5 Best Crypto Exchanges in the UK in 2025

Crypto exchanges make it quick and simple to buy and sell Bitcoin and other cryptocurrencies online. If you want to invest in crypto, the first thing you need to do is find the best crypto exchange in United Kingdom that meets your needs.

We’ve researched more than 100 crypto exchanges and compared them on a range of important criteria, including fees, security, regulation, and trading features. On this page, you’ll find reviews of the five exchanges that came out on top, along with everything else you need to know about using crypto exchanges in United Kingdom.

Best Crypto Exchanges in the UK - Our Top 3 Picks

If you want to start buying and selling crypto on an exchange right away, click on one of our top picks below.

The Best UK Crypto Exchanges for 2025

-

eToro – Overall Best Crypto Exchange in United Kingdom

-

OKX – Best Crypto Exchange in United Kingdom for Advanced Trading

-

Coinbase – Best Crypto Exchange in United Kingdom For Beginners

-

CEX.IO – Best Crypto Exchange in United Kingdom For Reliable Order Execution

-

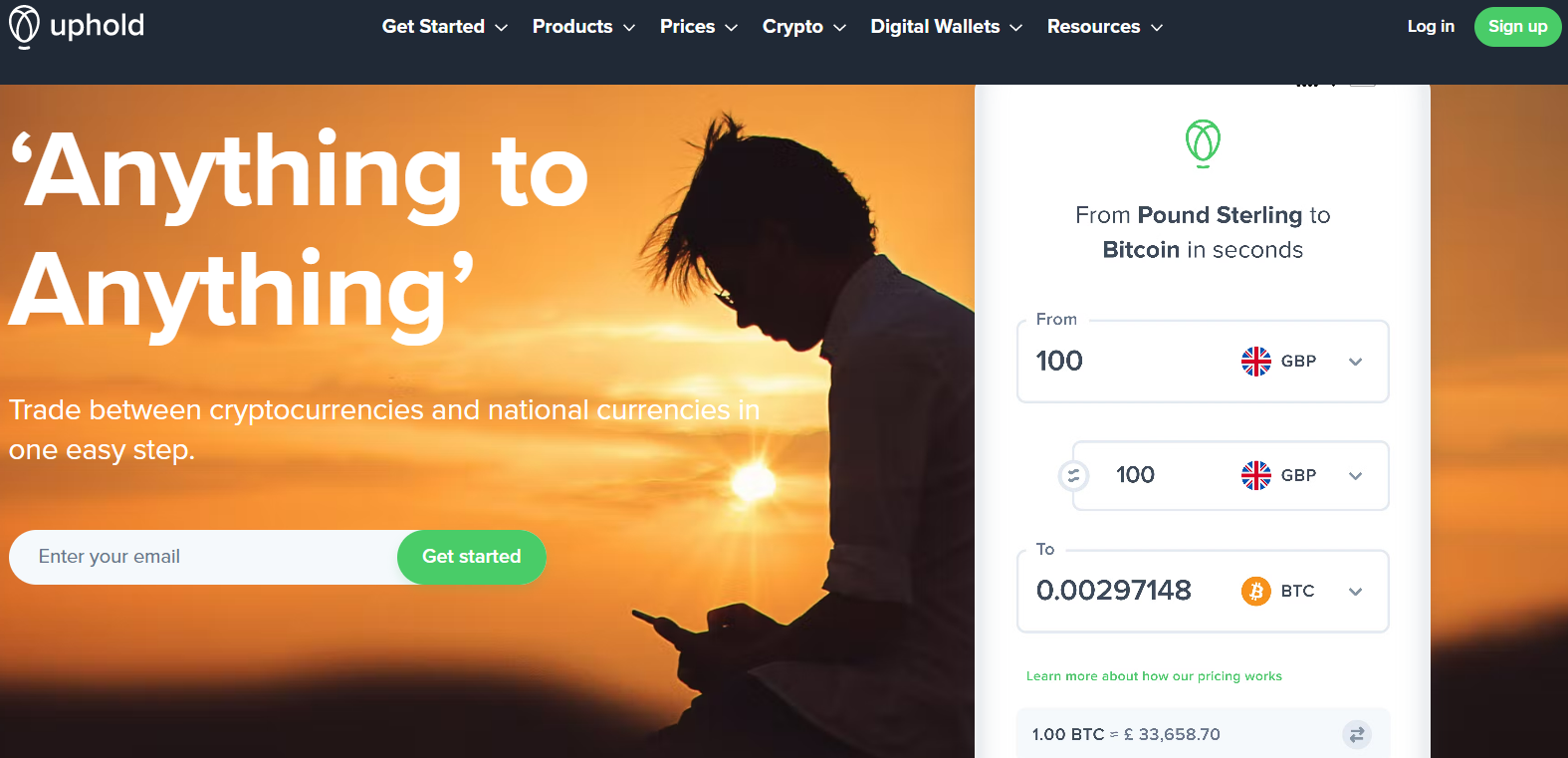

Uphold – Safest Crypto Exchange in United Kingdom

Top 5 Crypto Exchanges United Kingdom Quickly Compared

|

Regulation |

No. of coins |

Trading fees |

Min deposit |

|

|

eToro |

FCA, CySEC |

70+ |

1% plus spread |

£10 |

|

OKX |

VARA |

340+ |

Up to 0.1% |

Min purchase $5 |

|

Coinbase |

FCA, most US states |

150+ |

Up to 0.6% |

£50 |

|

CEX.IO |

GFSC, 33+ US states |

70+ |

Up to 0.25% |

£20 |

|

Uphold |

FCA, FinCEN |

160+ |

Spread of 0.85% to 1.25% |

£10 |

Top 5 Crypto & Bitcoin Exchanges in United Kingdom Reviewed

Here are details about our top 5 recommendations for crypto exchanges to use in United Kingdom.

1. eToro – Overall Best Crypto Exchange in United Kingdom

eToro is a multi-asset trading platform and crypto exchang with innovative features and more than 25 million users globally. It is very easy to use, letting you see which cryptocurrencies are trending or surging in the Discover tab and then purchase crypto them in a couple of clicks.

You can also find out more about each coin and analyse them using the data in the News, Stats, and Research tabs, and add your favourites to your watchlist to set up price alerts. In addition to over 70 cryptocurrencies, eToro provides access to stocks, ETFs, commodities, and forex.

The minimum deposit and minimum purchase size are both $10 (about £8) on eToro. United Kingdom customers have payment options of bank transfer, card, Neteller, Skrill, Trustly, and Rapid Transfer. There are no fees for deposits, and each crypto purchase or sale incurs a fee of 1% plus spread. Read our full eToro review here.

eToro Pros

-

User-friendly

-

Multiple asset types

-

Social investing features

-

Secure and FCA-regulated

-

Free deposits with a variety of payment options

-

Demo account

eToro Cons

-

Not as many coins as some competitors

-

Deposits via PayPal aren’t supported in United Kingdom

Why we chose this exchange

eToro’s strong reputation earned it the top spot on our list. The exchange has been providing reliable and user-friendly services for more than 15 years. United Kingdom customers can have confidence in eToro as it is licensed by the FCA and uses top-tier security measures, such as cold storage and SSL encryption.

