10 Best Cryptocurrency Brokers in 2025

On this page, we’re going to look at some of the best crypto brokers in depth with regard to important aspects like fees, security, and features. By the end, you should be well-equipped to decide which crypto broker best meets your needs.

Cryptocurrency brokers act as an intermediary between traders and the market, providing an accessible way to enter the crypto world and choose cryptocurrency to invest in, where there is potential for significant profits. There are many crypto brokers available, all with different pros and cons.

Top Crypto Brokers - Our Top 3 Picks

Looking for a quick answer? Here are our top 3 recommended crypto brokers to use for buying and selling cryptocurrency.

The Best Cryptocurrency Brokers - Key Metrics

Top Cryptocurrency Brokers - Why They Made the Cut

Best Crypto Brokers Reviewed

Pros and Cons of Using Cryptocurrency Brokers

Pros

- Easier for traders as the broker takes care of all the complexity of trading cryptos.

- Fiat options for payments make it easy for newcomers to use.

- Contracts allow for making profits without actually buying cryptocurrencies.

- Leveraged trading.

- Almost instant trades as only contracts are bought and sold, not the underlying cryptocurrencies.

Cons

- A premium on buying makes cryptos expensive.

- Limited crypto options than exchanges.

- Leveraging could lead to massive losses.

What Is a Cryptocurrency Broker?

A cryptocurrency broker is a platform where you can buy and sell cryptocurrencies and often make swaps between different coins. It acts as an intermediary between the user and the market, simplifying the cryptocurrency trading process.

Users can make a deposit or send a payment through a variety of methods, and the broker takes care of everything else. Brokers may offer the trading of derivatives such as CFDs rather than the underlying asset cryptocurrency.

How Do Cryptocurrency Brokers Work & What Do They Do?

To start using a cryptocurrency broker, you will need to complete the registration process. You may only need an email address and password to create an account, but regulated brokers will have Know Your Customer requirements, which means you’ll need to verify your identity before you can start trading.

To complete this process, you will need to provide further information, such as your full name, date of birth, address, and contact information. You will need to submit an image of a photo ID such as a driver’s license or passport to verify your identity, and you may also be asked for a document such as a utility bill or bank statement to verify your address.

Different brokers offer different types of financial services. On some broker platforms, you can buy cryptocurrencies at prices set by the broker. You simply specify which coin you want to buy and how much of it, and then the broker will fill the order for you and deliver your coins to a private crypto wallet or your web wallet on the platform.

Other brokers offer the trading of derivatives such as contracts for difference, which allow you to speculate on the difference between the current and future price of a cryptocurrency. A CFD is a contract between you and your broker and allows you to profit from the cryptocurrency price movements without actually owning it.

This means you don’t need to worry about storing your virtual currency or keeping it secure, but you can also lose money if the price doesn’t move in the way you expect.

Bitcoin Brokers typically generate their revenue from the spread, which is the difference between the ask (buy) and bid (sell) prices of a cryptocurrency. The broker may charge a commission on trades as well, while there may also be other costs, such as deposit, withdrawal, overnight, account management, and inactivity fees.

Different Types of Crypto Broker Trading Strategies

There are a number of different ways you can trade cryptocurrencies on your broker platform. We’re going to discuss a few popular trading strategies in more detail below.

Long and short positions

A trader takes a long position when they believe the value of a cryptocurrency will rise in the future or a short position when they believe it will fall. In practical terms, taking a long position simply means buying a cryptocurrency or digital asset. If the price does rise, they will be able to sell their coins at a profit later.

Taking a short position, on the other hand, generally involves selling coins that you don’t actually own. Traders can use a margin account to borrow cryptocurrency from their broker to sell. If the price falls as expected, the trader can make a profit by buying the coins at a lower price to pay back the broker. If the price rises, however, they will make a loss.

