chip cryptos, DYDX is listed on several popular exchanges, both centralized and decentralized. Oddly enough, DYDX is not listed on the dYdX exchange.

You can buy DYDX on exchanges like OKX.

8. Solana (SOL) – Best Non-EVM Smart Contract Blockchain

Solana is a smart contract platform that supports the development of decentralized applications. Essentially, it is like Etheruem, but with a few key differences. The first is that it does not use the Ethereum Virtual Machine to run decentralized applications.

The EVM is the “operating system” that runs applications on the Ethereum blockchain, Because Ethereum was the first to develop smart contracts, its operating system and smart contract language, called Solidity, are the industry standard.

Hence, most smart contract networks run the EVM or a variation of it.

Solana is in a class of blockchain technology networks that do not run the EVM. It uses the Rust programming language, making it a direct Ethereum rival.

While the network has not achieved as much adoption or popularity as Ethreum, it is in the big leagues of cryptos with a market cap of $8 billion.

Its native token, SOL, has a daily trading volume of $403 million with average daily movements between 3% and 8% depending on prevailing market trends and conditions. It is also listed by popular exchanges with deep liquidity so you can trade large positions for short term gains.

To learn more about the blockchain, read our Solana review. To buy SOL, sign up on an exchange like eToro.

9. Polygon (MATIC) – Best Sidechain Crypto

Polygon is an Etheruem sidechain built to help make Ethereum more scalable by moving transactions to a separate network that runs parallel to the main Ethereum chain. These sidechains processes and will verify transactions and then publishes them to the main chain.

Sidechains differ from layer 2 networks in the way they process transactions. Layer 2 networks are built on top of Ethereum so they inherit its data security and only need to handle computation.

Polygon, on the other hand, runs its own set of validators, has its own consensus mechanism, and is responsible for the security of the network. Furthermore, Polygon tech stack enables developers to create their own independent blockchains.

The Polygon sidechain is currently the fifth largest ecosystem according to total value locked with $1.09 billion worth of foreign digital assets on the network. Its native token, MATIC, has a market capitalization of $9.1 billion and a 24-hour trading volume of $354 million.

You can buy MATIC on more than 13 popular exchanges including popular ones like Binance. Read our Polygon review to learn more about this ecosystem and its unique consensus mechanism.

10. Chainlink (LINK) – Best Infrastructure Crypto

Chainlink is a blockchain Oracle service that brings off chain data to smart contracts on-chain. Off chain data includes data from real world events or markets that are usually closed off from blockchain networks.

Blockchain networks are isolated systems that cannot interact with the real world or each other without technology built to foster these communications. Decentralised Oracles are one of these technologies.

An Oracle fetches data from a source outside of the blockchain and delivers it to smart contracts on the blockchain that may need it. These smart contracts could include synthetic tokens that represent real world traditional investments and assets like stocks and commodities.

Chainlink is the largest Oracle service provider with a market cap of $3.7 billion and a 24-hour trade volume of $243 million.

Its native token, LINK, is listed on more than 14 crypto exchanges and is very liquid, even on decentralized markets. Volatility is quite strong averaging 2% on a regular day, which could lead to sizable moves on a weekly basis and opportunity for short term gains.

Read our Chainlink review to learn more. You can buy LINK on exchanges like Coinbase.

11. Polkadot (DOT) – Best Interoperable Crypto

Polkadot is known as a Layer 0 protocol that helps connect blockchains. If layer 1 networks are native blockchain networks, then layer 0 protocols are blockchains that connect other blockchains, and that is exactly what Polkadot does.

The “blockchain of blockchains” is made up of a relay chain that connects to several other blockchains, called the parachains. The relay chain facilitates the transfer of data, information, and assets between all connected parachains.

Polkadot is an approach towards an interoperable blockchain ecosystem where any one blockchain can communicate with any other blockchain in the industry.

Its native token, the DOT, has a 24-hour trade volume of $161 million and a market capitalization of $7.2 billion. It is available on over 13 crypto exchanges with sufficient liquidity to handle large positions.

While the coin has declined in value by over 80% since November 2021, it is still volatile enough to provide opportunity for traders and short term holders in the crypto space. Volatility is not strong on a daily basis, but it accumulates to significant moves over weeks and months.

For example, DOT rose 68% between January and February 2023, a move that would have been profitable for short-term holders in the crypto community.

You can buy DOT from an exchange like eToro.

12. Optimism (OP) – Best Rollup Crypto

Optimism is a Layer 2 network, like Arbitrum, that runs on a technology called an optimistic rollup. It helps Ethereum scale by moving transactions to a separate network built on top of the Ethereum network, processing them on the network, and then batch uploading them to the main Ethereum chain.

