Launched in 2009, Bitcoin is the original cryptocurrency. It was created for making peer-to-peer payments without intermediaries, and it is the best-known and largest cryptocurrency by market cap. Bitcoin has become a popular investment for many people and institutions as its value has increased astronomically since its launch.

This guide will provide you with in-depth reviews of where and how to invest in Bitcoin in the UK.

We’ll also take you through the buying process step by step, and discuss payment methods, wallets, and everything else you need to know about investing in Bitcoin in the UK.

How to Invest in Bitcoin in the UK

The easiest way to invest in Bitcoin in the UK is to purchase it online from a crypto exchange. Exchanges make it easy to buy and sell Bitcoin and other cryptocurrencies directly from your smartphone, tablet or computer. Check out our recommended platforms below and follow the steps to safely invest in Bitcoin in the UK.

1. Choose a platform

Choose a platform that provides the features, fees, and ease of navigation that fits your needs. A regulated and reputable platform is the best option as it will provide the best security and user experience. Check out our top picks below.

2. Create and fund an account

Click the sign-up button on the website and provide details such as an email address and password to create an account. You will probably need to complete KYC by submitting a photo ID to verify your account. Then choose a payment option to make a deposit.

3. Invest in Bitcoin UK

Search your platform for the BTC/GBP trading pair. You can then open a buy order and enter how much you want. Use a limit order to purchase BTC once it reaches a certain price or a market order to buy immediately. Hit the “Buy” button to complete the transaction.

Start Trading

Where to Buy Bitcoin in UK?

You have plenty of options when it comes to platforms that offer Bitcoin in the UK. Here is some in-depth information on some of the best.

1. eToro – Overall Best Place to Invest in Bitcoin UK

Our favourite platform for investing in Bitcoin in the UK is eToro, as it is rich in features and intuitive to use. By adding Bitcoin to your watchlist, you can keep up with its price action. You can also find the tools and information you need for analysis in the News, Research, and Stats tabs.

eToro’s social investing features distinguish it from its competitors, making it easy to connect with and learn from other Bitcoin traders. You can even view stats on other users’ risk profiles and profit margins, and choose a successful trader to copy with the unique CopyTrader feature.

There are more than 60 other cryptocurrencies you can invest in alongside Bitcoin, as well as other asset types, such as stocks, forex, and ETFs. Buying and selling assets is very simple on eToro, thanks to the platform’s intuitive interface.

Users can be confident in eToro’s strong security features, such as cold storage and SSL encryption, as well as the fact that the platform is regulated by the FCA. The minimum deposit to start using eToro is about £8 ($10), and buying BTC incurs a transparent fee of 1% plus the spread. Read our full eToro review here.

Pros

- Social investing features

- Multi-asset platform

- Easy to use

- Transparent fees

- FCA-regulated

- Strong security

- Variety of payment methods

- Virtual account

- Mobile app

Cons

- Not as many coins as some competitors

- PayPal deposits aren’t available in the UK

2. Binance – Best Crypto Exchange to Buy Bitcoin UK With Low Fees

Binance has the lowest trading fees on the market at just 0.1%—or less if you belong to a higher loyalty tier. It is also free to make crypto deposits, though withdrawals using the Bitcoin blockchain incur a 0.0002 BTC fee.

There are charts and tools for advanced trading of Binance’s 600+ cryptocurrencies, but inexperienced users can take advantage of the Buy Crypto and Convert features, which make the processes of buying and swapping BTC simple.

There’s also plenty of educational material in the Binance Academy to help you build your knowledge. The Earn section enables you to put any Bitcoin you buy into a savings account for an estimated APR of up to 5%. There are also higher yield BTC investment products, such as liquid swap and DeFi staking.

UK users can deposit a minimum of £15 by card or £2 by bank transfer, with fees of 1.8% and £1, respectively. The minimum amount of BTC you can buy is £10. Read our full Binance review here.

