Exness Review 2024

Exness is a retail securities broker that offers access to currency pairs, cryptocurrency, metals, stocks, energy, and indices to users from 130 countries, as well as platforms and tools that allow its users to trade these securities easily.

The broker is registered in Seychelle and authorised by the Financial Services Authorities (FSA). However, it holds subsidiaries in various countries like Curacao and the British Virgin Islands where it is registered under the governing agencies in those locations.

It has over 440,000 active users that generated $3.05 trillion in volume in February 2023. The broker processed over $1.13 billion client withdrawals in the fourth quarter of 2022 and about $99.1 million partner rewards in Q4-2022.

In our Exness review, we dive into the nuts and bolts of the securities broker. We explore its offering, discern its merits and demerits, and give our verdict on its suitability as your trading partner.

How It Works

Exness offers trading services across six major asset classes.

Forex Trading

Exness offers over 100 currency pairs including all the major pairs, the popular crosses, and several exotic pairs. Its spread is floating and can change with trading time and market volatility.

Accounts usually enjoy unlimited leverage, provided their balance does not exceed $999 while accounts with a balance exceeding $1,000 are limited to various leverage tiers based on how much capital is available. The table below sheds more light.

|

Account Balance |

Leverage |

|

$0 – $999 |

Unlimited |

|

$1,000 – $4,999 |

1:2000 |

|

$5,000 – $29,999 |

1:1000 |

|

$30,000+ |

1:500 |

Exness supports weekend and holiday trading on select pairs, however leverage during those periods is limited to a maximum of 1:200.

Metals Trading

You can trade precious metals like Gold, Silver, Platinum, and Palladium at no commission on standard accounts and a maximum margin of 1%. The website provides more information on metal trading.

Stock Trading

Exness provides access to over 60 equity CFDs, most from the United States. Spreads range from 0.3 pips to around 7 pips with a 5% margin requirement. Raw accounts users are not charged a commission on trading, only Zero accounts.

Cryptocurrency Trading

You can trade over 35 cryptocurrency CFDs commission free on Exness with a standard account. However, cryptocurrency spreads can be quite wide and require a 5% margin. To find a detailed list of available cryptos, visit the crypto section of the website.

