How to Mine Bitcoin Gold in 2025 - Complete Guide

Mining is the process that mints new Bitcoin Gold (BTG) tokens, adding them to the Bitcoin Gold ecosystem. Mining is also responsible for validating transactions conducted on the blockchain, and at the same time, securing the network against bad actors.

This makes mining critical for the survival of Bitcoin Gold, as the absence of miners will cause the whole system to collapse. Mining of Bitcoin Gold can be done either alone or as part of a pool, where miners work together to earn BTG.

Breaking Down Bitcoin Gold Mining

As you read on, you will learn what mining is all about, and the central role it plays in the cryptocurrency’s existence.

What is Bitcoin Gold Mining?

Traditional forms of financial systems have banks that act as middlemen, helping two parties conduct transactions. As custodians of the data, they are responsible for updating ledgers, or records, giving them authority over their users. This can lead to abuse of power, and history is riddled with examples of banks mismanaging clients’ funds and even putting restrictions on monetary movement — even freezing accounts and leaving people stranded.

On the Bitcoin Gold network, there are no banks, and the ledgers are kept updated through miners, who validate all transactions. To ensure no single entity rises amongst the miners, BTG is open to all participants to attempt transaction validations. All they need to do is use their computers to resolve puzzles. This free-for-all method means the miner who solves the equation first gains the right to append the transactions in a group, called a block. Miners are compensated for their efforts through block rewards, issued as Bitcoin Gold tokens.

Why Bitcoin Gold Miners are Important?

As validators of transactions, miners keep the digital currency’s ledgers updated accurately. Through timely updating and broadcasting of the information on the Bitcoin Gold network, they ensure that wallets are debited and credited so that no one can spend their coins twice. This is called the “double-spend problem”, and before Satoshi Nakamoto’s brilliant concept of blockchains, it foiled all previous attempts at creating a functional digital currency.

Using game theory models, Bitcoin Gold, like its original blockchain, requires miners to spend computing power to solve mathematical equations in order to validate transactions. In return, they are incentivised with block rewards, giving them a reason to keep doing their work. The computing power dedicated to the network is measured in ‘hashes’, and as more miners join the network, Bitcoin Gold increases the difficulty of the validation puzzles to ensure competition and the health of the system.

Bitcoin Gold Mining Limitations

Bitcoin Gold is a hard fork of Bitcoin’s code, and it broke from its parent blockchain in October 2017. A group of BTC miners initiated the split, believing that the extremely high hashrate of the original chain was detrimental to decentralisation, as only wealthy miners with access to expensive and powerful machines could take part, creating a new class of ‘elites’. The Bitcoin blockchain uses the energy-intensive SHA-256 Proof of Work (PoW) algorithm, whereas Bitcoin Gold uses the ASIC-resistant Equihash, giving mining abilities back to small participants who can use their GPUs.

The technical block aspects are the same as Bitcoin, with a block time of 10 minutes, the current reward at 6.25 BTG, and a maximum supply of 21 million coins. The limited coins and the block reward play a crucial role in creating value. Roughly after every four years, the block rewards fall by 50% in an event called the “halving”. Increased adoption over time puts pressure on demand, while the halving of issuance creates a supply shock. The basic economic rule of supply and demand comes into play and drives up the value.

At the same time, as more miners join the network in an attempt to gain the valued block rewards, the Bitcoin Gold coding adapts the computations required for the blocks, increasing in difficulty to promote healthy competition between miners. The adaptation works both ways, and if miners leave the network, the difficulty is reduced to keep the block time the same.

Tip to Mine Bitcoin Gold Efficiently for Greater Profits

Considering that Bitcoin Gold is a fork of the original Bitcoin blockchain, and has changed its Proof of Work algorithm to make it impossible to use dedicated mining machines such as FPGAs and ASICs, you would be better off using a powerful graphics card, or GPU, to mine BTG efficiently. Stand-alone mining is possible and can result in good profits if enough blocks are consistently mined, but miners today have formed pools, combining their GPU power. It would be prudent to join a mining pool or cloud mining service for greater profits.

Technical Aspects of Mining Bitcoin Gold Explained

Before you decide to use your GPU to start mining BTG, you should understand a few technicalities of mining, such as the hashrate and what happens when it increases, including the hardware required. In this section, we will cover these points in more detail.

Hashrate Simplified for Bitcoin Gold

- What does hashrate mean?

In simple terms, a hash is a cryptographic puzzle presented by the Bitcoin Gold network, and hashrate, therefore, measures the number of these puzzles that can be solved in a given amount of time. The combined hashrates of miners make up the total BTG hashrate, which can be interpreted as the network security too.

