Paybis Review 2025

Paybis is probably one of the best non-custodial cryptocurrency exchanges where you can buy and sell Bitcoin and other major cryptocurrencies. The exchange has been in operation since 2014, with the last seven years seeing it develop into a highly reputable platform.

The team behind the exchange has over the years acquired licences to operate in the UK, the US, and Europe, with its user base cutting across 180 countries. The exchange is also highly ranked on Trustpilot, with millions of users happy with its security, user-friendliness, and ease of access to buying crypto with any of the 47 supported fiat currencies.

Read this review for a comprehensive look at Paybis’ performance, functionality, fees and regulations and an answer to the question: “Is Paybis safe?”

The Best Crypto Exchanges to Try - Our Top 3 Choices

Looking for a quick answer? Here are our top crypto exchanges to use.

Top Crypto Exchanges to Try - Key Metrics

The Best Crypto Exchanges - Why They Made the Cut

The Top Crypto Exchanges to Try Reviewed

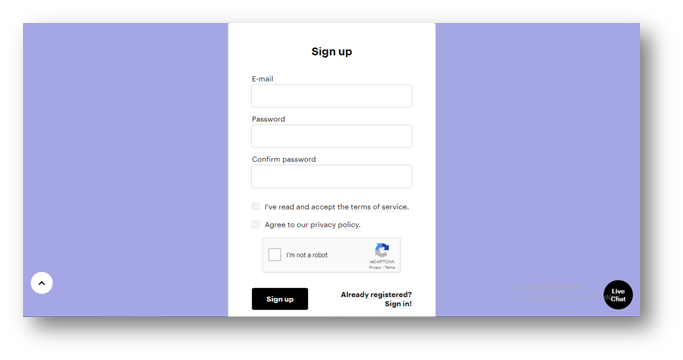

3 Steps to Sign Up to Paybis

Register: Easily create a free account by signing up with your email. Once you have set up and confirmed your password, agree on the T&Cs and sign up.

You will then receive an email to confirm your details, after which you should verify the account as prompted. The process takes 5-10 minutes.

Make a Deposit: After verifying your identity, you need to fund your account before buying. Ensure you have money in your preferred deposit method – credit card, bank account, or supported electronic wallet. This way, you can easily buy your desired cryptocurrency.

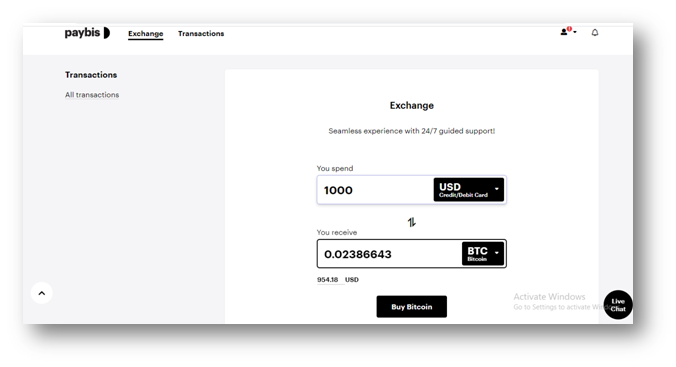

Purchase your Crypto: Purchasing crypto on Paybis is easy. Go to the “Exchange” page; choose a payment method, the fiat currency to transact, and the amount of crypto, say BTC, to buy.

Click on “Buy,” add your wallet address, and press “Continue” to complete the purchase and pay. That’s it!

Paybis Pros and Cons

Pros

- Regulated by the UK's Financial Conduct Authority (FCA) and also is registered by FinCEN as a Money Services Business

- Reputable - 7 years in operation

- Easy-to-use interface - sign-up is quick and buying crypto is seamless

- Great customer support available 24/7 via live chat

- Supports up to 47 fiat currencies across the globe, including USD, EUR, JPY, and GBP

- Available globally across 180 countries and accessible in 9 languages

- No hidden fees

- Non-custodial exchange

Cons

- Does not offer advanced trading features

- Coin selection smaller than some other services with a global footprint

Paybis Compared

Paybis is a great platform to buy major cryptos with a credit card and other payment methods, with its regulatory compliance across the UK, US, and EU making it attractive to many users. It’s also liked by new users for its transparent fee structure and robust security.