Pros

- Low fees

- Charts and tools for advanced trading

- More than 600 other coins

- Interest-bearing BTC investment products

- Educational materials

- Low minimum deposit in the UK

- Mobile app

Cons

- Choice of payment methods in the UK is limited

- Isn’t licensed by the FCA

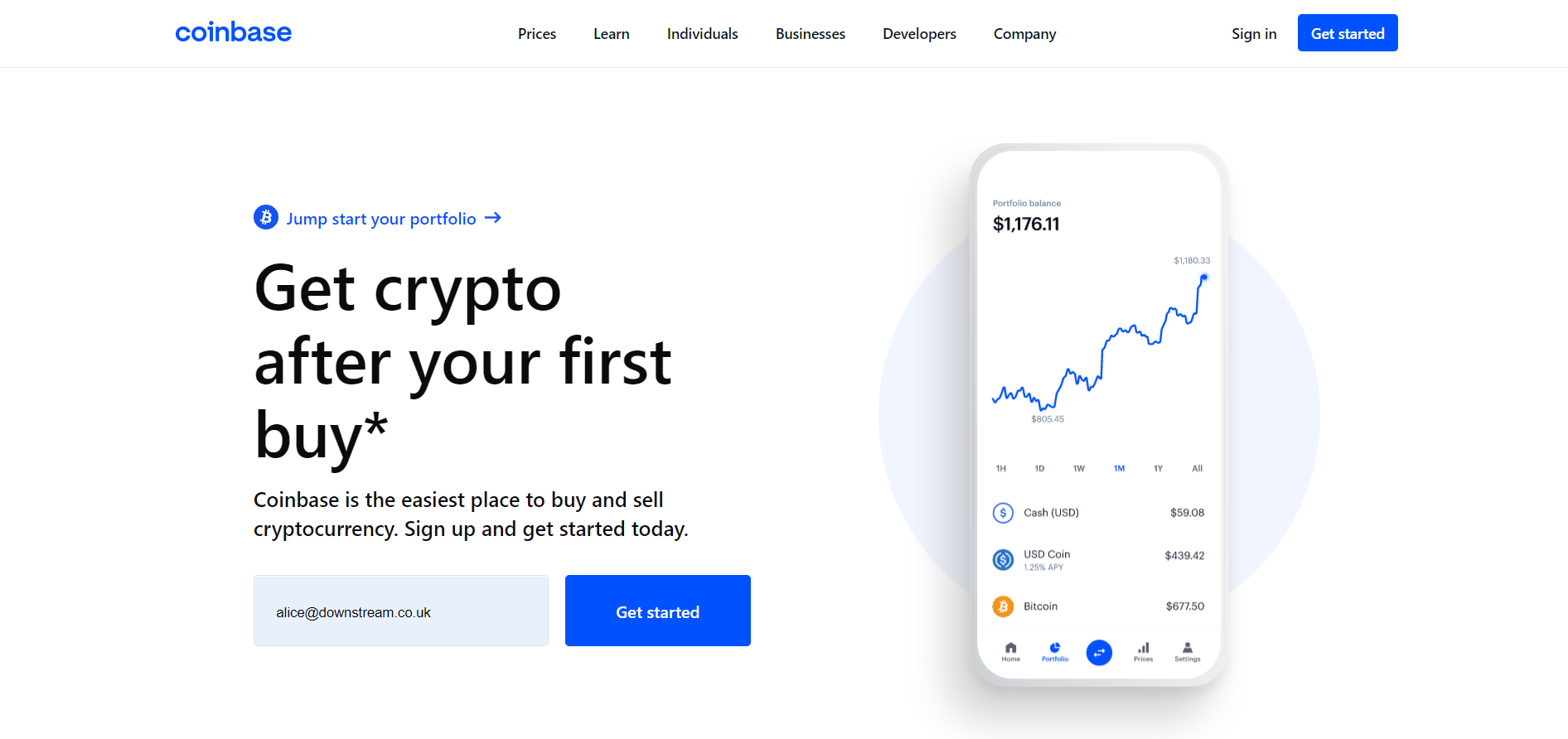

3. Coinbase – Best Place to Buy Bitcoin UK for Beginners

Coinbase makes it simple to invest in Bitcoin in the UK, regardless of experience. It’s as simple as clicking the “Buy / Sell” button, choosing Bitcoin, and typing in how much you want. You don’t need a big budget either as the minimum purchase amount is just £2.

Check out your dashboard for a clear display of your portfolio’s past performance, or use your watchlist to keep track of the price movement of Bitcoin or any of the 150+ other coins available. You can also set up automatic BTC purchases on a regular basis with the recurring buys feature.

Crypto newbies can head to the Learn section of the website to access tips, tutorials, and articles on Bitcoin and a range of other crypto topics. Coinbase’s regular learn and earn campaigns also provide an opportunity to earn some free crypto while you learn.

The platform received an e-money licence from the FCA and keeps your assets safe and insured, in cold storage. You will need to deposit at least £50 to get started, and after that, there will be fees of 0.6% plus spread when you buy or sell BTC. Read our full Coinbase review here.

Pros

- Very accessible for beginners

- Purchase as little as £2

- Recurring buys feature

- Educational materials

- Licensed by the FCA

- Strong security and crypto insurance

- Mobile app

Cons

- Limited payment methods for UK users

- Minimum deposit higher than many competitors

4. Bitpanda – Most Secure Exchange for Investing in Bitcoin UK

Bitpanda stores all of its users’ assets offline, making it a great place to invest in Bitcoin for the security-conscious. The platform holds all the necessary licences, is fully regulated, and is compliant with AML rules.

If you want to build a diversified portfolio around Bitcoin, Bitpanda offers more than 200 other cryptocurrencies. There are also crypto indices, stocks, ETFs, and metals available—and you can swap directly between different types of assets. To set up recurring purchases of Bitcoin—or any other asset—you can use the Bitpanda savings plan.

If you need help navigating the platform, you can find advice in the Helpdesk, while there are plenty of resources available in the Bitpanda Academy to help you build your crypto knowledge. The platform has received an excellent rating on Trustpilot from its customers.