- Why is a higher hashrate important?

Miners with higher hashrates have more chances of mining a block than others. As the entire hashrate of a blockchain increases, the coding adapts the difficulty levels of the equations that must be solved, making it harder to mine. This keeps the time it takes to mine each block constant.

With a higher hashrate, it becomes difficult to execute a 51% attack and take over the Bitcoin Gold blockchain. An attacker must control 51% of the network’s hashpower in order to control the chain. With a high hashrate, this becomes increasingly impractical and expensive to achieve due to hardware costs, thus securing the network.

- How is hashrate measured?

Hashrate is measured as the number of hashes done every second. Normally the units used are kilohashes/s, megahashes/s, gigahashes/s and so forth. As a fork of Bitcoin, Bitcoin Gold is a relatively smaller network, and the Equihash PoW algorithm means weaker devices (GPUs) are deployed instead of number-crunching ASICs. Therefore the BTG network’s hashrate is measured in the MH/s range.

Processing Power: CPU and GPU

Since Bitcoin Gold works on the Proof of Work principle, it requires miners to use their computers to perform calculations and present the right answer to claim a block. A higher computing power means a higher hashrate for the miner.

The early days of Bitcoin had seen miners using their CPUs to solve the block problems, but they quickly realised that their GPUs were more tuned towards mining and jumped to their graphic cards. Later on, miners started getting their hands on Field Programmable Gate Arrays (FPGAs), which are devices that can be altered to the requirements of the user. These were eventually followed by ASICs: Application-Specific Integrated Circuits. These high-power machines are geared towards using all of their computing abilities for mining.

Some miners believed that the use of FPGAs and ASICs deviated from the intentions of Satoshi Nakamoto, as the general public wasn’t capable of mining anymore. The Bitcoin Gold fork introduced a new PoW algorithm, Equihash, which makes mining using these advanced machines obsolete. Today, BTG is minable using GPUs, giving power back to the public.

Hashrate needed to mine Bitcoin Gold profitably

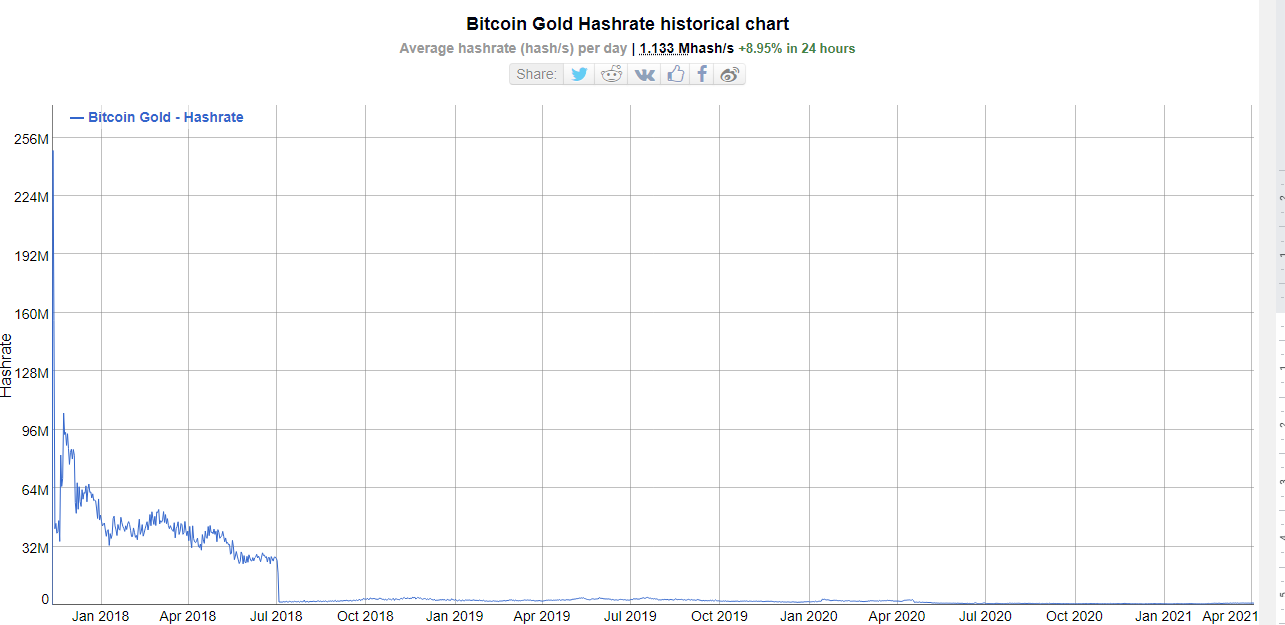

Source: BitInfoCharts.com

Without the ability to use their ASICs and other advanced machines, miners have not generally been in favour of Bitcoin Gold, and the relatively low power of GPUs means that the hashrate isn’t that high. The BTG hashrate is roughly 1.133 MH/s as of writing.