There are plenty of tools you can use to help you decide whether and when to go long or short. These include trading bots, signals, news, and advanced technical instruments such as indicators like moving averages, relative strength index, Fibonacci retracement, and support and resistance levels.

Swing traders open positions that last days or even weeks, while day traders open and close trades within the same day. Scalping involves opening positions for just minutes or even seconds.

CFDs

Contracts for difference are a type of derivative product that lets traders speculate on the price of cryptocurrencies without actually owning the underlying digital asset. The buyer of the CFD is bound by the contract to pay the seller the difference between the current value of the cryptocurrency and its value at the end of the contract.

Trading CFDs brings benefits such as simple execution and not having to custody any coins. You can also use leverage to magnify the potential profits of CFD trading, but this will also magnify any losses. CFDs are complex, high-risk instruments, so they should only be traded by people who know what they are doing. Some countries don’t allow CFDs or place restrictions on trading them.

Futures

Futures are another type of derivative product that enables traders to bet on the future value of a cryptocurrency. A futures contract is an agreement to buy or sell a fixed amount of cryptocurrency at a predetermined price on an agreed date in the future. Futures can be used for speculation or hedging.

Leverage is generally used when trading futures, meaning you don’t need to put up the full value of the contract in order to open the trade. Leverage can amplify losses as well as gains, however, so futures should only be traded by those with the necessary experience.

Cryptocurrency Brokers vs Crypto Exchanges

The line between brokers and exchanges has become somewhat blurred as crypto platforms are often referred to as both terms interchangeably, and some platforms offer both exchange and broker services. There is a difference, however, as will be explained below.

Cryptocurrency Brokers

When you use a broker, you don’t trade directly with other traders as the broker acts as an intermediary between you and the market. The prices quoted are set by the broker, though they will likely be similar to the rest of the market.

The difference between the buy and sell prices is called spread, and this is typically how brokers generate revenue, though they may also make money by charging other fees such as commissions on trades.

Brokers may allow you to initiate cryptocurrency trading without having the funds needed to pay for it in your account as settlement is more flexible on broker platforms. When it comes to cryptocurrencies, a number of brokers don’t provide trading of the coins to themselves but offer derivatives such as CFDs that let users speculate on the price of the underlying cryptocurrency.

Cryptocurrency Exchanges

Unlike on a brokerage platform, cryptocurrencies are exchanged between individual traders on a cryptocurrency exchange. Exchanges may offer fiat to crypto trading pairs and/or crypto to crypto trading pairs. When a user wants to buy a coin, they create a buy order. This order is put into an order book where it will be matched with a suitable sell order from another user.

The cryptocurrency exchange will charge trading fees known as maker and taker fees for facilitating this process, and the equilibrium price on an exchange is set by the balance between buy and sell action. Trades can be settled instantly when the cryptocurrency exchange has sufficient liquidity.

Key Things to Consider When Choosing a Cryptocurrency Broker

Type of Trading Available

If you want to conduct a particular type of trading, this may narrow down which cryptocurrency brokers you can use. For example, if you want to buy and hold crypto, you will need a platform that facilitates the purchase of actual cryptocurrencies. This is the case for most of the platforms on this page, though a couple of them only deal in derivatives.

Trading futures can be done on some platforms that offer futures alongside the trading of actual cryptocurrencies. These include Binance, KuCoin, and OKX. If you would prefer to trade CFDs, you will need to choose a CFD broker platform, such as Capital.com or Skilling.

Cryptocurrencies Available

If there are particular cryptocurrencies that you want to trade or invest in, you’ll need to find out whether they are offered by the platform you are considering using. Binance and KuCoin have the largest selection of coins and various digital assets available, making them a great choice for people looking to buy new or obscure coins.

Other platforms may have a smaller selection of coins but offer more desirable features or user experience, making them preferable for those who only want to purchase the more popular cryptocurrencies.