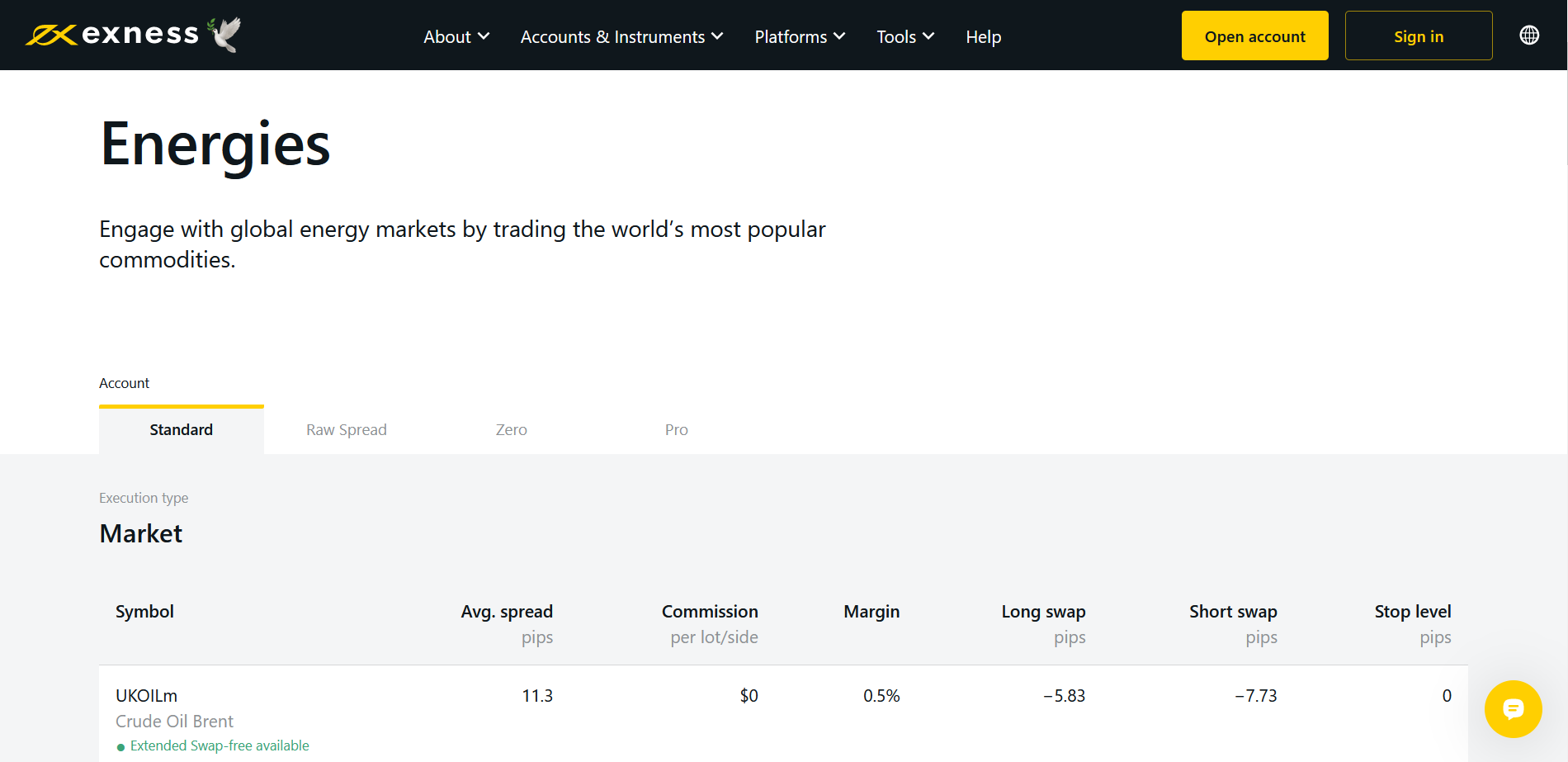

Energy Trading

You can trade US oil, UK oil, and Natural gas in the energies section of the website. Spreads can be quite high at a minimum of 6 pips and maximum of 16 pips, however these spreads are floating and can change with market conditions.

As usual, Raw accounts are charged a $3.5 commission per lot but get the raw market spreads while Zero accounts get lower spreads but pay higher commissions.