eToro’s unique selling point is its range of innovative social investing features. You can view the profitability and risk tolerance of other users and replicate the trades of the ones you like with the CopyTrader tool. You can also discuss ideas with other traders and access their collective wisdom.

Other top features include Smart Portfolios, which let you gain diversified exposure by setting up thematic investment strategies. What’s more, you don’t need to have a lot of money to join eToro. The minimums are low, there are no deposit fees, and you can even practice trading risk-free with the demo account.

2. OKX – Best Crypto Exchange in United Kingdom For Advanced Trading

OKX is a secure and efficient crypto exchange that enables you to buy and sell more than 340 cryptocurrencies. For quick and simple purchases, you can buy crypto with a card. You can also make instant fee-free conversions between any two supported cryptocurrencies.

One of the standout features of OKX is the Earn section. Once you’ve bought some crypto, you can head here to generate interest on it through a range of products, including savings accounts, staking, fixed income, dual investment, flash deals, and DeFi.

OKX doesn’t support fiat currency deposits, but you can deposit crypto and trade it with market-beating trading fees of 0.1% or less. If you prefer the simplicity of instant card purchases, you can buy a minimum of £9 worth of crypto for a 1.99% fee.

OKX Pros

-

Tools for advanced trading

-

Very low trading fees

-

340+ cryptocurrencies

-

Earn interest on crypto

-

Trading bot

-

Demo account

OKX Cons

-

No fiat deposits

Why we chose this exchange

We picked OKX as it is one of the best exchanges for people who want to go beyond simply buying and selling. As well as having a wider choice of coins than most competitors, OKX gives you all the tools and data you need for advanced trading, including customisable charts, technical indicators, and different order types.

You can even take advantage of OKX’s choice of trading bots to implement strategies such as dollar cost averaging, time-weighted average price, iceberg orders, and arbitrage. If you’re still honing your trading skills, you can practise risk-free in your demo account and read articles about advanced trading tools in the Learn section.

3. Coinbase – Best Crypto Exchange in United Kingdom For Beginners

Coinbase is a user-friendly crypto exchange where you can buy and sell more than 150 cryptocurrencies in a couple of clicks. You only need to click the “Buy & Sell” button and enter an amount to make simple card purchases instantly.

You can find out what the top-moving cryptocurrencies are and get price alerts for your favourites by adding them to your watchlist. Coinbase also lets you set up automatic purchases with the recurring buys feature, and earn interest on a handful of coins.

Coinbase is regulated by the FCA and keeps crypto secure with cold storage and insurance. You can get started with a bank deposit of at least £50 and then use the Trade tab to buy crypto for a 0.6% fee. Alternatively, you can pay higher fees to make instant card purchases. Read our full Coinbase review here.