You should be able to ascertain the available coin selection on each platform’s website. You might also want to find out which trading pairs are offered for your desired coins. Some platforms may only offer crypto to crypto trading pairs, while others may provide fiat to crypto pairs.

Regulation and Reputation

When taking the leap into crypto trading, it is best to find a broker that has built up a strong reputation for reliability over a number of years, like eToro. Platforms with a large user base and many satisfied customers are likely to be the best.

Sending money to an unregulated broker can be risky as they won’t necessarily have high-security standards, and you are unlikely to have any recourse if they lose your money. The safest way to trade crypto is, therefore, to do so on a regulated brokerage platform that complies with industry best security practices. You can check a platform’s website to find out which regulatory bodies if any, it is governed by such as Cyprus Securities, Australian Securities, or the UK’s Financial Conduct Authority.

Security and Safety

If you’re going to be trusting a Bitcoin broker with your funds and personal information, the very least you should expect is that it will keep them safe. As crypto platforms hold a significant amount of valuable assets, they are an attractive target for hackers. You should therefore look for a platform that ensures its assets and stores them offline.

The safest platforms will also protect your account and personal details through methods such as encryption, address whitelisting, and two-factor authentication. Regulated platforms like the ones listed on this page are the most likely to take these security measures.

User Experience and Features

The best platform for user experience and features comes down to personal preference. A new investor just getting into crypto and digital currencies may prefer a simple platform without all the bells and whistles that make it easy to buy and trade cryptocurrencies. An experienced trader, on the other hand, will likely already be adept at navigating complex trading platforms and prefer a broker with advanced tools and features.

If you want to undertake any kind of technical analysis, you will need to pick a broker that provides charting tools and indicators. Other features you may wish to check for include copy trading, recurring buys, staking, savings accounts, trading bots, and a mobile app.

Fees

You don’t want to be hit with any hidden costs, so make sure you check the small print to ascertain which fees you can expect to pay. Many crypto broker platforms use a spread between the bid and ask prices, and the size of the spread varies from one platform to the next. You may also be charged a commission or trading fee on each transaction that you make.

Most platforms charge a fee for deposits or withdrawals or both, and the size of the fee may depend on which payment method you choose. Other possible costs that you should be aware of include inactivity, account management, and overnight fees.

Geographical Availability

A cryptocurrency broker obviously needs to provide services in your country if you’re going to be able to use it. The list of countries that a platform serves should be available on its website. Certain types of trading, such as CFDs or futures, may be banned or have restrictions in some countries, which could affect which services a platform offers in which countries.

Payment Methods

If there is a specific payment method you want to use, this may affect your choice of crypto broker. Bank transfers and credit/debit cards are widely accepted, such as buying Bitcoin with American Express, so they can be used on most platforms. Other payment methods can be used on some platforms. eToro, for example, accepts PayPal, Skrill, Neteller, and Trustly, among other methods, and all can be used to make free deposits.

On some platforms, you will find that the accepted payment methods vary for different countries and may carry different fees, so this could be worth investigating before signing up.

Should You Use a Broker to Buy and Sell Cryptocurrency?

This will depend on your overall investment goals. Although crypto brokers are more beginner-friendly, the variety of crypto available from brokers can sometimes be limited when compared to other investing platforms such as cryptocurrency exchanges.

Brokers are a good option for most popular crypto coins, such as Ethereum and Bitcoin, but they do have their limitations when it comes to trading the current altcoin trends.

A balance needs to be struck between your needs of ease of use and convenience and the variety of trading options that are available.

What is one of the most important things to look out for when choosing a crypto platform to sign up to?

"The number one question the average trader should ask is - are your assets safe? Exchanges are infrastructure projects that compete on technical expertise. Hence it is important to start with a wallet you can trust on a platform that values security."Charmyn Ho

Head of Crypto Insights at Bybit

How to Trade Cryptocurrency With a Broker

It’s fairly straightforward to get started with a cryptocurrency broker. You can trade on eToro by following these simple steps.