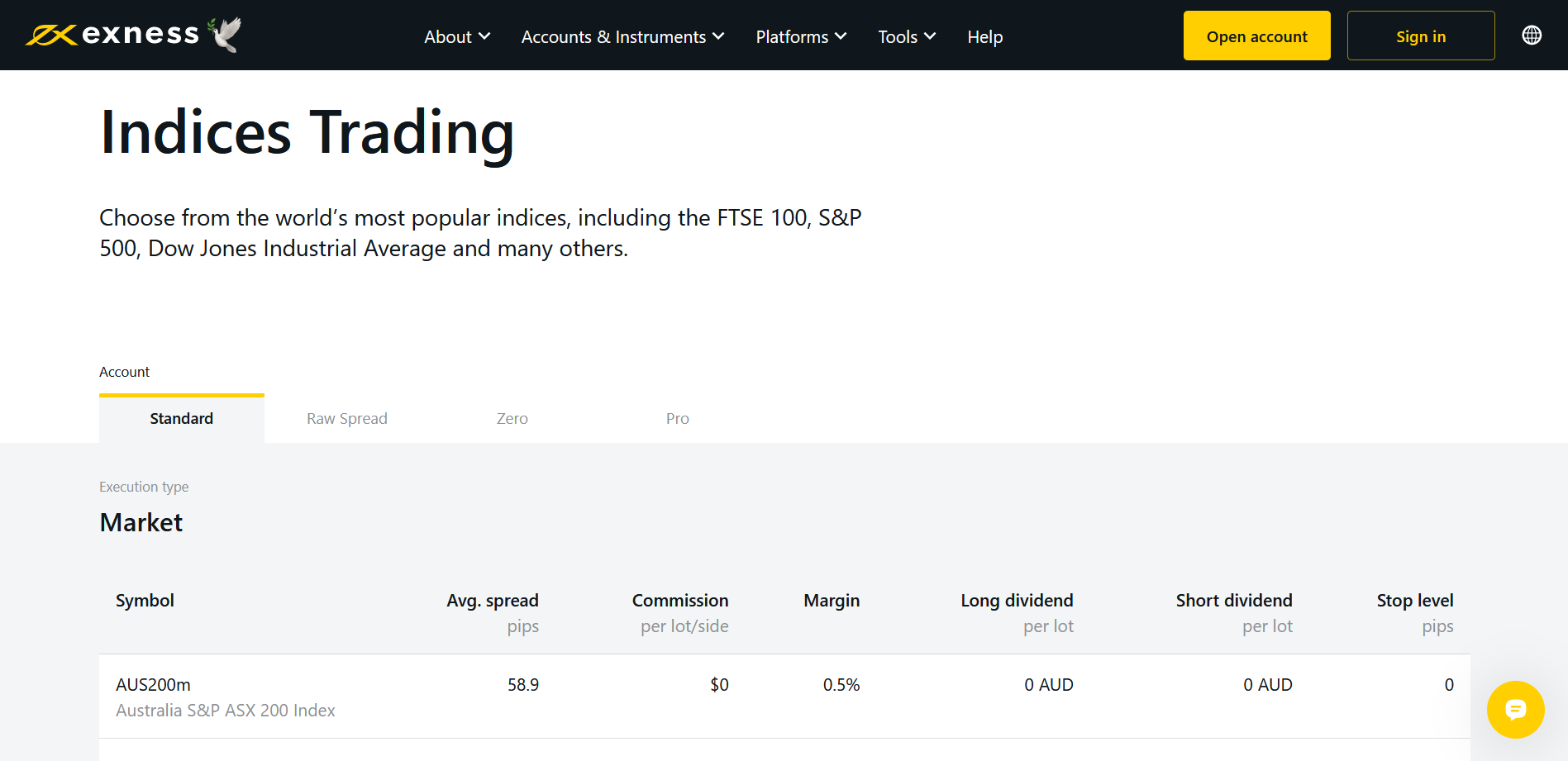

Indices Trading

Exness supports 10 popular stock market indices including the S&P 500, Wall St 30, Japan 225, German DAX, and others. You can access a full list in the indices section of the website.

Spreads on indices are quite wide, ranging from 6.8 pips to around 66 pips as of writing. The commission charge on Raw accounts also varies based on the index, although spreads are lower than on a standard account.

Features of Exness

Flexible Accounts

Exness features various accounts for traders at different levels. There are two main accounts that you can choose from.