There are a variety of payment options available for making a deposit, which will need to be a minimum of £25. The quoted price of BTC includes a 1.49% premium, and you can make an investment with as little as £1.

Pros

- Licensed and secure

- Multi-asset platform

- Intuitive interface

- Rated excellent on Trustpilot

- Minimum trade size of £1

- Variety of payment options

- Educational materials

- Mobile app

Cons

- Support only available via email

- Fees for crypto deposits

5. Bitstamp – Best Exchange to Buy Bitcoin UK for Customer Support![Bitstamp homepage]()

Bitstamp provides all the support you need while you invest in Bitcoin. The customer service team is available globally around the clock by telephone and email. If you want to learn about the latest market insights and global trends, you can check out the free Crypto Pulse Report available on the platform.

Bitstamp employs top-tier security measures, such as encrypting personal information and providing transaction confirmations and address whitelisting. Your Bitcoin will be kept as safe as possible, as Bitstamp keeps 98% of users’ assets in offline storage.

The platform has plenty of features to satisfy experienced traders, from advanced order types and technical analysis tools to powerful APIs and real-time data streaming. What’s more, the platform’s high uptime and liquidity mean you can enjoy fast order execution when buying Bitcoin or any of the other 75+ cryptocurrencies available.

Users in the UK can use Faster Payments to make free deposits, with the minimum amount being £10. When buying Bitcoin, the trading fees are up to 0.5%. Using Faster Payments to make GBP withdrawals incurs a £2 fee. You can also make direct purchases with a credit/debit card for a 5% fee.

Pros

- 24/7 phone and email support

- Intuitive to use

- Advanced trading features

- Fast order execution

- Industry-leading security

- Free deposits with Faster Payments

- Mobile app

Cons

- Card purchases have high fees

- Payment options for UK users are limited

6. OKX – Best Exchange for Advanced Bitcoin Investors![OKX homepage]()

OKX provides everything the advanced Bitcoin investor needs, such as customisable charts, technical indicators, and a variety of order types. There is even a trading bot for setting up smart portfolios and arbitrage orders.

OKX employs cold storage, emergency backups, and a semi-offline multi-signature mechanism for online storage to keep your BTC safe. There is also an OKX Bitcoin mining pool that users can join. You can even use the products in the Earn section to receive interest on your Bitcoin.

Beginners can access a range of educational materials in the Learn section, and simplify the trading process with instant card purchases and direct swaps between BTC and the more than 340 other cryptocurrencies available.

You can’t deposit fiat to OKX, but the minimum Bitcoin deposit is 0.00005 BTC, and the minimum trade size is 0.00001 BTC, at very competitive trading fees of up to 0.1%. You can also purchase a minimum of £9 worth of BTC with a credit/debit card for a 1.99% fee.