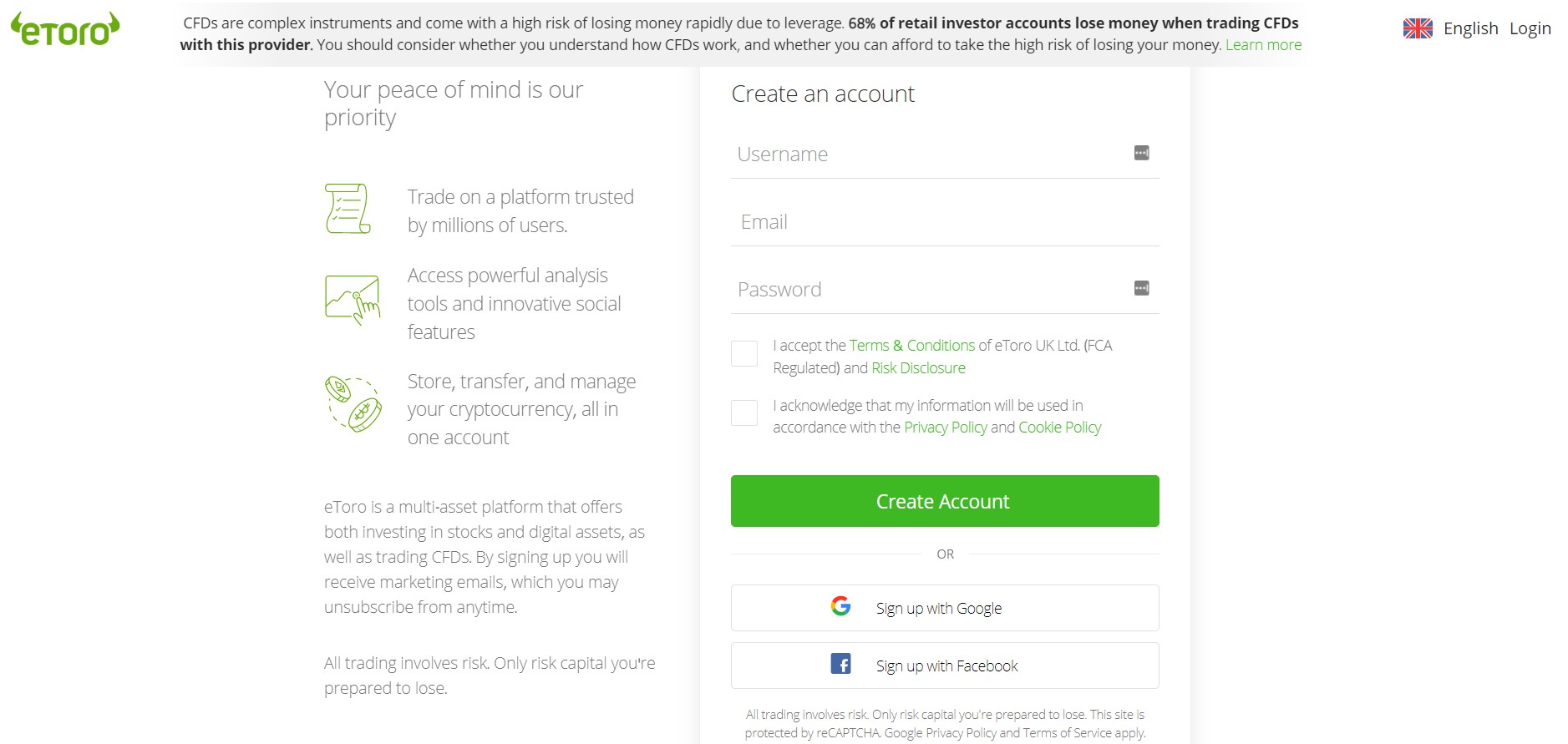

1. Open an account

Click the “Join Now” button at the top to access the registration form. You can sign up through Google or Facebook. Otherwise, a username, email address, and password are required, and you will need to accept the terms and conditions before clicking “Create Account”.