The use of a non-custodial model encourages users to use secure, private wallets, which is a best practice for security but may be inconvenient for traders.

But as noted, one of its main cons is the lack of advanced trading features available at rival exchanges.

History of Paybis

Paybis was founded in 2014 by Innokenty Isers, Konstantin Vasilenko, and Arturs Markevich, three motivated friends with a wealth of experience in online business, trading, IT, and e-sports.

The company is registered under Paybis LTD and is based in the UK, with Innokenty Isers as the CEO. The core team currently comprises seven key members and has a staff of 50+ dedicated professionals.

The exchange officially launched in 2015 and has since partnered with Simplex, an Israel-based payment processor that is providing services to some of the biggest companies in the crypto space.

In November 2020, the exchange announced a strategic partnership with FinCen-registered Money Service Business Zero Hash. The partnership with the fintech company allowed Paybis to offer its services across 48 US states and is looking to expand even further.

Paybis is unique in the sense that it is a self-funded initiative. Unlike most other cryptocurrency exchanges, its launch did not involve a token sale or external funding.

Paybis Regulation and Security

One of the many factors to consider before choosing a cryptocurrency exchange or broker platform is its regulatory and security status.

It is, therefore, worth noting that Paybis is a legal business registered and regulated by the Financial Conduct Authority (FCA), the UK’s tier-1 regulatory body.

It operates under the business name Paybis Limited and the registration reference number 928013, and the exchange maintains a physical address at 1 West Regent Street in the city of Glasgow.

As noted earlier, the exchange is also registered with the Financial Crimes Enforcement Network (FinCEN), which licenses money services businesses in the US.

Paybis operates in the country under FinCEN registration number 31000175037491, with approval to offer its services in 48 states. The exchange also holds a Polish licence that allows it to operate within the country and its regions.

Apart from that, the exchange is licensed as a fiat/crypto business in Estonia. It also operates in 180+ countries worldwide, a factor that adds to its credibility and growing reputation as a trusted platform.

Is Paybis Safe?

Paybis offers a safe and regulated platform for anyone to buy Bitcoin and 89 other cryptocurrencies. In the time since its launch, the exchange has maintained compliance with requirements in the UK, the EU, and the US, providing its users with safe services.

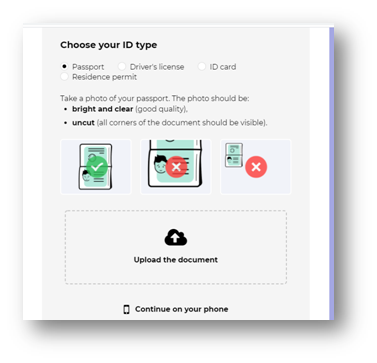

The team takes compliance seriously, with all users required to go through KYC verification in all of the 180 countries it operates. Other than the verification process, there are also checks to ensure AML compliance.

Although there’s no two-factor authentication (2FA), the exchange compensates for that by secure encryption of its website. It does not also store any of its users’ purchased crypto, meaning that the risk of losses in case of a breach is very low.

Privacy and safety are also ensured by not sharing any user data with third parties.

The exchange has also been comprehensively reviewed across several major publications, all of which point to Paybis’ regulation and oversight by tier-1 agencies as contributing to the overall safety enjoyed by users so far.

Paybis Reputation

For anyone looking to use Paybis, one of the first questions to ask is whether this platform is safe and reputable. As mentioned, this platform has been in operation for seven years now and has, since its inception, offered a safe environment for its users.

While most of this is down to its regulatory status in the UK, EU, and the USA, there are tens of thousands of reviews on Trustpilot that give the exchange a solid reputation in the market.

Growth across the globe is also a testament to the platform’s reputation. The exchange currently offers its services to nearly 1 million users across 180 different countries and with over $250,000,000 in annual trading volume.

These are features that continue to add to Paybis’ reputation as a go-to venue for those looking to quickly buy crypto with a credit card.

Is Paybis for Me?

Paybis is accessible and available for both those new to cryptocurrency buying and seasoned pros looking to instantly buy crypto. Let’s see how this suits you.

I’m a Beginner

Paybis is simple, with a straightforward registration and verification process. It’s easy to use as the website features quick steps that are easy to locate.

Apart from that, there is a blog and FAQ page with updated educational information that makes it super easy for new users to grasp how to go about using the platform. The interface is geared towards beginners, and you’ll find buying crypto a breeze.