Optimism stands out from other layer 2 networks because it uses a single-round fraud proof system to ensure that crypto and financial transactions are genuine. This makes it faster than other crypto asset rollup networks like Arbitrum or Boba.

The network is the sixth largest according to total value locked as it holds $906 million worth of assets from the 105+ protocols running on it. At the heart of the Optimism network is the OP token which trades at $2.21 as of writing. It has a market capitalization of $697 million with a 24-hour trade volume of $122 million.

OP is available on more than 11 exchanges and, depending on the exchange, can move between 5% and 15% per day, a positive option to buy crypto for short term gains.

You can buy OP on an exchange like Coinbase.

What is Crypto Trading?

Crypto trading is the practice of buying and selling cryptocurrencies over a short period for the sole purpose of profiting from price differences between the time you buy them and sell them.

Trading can be in two directions, a positive direction, called “longing”, where you sell at a higher price than you buy, and in a negative direction, called “shorting”, where you sell at a certain price and buy back at a lower price.

Shorting is a bit more complicated than longing as it seems impossible to sell before you buy. However, with shorting, you borrow some crypto from your broker, immediately sell them on the market, and then buy them back at a lower price.

The difference in price between when you sell them and buy them back is your profit. For example, say you borrow 2 BTC from your broker and sell it at $30,000 per BTC. You now have $60,000.

If you can buy 2 BTC at $25,000 per BTC, you’ll only spend $50,000 and have $10,000 to spare. You can then return the 2 BTC you borrowed and keep the $10,000 difference.

Crypto trading is usually done within a short period of time, although some strategies can span months. To trade crypto, you’ll need certain skills and tools to increase your likelihood of success.

Crypto Trading Vs. Crypto Investing

Crypto trading and crypto investing are both geared towards making money from crypto price movements but are executed in very different ways.

Crypto trading takes advantage of short term price movements. Liquidity and volatility are key as a trader is only interested in price differences. The wider the difference, the better (i.e. volatility).

Traders also need to be able to open and close positions easily without having to wait (i.e. liquidity).

To trade cryptos, you need price data, usually displayed as a chart, and some technical analysis skills. Technical analysis is a way of analyzing tradable assets using only numeric data like price, volume, and all their derivatives, e.g. momentum.

Crypto investing, on the other hand, involves buying cryptos over a long period, usually more than a year. Value is key as the point is to hold cryptos that have a high probability of increasing in value over time.

To invest in crypto, you’ll need fundamental analysis. This focuses on the innate properties of crypto projects, not just their tokens/coins. You’ll need to gauge their technology stack, value proposition, competitive edge, tokenomics, and even market conditions before buying a crypto.

Factors to Consider When Selecting the Best Crypto to Buy for Short Term

When choosing a crypto to day trade, you’ll want to look out for certain conditions to help your efforts. Some of them include:

Liquidity

When it comes to trading, liquidity is king. Liquidity ensures that when you buy a crypto, you can sell it anytime you want. In an efficient market, this process is automatic thanks to marketmakers.

However, another benefit of liquidity is price impact. The more of a token that exists in the market, the less of an effect a purchase or sale will have on the price of all the other tokens in the circulation.

For example, say there was 100 ETH in the market at $20 each. This means that there is $2,000 worth of ETH in the market, that is ETH’s liquidity. If you bought $1000 worth of ETH, you would slash the liquidity of ETH in half, thereby drastically increasing its price.

While this may sound like a good thing, the same is the case for when you sell ETH. Imagine there were 20 people trying to buy $300 worth of ETH. By the time the first few people bought, the price of ETH would rise so high that no one else in the market would want to buy.

Then, those who bought earlier wouldn’t be able to sell because their actions affected the balance of ETH in the market.

Situations like this arise when liquidity is low. However, if there were 2 million ETH in the market at $20 per ETH, then there would be $40 million worth of ETH liquidity. A $50,000 ETH position wouldn’t move the market. This is what traders want.

Volume

If liquidity is the foremost requirement, volume is the next. Crypto prices move when there is either high volume or low liquidity. You don’t want low liquidity because you want to easily open and close trades, so high volume is the best option.

Price responds to volume. When volume spikes, there is usually a significant price movement either upward or downward. Traders who predict the direction accurately get rewarded with profits.

This is why we included the daily trade volumes in our individual reviews, to give you an idea of which cryptos move.

Volatility

Volatility is the rate of change of price. If price changes are quick and sharp, then we say the market is volatile.

