The Bank of England’s (BoE) Governor has become the latest to take a stand against the cryptocurrency market, calling for the industry to be held to the same standards as the traditional financial system.

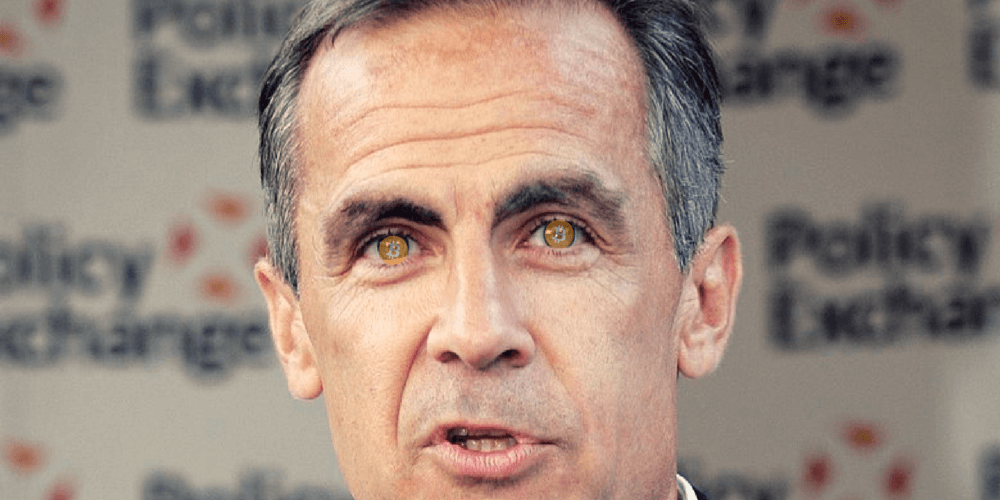

Addressing the inaugural Scottish Economics Conference, at Edinburgh University, via a video link, Mark Carney said that authorities need to decide whether to ‘isolate, regulate or integrate crypto-assets and their associated activities.’ In his opinion, though, rather than banning them like China has done, a better approach would be to ‘regulate elements of the crypto-asset ecosystem’ to tackle illegal activities, protect the financial system, and promote the market’s integrity.

“The time has come to hold the crypto-asset ecosystem to the same standards as the rest of the financial system,” Carney added. “Being part of the financial system brings enormous privileges, but with them great responsibilities. In this spirit, the EU and the U.S. are requiring crypto exchanges to meet the same anti-money laundering and counter the financing of terrorism standards as other financial institutions. In my view, holding crypto-asset exchanges to the same rigorous standards as those that trade securities would address a major underlap in the regulatory approach.”

Kevin Murcko, CEO of cryptocurrency exchange, CoinMetro, responding to Carney’s remarks said that while the content of the governor’s speech was ‘highly negative and damning,’ it illustrates that ‘a legal financial framework for the crypto space is quickly becoming a reality.’

Carney also spoke about how cryptocurrencies remain an inefficient means of exchange. In his opinion, this is a fundamental reason to be wary of their long-term value. According to Carney, no major retailer or online retailer accepts bitcoin as a form of payment in the U.K., whereas only a handful of the top 500 online U.S. retailers do. Despite this, however, a recent study has found that small and medium-sized enterprises (SMEs) believe that digital currency payments will become a reality on U.K. high streets within two years.

Even though Carney said that cryptocurrencies don’t pose a risk to financial stability due to its relative small size compared to global GDP, he said that in the future that may change.

“Looking ahead, financial stability risks could rise if retail participation significantly increased or linkages with the formal financial sector grew without material improvements in market integrity, anti-money laundering standards and cyber defences.”

Commenting on Carney’s remarks, a spokesperson for CryptoUK, the UK’s first self-regulatory trade body for the cryptocurrency industry explained the importance of discussions between the cryptocurrency industry and regulators

It is hugely important that policymakers and the Bank of England do not simply try to retrofit existing financial regulation onto this industry. Instead we need close dialogue with regulators over the coming weeks and months to develop a new framework and seize the opportunities that this sector can offer. The UK has an exciting opportunity to become a world leader in the crypto economy and to attract new talent, particularly in a post-Brexit climate. Now more than ever is the time to show that our financial markets invite financial innovation through a regulated framework.”

While Carney is dismissive of cryptocurrencies, claiming that bitcoin has failed to fulfill its role as money, it’s important that financial institutions should be careful not to stifle innovation.