AirSwap price went vertical on Thursday as cryptocurrencies attempted to recover. The AST token rose to a high of $0.1717, which was the highest level since September 19. At its peak on Thursday, the coin was up by more than 67% from the lowest level this month.

What is AirSwap and why is it rising?

AirsSwap is a small but fast-growing peer-to-peer decentralized exchange (DEX) that makes it possible for people to trade ERC20 tokens. Its goal is to solve the challenge of order books by replacing it with an off-chain negotiation and on-chain settlement. The challenge with order books is that they are difficult to scale and are often expensive for users.

AirSwap is made up of three key parties. First, there are makers and taker. The taker and maker will typically perform a trade negotiation off-chain. The third party in this case is the Ethereum smart contract, which the taker calls when ready to fill an order in the blockchain.

Data compiled by Dune Analytics show that the cumulative all-time volume on Ethereum is over $2.1 billion. It has conducted over 296k swaps and collected more than $2.2 million in fees. In September, AirSwap filled 72k swaps and handled volume worth over $155 million.

AST is the native governance toke for the ecosystem. 18% of the token in circulation has been staked while over 317k ASTs were distributed from the treasury.

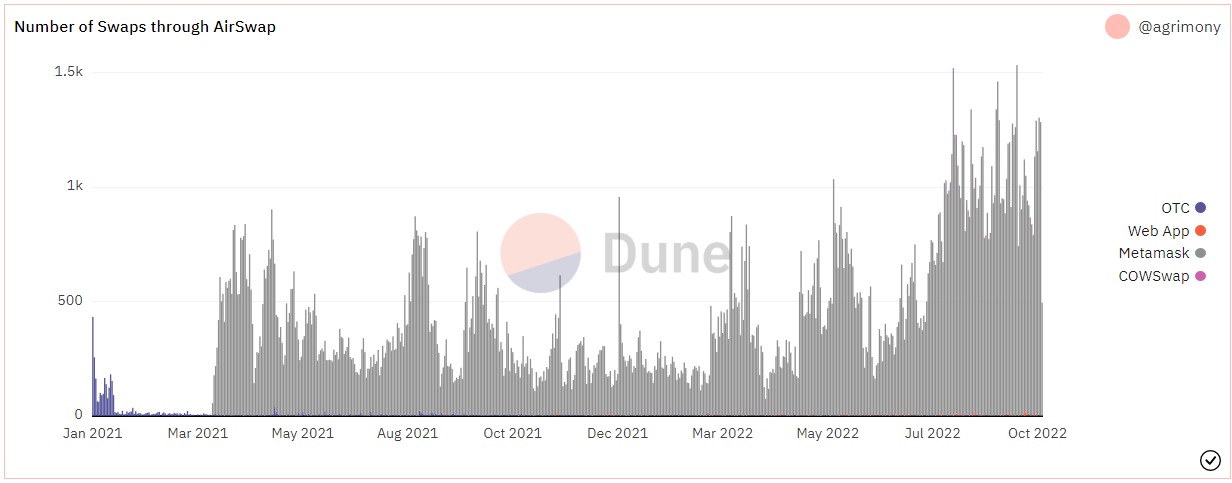

It is unclear why the AirSwap price went parabolic on Thursday since there is no direct cryptocurrency news. A possible reason is that the number of swaps done through AirSwap has been increasing even as cryptocurrencies recoil.

Still, the total volume of transactions has pulled back slightly recently as is with other cryptocurrency exchanges. Another possible reason is that this could be a pump-and-dump scheme.

AirSwap price prediction

The daily chart shows that the AST price has been in a tight range recently. It then went parabolic on Thursday as demand for the coin rose. AirSwap has moved above all moving averages while the Relative Strength Index (RSI) have moved to the overbought level.

Therefore, since there is no major reason for the rally, AirSwap will likely pull back in the coming days. If this happens, it will likely drop to the next key support level at $0.12. A move above Thursday’s high of $0.17 will invalidate the bearish view.