The good news for Ethereum investors is that the Merge came and went smoothly, without a hitch. Ethereum is now a Proof-of-Stake blockchain, meaning up to 99.95% lower energy consumption.

But it’s not all fun and games. The problem of centralisation is one that is much discussed, but when you jump on-chain and look at the statistics, it highlights quite how much of a problem it is.

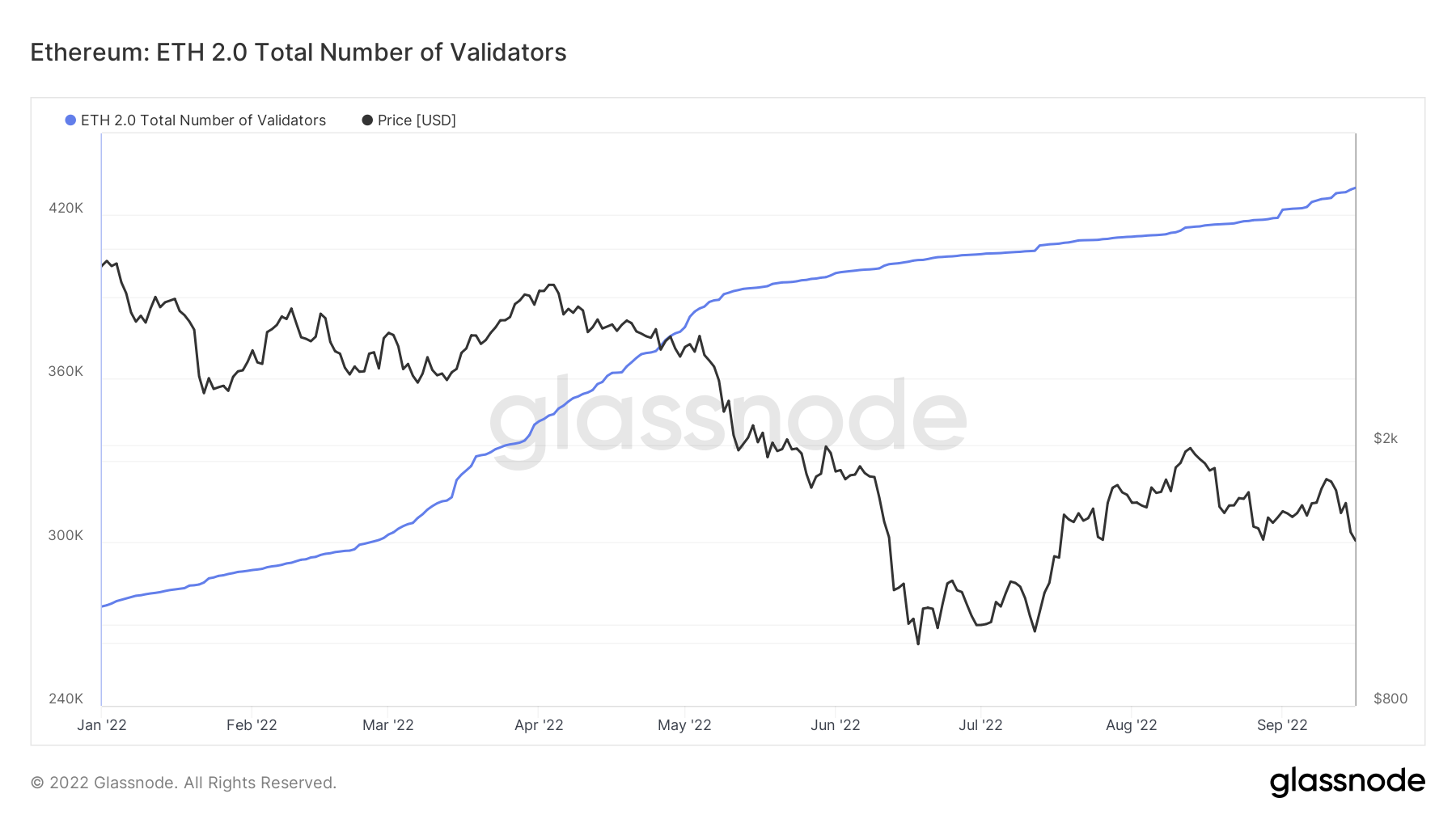

To explain the issue in basic terms, in order to become a validator on the Ethereum network, now that mining has become obsolete after the Merge moved the blockchain to Proof-of-Stake, an investor needs to hold at least 32 ETH.

