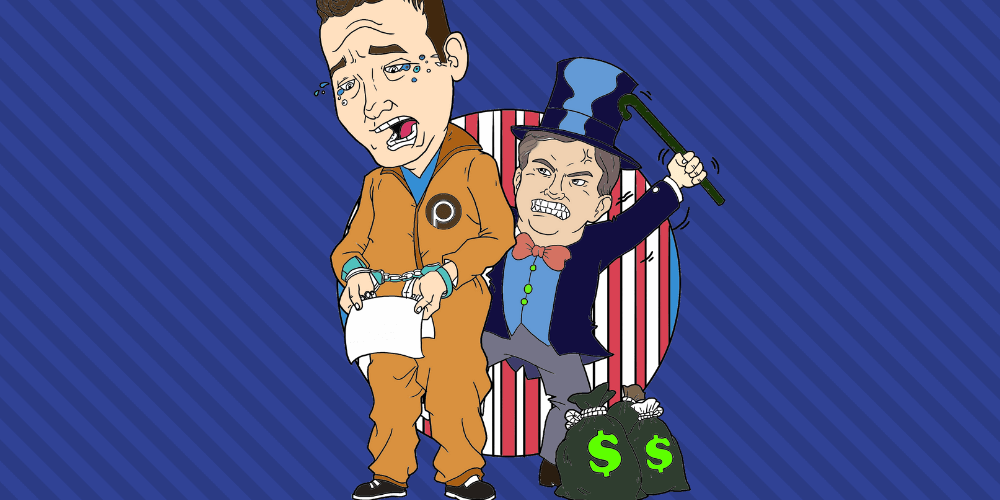

Finally, Crypto’s biggest villain of 2014 has his saga come to an end. A little less than three years after Paycoin’s launch and failure the CEO of GAW Miners, Joshua Homero Garza has been sentenced to 21 months in prison, along with an order to pay $9,187,000 in restitution and three years of supervised release after serving his sentence. The agreed on plea deal suggested that Garza serve significantly more time, up to 78 months. With good behavior, Garza could be out in 18 months.

Garza’s Lawyer asked for Garza to be sentenced to only supervised release and community service, eschewing jail time entirely. Judge Robert N. Chatigny determined that would not be enough of a general deterrent to prevent similar financial crimes in the future. He called Garza a changed man and said that he is no longer the egomaniac that he was when he perpetrated the scam. He also cited his new business (the details of which were unknown to reporters) as a reason for the low sentence. The idea being that if the business can survive he will be able to pay back the victims. The victims in attendance did not think that was likely.

Garza was also given three and a half months to prepare the business before he has to turn himself in. He was also allowed to pick which facility he will spend his incarceration in. Garza will begin his sentence on January 4th 2019.

It likely isn’t the amount of justice that Garza’s victims would have liked to see. Garza was facing up to 20 years of prison for each of his infractions, technically enough to send him away for the rest of his life. That was always unlikely, however, and Garza agreed to a plea deal in order to get the sentence down. The plea deal included recommendations for the sentence and as expected the judge stayed within those guidelines.

Two victims of Garza attended the sentencing and spoke to the judge asking for a strict sentence. They were not satisfied with the ruling. Garza’s father-in-law also spoke, in defense of Garza.

The 9.1 million restitution was all but guaranteed, although the judge could have decided on a different figure if he decided to. The SEC had a separate case against Garza and it levied the 9.1M disgorgement fine against Garza with the expectation that it would be satisfied by the sentencing today. He could have levied a higher fine and the SEC fine would have still technically have been satisfied but it would have given Garza the ability to appeal the sentence.

By staying within the guidelines for the fine and under the guidelines for the sentence the Judge ensured that Garza cannot appeal the sentencing. As part of the plea agreement, he could not withdraw his guilty plea or appeal the case but he could have appealed the sentencing which would have dragged out this case even longer.

The SEC also previously received a final judgement against GAW Miners and Zen Miners, both Garza owned companies, to the tune of $11 million.

As the sentence was handed down Garza showed little emotion, though he did appear to get choked up during his comments before the sentencing. He declined to comment coming out of the courtroom.

The judge has covered fraud cases in the past, though this appears to be his first major case relating to cryptocurrencies. He and all parties involved spoke of Paycoin as an ICO and how this case could set precedent for future cases involving ICOs

Josh Garza’s GAW Miners was once a titan among Bitcoin mining companies. But by 2014 they had started to lose ground and began a cloud mining scheme that now appears to have been fraudulent. Near the end, he launched his own cryptocurrency called Paycoin. It promised partnerships with major retailers and a $20 price floor. None of that materialized and the currency’s value dropped like a rock.

It was later revealed that Paycoin had something called Prime controllers that were given to certain insiders and provided over 300% interest. Garza himself held one as did Cryptsy, an ill-fated exchange that would collapse under its own scam accusations a year later. When one insider failed to return a hyperstaker to Garza, Garza seemingly threatened to give his address to Russian Mafioso.

Today, the state revealed that the majority of the investments were in the $20,000 to $80,000 range, indicated that a large number of the victims were likely middle and working class rather than institutional investors that could more easily absorb a loss investment.

That is all in the past now. It has been estimated that Paycoin fleeced over $20M from investors. Many of those investors would not have been happy with anything less than a life sentence. Indeed, compared to Ross Ulbricht, whose only crime was helping drug buyers connect with drug dealers, and received two consecutive life sentenced without the possibility for parole, 21 months seems quite lenient.

But that is the way of our justice system. Drug crimes are seen as something far worse than white collar crimes. Even when the drug crimes involve no violence, no victims and only involve willing participants, white collar crimes that wipe out life savings through fraud are seen as less troublesome. The judge even seemed impressed with Garza, saying that it was unfortunate that the changed man has to pay for the crimes of his former-self.

The fact that white collar crimes are deemed less egregious is even more apparent now. Garza received less than two years and will do even less if he stays out of trouble on the inside. I can’t imagine this will be a deterrent to future ICO scams. Indeed, it seems to give them a blueprint on how to get their sentence down. Just claim that it didn’t start as a scam, that you got in over your head, and apologize. If this case is any indication, you should be free within two years.

If we can determine what Garza’s new business is, we will report on it.