Bitcoin is trading around $38,385 on Monday, 2 May, still struggling against the bearish pressure seen over the past several months. The flagship cryptocurrency, which rose to prices near $70K last November, is down 44% since its peak.

This past week, the BTC/USD pair touched lows of $37,614 for its lowest price level in a month.

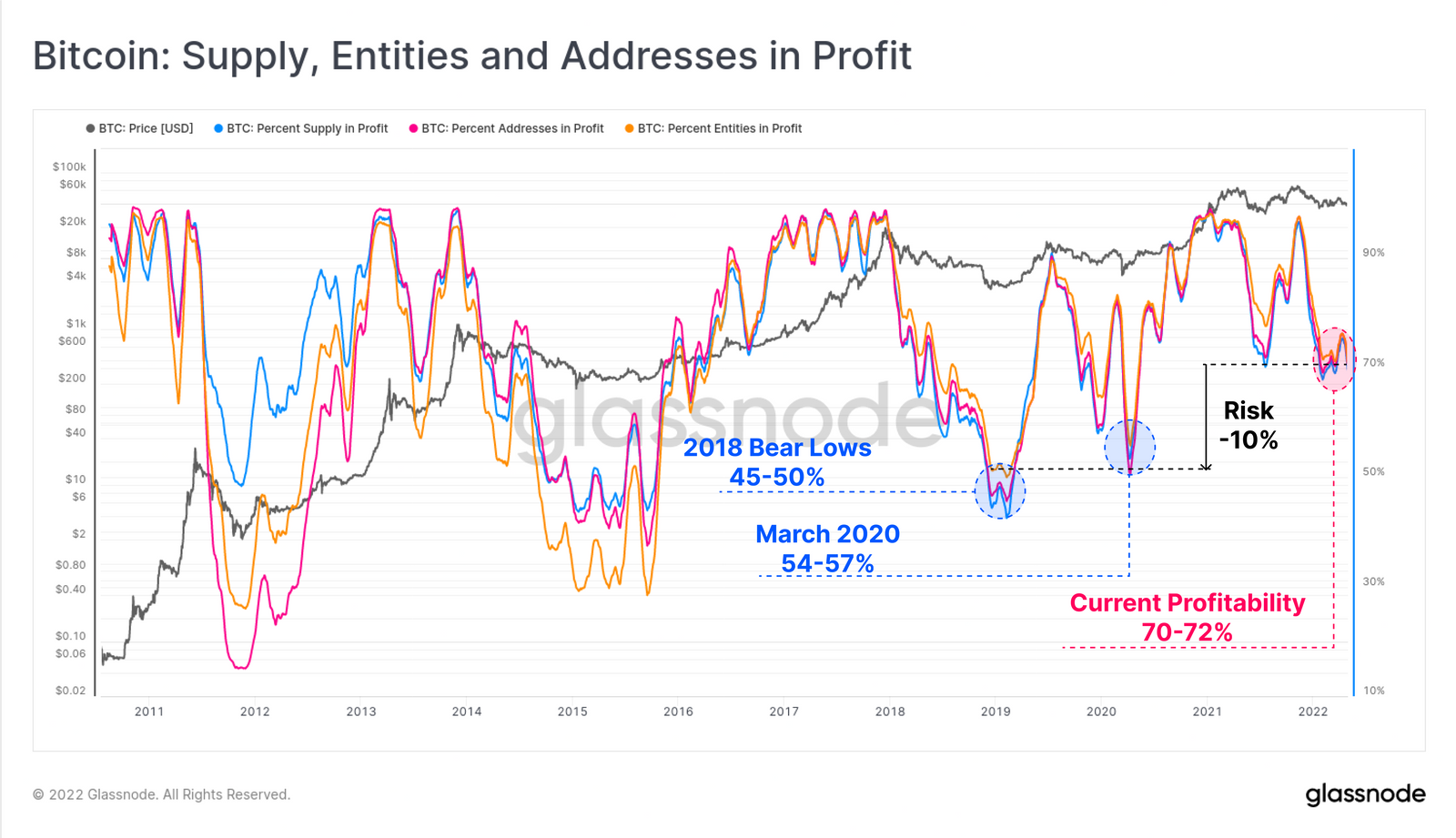

With markets largely negative, the 70% of Bitcoin supply that is profitable could decrease significantly and see a large group of Bitcoiners see unrealized losses. That is the outlook from an on-chain analysis report analytics platform Glassnode published on Monday.

At the edge of unprofitability

According to the report, the danger of a downside remains given Bitcoin’s recent high correlation with the S&P 500 and Nasdaq. This is even as there is continued roiling of markets amid concerns over inflation, higher interest rates and geopolitical uncertainties.

The result of a steep downside for equities could thus likely cascade into the crypto market and see a large group of BTC holders edge towards “the abyss of holding unprofitable positions,” Glassnode said in the newsletter.

Per on-chain data, the cost basis of short-term holders (STHs) is $46,910. This means the average coin currently held by short-term holders is at unrealized loss of -17.9%. The Market Value Realized Value (MVRV) metric for STHs is also pointing to significant pain, with the oscillator off the mean at -0.75 standard deviations.

“With prices trading at $38.5k at the time of writing, the market would need to fall to $33.6k in order to plunge an additional 1.9M BTC into an unrealized loss (10% of supply),” the Glassnode team wrote.

Chart showing 10% of BTC supply could fall into loss. Source: Glassnode

Chart showing 10% of BTC supply could fall into loss. Source: Glassnode

In 2018-2019 and in March 2020, profitability fell to between 45% and 57%, which means the worst could yet happen for short-term holders. If 40% or more of wallets fall into unrealized loss, it would increase the probability of a capitulation event, with a cascade of panic selling hitting the market.