-

Cryptocurrency prices had a good performance this week as Bitcoin rose to $26,000.

-

tomiNet was one of the best-performing tokens as it jumped to a record high.

-

VeChain price soared after being listed by Coinbase.

Cryptocurrency prices had a relatively good week as Bitcoin bounced back above $26,000 after falling below $25,000 on Monday. Some of the most important news were Franklin Templeton’s decision to apply for a Bitcoin ETF and Deutsche Bank’s move to offer crypto custody solutions.

There were other important news. Hedera Hashgraphg launched Stablecoin Studio, a product that empowers institutions to build stablecoins. Telegram, the giant messaging company integrated Toncoin while Coinbase added VeChain in its platform. This article looks at some of the top cryptocurrencies, including tomiNet, XDC Network, and VeChain.

tomiNet price prediction

tomiNet was one of the top breakout stars in the crypto industry this week as it surged to the highest level on record. As it jumped, the token moved to the top 100 of the biggest cryptocurrencies in the world, with its market cap surging to over $268 million.

For starters, tomiNet is a blockchain project that seeks to build quality applications. It has a browser, a DNS service, and a multichain digital wallet for tokens and NFTs. Its goal is to combine the best of Web2 and Web3 technologies to create a more private ecosystem.

It is unclear why the tomiNet price surged. A likely reason is that traders are just pumping the token since there was no major news in the ecosystem. On the two-hour chart, the token rose above the key resistance level at $3.60, the highest level on 11th September.

It has moved slightly above the 25-period moving average while the Relative Strength Index (RSI) has moved above the overbought level. Therefore, the token will likely retreat as sellers target the key support at $3.6 as the momentum fades.

XDC Network price prediction

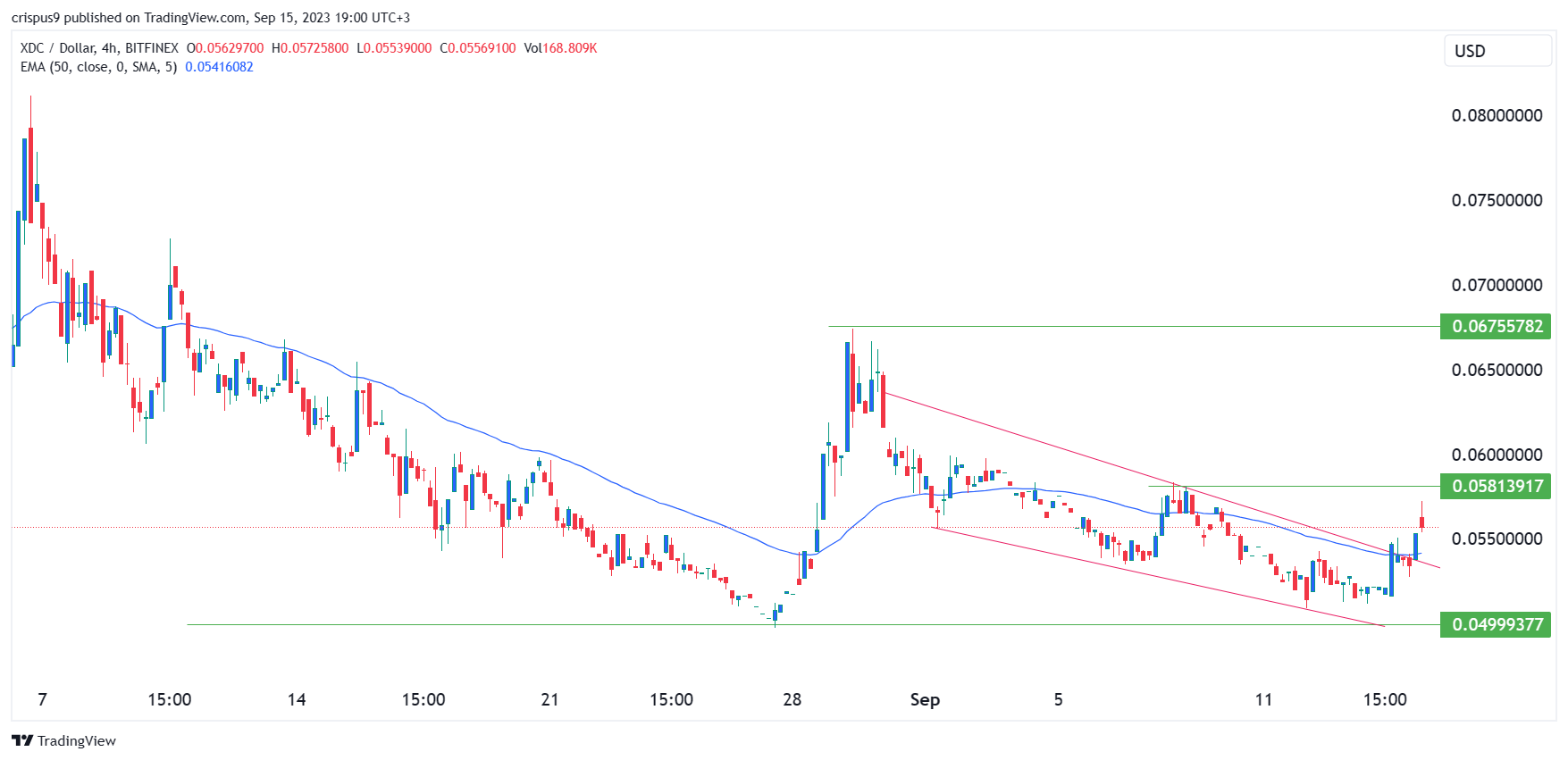

XDC Network token price made a strong bullish comeback after falling to a low of $0.050 on Monday. On the four-hour chart, the pair managed to cross the upper side of the falling wedge pattern shown in red. In price action analysis, this pattern is one of the most popular bullish signs.

XDC price has jumped above the 50-period moving average and is approaching the crucial resistance level at $0.058, the highest level on September 8th. Therefore, because of the falling wedge pattern, there is a likelihood that the token will continue rising as buyers target the key level at $0.60.

VeChain price prediction

VeChain price jumped sharply after the coin was listed by Coinbase, one of the biggest exchanges in the world. It rose by more than 17% from its lowest level on Monday. As it jumped, the coin flipped the important resistance level at $0.016 (August 29th) into support.

VeChain has moved above the 25-day and 50-day moving average while the MACD has jumped above the neutral point. The price is also above the Ichimoku cloud.

I suspect that VeChain price will likely retreat in the coming days as the bullish momentum fades. If this happens, the coin will likely retest the support at $0.01680. The alternative scenario is where the price jumps as buyers target the resistance at $0.018 (August 14th high).

How to buy VeChain

Bitvavo

The Bitvavo platform was launched in 2018, with the goal to bridge the gap between traditional currencies and digital assets. Bitvavo is making digital assets accessible to everyone, by offering transparent fees, a wide range of assets and an easy to use platform.

Coingate

CoinGate is a Lithuanian-based fintech company founded in 2014. The payment gateway offers cryptocurrency payment processing services for businesses of any sizes. Permission-based account management, fiat payouts to the bank account and brand new email billing feature are just a few reasons why CoinGate has become a go-to payment processor for many.