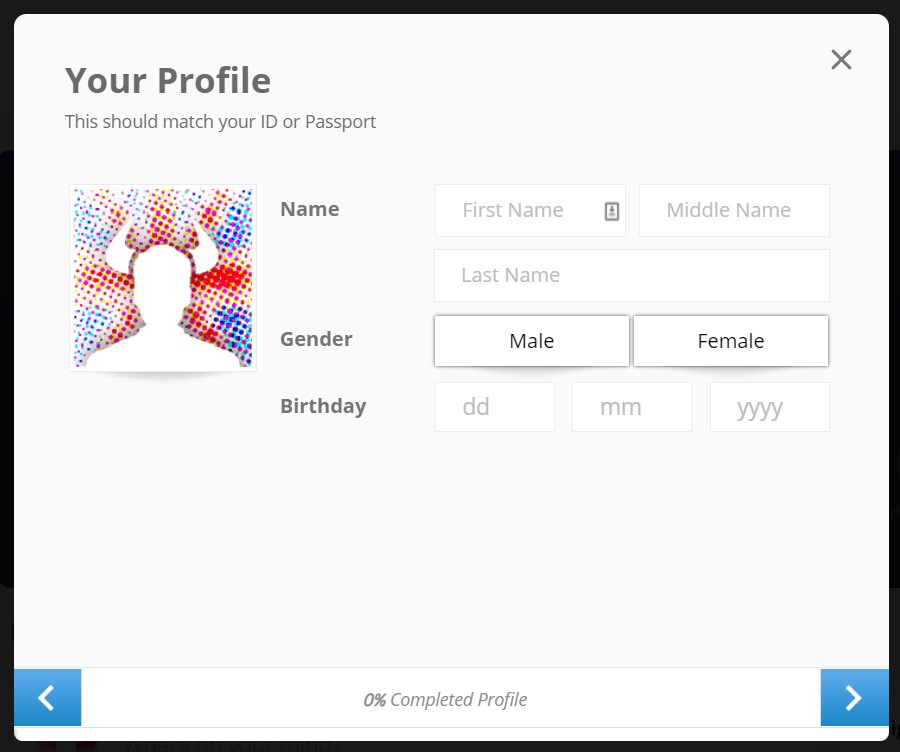

2. Verify your account

You will receive an email with a verification link that you will need to click, after which you will be prompted to provide your full name, date of birth, and phone number to complete your profile. You may also need to verify your identity by submitting a photo ID. You will then be asked some questions about your investing experience.

