- Bitflow launches Automated Dollar-Cost Averaging (DCA) for Bitcoin and Runes investments on Stacks.

- The AI-powered DCA enables trustless, recurring investments.

- Future plans include adding yield strategies and cross-layer flows.

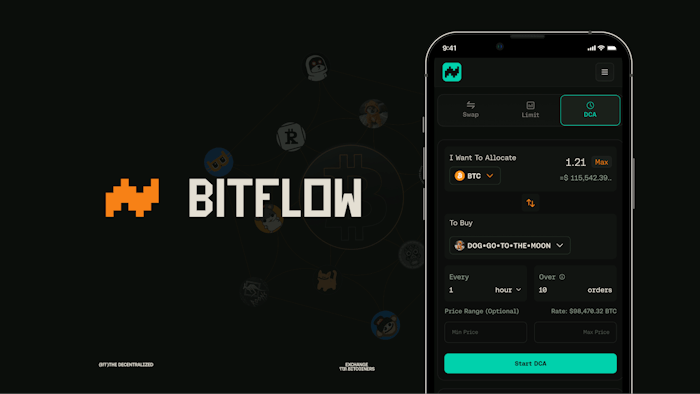

Bitflow, a decentralized exchange built on the Stacks ecosystem, has unveiled Automated Dollar-Cost Averaging (DCA), a groundbreaking feature that introduces AI-driven investment strategies to Bitcoin and its associated assets.

The automated DCA allows users to automate recurring purchases of Bitcoin (BTC), stablecoins, Stacks’ native STX token, sBTC, and popular Runes tokens like $DOG, all while retaining complete control over their funds.

Designed to simplify and enhance participation in the growing Bitcoin-native economy, Bitflow’s latest offering marks a significant milestone in decentralized finance (DeFi) on the Stacks Layer 2 network.

Simplifying Bitcoin DeFi investment with automation

At the heart of the Automated Dollar-Cost Averaging (DCA) is Bitflow Keepers, an intelligent automation engine that powers the DCA feature. This technology enables trustless, recurring transactions without requiring users to time the market or execute trades manually.

By supporting a wide range of assets, including SIP-10 tokens and the memecoin sensation $DOG (DOG•GO•TO•THE•MOON), Bitflow ensures that users can diversify their portfolios seamlessly.

For the first time, DeFi enthusiasts on Stacks can program their investment strategies, transforming Bitcoin into a dynamic, yield-generating asset.

Particularly, Bitflow’s non-custodial design keeps transactions fully onchain, providing transparency and security while eliminating dependence on third-party intermediaries.

Dylan Floyd, Bitflow’s Co-Founder and Lead Developer, emphasized the transformative potential of this feature, noting that Bitcoin DeFi is entering a new era of automation, where users can harness advanced tools to grow their holdings efficiently.

Notably, the Automated DCA feature is the first step in a roadmap aimed at integrating AI-driven automation into DeFi. Upcoming enhancements will include automated yield farming strategies, enabling users to optimize returns on BTC-based assets without constant oversight.

Plans are also in place for market-triggered swaps, which will allow traders to set conditions for executing transactions based on price movements or volatility, adding a layer of sophistication to Bitcoin trading.

Additionally, Bitflow intends to improve liquidity by facilitating seamless asset transfers between Bitcoin’s Layer 1 and Stacks’ Layer 2, bridging the gap between the two ecosystems.

This ambitious agenda underscores Bitflow’s role as a pioneer in the Stacks ecosystem, where it serves as a liquidity hub for trading Bitcoin assets.

By incorporating Runes and SIP-10 tokens into its decentralized exchange, Bitflow is broadening the scope of Bitcoin-native finance, appealing to both seasoned traders and newcomers looking for efficient ways to engage with the market.