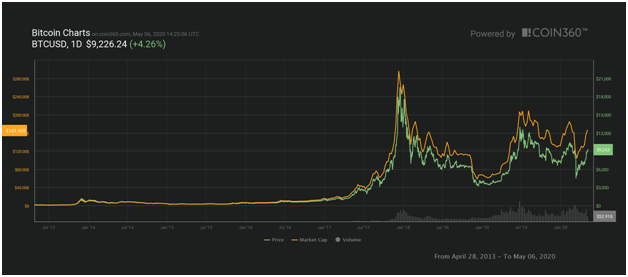

Bitcoin has hit a daily high of $9,392.64, the top cryptocurrency’s upside coming on the back of strong moves in the past 24 hours. Elsewhere, asset management firm Bitwise says that BTC would have boosted any portfolio even with its price decline after the 2017 bull run.

Bitcoin (BTC) is on a 24-hour surge that has seen its price top $9,300 and come within touching distance of $9.4k.

On Wednesday, the price of the largest crypto by market cap broke above the $9k level and did not relent as bulls pushed for a higher threshold.

In the past 48 hours, traders had watched the price charts keenly as prices appeared to stall below a level that has proved tough to break since dipping at the start of May. But with anticipation for higher Bitcoin prices building as miners edge towards fourth reward halving, bulls have inched BTC over 3% to peak at a new high for May.

Bitcoin’s upside today was in the making as the crypto closed above the recent bogey price level at $9,000. Significantly, Bitcoin’s upside means it is now out of its six-day stretch that saw prices remain range-bound. If the pioneer coin closes above this level again, it would be only its second time registering closing prices over the hurdle.

Meanwhile, a new study shows that holding Bitcoin (BTC) as part of a portfolio could boost an investor’s returns. According to the Bitwise report, even if an investor bought the coin at its all-time high and held it through the bearish market, returns were likely to remain in the positive for the entire portfolio.

The research reveals that a test portfolio where an investor mixed stocks and bonds with just a percentage of BTC, results showed the returns were higher with the crypto. That would still be the case even if the investor held the asset between its 2017 high of $20k and its low of $6.5k at the end of March.

According to the Bitwise report, if an investor allocated 2.5% of their investment portfolio to BTC in January 2014 and rebalanced it every quarter, returns would have jumped from 26% to nearly 45% at the end of March 2020.

Investors seeking to get onto the bitcoin scene will do well to note that the cryptocurrency’s price run from 2014 starting at just $750. By March 31, 2020, even with the massive tank of 2018, Bitcoin was still up 766%.

Bitcoin crashed to a low of $3,800 in March, but it’s outperformance of all major assets has seen it recoup 100% of the 2020 losses and pitch 26% in year-to-date trading.