Japan’s self-regulatory body for cryptocurrencies, the JVCEA, revealed that the number of active crypto traders in the country dropped off in March

Back in March, Japan saw a sudden spike in fiat deposits. This was shortly before the pandemic caused a state of emergency and led to a decrease in liquidity on crypto exchanges.

The Japan Virtual and Crypto Assets Exchange Association (JVCEA) revealed that the number of active and registered cryptocurrency accounts in the country had decreased from 2,048,501 in February to 2,044,806 in March of this year.

The data shows that 3,695 accounts may not have traded any digital assets.

A market analyst from Bitbank, Yuya Hasegawa, observed that the number of fiat deposits on exchanges increased during this period, even as the activity among crypto traders decreased.

It is speculated that this may have partly been caused by households that were expecting to receive a 100,000 yen stimulus payment (around $940), as proposed by the Japanese Government.

The deposits that were made were quickly withdrawn after Prime Minister of Japan Shinzo Abe declared a national state of emergency on April 8.

According to the report, the market turmoil generated after the onset of the coronavirus pandemic may have resulted in an increased demand for cash, which then forced users to withdraw their funds from crypto exchanges.

Despite the decrease in active accounts, Hasegawa highlights that it does not necessarily mean that the interest in cryptocurrencies is waning. The opposite appears to be happening instead, with Cointelegraph reporting cryptocurrency accounts that generally had low activity within the country observed two to three times more trading volume this week.

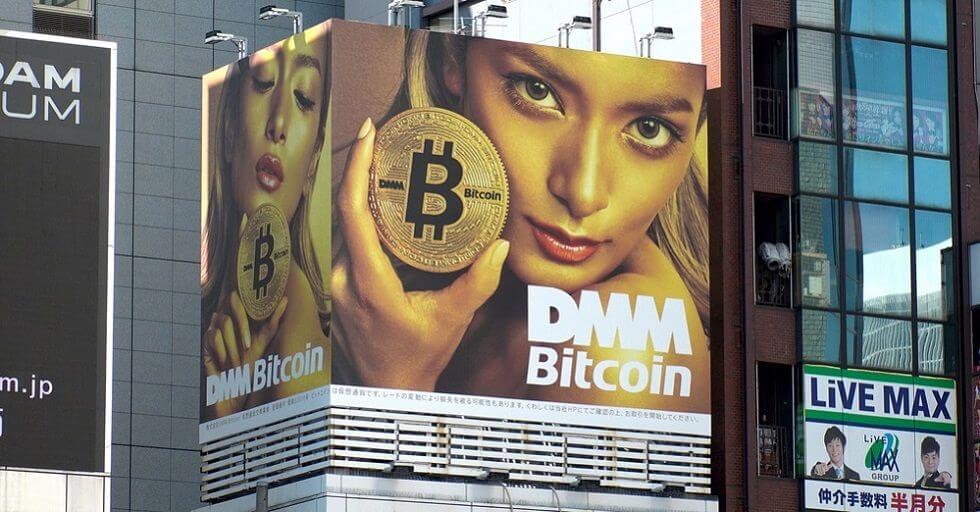

Japan is widely considered as a trailblazer in the cryptocurrency and blockchain technology industry. The government had formally recognised cryptocurrency as a form of money for processing payments as early as 2016. As well this, a bill introduced by the National Diet in the same year classified virtual currencies as a part of the growing field of financial technologies.

Cryptocurrencies are regulated by Japan’s Financial Services Agency, the entity responsible for monitoring all banking and investment in the country.

The Japan Virtual Currency Exchange association is a group of exchanges that are operating within the country, who have agreed to follow a set of rules and implement the industry’s top practices while operating in Japan.

The goal of the community is to make engaging in cryptocurrencies safer, more legitimate and more accessible for local consumers. It also functions as a single point of contact between government regulators and exchange operators.