Devcon1, the second major Ethereum Conference took place at a sold-out Gibson Hall. Previously serving as the headquarters for the National Provincial Bank, it provided an apt setting for a conference dedicated to the future of finance.

The building alone is a testament to how much the “Crypto space” has matured in the past years. Beneath decadent domed ceilings and chandeliers, the sold out crowd were treated to presentations and panels by members of Ethereum’s team, developers who’ve been using the platform, and representatives from Deloitte and UBS, the presence of which would have been nothing short of a pipe dream until recently when financial institutes became more vocal about their exploration of blockchain technology.

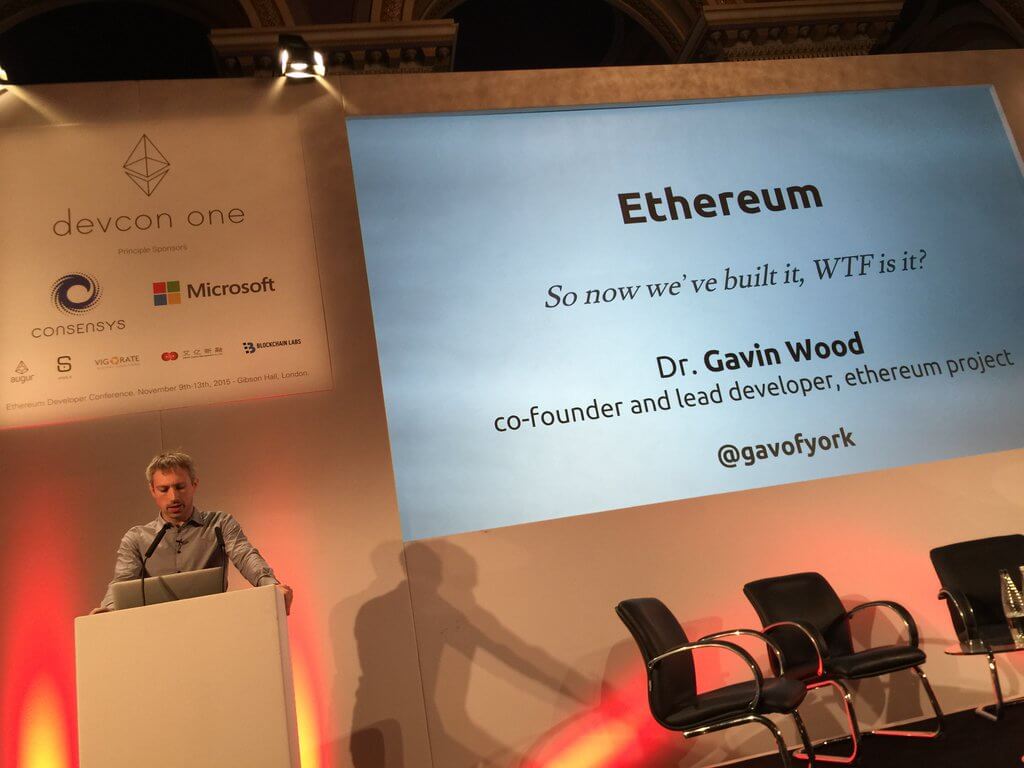

We spent last week at the conference and were fortunate enough to discuss scalability, the future of cryptocurrencies and Casper, Ethereum’s new “security deposit based economic consensus protocol” With Dr. Gavin Wood, Ethereum’s CTO who led the implementation of the Ethereum C++ client, GUI and IDE, and authored much of the vision for the project around decentralisation and Web 3 (http://gavwood.com/dappsweb3.

CoinJournal: On Monday there were many points made about the difference between Devcon0 & Devcon1. When you initially began working on Ethereum, did you ever believe that you’d be selling out a conference and attracting partnerships with Microsoft in under 2 years?

Dr Wood: When I initially began working on Ethereum I honestly doubted I’d ever see any money at all. It looked like yet another open-source project in the making; an unproven, and partially complete whitepaper. The reason I started work on it was two fold; academic curiosity (let’s see what is wrong with it!) and a desire to work on a green-field project for a bit of a break.

After I saw the amount of money in Bitcoin first-hand and the apparent lack of technical ambition within the community in general, I realised that the Ethereum proposition was indeed well placed; at that point I would have had no problem believing the magnitude of devcon-1.

CoinJournal: Of all the Ðapps you’ve seen, are there any that surprise you when you see them making full use of Ethereum? Also, of all of them, which do you think makes the best use of the platform?

