Bitcoin Cash (BCH) could target $900 if bulls establish support above its 52-week high of $774

Bitcoin Cash price has rallied nearly 70% in February, with the coin’s parabolic rally taking it past the $700 price level. BCH traded as high as $770 on most major exchanges, and remains bullish despite an easing-off seen over the past 24 hours.

Even so, BCH/USD is trending at its highest price level since August 2018; with this month being the best since the 98% rally in April 2018.

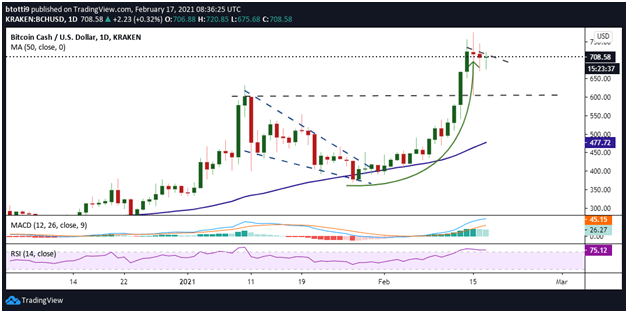

The uptrend, as seen on the daily chart below, has caused Bitcoin Cash’s market cap to rise to see the cryptocurrency climb back into the top 10 on CoinMarketCap. At the time of writing, BCH’s price is $706, with its market cap of $13.1 billion placing it ahead of ChainLink (LINK) with $12.7 billion.

Bitcoin Cash price parabolic rally

As shown on the daily chart, Bitcoin Cash price began to rally in late January this year. After trading within a falling wedge pattern from highs of $630, the BCH price broke after hitting a floor at $371 on 28 January.

A parabolic rise saw bulls enjoy a series of higher highs as prices surged above horizontal resistance lines at $530 and $600. Bitcoin Cash then broke above $630 on 13 February, before spiking to highs of $755 a day later. The upside above $700 followed Kim Dotcom’s tweets about the Bitcoin fork.

The Megaupload founder touted BCH as a better cryptocurrency, saying it’s currently undervalued. He even went on to establish a website (whybitcoincash.com) to explain why the price of Bitcoin Cash will continue to surge.

The past 24 hours have however seen sellers push hard against further upside moves with a short-term downtrend line capping action since the sharp fall to lows of $607. The easing of the upside momentum is unlikely to hold long, as the candlesticks suggest; bulls have not let bears have their way.

Bitcoin Cash price: Up or down?

Buyers have managed to stay above $700 despite the sell-off pressure, which suggests a breakout above $710 could allow for a retest of the 52-week highs at $774. Above this level, bulls can target $900, with attempts at the psychological $1,000 more likely.

On the contrary, if the BCH/USD pair fails to hold above $700, it could drop to $669 and then $603. It’s likely to trade sideways above this price level but will flip bearish below the $600 level.

Such a move could suggest weakness on the part of bulls, which would then invite bears to try reaching the 50-day simple moving average. The 50-SMA (4-hour chart) provides a solid support zone at $477.