Will Binance Smart Chain’s recent spate of hacks bring a bearish June for Binance Coin?

Being the fourth largest coin by market cap, Binance Coin (BNB) had made a major stride in price the last few months. But with major corrections beating it down and flash loan attacks on the Binance Smart Chain causing concern, will Binance Coin rise or fall in June?

Binance Coin started out at just a tad below $37.5 in 2021, but quickly rose in value and peaked out at $676 before making sharp corrections. As of 12th June, it is hovering at half that value of $331. Many believe that it has now finished its major bull run and is finding a resting value, while others believe that this is just a small setback from which it will recover.

What does June have in store for the evolved exchange token? Let’s have a look.

BNB One Year Performance and Current Price

Source: CoinMarketCap

In mid-June 2020, BNB was still a low-priced coin, worth $16. At that time it was more or less still an exchange token for the Binance exchange, giving discounts on a trading fee on the platform. As DeFi started spinning up and Binance launched its Binance Smart Chain (a smart contract-enabled parallel blockchain to its Binance Chain), things started to get interesting.

The Binance Coin quickly rose in value and hit its all-time high of $676 on 3rd May 2021. As BNB and the crypto market in general started running out of steam, many coins witnessed an erosion of their price, as did BNB. Today it is priced at $331, which is 50% of its ATH, but still an amazing feat since this is a 2068% growth in just 12 months.

Where to Buy Binance Coin

Binance Coin Price Factors in June 2021

There are a few factors in the crypto arena that can impact the price of BNB.

DeFi Regrowth

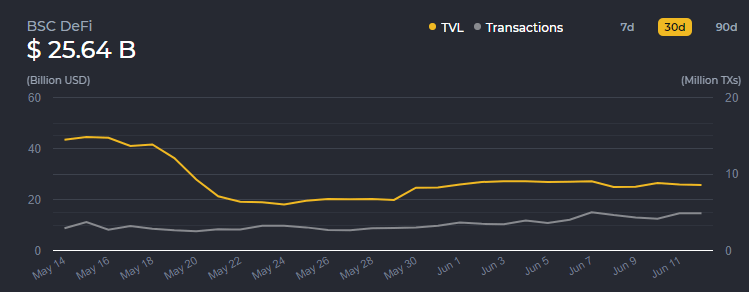

At its peak, the Total Value Locked (TVL) in DeFi projects was around $86.191 billion, just a month ago on May 12th. As sentiments cooled, the value has dropped to $56.3 billion, but even then the BSC still retains more than 45% of that locked value at $25.64 billion.

Source: www.defistation.com

As a major DeFi blockchain, BSC’s increased utilisation of DeFi protocols can drive up Binance Coin’s value in June as DeFi once again starts to house more and more value.

Flash Loan Attacks

The past few weeks have been filled with seven different DeFi platforms running on BSC subject to flash loan attacks, where bad actors were able to exploit the smart contracts to take out a flash loan (a quick and uncollateralised loan which must be returned usually within one block’s time), buy other assets en masse, which caused the latter’s value to rise against the loan, and then immediately sell out to return the loaned amount and keep the profits.

The vulnerabilities, though not on Binance Smart Chain itself but on platforms that are built on it, have their effects on Binance Coin, with the latest attack on 4th June. Binance has called for developers to code their applications in a better manner and even has offered free consultations through PeckShield and CertiK Security Leaderboard, two famous blockchain security firms.

While a robust security measure will likely not have a positive impact on BNB price in the short term, another exploit will drag its value down further.

Binance Coin Forecast

The crypt world is shaken by different governments taking different stances on cryptocurrencies lately, and this can have both positive and negative impacts on the Binance Coin price. In the meantime, let’s put aside the fundamental indicators and look at what different technical analysts have to say about the BNB price forecast.

