Blockchain startup Brickblock has raised €5 million in its Series A funding round. Led by Finch Capital, the funding will be used to accelerate BrickBlock’s ambition to “revolutionize the way real-world assets are bought and traded,” Brickblock’s CEO and co-founder Jakob Drzazga said. Following the investment, the Gibraltar-headquartered startup has appointed Radboud Vlaar, partner of Finch Capital, to its board of directors.

“The real estate sector is the biggest investable asset class in the world, with a value of US$200 trillion. We have seen the mortgage and brokerage market being disrupted, and the time is now ripe to disrupt the investment and trading side,” said Vlaar.

“Brickblock is well suited to lead this transformation, leveraging the blockchain to reduce costs for investors up to 80% and making it a frictionless and more liquid investment asset class. We are excited to support Jakob and his team to build out Brickblock as it gets greater adoption in the months to come and establishes itself as the go-to platform for tokenized asset transactions.”

Founded in 2017, Brickblock is building a smart contract platform to allow users to sell and invest in tokenized assets.

The blockchain-based solution will allow “sellers,” including fund managers and real estate developers, to offer tokenized real-world assets like properties and investment funds.

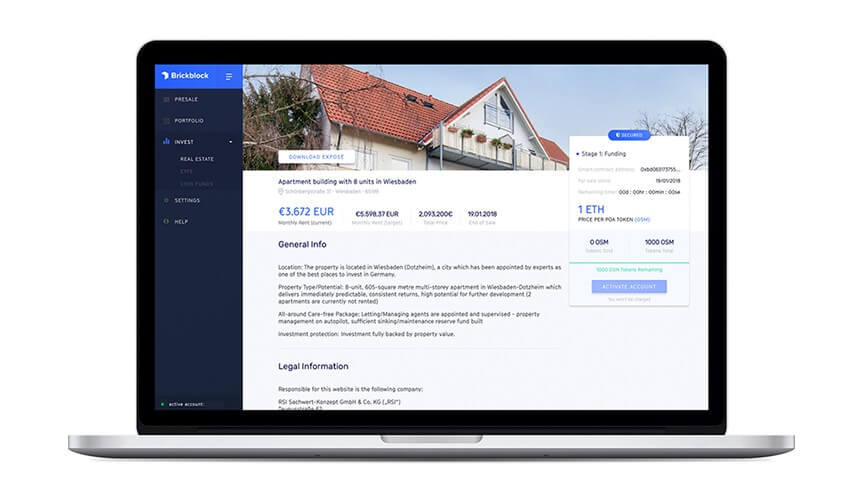

Each fund on the Brickblock platform will have its own denomination and its own “proof-of-asset” (PoA) token, which will legally entitle the owner to the profits of the underlying asset.

Meanwhile, retail and institutional investors will be able to invest in exchange –traded funds (ETFs), real estate funds (REFs), passive coin-traded funds (CTFs) and active coin managed funds (CMFs) by purchasing PoA tokens with cryptocurrency. These tokens will be traded through smart contracts on the Ethereum blockchain.

Brickblock’s infrastructure will be implemented as decentralized application (Dapp) and will run on the Ethereum network.

Brickblock, which also has operations in Berlin, said it was with its partners in the advanced stages of tokenizing the first residential real estate asset located in Wiesbaden, Germany.

In addition to the newly raised capital, Brickblock is preparing to launch its token sale for its Brickblock tokens (BBK) later this week, through which it hopes to raise as much as US$50 million.

BBK will only be released during the initial coin offering (ICO). The token will be listed on secondary marketplaces and exchangeable for Access Tokens, which will be needed by fund managers to list their fund on the platform and to pay for Brickblock fees when REFs, ETFs, CMFs or CTFs are sold.