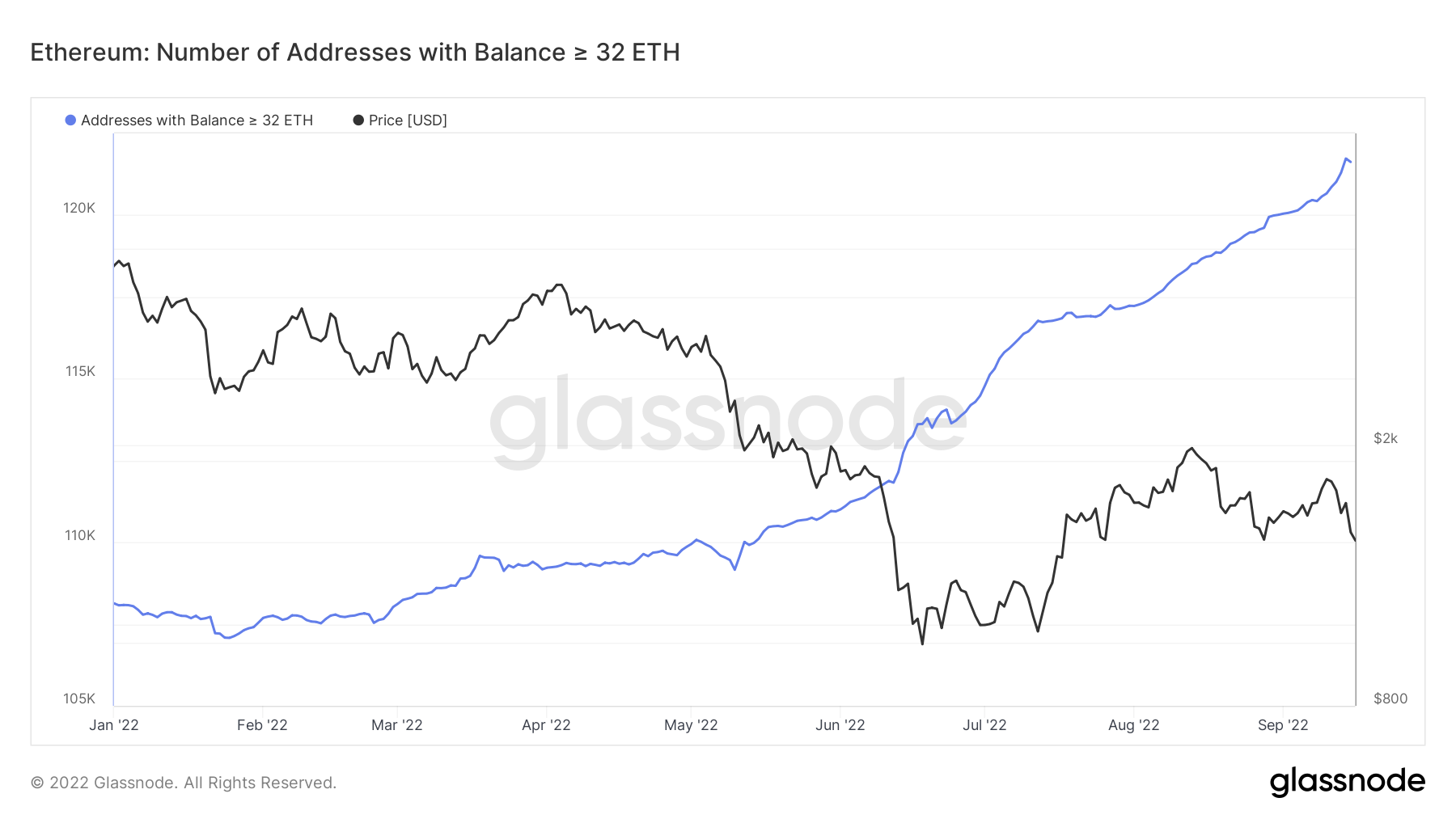

This is obviously a heavy chunk of change – worth $42,000 at time of writing – and hence not possible for the majority of investors. In fact, on-chain data below shows there are only 122,000 wallets holding greater than 32 ETH. That’s out of 86 million non-zero wallets.

So, enter staking pools.

So, enter staking pools.

In locking up their funds with a third party, investors can join pools with as little ETH as they like, with the third party gathering the funds to act as a validator. Think of it like buying equity in a company – you don’t own the whole company, but you get a percentage of the profits.

Only problem is, these third parties then control huge amounts of the network.

