Binance Coin climbs above Polkadot (DOT) and ChainLink (LINK) as the 5th largest cryptocurrency by market cap.

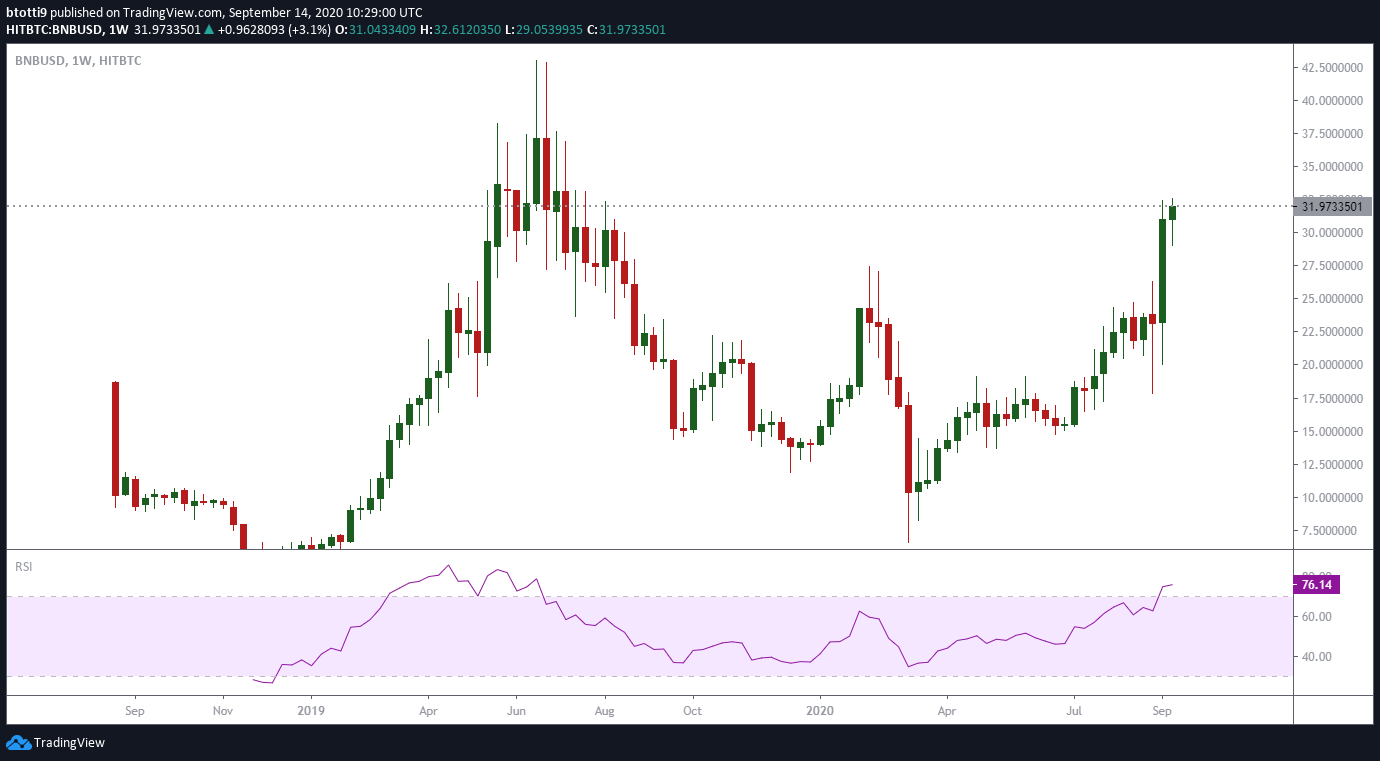

BNB/USD price traded at its highest price since August 2019 when it touched $32.00 over the weekend. After dipping to lows of $18.00 days ago, the price of Binance Coin has jumped more than 42% over the past seven days.

Over the weekend, BNB/USD jumped from lows of $25.00 to see bulls aim at breaking above a major resistance area. Above that, a continuation of the recent uptrend could potentially set bulls’ next target near the all-time high around $40.00

Thanks to the upside, Binance Coin has climbed into 5th spot on CoinMarketCap ahead of Polkadot (DOT) and ChainLink (LINK) in terms of market capitalization.

Per data on the market aggregator site, Binance Coin has a market cap of $4.54 billion; Polkadot has $4.44 billion while ChainLink drops to 7th spot with $4.13 billion as of writing.

Binance Coin uptrend

BNB/USD’s recent upside follows a bullish breakout associated with the growth witnessed on the Binance exchange and Binance Chain.

Other than the unveiling of Launchpool and the debut Bella Protocol (BEL), a lot of the growth is down to increased demand on Binance Chain and new DeFi platform Binance Smart Chain (BSC).