Pros

- Charts and indicators

- Trading bot

- Secure storage

- Products for earning interest

- 340+ other coins

- Educational resources

- Low trading fees

- Mobile app

Cons

- Card fees could be lower

- No fiat deposits

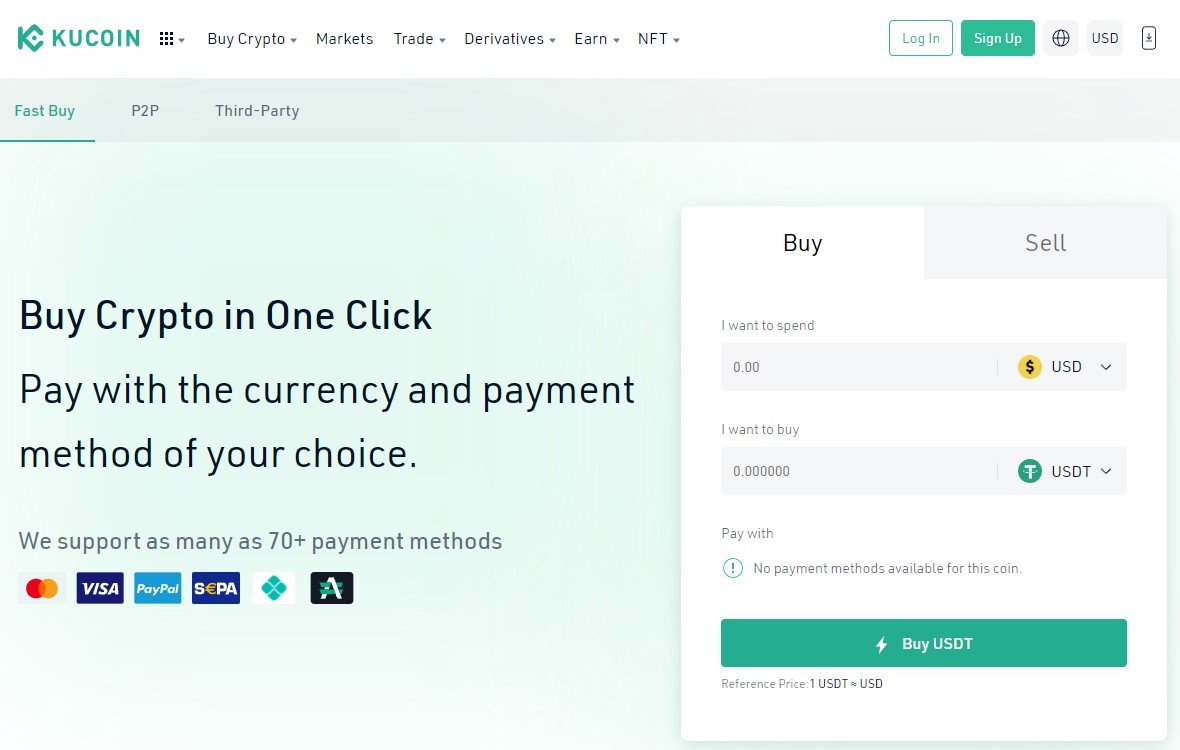

7. KuCoin – Best Exchange to Buy Bitcoin UK with Altcoins

If Bitcoin isn’t the only cryptocurrency you’re interested in, KuCoin is a great place to build a diverse crypto portfolio, as it supports more than 700 coins, including many new and obscure ones that you can’t get anywhere else.

Beginners can use the Convert feature to easily swap between Bitcoin and other cryptocurrencies with a single click and no fees. If you don’t have the time to keep up with the market, you can always use KuCoin’s trading bot to earn a passive income.

The platform provides plenty of information and research if you want to learn more about crypto. There are also charts, indicators, and technical tools for more advanced traders. After buying some BTC, you can put it in a flexible savings account to earn interest.

You can make a minimum deposit of £5 with a credit or debit card for a fee of 3.8%. There is no BTC/GBP trading pair, but you can purchase a minimum of 0.1 USDT of BTC, and the trading fees are competitive at up to 0.3%. Read our full KuCoin review here.

