Bitcoin (BTC)

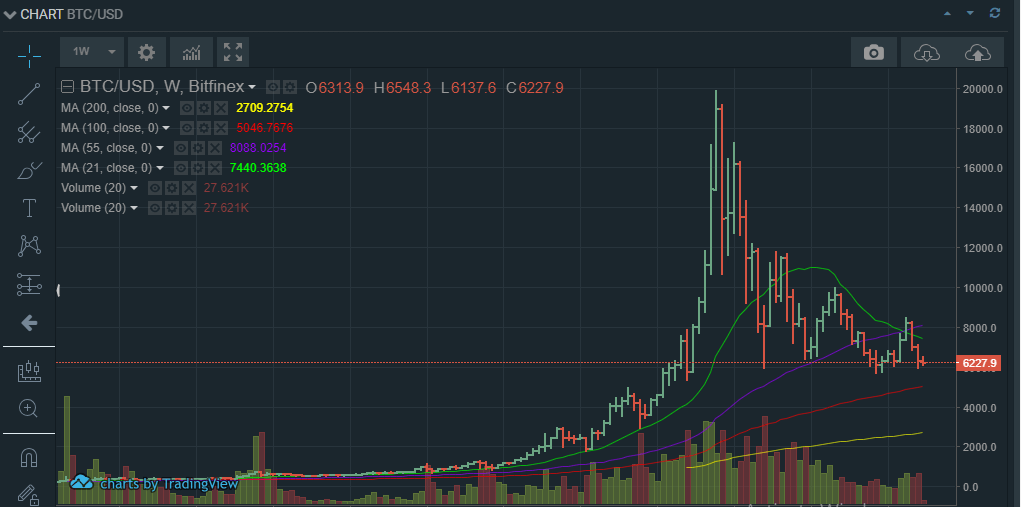

Bitcoin (BTC) is in the third bearish wave after its last rally failed at $8300. If the last two waves are anything to go by, then Bitcoin is possibly headed to a low of about $5000 – $4800.

At the moment, it is struggling to hold support at $6200. If it breaks below this level, then $5000 is very likely. This could be followed by a sustained period of consolidation. That’s because if it breaks below $5800, which was the last low before the failed $8k rally, chances are that investor interest would decline, making a steep rise in the near-term almost improbable.

In the near short-term (24-hours), bitcoin confirms the bearish trend that is likely pushing it towards $5k. It has been trading in a range between $6500 and $6200 for the last 5 days. This means that sellers are pushing the price down and testing support, while buyers are unable to move the price anywhere higher than this support region.

As such, chances are that bears could force the price to break below $6200, and push it lower towards $6000 – $5900 within the next 24-48 hours. However, a sudden increase in volumes, as is common in crypto could push the price back to $6500 in the day.

Ethereum (ETH)

Ethereum (ETH) like the rest of the market is tanking at the moment. In the long-term charts, Ethereum has broken below the 55-day moving average which means that $150 is the next key support level. With market volumes declining, there is a good chance that this long-term support level could get hit soon.

In the day, Ethereum is now in deep bear territory, having broken below the $300 price level. Given that today’s drop comes after yesterday’s bearish continuation pattern, the next 24 hours could see its price break below $200.

Of course, it is also being pushed lower by bitcoin’s increased bearish momentum, which seems to be headed towards $6000. If

breaks below $200 and establishes support at $150, it could consolidate at this level before any bull run happens. That’s for the same reason that bitcoin is headed into consolidation, a decline in investor interest due to the lower prices.

Ethereum Classic (ETC)

After the Coinbase listing gave Ethereum Classic (ETC) a push above $21, it seems to have succumbed to the bear, and is now trading at $12. From the long-term charts, it is clear that Ethereum Classic (ETC) could test $10, it’s long-term support level.

In the day, Ethereum Classic (ETC) is clearly in a bearish trend, and selling volumes are on the rise. If this momentum continues, Ethereum Classic (ETC) could test $10 within the day.

A break below this price level could see Ethereum Classic (ETC) test $7. However, if there is a marketwide rebound, Ethereum Classic (ETC) could rise back to around $17, though it’s highly unlikely under current market conditions.