According to Bscscan, which looks very similar to Etherscan, the daily transactions count on the Binance Smart Chain spiked from around 30k on Saturday to hit over 139,000 Sunday.

Binance CEO Changpeng Zhao tweeted about the metric, noting that at the time that transaction had reached 14% of Ethereum’s. Burgerswap accounted for most of the transactions, with investors staking nearly $400 million worth of BNB tokens.

Apart from BurgerSwap, Binance Smart Chain could see massive volume from Cream Finance and BakerySwap.

BNB/USD technical picture

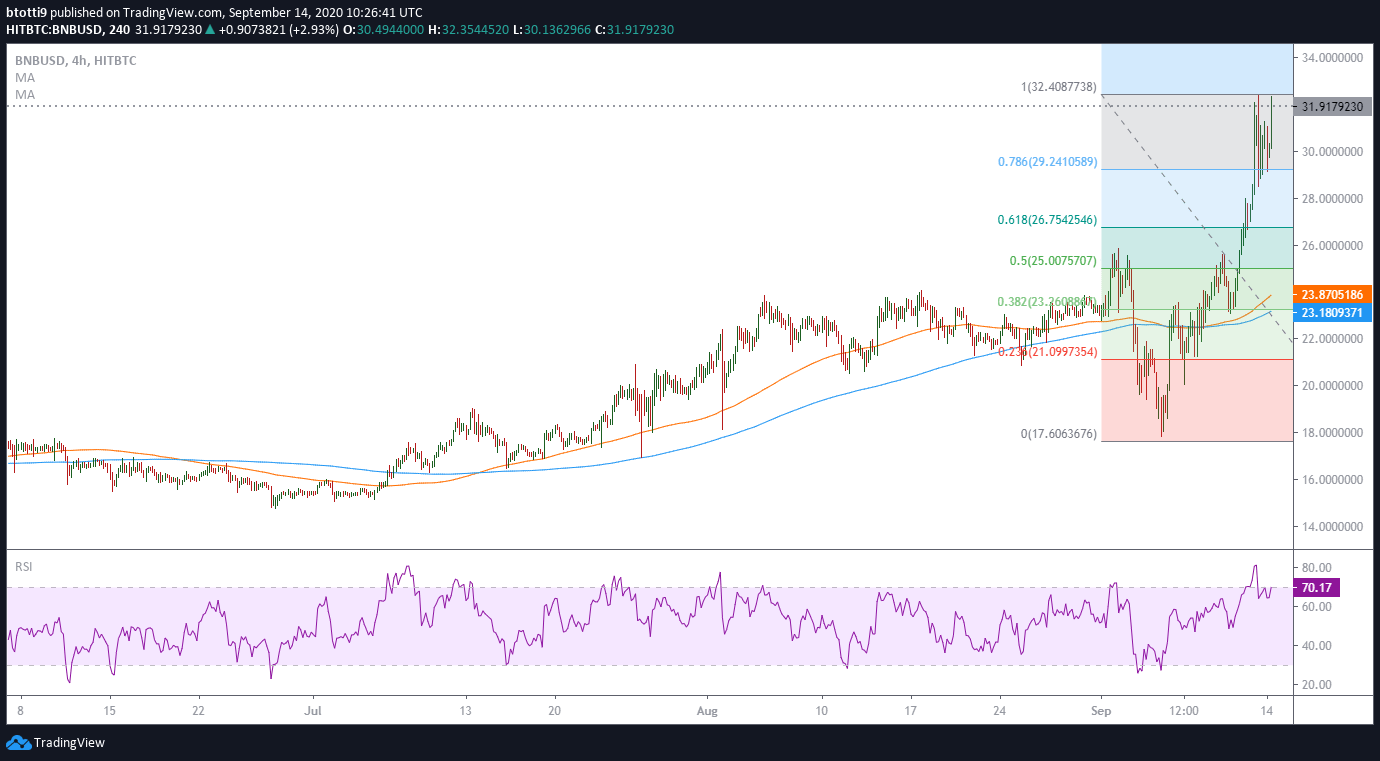

BNB/USD managed the latest bounce after it cleared resistances at the 50-MA and 200-MA, with increased buying volume providing impetus to the upside momentum. A look at the 4-hour chart shows that the MACD is bullish and the RSI isn’t overextended into overbought territory yet.

If bulls manage that, a close above $35.00 on the weekly candle could see BNB/USD hit $40.00. If a reversal forms, BNB/USD has healthy support at the 100 MA and 200 MA around $23.18 and $23.89.

As of writing, Binance Coin is trading at $32.07 and is in a strong uptrend on the 4-hour time frame.