Pros

- Over 700 coins supported

- Trading bot

- Savings accounts

- Research and analysis available

- Low trade and deposit minimums

- Low fees

- Mobile app

Cons

- Not regulated by the FCA

- Can be a bit complicated for beginners

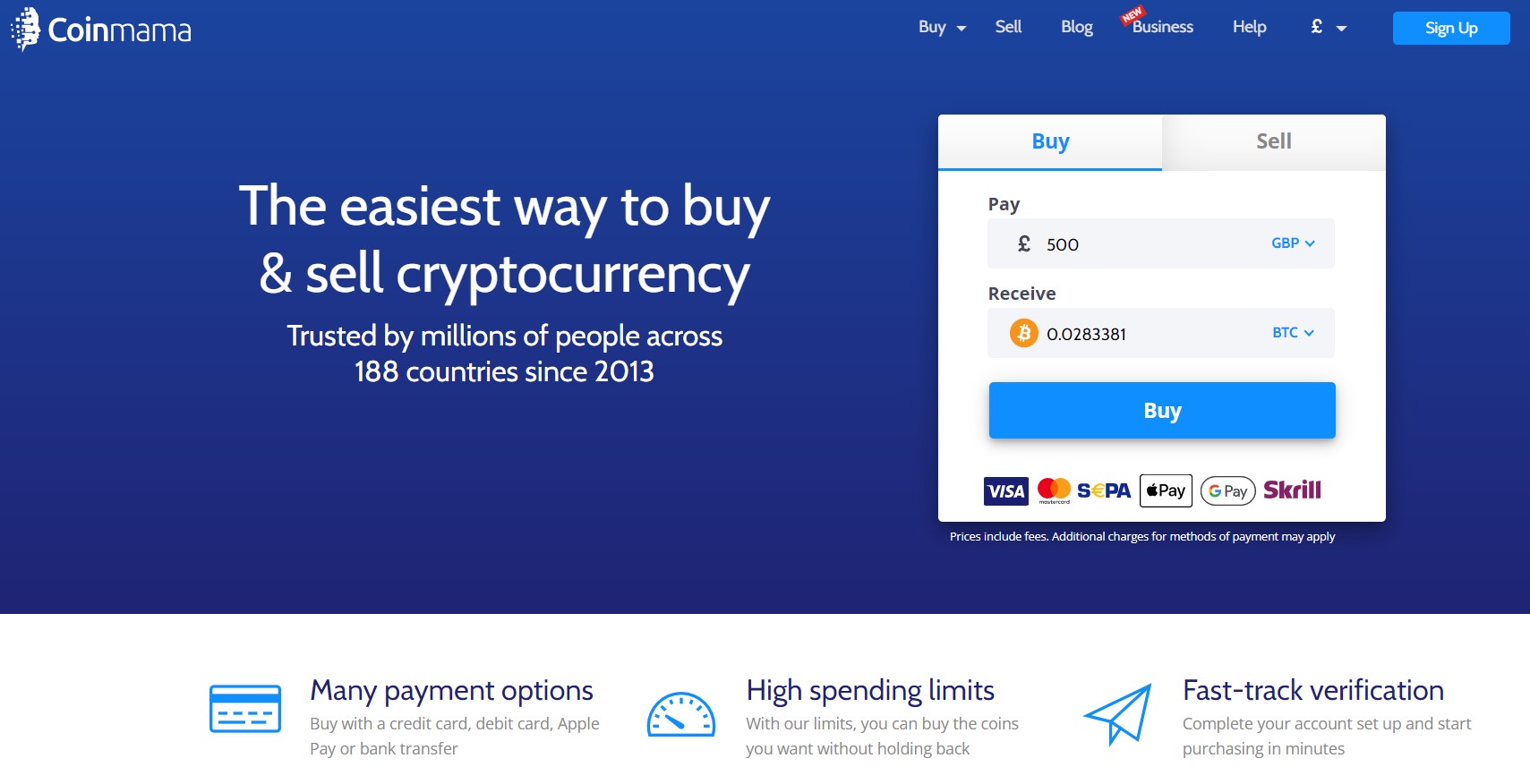

8. Coinmama – Best Place to Make Large Investments in Bitcoin UK

If you want to make a large investment in Bitcoin, Coinmama could be the platform for you as it has higher spending limits than most competitors. You can buy as much as £25,000 worth of Bitcoin in a single transaction.

Most of the payment options are fairly fast, so you could receive your Bitcoin within 10 minutes. Users also stay in full control of their funds throughout the process as Coinmama is non-custodial and doesn’t store payment information.

There are 15 cryptocurrencies available in total. Although advanced traders may not be satisfied with the limited choice of coins and the lack of charts and tools, the platform is designed to make the buying process simple, and there is a customer support team on hand to help.

The minimum purchase amount is £42, and you can pay with a credit/debit card, bank transfer, Google Pay, or Apple Pay. Coinmama adds 2% to the market rate for BTC, and there is a commission of up to 3.9% for purchases. There is an additional 5% momentum fee on card transactions. Read our full Coinmama review here.

Pros

- Buy large amounts of Bitcoin

- Keep control of your info and custody of your coins

- Very easy to use

- Variety of payment methods

- Fast-track verification process

- 24/7 customer support

Cons

- No charts and tools for traders

- Not many cryptocurrencies are available

- Higher fees than competitors

- No mobile app

9. Uphold – Best Place to Easily Invest in Bitcoin With GBP

Buying Bitcoin in the UK couldn’t be simpler on Uphold. You can buy directly with GBP, so there’s no need to complicate the process with currency conversions or buying stablecoins. Once you’ve made an account, you can enter the amount of GBP you want to spend and click Buy.

There are more than 160 cryptocurrencies available, and you can set up regular automatic purchases or limit orders without commitment or blocked funds. The mobile app makes it easy to manage your portfolio and trade from anywhere.

Although Uphold doesn’t offer savings accounts, you can stake some altcoins to earn rewards. The platform is transparent, fully reserved, and adheres to high security standards. It is also regulated by the FCA.

Uphold doesn’t charge any fees for deposits, withdrawals, or commission. There is just a spread, which is 0.85% when buying BTC and 1% when selling it. UK customers can fund their accounts with a debit card or bank transfer via Faster Payments.

Pros

- Buy Bitcoin directly with GBP

- Easy to use

- 160+ other coins

- Limit orders and automatic purchases

- High security standards

- FCA-regulated

- No deposit/withdrawal/commission fees

- Mobile app

Cons

- No credit card deposits

- Lack of technical trading tools

10. CEX.IO – Best Place to Buy Bitcoin UK for Reliable Order Execution

CEX.IO enables users to invest in Bitcoin quickly thanks to its high liquidity order book and favourable conditions for market making. Trades can be executed reliably with the platform’s advanced order matching algorithms, making high-frequency trading and scalping strategies possible.

There are more than 70 cryptocurrencies available in total on CEX.IO, as well as a range of API solutions for automated trading. The platform keeps funds safe with security features like cold storage, full data encryption, and protection against DDoS attacks.

If you’re new to crypto, you can use the Instant Buy feature for a simple way to buy Bitcoin, and there is dedicated support available 24/7 by phone, email, and live chat. You can also check out the university for lessons on blockchain fundamentals and trading.

The minimum deposit is £20, and there is a 1.49% fee for card transactions in the UK and no fee for using Faster Payments. The trading fees are pretty competitive at 0.25% or less, and you can withdraw your Bitcoin for a 0.0005 BTC withdrawal fee. Read our full CEX.IO review here.

Pros

- High liquidity

- API solutions

- Strong security

- Make instant purchases easily

- 24/7 dedicated support

- Educational resources

- Mobile app

Cons

- Trading interface may be too technical for beginners

- ID verification process isn’t straightforward

11. Crypto.com – Best Way to Invest in Bitcoin in the UK on the Go

If you want to be able to buy and use Bitcoin anywhere, then Crypto.com has everything you need. The app is available for Apple and Android devices and is easy to use, making it simple to buy BTC or any of the other 250+ cryptocurrencies supported.