Coinbase Pros

-

Accessible for beginners

-

Low minimum purchase size

-

150+ cryptocurrencies

-

Recurring buys feature

-

Learning rewards

-

FCA-regulated

Coinbase Cons

-

Limited choice of payment methods in United Kingdom

-

Card purchase fees can be high

-

Deposit minimum is higher than many competitors

Why we chose this exchange

We chose Coinbase as it is one of the best places to get started if you are new to crypto, or even new to investing in general. The interface is clear and easy to navigate, and you can start off with minimal exposure thanks to the minimum purchase size of just £2. Dollar cost averaging is also made easy with the recurring buys feature.

If you want to develop a better understanding of crypto, you can find a wealth of resources in Coinbase’s impressive Learn section. You can even earn free crypto while learning about certain crypto projects in the Learning Rewards section.

4. CEX.IO Best Crypto Exchange in United Kingdom For Reliable Order Execution

CEX.IO is a trusted and secure crypto exchange that provides access to more than 70 cryptocurrencies. You can easily use your credit or debit card to make simple crypto purchases in a matter of minutes.

Traders will appreciate the more advanced features, including charts, limit orders, and a range of API solutions for implementing automated trading strategies. There is also an Earn section where you can generate interest on your coins through staking or savings accounts.

Users in United Kingdom can make a minimum deposit of £20 for free via Faster Payments. Alternatively, you can make an instant card purchase for a fee of 1.49%. When making trades on the exchange, the trading fee is a competitive 0.25%. Read our full CEX.IO review here.

CEX.IO Pros

-

Fast order execution

-

API solutions

-

Earn interest on crypto

-

Strong security

-

24/7 support

CEX.IO Cons

-

Verification process isn’t straightforward

Why we chose this exchange

CEX.IO is popular for its reliable order execution. Its high-liquidity order book, favourable conditions for market making, and advanced order matching algorithms mean that orders are executed very quickly. This makes it possible to implement high-frequency trading and scalping strategies.

The exchange also provides 24/7 customer support and employs strong security measures, such as offline storage, DDoS protection, data encryption, and compliance with PCI DSS safeguarding standards. CEX.IO has never lost any customer funds during its decade-long history.

5. Uphold – Safest Crypto Exchange in United Kingdom![Uphold Homepage]()

Uphold is a transparent crypto exchange that makes it easy for United Kingdom citizens to buy and sell crypto in a couple of clicks. You can make a purchase with GBP, so there is no need to pay a currency conversion fee or buy stablecoins first.

There are more than 160 cryptocurrencies available, and you can buy them with an instant purchase, a limit order, or set up recurring automatic purchases. An impressive feature of Uphold is its staking service. You can earn weekly rewards on over 20 coins with interest of up to 25% APY.

A minimum deposit of £10 is required to fund your account. You can deposit for free via bank transfer or for a 2.49% fee via debit card. When making a crypto purchase or sale, there is a spread that varies by coin, which is typically in the range of 0.85% to 1.25%.

Uphold Pros

-

Easy to use

-

Limit orders and automatic purchases

-

160+ coins

-

Staking service

-

FCA-regulated

Uphold Cons

-

Credit card deposits not available in United Kingdom

-

No advanced trading features

Why we chose this exchange

Uphold is on our list as it makes it easy to buy and sell crypto safely. In addition to being regulated by the FCA, Uphold uses a variety of security measures, such as a responsive 24/7 monitoring system, auditing and testing, encryption, personnel standards, third-party due diligence, and a bug bounty programme.

What’s more, Uphold provides complete transparency for its 10 million customers. The crypto exchange never loans out users’ funds and is always fully reserved. It also publishes all transactions and holdings in real time so users can see the platform’s reserves whenever they like.

What Is a Crypto Exchange & How Do They Work?

A crypto exchange is a platform that you can access on the web or through an app and use to buy and sell cryptocurrencies. Some exchanges only enable you to exchange crypto with fiat currencies, while some only allow exchanges between different cryptocurrencies, and some facilitate both.

The exchange functions as an intermediary between different users to facilitate trades between them. It typically does this through the use of an order book. When someone wants to make a purchase, they can create a buy order, which goes into the order book, where it can be matched with a sell order.

Many exchanges offer instant purchases as well as or instead of trading against an order book. Instant purchases don’t require the creation of a buy order, as the exchange will purchase the amount you want at market price on your behalf.

Exchanges tend to charge a fee for providing this service called a trading fee, which is usually charged as a percentage of the purchase or sale amount. On top of this, you may have to pay a fee when you deposit and/or withdraw fiat or crypto.

A number of crypto exchanges offer a variety of services in addition to facilitating the exchange of crypto. These services could include wallet custody, staking, trading robots, and NFT trading.

To start using an exchange, you need to create an account. Regulated exchanges must implement Know Your Customer (KYC) processes. This means that you can’t use the exchange until you have verified your identity, which usually requires you to upload a copy of your photo ID.