With GPUs ranging from 100 to 700 H/s in power, using standalone mining rigs isn’t possible unless multiple devices are connected to work in tandem. Even then, profits are not guaranteed, as pools exist that see hundreds of miners coming together to solve the equations. You would need power in the upper regions of kilohashes per second to be effective.

Pros and Cons of Mining Bitcoin Gold

Pros

- Earnings can be significant as 1 BTG is roughly $46, and a block reward is 6.25 BTG

- Easy to mine due to ASIC-resistant nature

- Lower electrical bills versus ASIC=friendly algorithms

- Securing the network in the long run

- Profitability is higher if mining with a cheaper electrical provider

Cons

- Not many crypto exchanges support BTG

- Mining can be energy-intensive and inflate your utility bills

- Higher power GPUs are expensive

- In-depth research is required to avoid mining pool scams

DIY Bitcoin Gold Mining - How to Get Started

We will now explain how to set up your mining operation on the Bitcoin Gold network. Here, you will learn about the different kinds of hardware, relevant software, and other important details.

Best Mining Hardware for Bitcoin Gold

Even with the Equihash PoW algorithm for BTG and the network’s low hashrate, it is very difficult to solo mine profitably. Though it is possible, you will need to invest in multiple top-of-the-line GPUs to stand a chance of getting a block reward. You can always opt for joining a pool to gain more consistent profits.

If you are interested in getting your own mining rig, you should check out our selection of GPUs.

The NVIDIA GeForce GTX1060 is a perfect device for entry-level miners. Though not the best device for mining, it is perhaps the most efficient. The device is compact and is clocked at around 1600 MHz, making it suitable for people who want to mine BTG but don’t want to commit serious power. The device only draws 120Wh and is in such demand that it can be difficult to find one. The 1060 can cost as little as $300.

If you want relatively good hash power but have a constrained budget, perhaps the AMD Radeon RX580 is what you should look for. AMD is famous for its quality hardware devices, and the RX580 doesn’t disappoint. A few minor adjustments here and there in the settings and you can get as much as 29 MH/s from this card for just $50 more than what you would pay for the GTX1060.

If you have cheap electricity, you can go for the top-end NVIDIA GeForce GTX 1080 Ti. The GPU can go as high as 32.3 MH/s but consumes 250 Wh. This makes it a good choice only if you have low utility rates; otherwise, the electrical bill will quickly eat into your profits. The price tag also reflects the power, coming in at $860.

Other Costs to be Considered

Of course, the GPUs are not stand-alone units, and you will need to invest in proper computer systems that have compatible motherboards, hard disks, processors, and so on. These can set you back a few hundred dollars too.

Your utility provider will have a big role to play in your profits. Cheaper electricity, of course, means cheaper bills. Then there is the cooling cost. These devices can generate a lot of heat, especially if you connect a few of them to combine their hashrate. There are even stories of miners siphoning off the heat from their GPU rigs to warm up their greenhouse!

Software

Software is a key requirement if you are to mine any cryptocurrency, let alone Bitcoin Gold. What software does is allow you to connect your hardware equipment to the BTG blockchain. You use the interface to configure mining settings before you begin to mine for the reward on offer.

Remember that different types of mining software support different types of graphics cards, which is why you must ensure you only use software that’s compatible with your hardware.

Some software download to your desktop computer and support Windows and Linux OS, while some come with support for mobile access via Android and iOS. Take note of this fact too as you choose your mining software. If you are using a mining pool, you should find out the supported products before you proceed.

Which software people use to mine Bitcoin Gold

There are several providers of Bitcoin Gold mining software in the market today, which means a beginner miner won’t have a problem with a suitable one. But which software do people use most when mining BTG?

OptiMiner: OptiMiner is a Windows and Linux compatible software tool that supports both AMD and Nvidia graphic cards.

Claymore’s Dual Miner: The Dual Miner is a great software tool that comes with an easy-to-use interface. It’s compatible with Windows and supports AMD and Nvidia graphic cards

EWBF Miner: EWBF supports Windows and Linux operating systems and is best suited for Nvidia GPUs.

Can I Use my Personal Computer to Mine Bitcoin Gold?