You can earn rewards on your coins in the Crypto Earn section of the platform, which offers up to 6% p.a. on Bitcoin. There is also an exchange for more advanced trading with low fees and deep liquidity.

A popular feature of Crypto.com is the Visa Card, which allows you to spend your Bitcoin and other cryptocurrencies anywhere. It comes with no annual fees, up to 5% back on spending, and a range of other benefits.

UK customers can deposit GBP to their fiat wallet for free with Faster Payments. You can purchase as little as 0.000001 BTC on the exchange for competitive trading fees of 0.4% or less.

Pros

- Easy-to-use app

- 250+ cryptocurrencies

- Earn up to 6% p.a. on your BTC

- Crypto.com Visa Card

- Free GBP deposits

- Low trade minimum

- Competitive fees

Cons

- No BTC/GBP trading pair

-

Live support in the app can be slow

What Is Bitcoin & How Does It Work?

Bitcoin was launched in 2009 by an anonymous person or group known as Satoshi Nakamoto. It is the original cryptocurrency, created to provide a way to make peer-to-peer transactions without the involvement of intermediaries like banks.

It is a Proof of Work blockchain, meaning there is a network of “miners” who secure the blockchain by providing computational power and validating transactions. The network is entirely decentralised, so no one is in control, and anyone can use the blockchain or become a miner.

Bitcoin has inspired many other cryptocurrencies, but it is still the most popular and has the largest market cap. Many retail and institutional investors alike have bought Bitcoin, including big names like Tesla.

Is Bitcoin a Good Investment?

Whether or not to invest in Bitcoin is ultimately a decision for each individual investor, but here are a few factors you may want to consider.

Bitcoin is considered by many to be one of the safer cryptocurrencies to invest in, as with more than a decade of history, it has already established its longevity. However, despite being one of the oldest cryptocurrencies, only a small minority of people own it, meaning investors still have a chance to get in relatively early.

The technology and economics of the coin are also major attractions. The finite supply means it won’t be devalued through inflation like fiat currencies. What’s more, the network is entirely decentralised, making it beyond the control of banks and governments. The mining algorithm makes Bitcoin very secure, and its separation from the traditional banking system provides some level of anonymity.

Many investors favour Bitcoin for its accessibility—anyone can create an account on a crypto platform, and you don’t need to have a large amount of capital as you can purchase a tiny fraction of a Bitcoin. It is also accepted as payment by an ever-growing number of businesses. Bitcoin holders can even earn interest on their coins with savings accounts provided by platforms like Nexo .

Many Bitcoin investors have so far seen astronomical returns, and even institutions are now getting in on the action. All this could suggest that Bitcoin still has strong price potential for the future.

Risks of Investing in Bitcoin

When purchasing Bitcoin—or any other cryptocurrency for that matter—there are some inherent risks. For example, bad actors sometimes try to scam or hack crypto investors, and with regulations still evolving, the FCA could potentially establish rules that restrict the trading of cryptocurrencies.

To stay as safe as possible, you should only use trusted and regulated platforms to invest in BTC, and keep it somewhere safe, such as a hardware wallet. You should also be wary of phishing emails and never share your private keys or passwords.

A Bitcoin-specific factor that you should bear in mind is that the network fees can get pretty high when a lot of people are using it, so small investors might sometimes find it uneconomical to make transactions.

What Payment Methods Can I Use When Buying Bitcoin UK?

As the most popular cryptocurrency, there are many different ways of investing in Bitcoin. We’ll discuss a few in more detail below.

Credit/Debit Card

Many people find it most convenient to buy Bitcoin with their credit card or debit card as this is usually a fast payment method that they already use for other types of purchases. eToro is the best place to pay by card as deposits are free. On other platforms, however, card deposits may carry higher fees. You will be charged 2.49% on Coinbase, for example, and 1.8% on Binance.

Bank Account

Bank transfers are favoured by many investors as they are usually the cheapest deposit option, but they can sometimes take longer to process if your platform doesn’t support Faster Payments. Binance and Coinbase both support Faster Payments and accept bank deposits for a £1 fee and for free, respectively. Bank deposits are also free on eToro.

Skrill

Making online purchases is fast and simple with the Skrill digital wallet. The best place to buy Bitcoin with Skrill is eToro, which accepts Skrill deposits from UK users for free. Bitpanda also supports Skrill deposits in the UK.

Neteller

Neteller is another digital wallet for e-money transfers, similar to Skrill. It is becoming an increasingly popular way to buy Bitcoin. The cheapest and most reliable way to do this is to make a Neteller deposit on eToro for free.

Ways to Invest in Bitcoin UK

You can invest in Bitcoin in different ways, depending on your needs and aims. We’ll discuss these ways below.

Buy and Hold Bitcoin

The buy-and-hold strategy is pretty self-explanatory—you just buy some BTC and hold onto it for the long term. You don’t need to have any particular skills to find success with this strategy, so it is potentially an easy way to make a profit. You could even put your long-term Bitcoin holdings into a savings account to increase your profits.