Is Crypto legal in United Kingdom?

Yes, crypto is legal in United Kingdom. United Kingdom citizens are allowed to engage in a range of crypto activities, including buying, selling, trading, staking, and DeFi. The United Kingdom government has never made any attempt to ban crypto, although it has warned consumers about the risks involved.

United Kingdom’s financial regulator, the FCA, has banned crypto derivatives, like futures, options, and CFDs, for retail traders. However, cryptocurrencies themselves can be traded by anyone in United Kingdom.

Are Crypto Exchanges Regulated in United Kingdom?

Yes, crypto asset businesses, including crypto exchanges, are regulated by the FCA in United Kingdom. This means that United Kingdom crypto exchanges are required by law to register with the FCA and comply with anti-money laundering and counter-terrorist financing requirements.

Cryptocurrencies themselves, on the other hand, aren’t regulated by any authority in United Kingdom. This means that you are unlikely to have access to the Financial Ombudsman Service (FOS) or the Financial Services Compensation Scheme (FSCS) if something goes wrong with your crypto investment.

Do I Have to Pay Tax on Crypto in United Kingdom When Buying Through an Exchange?

Crypto profits are taxed in United Kingdom regardless of where you buy your crypto. There is no tax for simply buying and holding crypto, but when you dispose of it by selling, swapping, or gifting it, any profit realised counts as a capital gain.

There is an annual tax-free threshold in United Kingdom, and you will only need to pay Capital Gains Tax if your capital gains exceed this threshold. If you participate in DeFi activities such as staking, any profits you make could trigger CGT or Income Tax, depending on the nature of the return.

Many exchanges cooperate with tax authorities by sharing information about their users, so it is important that you report your crypto dealings accurately to HMRC on your tax return, even if you don’t owe anything, to avoid receiving a penalty. You can learn more about what and how to report in our Crypto Tax United Kingdom Guide.

Different Types of Crypto Exchange in UK

There are a variety of different exchanges that work in different ways. You can find explanations of the main types below.

Centralised

A centralised exchange (CEX) is owned and operated by a company that acts as a central authority with overall control over the service. They work rather similarly to conventional stock exchanges. All the exchanges on this page fall into this category.

When you buy crypto on a centralised exchange, you either create a buy order that goes into the exchange’s order book, or just enter the amount you want and the exchange purchases it on your behalf. CEXs may facilitate crypto-crypto trades, crypto-fiat trades, or both.

When you make a deposit on a CEX, your funds are held by the exchange, which is why it is important to select one with strong security. Most CEXs also provide exchange wallets where you can keep your crypto. These are generally custodial wallets, meaning that your exchange will be in charge of looking after your private key.

As there is a company that operates a centralised exchange and provides financial services, it will have legal and regulatory requirements. This is why many CEXs have a KYC process, requiring users to verify their identity before making any trades.

Decentralised

There is no central authority in charge of a decentralised exchange (DEX), as it runs on the blockchain with operations automated by smart contracts. Trading is done on a peer-to-peer basis without the need for intermediaries.

DEXs only support crypto-crypto trades and often use liquidity pools instead of order books. This model doesn’t require the matching of buy and sell orders, as the swaps are made via the liquidity pools of the tokens in question. These pools are funded by other users, who are paid with transaction fees for providing liquidity.

The decentralised nature means that there is no single point of failure, and there are no KYC requirements, so users can trade anonymously. All you need is a wallet such as MetaMask to connect to the DEX. As there are no fiat on/off ramps, you’ll need to acquire some crypto, e.g. from a CEX, to fund your wallet before you can make swaps on the DEX.

DEXs are more difficult to navigate for the uninitiated than the more user-friendly CEXs and have fewer features and trading options. While there is no single point of failure, smart contracts can still be vulnerable to bugs and exploits, and there is no authority to make a claim to if your tokens are stolen. What’s more, although the trading fees tend to be low, you will also need to pay gas fees to use a DEX, and these can sometimes be pretty expensive.

Hybrid

Hybrid crypto exchanges are a more recent development that aims to combine the best elements of centralised and decentralised exchanges, while addressing the limitations of both.

They bring together the high liquidity, fast transactions, and user-friendliness of centralised exchanges with the security and anonymity of decentralised exchanges. They tend to have a scalable design and enable users to be the sole custodians of their assets.

Features of hybrid crypto exchanges could include atomic swaps, which are automated cross-chain peer-to-peer token exchanges. Hybrid exchanges may also use escrow, which is a service that provides security during the token-swapping process.

P2P

Peer-to-peer (P2P) exchanges don’t use an order book to match buy and sell orders, as buyers choose sellers themselves. You can click on the seller you want to buy from, send them the money, and they will send you the crypto in return.

P2P exchanges generally hold the money and crypto in escrow for security until both parties have made the transfer. Some P2P exchanges don’t require KYC information, so are popular with people who want to trade anonymously.