Dr Wood: The heavy-weight Ðapps surprise me somewhat; I heard that a certain prediction market uses all sorts of mathematical modelling such that it can barely run with the present gas limit. Many make different uses of the platform in different ways. The idea of Provenance (supply-chain information, accessible to the consumer) uses Ethereum to truly cross trust boundaries; the larger ideas behind Slockit (physical locking and unlocking through blockchain logic) use Ethereum to automate the sharing economy. I think the truly revolutionary Ðapps have yet to be proposed.

CoinJournal: Ethereum has always been an ambitious project, Do you think that a project of this magnitude has had a positive impact on crypto awarness as a whole? Further to this, do you think that Ethereum adoption will drive the adoption of other similar projects?

Dr Wood: Yes; very much so. Blockchain is a nascent technology. Bitcoin was an important part of getting this technology recognised, largely through the socially-sensitive MVP of a currency. However it didn’t really capture the imagination of developers in general. Ethereum, I think, is beginning to do that. Still, it’ll take another 5+ years (and probably a burst bubble) before the technology pervades society fully. The timescale is dependent upon the uptake of developers, investors, business leaders and, eventually, consumers; it’ll happen eventually because it’s simply a superior way of doing business.

CoinJournal: Bitcoin seems to be a “dirty word” for banks, and during Friday’s adoption panel it was suggested that the political views that it was founded on have been a hindrance. Do you think there are other reasons that Ethereum is more inviting to the financial industry than the Bitcoin blockchain?

Dr Wood: With a few exceptions, Bitcoin is old, stubborn and self-serving. Comparatively, Ethereum is hot, young and willing to please.

What’s not to like? :-)?

CoinJournal: Do you worry about other projects adopting elements of Ethereum, but run on the Bitcoin blockchain? For example, http://www.rootstock.io/

Dr Wood: In general I don’t “worry” about other technology. I’m in the business of creating value, not a monopoly.

CoinJournal: The “hot topic” of Monday’s talks was how to scale Ethereum. Of all the proposed strategies, which are you most backing at this stage and why?

Dr Wood: Chain fibres; an idea I came up with when chatting to Janislav Malahov (self-styled “godfather of Ethereum”) back in July 2014. Vitalik [Buterin] and I went discussed it and we made some important improvements. It’s basically sharding over state space, with transactions collators providing proofs to allow validators/miners to do their job without being forced to maintain every chain. Cross-shard transactions happen through validators that maintain multiple chains. It differs from other approaches in that it’s still possible to make synchronous transactions involving multiple accounts if you pay more/accept a delay to get them into the chain. It’s non-deterministic and relies upon market mechanisms to provide cross-shard transaction execution.

CoinJournal: On Monday, Vlad talked about Casper in more detail. What was the path to creating a revised POS protocol like? How did you agree on this?

Dr Wood: The desire to have a PoS chain was strong, even back before Frontier. However we felt current approaches were lacking in several ways including security. Having some sort of upgrade once we had an approach we were all comfortable with seemed the best chance of getting a secure, PoS-based Ethereum.

CoinJournal: Do you think that Economic based consensus protocol could potentially hinder, or serve as an additional pain point for a platform that is still in its infancy?

Dr Wood: In some senses, yes. Ethereum was not meant to be crypto-currency, but rather a platform for creating applications. Forcing those who actually wish to *only* create an application and don’t want to be concerned with currency (crypto- or otherwise) introduces a conceptual barrier over that of, say, just using some open-source software.

However, the fact of the matter is that Ethereum is a community-maintained resource. There must be some sort of give and take to avoid misuse of the resource. The question must really be how to make that give-and-take sufficiently transparent and convenient that no would-be users are put off.

CoinJournal: During the adoption panel there were discussions about funding. Do you think that amount of money being invested into Bitcoin companies will boost innovation and allow them to solve problems quicker than Ethereum?

Dr Wood: One thing I’ve noticed over the past 24 months is that while money might help with some problems, its effectiveness is neither infinite nor consistent; in some senses it can actually hinder progress. It’s worth noting that much of the critical work within the Ethereum project (Whitepaper, Yellowpaper, global meetup network, three interoperable multiplatform smart-contract-capable clients) was done with very little financing in the first 6 months of the project.

The Bitcoin community has indeed had a vast amount of money pumped into it. It has not helped them avoid trivialities like the block size debate or bringing forth other basic improvements to the protocol.

In my opinion, real innovation comes from having freedom in ones heart and mind. A bag of cash is useful only in so much as to guarantee that freedom.