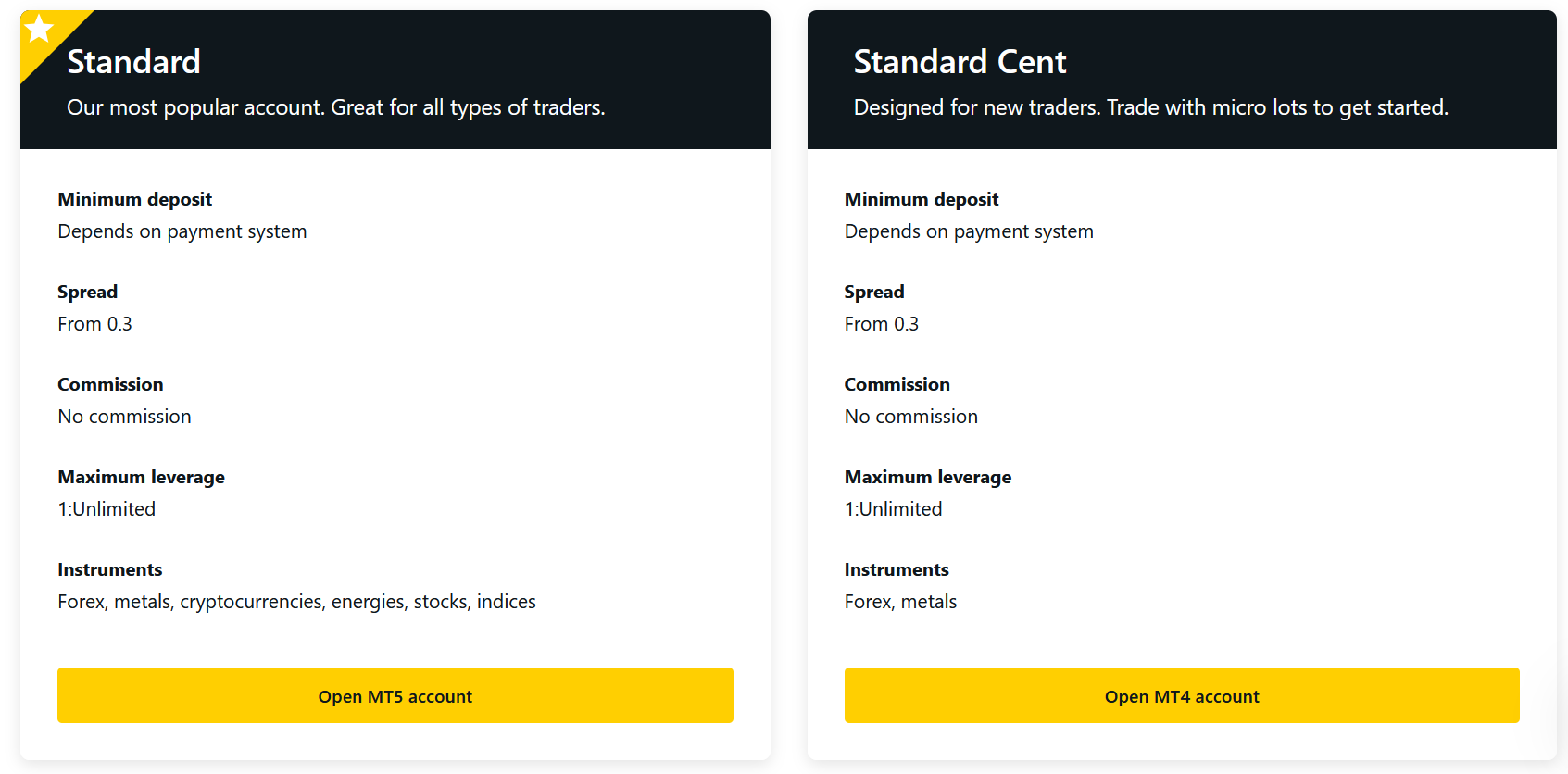

Standard Accounts

Standard accounts are the run-of-the-mill type of accounts that all brokers offer. Exness offers two types of standard accounts: the Standard and the Standard Cent accounts.

Standard accounts are usually commission-free. Exness doesn’t charge commission on these accounts, instead they add a markup to the bid-ask spread, usually from 0.3 pips upwards.

Standard account holders can trade instruments under all asset classes with unlimited leverage for accounts with balances below $1,000. The minimum lot size is 0.01 lot (a micro lot) while the maximum position size is 200 lots.

You can open an unlimited number of positions provided you maintain a margin of 60%. However, you only get stopped out when your account balance falls to zero.

Standard Cent accounts cater more to new users. With this account, you can only trade Forex and Metals and open a maximum of 1,000 positions simultaneously. However, everything else is the same as with a standard account.

We included a table comparing both types of accounts.

