Binance Coin has, after over a week of retracing, finally made a move that could propel its price back to recent highs

Fundamentals and past price performance

With Binance Smart Chain (BSC) rushing the market and becoming increasingly popular as a DeFi platform in recent weeks, BNB has not gone unnoticed. Since any performance of the BSC is linked to how people perceive and value BNB, it is safe to say that Binance Coin’s fundamentals are improving day after day.

Changpeng Zhao, the CEO of Binance, posted a tweet showing that BSC is sustaining 2x daily transaction volume when compared to Ethereum, while its underlying BNB token is at only 1/5 of ETH’s market cap:

https://twitter.com/cz_binance/status/1365236750893805568

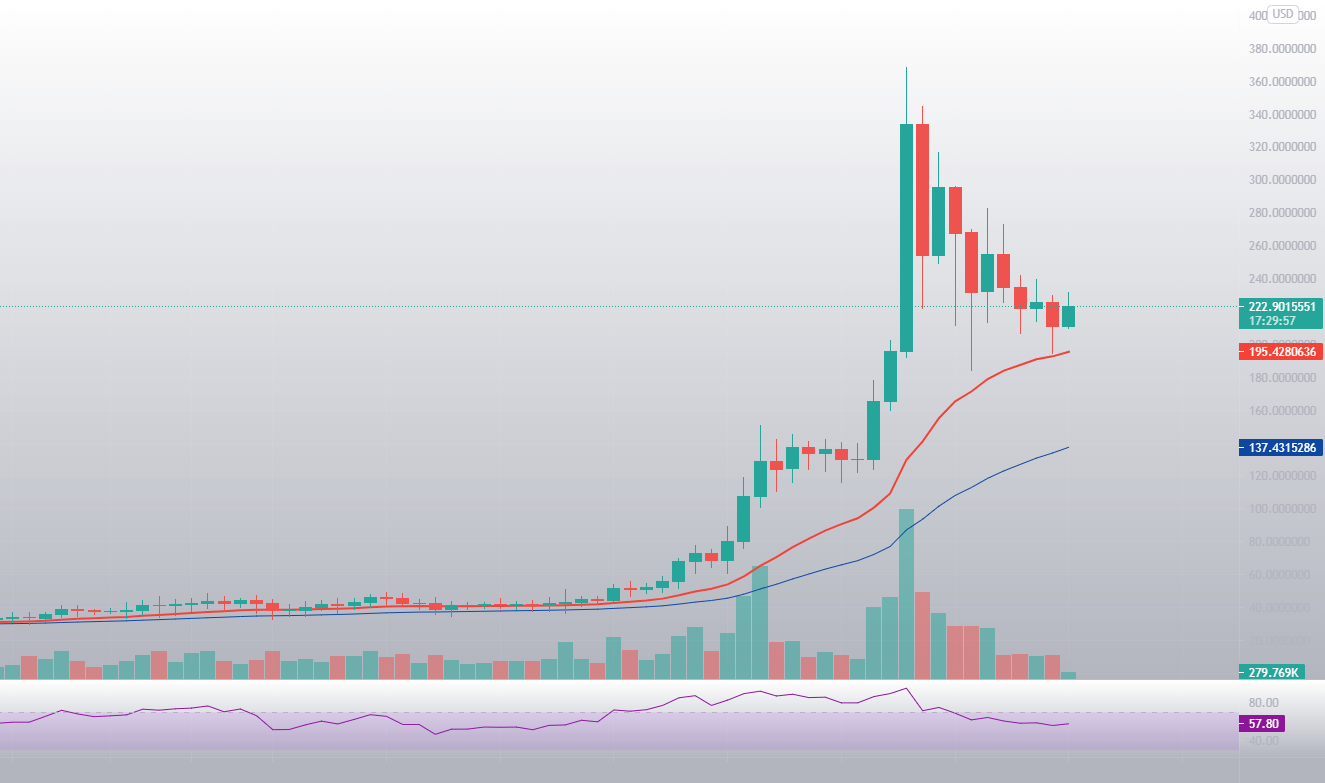

BNB/USD daily chart price analysis

After reaching its all-time high of $368.29, Binance Coin entered a retracement. After nine days, this retracement might be finally coming to an end after it managed to find strong support on the 21-hour EMA, which pushed its price up slightly. However, this might just be enough to propel its price back to its recent highs. On top of that, the overall cryptocurrency market is turning green, suggesting BNB will follow suit.