You will often find a wider range of accepted payment methods on P2P exchanges, though generally fewer supported cryptocurrencies, than on other types of exchanges. There isn’t usually a fee for buying crypto on a P2P exchange, but each seller decides the price, so you could still end up paying more than when using a CEX with fees.

P2P exchanges tend to have less in the way of features than CEXs. For example, they may not provide price charts, limit orders, or wallet custody. The ability to trade anonymously can also attract criminals, so you will need to be wary of scams. However, a number of CEXs, like OKX and Binance, have launched their own P2P crypto exchange platforms, providing the best of both worlds.

Instant Exchanges

Instant exchanges, like Changelly and ChangeNOW, are growing in popularity as they are very easy to use. They often have a quick and simple sign-up process that enables you to make swaps with just an email or wallet address, without having to go through verification.

Instant exchanges are non-custodial, so you will need to set up your own wallet and you will be in control of your own funds throughout the process. In order to execute your trade, the instant exchange aggregates the prices and liquidity of a variety of custodial exchanges.

While making swaps on an instant exchange is very simple, users will need the skills to set up and safeguard their own wallet. As well as a lack of wallet custody, instant exchanges also tend to have less sophisticated interfaces and lack features for advanced trading. The fees on instant exchanges can also be higher than on traditional CEXs.

Derivatives Exchanges

Crypto derivatives exchanges are exchanges that enable you to trade derivatives of crypto, which are financial contracts such as futures, options, and CFDs. These enable you to speculate on the price of crypto without actually buying any.

Derivatives exchanges tend to have low trading fees, fast order execution, and provide advanced trading features, such as a range of order types and risk management tools. You can trade crypto derivatives with leverage, which increases any profits you make, but will also increase any losses.

The complex nature of crypto derivatives exchanges and the increased risk when using leverage mean that derivatives should not be traded by inexperienced users. Indeed, most retail traders lose money on crypto derivatives.

There is also a lack of due diligence in the crypto derivatives market, with many of the exchanges that offer these products being unregulated and therefore risky to use. You can find crypto derivatives services on some traditional crypto CEXs, like OKX and Binance, though they may not make these services available in jurisdictions where crypto derivatives are banned for retail traders, such as United Kingdom.

How We Chose the Best Crypto Exchange in the UK

When deciding which crypto exchange is the best to use, there are a variety of different factors that you should consider. Some of the most important criteria are explained below.

Assets available

Which assets an exchange supports is an important factor when deciding whether it’s right for you. If you want to buy a specific obscure cryptocurrency, this may rule out a lot of the available options.

Crypto investors who want to stick to the best-known and most well-established coins, like Bitcoin and Ethereum, will have a wide range of exchanges to choose from. All the exchanges recommended on this page offer a good range of cryptocurrencies, including all the most popular ones.

Some crypto exchanges, like OKX, have a wider selection of coins than most competitors, making them a great place to pick up less well-known cryptocurrencies. There are even platforms that offer traditional financial assets alongside crypto. On eToro, for example, you’ll be able to trade stocks, commodities, ETFs, forex, and crypto all in the same place.

Features and tools

Features and tools can vary a lot from one exchange to the next. Some exchanges just offer a very simple interface that enables you to make purchases or swaps and not much else. Others, meanwhile, have all kinds of extra features to make them a one-stop shop for all your crypto activities.

Different types of trading

Every exchange, by definition, enables you to make exchanges. This could be in the form of simplified crypto-to-crypto swaps or through an instant card purchase feature. Some exchanges go beyond this to offer the tools needed for more advanced trading.

You will find detailed spot trading facilities on crypto exchanges such as OKX and CEX.IO, where you can set up more advanced order types, like limit orders, stop losses, and take profits. You may also find features for trading with margin or derivatives.

Wallet custody

The availability and type of wallets offered by exchanges can vary, and which is best will depend on your personal preferences. Those who prefer to use their own private wallet to self custody their coins won’t place much importance on wallet availability.

Those who only want to buy a small amount of crypto and aren’t comfortable with setting up and safeguarding their own wallets should select an exchange that offers custodial wallets. You can always transfer your crypto from the exchange wallet to a private wallet later if you want to.

All the exchanges on this page provide a free custodial wallet where you can store your crypto. This is a very convenient storage solution for easy access, but the hacking target that large exchange wallets represent means that you should select an exchange with strong security features, like cold storage.

As well as offering a custodial exchange wallet, some exchanges, like Coinbase and OKX, also provide self-custodial crypto wallets that are Web3 enabled and can be used to access dApps.

Charts and pricing

All crypto exchanges tell you what the current price of a cryptocurrency is when you buy it, but whether they provide data beyond this and how much varies. All our recommendations provide price charts, enabling you to view the price history of all available coins.

Some provide more detailed charts than others. OKX, for example, supplies comprehensive, customisable charts on which you can alter the time interval and display and apply drawing tools and technical indicators.

On many exchanges, you can set up price alerts so that you will be notified when a cryptocurrency hits a certain price. Some exchanges will offer you even more data, such as volume, order book depth, volatility, sentiment, open interest, and long/short ratio.

