BTC’s price decline presents an opportunity for short-sellers to make profitable trades.

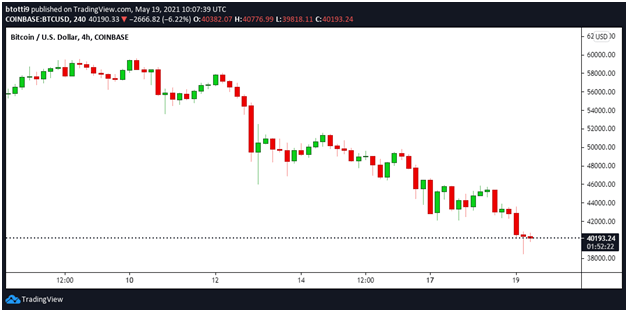

Bitcoin price has fallen to lows of $38,500 as crypto markets continue to reel from increased selling pressure. The sell-off has seen Bitcoin price decline by 30% over the past seven days, with overall losses since BTC hit a new all-time high of $63,895 in mid-April rising to 40%.

How to short Bitcoin

You can short Bitcoin just like you would any other financial instrument. You do this by borrowing bitcoins from an exchange or broker. You then sell them at the prevailing market price and look to buy when prices drop. This way, you can return the borrowed BTC and keep the gains.

You can also short Bitcoin through a Contract for Difference (CFD) contract. What this means is that you don’t borrow and sell the actual Bitcoins. Instead, you open a short position via a broker, which sells the coins. You get the price difference when you buy back at reduced prices.

What is behind Bitcoin’s latest correction?

Apart from a bearish flip associated with Tesla CEO Elon Musk’s comments about Bitcoin mining and clean energy, the rot seen in early trades this Wednesday appear to have been accelerated by the news that China was again banning financial institutions and business from using crypto services.

As the Bitcoin price chart below shows, the cryptocurrency remains in a downtrend. Buyers are finding it difficult to string together any significant upside, with a bearish wall just above $40,000 likely to see prices slump further. If it happens, Bitcoin price can dip to lows last seen in December 2020.