BNB/USD daily price chart. Source: TradingView

BNB’s RSI on the daily timeframe is slowly descending towards the regular trading range, with its current value sitting at 57.80.

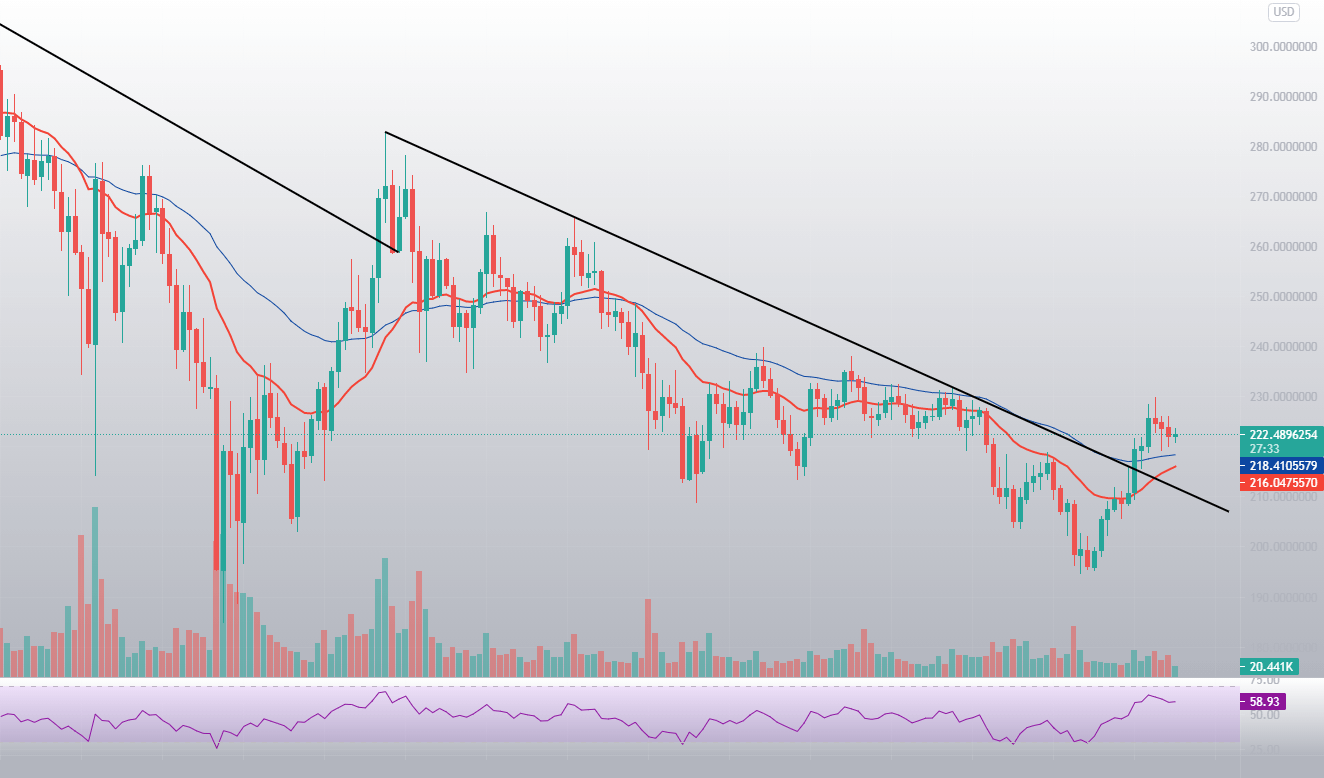

BNB/USD hourly chart price analysis

Zooming in to the hourly timeframe, we can see that BNB has been following a descending line ever since 24 February. However, its recent push managed to break above it, as well as stabilising its price without dropping back below.

BNB/USD 1-hour chart. Source: TradingView

BNB’s currently trying to confirm its position above this level, with both the descending line, 21-hour and 50-hour EMAs below it. However, not everything is up to BNB, as overall market movements played a significant role in recent days.