Automated trading tools

There are a growing number of tools that enable people to trade passively. The most simple example of this is Coinbase’s recurring buys feature that enables you to set up automatic purchases on a regular basis.

CEX.IO provides a range of API solutions that allow users to implement automated strategies and integrate trading bots or third-party terminals. Meanwhile, OKX has a broad selection of ready-made robots to choose from, as well as facilities for users to create their own.

One of the most accessible and popular methods of passive trading is copy trading. The innovative CopyTrader feature on eToro can be used to select a preferred pro trader based on their risk tolerance and profitability and then automatically copy the trades they make.

Staking and savings accounts

Crypto exchanges, platforms and apps that offer interest on crypto holdings are an ever more popular place to store crypto, as they tend to provide much higher interest rates than traditional bank accounts.

All the exchanges listed in this guide offer staking services. All you need to do is click a button and the exchange will stake your coins and give you rewards. OKX and CEX.IO also offer savings accounts, which provide a low-risk way to earn interest on a wider range of coins.

NFT support

With the explosion in popularity of non-fungible tokens, some exchanges have begun to add features specifically to support the use of NFTs.

OKX has its own NFT marketplace, as well as the tools to create your own NFTs. Meanwhile, the self-custodial Coinbase Wallet has the functionality to store and trade NFTs.

Fees

All centralised exchanges generate their revenue by charging fees. The type and size of fees charged are different for different exchanges, so you will need to aggregate the various fees explained below to work out which exchange is the cheapest to use.

Trading fees

This can be known as a trading fee, transaction fee, or commission, and it is the fee that many exchanges charge every time you make a purchase, sale, or swap. It is typically charged as a percentage of your order size.

The lowest trading fees can be found on OKX, where they are just 0.1% or less. The highest trading fees tend to be for instant card purchases, which are typically around 2%, but can be higher.

Spread

Spread is the term for the difference between the current market price of an asset and the price you pay for it on an exchange. How much the spread is can depend on which cryptocurrency you are trading and the volatility of the market. Not all exchanges charge a spread fee. There is no spread fee on OKX, for example.

Some exchanges just charge spread fees on trades, while others charge a spread fee on top of the trading fee or commission. There is a spread for all crypto trades on eToro, while Coinbase charges a spread on simple purchases, sales, and conversions but not on trades made through its order book in the Trade tab.

Deposit and withdrawal fees

On most exchanges, you will need to pay a fee for deposits or withdrawals or both. Your location and payment method could determine the size of this fee.

The cheapest app for making deposits is eToro, as it never charges any deposit fees. All withdrawal methods, however, carry a $5 fee.

On Coinbase, you can make free deposits via bank transfer, which is the only accepted deposit method in United Kingdom. To withdraw to your bank account, you will need to pay a £1 fee.

The deposit fee on CEX.IO depends on the payment method chosen. Faster Payments bank transfers are free, while card deposits incur a 1.49% fee, and there is a 3.99% fee for using Apple Pay or Google Pay.

You may have the option to make instant card purchases on some exchanges. The fee for this is typically higher than making a deposit. The size of the card purchase fee varies on Coinbase and is 1.99% on OKX.

OKX doesn’t support fiat deposits, but you can deposit crypto. It is free to deposit crypto on OKX, but there are withdrawal fees it.

Other fees

Some exchanges may charge other kinds of fees as well. You may need to pay a currency conversion fee, for example, if your exchange is denominated in a currency other than your local currency.

Overnight fees could be charged for leaving a position open overnight, but this mostly applies to CFD crypto trading platfroms. On top of this, you might come across inactivity and account management fees.

Payment options

It is important to find an exchange that you can deposit to and withdraw from with ease. Which payment methods are accepted differs from one exchange to another, but all of our recommendations accept methods that are accessible to most United Kingdom users.

eToro supports a good range of payment methods, and in United Kingdom, your options will be bank transfer, credit or debit card, Skrill, Rapid Transfer, or Trustly.

Coinbase has the most limited deposit options in United Kingdom, as GBP deposits can only be made via bank transfer. However, Coinbase users can also make instant purchases with their credit or debit card.

Fiat deposits aren’t accepted on OKX, but the instant purchase feature supports payment by card, as well as Google Pay, Apple Pay, and local payment methods through third-party payment processors. You can also buy crypto with most United Kingdom bank accounts, PayPal, Neteller, and Skrill if you use OKX P2P.

Safety and security

Security should be one of your top priorities when choosing an exchange, as you want your crypto and personal information to be kept safe. We only recommend exchanges that provide security that can be relied upon.

All of the exchanges on this page use offline storage for the majority of the crypto they custody, meaning it isn’t vulnerable to hacking. They also secure your personal details and password with the use of strong encryption.

Other positive security features include Coinbase’s crypto insurance, which protects the value of assets stored in their hot wallets in the event of a hack. If your exchange allows you to set up extra levels of security, you should do so. These might include 2FA, address whitelisting, and security questions.

