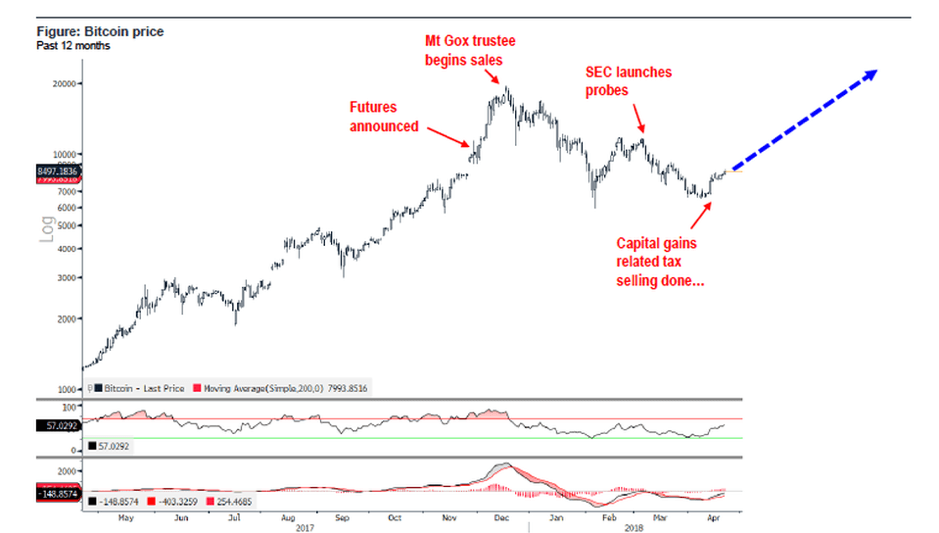

There are a number of theories for Bitcoin’s price decline since the cryptocurrency market peaks of December 2017, including the Mt Gox sell-off, increased regulatory scrutiny, and imminent tax deadlines. Less supportive parties declared the boom was over, but some experts including Fundstrat’s Tom Lee believe its barely begun.

Lee is Head of Research for Fundstrat Global Advisors and a prominent figure in both traditional trading and cryptocurrency markets. Lee predicted tax loss selling could reduce Bitcoin’s market capitalization by $20 to $25 per $1 of Bitcoin sold. As the April 17th tax deadline has passed Lee believes three critical influences on Bitcoin’s price have now ended, leaving Bitcoin ready to hit $20,000 by the middle of the year. He also forecasts Bitcoin will hit $25,000 by the end of the year.

Some reports, however, indicate the number of investors filing cryptocurrency gains is low which could dispute this theory. Bitcoin buyers may also have been hesitating, waiting for the impact of potential tax loss selling to pass. If investors have indeed sold some of their holdings to cash in and pay pending tax bills, that period should now be over.

A cryptocurrency hedge fund with $800 million in assets, Pantera Capital, also connected the deadline for filing taxes in the US to selling pressure in a letter to investors:

“I could imagine that a portion of the selling pressure on the market, in general, has been unintended tax positions. Imagine a trader actively buying and selling BTC, ETH, XRP, etc,” Pantera said. “Great year. Made a ton of money. Kept it all in the markets. Come the spring their accountants tell them that every sale at a profit created a taxable gain.”

Lee estimates that U.S Bitcoin investors owe around $25 billion in capital-gains taxes, driving some of the Bitcoin sell-off as investors raise money to pay taxes on 2017 profits.

“As a consequence, if this analysis is correct, selling pressure for bitcoin should be alleviated after April 15th,” predicted Lee.

Though at the start of April Lee did also describe possible regulatory action risk and any subsequent influence as “still substantial” and that “sentiment remains awful” investors are now demonstrating regaining optimism as cryptocurrency markets show signs of recovery.

On Friday April 20th, 2018, Lee issued a note to clients reiterating his theory based on recent market performance:

“The U.S. tax day is behind us (April 17th) and since then, the overall tone in the crypto market has improved. We believe the ‘winter’ is ending for Bitcoin, as the crypto to fiat pressures from tax day subside, and as headline risks seem to be fading.”

Another expert, Frank Cappelleri, Executive Director, Institutional Equities at Nomura Instinet is more conservative with his technical analysis:

“Bitcoin now is testing a very important downtrend line, the same one that the Cryptocurrency failed at in January and again in March.”

Cappelleri believes if Bitcoin can break above the line the price will rise, with an immediate prediction on April 20th of a rise towards $9,173. Over the weekend Bitcoin reached $8,962, and is still trading around the $8,900 mark so far today.