As noted above, Bitcoin Gold uses a mining algorithm that is ASIC resistant, which means CPU and GPU mining.

In this case, you can mine using your personal computer or even one of these powerful laptops. However, even though you can technically mine Bitcoin Gold on your computer’s processor, you will find it too slow. And because the PC lacks the processing speed to compete with powerful video cards, you are likely to never mine any BTG with just the computer.

If you want to use your home-grade processor to mint BTG and have a chance to recoup more than just electricity costs, give it a boost by adding dedicated GPU power.

As mentioned earlier, you will need six video cards, a good hard drive, RAM (4 GB or more), a motherboard, a power supply unit and a cooling system.

With these in place, you can assemble a simple but powerful enough GPU mining rig to work with your PC. If you cannot manage the above setup, then thinking of mining with your consumer-grade computer is like experimenting on how fast your device can get damaged.

Technical Knowledge Required to Mine Bitcoin Gold

Mining can be a complex activity, especially for a newcomer with no grip on the technical language used in crypto mining. You need the right tools to mine, but topping that with an understanding of how mining works will make it even easier to get going. To help you get a grip on some of the words, we have provided a simplified explanation of crypto mining terminology.

- Consensus algorithm: A set of rules on the network that allows for decentralised consensus on the validity of blocks. There are different types of consensus algorithms with Proof of Work, the one that supports mining on blockchains like Bitcoin Gold. Specific examples include SHA-256, Scrypt, Equihash and CryptoNight.

- ASIC-resistant: An algorithm that does not support the use of specially-designed ASIC miners is resistant. Developers make the network’s mining memory-intensive, which means miners require more memory than an ASIC chip can pack.

- Block: A part of the blockchain that contains a record of verified transactions. The mining process is what allows for new blocks to be added to the network’s growing chain.

- Block time: The estimated amount of time it takes for miners to figure out the hash of a given block and add the new block to the blockchain. Bitcoin Gold shares the same block generation time of 10 minutes with Bitcoin.

- Block reward: This is what miners earn after they successfully find a new valid block. In the case of Bitcoin Gold, the block reward reduces every four years. Currently, miners earn 6.25 BTG.

- Mining difficulty: This is a measure of how much work miners have to put in before they find the valid block. The difficulty adjusts regularly to keep block time within the estimated 10-minute interval, so it can increase or adjust downwards.

- Hash rate: The amount of computing power needed for a miner to calculate the hash function and solve the block puzzle. It’s simply the processing power of your hardware measured in hashes per second. The more powerful, the higher the hash rate and the better the chances of quickly finding a block reward.

- Mining profitability: A calculation of how much revenue you can earn with the given hash rate when taken into consideration with factors such as cost of hardware, power consumption, and the cryptocurrency’s price. Mining calculators make it easy to estimate the profitability of popular BTG mining rigs.

Start Mining!

With your hardware all set and ready to run, all you need is to download the right mining software. But before you do that, don’t forget to create your Bitcoin Gold wallet. Since the rewards will be paid out in BTG, you will need to provide the mining software with a valid wallet address.

You have a wide variety of mining software packages that support the Equihash Proof of Work algorithm, the most popular being MinerGate and GMiner. You can download the software and install it on your computer. The mining software will detect your GPU device and run the algorithm needed to mine BTG.

You can always increase your chances of profits by signing up with a mining pool. Gathering hashrates of miners spread across the globe, these pools have a much higher chance of claiming the block rewards. You can check out 2Miners and MinerGate if you are interested in pool mining.

Mining Services/Solutions

As mentioned above, pools are a good way of increasing your mining earnings. By combining the hardware power of multiple machines, pools allow you to get ahead in the game and compete with the big players. Pools do have some drawbacks, however.

First of all, since you are not the only one who will lay a claim on the newly found block, all participants of the pool will receive a share of the rewards that are earned. Your share of the rewards is calculated based on your hashrate contribution to the pool. Thus, though pooling will guarantee higher chances of a payout, the sum will be significantly diluted and may not be enough to cover the running costs of your rigs.

Remember, a larger pool will have more likelihood of block reward claim but will lower your payout, as you will have a smaller share of the pool. Some pools even mine multiple coins, meaning you can earn from more than just BTG.

Check out their payment structure too. There are usually four different ways mining pools let you make profits. Pay Per Share (PPS) is a straightforward method where pools pay out a fixed amount, regardless of the team mining a block or not. The payment is low, but since you are not at risk, this is a good way to ensure a steady stream of income for many miners. A variation, called Full Pay Per Share (FPPS), works on the same principle but adds transaction fees paid to the miners onto block rewards.

