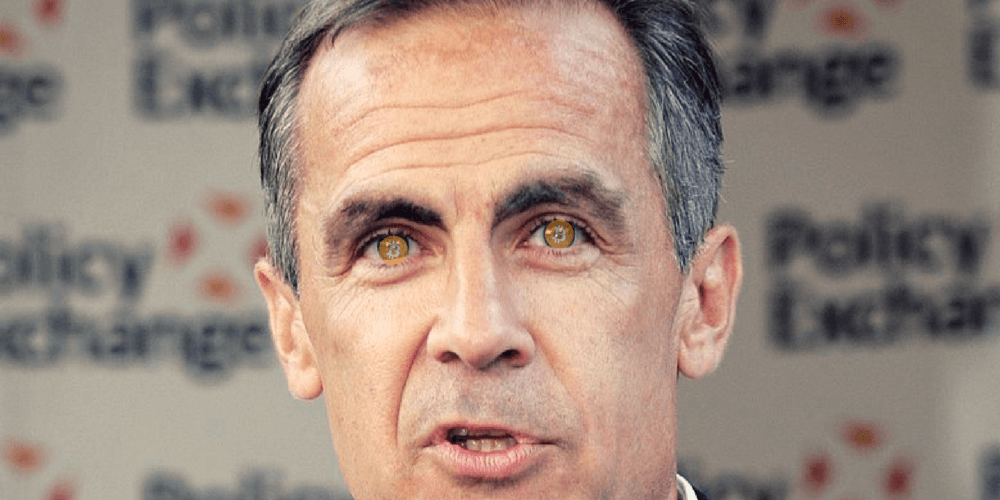

Mark Carney, the Governor of the Bank of England (BoE), has claimed that “[Bitcoin] has pretty much failed thus far on … the traditional aspects of money. It is not a store of value because it is all over the map. Nobody uses it as a medium of exchange.”

These comments were made Monday evening at an event at Regent’s University in London.

With this statement, Governor Carney has contradicted Goldman Sachs, which recently acknowledged Bitcoin as a legitimate form of money. The investment bank distributed a report to their clients titled “Bitcoin is Money.”

To be considered a form of money, a given medium must satisfy three criteria: It must be usable as a unit of account, a store of value, and a medium of exchange. Bitcoin meets all of these requirements.

By its nature, Bitcoin is clearly a unit of account. The entire Bitcoin blockchain is essentially a system of recording and maintaining accounts. Bitcoin is also utilized as a medium of exchange by thousands of people every day. In the past 24 hours alone, over 200,000 Bitcoin transactions have taken place.

The best argument against Carney’s claim that “nobody uses [Bitcoin] as a medium of exchange” is to cite the various instances of individuals using Bitcoin for that exact purpose, such as the fifty luxury flats in Dubai that have been purchased using Bitcoin. Although, one doesn’t need to look at the extremely wealthy to see Bitcoin being utilized as a medium of exchange—Bitcoin users can spend their coins on any product offered on Overstock.com and other retailers, online and offline, who accept payment in cryptocurrency.

While it certainly is true that high transaction fees and slow confirmation times have made Bitcoin unattractive as a medium of exchange in small transactions, especially in comparison to other cryptocurrencies such as Litecoin or Bitcoin Cash, these issues do not disqualify Bitcoin as a medium of exchange. Gold, one of the oldest media of exchange in human history, is far more cumbersome and expensive to utilize for small transactions than Bitcoin. However, no central banker would ever make the claim that “gold has failed as money” because there are preferable media of exchange.

Due to Bitcoin’s volatility, the argument could be made that it is unwise to hold it as a store of value. However, this is different from claiming that it is “not a store of value.” That statement is simply false. Anyone who has purchased Bitcoin with the intention of holding it as an investment is utilizing it as a store of value.

Governor Carney’s remarks also only apply to individuals in the developed world whose national currencies and equity markets are stable. In Venezuela, for instance, thousands of citizens are choosing to mine and hold Bitcoin and other cryptocurrencies as an alternative to earning and holding the hyperinflated bolívar. In comparison to the bolívar, Bitcoin is a far safer store of value.

The central banker’s dismissive comments are typical of the mainstream finance industry’s attitude towards cryptocurrencies thus far. However, as more and more people begin accepting and using digital currencies, this attitude will become less and less prevalent, and more financial institutions will be going the way of Goldman Sachs, not the Bank of England.