Online payments business Skrill (formerly Moneybookers) recently enabled Bitcoin deposits for at least some of its users. The London-based PayPal alternative, which is a subsidiary of Paysafe Group, has not talked about their Bitcoin integration much at all, and requests for comments on the subject were not returned.

Bitcoin deposits are not available in the United States, and a full list of countries where this deposit method is possible has not been made public. Having said that, Umati Blockchain Ltd. CEO Michael Kimani confirmed to CoinJournal that the option is available in his account in Kenya. CoinJournal reached out to Kimani to get more details on how bitcoin is filling the gaps between different payment systems in Kenya.

Is Skrill Popular in Kenya?

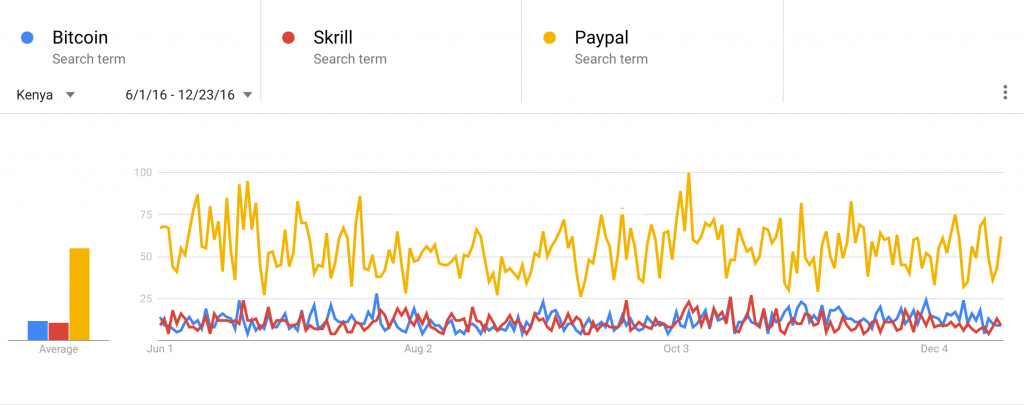

PayPal is the most popular online wallet in Kenya by far, with Skrill in competition for second place with Neteller (also owned by Paysafe Group). According to Google Trends data, Bitcoin is at least just as popular as Skrill in terms of general interest.

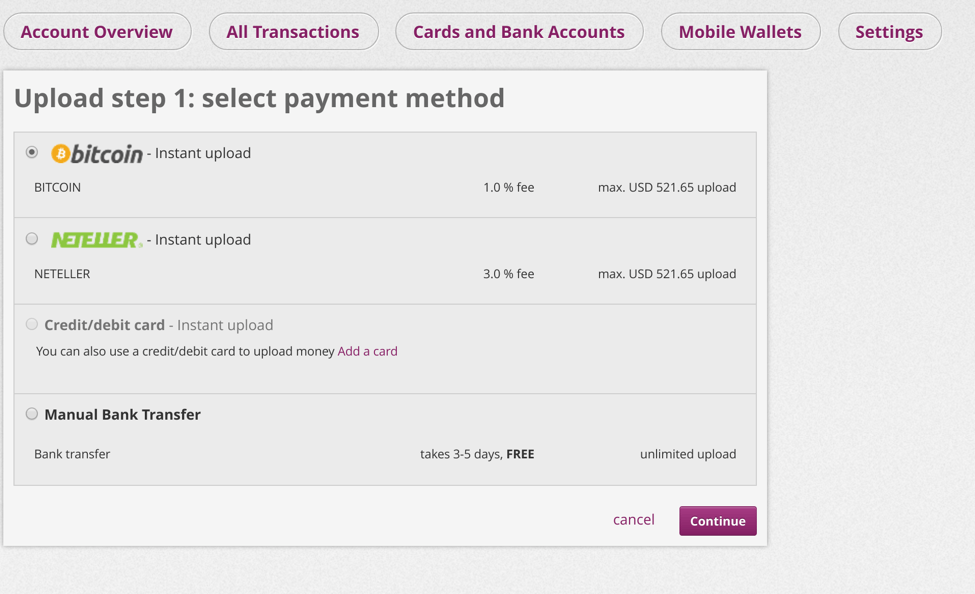

For Skrill, Bitcoin may be a useful payment option for helping people in Kenya deposit money into their accounts in an easier, simpler manner. “It is pretty evident there is an online payments gap in depositing money to online wallets from local currency,” said Kimani.

According to Kimani, Skrill’s Bitcoin integration is made possible through the use of Bitpay. “Debit cards have online transaction limits, and require activation,” added Kimani. “Bank transfers take too long, 3 to 5 days. Bitcoin is instant.”

In addition to their use of Bitcoin for deposits, Skrill also recently enabled withdrawals to M-Pesa, which is a widely popular mobile wallet used in Kenya. The transactions processed by M-Pesa in Kenya amount to nearly half of the country’s overall GDP.

Skrill’s use of M-Pesa for withdrawals means online freelancers in Kenya no longer have to go through a broker in order to get money from their Skrill account to their M-Pesa account.

Bitcoin’s Growing Popularity Among Payments Brokers

Speaking of payment brokers, Bitcoin has played a role in bridging the gap between various online and mobile payment systems in Kenya. “Bitcoin is flexible and convenient because it bridges well with existing mobile payment systems like M-Pesa locally and multiple online e-wallets,” said Kimani. “It really opens up the number of options available depending on what and where you can use it.”

Kimani explained that Kenyan entrepreneurs are able to exchange money in their M-Pesa wallet for bitcoin via LocalBitcoins or some other online broker. Once these individuals have bitcoin, they have a number of different options to move that money around the Internet such as Neteller, Solid Trust Pay, and now Skrill.

According to Kimani, there are a number of young Kenyan entrepreneurs who act as online brokers between the various virtual wallet providers. Anyone who needs to quickly move money between PayPal, M-Pesa, Skrill, or any other online wallet can do so via these brokers for a fee.

“What has been interesting to observe is these same brokers begin to transition into bitcoin and add bitcoin as one of the many currencies they market make,” explained Kimani. “There is a service gap that brokers are filling, a payments gap. Bitcoin is now one other option. It’s been fascinating to watch.”

Who Will Use Bitcoin for Skrill Deposits?

According to Kimani, there are a variety of different online entrepreneurs who may be helped out by Skrill’s recent Bitcoin integration. Freelancers, sports bettors, forex traders, and anyone else who has found an opportunity to earn money online can now take advantage of bitcoin as a solution to fill the various payments gaps in the country.

Kimani pointed to Kenyan freelancer groups on Facebook, such as Awesome Transcribers in Kenya and Academia Research Writers, as places where he often sees young entrepreneurs trying to find a broker to help them fund their Skrill accounts.

Bitcoin users in Kenya are illustrating the usefulness of this open financial network that any person or company can plug into without permission from a bank or government.