Another method of payment, Pay Per Last N Share (PPLNS), is a complex method of determining your share of the rewards, which are only paid out if a block is mined. This means that sometimes you will receive nothing, but when a block is successfully mined by the pool, you will earn a larger reward.

MinerGate is a popular Bitcoin Gold pool. You can simply register on the platform and connect your mining software using the server URL provided. Easy to connect, MinerGate uses the Pay Per Last N Share model and will charge you a 1% pool fee. 2Miners is another BTG-supported pool that uses the same PPLNS model. Connecting to the pool is a bit more complex as it requires you to alter your GPU’s BAT file. Luckily for the uninitiated, they have a complete tutorial on how to go about it, including a video.

If you find that buying and running a mining operation is just not your cup of tea, you can always check out cloud mining. Renting out the GPU power of others using an online marketplace, you don’t invest in the hardware itself, and somebody else does the mining on your behalf. Though you save a lot on costs, cloud mining does cost you, and you may end up paying over the odds in the long run. You should look up a good profitability calculator and compare it to see which one will suit you best.

MiningRigRentals is a good place to start cloud mining. They have an extensive marketplace where you can prospect miners who are willing to rent out their computing power. The marketplace has detailed information, such as the hashrate you will get, the price per day, and the minimum and maximum number of hours you can rent it out. Payments are accepted in BTC, ETH, LTC, and BCH.

NiceHash also offers good rates, with different markets sectioned according to their geographical locations. You can check out the different renting options and view the speed dedicated for the contract, including the number of miners in the cloud pool, the maximum limit you can rent, and the price of the contract.

There are many other platforms offering cloud mining for Bitcoin Gold, but you have to be careful in selecting these. The payment is always upfront, and unless the service is reliable, the chance of scammers running away with your money is high. Checking Trustpilot reviews can help to protect you against scammers and fraudsters.

How Profitable is Mining Bitcoin Gold?

Profitability is a key consideration that you must make before you start mining any cryptocurrency, Bitcoin Gold included. While you can profit from mining BTG today, how well you do will depend on several factors that include initial investment and overhead costs.

To determine how profitable mining BTG is at the time of your investment plans, use a Bitcoin Gold mining calculator. You can then check how much revenue mining BTG will bring you in a day, week, monthly, or annually based on the following parameters:

- Cost of hardware

- Hash rate

- Power consumption

- Cost of electricity (per kWh)

- Pool fee (if you join a mining pool)

- Bitcoin Gold price

For example, the Nvidia GTX 1080 GPU that offers 550H/s and consumes about 150W returns on average $12.49 per day. If you deduct electricity costs at $0.10/kWh and a pool fee of 1%, the daily profit is $12.00. According to the Bitinfocharts mining calculator, the average return for six months is currently at $2,160.

Where to Save my Coins After Mining?

It doesn’t matter if you do your BTG mining solo, through a pool, or in the cloud — you will need a place to store your earnings. Each service or software package will ask you for your wallet address for the payouts, so you should set up one first.

Depending on what you want to do with your BTG, you can set up a wallet on a crypto exchange (for trading or liquidating), use a mobile wallet (for ease of access and usability), or purchase a hardware wallet (for long-term, secure storage of your coins).

Below is a selection of the best Bitcoin Gold wallets for you to decide on which one you should set up in order to secure your mining operation comprehensively.

Alternatives to Bitcoin Gold Mining

Mining isn’t for everyone—acquiring the right hardware and powering it can involve a significant amount of effort and expense. What’s more, you may find yourself competing with industrial-scale mining operations, such as Riot Blockchain, Marathon Digital Holdings, and Argo Blockchain.

A simpler and cheaper way to profit from mining is to buy shares in one of these mining companies. This is easily done by signing up with a broker that offers mining company stocks. You can get started by clicking on the link to our preferred partner below.

Riot Blockchain (RIOT)

Riot Blockchain has Bitcoin mining facilities in New York and Texas, including North America’s single largest Bitcoin mining and hosting facility. The company aims to increase its capacity and hash rate by expanding its operations with the purchase of more mining machines.

Marathon Digital Holdings (MARA)

Digital asset technology company Marathon Digital Holdings has been around since 2010, when it started collecting encryption-related patents. The company already has a sizeable fleet of Bitcoin miners and aims to build North America’s largest mining operation while keeping energy costs low.

Argo Blockchain (ARB)

Argo Blockchain comprises a dynamic team of mining and blockchain experts that prize innovation. The company supports the development of blockchain technologies and advocates the use of renewable power sources to create a sustainable blockchain infrastructure.