Trade Bitcoin

Alternatively, you could trade Bitcoin by buying and selling it much more regularly. Traders often use charts and indicators to decide when to buy and sell. Depending on the frequency of their trading, it might constitute swing trading, day trading, or scalping.

Trading Bitcoin derivatives, like futures, options, or CFDs, has been banned by the FCA, so regulated platforms no longer offer these products to retail traders.

Mine Bitcoin

You can also earn BTC through Bitcoin mining. This involves providing computational power to validate transactions and help secure the network in return for block rewards. You will need some specialised hardware, which can be expensive, and to join a mining pool. A simpler and cheaper way to profit from mining is to buy a contract from a cloud mining company like CCG Mining .

Choosing a Bitcoin Wallet - Storing Bitcoin Safely

There are a number of Bitcoin wallets to suit different needs and uses. Let’s explore them in more detail.

Bitcoin Software Wallets

- Web wallet: Although web wallets are the least secure option, they are also the most convenient, especially for traders and small investors. The safest web wallets are provided by regulated platforms with strong security. Most of the platforms reviewed on this page provide free web wallets.

- Mobile wallet: A convenient way to store your Bitcoin is to download a mobile wallet onto your smartphone that you can access from anywhere. The top mobile wallet recommendations on Bitcoin.org are Unstoppable for iOS devices and Bitcoin Wallet for Android devices.

- Desktop wallet: This is a secure and convenient wallet for managing your Bitcoin from your computer. The majority of desktop wallets support Bitcoin, but the most popular full-node wallet is Bitcoin Core.

Physical and Hardware Wallets

- Hardware wallet: Although these wallets can be expensive, they are the most secure storage solution, making them ideal for those holding a large amount of Bitcoin for the long term. Trezor, BitBox, and Ledger are the most popular hardware wallets.

- Paper wallet: You can print or write down private and public keys generated by an online key generator to create a paper wallet, but this is not recommended as it’s not a very secure way to store your Bitcoin.

Wallet Combinations

It is also possible to use more than one type of wallet at once. For example, you could download the Ledger Live app to use in conjunction with the Ledger hardware wallet. You might also want to use both a web wallet and a hardware wallet for trading Bitcoin and using a buy and hold strategy, respectively.

Should I Buy Bitcoin Now? - Things to Consider Before Investing in Bitcoin in the UK

The things covered in the section on whether Bitcoin is a good investment are factors you’ll likely want to consider before buying Bitcoin, but there are some other practical factors that also warrant consideration.

Bitcoin Fees & Regulations

There are network fees for making transactions on the Bitcoin blockchain, and these can sometimes be very expensive when the network is congested. However, as many platforms like eToro charge a fixed fee for trades, you don’t need to worry about network fees when making purchases and sales.

There are other fees that your platform will charge. For example, you will likely have to pay fees on deposits and/or withdrawals, which may differ depending on the payment method used. Account management, inactivity, and overnight fees may also be charged by some platforms.

All cryptocurrencies are unregulated in the UK, so Bitcoin investors are unlikely to have access to the Financial Ombudsman Service or the Financial Services Compensation Scheme. This is why it is important to keep your BTC as safe as possible and only buy and trade it on regulated platforms.

When to Buy Bitcoin?

Your strategy and investment aims will likely influence your decision on when is the best time to buy. For example, when using a buy-and-hold strategy, the exact entry point is less important as people who employ this strategy believe that ultimately the price of Bitcoin will rise.

Traders may decide when to buy and sell Bitcoin based on the news or signals from technical indicators, such as moving averages or the relative strength index. eToro’s CopyTrader feature even lets you buy automatically when a professional Bitcoin trader of your choice makes a purchase.

Buying the dip is a popular strategy, but knowing when the price will dip requires some prediction skills, which will be explored in the next section.

Bitcoin Price & Price Prediction

The are many different things that can affect Bitcoin price. News about updates could have an impact, as well as news about Bitcoin regulation, institutional investment, and changes in the wider economy.

An aspect that’s more specific to Bitcoin is halving events. This is when the BTC reward paid to miners is cut in half, and it happens approximately every four years. Bitcoin’s price history has so far been defined by roughly four-year cycles that appear to correlate with halving events.

Understanding all these factors can help with predicting the future price movement of Bitcoin, as can learning technical analysis skills such as identifying trends and reversals.

Buying Bitcoin Safely in the UK

A regulated platform with a strong reputation is the safest way to invest in Bitcoin, as they usually have the most stringent security measures, as well as better features and support. In the UK, the safest platforms are those licensed by the FCA, like eToro. Security features to look for include offline storage, insurance, address whitelisting, and two-factor authentication.

You should act responsibly when you invest by never investing more than you can afford to lose. You should also keep your investment somewhere safe, like a hardware wallet. Storing your seed phrase safely is important in case you ever need to recover access to your wallet.

