The ex-hedge fund manager predicted last month that Bitcoin could hold at $42,000

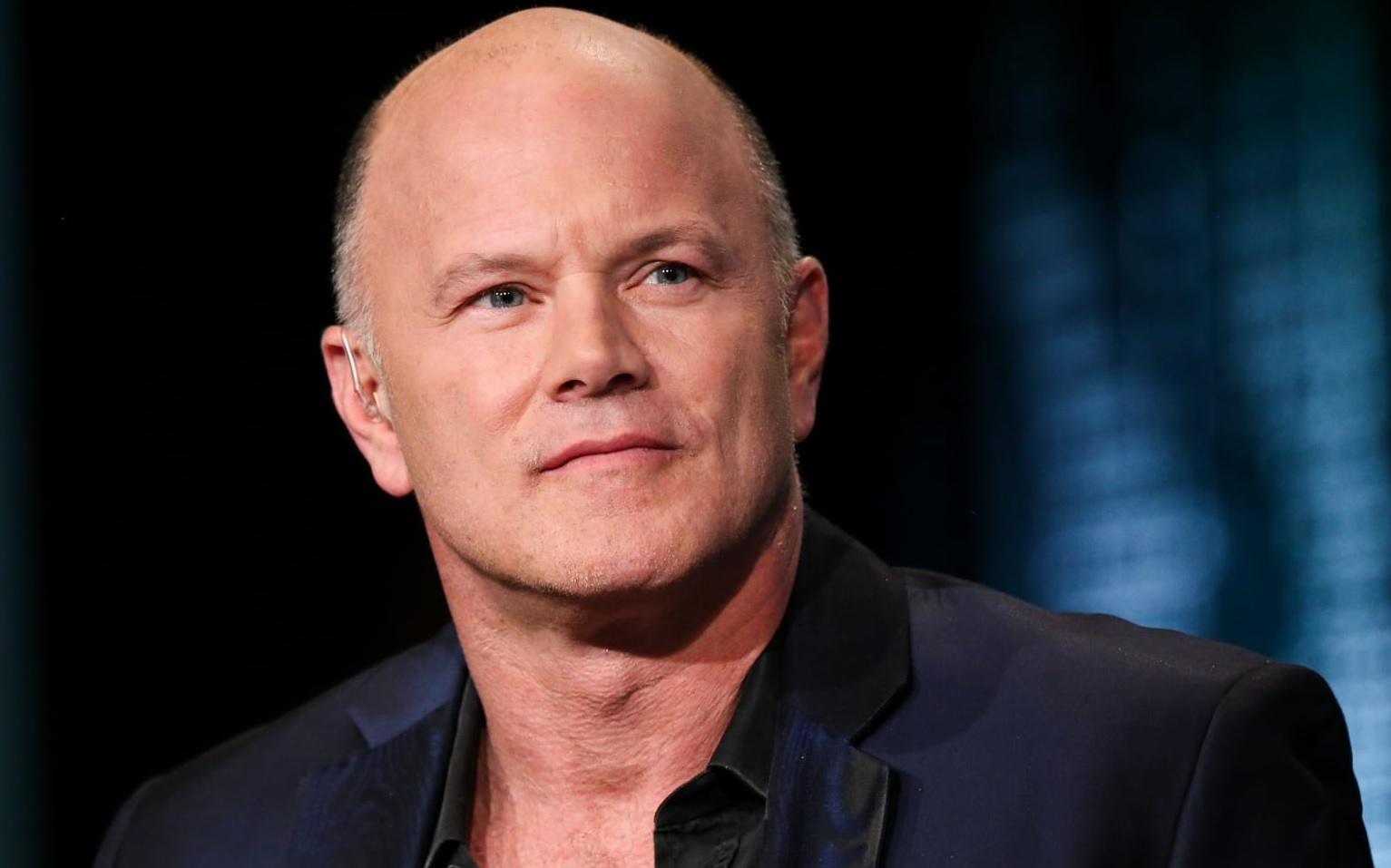

Financier and crypto investor Mike Novogratz recently told CNBC that he expects to see Bitcoin fall even further to a price floor much around $40,000 or $38,000. Bloomberg reported the change of heart from the crypto bull who recently opined that Bitcoin could hold at $42,000.

Delving into the projection, Novogratz stated that he would put a hold on buying crypto again. The Galaxy Investment chief added that there is a substantial amount of institutional money, ready to pounce on the opportunity to get into the space.

"(There is a) tremendous amount of institutional demand on the sidelines," he said.

He insisted he is not tense about the medium-term performance of cryptocurrencies even though the next few weeks will be quite volatile.

Federal Reserve meeting

Currently hovering around the vital $41,900 mark, the world's largest crypto asset has suffered a significant decline in the past few days. Experts attributed last week's dip to the uncertainty caused by the minutes of a December Federal Reserve, hinting at an increase in interest rates.

The minutes published last Wednesday showed that the Reserve suggested that it could seek to take a much faster than anticipated path towards hiking interest rates and reducing monetary support policies, citing a strengthening economy, inflation, and the labour market. Some members of the Fed found it necessary to start shedding off some of its $8.8 trillion balance sheet.

Bitcoin has been highly volatile in recent months, and a bearish flavour has consequently developed in the investors' tongues. Some crypto analysts chalk up the slump to recent protests witnessed in Kazakhstan, a major Bitcoin mining pool. Analysts contend that the unrest led to a dip in the network's hashrate as the country suffered repeated internet shutdowns taking as much as 15% of the Bitcoin network offline.

The Fear and Greed Index

On Saturday, Bitcoin's Fear and Greed Index hit a multi-month low score of 10, moments after the price of bitcoin fell to around $40,500. It had been over six months since the CFGI score sunk as low. The score is now up to 23 as of writing.

The leading cryptocurrency is currently trading at $41,941 – down almost 39% from its all-time high as per market data. The price figure now means Bitcoin has shed 11% in the last seven days. Its global trade volume has dropped by 23.90% in the last 24 hours to $21.1 billion.