Because traders hold cryptos for a short period, they want cryptos that move within that period. The trick with volatility is that you could make (or lose) money very quickly if you are correct (or wrong).

Crypto Exchange

While not a criteria for searching for a coin, it is important as the trading facilities you use can contribute to your success (or failure).

When you have decided on the cryptos to trade, you’ll need to use an exchange with fast execution speeds, consistent uptime, adequate charts, and dynamic order types, especially if you intend to trade crypto derivatives or with leverage.

The ideal exchange should also offer cheaper transactions and not charge high fees to execute positions as you will be opening and closing positions frequently. High charges in this regard could add up over time, especially when compared to exchanges with low fees.

To learn more about trading platforms, check out our page on the best exchanges for day trading.

Styles of Trading

There are three major styles of trading, depending on how long positions are held. Here, we compare them.

| Day Trading | Swing Trading | Position Trading |

| Positions are opened and closed within a day. | Positions are opened and closed within a few days. | Positions can be open for months. |

| Profit margin per trade is usually small. | Profit margin per trade can be a bit more significant. | Profit margin per trade can be large. |

| Multiple trades required to be net positive. | Few trades required to be net positive. | Very few trades required to be net positive. |

| Quick, precise entries with tight stop losses. | Quick entries. Doesn’t need to be as precise. | Entry can be properly planned and stop loss can be generous. |

| Requires constant monitoring. | Can be monitored intermittently. | Can be monitored loosely. |

| Hard to achieve consistent success. | Moderately difficult to achieve consistent success | Easier to achieve consistent success. |

The Best Crypto Day Trading Strategies for Short Term Investment

Scalping

Scalping is a day trading strategy that involves closing positions immediately when they become profitable. The positions are usually highly leveraged and trades are executed on very small time frames, often below 15 minutes.

Scalp trades are usually open for a few minutes at the most and for a few seconds in some extreme cases. Profit margins with scalping is very small so the goal is to execute as many profitable trades as possible within a day.

Range Trading

Range trading involves marking out support and resistance levels on smaller time frames and trading within these levels depending on the direction of the market. This strategy is best executed in a trending market.

The trick here is to execute this strategy on a small enough time frame that price can move through or between several support and resistance levels within a day.

Momentum Trading

Momentum trading involves using volume, volatility, and price data to execute positions that take advantage of growing momentum in the market when selling and buying crypto.

The rule is that volume movements precede price movements, and volatility is the rate of change of price. With the proper indicators and tools, you can track major volume movements and ride the momentum created by price changes.

News-Based Trading

This strategy involves riding the waves made by important news events. Financial markets generally respond to news and economic events like inflation data, GDP reports, and most especially, interest rate policies.

There is usually a knee-jerk reaction from the market when these reports exceed or fall below expectations. The trick here is to accurately predict which direction the reaction will tend. Risk can easily be mitigated by hedging.

High Frequency Trading

High frequency trading is not exactly a day trading strategy like the others on this list. However, it is usually lumped in with other day trading strategies because it involves executing trades within a short period of time.

High frequency trading is in a class of its own because it involves artificial intelligence by using sophisticated algorithms to execute trades at inhuman speeds and analyze impossible amounts of data.

When is the Best Time to Trade Crypto?

The best time to trade crypto is when there is high volume, volatility, and liquidity. These are during official trading times for the three major financial zones in the world.

The Tokyo trading session where banks and institutions in Asia start business operations and institutional trading activities. This is usually between 12:00 am to 9:00 am UTC.

The London trading session where financial institutions in London and Europe begin trading and financial operations. This is between 7:00 am and 4:00 pm UTC.

The New York session where US and Northern American institutions trade, which is between 1:00 pm to 10:00 pm UTC.

Ideally, the best times to trade are the overlaps between the major sessions, i.e., between 7:00 am and 9:00 am UTC when the Tokyo and London sessions overlap, and between 1:00 pm and 4:00 pm UTC when the London and New York sessions overlap.