I’m Advanced

As an advanced user, you will find Paybis great for you when it comes to instant purchases of major cryptocurrencies to your wallet or trading account. This makes it possible to leverage trading opportunities that may arise as prices fluctuate across the market.

Exchange Wallets: Features, Supported Cryptocurrencies, and Security

Paybis now offers a built-in account-associated wallet, allowing users to store cryptos on the platform. The site still allows users to integrate their own wallets if they wish. This feature supports all wallets, be it online, desktop or hardware.

All you need is to have the correct wallet address whenever you want to buy crypto.

Users can choose to use the available wallet option or use theirs, a feature that adds to the overall security of the platform. It also means that users have access to the private keys of their holdings.

For the security of your account, though, you should set a strong password as well as ensure you do not share your credit card information. Paybis does a great job protecting users by automatically blurring critical data during the verification process.

Supported cryptocurrencies

Paybis supports 90 cryptocurrencies. The top ones include:

- Bitcoin

- Ethereum

- XRP

- Binance Coin

- Bitcoin Cash

- Litecoin

- Stellar

- TRON

- Dogecoin

- Tether (USDT)

How to Transfer Your Crypto Funds From/To Paybis

You can buy cryptos directly to your wallet address using up to eight payment popular methods. For withdrawals, five popular methods are available to process requests. The supported payment methods, their fees, and limits are listed in various subsections below.

To buy directly into your wallet, navigate to the buy crypto page and input the currency you wish to transact with. This will filter the list of payment methods available for that currency. Note that not all payment methods are available for all currencies.

Once you select your preferred currency and payment method, input the amount you wish to buy. The field next to it which shows the equivalent amount of crypto will automatically be filled according to prevailing market rates. Fees are automatically deducted so you see the exact amount you’ll receive.

Proceed with the transaction and input your wallet address to receive your crypto. Ensure you are aware of the network you are receiving on; it must match the address provided.

If you wish to sell BTC for cash, go to the sell crypto page. The process is the same as with buying, select the crypto to sell, input the amount, select the currency you wish to sell to, select any of the available payment methods for that currency, and proceed with the transaction. Remember that you must have completed the verification process to sell BTC.

Fees and Costs of Paybis

Fees and commissions on Paybis are very competitive, but as you are likely to find out, they vary widely depending on the payment method you use and the cryptocurrency you buy.

Fees

There are no fees charged on the first transaction – yes, Paybis will apply 0% cost on your credit card, bank transfer, or e-wallet deposit. The same applies to your first BTC sale. However, it is worth noting that this is from Paybis’ end and your bank or payment processor costs and fees still apply.

In terms of subsequent transactions, Paybis fees vary depending on the payment method used. The table below outlines these mthods and associated fees.

| Payment Method | Buys | Sells |

| Debit/Credit Cards (incl. Google and Apple Pay) | 6.99% – 9.19% sell | 2 gbp + 1.99 – 3.19%. |

| ACH Online Banking | buy = 1.7 USD + 1.99% | – |

| Giropay | 2,19% | – |

| AstroPay | 7.5 – 10.5%. | – |

| Skrill, Neteller | 3.5-4% (+1.9% for USD) + 3.49% for EUR or 3.59% for USD | 1.00% + 2.49% for EUR or 3.49% for USD |

| SEPA Bank Transfer | 1.04 – 2.04% | 0.2 – 2.34% |

| M-Pesa | 6.9% | – |

There is also a $10 local currency minimum processing fee or 4.5% for USD, EUR, and GBP. The fee can rise to 6.5% if the payment is in another currency.

Note that there are also network fees, which vary depending on what you pay to the miners to process transactions on the blockchain.

Payment Methods & Limits

You can purchase any of the supported cryptocurrencies on Paybis using USD, EUR, and GBP or any of the 47 fiat currencies. The exchange offers several payment options, including credit/debit cards, bank transfers, Neteller, and Skrill.

The transaction limits for these payment methods vary. The tables below outline them clearly for deposits and withdrawals, respectively.

