Binance Coin price shot 48% to a new all-time high of $196, with bulls likely to see $200 shortly

Binance Coin (BNB) has skyrocketed by 48% in the past 24 hours to trade at a new all-time high of $196. BNB price has increased by more than 330% this month, having traded for around $44 on 1 February. As per the fundamental and technical picture for BNB/USD, a brief breather could be followed by a spike above $200.

The native coin in the Binance ecosystem, including the Binance Smart Chain, is now the 4th largest cryptocurrency by market cap. According to CoinMarketCap, BNB’s cap now stands at $29.7 billion to put Binance Coin ahead of Polkadot (DOT), Cardano (ADA), and XRP.

Binance price rallies off strong Binance Smart Chain

As Santiment recently pointed out, BNB price has surged amid an increase in the number of addresses holding 100,000 or more tokens. For example, there were just 26 such addresses in August 2020 but that number rose to 48 in mid-January 2021. It is around this time that BNB price posted its “initial liftoff”.

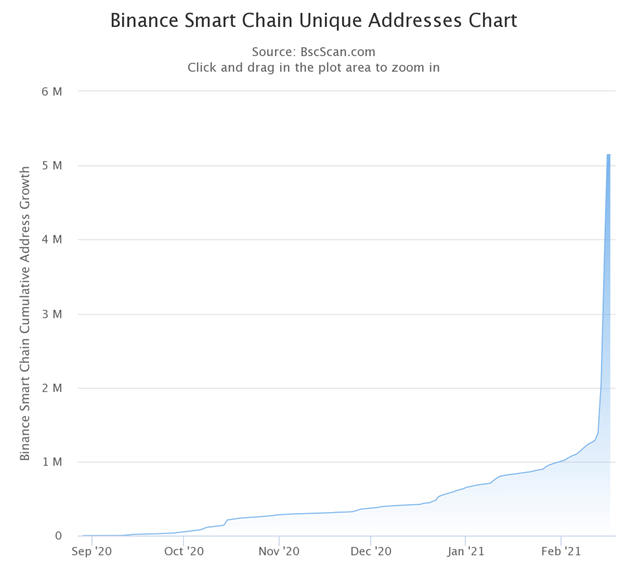

Growth for Binance Smart Chain (BSC) looks to be another spark that has ignited BNB’s recent rally. Launched in September 2020, the decentralized finance (DeFi) venture has seen massive user uptake.

It now sees more daily transactions than what has been recorded on the Ethereum network and adoption is set to continue as the unique addresses metric rises.

On 16 February Binance CEO Changpeng Zhao posted the following regarding BSC.

“There are currently more daily transactions on #BSC than on ETH network. Soon, the total value transacted on #BSC will also surpass ETH. Just a matter of time now. #BNB (I am not against ETH. I support growth of both.)”

The Binance CEO now believes BSC adoption is just beginning.

“I believe #BSC has passed the tipping point. Now all the wallets and other tool makers will want have better and native support for #BSC, and not just a #ETH variant. Virtuous cycle now.”

Binance Coin price: what next?

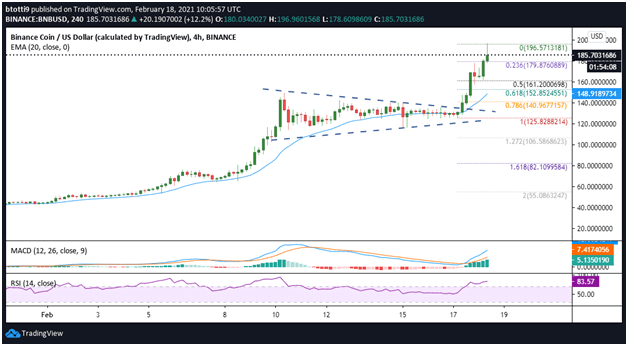

BNB price is well above a bearish trend line that had capped its growth near $130. Price action on the 4-hour chart shows BNB/USD broke above multiple resistance levels on its way to the $196 high.

A new support level is at the 0.236 Fibonacci retracement level ($179.87), which could provide the springboard to higher prices. If bulls break above immediate resistance around $188, they can retest the intraday peak and even rally to a new record above $200.

Both the MACD and RSI on the 4-hour time frame support the potential for more gains.

On the downside, the short-term outlook suggests bulls have robust support at $165, the 0.5 Fibonacci level ($161.20), and the 0.618 Fib level ($152.85). If there’s increased downward pressure in the short term, the BNB/USD pair could rely on strong support at the 20-EMA (4-hour), currently around $149.21.