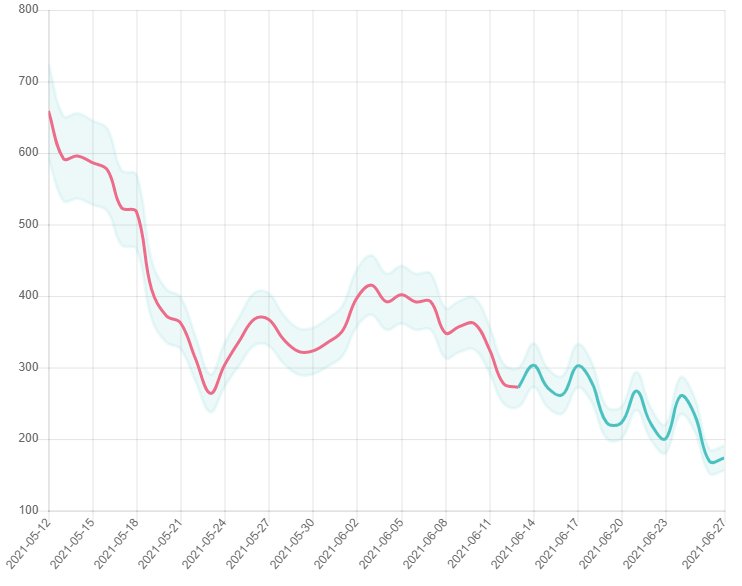

Source: www.gov.capital

Using their proprietary machine learning system, Gov Capital is able to take in a variety of inputs such as volume, past performances, and market cycles. According to the platform, the short term negative trend will continue and the month might close with BNB at $173, with an optimistic maximum price at $190 and a pessimistic outcome around $151.

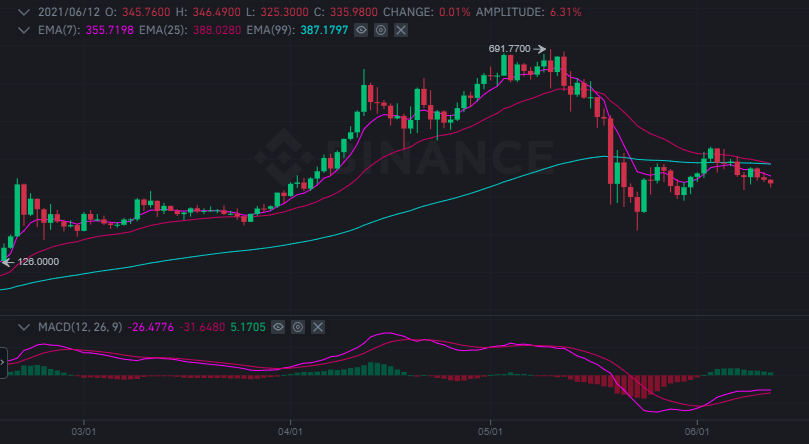

Source: Binance

Looking at the 1-day candlesticks of BNB, the trend also shows the same using MACD. The magenta line (MACD) in the lower graph is about to make a bearish crossover, which means the prices are likely to fall. At the end of June, the Binance Coin could go below the mid $200 range.

The above two predictions give the same outlook towards a slightly bearish Binance Coin market. Of course, this is a purely technical analysis that employs price movements and past trends. A change in market sentiment could flip this downward move (or potentially propel it faster).

One key fundamental move that can push BNB more into the red is another exploit on any of the several DeFi protocols that are constantly popping up on the chain. Apart from that, with the next fiscal budgets coming out, any move by a major country towards curbing cryptocurrencies will also add to this.

On the other hand, one major DeFi booster will be President Biden’s proposed budget. The estimated $6 trillion will lead to more fiat injection in the US economy that will simply lead to inflation and lower interest rates even further.

A huge amount of Dollars were printed (real and virtual) by the Federal Reserve under former President Trump’s coronavirus relief funding, and that was a major driver in pushing people towards investing in cryptocurrencies and DeFi based farming, which eventually led to a boom for BNB as BSC based platforms started attracting investments.

Please note, the above is a purely opinion-based piece, based on relevant data available. It should not be deemed as direct investment advice.