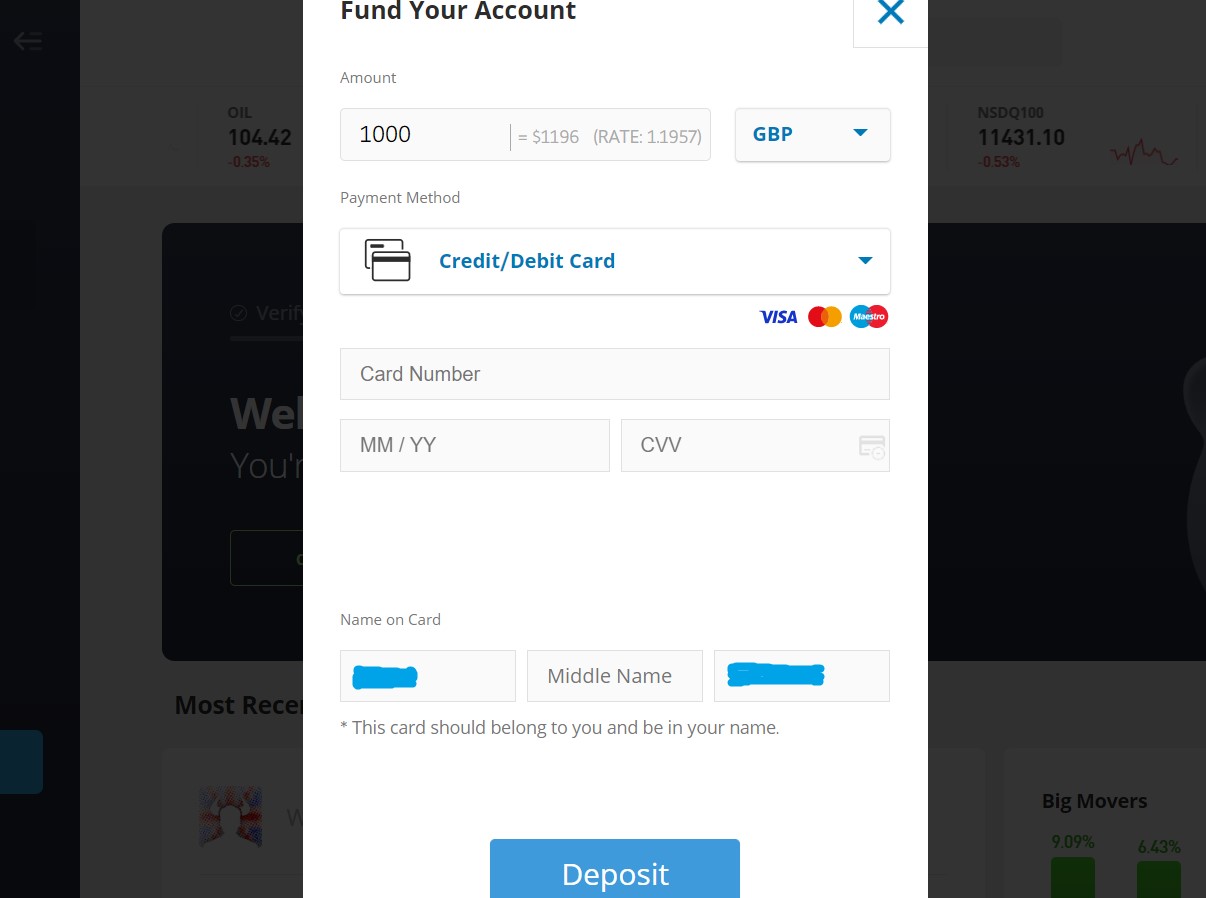

3. Make a deposit

Click on the button marked “Deposit Funds” and type in an amount. You can select your local currency and a preferred payment method from the dropdown lists and provide any payment details required for your chosen method of payment. Now hit the “Deposit” button to transfer the funds.