For deposits

| Payment Method | Minimum Limit | Maximum Limit |

| Debit/Credit Cards (incl. Google and Apple Pay) | 4 | 20,000 |

| ACH Online Banking | 10 | 20,000 |

| Giropay | 5 | 5,000 |

| AstroPay | 5 | 10,000 |

| Skrill, Neteller | 20 | 200,000 |

| SEPA Bank Transfer | 200 | 1,000,000 |

| M-Pesa | 5 | 1,000 |

For withdrawals

| Payment Method | Minimum Limit | Maximum Limit |

| Debit/Credit Cards (incl. Google and Apple Pay) | 10 | 20,000 |

| AstroPay | 5 | 7,000 |

| Skrill, Neteller | 50 | 25,000 |

| SEPA Bank Transfer | 240 | 100,000 |

Paybis: Performance, Features, and Functionality

Buying cryptocurrency remains quite challenging for new users seeking to make their first purchase. This is true of some complicated platforms available in the market, but not with Paybis.

A functional, simple, and easy-to-use interface makes this exchange stand out, with a straightforward registration process that allows users to be ready for their first buy within 5-10 minutes. Buy BTC instantly at a 0% fee on your first credit card transaction.

Purchasing other cryptocurrencies is seamless as well, with all coins directly stored in users’ preferred wallets.

Unlike most exchanges in the market, this platform’s UI is uncluttered. There are very few buttons and pages to access when making a purchase.

The reason investors prefer this exchange is that it’s registered and regulated in major jurisdictions around the world. This gives users a sense of comfort when using the site.

If you require assistance setting up your account or executing transactions, you can reach out to the customer service team through email, live chat, the help centre, and the FAQ section. The team is responsive and fast, as shown by the thousands of satisfied users who have reviewed the exchange.

Another feature that makes Paybis attractive to both beginners and pro users is the payment fallback feature which automatically switches payment methods within 10 seconds of the failure of a credit card payment. This allows for a smooth transaction experience.

Trading Platform

The Paybis exchange is always online, allowing anyone looking to buy crypto anytime and from anywhere it is supported. Unfortunately, it does not provide a dedicated trading platform, as do some cryptocurrency exchanges.

Users can only buy and sell cryptocurrencies, making it more attractive to people who want a simple online platform to buy digital assets.

As of now, Paybis does not also provide a mobile app.

Educational Resources

Learning more as you navigate the crypto space is what will take you from a newbie to a seasoned veteran. Paybis offers several educational resources for you to use, including a YouTube channel with videos and tutorials on how to buy cryptocurrencies.

There’s also a support portal where users can search various topics like getting started, security, and joining the affiliate program. Paybis also runs an updated blog and an FAQ page that provides several insights and news related to the exchange and the broader crypto industry.

Trading options

Paybis’ simple and uncomplicated user experience limits the trading experience to buying and selling at prevailing market prices. You can buy coins directly into your wallet, but that’s about it.

If you want to trade, check our recommended platforms like Binance and eToro which support more robust trading options like options, futures trading, or social trading.

Account Types

All Paybis account holders use the same types; however, they can be differentiated based on KYC verification. The exchange allows users in some countries to transact within a certain limit without completing KYC.

These limits depend on how risky doing business within that country is. Paybis sorts countries into three main categories:

- Low-risk countries: Users from these countries can transact up to $1,000 without KYC.

- Medium-risk countries: Users from these countries can transact up to $500 without KYC.

- Hig-risk countries: Users from these countries must complete basic verification and fill out a questionnaire before being allowed to transact.

Account restrictions are effected in unsupported countries and some US states, which is why you need to find this out before you proceed.

Final Thoughts on Paybis

Attracting users in a crowded field such as the cryptocurrency exchange market can be tricky for some businesses. Paybis’s unique selling point as a cryptocurrency platform is that it makes it unbelievably easy to buy up to 90 cryptocurrencies.

Its regulatory status, reputation, and easy-to-use interface are drivers for its active user base which has grown massively over the past seven years.

It also has a transparent fee structure, is secure, and offers all the major payment options. These features make Paybis one of the leading platforms to buy and sell crypto, despite its limited trading facilities. Remember that you need to set up a wallet before you can buy cryptocurrencies on this platform.

If you are looking to buy one of the top cryptocurrencies and gain full access by controlling the private keys, then Paybis could be the platform you want to use. It is, however, advisable to note that crypto is still a nascent industry and that cryptos can be a risky investment, no matter how secure and safe the exchange you use.