Regulation and reputation

The best exchanges to use are regulated exchanges, like the ones listed in this guide, as they should have the highest levels of security, and often provide the best user experience. Exchanges that haven’t achieved regulatory approval might not do their due diligence, and could even be scams.

For users in United Kingdom, the best exchanges to opt for are ones that are registered with the FCA, or another regulatory body that is recognised by the FCA. eToro, Coinbase, and Uphold are all regulated by the FCA, while OKX is licensed by VARA and CEX.IO holds licences from FinCEN, GFSC, and FINTRAC.

As well as regulatory status, an exchange could build a strong reputation by forging strong partnerships and achieving a long history of providing reliable services without security breaches. You can use forums and online review sites to find out what other customers think of an exchange.

Support

Support you can rely on is a key factor, especially for beginners who may need extra help navigating the platform or crypto exchange. It would be ideal to find an exchange that offers 24/7 support in your local language via different channels, such as telephone, email, and web chat.

You’ll be able to find the answers to most queries in the FAQ or help section. You will also be able to find more detailed educational resources about crypto and trading in the Learn section provided by some exchanges, like Coinbase and OKX.

How to Buy Crypto in United Kingdom With a Crypto Exchange

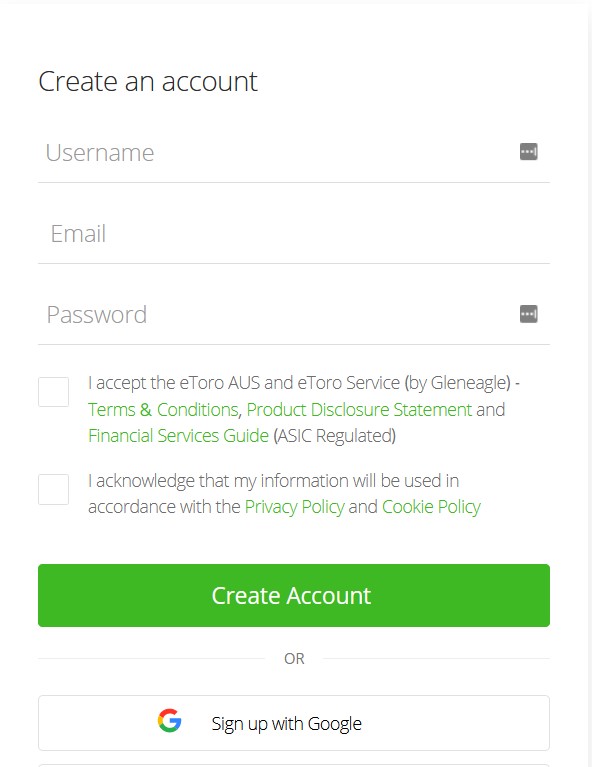

1. Open an account with a United Kingdom crypto exchange

Find a crypto exchange that meets your needs. You can find links to our top three recommendations at the top of this page and click on one to go to the exchange website, or pick our top provider eToro. There, you can click the sign-up button to get to the registration form. You will need to provide a few details, such as your email address or phone number, and then you can create an account once you have accepted the terms and conditions.

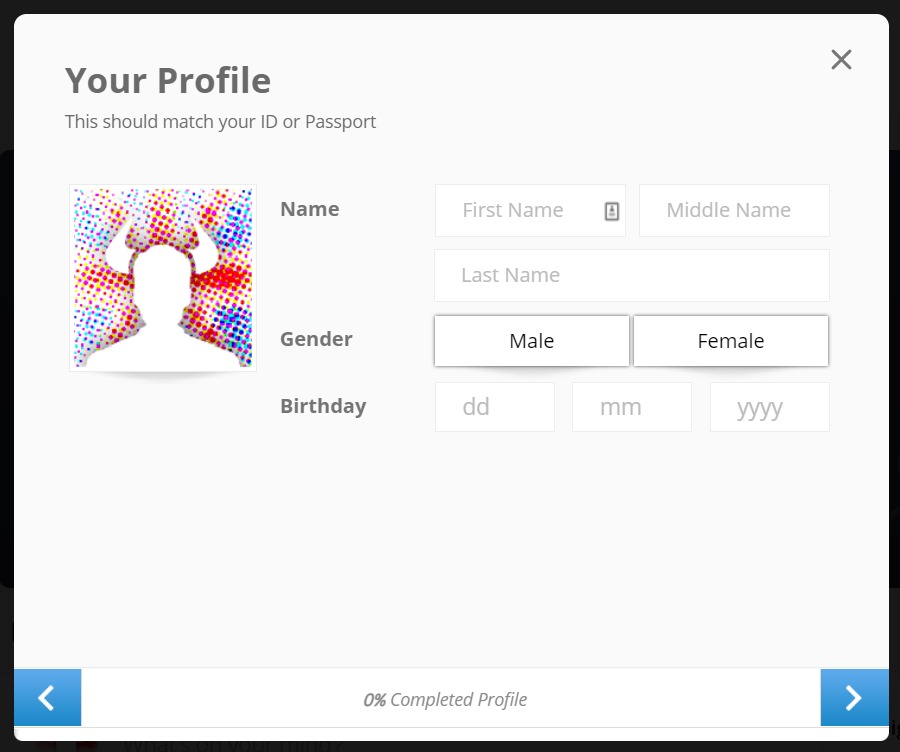

2. Verify your account

You will need to verify your email address or phone number by clicking a link or entering a confirmation code that will be emailed or texted to you. Regulated exchanges have a KYC process that new customers need to complete before they can use the exchange. You will be required to verify your identity, which typically involves uploading an image of your driving licence or passport. Some exchanges may also require you to submit a bank statement or utility bill to verify your address.