|

Feature |

Standard Account |

Standard Cent Account |

|

Commission Fees |

None |

None |

|

Spreads |

From 0.03 |

From 0.03 |

|

Tradable Instruments |

All Instruments |

Forex and Metals |

|

Minimum Deposit |

Depends on Payment System |

Depends on Payment System |

|

Leverage |

Unlimited |

Unlimited |

|

Minimum Lot Size |

0.01 |

0.01 |

|

Maximum Lot Size |

200 |

200 |

|

No of Open Positions |

Unlimited |

1,000 |

|

Margin Call |

60% |

60% |

|

Order Execution Type |

Market |

Market |

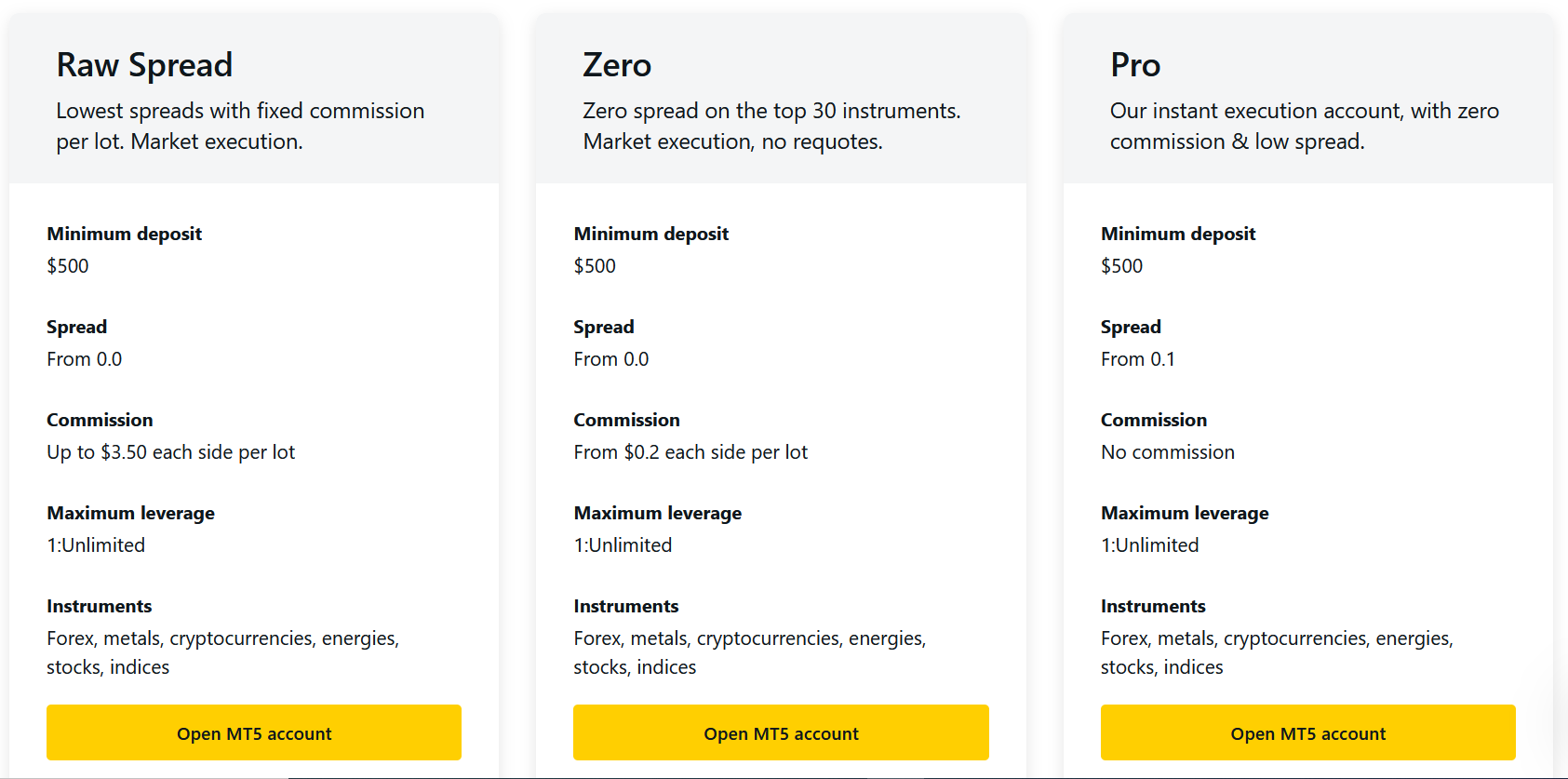

Professional Accounts

There are three types of professional accounts that you can choose from: the Raw, Zero, and Pro accounts. These accounts are customised and each comes with features that appeal to a specific type of professional trader.

Raw Spread accounts allow traders access to raw market spreads on instruments but with a fixed commission per lot per position. Zero accounts allow users to trade about 30 instruments at zero spreads, but with variable commissions per lot, while Pro accounts grant instant execution and no commission charges but with a markup to spreads.

|

Features |

Raw Accounts |

Zero Accounts |

Pro Accounts |

|

Minimum Deposit |

$200 |

$200 |

$200 |

|

Spread |

From 0.0 |

From 0.0 |

From 0.1 |

|

Commission |

$3.50 per lot |

Varies with instrument |

None |

|

Leverage |

Unlimited |

Unlimited |

Unlimited |

|

Minimum Lot Size |

0.01 |

0.01 |

0.01 |

|

Maximum Lot Size |

200 |

200 |

200 |

|

Maximum Open Positions |

Unlimited |

Unlimited |

Unlimited |

|

Margin Call |

30% |

30% |

30% |

|

Stop Out |

0% |

0% |

0% |

|

Order Execution Type |

Market |

Market |

Instant |

Multiple Trading Platforms

Exness supports multiple platforms for traders. They include

Exness Trade App

The trade app is a mobile application that allows traders to set orders, monitor trades, and manage their account on the go. It is available on the Android and iOS stores.

With the mobile application, you can deposit and withdraw funds from your account at any time, set dynamic orders, and trade over 200 instruments on multiple accounts.

You also get access to an in-app calculator for margins, spreads and swaps, a demo account for practice, analytics of your trades, and 24/7 in-app support.

However, the app only supports MT5 accounts, line and candle charts, and six time frames (M1, M5, M30, H1, H4, and D1).