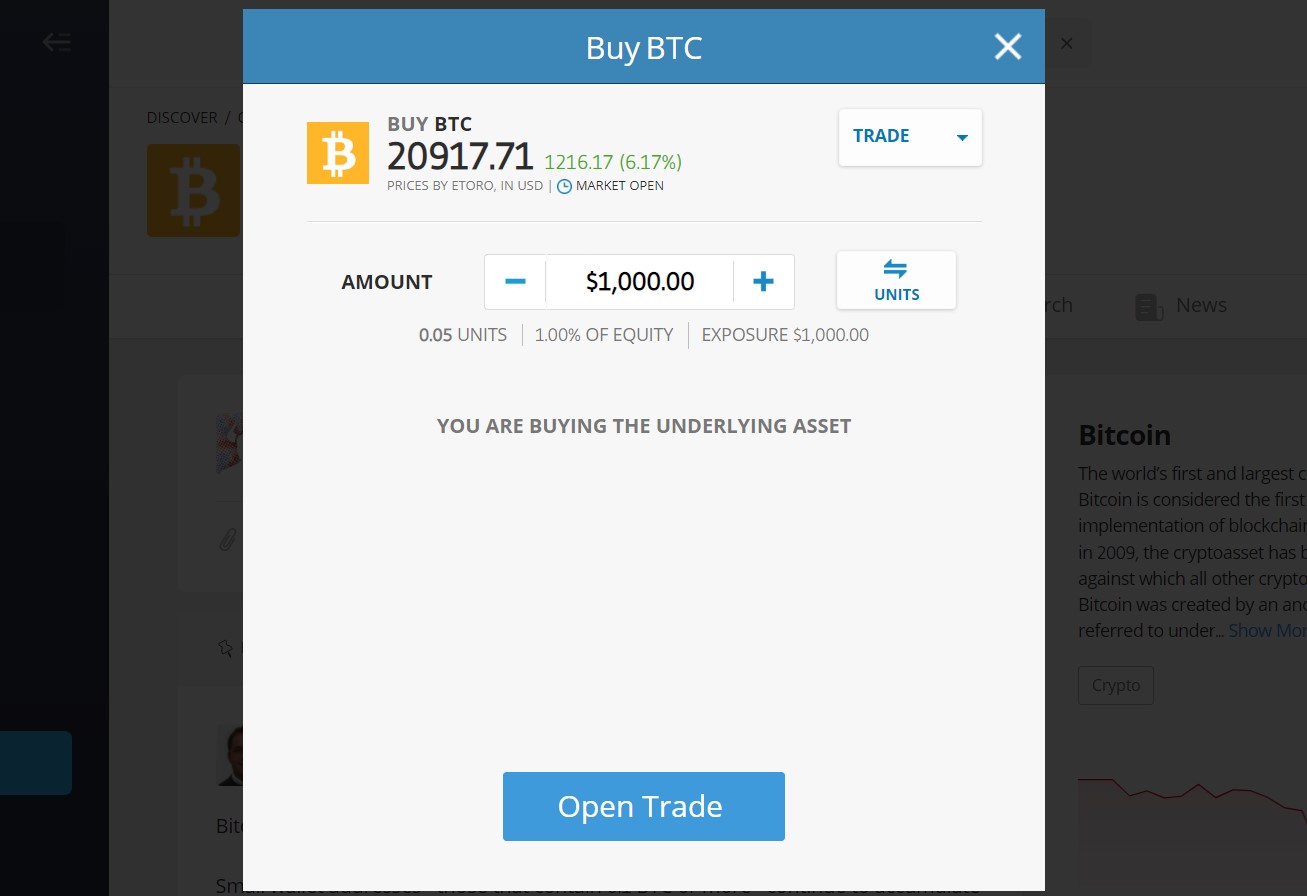

4. Start trading

You can explore cryptocurrencies in the Discover tab or use the search box to look for a specific coin. Click the “Trade” button next to your chosen cryptocurrency and use trade to buy now or Order to create a limit order. To buy now, just choose the amount you wish to purchase and tap “Open Trade”.

How to use a Bitcoin Broker

Using a Bitcoin broker is a very straightforward task. You simply need to select a broker to sign up with, make your first deposit and then purchase the cryptocurrency coins that you’re interested in at the price which the platform gives you.

Do You Need a Broker to Buy Bitcoin?

It is highly advised that you use a trusted and regulated broker to purchase your Bitcoin. Using regulated brokers will help to protect you against crypto scams. You should never buy Bitcoin from a platform that is not regulated, or directly with a person.

Final Thoughts on Crypto Brokers

If you want to trade or buy cryptocurrency, there are lots of aspects to consider when it comes to selecting the right broker. Some of them are a matter of personal preference for things like features and choice of coins, while factors such as your location and the type of trading you want to do may also affect which platforms are available to you.

Our research suggests that eToro is the best cryptocurrency broker overall as it ticks all the important boxes. These include strong security, regulation, free deposits, and user-friendliness, not to mention its unique features such as copy trading.