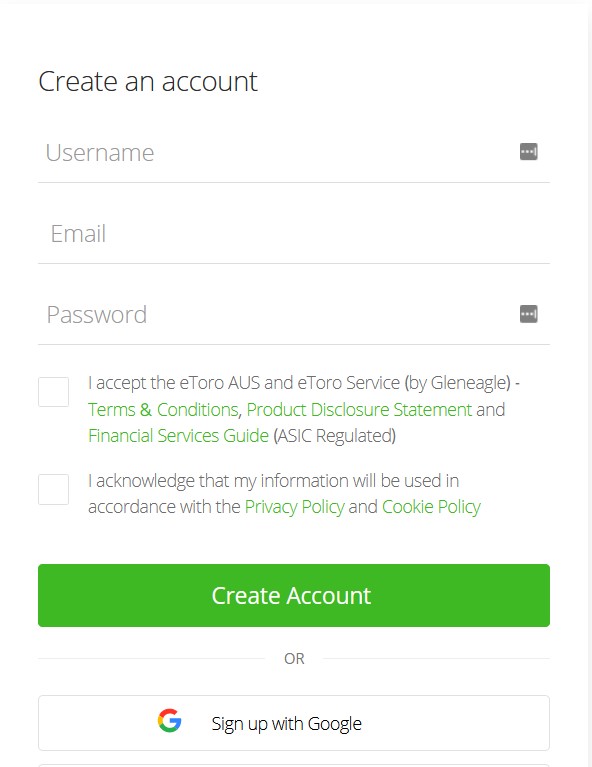

How to Open an Account to Buy and Trade Crypto Today

To start day trading crypto, open an account with a centralized broker. We used eToro because it is our top choice for brokers.

1. Open an Account

Navigate to the eToro website and create an account by clicking on the Start investing icon. You can also create an account on the mobile app. Fill out the form with your full name, email address, and password.

2. Verify Your Account

Verify your account by completing your profile and submitting KYC documents like proof of ID (National ID or driver’s licence) and proof of residence (utility bill).

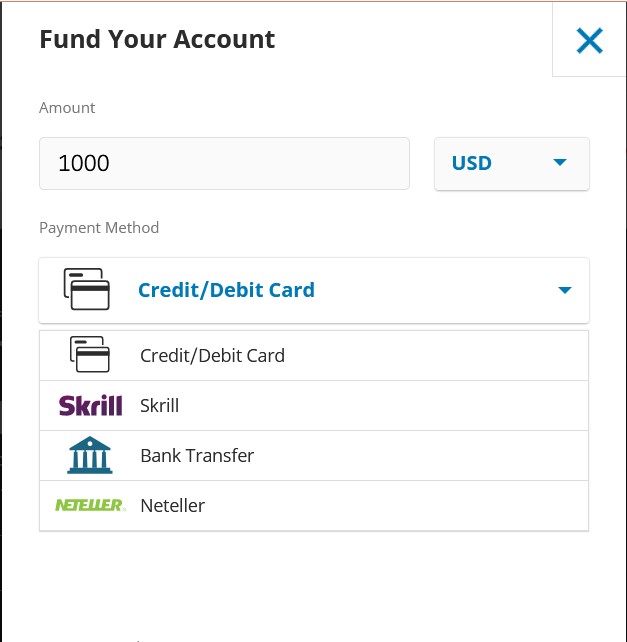

3. Make a Deposit

Once your account has been verified, deposit funds using any of the available methods. Input the amount you’d like to deposit. Note that the minimum is $10.

4. Load Crypto Charts

Once your account is funded, search for any crypto in the Discover tab. An interface like the one below should load. You can carry out your analysis on the chart or use external charting software like TradingView. Set your parameters and execute your order.

Latest News on Trading Cryptos

- Bitcoin Cash’s price has surged to a 3-month high with the potential help of Wall Street recognizing the crypto.

- Bitcoin has risen to its highest level in three weeks with an increase in trading from whales.

Final Thoughts on the Best Cryptocurrency to Invest Today for Short Term

We explored the best cryptocurrencies to buy today for short term and chose Bitcoin as our top choice because it is a blue chip cryptocurrency with billions of dollars in daily trading volume. It is also available on virtually every crypto exchange on the market and has deep enough liquidity to accommodate large positions.

Nonetheless, any of the other cryptos on our list are great choices for short term trades, depending on how much volatility you can tolerate.

We also explored the differences between day trading, swing trading, and position trading, taking into consideration their difficulty levels, time horizon, and probability of success.

Lastly, we outlined the best times to trade based on the official trading sessions of the three major financial regions in the world.

To begin day trading cryptocurrencies, you’ll need to sign up to a low fee crypto exchange so you can do so in an affordable way. Our top choice is eToro.

Methodology

The cryptos listed in this guide were chosen through rigorous testing, research, and trials. We have traded all the tokens on this list to ensure that they are in fact good choices for day trading.

The cryptos listed are the best we found in the various categories we listed them. For example, we found that Dogecoin was the only memecoin to post strong daily trading volumes so we named it the best memecoin to trade.

Check out our why trust us and how we test pages for more information on our testing process.