3. Make a deposit

To fund your account, go to the deposit page on your exchange. You can select GBP as your currency and select the payment method you want to use. Most crypto exchanges support deposits via bank transfer and/or card. You’ll need to provide your bank or card details and enter the amount you wish to deposit before you can complete the transfer.

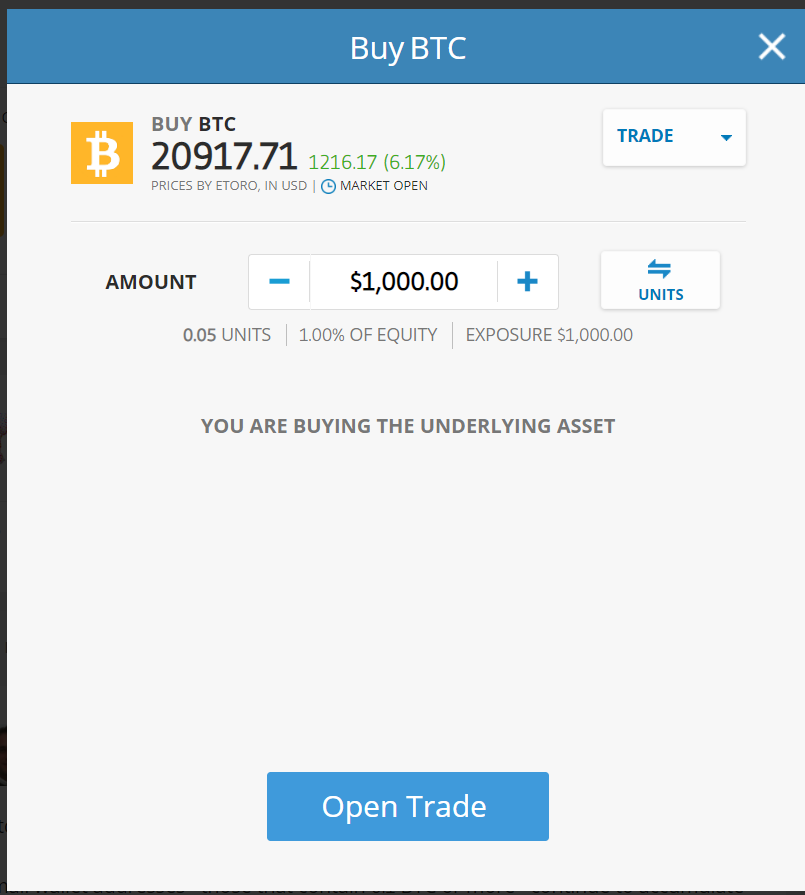

4. Purchase cryptocurrency

Browse the market or use the search bar on your exchange to find the particular cryptocurrency you want. Your exchange may support instant purchases, in which case you can simply click a “Buy” button. The alternative is to create a buy order for the amount you wish to purchase. You can use a market order to buy immediately at the current price, or a limit order to buy the coin once it reaches a certain price.

Final Thoughts

A crypto exchange is the easiest way to buy and sell crypto online. We tested a variety of different exchanges and compared them on their security, user experience, fees, and other factors. This page has detailed the exchanges that came out on top.

To summarise, our top recommended crypto exchange for United Kingdom users eToro. This is because it uses state-of-the-art security, is regulated by the FCA, and charges fees that are reasonable and transparent.

The multi-asset exchange is a great one-stop shop for all kinds of crypto investors of all experience levels. As well as benefiting from free deposits and a virtual account, eToro users get access to a range of unique social investing features, such as the ability to copy the trades of pros.

You can set up an account with eToro and make your first crypto purchase in a matter of minutes. Just click the link below to get started.

Review Methodology

To ensure that we only provide the most accurate and reliable information, we thoroughly test every exchange that we review. Our aim is to provide our readers with the unbiased guidance they need to make well-informed investing decisions when they’re looking for the best UK cryptocurrency exchange.

We evaluate a range of factors and processes when we test an exchange, such as registration, deposit methods, available assets, ease of use, features and tools, types of trading supported, security, regulation, and customer support.

Take a look at our why trust us and how we test pages to find out more about our testing methods.

Similar United Kingdom Guides

Want to learn more about how to buy and use crypto in United Kingdom? Check out our other United Kingdom guides below.