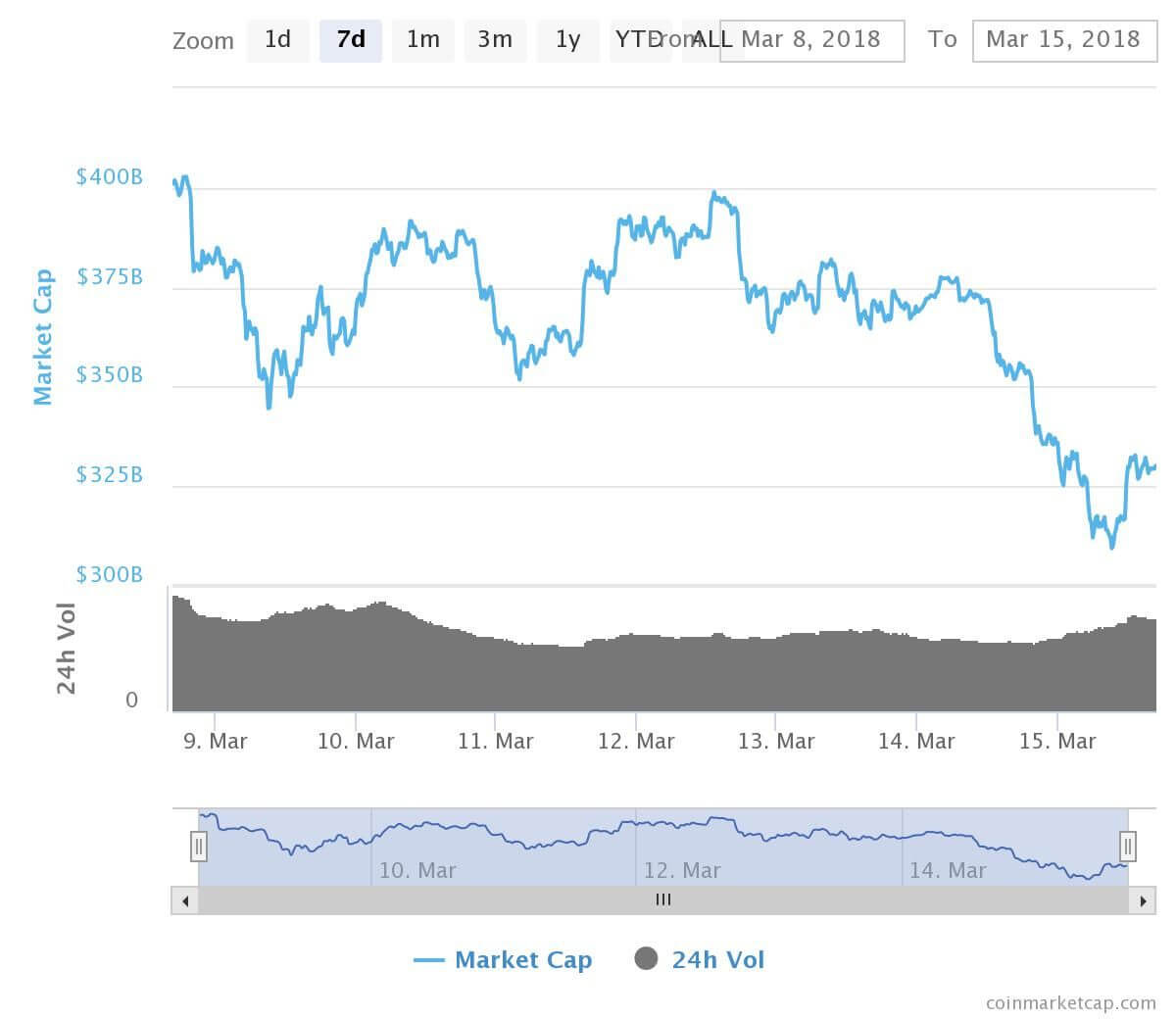

The cryptocurrency market has shed more $60 billion since Monday as the Google announcement that it will ban cryptocurrency related ads continues to take toll on the market. While it not unusual for the highly volatile market, the current slump marks one of the highest sell off after a similar depression early February.

Bitcoin fell slightly below $8000 on Wednesday as news of the impending ban spread. Increased regulatory scrutiny has also significantly contributed to the current sell-off. Cryptocurrency traders have come under intense pressure as regulators crack down from various fronts.

Total market cap is now estimated at 331 billion according to CoinMarketCap. About $37 billion has been wiped off in the last 24 hours alone.

On Monday, the total cryptocurrency market cap was in excess $396 billion compared to $330 billion on Thursday. Bitcoin alone had a market cap of $335 billion at its peak in December.

It is now has a market cap of below $140 billion and a market share of 43.2%. The flagship cryptocurrency has however been trying to gain its footing in the last hour.

On aggregate, Bitcoin, Ethereum and Ripple has lost 16%, 18% and 18% respectively in the last seven days. Most coins have lost anything between 15-30% over a similar period.

Bitcoin has lost 5% of its value on average in the last 24 hours. Most of the other alternative cryptocurrencies have similarly fell shedding anything between 5-10% of the value.

Second placed Ethereum has lost over 7% to trade at $613 according to CoinMarketCap. At its peak, it was gong for $1400 a unit in January. Third placed Ripple is now trading $0.7 after dipping 5% in the last 24 hours. Litecoin has somewhat been holding its ground losing only less than 1% during the same period.

The fact that trade volumes have been increasing in the last hour presents a ray of hope in the market.

The market’s slow recovery was rattled on Tuesday by a number of negative events. Earlier this week, IMF chief Christine Lagarde called on governments to do more to regulate cryptocurrencies raising concern over money laundering and other criminal activities.

The US Securities & Exchange Commission also issued subpoenas to a number of cryptocurrency exchanges.

Google Ban

Internet giant Google on Wednesday it will ban all cryptocurrency ads including ICOs. The move was taken ostensibly to protect consumers from harmful promotional material. In an update to its policy, Google also said it will ban CFDs and other highly speculative financial products.

IMF Chief’s Call for Regulation

IMF Chief Christine Lagarde also weighed in on cryptocurrencies in a blog post. While she noted the potential for Blockchain technology, she called on governments to establish more control over the sector.

Bitcoin Whale

This week, it also emerged that Mt Gox trustee Nabuaki Kobayashi has been dumping Bitcoin to pay off creditors of the now bankrupt exchange. The massive sell-off is thought to have set off a chain reaction among other traders that saw prices fall below &6000 in February.

He still holds at least 166,000 Bitcoin but local media reports indicate he cannot sell until he gets further authorization from the courts. The hearing will not happen until September.

Regulatory Scrutiny

In Japan, the Financial Services Commission has been imposing penalties on a number of exchanges for various violations. Bit Station and FSHO were suspended for inadequate security controls to safeguard customer deposits.

Coincheck, which was hacked late January was similarly issued with improvement orders. The exchange has paid $440 million as compensation to its customers for their stolen NEM tokens. NEM tokens worth at least $523 million were stolen in the attack.

Credit Card Bans

A number of banks have barred customers from purchasing cryptocurrencies using their credit cards putting further pressure on the market. The latest was the HDFC Bank, the largest lender in India.

In February, major US banks banned their customers from using their issued credit cards for cryptocurrency purchases. These included Bank of America and Citigroup.

This came after a flurry of claims after the February slump. Many of the customers who had used credit cards as leveraging tools would not be able to repay, it was feared.

The sustained pressure has seen many new entrant selling off in a bid to cut their losses.