Bitcoin investors are a target for hackers and scammers, so always be vigilant. You should check the provenance of emails purporting to be from your platform or wallet provider, and never share your password or private key with anyone.

Buying Bitcoin Anonymously in the UK

UK regulations require crypto platforms to verify the identities of their users in a process called “Know Your Customer” (KYC). This makes it difficult to buy Bitcoin anonymously as most platforms require contact details and proof of identity, like a passport.

You would therefore need to use an unregulated platform to buy BTC anonymously in the UK. This is possible on some peer-to-peer (P2P) marketplaces, like Paxful, where you could use a fake email address to set up an account. Paxful enables users to buy Bitcoin from some sellers without completing verification.

Another type of unregulated platform you could use is decentralised exchanges (DEXs), as they don’t require any personal information—just a wallet. However, you would need to buy Wrapped Bitcoin (WBTC) on a DEX as none of the well-known DEXs supports the Bitcoin blockchain. You would also need to acquire another cryptocurrency first to swap for it.

Using an unregulated platform could put you at risk of being scammed, and they are also harder to use. For these reasons, it is simpler and safer to spend a few minutes verifying your identity so you can buy Bitcoin on a regulated platform, which is perfectly legal in the UK.

Best Ways to Invest – A Comparison Between Centralised Exchanges & Decentralised Exchanges

Centralised Exchanges

All the platforms in this guide are centralised, meaning they are operated by a company. Many platforms have an order book, where buy orders are matched with sell orders to facilitate trades. The platform will charge you a fee for this service.

Beginners appreciate centralised exchanges (CEXs) as they provide a better user experience, are usually easy to navigate, and often provide customer support and educational resources. They’re popular with experienced traders as well, as many platforms provide more advanced features, such as a variety of order types and tools for technical analysis.

Decentralised Exchanges

Conversely, there is no company or authority in charge of a decentralised exchange (DEX), as it operates through smart contracts on the blockchain. Instead of facilitating trades through an intermediary, DEXs tend to use liquidity pools. These are pools of crypto assets that trades are made against. People are incentivised to provide assets for these pools as they will receive exchange fees in return.

DEXs are popular with people who want to retain full custody of their assets and trade anonymously. However, the network fees can be expensive on DEXs, and they don’t provide many features. What’s more, you can’t buy Bitcoin on any of the well-known DEXs. You can purchase WBTC, but you will need to buy another cryptocurrency first to swap for it as DEXs don’t tend to have fiat on/off ramps.

Bitcoin ATM

There are a number of Bitcoin ATMs in the UK, especially in London—look out for an ATM with the Bitcoin logo on it. You will usually need to create an account with the ATM provider before can buy Bitcoin. You should be able to do this at the machine, such as by providing your phone number and confirming it with a verification code.

You’ll need to set up a wallet first, which you can do by downloading a wallet app, creating a paper wallet, or using an exchange wallet if you have one. Scan the QR code for your wallet address, so the ATM knows where to send your coins. Once you pay for your purchase with cash or a card, the equivalent amount of BTC will be sent to your address.

Bitcoin ATMs aren’t the most convenient way to buy BTC—for starters, you have to go out and find one. Also, some machines charge exorbitant fees, and you may have to wait up to an hour before the coins appear in your wallet. This is why many people prefer to use a crypto platform, where they can buy Bitcoin instantly with low fees.

Selling Bitcoin in the UK

The strategy you decide to use may dictate when you should sell your Bitcoin. For example, buy-and-hold investors will hold onto their BTC for a long time, and the exact timing for a sale isn’t very important. When using a shorter-term trading strategy, on the other hand, you may choose to sell when a particular technical indicator gives you a certain signal.

On most platforms, the selling process is pretty straightforward and doesn’t differ much from the buying process. For instance, on eToro, you just select Bitcoin in your portfolio and click on the “Close” button.

You may need to create a sell order on other platforms. You might be given the choice between a market sell order, which involves selling immediately at the current price, or a limit sell order, which lets you make a sale once Bitcoin reaches a certain price.

Final Thoughts Buying Bitcoin in the UK

As the first and most popular cryptocurrency, Bitcoin can be purchased from pretty much any crypto platform. While this array of choices may seem overwhelming, this guide should show you the top options and whether they’re right for you.

After careful consideration, we believe eToro is the best place to buy Bitcoin in the UK, as it is FCA-regulated, secure, easy to use, and provides access to unique features, like copy trading. To see how easy it is to invest in Bitcoin on eToro, just follow the step-by-step tutorial further up this page.

More Cryptocurrency Guides in United Kingdom

Check out more of our popular crypto guides for the United Kingdom below.

Methodology - How We Picked the Best Platform to Invest in Bitcoin in the UK

To provide information you can trust, we conduct extensive research and use quality control processes. We want to enable you to make informed decisions about investing, which is why we rigorously test all the platforms we review.

When testing a platform, we look at things such as the account creation and deposit processes, the assets and trading types offered, user experience, fees, features, regulation, educational content, and customer service.