Exness Terminal

The Exness terminal is a web-based trading station equipped with over 100 indicators and 50 drawing tools. Its charts are powered by leading charting software provider, TradingView.

Like the mobile app, the web terminal only supports MT5 accounts. However, it supports candle, bar, and line charts as well as dynamic order types.

MT5 Software

MetaTrader 5 is the latest version of the market-leading trading software. It features 21 timeframes to aid multiple time-frame analysis, 22 in-built analytical tools and over 38 indicators.

With an MT5 Exness account, you can trade over 200 instruments, including stock CFDs, set dynamic stop loss parameters like the trailing stop, hedge against open positions, and also access the mobile version of the trading software.

MT4 Software

The MetaTrader 4 trading software is still the most popular version in the MetaTrader lineup. It features 30 built-in technical indicators, 23 analytical objects, and dynamic orders like trailing stops. It also allows for automated bot trading.

With an MT4 Exness account, you can trade on 9 time frames and 3 chart types with low spreads (depending on account type) and instant executions. You can also use the web or mobile versions to trade.

Helpful Tools

Exness provides tools to help traders make accurate trade decisions, manage their risk, and prepare for important events. These tools include:

Investment Calculator

The investment calculator helps traders calculate the spreads, commissions, swap fees, and pip values for all the instruments it trades at various lot sizes. All you need to do is input the chosen instruments, the lot size and leverage, and the calculator outputs the above mentioned parameters.

With this tool, you know exactly how much you are risking and what you stand to gain before opening a trade.

Economic Calendar

The economic calendar tracks impactful planned events and releases like Central bank policy decisions, inflation report release dates, GDP report dates, and more, which could significantly influence the market.

Currency Converter

The currency converter provides accurate and up-to-date information on currency rates. You can find out how much converting between currencies costs. However, this tool doesn’t process conversions.

Tick History

The tick history tool provides data on over 100 instruments, downloadable to Excel. You get access to bid and ask prices, price data, volume data, and more.

VPS Hosting

Virtual Private Server hosting allows you to create a secure trading environment on a private server that runs independent of your personal laptop or mobile device. You can run automated trading strategies in the cloud and access your account from anywhere in the world.

Trading Central WebTv

This internet Tv service provides the latest news directly from the trading floor. It also provides market commentary from experts and actionable trade ideas from leading investment research provider, Trading Central.

Flexible Funding Methods

Funding methods differ with geographic regions, but all account holders should be able to deposit and withdraw funds using Bitcoin, bank cards, Skrill, and Perfect Money.

Bank card and Skrill deposits are quick, usually being settled within 30 minutes while withdrawals can take up to 24 hours. The minimum required amount for deposits and withdrawals is $10.

Perfect Money deposits are similar to the above, it takes around 30 minutes and is subject to a $10 minimum. However, withdrawals are much faster at 30 minutes and are subject to a minimum of $2.

Customer Service

Exness runs a global customer support team with physical offices in Cyprus, the UK, British Virgin Islands, Kenya, Seychelle, South Africa, and Curacao.

However, customer service agents are available to users in the 130+ countries where Exness operates. They can be reached via live chat, email, and phone, and are available 24/7.

Pros and Cons of Exness

Pros

- No account maintenance fees

- Easy sign up

- Helpful tools

- Multiple platform support

- Dynamic account options

Cons

- High leverage could be detrimental for new traders

- Not available to US residents

Why You Should Use It

Exness stands out from other brokers by offering “better than market conditions”, which in this case mens accounts that help reduce the cost of trading, tools that help inform your decisions, and funding methods that are quick and easy.

Trading accounts support various currencies, so despite the popularity of the USD, you can open accounts in GBP or EUR if you so wished.

Customer service is quite extensive with Exness. Users can receive support in over 16 languages at any time of the day, regardless of time zones.

Finally, pricing is transparent as the website provides extensive information on fees for each account and each instrument. Traders know how much they’ll pay for trading and can plan for it.

Verdict

Exness is a securities broker that can boast of impressive numbers and flexible terms. Not a lot of brokers offer unlimited leverage, even on small accounts.

However, despite the availability of Standard Cent accounts, Exness is not beginner friendly. Not only does it lack learning materials, it provides unlimited leverage that could easily backfire for the uninitiated.

Nonetheless, intermediate to experienced traders will find a good companion in this service as its flexibility, both with its professional accounts and with its funding methods appeals to traders who have come into their own.