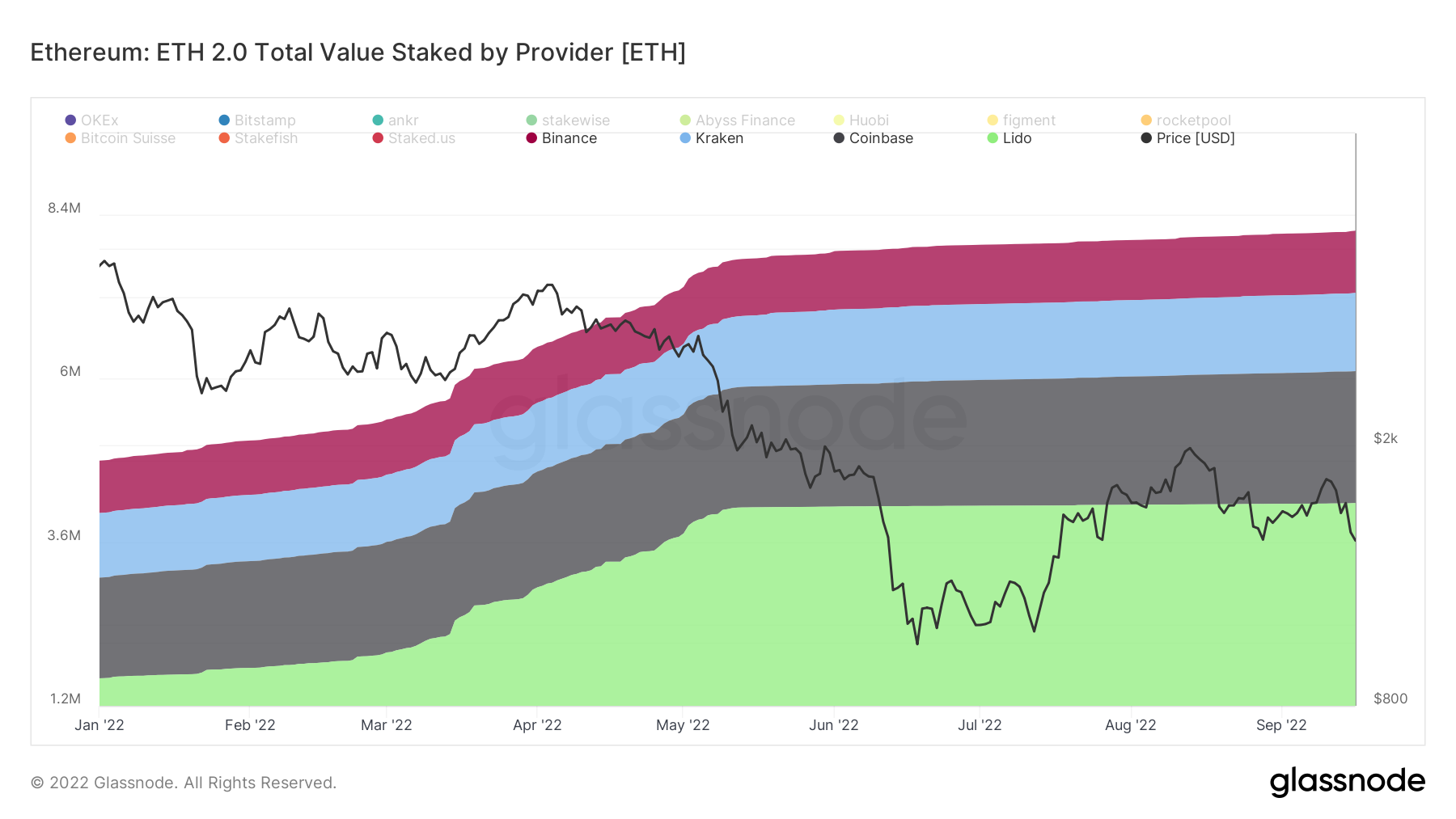

In fact, narrowing in on the four biggest staking pools shows the problem. Out of 13.7 million total ETH currently staked, 4.2 million is via Lido, 1.9 million via Coinbase, 1.1 million via Kraken and 0.9 million via Binance. That’s 59% of the total value staked through those four providers alone.

The data explains simply why some are concerned that the Merge to Proof-of-Stake has led to greater centralisation of the Ethereum network. Because in truth, it has – and it’s hard to argue with the above numbers.

It’s sobering to think about what could happen if one of the above providers suddenly stopped performing their staking duties, for whatever reason. Perhaps some kind of scandal at the company, or a regulatory reason (remember Tornado Cash) or any other unpredictable happening.

With so much staked ETH funnelled through these providers, it’s an immense amount of value – and a key, central source of risk for the entire Ethereum blockchain.